Global Blockchain in Retail Banking Market - Industry Dynamics, Market Size, And Opportunity Forecast To 2030

Report ID: MS-2245 | Business finance | Last updated: Dec, 2024 | Formats*:

Blockchain in retail Banking Report Highlights

| Report Metrics | Details |

|---|---|

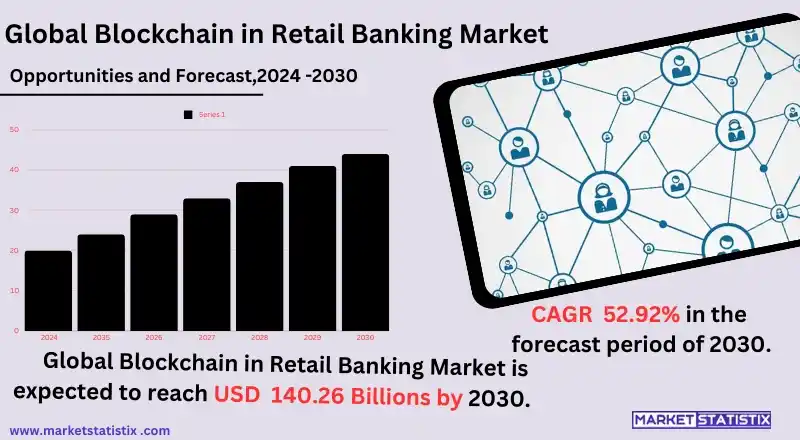

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2023 |

| Growth Rate | CAGR of 52.92% |

| Forecast Value (2030) | USD 140.26 Billion |

| By Product Type | Public, Private, Hybrid, Component Outlook (R |

| Key Market Players |

|

| By Region |

|

Blockchain in retail Banking Market Trends

Accessing your blockchain in retail banking markets means entering a new dimension in ushering the financial industry with security and transparency for transactions. Most retail banks are accepting the adoption of blockchain technology to enable streamlined payments, combat fraud, and take customer data security to a different level. Because of this decentralisation, such transactions can now be validated and made auditable in real time; hence, it is being linked to such applications as cross-border payments, digital wallets, and even identity management. Banks are heaving under increased demand for more secure and quicker solutions, which makes financial institutions look to blockchain's competitive edge and thus increases customers' trust. It is the coalescence of blockchain with artificial intelligence (AI) and other emerging innovations that markedly complements trends in the banking industry. These are institutions that lend their creative powers to innovation in re-engineering operations through the use of smart contracts in automating processes such as loan approvals, insurance claims processing, and funds transfers with little human intervention, resulting in increased operational efficiency. Additionally, recognition is growing on how processing overhead costs can drop with blockchain by eliminating intermediaries and automating back-office functions.Blockchain in retail Banking Market Leading Players

The key players profiled in the report are Unicsoft, Accenture plc, Cognizant technology solutions corp., International Business Machines Corporation (IBM), Microsoft Corporation, Digital Asset Holdings, LLC, Tata Consultancy Services (TCS), Axoni (SCHVEY, INC.), Ping An Insurance (Group) Company of China, Ltd., Santander Bank, N. A., Sofocle Technologies (Uttar Pradesh, India), Capgemini SE (Paris, France)Growth Accelerators

The major market drivers of retail banking professionals within the framework of blockchain are heightened security and a decline in fraud. Being decentralised and immutable, the fruits of blockchain technology operate in such a way as to provide safe and visible transactions regardless of any fraudulent act like a cyberattack. Retail banks will increasingly use blockchain as a means of doing away with shadows of security protocols and heightening customer brands with the improved sophistication of cyber threats. It has additional attractiveness in potentially reducing transaction costs and fast cross-border payments, making traditional banking institutions more superior. Operational efficiency and cost reduction seem to be other key drivers. Blockchain allows an automated model, real-time transactions made with smart contracts, which can eliminate the need for intermediaries and hence manual processing, and thereby reduce indirect administrative costs. Also, now speed and accuracy of operations are heightened because of efficiency, which is much demanded in retail banking, as the customer expects it to be faster.Blockchain in retail Banking Market Segmentation analysis

The Global Blockchain in retail Banking is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Public, Private, Hybrid, Component Outlook (R . The Application segment categorizes the market based on its usage such as Remittances, KYC & Fraud Prevention, Risk Assessment, Billing Transaction Processing. Geographically, the market is assessed across key Regions like North America(United States, Canada, Mexico), South America(Brazil, Argentina, Chile, Rest of South America), Europe(Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific(China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA(Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The competition patterns within retail banking of blockchain are made with the presence of the banking structures, technology powerhouses, and innovative fintech startups. Investment in emerging technology was highly endorsed by major banks and financial services providers to incorporate but further integrate different aspects of their operations with low-cost blockchain applications for payments, identity verification, and fraud prevention purposes. For instance, banks that are major in this area include JPMorgan, HSBC, Bank of America, etc. These banks all have either developed their internal proprietary technology or partnered with external companies that have developed blockchain technologies for their institutions. Apart from that, intra-fintech competition is emerging as strong contenders through solutions that offer blockchain-based delivery services tailored for the retail banking sector, such as decentralised finance (DeFi) and blockchain-enabled lending platforms.Challenges In Blockchain in retail Banking Market

The blockchain in the retail banking market faces several regulatory and compliance challenges, often causing actions within decentralised networks. There are many privacy, data protection, and anti-money laundering regulations that are not perfectly compatible with existing financial legislation and standards. In this regard, banks and financial institutions must ensure that an appropriate system for blockchain is developed and deployed within the framework of local and global regulatory frameworks, which, of course, differ from region to region. Another significant challenge in retail banking is the scalability and integration of blockchain technologies into existing banking infrastructure. Often retail banks will rely on legacy systems, and integrating blockchain could prove expensive both in terms of time and resources. Moreover, the decentralised nature of blockchain might result in lower transaction speeds and higher costs for large-scale transactions, rendering it less efficient than traditional banking systems.Risks & Prospects in Blockchain in retail Banking Market

Market opportunities in retail banking include increased transparency, security, and efficiency in transactional processes by blockchain. Blockchain can be used for the faster, cheaper, and more efficient way of processing payments, reducing fraudulent activities, and lowering operational costs. Retail banks may consider using blockchains for cross-border payments in offering swift and economical solutions for money transfer across countries for both individuals and businesses. Smart contracts facilitating automated procedures in banking, such as loan agreements and repayments, are important from the viewpoint of improving customer experience as well as operational efficiency. In addition, it enables the tokenisation of assets such as real estate or securities, enabling fractional ownership and consequently greater access to investment opportunities. Also, DeFi has opened a new frontier, as blockchain displaces traditional banking while lending, borrowing, and trading take place outside of the traditional banking environment, thus innovating new revenue streams and business models for retail banks.Key Target Audience

The primary target audience of the blockchain in the retail banking market includes retail banks and financial institutions that would focus on enhancing the efficiency, security, and transparency of their operations. Such institutions adopt blockchain technology for the above purposes as well as in streamlining processes, including payment, cross-border transactions, and identity verification. Further, it decreases fraud and reduces operation costs. Besides, blockchain enables better customer reliability with a decentralised and immutable record of transactions that becomes highly alluring to banks intending to modernise their systems and offer innovative financial products.,, An equally important audience segment comprises technology and fintech companies that develop and deploy blockchain-based solutions for banking applications. These companies develop blockchain platforms, software, and tools that enable retail banks to further integrate blockchain enforcement into their existing infrastructures.Merger and acquisition

The present M&A scenario of the blockchain in retail banking markets has been transformed into an array of strategic moves that seek to increase the market reach through technological advancements. Most notable of these moves occurred in July 2021, when ICICI Bank, HDFC Bank, and Axis Bank pooled their resources into appointing IBBIC Pvt Ltd to enhance their stake in blockchain technology for the use of digitising trade finance processes. The merger would completely revolutionise the banking process that is stuck in legacy systems, where it would make the use of blockchain significantly higher in the area of efficiency and security in retail banking transactions. Furthermore, the acquisition of a controlling interest in Crypto Finance AG for $108.6 million by Deutsche Börse in June 2021 adds to the trend of integrating blockchain solutions by financial institutions in the effort of expanding their digital asset offerings towards the future. These mainly comprise IBM, Amazon Web Services, and Microsoft, and these companies are immersing themselves in partnerships and acquisitions in order to solidify their presence within the industry. Rising interests in cryptocurrency and other digital payment solutions are always in the news and now drive companies to offer more innovative ways to leverage the technology, like smart contracts and secured means of transacting. >Analyst Comment

"The Blockchain in Retail Banking Market is experiencing rapid growth due to the increasing adoption of blockchain technology across various industries. This market is driven by the need for secure, efficient, and transparent solutions to address challenges in traditional banking operations. Blockchain offers a transformative solution by providing a decentralized and immutable ledger that can streamline processes, reduce costs, and enhance security."- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Blockchain in retail Banking- Snapshot

- 2.2 Blockchain in retail Banking- Segment Snapshot

- 2.3 Blockchain in retail Banking- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Blockchain in retail Banking Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Public

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Private

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Hybrid

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Component Outlook (R

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

5: Blockchain in retail Banking Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Remittances

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 KYC & Fraud Prevention

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Risk Assessment

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Billing Transaction Processing

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

6: Blockchain in retail Banking Market by Retail Platform

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 Bitcoin

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 Ripple

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

- 6.4 Ethereum

- 6.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.2 Market size and forecast, by region

- 6.4.3 Market share analysis by country

- 6.5 R3 Corda

- 6.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.2 Market size and forecast, by region

- 6.5.3 Market share analysis by country

7: Blockchain in retail Banking Market by Region

- 7.1 Overview

- 7.1.1 Market size and forecast By Region

- 7.2 North America

- 7.2.1 Key trends and opportunities

- 7.2.2 Market size and forecast, by Type

- 7.2.3 Market size and forecast, by Application

- 7.2.4 Market size and forecast, by country

- 7.2.4.1 United States

- 7.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.1.2 Market size and forecast, by Type

- 7.2.4.1.3 Market size and forecast, by Application

- 7.2.4.2 Canada

- 7.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.2.2 Market size and forecast, by Type

- 7.2.4.2.3 Market size and forecast, by Application

- 7.2.4.3 Mexico

- 7.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.3.2 Market size and forecast, by Type

- 7.2.4.3.3 Market size and forecast, by Application

- 7.2.4.1 United States

- 7.3 South America

- 7.3.1 Key trends and opportunities

- 7.3.2 Market size and forecast, by Type

- 7.3.3 Market size and forecast, by Application

- 7.3.4 Market size and forecast, by country

- 7.3.4.1 Brazil

- 7.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.1.2 Market size and forecast, by Type

- 7.3.4.1.3 Market size and forecast, by Application

- 7.3.4.2 Argentina

- 7.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.2.2 Market size and forecast, by Type

- 7.3.4.2.3 Market size and forecast, by Application

- 7.3.4.3 Chile

- 7.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.3.2 Market size and forecast, by Type

- 7.3.4.3.3 Market size and forecast, by Application

- 7.3.4.4 Rest of South America

- 7.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.4.2 Market size and forecast, by Type

- 7.3.4.4.3 Market size and forecast, by Application

- 7.3.4.1 Brazil

- 7.4 Europe

- 7.4.1 Key trends and opportunities

- 7.4.2 Market size and forecast, by Type

- 7.4.3 Market size and forecast, by Application

- 7.4.4 Market size and forecast, by country

- 7.4.4.1 Germany

- 7.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.1.2 Market size and forecast, by Type

- 7.4.4.1.3 Market size and forecast, by Application

- 7.4.4.2 France

- 7.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.2.2 Market size and forecast, by Type

- 7.4.4.2.3 Market size and forecast, by Application

- 7.4.4.3 Italy

- 7.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.3.2 Market size and forecast, by Type

- 7.4.4.3.3 Market size and forecast, by Application

- 7.4.4.4 United Kingdom

- 7.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.4.2 Market size and forecast, by Type

- 7.4.4.4.3 Market size and forecast, by Application

- 7.4.4.5 Benelux

- 7.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.5.2 Market size and forecast, by Type

- 7.4.4.5.3 Market size and forecast, by Application

- 7.4.4.6 Nordics

- 7.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.6.2 Market size and forecast, by Type

- 7.4.4.6.3 Market size and forecast, by Application

- 7.4.4.7 Rest of Europe

- 7.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.7.2 Market size and forecast, by Type

- 7.4.4.7.3 Market size and forecast, by Application

- 7.4.4.1 Germany

- 7.5 Asia Pacific

- 7.5.1 Key trends and opportunities

- 7.5.2 Market size and forecast, by Type

- 7.5.3 Market size and forecast, by Application

- 7.5.4 Market size and forecast, by country

- 7.5.4.1 China

- 7.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.1.2 Market size and forecast, by Type

- 7.5.4.1.3 Market size and forecast, by Application

- 7.5.4.2 Japan

- 7.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.2.2 Market size and forecast, by Type

- 7.5.4.2.3 Market size and forecast, by Application

- 7.5.4.3 India

- 7.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.3.2 Market size and forecast, by Type

- 7.5.4.3.3 Market size and forecast, by Application

- 7.5.4.4 South Korea

- 7.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.4.2 Market size and forecast, by Type

- 7.5.4.4.3 Market size and forecast, by Application

- 7.5.4.5 Australia

- 7.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.5.2 Market size and forecast, by Type

- 7.5.4.5.3 Market size and forecast, by Application

- 7.5.4.6 Southeast Asia

- 7.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.6.2 Market size and forecast, by Type

- 7.5.4.6.3 Market size and forecast, by Application

- 7.5.4.7 Rest of Asia-Pacific

- 7.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.7.2 Market size and forecast, by Type

- 7.5.4.7.3 Market size and forecast, by Application

- 7.5.4.1 China

- 7.6 MEA

- 7.6.1 Key trends and opportunities

- 7.6.2 Market size and forecast, by Type

- 7.6.3 Market size and forecast, by Application

- 7.6.4 Market size and forecast, by country

- 7.6.4.1 Middle East

- 7.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.6.4.1.2 Market size and forecast, by Type

- 7.6.4.1.3 Market size and forecast, by Application

- 7.6.4.2 Africa

- 7.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.6.4.2.2 Market size and forecast, by Type

- 7.6.4.2.3 Market size and forecast, by Application

- 7.6.4.1 Middle East

- 8.1 Overview

- 8.2 Key Winning Strategies

- 8.3 Top 10 Players: Product Mapping

- 8.4 Competitive Analysis Dashboard

- 8.5 Market Competition Heatmap

- 8.6 Leading Player Positions, 2022

9: Company Profiles

- 9.1 Unicsoft

- 9.1.1 Company Overview

- 9.1.2 Key Executives

- 9.1.3 Company snapshot

- 9.1.4 Active Business Divisions

- 9.1.5 Product portfolio

- 9.1.6 Business performance

- 9.1.7 Major Strategic Initiatives and Developments

- 9.2 Accenture plc

- 9.2.1 Company Overview

- 9.2.2 Key Executives

- 9.2.3 Company snapshot

- 9.2.4 Active Business Divisions

- 9.2.5 Product portfolio

- 9.2.6 Business performance

- 9.2.7 Major Strategic Initiatives and Developments

- 9.3 Cognizant technology solutions corp.

- 9.3.1 Company Overview

- 9.3.2 Key Executives

- 9.3.3 Company snapshot

- 9.3.4 Active Business Divisions

- 9.3.5 Product portfolio

- 9.3.6 Business performance

- 9.3.7 Major Strategic Initiatives and Developments

- 9.4 International Business Machines Corporation (IBM)

- 9.4.1 Company Overview

- 9.4.2 Key Executives

- 9.4.3 Company snapshot

- 9.4.4 Active Business Divisions

- 9.4.5 Product portfolio

- 9.4.6 Business performance

- 9.4.7 Major Strategic Initiatives and Developments

- 9.5 Microsoft Corporation

- 9.5.1 Company Overview

- 9.5.2 Key Executives

- 9.5.3 Company snapshot

- 9.5.4 Active Business Divisions

- 9.5.5 Product portfolio

- 9.5.6 Business performance

- 9.5.7 Major Strategic Initiatives and Developments

- 9.6 Digital Asset Holdings

- 9.6.1 Company Overview

- 9.6.2 Key Executives

- 9.6.3 Company snapshot

- 9.6.4 Active Business Divisions

- 9.6.5 Product portfolio

- 9.6.6 Business performance

- 9.6.7 Major Strategic Initiatives and Developments

- 9.7 LLC

- 9.7.1 Company Overview

- 9.7.2 Key Executives

- 9.7.3 Company snapshot

- 9.7.4 Active Business Divisions

- 9.7.5 Product portfolio

- 9.7.6 Business performance

- 9.7.7 Major Strategic Initiatives and Developments

- 9.8 Tata Consultancy Services (TCS)

- 9.8.1 Company Overview

- 9.8.2 Key Executives

- 9.8.3 Company snapshot

- 9.8.4 Active Business Divisions

- 9.8.5 Product portfolio

- 9.8.6 Business performance

- 9.8.7 Major Strategic Initiatives and Developments

- 9.9 Axoni (SCHVEY

- 9.9.1 Company Overview

- 9.9.2 Key Executives

- 9.9.3 Company snapshot

- 9.9.4 Active Business Divisions

- 9.9.5 Product portfolio

- 9.9.6 Business performance

- 9.9.7 Major Strategic Initiatives and Developments

- 9.10 INC.)

- 9.10.1 Company Overview

- 9.10.2 Key Executives

- 9.10.3 Company snapshot

- 9.10.4 Active Business Divisions

- 9.10.5 Product portfolio

- 9.10.6 Business performance

- 9.10.7 Major Strategic Initiatives and Developments

- 9.11 Ping An Insurance (Group) Company of China

- 9.11.1 Company Overview

- 9.11.2 Key Executives

- 9.11.3 Company snapshot

- 9.11.4 Active Business Divisions

- 9.11.5 Product portfolio

- 9.11.6 Business performance

- 9.11.7 Major Strategic Initiatives and Developments

- 9.12 Ltd.

- 9.12.1 Company Overview

- 9.12.2 Key Executives

- 9.12.3 Company snapshot

- 9.12.4 Active Business Divisions

- 9.12.5 Product portfolio

- 9.12.6 Business performance

- 9.12.7 Major Strategic Initiatives and Developments

- 9.13 Santander Bank

- 9.13.1 Company Overview

- 9.13.2 Key Executives

- 9.13.3 Company snapshot

- 9.13.4 Active Business Divisions

- 9.13.5 Product portfolio

- 9.13.6 Business performance

- 9.13.7 Major Strategic Initiatives and Developments

- 9.14 N. A.

- 9.14.1 Company Overview

- 9.14.2 Key Executives

- 9.14.3 Company snapshot

- 9.14.4 Active Business Divisions

- 9.14.5 Product portfolio

- 9.14.6 Business performance

- 9.14.7 Major Strategic Initiatives and Developments

- 9.15 Sofocle Technologies (Uttar Pradesh

- 9.15.1 Company Overview

- 9.15.2 Key Executives

- 9.15.3 Company snapshot

- 9.15.4 Active Business Divisions

- 9.15.5 Product portfolio

- 9.15.6 Business performance

- 9.15.7 Major Strategic Initiatives and Developments

- 9.16 India)

- 9.16.1 Company Overview

- 9.16.2 Key Executives

- 9.16.3 Company snapshot

- 9.16.4 Active Business Divisions

- 9.16.5 Product portfolio

- 9.16.6 Business performance

- 9.16.7 Major Strategic Initiatives and Developments

- 9.17 Capgemini SE (Paris

- 9.17.1 Company Overview

- 9.17.2 Key Executives

- 9.17.3 Company snapshot

- 9.17.4 Active Business Divisions

- 9.17.5 Product portfolio

- 9.17.6 Business performance

- 9.17.7 Major Strategic Initiatives and Developments

- 9.18 France)

- 9.18.1 Company Overview

- 9.18.2 Key Executives

- 9.18.3 Company snapshot

- 9.18.4 Active Business Divisions

- 9.18.5 Product portfolio

- 9.18.6 Business performance

- 9.18.7 Major Strategic Initiatives and Developments

10: Analyst Perspective and Conclusion

- 10.1 Concluding Recommendations and Analysis

- 10.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

By Retail Platform |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Blockchain in retail Banking in 2030?

+

-

Which application type is expected to remain the largest segment in the Global Blockchain in retail Banking market?

+

-

How big is the Global Blockchain in retail Banking market?

+

-

How do regulatory policies impact the Blockchain in retail Banking Market?

+

-

What major players in Blockchain in retail Banking Market?

+

-

What applications are categorized in the Blockchain in retail Banking market study?

+

-

Which product types are examined in the Blockchain in retail Banking Market Study?

+

-

Which regions are expected to show the fastest growth in the Blockchain in retail Banking market?

+

-

What are the major growth drivers in the Blockchain in retail Banking market?

+

-

Is the study period of the Blockchain in retail Banking flexible or fixed?

+

-