Global Blockchain in Insurance Market Size, Share & Trends Analysis Report, Forecast Period, 2024-2031

Report ID: MS-206 | Business finance | Last updated: Dec, 2024 | Formats*:

Blockchain in Insurance Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2031 |

| Base Year Of Estimation | 2023 |

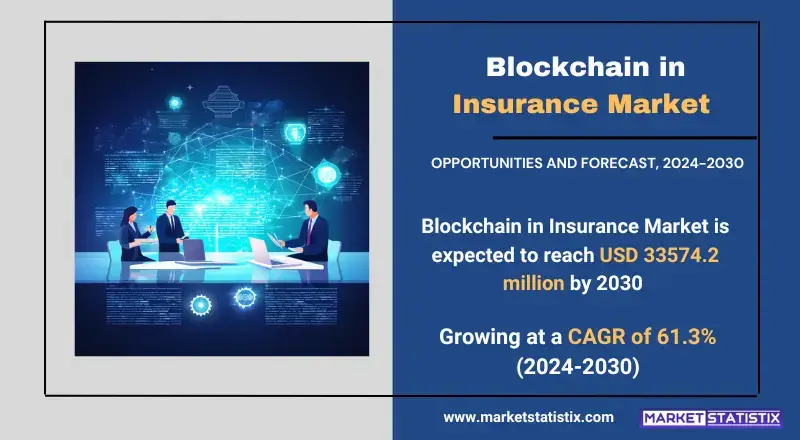

| Growth Rate | CAGR of 61.3% |

| Forecast Value (2031) | USD 33574.2 Million |

| Key Market Players |

|

| By Region |

Blockchain in Insurance Market Trends

Some crucial factors would be the ability of the blockchain technology to restrict fraud with immutable ledgers, speed up claims processing, and improve transparency. The advent of smart contracts with additional features enabling their integration with IoT devices would alter the performance landscape, enabling faster settlements, improved risk assessments, and the creation of personalised insurance models. Decentralised insurance services and tokenisation of assets are emerging areas directed towards cost efficiency and innovation. Technological innovation, from blockchain interoperability and the integration of AI to solutions focusing on privacy, is shaking the industry. Indeed, companies like Allianz use the platform to process claims across borders in a very efficient manner. Regionally, North America will have the bigger chunk of the market this year, while Asia-Pacific emerges as the fastest-growing region as digitisation and regulatory reforms in insurance continue to gain momentum. These advances are now being followed by the critical considerations of the industry's future, which are cybersecurity risks and new demands for conformity.Blockchain in Insurance Market Leading Players

The key players profiled in the report are B3i (Switzerland), ChainThat (U.K.), CONSENSYS (U.S.), Deloitte (U.S.), Etherisc (Germany), Guardtime (Estonia), IBM Corporation (U.S.), IntellectEU, Inc. (U.S.), Teambrella (U.S.), Tierion (U.S.)Growth Accelerators

The primary demand for the adoption of blockchain technology in the insurance market is traced to the requirements of increasing transparency and efficiency across the entire insurance value chain. The classical process of insurance often involves a lot of paperwork, long processing periods, and risks of fraud. This technology is designed to build a decentralised, tamper-proof ledger to enhance the security of data, reduce fraud, and facilitate claims processing. The capability to automate most of the processes using smart contracts for eliminating the envelope reduces costs and enhances customer experience, which makes it very attractive to insurers. Another factor driving all this is the increased adoption of blockchain in fraud prevention and regulatory compliance enhancement. It is common knowledge that insurance companies incur billions of losses annually due to false claims, and fraud has therefore become one of the gravest challenges in the insurance industry. Its immutability feature makes sure data cannot be changed to verify the identity of the policyholder or claimant. It would also be of great value to insurers regarding validation claims and the identification of inconsistencies.Blockchain in Insurance Market Segmentation analysis

The Global Blockchain in Insurance is segmented by Application, and Region. . The Application segment categorizes the market based on its usage such as GRC Management, Claims Management, Identity Management and Fraud Detection, Payments, Smart Contracts, Others. Geographically, the market is assessed across key Regions like {regionNms} and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The blockchain in insurance profiles has allowed full competition in response to the demands for increased transparency, efficiency, and fraud mitigation among insurance processes. Key participants such as IBM, Microsoft, and Oracle are holding the lights in this sector by means of their powerful technological framework for providing Blockchain-as-a-Service (BaaS)-based solutions for insurance. Startups like Etherisc and ChainThat are starting to focus on micro vertical domains such as parametric insurance or claims automation, thereby finding new and less expensive avenues to challenge established models. Today, partnerships between insurers and tech firms have become a mainstream feature to empower collaboration in aspects such as policy management, claims processing, and risk assessment through blockchain technology. Competitive market forces are regulatory compliance, scalable blockchain solutions, and integration with current legacy systems. Enterprises that could strike a balance between innovation in theory and practical implementation would be really placed to garner that competitive edge.Challenges In Blockchain in Insurance Market

The blockchain insurance market, as a major theme of concern, meets some very pertinent levels of uncertainty in regulation and integration complexities. As these emerging technologies gain ground, the rest of the world continues to lag behind. This causes inconsistency in compliance standards across regions and makes it impractical for insurers to adopt blockchain without exceptions. Most importantly, the industry is moving away from traditional, centralised systems, which pose the challenges of integration. Implementing a really decentralised model on the blockchain needs a huge investment in infrastructure and training, which tends to deter companies from the technology. It is possible to include other challenges under data privacy and scalability. Transparency may be what the industry seeks; however, it brings to light the question of sensitive insurance data, how it will be stored and shared. A delicate balance is required for transparency and confidentiality, and that proves difficult to achieve. Adequate scalability remains an issue since the current blockchain solutions are incapable of underwriting the high transactional businesses of such an insurance business. These problems thus hinder scepticism and understanding on the part of few people as far as blockchain adoption goes.Risks & Prospects in Blockchain in Insurance Market

The blockchain market in the insurance sector is expected to grow rapidly given its aptitude for promoting transparency, reducing fraud, and cutting operational costs. The development of secure and immutable records will make the claims process simple and improve the trust between insured and insurer. The smart contracts may automate the execution of the policy, thus eradicating manual errors resulting in low operational costs. The decentralised nature of blockchain would enable risk-sharing and peer-to-peer insurance model options that are entirely new to innovation concerning insurance product and service engineering. The use of blockchain has been propelled by increasing legal requirements for transparency and security. Insurers can use blockchain for waste-free compliance with regulatory requirements, for example, Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols. In addition, the technology enables real-time data sharing between the parties involved, promoting collaborative improvement of risk analysis.Key Target Audience

The most significant target audience for blockchain in the insurance market will be insurers, policyholders, and regulatory authority personnel themselves. The benefits of operating within blockchain facilities, such as higher efficiency in business operations, reduction of fraud, and streamlined claims processing, have been earmarked for insurers. With the introduction of smart contracts and decentralised ledgers, it becomes possible for insurers to fully automate their processes as concerns the issuance of a policy and settlement of claims, thus enhancing transparency and trust.,, They are policyholders and regulatory bodies. By cutting down administrative costs and reducing fraud, policyholders will benefit from quicker and safer transactions and decreased premiums. Trust is created as customers are able to easily verify policy terms and the process of making claims thanks to the transparency of blockchain. Regulators could also improve their oversight and compliance tracking with the help of blockchain technology and ensure that the industry abides by legal standards while minimising fraud and disputes.Merger and acquisition

The recent trend of mergers and acquisitions in the blockchain insurance industry indicates a strategic movement of integrating advanced and futuristic technologies to effectively heighten operational efficiency and combat fraud. Companies like Allianz and AXA have been targeting these kinds of partnerships and acquisitions specifically to add their blockchain capabilities. For instance, the company, Allianz, acquiring technology firms aims at refining its digital offerings while AXA's earlier forays meant to build the platforms reveal the ongoing pursuit by the industry around this technology in search of solutions for certain barriers, such as insufficient market demand and distribution channels. Increasingly, players optimise efficiencies through this means of merger and collaboration to strengthen technological prowess and product offerings, the critical requirements to overcome the multifaceted challenges arising from regulatory compliance and instilling of customer trust in a rapidly changing digital environment. >Analyst Comment

"It is to be expected that the insurance blockchain market can experience growth, which can be attributed to the innovation and promises of the technology to futureproof the insurance business. It is enhanced security, improved transparency, and effectiveness in claims processing, underwriting, and reinsurance. With the smart contract and decentralised ledger mechanism, the blockchain should be able to automate tasks, reduce fraud, and improve the customer experience. Due to the immature status of the market, many insurance companies and start-ups have been seen to make attempts to explore blockchain solutions. As technology matures and regulatory frameworks develop, it is expected that adoption will also grow, leading to market growth and innovative avenues for development."- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Blockchain in Insurance- Snapshot

- 2.2 Blockchain in Insurance- Segment Snapshot

- 2.3 Blockchain in Insurance- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Blockchain in Insurance Market by Application / by End Use

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 GRC Management

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Claims Management

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Identity Management and Fraud Detection

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Payments

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

- 4.6 Smart Contracts

- 4.6.1 Key market trends, factors driving growth, and opportunities

- 4.6.2 Market size and forecast, by region

- 4.6.3 Market share analysis by country

- 4.7 Others

- 4.7.1 Key market trends, factors driving growth, and opportunities

- 4.7.2 Market size and forecast, by region

- 4.7.3 Market share analysis by country

5: Blockchain in Insurance Market by Provider

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Application and Solution Provider

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Middleware Provider

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Infrastructure and Protocols Provider

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

6: Blockchain in Insurance Market by Enterprise Type

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 SMEs

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 Large Enterprises

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

7: Competitive Landscape

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 B3i (Switzerland)

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 ChainThat (U.K.)

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 CONSENSYS (U.S.)

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 Deloitte (U.S.)

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Etherisc (Germany)

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Guardtime (Estonia)

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 IBM Corporation (U.S.)

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 IntellectEU

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 Inc. (U.S.)

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 Teambrella (U.S.)

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

- 8.11 Tierion (U.S.)

- 8.11.1 Company Overview

- 8.11.2 Key Executives

- 8.11.3 Company snapshot

- 8.11.4 Active Business Divisions

- 8.11.5 Product portfolio

- 8.11.6 Business performance

- 8.11.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Application |

|

By Provider |

|

By Enterprise Type |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Blockchain in Insurance in 2031?

+

-

What is the growth rate of Blockchain in Insurance Market?

+

-

What are the latest trends influencing the Blockchain in Insurance Market?

+

-

Who are the key players in the Blockchain in Insurance Market?

+

-

How is the Blockchain in Insurance } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Blockchain in Insurance Market Study?

+

-

What geographic breakdown is available in Global Blockchain in Insurance Market Study?

+

-

Which region holds the second position by market share in the Blockchain in Insurance market?

+

-

Which region holds the highest growth rate in the Blockchain in Insurance market?

+

-

How are the key players in the Blockchain in Insurance market targeting growth in the future?

+

-