Global Bluetooth and Wireless Speaker Market Size, Share & Trends Analysis Report, Forecast Period, 2023-2030

Report ID: MS-2252 | Automation and Process Control | Last updated: Dec, 2024 | Formats*:

Bluetooth and Wireless Speaker Report Highlights

| Report Metrics | Details |

|---|---|

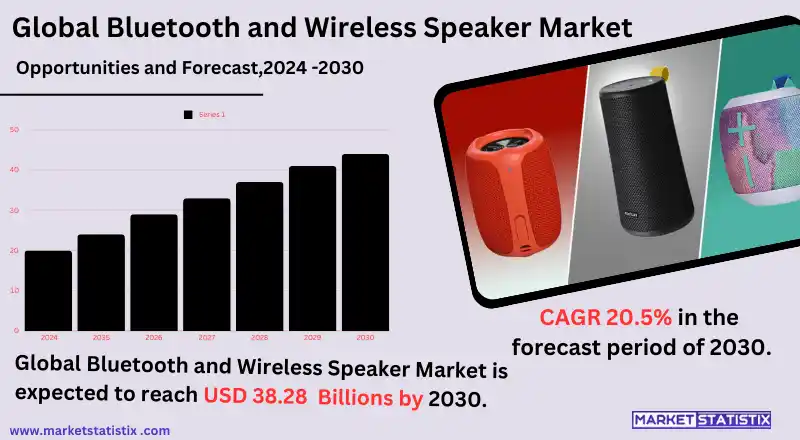

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2023 |

| Growth Rate | CAGR of 20.5% |

| Forecast Value (2030) | USD 38.28 Billion |

| By Product Type | Mini, Pocket, Capsule and others |

| Key Market Players |

|

| By Region |

|

Bluetooth and Wireless Speaker Market Trends

On the other hand, the Bluetooth and wireless speaker market space is indeed booming because users want portable products that would easily and comfortably offer good, quality sound. In fact, people are bound with their wireless technologies because Bluetooth and wireless speakers would find an easy way to connect devices and are very portable. Moreover, there is a trend toward integration with smart devices such as smartphones, tablets, and voice assistants like Amazon Alexa and Google Assistant to allow users to control everything voice- and hands-free. The next major thing is sound quality and battery longevity, where brands are innovating to keep improving to meet customer expectations in the performance and convenience aspects. Today, there is an emerging trend in end-user adoption toward multi-room audio, in which consumers can sync up multiple speakers in one house. In addition, there is an increased demand for premium and smart speakers with advanced features such as voice control, smart home integration, and high-fidelity audio. These are all growing, especially in urban spaces.Bluetooth and Wireless Speaker Market Leading Players

The key players profiled in the report are Harman International, Bose Corporation, Sony Group Corporation, Marshall Group Ab, Apple Inc., Bang & Olufsen, Logitech, Plantronics Inc., Voxx International Corporation, Fugoo, Bang & Olufsen (Denmark), SoundWorks, Inc. (US), Apple Inc. (Beats Electronics LLC) (US), House of Marley, LLC (US)Growth Accelerators

The increasing demand for portable, easy-to-use, and available audio systems with the advent of smartphones, tablets, and other smart devices drives demand for the Bluetooth and wireless speaker market. Through Bluetooth technology, streaming music or any audio has been made possible without the hassles of dealing with wires. The other major reason for increasing demand is the constant development in audio technology, which is improving sound quality with the best battery performance and compact design. As more and more people become technology literate, they expect better performance and seamless connectivity with other smart devices. For example, with smart TVs, home assistants, and smart wearable devices themselves. Streaming services are also a beneficial contribution to the demand for wireless speakers, such as the continuous development of streaming platforms, which further boosts demand because most music is consumed while on the go.Bluetooth and Wireless Speaker Market Segmentation analysis

The Global Bluetooth and Wireless Speaker is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Mini, Pocket, Capsule and others . The Application segment categorizes the market based on its usage such as Commercial, Residential. Geographically, the market is assessed across key Regions like North America(United States, Canada, Mexico), South America(Brazil, Argentina, Chile, Rest of South America), Europe(Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific(China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA(Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

Competitive play is heating up, with Harman International and Bang & Olufsen waving their exemplary product launches, like that of the former's Beosound Explore portable high-end speaker. Beosound Explore is an expertly crafted outdoor product fitted with the finest features. It is primarily within such a context of continuous advancement and strategic consolidation that companies are redeveloping themselves to meet the changes in consumer buying behaviour about wireless audio.Challenges In Bluetooth and Wireless Speaker Market

The Bluetooth and wireless speaker market is fraught with many troubles. It finds itself in very intense competition and suffers from price pressures. Many brands have manufactured similar products, which have made differentiation in terms of sound quality, design, and features very difficult. The consumer choices are many, resulting in possible market saturation, making it impossible for brands to maintain profit levels. Another big challenge to be faced is the constant change brought about by fast-paced technological improvements, which require reinventing or adapting from the manufacturer. At the same time, there are issues related to connectivity, latency, and compatibility with devices, which lead to poor user experiences, increased dissatisfaction, and resultant returns. Continuous investing in research and development is now the order of the day for manufacturers to keep pace with such fast-changing requirements and retain market share.Risks & Prospects in Bluetooth and Wireless Speaker Market

The demand for portable, mobile, and quality audio devices is rising in the growing Indian market of Bluetooth and wireless speakers. The trend blatantly indicates that consumers prefer mobility to wired home audio devices. Hill hikes, trips, and the day-increasing trend of home entertainment systems create countless opportunities for market growth. Apart from all of this, the other great opportunity is the penetration of smart home ecosystems. The smarter home devices are bought by consumers, the more Bluetooth and wireless speakers become important parts of putting an integrated audio system in homes. So far, it is an emerging market set to gain popularity within such economies as it can be packaged in growing disposable income and the rising quest for consumer electronics as trends that will make the Bluetooth and wireless speaker markets always boast of growth into various market ends.Key Target Audience

The key target consumer of the Bluetooth and wireless speaker market is well defined, comprising technically advanced people and individuals with an inclination towards convenience, portability, and superior quality sound. Technically, this group consists of young adults, which mainly comprises millennials and Gen Z. It is often first-generation technology adopters who use music, podcasts, and audiobooks in a moving configuration. They look forward to Bluetooth and wireless speakers for one-touch control and seamless compatibility with devices like smartphones, laptops, and others.,, Another important customer group includes customers who ask for premium audio experiences, such as audiophiles or those heavily investing in the home entertainment system. As the wireless speaker technology improves, eventually combining good sound quality, noise-cancelling, and smart integration of voice assistants, the younger and older generation consumers notice more of these products. Bluetooth and wireless speakers can now fit into a variety of lifestyles—from being used in workout sessions by fitness buffs to very high-quality speakers required by professionals for virtual meetings and presentations.Merger and acquisition

At this point in time, the Bluetooth and wireless speaker market is bustling and active with mergers and acquisitions owing to high consumer demand and fast-growing technology. Last May, a two-speaker drink called SRS-XV800 and SRS-XB100 was introduced by Sony Electronics to make its collection more in tune with the latest customer preferences regarding portable audio products. Consumers enjoy an in-house product delivered by JBL, collaborating with Epic Games to launch the limited edition Fortnite Pulse 5 portable speaker, a clear indication that companies use the trend of innovative partnerships in capturing the niche markets. This is thus showing what is observed at a larger level: the major players in the market are making a driven effort toward acquisitions and collaborations to extend their reach and improve their portfolio products. >Analyst Comment

"The remarkable market between Bluetooth and wireless speakers has been through these wonderful years, which were brought by improvements in technology, much consumer demand in the present day, and more disposable income enjoyed by consumers. Bluetooth technology has transformed the lives of people, bringing them together at distant places for audio collection through wireless audio streaming. This always lends a hand to the differentiation of a line of products, namely, small portable speakers and really expensive home audio systems. Most market-driving factors include the increasing adoption of audio streaming, an increasing consumer preference for smart homes, and advanced device specifications like voice assistants and noise cancellation among features."- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Bluetooth and Wireless Speaker- Snapshot

- 2.2 Bluetooth and Wireless Speaker- Segment Snapshot

- 2.3 Bluetooth and Wireless Speaker- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Bluetooth and Wireless Speaker Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Mini

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Pocket

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Capsule and others

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

5: Bluetooth and Wireless Speaker Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Commercial

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Residential

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

6: Bluetooth and Wireless Speaker Market by Connectivity

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 Bluetooth

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 Hybrid

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

- 6.4 Others

- 6.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.2 Market size and forecast, by region

- 6.4.3 Market share analysis by country

7: Bluetooth and Wireless Speaker Market by Distribution Channel

- 7.1 Overview

- 7.1.1 Market size and forecast

- 7.2 Store-Based

- 7.2.1 Key market trends, factors driving growth, and opportunities

- 7.2.2 Market size and forecast, by region

- 7.2.3 Market share analysis by country

- 7.3 Non-Store-Based

- 7.3.1 Key market trends, factors driving growth, and opportunities

- 7.3.2 Market size and forecast, by region

- 7.3.3 Market share analysis by country

8: Bluetooth and Wireless Speaker Market by Region

- 8.1 Overview

- 8.1.1 Market size and forecast By Region

- 8.2 North America

- 8.2.1 Key trends and opportunities

- 8.2.2 Market size and forecast, by Type

- 8.2.3 Market size and forecast, by Application

- 8.2.4 Market size and forecast, by country

- 8.2.4.1 United States

- 8.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 8.2.4.1.2 Market size and forecast, by Type

- 8.2.4.1.3 Market size and forecast, by Application

- 8.2.4.2 Canada

- 8.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 8.2.4.2.2 Market size and forecast, by Type

- 8.2.4.2.3 Market size and forecast, by Application

- 8.2.4.3 Mexico

- 8.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 8.2.4.3.2 Market size and forecast, by Type

- 8.2.4.3.3 Market size and forecast, by Application

- 8.2.4.1 United States

- 8.3 South America

- 8.3.1 Key trends and opportunities

- 8.3.2 Market size and forecast, by Type

- 8.3.3 Market size and forecast, by Application

- 8.3.4 Market size and forecast, by country

- 8.3.4.1 Brazil

- 8.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 8.3.4.1.2 Market size and forecast, by Type

- 8.3.4.1.3 Market size and forecast, by Application

- 8.3.4.2 Argentina

- 8.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 8.3.4.2.2 Market size and forecast, by Type

- 8.3.4.2.3 Market size and forecast, by Application

- 8.3.4.3 Chile

- 8.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 8.3.4.3.2 Market size and forecast, by Type

- 8.3.4.3.3 Market size and forecast, by Application

- 8.3.4.4 Rest of South America

- 8.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 8.3.4.4.2 Market size and forecast, by Type

- 8.3.4.4.3 Market size and forecast, by Application

- 8.3.4.1 Brazil

- 8.4 Europe

- 8.4.1 Key trends and opportunities

- 8.4.2 Market size and forecast, by Type

- 8.4.3 Market size and forecast, by Application

- 8.4.4 Market size and forecast, by country

- 8.4.4.1 Germany

- 8.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.1.2 Market size and forecast, by Type

- 8.4.4.1.3 Market size and forecast, by Application

- 8.4.4.2 France

- 8.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.2.2 Market size and forecast, by Type

- 8.4.4.2.3 Market size and forecast, by Application

- 8.4.4.3 Italy

- 8.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.3.2 Market size and forecast, by Type

- 8.4.4.3.3 Market size and forecast, by Application

- 8.4.4.4 United Kingdom

- 8.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.4.2 Market size and forecast, by Type

- 8.4.4.4.3 Market size and forecast, by Application

- 8.4.4.5 Benelux

- 8.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.5.2 Market size and forecast, by Type

- 8.4.4.5.3 Market size and forecast, by Application

- 8.4.4.6 Nordics

- 8.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.6.2 Market size and forecast, by Type

- 8.4.4.6.3 Market size and forecast, by Application

- 8.4.4.7 Rest of Europe

- 8.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.7.2 Market size and forecast, by Type

- 8.4.4.7.3 Market size and forecast, by Application

- 8.4.4.1 Germany

- 8.5 Asia Pacific

- 8.5.1 Key trends and opportunities

- 8.5.2 Market size and forecast, by Type

- 8.5.3 Market size and forecast, by Application

- 8.5.4 Market size and forecast, by country

- 8.5.4.1 China

- 8.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.1.2 Market size and forecast, by Type

- 8.5.4.1.3 Market size and forecast, by Application

- 8.5.4.2 Japan

- 8.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.2.2 Market size and forecast, by Type

- 8.5.4.2.3 Market size and forecast, by Application

- 8.5.4.3 India

- 8.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.3.2 Market size and forecast, by Type

- 8.5.4.3.3 Market size and forecast, by Application

- 8.5.4.4 South Korea

- 8.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.4.2 Market size and forecast, by Type

- 8.5.4.4.3 Market size and forecast, by Application

- 8.5.4.5 Australia

- 8.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.5.2 Market size and forecast, by Type

- 8.5.4.5.3 Market size and forecast, by Application

- 8.5.4.6 Southeast Asia

- 8.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.6.2 Market size and forecast, by Type

- 8.5.4.6.3 Market size and forecast, by Application

- 8.5.4.7 Rest of Asia-Pacific

- 8.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.7.2 Market size and forecast, by Type

- 8.5.4.7.3 Market size and forecast, by Application

- 8.5.4.1 China

- 8.6 MEA

- 8.6.1 Key trends and opportunities

- 8.6.2 Market size and forecast, by Type

- 8.6.3 Market size and forecast, by Application

- 8.6.4 Market size and forecast, by country

- 8.6.4.1 Middle East

- 8.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 8.6.4.1.2 Market size and forecast, by Type

- 8.6.4.1.3 Market size and forecast, by Application

- 8.6.4.2 Africa

- 8.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 8.6.4.2.2 Market size and forecast, by Type

- 8.6.4.2.3 Market size and forecast, by Application

- 8.6.4.1 Middle East

- 9.1 Overview

- 9.2 Key Winning Strategies

- 9.3 Top 10 Players: Product Mapping

- 9.4 Competitive Analysis Dashboard

- 9.5 Market Competition Heatmap

- 9.6 Leading Player Positions, 2022

10: Company Profiles

- 10.1 Harman International

- 10.1.1 Company Overview

- 10.1.2 Key Executives

- 10.1.3 Company snapshot

- 10.1.4 Active Business Divisions

- 10.1.5 Product portfolio

- 10.1.6 Business performance

- 10.1.7 Major Strategic Initiatives and Developments

- 10.2 Bose Corporation

- 10.2.1 Company Overview

- 10.2.2 Key Executives

- 10.2.3 Company snapshot

- 10.2.4 Active Business Divisions

- 10.2.5 Product portfolio

- 10.2.6 Business performance

- 10.2.7 Major Strategic Initiatives and Developments

- 10.3 Sony Group Corporation

- 10.3.1 Company Overview

- 10.3.2 Key Executives

- 10.3.3 Company snapshot

- 10.3.4 Active Business Divisions

- 10.3.5 Product portfolio

- 10.3.6 Business performance

- 10.3.7 Major Strategic Initiatives and Developments

- 10.4 Marshall Group Ab

- 10.4.1 Company Overview

- 10.4.2 Key Executives

- 10.4.3 Company snapshot

- 10.4.4 Active Business Divisions

- 10.4.5 Product portfolio

- 10.4.6 Business performance

- 10.4.7 Major Strategic Initiatives and Developments

- 10.5 Apple Inc.

- 10.5.1 Company Overview

- 10.5.2 Key Executives

- 10.5.3 Company snapshot

- 10.5.4 Active Business Divisions

- 10.5.5 Product portfolio

- 10.5.6 Business performance

- 10.5.7 Major Strategic Initiatives and Developments

- 10.6 Bang & Olufsen

- 10.6.1 Company Overview

- 10.6.2 Key Executives

- 10.6.3 Company snapshot

- 10.6.4 Active Business Divisions

- 10.6.5 Product portfolio

- 10.6.6 Business performance

- 10.6.7 Major Strategic Initiatives and Developments

- 10.7 Logitech

- 10.7.1 Company Overview

- 10.7.2 Key Executives

- 10.7.3 Company snapshot

- 10.7.4 Active Business Divisions

- 10.7.5 Product portfolio

- 10.7.6 Business performance

- 10.7.7 Major Strategic Initiatives and Developments

- 10.8 Plantronics Inc.

- 10.8.1 Company Overview

- 10.8.2 Key Executives

- 10.8.3 Company snapshot

- 10.8.4 Active Business Divisions

- 10.8.5 Product portfolio

- 10.8.6 Business performance

- 10.8.7 Major Strategic Initiatives and Developments

- 10.9 Voxx International Corporation

- 10.9.1 Company Overview

- 10.9.2 Key Executives

- 10.9.3 Company snapshot

- 10.9.4 Active Business Divisions

- 10.9.5 Product portfolio

- 10.9.6 Business performance

- 10.9.7 Major Strategic Initiatives and Developments

- 10.10 Fugoo

- 10.10.1 Company Overview

- 10.10.2 Key Executives

- 10.10.3 Company snapshot

- 10.10.4 Active Business Divisions

- 10.10.5 Product portfolio

- 10.10.6 Business performance

- 10.10.7 Major Strategic Initiatives and Developments

- 10.11 Bang & Olufsen (Denmark)

- 10.11.1 Company Overview

- 10.11.2 Key Executives

- 10.11.3 Company snapshot

- 10.11.4 Active Business Divisions

- 10.11.5 Product portfolio

- 10.11.6 Business performance

- 10.11.7 Major Strategic Initiatives and Developments

- 10.12 SoundWorks

- 10.12.1 Company Overview

- 10.12.2 Key Executives

- 10.12.3 Company snapshot

- 10.12.4 Active Business Divisions

- 10.12.5 Product portfolio

- 10.12.6 Business performance

- 10.12.7 Major Strategic Initiatives and Developments

- 10.13 Inc. (US)

- 10.13.1 Company Overview

- 10.13.2 Key Executives

- 10.13.3 Company snapshot

- 10.13.4 Active Business Divisions

- 10.13.5 Product portfolio

- 10.13.6 Business performance

- 10.13.7 Major Strategic Initiatives and Developments

- 10.14 Apple Inc. (Beats Electronics LLC) (US)

- 10.14.1 Company Overview

- 10.14.2 Key Executives

- 10.14.3 Company snapshot

- 10.14.4 Active Business Divisions

- 10.14.5 Product portfolio

- 10.14.6 Business performance

- 10.14.7 Major Strategic Initiatives and Developments

- 10.15 House of Marley

- 10.15.1 Company Overview

- 10.15.2 Key Executives

- 10.15.3 Company snapshot

- 10.15.4 Active Business Divisions

- 10.15.5 Product portfolio

- 10.15.6 Business performance

- 10.15.7 Major Strategic Initiatives and Developments

- 10.16 LLC (US)

- 10.16.1 Company Overview

- 10.16.2 Key Executives

- 10.16.3 Company snapshot

- 10.16.4 Active Business Divisions

- 10.16.5 Product portfolio

- 10.16.6 Business performance

- 10.16.7 Major Strategic Initiatives and Developments

11: Analyst Perspective and Conclusion

- 11.1 Concluding Recommendations and Analysis

- 11.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

By Connectivity |

|

By Distribution Channel |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Bluetooth and Wireless Speaker in 2030?

+

-

What is the growth rate of Bluetooth and Wireless Speaker Market?

+

-

What are the latest trends influencing the Bluetooth and Wireless Speaker Market?

+

-

Who are the key players in the Bluetooth and Wireless Speaker Market?

+

-

How is the Bluetooth and Wireless Speaker } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Bluetooth and Wireless Speaker Market Study?

+

-

What geographic breakdown is available in Global Bluetooth and Wireless Speaker Market Study?

+

-

Which region holds the second position by market share in the Bluetooth and Wireless Speaker market?

+

-

How are the key players in the Bluetooth and Wireless Speaker market targeting growth in the future?

+

-

What are the opportunities for new entrants in the Bluetooth and Wireless Speaker market?

+

-