Calcium Nitrate Market - Industry Dynamics, Market Size, And Opportunity Forecast To 2031

Report ID: MS-294 | Chemicals And Materials | Last updated: Jan, 2025 | Formats*:

Calcium Nitrate Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2031 |

| Base Year Of Estimation | 2024 |

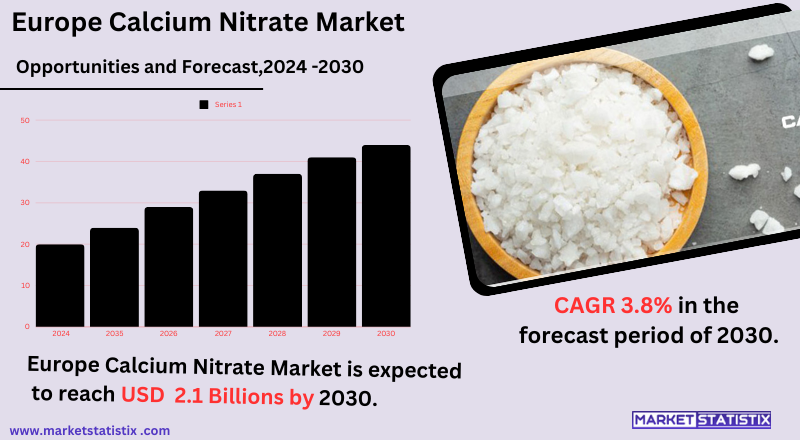

| Growth Rate | CAGR of 3.8% |

| Forecast Value (2031) | USD 2.1 Billion |

| By Product Type | Agricultural Grade, Industrial Grade, Technical Grade |

| Key Market Players |

|

| By Region |

Calcium Nitrate Market Trends

The market for calcium nitrate is gaining traction in the agricultural field as one of the high-performance fertilizers. There is an increased production of food due to population growth and a parallel rise in demand for calcium nitrate. This is due to the fact that calcium nitrate enhances the absorption of nutrients by plants while promoting root growth and increasing crop yields. Precision farming and sustainable agricultural practices have also been driving calcium nitrate applications in controlled-release fertilizer systems to reduce nutrient pollution. Another emerging trend in calcium nitrate is demand from various industries, especially those whose areas include wastewater treatment and concrete. In wastewater treatment, calcium nitrate is utilized for controlling harmful nitrogen compound formation, thus improving water quality. In construction, it is used as an accelerant in the production of cement for faster set times, as well as for better durability under varying weather conditions.Calcium Nitrate Market Leading Players

The key players profiled in the report are Yara International ASA, Sterling Chemicals, Nutrien, Jiaocheng Sanxi Chemical, URALCHEM, ADOB ChemicalHaifa Chemicals Ltd, Haifa Chemicals Ltd, Agrium, GFS Chemicals Inc., Wentong Potassium Salt GroupGrowth Accelerators

The foremost market driver for calcium nitrate is the increased demand for fertilizers in the agricultural industry. Calcium nitrate is an essential nutrient in fertilizers that is quite effective in improving soil quality for plants as well as preventing nutrient deficiencies in crops. With a global population, there is an increased need for food, which is highly dependent on efficient fertilizers to grow crops, hence increasing the investment in calcium nitrate crop cultivation. The increase in applications of calcium nitrate in industrial segments, for instance, wastewater treatment, concrete, and explosive manufacture, is another emerging growth factor. In wastewater treatment, calcium nitrate is used in reducing nitrogen levels for environmental welfare concerns related to water pollution. In the construction sector, it is used as an accelerator for concrete, thereby improving curing times and development of strength; all these areas of application are quite diverse across the industries, and their growth is a further stimulant of the growth of the market for calcium nitrate globally.Calcium Nitrate Market Segmentation analysis

The Global Calcium Nitrate is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Agricultural Grade, Industrial Grade, Technical Grade . The Application segment categorizes the market based on its usage such as Fertilizers,, Wastewater Treatment, Concrete Manufacturing, Explosives. Geographically, the market is assessed across key Regions like {regionNms} and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The competitive backdrop of the calcium nitrate marketplace is such that prominent global and regional players have captured the production and supply stakes of calcium nitrate. For instance, Yara International, Nutrien, and Sinochem International rely on extensive production capacities and provisions of strong distribution networks for maintaining their shares of the market. These companies focus on producing high-quality products, tailored and economically fit-for-purpose uses, relating to agriculture and water treatment as well as industrial applications. The companies also tend to invest hugely in research and development in product formulations, sustainability, and other evolving environmental standards.Challenges In Calcium Nitrate Market

Mainly the calcium nitrate market is encumbered due to production costs as well as environmental challenges. Calcium nitrate needs ammonia and nitric acid for manufacturing, and hence it has incurring and energy-intensive and high processes for production, which adds to the high cost that makes production uneconomical. All these wince revenues and competitiveness of the manufacturers in the said market. Unchained price volatility of raw materials, for instance, ammonia, may be subject to disruptions in the supply chain, the emergence of geopolitical tensions, and the ever-dynamic change in global demand. Such a form of unpredictability can straddle the stability and growth of the calcium nitrate market. Most especially, the market is facing more and more challenges as many consumers and industries demand high-quality, environmentally friendly products as well as efficiency in production. Manufacturers are enjoined to spend a lot on research and development to stay afloat in going through these challenges.Risks & Prospects in Calcium Nitrate Market

The market for calcium nitrate is attracting huge attention in agriculture as it is one of the most important fertilizers for plants. With the increasing population of the world, growing food demand creates the most important nutrient for the plant in improving yield and quality—the role of calcium nitrate. In addition to this, the use of calcium nitrate is increased with the developing trend of controlled-release fertilizers and advanced precision farming approaches, as it promotes a steady feed of nitrogen and calcium necessary for the best growth of plants. Also, another possible area for growth would be in construction. Calcium nitrate is added to concrete as an accelerator, especially when cold weather exists. It helps improve the curing time and strength of the material. The increase in infrastructure development as well as construction projects in developing parts of the world means that the demand for calcium nitrate is expected to foreseeably go up in concrete applications.Key Target Audience

The major target market in calcium nitrate is agricultural producers, particularly fertiliser manufacturers. Historically, calcium nitrate has been an important constituent of fertilisers, as it plays an important role in plant metabolism for cell wall strength and nutrient uptake. Agriculturalists and large-scale farms use calcium nitrate for increasing production, specifically in high-value sectors such as fruits, vegetables, and flowers. Thus, agriculture is the largest end-use segment of calcium nitrate.,, Aside from this, the civil construction and chemical industries also consume calcium nitrate in significant amounts. In civil construction speciality use, it is included in production for concrete admixtures, where it makes the material highly durable under very cold temperatures. In the chemical industry, calcium nitrate can also be found in different chemical production and can act as a catalyst in reactions. Such industries specify their contribution to much calcium nitrate demand in global markets.Merger and acquisition

The recent moves in mergers and acquisitions by companies within the calcium nitrate domain indicate a strategic push by key players to enhance their production capabilities and presence in the market. In April 2022, Casale acquired Green Granulation, a company specializing in systems for urea and ammonium nitrate granulation, a development that is expected to widen the scope of offerings in calcium nitrate. This acquisition is in line with the rising trend in demand for sustainable fertilizers, particularly towards the gaining importance of serving agricultural markets from a sustainable standpoint because Casale is well-positioned to deliver this. In August 2022, Acron Group commissioned a new facility in Russia for the production of granulated calcium nitrate. The investment reserves about RUB 1.5 billion and would significantly increase output capacity. On the other hand, the market has been witnessing novel partnerships aimed toward improving a production process. Evidence of this is the one announced by Nitricity Inc. this April 2024 with Olam Food Ingredients to produce "local" lines of liquid calcium nitrate, marking a turn toward fertilizer sources that are more climate smart. All this reflects in the initiatives toward a strategic response to increasing demands of calcium nitrate in agriculture as well as wastewater treatment, with the market expected to explode by around 2032, amassing an estimated USD 18.4 billion due to investments to scale their product lines and improve sustainability practices. >Analyst Comment

"The calcium nitrate market is expected to grow steadily. It is mainly used in agriculture, industrial, and water treatment processes. In agriculture, it has conventionally been used as a fertiliser that gives calcium and nitrogen needed for plant growth, especially in fruit and vegetable crops. The demand for high-yield crops is escalating, and modern farming techniques have boosted the market growth for calcium nitrate fertilizer. The use of calcium nitrate to manufacture nitrates for various industrial applications, including explosives and chemicals, thereby contributes to the market expansion."- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Calcium Nitrate- Snapshot

- 2.2 Calcium Nitrate- Segment Snapshot

- 2.3 Calcium Nitrate- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Calcium Nitrate Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Agricultural Grade

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Industrial Grade

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Technical Grade

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

5: Calcium Nitrate Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Fertilizers

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Wastewater Treatment

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Concrete Manufacturing

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Explosives

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

6: Competitive Landscape

- 6.1 Overview

- 6.2 Key Winning Strategies

- 6.3 Top 10 Players: Product Mapping

- 6.4 Competitive Analysis Dashboard

- 6.5 Market Competition Heatmap

- 6.6 Leading Player Positions, 2022

7: Company Profiles

- 7.1 Yara International ASA

- 7.1.1 Company Overview

- 7.1.2 Key Executives

- 7.1.3 Company snapshot

- 7.1.4 Active Business Divisions

- 7.1.5 Product portfolio

- 7.1.6 Business performance

- 7.1.7 Major Strategic Initiatives and Developments

- 7.2 Sterling Chemicals

- 7.2.1 Company Overview

- 7.2.2 Key Executives

- 7.2.3 Company snapshot

- 7.2.4 Active Business Divisions

- 7.2.5 Product portfolio

- 7.2.6 Business performance

- 7.2.7 Major Strategic Initiatives and Developments

- 7.3 Nutrien

- 7.3.1 Company Overview

- 7.3.2 Key Executives

- 7.3.3 Company snapshot

- 7.3.4 Active Business Divisions

- 7.3.5 Product portfolio

- 7.3.6 Business performance

- 7.3.7 Major Strategic Initiatives and Developments

- 7.4 Jiaocheng Sanxi Chemical

- 7.4.1 Company Overview

- 7.4.2 Key Executives

- 7.4.3 Company snapshot

- 7.4.4 Active Business Divisions

- 7.4.5 Product portfolio

- 7.4.6 Business performance

- 7.4.7 Major Strategic Initiatives and Developments

- 7.5 URALCHEM

- 7.5.1 Company Overview

- 7.5.2 Key Executives

- 7.5.3 Company snapshot

- 7.5.4 Active Business Divisions

- 7.5.5 Product portfolio

- 7.5.6 Business performance

- 7.5.7 Major Strategic Initiatives and Developments

- 7.6 ADOB ChemicalHaifa Chemicals Ltd

- 7.6.1 Company Overview

- 7.6.2 Key Executives

- 7.6.3 Company snapshot

- 7.6.4 Active Business Divisions

- 7.6.5 Product portfolio

- 7.6.6 Business performance

- 7.6.7 Major Strategic Initiatives and Developments

- 7.7 Haifa Chemicals Ltd

- 7.7.1 Company Overview

- 7.7.2 Key Executives

- 7.7.3 Company snapshot

- 7.7.4 Active Business Divisions

- 7.7.5 Product portfolio

- 7.7.6 Business performance

- 7.7.7 Major Strategic Initiatives and Developments

- 7.8 Agrium

- 7.8.1 Company Overview

- 7.8.2 Key Executives

- 7.8.3 Company snapshot

- 7.8.4 Active Business Divisions

- 7.8.5 Product portfolio

- 7.8.6 Business performance

- 7.8.7 Major Strategic Initiatives and Developments

- 7.9 GFS Chemicals Inc.

- 7.9.1 Company Overview

- 7.9.2 Key Executives

- 7.9.3 Company snapshot

- 7.9.4 Active Business Divisions

- 7.9.5 Product portfolio

- 7.9.6 Business performance

- 7.9.7 Major Strategic Initiatives and Developments

- 7.10 Wentong Potassium Salt Group

- 7.10.1 Company Overview

- 7.10.2 Key Executives

- 7.10.3 Company snapshot

- 7.10.4 Active Business Divisions

- 7.10.5 Product portfolio

- 7.10.6 Business performance

- 7.10.7 Major Strategic Initiatives and Developments

8: Analyst Perspective and Conclusion

- 8.1 Concluding Recommendations and Analysis

- 8.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Calcium Nitrate in 2031?

+

-

Which type of Calcium Nitrate is widely popular?

+

-

What is the growth rate of Calcium Nitrate Market?

+

-

What are the latest trends influencing the Calcium Nitrate Market?

+

-

Who are the key players in the Calcium Nitrate Market?

+

-

How is the Calcium Nitrate } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Calcium Nitrate Market Study?

+

-

What geographic breakdown is available in Global Calcium Nitrate Market Study?

+

-

How are the key players in the Calcium Nitrate market targeting growth in the future?

+

-

What are the opportunities for new entrants in the Calcium Nitrate market?

+

-