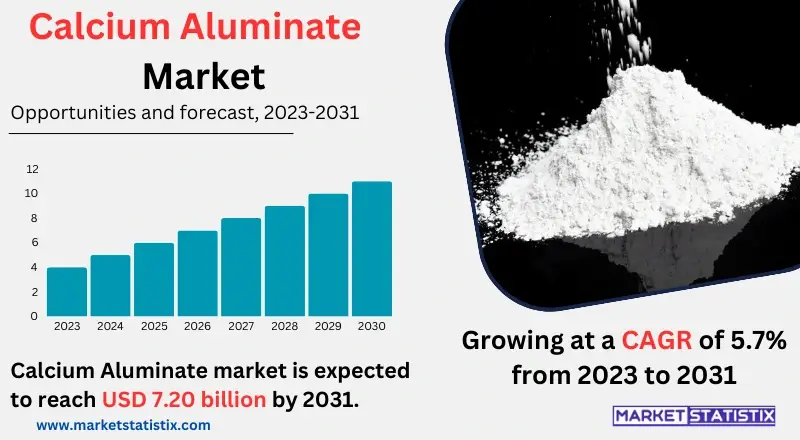

Global Calcium Aluminate Market Size, Share & Trends Analysis Report, Forecast Period, 2023-2031

Report ID: MS-1571 | Chemicals And Materials | Last updated: Sep, 2024 | Formats*:

Calcium Aluminate Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2031 |

| Base Year Of Estimation | 2023 |

| Growth Rate | CAGR of 5.7% |

| By Product Type | Pre-Melting, Sintered Type |

| Key Market Players |

|

| By Region |

|

Calcium Aluminate Market Trends

With increasing use in sectors such as construction, refractory, and the environmental sector, the calcium aluminate market is expanding. The rising demand for durable and high-performance materials, coupled with increasing infrastructure development, is propelling the market demand. Moreover, this material enjoys exemplary resistance to extremely high temperatures as well as highly corrosive environments; it finds itself quite indispensable to the steelmaking and cement industries. The market is subject to strong sensitivity over the raw product innovation, cost compression, and the creation of new applications are the counter-offensive strategies that players in the industry are adopting. material price, more severe environmental standards, and the possibility of alternate materials being developed. Product innovation, cost compression, and the creation of new applications are the counter-offensive strategies that players in the industry are adopting. On the whole, the scenario for the world market for calcium aluminate is an optimistic one due to its potential so far and the increasing demand from a host of industries.Calcium Aluminate Market Leading Players

The key players profiled in the report are BPI Inc., Caltra Nederland B.V., Nikita Metallurgical Pvt Ltd., Ambition Refractories Co. Ltd., Imerys, Harsco Environmental, Refratechnik, American Elements, Çimsa, K K Minerals Industries, Calucem, Royal White Cement Inc., Horizon Refractories Private LimitedGrowth Accelerators

The calcium aluminate market is driven by several factors. First and foremost, it gets a fillip from the growth in the construction industry, itself driven by urbanisation and infrastructure development. Being a fast-setting and hardening material makes it absolutely necessary for projects that require rapid turnarounds. Another reason is the use of calcium aluminate in the refractory industry because of its excellent heat-resistant characteristics and durability, which essentially make it a necessity where high-temperature applications are involved. Growing emphasis on industrial safety and fire prevention has also raised the demand for flame-retardant materials in which calcium aluminate is preeminent. The growing global economy and a plethora of infrastructure projects will keep the demand for calcium aluminate at elevated levels.Calcium Aluminate Market Segmentation analysis

The Global Calcium Aluminate is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Pre-Melting, Sintered Type . The Application segment categorizes the market based on its usage such as Steel Refining, Calcium Aluminate Cements. Geographically, the market is assessed across key Regions like North America(United States, Canada, Mexico), South America(Brazil, Argentina, Chile, Rest of South America), Europe(Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific(China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA(Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The outlook for the calcium aluminate market has risen with contributions from some established industry players and regional manufacturers. Large players in the calcium aluminate market have huge production capacities, well-diversified product portfolios, and large distribution networks. Companies face huge investments in product quality improvement and the expansion of applications; hence, they heavily invest in research and development. The market is also feeling increased competition from regional players, who are mostly small and target niche segments with specialised products. Companies regionally are better placed to leverage cost advantages to compete effectively. Overall, the competitive scenario characterises companies trying to differentiate their product offerings, gain market share, and meet the evolving needs of various industries.Challenges In Calcium Aluminate Market

Although the calcium aluminate market is very promising, the material faces a variety of challenges. First of all, the higher production costs of the material may seriously impede its wider use, mostly in those areas of application where price is crucial. At the same time, availability and quality variability of raw materials have implications for production and the subsequent price tag. Moreover, substitute products with similar performance developed at a lower price compete with calcium aluminate. This contributes to the fluctuation of the uncertain market demand by changes in end-user industries such as construction and refractory. All these challenges call for endless research and development in fields such as production process optimisation, cheaper raw material substitutes, and expanding the application range of calcium aluminate.Risks & Prospects in Calcium Aluminate Market

This will open up other lucrative opportunities for the calcium aluminate market. Demand for infrastructure, more so in developing economies, is continuously rising and has a great deal of focus on high-performance construction materials. Infrastructural works require effective setting and strength properties, such as bridges, tunnels, and dams, where calcium aluminate proves to be very important. Growing emphasis on energy efficiency and sustainability is again creating new opportunities for applications of calcium aluminate. This could be in refractory materials used in industrial furnaces and kilns, thus helping save energy and reducing associated emissions. Technology and research are also likely to discover newer uses of calcium aluminate and thus further open up avenues for this market.Key Target Audience

Primary applications of calcium aluminate include refractory works that require high temperature resistance and rapid-setting properties. Such industries utilise calcium aluminate to manufacture refractory materials for use in furnaces, kilns, and all high-temperature applications.,, Besides, the building in fast-setting concretes, repair mortars, and refractory castables, thereby, becomes crucial for works related to the development and maintenance of infrastructure. and construction sectors use huge amounts of calcium aluminate. Its need in fast-setting concretes, repair mortars, and refractory castables, thereby, becomes crucial for works related to the development and maintenance of infrastructure. On the other hand, the chemical industry makes use of calcium aluminate as a catalyst and also in water treatment processes, thereby increasing demand for the market.Merger and acquisition

The other areas of massive consolidation that have characterised the calcium aluminate market for the past few years are basically in the lines of mergers and acquisitions. Such strategic consolidations are aiming at better market positioning, broadening product portfolios, and deriving benefits from economies of scale. One great example is the merging of Cementos Molins with the producer of calcium aluminate cement, Calucem, in November 2021, which has made it the world's second-largest producer with a wider product basket and geographical footing. These mergers and acquisitions wouldn't be exclusively useful in changing the competitive landscape but would also very much encourage innovation and further growth in the calcium aluminate market. One may well imagine that down the line, with such incredible demand for performance materials, one can only expect much greater consolidation and many strategic partnerships among the industry players.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Calcium Aluminate- Snapshot

- 2.2 Calcium Aluminate- Segment Snapshot

- 2.3 Calcium Aluminate- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Calcium Aluminate Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Pre-Melting

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Sintered Type

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: Calcium Aluminate Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Steel Refining

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Calcium Aluminate Cements

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

6: Calcium Aluminate Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 BPI Inc.

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 Caltra Nederland B.V.

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Nikita Metallurgical Pvt Ltd.

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 Ambition Refractories Co. Ltd.

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Imerys

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Harsco Environmental

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Refratechnik

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 American Elements

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 Çimsa

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 K K Minerals Industries

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

- 8.11 Calucem

- 8.11.1 Company Overview

- 8.11.2 Key Executives

- 8.11.3 Company snapshot

- 8.11.4 Active Business Divisions

- 8.11.5 Product portfolio

- 8.11.6 Business performance

- 8.11.7 Major Strategic Initiatives and Developments

- 8.12 Royal White Cement Inc.

- 8.12.1 Company Overview

- 8.12.2 Key Executives

- 8.12.3 Company snapshot

- 8.12.4 Active Business Divisions

- 8.12.5 Product portfolio

- 8.12.6 Business performance

- 8.12.7 Major Strategic Initiatives and Developments

- 8.13 Horizon Refractories Private Limited

- 8.13.1 Company Overview

- 8.13.2 Key Executives

- 8.13.3 Company snapshot

- 8.13.4 Active Business Divisions

- 8.13.5 Product portfolio

- 8.13.6 Business performance

- 8.13.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

Which application type is expected to remain the largest segment in the Global Calcium Aluminate market?

+

-

How do regulatory policies impact the Calcium Aluminate Market?

+

-

What major players in Calcium Aluminate Market?

+

-

What applications are categorized in the Calcium Aluminate market study?

+

-

Which product types are examined in the Calcium Aluminate Market Study?

+

-

Which regions are expected to show the fastest growth in the Calcium Aluminate market?

+

-

What are the major growth drivers in the Calcium Aluminate market?

+

-

Is the study period of the Calcium Aluminate flexible or fixed?

+

-

How do economic factors influence the Calcium Aluminate market?

+

-

How does the supply chain affect the Calcium Aluminate Market?

+

-