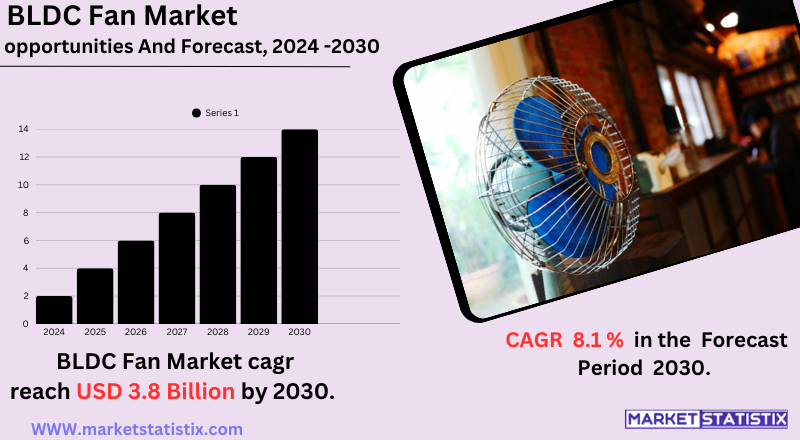

Global BLDC Fan Market Size, Share & Trends Analysis Report, Forecast Period, 2024-2030

Report ID: MS-618 | Electronics and Semiconductors | Last updated: Mar, 2025 | Formats*:

BLDC Fan Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

| Growth Rate | CAGR of 8.1% |

| Forecast Value (2030) | USD 3.8 Billion |

| By Product Type | Table fans, Exhaust fans, Ceiling fans, Others |

| Key Market Players | BLDC Fan Market Size 2025-2029 The BLDC fan market size is forecast to increase by USD 1.39 billion at a CAGR of 8.7% between 2024 and 2029. The market is witnessing significant growth due to the increasing demand for energy-efficient electrical fans. With rising energy costs and concerns over environmental sustainability, consumers are increasingly opting for BLDC fans, which offer higher energy efficiency compared to traditional AC motor fans. The market is primarily driven by the commercial segment due to its extensive application in various industries, including cooling systems, computer peripherals, robotics, and medical equipment. Furthermore, the increasing disposable income of individuals, particularly in developing economies, is driving the market growth. However, the high-end product cost remains a challenge for the market, limiting its penetration In the mass market segment. To mitigate this challenge, manufacturers are focusing on price reduction through economies of scale and technological advancements. Overall, the market is expected to witness steady growth In the coming years, driven by these market trends and growth factors. What will be the Size of the BLDC Fan Market During the Forecast Period? BLDC Fan Market Size Request Free Sample The market encompasses energy-efficient fans for various applications, including cooling systems in residential, commercial, and industrial environments. BLDC fans, also known as brushless DC fans or EC fans, utilize advanced technologies such as permanent magnets, microcontrollers, inverters, and copper wire In their construction. These fans offer several advantages over traditional AC motor equivalents, including improved energy efficiency, quieter operation, and longer motor life due to reduced heat generation and elimination of fan bearings and winding failure. BLDC fans are increasingly adopted in energy-saving appliances and smart home systems. In residential buildings, they are used as alternatives to standard ceiling fans, while in commercial and industrial settings, they serve as induction fans for HVAC systems. Noise levels are a critical consideration in both residential and commercial environments, making BLDC fans an attractive option due to their quiet operation. Overall, the market is experiencing significant growth, driven by increasing energy efficiency norms, the demand for energy-saving solutions, and the need for quieter, more efficient cooling systems. How is this BLDC Fan Industry segmented and which is the largest segment? The bldc fan industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments. End-user Commercial Residential Speed More than 400 RPM Below 300 RPM 300-400 RPM Type Ceiling fans Exhaust fans Table fans Others Geography APAC China India Japan South Korea North America Canada US Europe Germany UK France South America Middle East and Africa By End-user Insights The commercial segment is estimated to witness significant growth during the forecast period. The increasing demand for energy-efficient appliances and the need for high-performance, low-maintenance fans in both residential and commercial buildings are significant factors fueling market growth. BLDC fans, with their permanent magnets, smart features, and energy efficiency, are becoming increasingly popular alternatives to AC motor equivalents in various environments. In the residential sector, these fans offer utility, aesthetic appeal, and smart home integration, while in commercial and industrial settings, they contribute to sustainable living and reduced carbon footprint. BLDC Fan Market Size Get a glance at the market report of share of various segments Request Free Sample The commercial segment was valued at USD 1.22 billion in 2019 and showed a gradual increase during the forecast period. Regional Analysis APAC is estimated to contribute 63% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. The market in APAC holds a significant share due to the high demand In the commercial sector, driven by the manufacturing of industrial electronic equipment in countries like China, Japan, Vietnam, and India. Additionally, the need for cooling solutions in residential applications in temperate countries withIn the region, such as those reaching up to 55 degrees C during summer, will further fuel market growth. Energy-efficient appliances, cooling systems, residential and commercial buildings, and various industries, including HVAC systems, refrigeration equipment, industrial machinery, high-performance computing systems, servers, data centers, and domestic and commercial segments, increasingly utilize BLDC fans due to their energy efficiency, smart features, and low noise levels. BLDC Fan Market Share by Geography For more insights on the market size of various regions, Request Free Sample BLDC fans, with their permanent magnets, motor control, and smart home systems integration, offer advantages such as high-performance, long lifespan, smart home appliances, and sustainable living. The market is expected to grow as governments prioritize sustainable development and energy efficiency norms, and as construction materials, design aesthetics, and performance standards evolve. Market Dynamics Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage. What are the key market drivers leading to the rise In the adoption of BLDC Fan Industry? Growing demand for energy-efficient electrical fans is the key driver of the market. BLDC fans, also known as Brushless Direct Current fans, are gaining popularity in various industries due to their energy efficiency and compact size. In the market for cooling systems, BLDC fans are increasingly used in both residential and commercial buildings, as well as in industrial machinery and high-performance computing systems. Compared to Alternating Current fans, BLDC fans offer several advantages, including noise reduction, longer lifespan, and speed control. BLDC fans have two main types: inner rotor and outer rotor. The rotor In these fans is driven by a stator using permanent magnets, eliminating the need for commutators and brushes found in Induction motors. This design results in reduced friction, lower noise levels, and higher power-to-weight ratio. BLDC fans are utilized in HVAC systems, refrigeration equipment, and various industrial applications. They are also employed in cooling systems for electrical equipment, such as servers, data centers, computer peripherals, and medical devices. In the residential segment, BLDC fans are used as energy-saving alternatives to traditional ceiling fans, while In the commercial segment, they are used in air conditioning systems and other large-scale cooling applications. BLDC fans are also used in smart home appliances, where they offer smart features such as energy efficiency norms, motor control, and smart home systems integration. What are the market trends shaping the BLDC Fan Industry? Increasing disposable income of individuals is the upcoming market trend. The global market for energy-efficient appliances, including cooling systems, has experienced substantial growth due to rising disposable income levels and increasing focus on sustainable development. In residential and commercial buildings, the demand for BLDC fans, as energy-saving alternatives to traditional AC motor fans, has increased. These fans offer advantages such as high-performance, low noise levels, long lifespan, and speed control. BLDC fans, which utilize permanent magnets and advanced motor control technology, are gaining popularity in various environments, from HVAC systems and refrigeration equipment to industrial machinery, high-performance computing systems, servers, and data centers. Consumers are increasingly seeking energy-efficient solutions for their homes and businesses, driven by government policies and a growing awareness of the importance of reducing carbon footprints. Smart home appliances, including BLDC fans, are becoming increasingly popular, offering features such as noise reduction, smart home systems integration, and performance standards that cater to diverse design aesthetics, utility, and sizes. The construction materials and finishes of these fans are also being tailored to meet the demands of various environments, from residential to commercial and industrial. BLDC fans, which include both inner rotor and outer rotor designs, offer advantages over traditional induction motors in terms of power-to-weight ratio, energy efficiency, and low maintenance requirements. They are being used in a wide range of applications, from electrical equipment and computer peripherals to medical devices, robotics, and electrical equipment. What challenges does the BLDC Fan Industry face during its growth? High-end product cost is a key challenge affecting the industry growth. BLDC fans, also known as Brushless Direct Current fans, are gaining popularity in both residential and commercial environments due to their energy efficiency and high-performance capabilities. These fans are commonly used in cooling systems, HVAC systems, refrigeration equipment, industrial machinery, high-performance computing systems, servers, and data centers. BLDC fans are more energy-efficient than traditional Alternating Current fans, resulting in lower electricity consumption and utility bills. Despite their advantages, BLDC fans are more expensive than their counterparts due to the use of advanced components such as permanent magnets, motor control, and microcontrollers. The domestic segment's growth In the market is limited due to the high cost of these fans, particularly in underdeveloped and developing countries where disposable income is limited. Moreover, some crucial components of BLDC fans, such as magnets and motor control, are primarily imported from countries like China. However, domestic firms are now manufacturing these components in-house, reducing dependence on imports and increasing the market's sustainability. Noise reduction is another significant factor driving the market's growth, particularly in residential and commercial environments. Smart home appliances, smart home systems, and construction materials that prioritize design aesthetics, performance standards, and sustainable living are increasingly incorporating BLDC fans. BLDC fans offer several advantages over traditional fans, including longer lifespan, speed control, and low maintenance. They also have a better power-to-weight ratio, making them suitable for use in computer peripherals, medical devices, robotics, and electrical equipment. Exclusive Customer Landscape The BLDC fan market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the bldc fan market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies. BLDC Fan Market Share by Geography Customer Landscape Key Companies & Market Insights Companies are implementing various strategies, such as strategic alliances, bldc fan market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry. Atomberg Technologies Pvt. Ltd. - The company offers BLDC Fans such as Renesa Smart and Studio Plus Series. The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including: BHARAT BRUSHLESS MOTORS Brilltech Vayu Crompton Greaves Consumer Electricals Ltd. Fanimation Fantasia Ceiling Fans Havells India Ltd. Hunter Fan Co. Kichler Lighting LLC Luminance Brands LLC MinebeaMitsumi Inc. Minka Lighting Inc. Nidec Corp. OCECO ENERGY PVT LTD Orient Electric Ltd. Panasonic Holdings Corp. |

| By Region |

BLDC Fan Market Trends

The BLDC fan market is facing a robust upward inclination mainly attributed to an increasing consumer and industrial pursuit of energy efficiency. The growth of integration with the latest smart technology to enable remote control, automated operation, and seamless integration into smart home ecosystems is another strong trend. The entire trend is nourished by the increased adoption of IoT and the demand for the utmost convenient and personalized control of home appliances. The automotive sector is also narrowing down a few market opportunities as the automotive BLDC fans in vehicle cooling systems are finding greater use due to their efficiency and compactness. A geographical shift is also taking place, with emerging economies setting the trend as rising disposable incomes and heightened energy conservation awareness are triggering demand.BLDC Fan Market Leading Players

The key players profiled in the report are The commercial segment was valued at USD 1.22 billion in 2019 and showed a gradual increase during the forecast period.,, Havells India Ltd., Key Companies & Market Insights,, , Nidec Corp., For more insights on the market size of various regions, Request Free Sample, End-user, Type, Geography, Atomberg Technologies Pvt. Ltd. - The company offers BLDC Fans such as Renesa Smart and Studio Plus Series.,, , Japan, Market Dynamics, APAC, Crompton Greaves Consumer Electricals Ltd., MinebeaMitsumi Inc., Kichler Lighting LLC, South Korea, By End-user Insights, Moreover, some crucial components of BLDC fans, such as magnets and motor control, are primarily imported from countries like China. However, domestic firms are now manufacturing these components in-house, reducing dependence on imports and increasing the market's sustainability. Noise reduction is another significant factor driving the market's growth, particularly in residential and commercial environments. Smart home appliances, smart home systems, and construction materials that prioritize design aesthetics, performance standards, and sustainable living are increasingly incorporating BLDC fans. BLDC fans offer several advantages over traditional fans, including longer lifespan, speed control, and low maintenance. They also have a better power-to-weight ratio, making them suitable for use in computer peripherals, medical devices, robotics, and electrical equipment., Middle East and Africa, Get a glance at the market report of share of various segments Request Free Sample, Fantasia Ceiling Fans, Noise levels are a critical consideration in both residential and commercial environments, making BLDC fans an attractive option due to their quiet operation. Overall, the market is experiencing significant growth, driven by increasing energy efficiency norms, the demand for energy-saving solutions, and the need for quieter, more efficient cooling systems., This design results in reduced friction, lower noise levels, and higher power-to-weight ratio. BLDC fans are utilized in HVAC systems, refrigeration equipment, and various industrial applications. They are also employed in cooling systems for electrical equipment, such as servers, data centers, computer peripherals, and medical devices. In the residential segment, BLDC fans are used as energy-saving alternatives to traditional ceiling fans, while In the commercial segment, they are used in air conditioning systems and other large-scale cooling applications. BLDC fans are also used in smart home appliances, where they offer smart features such as energy efficiency norms, motor control, and smart home systems integration., BLDC Fan Market Size 2025-2029, Fanimation, Customer Landscape, Germany, More than 400 RPM, Speed, Increasing disposable income of individuals is the upcoming market trend. The global market for energy-efficient appliances, including cooling systems, has experienced substantial growth due to rising disposable income levels and increasing focus on sustainable development. In residential and commercial buildings, the demand for BLDC fans, as energy-saving alternatives to traditional AC motor fans, has increased. These fans offer advantages such as high-performance, low noise levels, long lifespan, and speed control. BLDC fans, which utilize permanent magnets and advanced motor control technology, are gaining popularity in various environments, from HVAC systems and refrigeration equipment to industrial machinery, high-performance computing systems, servers, and data centers. Consumers are increasingly seeking energy-efficient solutions for their homes and businesses, driven by government policies and a growing awareness of the importance of reducing carbon footprints., Hunter Fan Co., BLDC fans, with their permanent magnets, motor control, and smart home systems integration, offer advantages such as high-performance, long lifespan, smart home appliances, and sustainable living. The market is expected to grow as governments prioritize sustainable development and energy efficiency norms, and as construction materials, design aesthetics, and performance standards evolve., BHARAT BRUSHLESS MOTORS, Europe, The BLDC fan market size is forecast to increase by USD 1.39 billion at a CAGR of 8.7% between 2024 and 2029., China, The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:, Smart home appliances, including BLDC fans, are becoming increasingly popular, offering features such as noise reduction, smart home systems integration, and performance standards that cater to diverse design aesthetics, utility, and sizes. The construction materials and finishes of these fans are also being tailored to meet the demands of various environments, from residential to commercial and industrial. BLDC fans, which include both inner rotor and outer rotor designs, offer advantages over traditional induction motors in terms of power-to-weight ratio, energy efficiency, and low maintenance requirements. They are being used in a wide range of applications, from electrical equipment and computer peripherals to medical devices, robotics, and electrical equipment., BLDC Fan Market Size,, OCECO ENERGY PVT LTD, How is this BLDC Fan Industry segmented and which is the largest segment?,, , Commercial,, Regional Analysis, Table fans, Residential, The market encompasses energy-efficient fans for various applications, including cooling systems in residential, commercial, and industrial environments. BLDC fans, also known as brushless DC fans or EC fans, utilize advanced technologies such as permanent magnets, microcontrollers, inverters, and copper wire In their construction. These fans offer several advantages over traditional AC motor equivalents, including improved energy efficiency, quieter operation, and longer motor life due to reduced heat generation and elimination of fan bearings and winding failure. BLDC fans are increasingly adopted in energy-saving appliances and smart home systems. In residential buildings, they are used as alternatives to standard ceiling fans, while in commercial and industrial settings, they serve as induction fans for HVAC systems., BLDC Fan Market Share by Geography, Luminance Brands LLC,, UK, Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.,, India,, Minka Lighting Inc., Growing demand for energy-efficient electrical fans is the key driver of the market. BLDC fans, also known as Brushless Direct Current fans, are gaining popularity in various industries due to their energy efficiency and compact size. In the market for cooling systems, BLDC fans are increasingly used in both residential and commercial buildings, as well as in industrial machinery and high-performance computing systems. Compared to Alternating Current fans, BLDC fans offer several advantages, including noise reduction, longer lifespan, and speed control. BLDC fans have two main types: inner rotor and outer rotor. The rotor In these fans is driven by a stator using permanent magnets, eliminating the need for commutators and brushes found in Induction motors., Ceiling fans, The commercial segment is estimated to witness significant growth during the forecast period. The increasing demand for energy-efficient appliances and the need for high-performance, low-maintenance fans in both residential and commercial buildings are significant factors fueling market growth. BLDC fans, with their permanent magnets, smart features, and energy efficiency, are becoming increasingly popular alternatives to AC motor equivalents in various environments. In the residential sector, these fans offer utility, aesthetic appeal, and smart home integration, while in commercial and industrial settings, they contribute to sustainable living and reduced carbon footprint.,, North America, France, APAC is estimated to contribute 63% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. The market in APAC holds a significant share due to the high demand In the commercial sector, driven by the manufacturing of industrial electronic equipment in countries like China, Japan, Vietnam, and India. Additionally, the need for cooling solutions in residential applications in temperate countries withIn the region, such as those reaching up to 55 degrees C during summer, will further fuel market growth. Energy-efficient appliances, cooling systems, residential and commercial buildings, and various industries, including HVAC systems, refrigeration equipment, industrial machinery, high-performance computing systems, servers, data centers, and domestic and commercial segments, increasingly utilize BLDC fans due to their energy efficiency, smart features, and low noise levels., Below 300 RPM, Request Free Sample, What are the key market drivers leading to the rise In the adoption of BLDC Fan Industry?, Exhaust fans, Canada,, , South America, 300-400 RPM, BLDC Fan Market Size, What challenges does the BLDC Fan Industry face during its growth?, Others, Companies are implementing various strategies, such as strategic alliances, bldc fan market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry., BLDC Fan Market Share by Geography, The bldc fan industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments., The BLDC fan market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the bldc fan market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies., Exclusive Customer Landscape,, High-end product cost is a key challenge affecting the industry growth. BLDC fans, also known as Brushless Direct Current fans, are gaining popularity in both residential and commercial environments due to their energy efficiency and high-performance capabilities. These fans are commonly used in cooling systems, HVAC systems, refrigeration equipment, industrial machinery, high-performance computing systems, servers, and data centers. BLDC fans are more energy-efficient than traditional Alternating Current fans, resulting in lower electricity consumption and utility bills. Despite their advantages, BLDC fans are more expensive than their counterparts due to the use of advanced components such as permanent magnets, motor control, and microcontrollers. The domestic segment's growth In the market is limited due to the high cost of these fans, particularly in underdeveloped and developing countries where disposable income is limited., US, Orient Electric Ltd., Brilltech Vayu, What will be the Size of the BLDC Fan Market During the Forecast Period?, What are the market trends shaping the BLDC Fan Industry?, The market is witnessing significant growth due to the increasing demand for energy-efficient electrical fans. With rising energy costs and concerns over environmental sustainability, consumers are increasingly opting for BLDC fans, which offer higher energy efficiency compared to traditional AC motor fans. The market is primarily driven by the commercial segment due to its extensive application in various industries, including cooling systems, computer peripherals, robotics, and medical equipment. Furthermore, the increasing disposable income of individuals, particularly in developing economies, is driving the market growth. However, the high-end product cost remains a challenge for the market, limiting its penetration In the mass market segment. To mitigate this challenge, manufacturers are focusing on price reduction through economies of scale and technological advancements. Overall, the market is expected to witness steady growth In the coming years, driven by these market trends and growth factors.,, Panasonic Holdings Corp.Growth Accelerators

The main factor that is driving the market associated with BLDC fans is the growing demand for improved energy efficiency. Rising electricity tariffs and greater awareness of environmental sustainability compel consumers and industries to resort to the use of BLDCs due to their much lower energy consumption than conventional AC fans. Moreover, stringent government regulations and energy efficiency standards enforced in various regions compel manufacturers to produce and promote DWLs. The continuous reduction in prices of electronic components, coupled with improved manufacturing processes, should help bring BLDC fans into the realm of affordability and increase accessibility. The growing adoption of BLDC fans at residential, commercial, and industrial locations evidences the growing range of applications in which these fans are being applied. Important driving factors also include the increasing demand from the automotive sector for cooling systems as well as the HVAC segment, which calls for more efficient air circulation.BLDC Fan Market Segmentation analysis

The Global BLDC Fan is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Table fans, Exhaust fans, Ceiling fans, Others . The Application segment categorizes the market based on its usage such as Commercial, Residential. Geographically, the market is assessed across key Regions like {regionNms} and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

Market competitiveness of BLDC bands horizontally from the established companies to the forthcoming entrants, thereby witnessing stiff competition in this product category. Some key differentiators are product innovation, energy efficiency, and smart features. While the established companies rely on brand reputation and widespread distribution, the newer players are targeting niche markets with competitive pricing. Another major trend in the industry is the differentiation of their products in terms of aesthetics, lower noise, and advanced control systems.Challenges In BLDC Fan Market

The BLDC (Brushless DC) fan market meets with various challenges like high initial cost and limited consumer awareness. In comparison to conventional ceiling fans, BLDC fans are more expensive because of advanced motor and electronic technology; attributed to this, price-sensitive consumers admit rejection in developing markets. Furthermore, there is still a lack of awareness amongst many consumers about energy savings and other advantages accrued over BLDC technology concerning long-term use. Thus, market adoption becomes gradual in spite of government backing and promotion of energy-efficient products. Another huge hindrance facing the industry is the availability of counterfeit and low-quality products that are detrimental to performance and reliability, therefore hurting consumer confidence. Production and prices are also affected by supply chain disruptions and shortages of semiconductors; in addition, limited compatibility with older electrical infrastructure in several regions presents installation challenges. Conquering these hurdles will require better consumer education, cost-effective technological advancements, and stronger distribution networks aimed at expanding market reach.Risks & Prospects in BLDC Fan Market

The Brushless Direct Current (BLDC) fan market is growing at a steady pace with the increasing consumer demand to have energy-efficient and technology-driven appliances. Used in BLDC fans, energy consumption is reduced by close to 65-70% when compared to the conventional induction motor fans, a cost-effective and green choice. In terms of geography, Asia-Pacific is the top market for BLDC fans, accounting for about 45% of total revenue in 2023. The region dominated the market due to a rapid rate of urbanization, the development of infrastructure, and a rising population of the middle class in countries such as China and India. Energy conservation and environmentally friendly products were government initiatives that supported the growth of this market in the region. North America and Europe are other major shareholding areas owing to the rigorous energy consumption laws and rise in preference for smart home appliances.Key Target Audience

, The consumers targeted for BLDC fans are themselves a very diverse mix of residential and commercial consumers. A significant segment, however, is mainly composed of those environmentally aware and energy-efficient consumers who believe that using such devices can lessen their electricity bills. This category comprises homeowners who want to replace their regular fans with smart energy-saving fans and those currently living in high-cost energy countries. This also includes families with small children or noise-sensitive people who require a quieter and more comfortable living environment., Moreover, architects, builders, and interior designers now specify BLDC fans in their projects as part of the incorporation of newer and energy-efficient solutions. With the rise of smart homes and building automation systems, this will extend to include people and businesses looking for integrated solutions from their homes and about distant control.Merger and acquisition

As of March 2025, the Brushless DC (BLDC) fan market has not seen much activity in terms of mergers and acquisitions. Rather, growth in the industry comes largely through innovations and strategic expansions from key players. For example, Atomberg Technologies, a major BLDC fan manufacturer, branched into kitchen appliances and used its knowledge in BLDC motors to launch advanced mixer grinders. Such decisions indicate a preference trend for companies to leverage their technological strengths to implement diversification strategies and build market presence without seeking mergers and acquisitions. Atomberg also widened its offline retail presence to 30,000 outlets across India, garnering a 10% share in the overall fan market and an overwhelming 70% share in BLDC. Presently characterized by organic growth strategies aimed at innovation and market expansion, the competitive landscape for the BLDC fan industry is now operating in a paradigm where companies are choosing growth through internal development rather than consolidation. >Analyst Comment

There is overwhelming growth in the market for Brushless DC (BLDC) fans that occurred as a result of the increase in demand for energy-efficient cooling solutions. With respect to standard AC fans, BLDC fans consume up to 70% less power. Hence, their popularity has gained the most among flats, shopping malls, and industrial settings. Energy efficiency promotion initiatives by the government, increasing commercial electricity costs, and awareness among consumers continue to foster the uptake of these technologies, especially in developing regions. Other advances in technologies like remote control operation, IoT, and smart homes are also potential avenues for further expansion of the market.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 BLDC Fan- Snapshot

- 2.2 BLDC Fan- Segment Snapshot

- 2.3 BLDC Fan- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: BLDC Fan Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Ceiling fans

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Exhaust fans

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Table fans

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Others

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

5: BLDC Fan Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Commercial

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Residential

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

6: Competitive Landscape

- 6.1 Overview

- 6.2 Key Winning Strategies

- 6.3 Top 10 Players: Product Mapping

- 6.4 Competitive Analysis Dashboard

- 6.5 Market Competition Heatmap

- 6.6 Leading Player Positions, 2022

7: Company Profiles

- 7.1 BLDC Fan Market Size 2025-2029

- 7.1.1 Company Overview

- 7.1.2 Key Executives

- 7.1.3 Company snapshot

- 7.1.4 Active Business Divisions

- 7.1.5 Product portfolio

- 7.1.6 Business performance

- 7.1.7 Major Strategic Initiatives and Developments

- 7.2 The BLDC fan market size is forecast to increase by USD 1.39 billion at a CAGR of 8.7% between 2024 and 2029.

- 7.2.1 Company Overview

- 7.2.2 Key Executives

- 7.2.3 Company snapshot

- 7.2.4 Active Business Divisions

- 7.2.5 Product portfolio

- 7.2.6 Business performance

- 7.2.7 Major Strategic Initiatives and Developments

- 7.3 The market is witnessing significant growth due to the increasing demand for energy-efficient electrical fans. With rising energy costs and concerns over environmental sustainability

- 7.3.1 Company Overview

- 7.3.2 Key Executives

- 7.3.3 Company snapshot

- 7.3.4 Active Business Divisions

- 7.3.5 Product portfolio

- 7.3.6 Business performance

- 7.3.7 Major Strategic Initiatives and Developments

- 7.4 consumers are increasingly opting for BLDC fans

- 7.4.1 Company Overview

- 7.4.2 Key Executives

- 7.4.3 Company snapshot

- 7.4.4 Active Business Divisions

- 7.4.5 Product portfolio

- 7.4.6 Business performance

- 7.4.7 Major Strategic Initiatives and Developments

- 7.5 which offer higher energy efficiency compared to traditional AC motor fans. The market is primarily driven by the commercial segment due to its extensive application in various industries

- 7.5.1 Company Overview

- 7.5.2 Key Executives

- 7.5.3 Company snapshot

- 7.5.4 Active Business Divisions

- 7.5.5 Product portfolio

- 7.5.6 Business performance

- 7.5.7 Major Strategic Initiatives and Developments

- 7.6 including cooling systems

- 7.6.1 Company Overview

- 7.6.2 Key Executives

- 7.6.3 Company snapshot

- 7.6.4 Active Business Divisions

- 7.6.5 Product portfolio

- 7.6.6 Business performance

- 7.6.7 Major Strategic Initiatives and Developments

- 7.7 computer peripherals

- 7.7.1 Company Overview

- 7.7.2 Key Executives

- 7.7.3 Company snapshot

- 7.7.4 Active Business Divisions

- 7.7.5 Product portfolio

- 7.7.6 Business performance

- 7.7.7 Major Strategic Initiatives and Developments

- 7.8 robotics

- 7.8.1 Company Overview

- 7.8.2 Key Executives

- 7.8.3 Company snapshot

- 7.8.4 Active Business Divisions

- 7.8.5 Product portfolio

- 7.8.6 Business performance

- 7.8.7 Major Strategic Initiatives and Developments

- 7.9 and medical equipment. Furthermore

- 7.9.1 Company Overview

- 7.9.2 Key Executives

- 7.9.3 Company snapshot

- 7.9.4 Active Business Divisions

- 7.9.5 Product portfolio

- 7.9.6 Business performance

- 7.9.7 Major Strategic Initiatives and Developments

- 7.10 the increasing disposable income of individuals

- 7.10.1 Company Overview

- 7.10.2 Key Executives

- 7.10.3 Company snapshot

- 7.10.4 Active Business Divisions

- 7.10.5 Product portfolio

- 7.10.6 Business performance

- 7.10.7 Major Strategic Initiatives and Developments

- 7.11 particularly in developing economies

- 7.11.1 Company Overview

- 7.11.2 Key Executives

- 7.11.3 Company snapshot

- 7.11.4 Active Business Divisions

- 7.11.5 Product portfolio

- 7.11.6 Business performance

- 7.11.7 Major Strategic Initiatives and Developments

- 7.12 is driving the market growth. However

- 7.12.1 Company Overview

- 7.12.2 Key Executives

- 7.12.3 Company snapshot

- 7.12.4 Active Business Divisions

- 7.12.5 Product portfolio

- 7.12.6 Business performance

- 7.12.7 Major Strategic Initiatives and Developments

- 7.13 the high-end product cost remains a challenge for the market

- 7.13.1 Company Overview

- 7.13.2 Key Executives

- 7.13.3 Company snapshot

- 7.13.4 Active Business Divisions

- 7.13.5 Product portfolio

- 7.13.6 Business performance

- 7.13.7 Major Strategic Initiatives and Developments

- 7.14 limiting its penetration In the mass market segment. To mitigate this challenge

- 7.14.1 Company Overview

- 7.14.2 Key Executives

- 7.14.3 Company snapshot

- 7.14.4 Active Business Divisions

- 7.14.5 Product portfolio

- 7.14.6 Business performance

- 7.14.7 Major Strategic Initiatives and Developments

- 7.15 manufacturers are focusing on price reduction through economies of scale and technological advancements. Overall

- 7.15.1 Company Overview

- 7.15.2 Key Executives

- 7.15.3 Company snapshot

- 7.15.4 Active Business Divisions

- 7.15.5 Product portfolio

- 7.15.6 Business performance

- 7.15.7 Major Strategic Initiatives and Developments

- 7.16 the market is expected to witness steady growth In the coming years

- 7.16.1 Company Overview

- 7.16.2 Key Executives

- 7.16.3 Company snapshot

- 7.16.4 Active Business Divisions

- 7.16.5 Product portfolio

- 7.16.6 Business performance

- 7.16.7 Major Strategic Initiatives and Developments

- 7.17 driven by these market trends and growth factors.

- 7.17.1 Company Overview

- 7.17.2 Key Executives

- 7.17.3 Company snapshot

- 7.17.4 Active Business Divisions

- 7.17.5 Product portfolio

- 7.17.6 Business performance

- 7.17.7 Major Strategic Initiatives and Developments

- 7.18 What will be the Size of the BLDC Fan Market During the Forecast Period?

- 7.18.1 Company Overview

- 7.18.2 Key Executives

- 7.18.3 Company snapshot

- 7.18.4 Active Business Divisions

- 7.18.5 Product portfolio

- 7.18.6 Business performance

- 7.18.7 Major Strategic Initiatives and Developments

- 7.19 BLDC Fan Market Size

- 7.19.1 Company Overview

- 7.19.2 Key Executives

- 7.19.3 Company snapshot

- 7.19.4 Active Business Divisions

- 7.19.5 Product portfolio

- 7.19.6 Business performance

- 7.19.7 Major Strategic Initiatives and Developments

- 7.20 Request Free Sample

- 7.20.1 Company Overview

- 7.20.2 Key Executives

- 7.20.3 Company snapshot

- 7.20.4 Active Business Divisions

- 7.20.5 Product portfolio

- 7.20.6 Business performance

- 7.20.7 Major Strategic Initiatives and Developments

- 7.21 The market encompasses energy-efficient fans for various applications

- 7.21.1 Company Overview

- 7.21.2 Key Executives

- 7.21.3 Company snapshot

- 7.21.4 Active Business Divisions

- 7.21.5 Product portfolio

- 7.21.6 Business performance

- 7.21.7 Major Strategic Initiatives and Developments

- 7.22 including cooling systems in residential

- 7.22.1 Company Overview

- 7.22.2 Key Executives

- 7.22.3 Company snapshot

- 7.22.4 Active Business Divisions

- 7.22.5 Product portfolio

- 7.22.6 Business performance

- 7.22.7 Major Strategic Initiatives and Developments

- 7.23 commercial

- 7.23.1 Company Overview

- 7.23.2 Key Executives

- 7.23.3 Company snapshot

- 7.23.4 Active Business Divisions

- 7.23.5 Product portfolio

- 7.23.6 Business performance

- 7.23.7 Major Strategic Initiatives and Developments

- 7.24 and industrial environments. BLDC fans

- 7.24.1 Company Overview

- 7.24.2 Key Executives

- 7.24.3 Company snapshot

- 7.24.4 Active Business Divisions

- 7.24.5 Product portfolio

- 7.24.6 Business performance

- 7.24.7 Major Strategic Initiatives and Developments

- 7.25 also known as brushless DC fans or EC fans

- 7.25.1 Company Overview

- 7.25.2 Key Executives

- 7.25.3 Company snapshot

- 7.25.4 Active Business Divisions

- 7.25.5 Product portfolio

- 7.25.6 Business performance

- 7.25.7 Major Strategic Initiatives and Developments

- 7.26 utilize advanced technologies such as permanent magnets

- 7.26.1 Company Overview

- 7.26.2 Key Executives

- 7.26.3 Company snapshot

- 7.26.4 Active Business Divisions

- 7.26.5 Product portfolio

- 7.26.6 Business performance

- 7.26.7 Major Strategic Initiatives and Developments

- 7.27 microcontrollers

- 7.27.1 Company Overview

- 7.27.2 Key Executives

- 7.27.3 Company snapshot

- 7.27.4 Active Business Divisions

- 7.27.5 Product portfolio

- 7.27.6 Business performance

- 7.27.7 Major Strategic Initiatives and Developments

- 7.28 inverters

- 7.28.1 Company Overview

- 7.28.2 Key Executives

- 7.28.3 Company snapshot

- 7.28.4 Active Business Divisions

- 7.28.5 Product portfolio

- 7.28.6 Business performance

- 7.28.7 Major Strategic Initiatives and Developments

- 7.29 and copper wire In their construction. These fans offer several advantages over traditional AC motor equivalents

- 7.29.1 Company Overview

- 7.29.2 Key Executives

- 7.29.3 Company snapshot

- 7.29.4 Active Business Divisions

- 7.29.5 Product portfolio

- 7.29.6 Business performance

- 7.29.7 Major Strategic Initiatives and Developments

- 7.30 including improved energy efficiency

- 7.30.1 Company Overview

- 7.30.2 Key Executives

- 7.30.3 Company snapshot

- 7.30.4 Active Business Divisions

- 7.30.5 Product portfolio

- 7.30.6 Business performance

- 7.30.7 Major Strategic Initiatives and Developments

- 7.31 quieter operation

- 7.31.1 Company Overview

- 7.31.2 Key Executives

- 7.31.3 Company snapshot

- 7.31.4 Active Business Divisions

- 7.31.5 Product portfolio

- 7.31.6 Business performance

- 7.31.7 Major Strategic Initiatives and Developments

- 7.32 and longer motor life due to reduced heat generation and elimination of fan bearings and winding failure. BLDC fans are increasingly adopted in energy-saving appliances and smart home systems. In residential buildings

- 7.32.1 Company Overview

- 7.32.2 Key Executives

- 7.32.3 Company snapshot

- 7.32.4 Active Business Divisions

- 7.32.5 Product portfolio

- 7.32.6 Business performance

- 7.32.7 Major Strategic Initiatives and Developments

- 7.33 they are used as alternatives to standard ceiling fans

- 7.33.1 Company Overview

- 7.33.2 Key Executives

- 7.33.3 Company snapshot

- 7.33.4 Active Business Divisions

- 7.33.5 Product portfolio

- 7.33.6 Business performance

- 7.33.7 Major Strategic Initiatives and Developments

- 7.34 while in commercial and industrial settings

- 7.34.1 Company Overview

- 7.34.2 Key Executives

- 7.34.3 Company snapshot

- 7.34.4 Active Business Divisions

- 7.34.5 Product portfolio

- 7.34.6 Business performance

- 7.34.7 Major Strategic Initiatives and Developments

- 7.35 they serve as induction fans for HVAC systems.

- 7.35.1 Company Overview

- 7.35.2 Key Executives

- 7.35.3 Company snapshot

- 7.35.4 Active Business Divisions

- 7.35.5 Product portfolio

- 7.35.6 Business performance

- 7.35.7 Major Strategic Initiatives and Developments

- 7.36 Noise levels are a critical consideration in both residential and commercial environments

- 7.36.1 Company Overview

- 7.36.2 Key Executives

- 7.36.3 Company snapshot

- 7.36.4 Active Business Divisions

- 7.36.5 Product portfolio

- 7.36.6 Business performance

- 7.36.7 Major Strategic Initiatives and Developments

- 7.37 making BLDC fans an attractive option due to their quiet operation. Overall

- 7.37.1 Company Overview

- 7.37.2 Key Executives

- 7.37.3 Company snapshot

- 7.37.4 Active Business Divisions

- 7.37.5 Product portfolio

- 7.37.6 Business performance

- 7.37.7 Major Strategic Initiatives and Developments

- 7.38 the market is experiencing significant growth

- 7.38.1 Company Overview

- 7.38.2 Key Executives

- 7.38.3 Company snapshot

- 7.38.4 Active Business Divisions

- 7.38.5 Product portfolio

- 7.38.6 Business performance

- 7.38.7 Major Strategic Initiatives and Developments

- 7.39 driven by increasing energy efficiency norms

- 7.39.1 Company Overview

- 7.39.2 Key Executives

- 7.39.3 Company snapshot

- 7.39.4 Active Business Divisions

- 7.39.5 Product portfolio

- 7.39.6 Business performance

- 7.39.7 Major Strategic Initiatives and Developments

- 7.40 the demand for energy-saving solutions

- 7.40.1 Company Overview

- 7.40.2 Key Executives

- 7.40.3 Company snapshot

- 7.40.4 Active Business Divisions

- 7.40.5 Product portfolio

- 7.40.6 Business performance

- 7.40.7 Major Strategic Initiatives and Developments

- 7.41 and the need for quieter

- 7.41.1 Company Overview

- 7.41.2 Key Executives

- 7.41.3 Company snapshot

- 7.41.4 Active Business Divisions

- 7.41.5 Product portfolio

- 7.41.6 Business performance

- 7.41.7 Major Strategic Initiatives and Developments

- 7.42 more efficient cooling systems.

- 7.42.1 Company Overview

- 7.42.2 Key Executives

- 7.42.3 Company snapshot

- 7.42.4 Active Business Divisions

- 7.42.5 Product portfolio

- 7.42.6 Business performance

- 7.42.7 Major Strategic Initiatives and Developments

- 7.43 How is this BLDC Fan Industry segmented and which is the largest segment?

- 7.43.1 Company Overview

- 7.43.2 Key Executives

- 7.43.3 Company snapshot

- 7.43.4 Active Business Divisions

- 7.43.5 Product portfolio

- 7.43.6 Business performance

- 7.43.7 Major Strategic Initiatives and Developments

- 7.44 The bldc fan industry research report provides comprehensive data (region-wise segment analysis)

- 7.44.1 Company Overview

- 7.44.2 Key Executives

- 7.44.3 Company snapshot

- 7.44.4 Active Business Divisions

- 7.44.5 Product portfolio

- 7.44.6 Business performance

- 7.44.7 Major Strategic Initiatives and Developments

- 7.45 with forecasts and estimates in "USD billion" for the period 2025-2029

- 7.45.1 Company Overview

- 7.45.2 Key Executives

- 7.45.3 Company snapshot

- 7.45.4 Active Business Divisions

- 7.45.5 Product portfolio

- 7.45.6 Business performance

- 7.45.7 Major Strategic Initiatives and Developments

- 7.46 as well as historical data from 2019-2023 for the following segments.

- 7.46.1 Company Overview

- 7.46.2 Key Executives

- 7.46.3 Company snapshot

- 7.46.4 Active Business Divisions

- 7.46.5 Product portfolio

- 7.46.6 Business performance

- 7.46.7 Major Strategic Initiatives and Developments

- 7.47 End-user

- 7.47.1 Company Overview

- 7.47.2 Key Executives

- 7.47.3 Company snapshot

- 7.47.4 Active Business Divisions

- 7.47.5 Product portfolio

- 7.47.6 Business performance

- 7.47.7 Major Strategic Initiatives and Developments

- 7.48 Commercial

- 7.48.1 Company Overview

- 7.48.2 Key Executives

- 7.48.3 Company snapshot

- 7.48.4 Active Business Divisions

- 7.48.5 Product portfolio

- 7.48.6 Business performance

- 7.48.7 Major Strategic Initiatives and Developments

- 7.49 Residential

- 7.49.1 Company Overview

- 7.49.2 Key Executives

- 7.49.3 Company snapshot

- 7.49.4 Active Business Divisions

- 7.49.5 Product portfolio

- 7.49.6 Business performance

- 7.49.7 Major Strategic Initiatives and Developments

- 7.50 Speed

- 7.50.1 Company Overview

- 7.50.2 Key Executives

- 7.50.3 Company snapshot

- 7.50.4 Active Business Divisions

- 7.50.5 Product portfolio

- 7.50.6 Business performance

- 7.50.7 Major Strategic Initiatives and Developments

- 7.51 More than 400 RPM

- 7.51.1 Company Overview

- 7.51.2 Key Executives

- 7.51.3 Company snapshot

- 7.51.4 Active Business Divisions

- 7.51.5 Product portfolio

- 7.51.6 Business performance

- 7.51.7 Major Strategic Initiatives and Developments

- 7.52 Below 300 RPM

- 7.52.1 Company Overview

- 7.52.2 Key Executives

- 7.52.3 Company snapshot

- 7.52.4 Active Business Divisions

- 7.52.5 Product portfolio

- 7.52.6 Business performance

- 7.52.7 Major Strategic Initiatives and Developments

- 7.53 300-400 RPM

- 7.53.1 Company Overview

- 7.53.2 Key Executives

- 7.53.3 Company snapshot

- 7.53.4 Active Business Divisions

- 7.53.5 Product portfolio

- 7.53.6 Business performance

- 7.53.7 Major Strategic Initiatives and Developments

- 7.54 Type

- 7.54.1 Company Overview

- 7.54.2 Key Executives

- 7.54.3 Company snapshot

- 7.54.4 Active Business Divisions

- 7.54.5 Product portfolio

- 7.54.6 Business performance

- 7.54.7 Major Strategic Initiatives and Developments

- 7.55 Ceiling fans

- 7.55.1 Company Overview

- 7.55.2 Key Executives

- 7.55.3 Company snapshot

- 7.55.4 Active Business Divisions

- 7.55.5 Product portfolio

- 7.55.6 Business performance

- 7.55.7 Major Strategic Initiatives and Developments

- 7.56 Exhaust fans

- 7.56.1 Company Overview

- 7.56.2 Key Executives

- 7.56.3 Company snapshot

- 7.56.4 Active Business Divisions

- 7.56.5 Product portfolio

- 7.56.6 Business performance

- 7.56.7 Major Strategic Initiatives and Developments

- 7.57 Table fans

- 7.57.1 Company Overview

- 7.57.2 Key Executives

- 7.57.3 Company snapshot

- 7.57.4 Active Business Divisions

- 7.57.5 Product portfolio

- 7.57.6 Business performance

- 7.57.7 Major Strategic Initiatives and Developments

- 7.58 Others

- 7.58.1 Company Overview

- 7.58.2 Key Executives

- 7.58.3 Company snapshot

- 7.58.4 Active Business Divisions

- 7.58.5 Product portfolio

- 7.58.6 Business performance

- 7.58.7 Major Strategic Initiatives and Developments

- 7.59 Geography

- 7.59.1 Company Overview

- 7.59.2 Key Executives

- 7.59.3 Company snapshot

- 7.59.4 Active Business Divisions

- 7.59.5 Product portfolio

- 7.59.6 Business performance

- 7.59.7 Major Strategic Initiatives and Developments

- 7.60 APAC

- 7.60.1 Company Overview

- 7.60.2 Key Executives

- 7.60.3 Company snapshot

- 7.60.4 Active Business Divisions

- 7.60.5 Product portfolio

- 7.60.6 Business performance

- 7.60.7 Major Strategic Initiatives and Developments

- 7.61 China

- 7.61.1 Company Overview

- 7.61.2 Key Executives

- 7.61.3 Company snapshot

- 7.61.4 Active Business Divisions

- 7.61.5 Product portfolio

- 7.61.6 Business performance

- 7.61.7 Major Strategic Initiatives and Developments

- 7.62 India

- 7.62.1 Company Overview

- 7.62.2 Key Executives

- 7.62.3 Company snapshot

- 7.62.4 Active Business Divisions

- 7.62.5 Product portfolio

- 7.62.6 Business performance

- 7.62.7 Major Strategic Initiatives and Developments

- 7.63 Japan

- 7.63.1 Company Overview

- 7.63.2 Key Executives

- 7.63.3 Company snapshot

- 7.63.4 Active Business Divisions

- 7.63.5 Product portfolio

- 7.63.6 Business performance

- 7.63.7 Major Strategic Initiatives and Developments

- 7.64 South Korea

- 7.64.1 Company Overview

- 7.64.2 Key Executives

- 7.64.3 Company snapshot

- 7.64.4 Active Business Divisions

- 7.64.5 Product portfolio

- 7.64.6 Business performance

- 7.64.7 Major Strategic Initiatives and Developments

- 7.65 North America

- 7.65.1 Company Overview

- 7.65.2 Key Executives

- 7.65.3 Company snapshot

- 7.65.4 Active Business Divisions

- 7.65.5 Product portfolio

- 7.65.6 Business performance

- 7.65.7 Major Strategic Initiatives and Developments

- 7.66 Canada

- 7.66.1 Company Overview

- 7.66.2 Key Executives

- 7.66.3 Company snapshot

- 7.66.4 Active Business Divisions

- 7.66.5 Product portfolio

- 7.66.6 Business performance

- 7.66.7 Major Strategic Initiatives and Developments

- 7.67 US

- 7.67.1 Company Overview

- 7.67.2 Key Executives

- 7.67.3 Company snapshot

- 7.67.4 Active Business Divisions

- 7.67.5 Product portfolio

- 7.67.6 Business performance

- 7.67.7 Major Strategic Initiatives and Developments

- 7.68 Europe

- 7.68.1 Company Overview

- 7.68.2 Key Executives

- 7.68.3 Company snapshot

- 7.68.4 Active Business Divisions

- 7.68.5 Product portfolio

- 7.68.6 Business performance

- 7.68.7 Major Strategic Initiatives and Developments

- 7.69 Germany

- 7.69.1 Company Overview

- 7.69.2 Key Executives

- 7.69.3 Company snapshot

- 7.69.4 Active Business Divisions

- 7.69.5 Product portfolio

- 7.69.6 Business performance

- 7.69.7 Major Strategic Initiatives and Developments

- 7.70 UK

- 7.70.1 Company Overview

- 7.70.2 Key Executives

- 7.70.3 Company snapshot

- 7.70.4 Active Business Divisions

- 7.70.5 Product portfolio

- 7.70.6 Business performance

- 7.70.7 Major Strategic Initiatives and Developments

- 7.71 France

- 7.71.1 Company Overview

- 7.71.2 Key Executives

- 7.71.3 Company snapshot

- 7.71.4 Active Business Divisions

- 7.71.5 Product portfolio

- 7.71.6 Business performance

- 7.71.7 Major Strategic Initiatives and Developments

- 7.72 South America

- 7.72.1 Company Overview

- 7.72.2 Key Executives

- 7.72.3 Company snapshot

- 7.72.4 Active Business Divisions

- 7.72.5 Product portfolio

- 7.72.6 Business performance

- 7.72.7 Major Strategic Initiatives and Developments

- 7.73 Middle East and Africa

- 7.73.1 Company Overview

- 7.73.2 Key Executives

- 7.73.3 Company snapshot

- 7.73.4 Active Business Divisions

- 7.73.5 Product portfolio

- 7.73.6 Business performance

- 7.73.7 Major Strategic Initiatives and Developments

- 7.74 By End-user Insights

- 7.74.1 Company Overview

- 7.74.2 Key Executives

- 7.74.3 Company snapshot

- 7.74.4 Active Business Divisions

- 7.74.5 Product portfolio

- 7.74.6 Business performance

- 7.74.7 Major Strategic Initiatives and Developments

- 7.75 The commercial segment is estimated to witness significant growth during the forecast period. The increasing demand for energy-efficient appliances and the need for high-performance

- 7.75.1 Company Overview

- 7.75.2 Key Executives

- 7.75.3 Company snapshot

- 7.75.4 Active Business Divisions

- 7.75.5 Product portfolio

- 7.75.6 Business performance

- 7.75.7 Major Strategic Initiatives and Developments

- 7.76 low-maintenance fans in both residential and commercial buildings are significant factors fueling market growth. BLDC fans

- 7.76.1 Company Overview

- 7.76.2 Key Executives

- 7.76.3 Company snapshot

- 7.76.4 Active Business Divisions

- 7.76.5 Product portfolio

- 7.76.6 Business performance

- 7.76.7 Major Strategic Initiatives and Developments

- 7.77 with their permanent magnets

- 7.77.1 Company Overview

- 7.77.2 Key Executives

- 7.77.3 Company snapshot

- 7.77.4 Active Business Divisions

- 7.77.5 Product portfolio

- 7.77.6 Business performance

- 7.77.7 Major Strategic Initiatives and Developments

- 7.78 smart features

- 7.78.1 Company Overview

- 7.78.2 Key Executives

- 7.78.3 Company snapshot

- 7.78.4 Active Business Divisions

- 7.78.5 Product portfolio

- 7.78.6 Business performance

- 7.78.7 Major Strategic Initiatives and Developments

- 7.79 and energy efficiency

- 7.79.1 Company Overview

- 7.79.2 Key Executives

- 7.79.3 Company snapshot

- 7.79.4 Active Business Divisions

- 7.79.5 Product portfolio

- 7.79.6 Business performance

- 7.79.7 Major Strategic Initiatives and Developments

- 7.80 are becoming increasingly popular alternatives to AC motor equivalents in various environments. In the residential sector

- 7.80.1 Company Overview

- 7.80.2 Key Executives

- 7.80.3 Company snapshot

- 7.80.4 Active Business Divisions

- 7.80.5 Product portfolio

- 7.80.6 Business performance

- 7.80.7 Major Strategic Initiatives and Developments

- 7.81 these fans offer utility

- 7.81.1 Company Overview

- 7.81.2 Key Executives

- 7.81.3 Company snapshot

- 7.81.4 Active Business Divisions

- 7.81.5 Product portfolio

- 7.81.6 Business performance

- 7.81.7 Major Strategic Initiatives and Developments

- 7.82 aesthetic appeal

- 7.82.1 Company Overview

- 7.82.2 Key Executives

- 7.82.3 Company snapshot

- 7.82.4 Active Business Divisions

- 7.82.5 Product portfolio

- 7.82.6 Business performance

- 7.82.7 Major Strategic Initiatives and Developments

- 7.83 and smart home integration

- 7.83.1 Company Overview

- 7.83.2 Key Executives

- 7.83.3 Company snapshot

- 7.83.4 Active Business Divisions

- 7.83.5 Product portfolio

- 7.83.6 Business performance

- 7.83.7 Major Strategic Initiatives and Developments

- 7.84 while in commercial and industrial settings

- 7.84.1 Company Overview

- 7.84.2 Key Executives

- 7.84.3 Company snapshot

- 7.84.4 Active Business Divisions

- 7.84.5 Product portfolio

- 7.84.6 Business performance

- 7.84.7 Major Strategic Initiatives and Developments

- 7.85 they contribute to sustainable living and reduced carbon footprint.

- 7.85.1 Company Overview

- 7.85.2 Key Executives

- 7.85.3 Company snapshot

- 7.85.4 Active Business Divisions

- 7.85.5 Product portfolio

- 7.85.6 Business performance

- 7.85.7 Major Strategic Initiatives and Developments

- 7.86 BLDC Fan Market Size

- 7.86.1 Company Overview

- 7.86.2 Key Executives

- 7.86.3 Company snapshot

- 7.86.4 Active Business Divisions

- 7.86.5 Product portfolio

- 7.86.6 Business performance

- 7.86.7 Major Strategic Initiatives and Developments

- 7.87 Get a glance at the market report of share of various segments Request Free Sample

- 7.87.1 Company Overview

- 7.87.2 Key Executives

- 7.87.3 Company snapshot

- 7.87.4 Active Business Divisions

- 7.87.5 Product portfolio

- 7.87.6 Business performance

- 7.87.7 Major Strategic Initiatives and Developments

- 7.88 The commercial segment was valued at USD 1.22 billion in 2019 and showed a gradual increase during the forecast period.

- 7.88.1 Company Overview

- 7.88.2 Key Executives

- 7.88.3 Company snapshot

- 7.88.4 Active Business Divisions

- 7.88.5 Product portfolio

- 7.88.6 Business performance

- 7.88.7 Major Strategic Initiatives and Developments

- 7.89 Regional Analysis

- 7.89.1 Company Overview

- 7.89.2 Key Executives

- 7.89.3 Company snapshot

- 7.89.4 Active Business Divisions

- 7.89.5 Product portfolio

- 7.89.6 Business performance

- 7.89.7 Major Strategic Initiatives and Developments

- 7.90 APAC is estimated to contribute 63% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. The market in APAC holds a significant share due to the high demand In the commercial sector

- 7.90.1 Company Overview

- 7.90.2 Key Executives

- 7.90.3 Company snapshot

- 7.90.4 Active Business Divisions

- 7.90.5 Product portfolio

- 7.90.6 Business performance

- 7.90.7 Major Strategic Initiatives and Developments

- 7.91 driven by the manufacturing of industrial electronic equipment in countries like China

- 7.91.1 Company Overview

- 7.91.2 Key Executives

- 7.91.3 Company snapshot

- 7.91.4 Active Business Divisions

- 7.91.5 Product portfolio

- 7.91.6 Business performance

- 7.91.7 Major Strategic Initiatives and Developments

- 7.92 Japan

- 7.92.1 Company Overview

- 7.92.2 Key Executives

- 7.92.3 Company snapshot

- 7.92.4 Active Business Divisions

- 7.92.5 Product portfolio

- 7.92.6 Business performance

- 7.92.7 Major Strategic Initiatives and Developments

- 7.93 Vietnam

- 7.93.1 Company Overview

- 7.93.2 Key Executives

- 7.93.3 Company snapshot

- 7.93.4 Active Business Divisions

- 7.93.5 Product portfolio

- 7.93.6 Business performance

- 7.93.7 Major Strategic Initiatives and Developments

- 7.94 and India. Additionally

- 7.94.1 Company Overview

- 7.94.2 Key Executives

- 7.94.3 Company snapshot

- 7.94.4 Active Business Divisions

- 7.94.5 Product portfolio

- 7.94.6 Business performance

- 7.94.7 Major Strategic Initiatives and Developments

- 7.95 the need for cooling solutions in residential applications in temperate countries withIn the region

- 7.95.1 Company Overview

- 7.95.2 Key Executives

- 7.95.3 Company snapshot

- 7.95.4 Active Business Divisions

- 7.95.5 Product portfolio

- 7.95.6 Business performance

- 7.95.7 Major Strategic Initiatives and Developments

- 7.96 such as those reaching up to 55 degrees C during summer

- 7.96.1 Company Overview

- 7.96.2 Key Executives

- 7.96.3 Company snapshot

- 7.96.4 Active Business Divisions

- 7.96.5 Product portfolio

- 7.96.6 Business performance

- 7.96.7 Major Strategic Initiatives and Developments

- 7.97 will further fuel market growth. Energy-efficient appliances

- 7.97.1 Company Overview

- 7.97.2 Key Executives

- 7.97.3 Company snapshot

- 7.97.4 Active Business Divisions

- 7.97.5 Product portfolio

- 7.97.6 Business performance

- 7.97.7 Major Strategic Initiatives and Developments

- 7.98 cooling systems

- 7.98.1 Company Overview

- 7.98.2 Key Executives

- 7.98.3 Company snapshot

- 7.98.4 Active Business Divisions

- 7.98.5 Product portfolio

- 7.98.6 Business performance

- 7.98.7 Major Strategic Initiatives and Developments

- 7.99 residential and commercial buildings

- 7.99.1 Company Overview

- 7.99.2 Key Executives

- 7.99.3 Company snapshot

- 7.99.4 Active Business Divisions

- 7.99.5 Product portfolio

- 7.99.6 Business performance

- 7.99.7 Major Strategic Initiatives and Developments

- 7.100 and various industries

- 7.100.1 Company Overview

- 7.100.2 Key Executives

- 7.100.3 Company snapshot

- 7.100.4 Active Business Divisions

- 7.100.5 Product portfolio

- 7.100.6 Business performance

- 7.100.7 Major Strategic Initiatives and Developments

- 7.101 including HVAC systems

- 7.101.1 Company Overview

- 7.101.2 Key Executives

- 7.101.3 Company snapshot

- 7.101.4 Active Business Divisions

- 7.101.5 Product portfolio

- 7.101.6 Business performance

- 7.101.7 Major Strategic Initiatives and Developments

- 7.102 refrigeration equipment

- 7.102.1 Company Overview

- 7.102.2 Key Executives

- 7.102.3 Company snapshot

- 7.102.4 Active Business Divisions

- 7.102.5 Product portfolio

- 7.102.6 Business performance

- 7.102.7 Major Strategic Initiatives and Developments

- 7.103 industrial machinery

- 7.103.1 Company Overview

- 7.103.2 Key Executives

- 7.103.3 Company snapshot

- 7.103.4 Active Business Divisions

- 7.103.5 Product portfolio

- 7.103.6 Business performance

- 7.103.7 Major Strategic Initiatives and Developments

- 7.104 high-performance computing systems

- 7.104.1 Company Overview

- 7.104.2 Key Executives

- 7.104.3 Company snapshot

- 7.104.4 Active Business Divisions

- 7.104.5 Product portfolio

- 7.104.6 Business performance

- 7.104.7 Major Strategic Initiatives and Developments

- 7.105 servers

- 7.105.1 Company Overview

- 7.105.2 Key Executives

- 7.105.3 Company snapshot

- 7.105.4 Active Business Divisions

- 7.105.5 Product portfolio

- 7.105.6 Business performance

- 7.105.7 Major Strategic Initiatives and Developments

- 7.106 data centers

- 7.106.1 Company Overview

- 7.106.2 Key Executives

- 7.106.3 Company snapshot

- 7.106.4 Active Business Divisions

- 7.106.5 Product portfolio

- 7.106.6 Business performance

- 7.106.7 Major Strategic Initiatives and Developments

- 7.107 and domestic and commercial segments

- 7.107.1 Company Overview

- 7.107.2 Key Executives

- 7.107.3 Company snapshot

- 7.107.4 Active Business Divisions

- 7.107.5 Product portfolio

- 7.107.6 Business performance

- 7.107.7 Major Strategic Initiatives and Developments

- 7.108 increasingly utilize BLDC fans due to their energy efficiency

- 7.108.1 Company Overview

- 7.108.2 Key Executives

- 7.108.3 Company snapshot

- 7.108.4 Active Business Divisions

- 7.108.5 Product portfolio

- 7.108.6 Business performance

- 7.108.7 Major Strategic Initiatives and Developments

- 7.109 smart features

- 7.109.1 Company Overview

- 7.109.2 Key Executives

- 7.109.3 Company snapshot

- 7.109.4 Active Business Divisions

- 7.109.5 Product portfolio

- 7.109.6 Business performance

- 7.109.7 Major Strategic Initiatives and Developments

- 7.110 and low noise levels.

- 7.110.1 Company Overview

- 7.110.2 Key Executives

- 7.110.3 Company snapshot

- 7.110.4 Active Business Divisions

- 7.110.5 Product portfolio

- 7.110.6 Business performance

- 7.110.7 Major Strategic Initiatives and Developments

- 7.111 BLDC Fan Market Share by Geography

- 7.111.1 Company Overview

- 7.111.2 Key Executives

- 7.111.3 Company snapshot

- 7.111.4 Active Business Divisions

- 7.111.5 Product portfolio

- 7.111.6 Business performance

- 7.111.7 Major Strategic Initiatives and Developments

- 7.112 For more insights on the market size of various regions

- 7.112.1 Company Overview

- 7.112.2 Key Executives

- 7.112.3 Company snapshot

- 7.112.4 Active Business Divisions

- 7.112.5 Product portfolio

- 7.112.6 Business performance

- 7.112.7 Major Strategic Initiatives and Developments

- 7.113 Request Free Sample

- 7.113.1 Company Overview

- 7.113.2 Key Executives

- 7.113.3 Company snapshot

- 7.113.4 Active Business Divisions

- 7.113.5 Product portfolio

- 7.113.6 Business performance

- 7.113.7 Major Strategic Initiatives and Developments

- 7.114 BLDC fans

- 7.114.1 Company Overview

- 7.114.2 Key Executives

- 7.114.3 Company snapshot

- 7.114.4 Active Business Divisions

- 7.114.5 Product portfolio

- 7.114.6 Business performance

- 7.114.7 Major Strategic Initiatives and Developments

- 7.115 with their permanent magnets

- 7.115.1 Company Overview

- 7.115.2 Key Executives

- 7.115.3 Company snapshot

- 7.115.4 Active Business Divisions

- 7.115.5 Product portfolio

- 7.115.6 Business performance

- 7.115.7 Major Strategic Initiatives and Developments

- 7.116 motor control

- 7.116.1 Company Overview

- 7.116.2 Key Executives

- 7.116.3 Company snapshot

- 7.116.4 Active Business Divisions

- 7.116.5 Product portfolio

- 7.116.6 Business performance

- 7.116.7 Major Strategic Initiatives and Developments

- 7.117 and smart home systems integration

- 7.117.1 Company Overview

- 7.117.2 Key Executives

- 7.117.3 Company snapshot

- 7.117.4 Active Business Divisions

- 7.117.5 Product portfolio

- 7.117.6 Business performance

- 7.117.7 Major Strategic Initiatives and Developments

- 7.118 offer advantages such as high-performance

- 7.118.1 Company Overview

- 7.118.2 Key Executives

- 7.118.3 Company snapshot

- 7.118.4 Active Business Divisions

- 7.118.5 Product portfolio

- 7.118.6 Business performance

- 7.118.7 Major Strategic Initiatives and Developments

- 7.119 long lifespan

- 7.119.1 Company Overview

- 7.119.2 Key Executives

- 7.119.3 Company snapshot

- 7.119.4 Active Business Divisions

- 7.119.5 Product portfolio

- 7.119.6 Business performance

- 7.119.7 Major Strategic Initiatives and Developments

- 7.120 smart home appliances

- 7.120.1 Company Overview

- 7.120.2 Key Executives

- 7.120.3 Company snapshot

- 7.120.4 Active Business Divisions

- 7.120.5 Product portfolio

- 7.120.6 Business performance

- 7.120.7 Major Strategic Initiatives and Developments

- 7.121 and sustainable living. The market is expected to grow as governments prioritize sustainable development and energy efficiency norms

- 7.121.1 Company Overview

- 7.121.2 Key Executives

- 7.121.3 Company snapshot

- 7.121.4 Active Business Divisions

- 7.121.5 Product portfolio

- 7.121.6 Business performance

- 7.121.7 Major Strategic Initiatives and Developments

- 7.122 and as construction materials

- 7.122.1 Company Overview

- 7.122.2 Key Executives

- 7.122.3 Company snapshot

- 7.122.4 Active Business Divisions

- 7.122.5 Product portfolio

- 7.122.6 Business performance

- 7.122.7 Major Strategic Initiatives and Developments

- 7.123 design aesthetics

- 7.123.1 Company Overview

- 7.123.2 Key Executives

- 7.123.3 Company snapshot

- 7.123.4 Active Business Divisions

- 7.123.5 Product portfolio

- 7.123.6 Business performance

- 7.123.7 Major Strategic Initiatives and Developments

- 7.124 and performance standards evolve.

- 7.124.1 Company Overview

- 7.124.2 Key Executives

- 7.124.3 Company snapshot

- 7.124.4 Active Business Divisions

- 7.124.5 Product portfolio

- 7.124.6 Business performance

- 7.124.7 Major Strategic Initiatives and Developments

- 7.125 Market Dynamics

- 7.125.1 Company Overview

- 7.125.2 Key Executives

- 7.125.3 Company snapshot

- 7.125.4 Active Business Divisions

- 7.125.5 Product portfolio

- 7.125.6 Business performance

- 7.125.7 Major Strategic Initiatives and Developments

- 7.126 Our researchers analyzed the data with 2024 as the base year

- 7.126.1 Company Overview

- 7.126.2 Key Executives

- 7.126.3 Company snapshot

- 7.126.4 Active Business Divisions

- 7.126.5 Product portfolio

- 7.126.6 Business performance

- 7.126.7 Major Strategic Initiatives and Developments

- 7.127 along with the key drivers

- 7.127.1 Company Overview

- 7.127.2 Key Executives

- 7.127.3 Company snapshot

- 7.127.4 Active Business Divisions

- 7.127.5 Product portfolio

- 7.127.6 Business performance

- 7.127.7 Major Strategic Initiatives and Developments

- 7.128 trends

- 7.128.1 Company Overview

- 7.128.2 Key Executives

- 7.128.3 Company snapshot

- 7.128.4 Active Business Divisions

- 7.128.5 Product portfolio

- 7.128.6 Business performance

- 7.128.7 Major Strategic Initiatives and Developments

- 7.129 and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

- 7.129.1 Company Overview

- 7.129.2 Key Executives

- 7.129.3 Company snapshot

- 7.129.4 Active Business Divisions

- 7.129.5 Product portfolio

- 7.129.6 Business performance

- 7.129.7 Major Strategic Initiatives and Developments

- 7.130 What are the key market drivers leading to the rise In the adoption of BLDC Fan Industry?

- 7.130.1 Company Overview

- 7.130.2 Key Executives

- 7.130.3 Company snapshot

- 7.130.4 Active Business Divisions

- 7.130.5 Product portfolio

- 7.130.6 Business performance

- 7.130.7 Major Strategic Initiatives and Developments

- 7.131 Growing demand for energy-efficient electrical fans is the key driver of the market. BLDC fans

- 7.131.1 Company Overview

- 7.131.2 Key Executives

- 7.131.3 Company snapshot

- 7.131.4 Active Business Divisions

- 7.131.5 Product portfolio

- 7.131.6 Business performance

- 7.131.7 Major Strategic Initiatives and Developments

- 7.132 also known as Brushless Direct Current fans

- 7.132.1 Company Overview

- 7.132.2 Key Executives

- 7.132.3 Company snapshot

- 7.132.4 Active Business Divisions

- 7.132.5 Product portfolio

- 7.132.6 Business performance

- 7.132.7 Major Strategic Initiatives and Developments

- 7.133 are gaining popularity in various industries due to their energy efficiency and compact size. In the market for cooling systems

- 7.133.1 Company Overview

- 7.133.2 Key Executives

- 7.133.3 Company snapshot

- 7.133.4 Active Business Divisions

- 7.133.5 Product portfolio

- 7.133.6 Business performance

- 7.133.7 Major Strategic Initiatives and Developments

- 7.134 BLDC fans are increasingly used in both residential and commercial buildings

- 7.134.1 Company Overview

- 7.134.2 Key Executives

- 7.134.3 Company snapshot

- 7.134.4 Active Business Divisions

- 7.134.5 Product portfolio

- 7.134.6 Business performance

- 7.134.7 Major Strategic Initiatives and Developments

- 7.135 as well as in industrial machinery and high-performance computing systems. Compared to Alternating Current fans

- 7.135.1 Company Overview

- 7.135.2 Key Executives

- 7.135.3 Company snapshot

- 7.135.4 Active Business Divisions

- 7.135.5 Product portfolio

- 7.135.6 Business performance

- 7.135.7 Major Strategic Initiatives and Developments

- 7.136 BLDC fans offer several advantages

- 7.136.1 Company Overview

- 7.136.2 Key Executives