Global Chemical Milling Market - Industry Dynamics, Market Size, And Opportunity Forecast To 2031

Report ID: MS-2056 | Chemicals And Materials | Last updated: Dec, 2024 | Formats*:

chemical milling Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2031 |

| Base Year Of Estimation | 2023 |

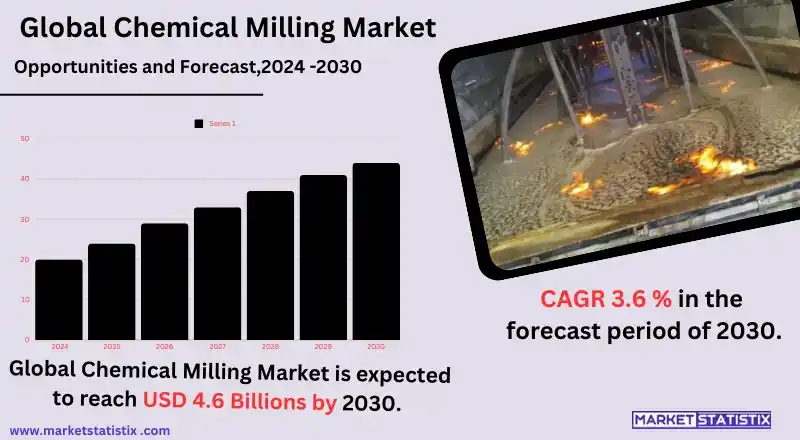

| Growth Rate | CAGR of 3.6% |

| Forecast Value (2031) | USD 4.6 Million |

| By Product Type | Titanium Alloys Chemical Etched Part, Aluminum Alloys Chemical Etched Part, Steel Alloys Chemical Etched Part, Copper Alloys Chemical Etched Part, Others |

| Key Market Players |

|

| By Region |

|

chemical milling Market Trends

The worldwide chemical milling market is observing an increasing direction towards automation and implementation of advanced manufacturing technologies that increase efficiency and precision in the milling process. Given that industries such as aerospace, automotive, and electronics opt for component parts that are complex and light weight in nature, manufacturers are employing complex chemical milling techniques to achieve intricate geometric shapes and close tolerances. This alteration not only enhances the quality of the products but also decreases the lead times and costs, thereby making chemical milling an ideal option for organisations that want to be competitive in such dynamic and challenging business environments. Another notable trend that is being witnessed in the chemical milling market is a rising focus on sustainability and environmentalism. Some manufacturers are pursuing greener chemicals and practices because there are regulations to comply with and consumers are becoming educated about a lot of issues. This also incorporates making safer and more efficient chemicals and designing better ways to eliminate or recycle waste products from chemical processes.chemical milling Market Leading Players

The key players profiled in the report are Great Lakes Engineering, Inc. (United States), Tech Etch Inc. (United States), United Western Enterprises Inc. (United States), VACCO Industries Inc. (United States), Lancaster Metals Science Co. (United States), Tech Met, Inc. (United States), Orbel Corporation (United States), Precision Micro Ltd. (United Kingdom), Veco BV (The Netherlands), Micro Etch Technologies (United States)Growth Accelerators

The global chemical milling industry is primarily stimulated by the growing need for highly precise machined parts and components in various end-user segments such as aerospace, automotive, electronics, etc. As lightweight but strong materials are the requirement of today, chemical milling processes are considered the best alternative to create sophisticated and complicated designs with less to no excessive material. This requirement is most pronounced in the aerospace industry, where advanced manufacturing processes such as chemical milling are vital due to limitations on size, weight, and performance. It is also a logical consequence of market needs that this technology allows achieving high surface quality and tolerances, which is a very attractive characteristic for many manufacturers. Another important factor that is driving the growth of the chemical milling market is the rising focus on sustainability and cost-effectiveness of the manufacturing processes. Compared to conventional machining processes, chemical milling offers a more efficient method with considerable raw material savings since it only removes material from selected areas, which creates no unnecessary waste. Such efficiency not only cuts expenses for the production but also supports the current international tendency towards more eco-friendly production systems.chemical milling Market Segmentation analysis

The Global chemical milling is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Titanium Alloys Chemical Etched Part, Aluminum Alloys Chemical Etched Part, Steel Alloys Chemical Etched Part, Copper Alloys Chemical Etched Part, Others . The Application segment categorizes the market based on its usage such as Aerospace, Electronic, Medical, Automotive, Others. Geographically, the market is assessed across key Regions like North America(United States, Canada, Mexico), South America(Brazil, Argentina, Chile, Rest of South America), Europe(Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific(China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA(Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The rise is due to the increasing consumption of the product in different applications such as aerospace, electronics, medical devices, and automotive industries. The market growth is also aided by the improvements in chemical milling technologies, which allow for more accurate and productive manufacturing processes. The major players within such markets are Great Lakes Engineering, United Western Enterprises, VACCO Industries, and Tech-Etch; these companies hold nearly thirty percent of the market share. On the other hand, while analysis shows demand for chemical milling in the modern weapon system, effective control of chemical milling is of utmost importance. Economically developed countries can be said to be saturated markets, where the factors of performance and price tend to be leveled, hence new generation chemical milling companies set up focus on innovation. The market’s little shares are steel alloys and aluminium alloys and, to a lesser extent, other industries. Presently, due to the strong defense investments of its aerospace and electronics market, North America is the most prominent consumer of chemical milling services, while geographies like Asia Pacific are also expected to grow at a rapid pace on account of rising industrialization and the need for precision machined parts.Challenges In chemical milling Market

There are numerous challenges in the global chemical milling market, of which regulatory compliance is one leading challenge. The use of chemicals and the disposal of waste are controlled with a lot of regulations in place. This has led to many countries embracing stringent measures with a view to protecting the environment and its citizens, thereby making it difficult for chemical milling organizations to operate. These regulations necessitate the manufacture of some expensive equipment or seeking new staff training, which is an added cost burden to the manufacturers, more so to the small-scale ones. The chemical milling market’s inadequacies do not end there; the costs of inputs are also subject to changes. In the milling operation, for instance, the prices of the chemicals involved may be swayed by many things, such as the supply chain, political instability, or the demand for the chemical in different sectors. Such effects on price margins can have adverse effects on profits within the company and also present problems in setting the pricing of the products.Risks & Prospects in chemical milling Market

Moreover, the demand for intricate and lightweight components in different segments, particularly the aviation and automotive industries, is expected to create favourble conditions for the global chemical milling market. As manufacturers seek to achieve a balance between the weight of components and their ability to perform a function, chemical milling comes into play as a viable and cost-efficient process for manufacturing complex components with close tolerances. This allows for the precise working of lightweight materials such as titanium and aluminum alloys, which are crucial in the field of aerospace technology today. With the aerospace industry growing continuously and the increasing demand for fuel efficiency, the chemical milling market is expected to experience massive demand for its services. A further opportunity can also be found in the increasing desire to practice sustainability in the production processes that are adopted. Chemical milling is less wasteful than the mechanical milling processes, thus contributing to the green movement, which is the current focus of the chemical milling industry. Not only that, new chemical milling technologies and new etching solutions developed can also improve the efficiency as well as the accuracy of the process. Such developments offer a room for those players in the chemical milling market who are willing to embrace new strategies and green solutions.Key Target Audience

The primary target market for the global chemical milling industry encompasses manufacturers of aerospace, automotive, and electronics, who require complex structural surfaces and aerodynamic shapes manufactured with precision. These industries practice chemical milling to manufacture parts that are lightweight yet possess high strength characteristics and have stringent specifications and tolerances. Chemical milling offers aerospace industries an added advantage when it comes to the processing of parts such as brackets and housings, as possible shapes are not limited and the same structures incur little weight.,, So, they apply chemical milling to engine parts and skin panels, too, because they are more concerned about cost and effectiveness.,, An additional important portion of the chemical milling industry is formed by research and development and information technology companies that always need new and often exotic materials as well as atypical solutions. This audience tends to work with providers of chemical milling services in order to manufacture such components in small quantities or make one-off designs instead, utilizing the technology’s ability to fabricate very intricate features and enhance the properties of materials.Merger and acquisition

The recent trends regarding mergers and acquisitions in the worldwide chemical milling industry have demonstrated quite a range of strategic actions that have focused on improving the operational abilities as well as geographical expansion. For example, Brenntag's acquisition of Lawrence Industries in April 2024 for an undisclosed amount demonstrates this trend as Brenntag seeks to fortify its hold in materials science, especially in coating, adhesive, sealant, and elastomer (CASE) markets. Moreover, the acquisition of Precision Polymer Corporation by Hydrite Chemical is also illustrative of the ongoing wave of consolidation since it enables Hydrite to enhance its water treatment solutions offering as regulatory regimes tighten. On the other hand, it is predicted that M&A cycles will gain momentum in the chemical sector as players look for avenues of growth due to continuing margin pressures. 2023 had a downturn in M&A activities attributed to high borrowing costs and uncertainties in the economy, but the mood among chemical industry players is upbeat, with a good number indicating they have an appetite for more acquisitions in the near future. This is indicative of the fact that, even though challenges have been experienced in the recent past, the environment conducive to unprecedented growth in mergers and acquisitions in the chemical milling sector is being managed for the year 2024 and after.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 chemical milling- Snapshot

- 2.2 chemical milling- Segment Snapshot

- 2.3 chemical milling- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: chemical milling Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Titanium Alloys Chemical Etched Part

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Aluminum Alloys Chemical Etched Part

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Steel Alloys Chemical Etched Part

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Copper Alloys Chemical Etched Part

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

- 4.6 Others

- 4.6.1 Key market trends, factors driving growth, and opportunities

- 4.6.2 Market size and forecast, by region

- 4.6.3 Market share analysis by country

5: chemical milling Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Aerospace

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Electronic

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Medical

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Automotive

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Others

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

6: chemical milling Market by End Users

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 Aerospace

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 Electronics

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

- 6.4 Medical

- 6.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.2 Market size and forecast, by region

- 6.4.3 Market share analysis by country

- 6.5 Automotive

- 6.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.2 Market size and forecast, by region

- 6.5.3 Market share analysis by country

- 6.6 Others

- 6.6.1 Key market trends, factors driving growth, and opportunities

- 6.6.2 Market size and forecast, by region

- 6.6.3 Market share analysis by country

7: chemical milling Market by Region

- 7.1 Overview

- 7.1.1 Market size and forecast By Region

- 7.2 North America

- 7.2.1 Key trends and opportunities

- 7.2.2 Market size and forecast, by Type

- 7.2.3 Market size and forecast, by Application

- 7.2.4 Market size and forecast, by country

- 7.2.4.1 United States

- 7.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.1.2 Market size and forecast, by Type

- 7.2.4.1.3 Market size and forecast, by Application

- 7.2.4.2 Canada

- 7.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.2.2 Market size and forecast, by Type

- 7.2.4.2.3 Market size and forecast, by Application

- 7.2.4.3 Mexico

- 7.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.3.2 Market size and forecast, by Type

- 7.2.4.3.3 Market size and forecast, by Application

- 7.2.4.1 United States

- 7.3 South America

- 7.3.1 Key trends and opportunities

- 7.3.2 Market size and forecast, by Type

- 7.3.3 Market size and forecast, by Application

- 7.3.4 Market size and forecast, by country

- 7.3.4.1 Brazil

- 7.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.1.2 Market size and forecast, by Type

- 7.3.4.1.3 Market size and forecast, by Application

- 7.3.4.2 Argentina

- 7.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.2.2 Market size and forecast, by Type

- 7.3.4.2.3 Market size and forecast, by Application

- 7.3.4.3 Chile

- 7.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.3.2 Market size and forecast, by Type

- 7.3.4.3.3 Market size and forecast, by Application

- 7.3.4.4 Rest of South America

- 7.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.4.2 Market size and forecast, by Type

- 7.3.4.4.3 Market size and forecast, by Application

- 7.3.4.1 Brazil

- 7.4 Europe

- 7.4.1 Key trends and opportunities

- 7.4.2 Market size and forecast, by Type

- 7.4.3 Market size and forecast, by Application

- 7.4.4 Market size and forecast, by country

- 7.4.4.1 Germany

- 7.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.1.2 Market size and forecast, by Type

- 7.4.4.1.3 Market size and forecast, by Application

- 7.4.4.2 France

- 7.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.2.2 Market size and forecast, by Type

- 7.4.4.2.3 Market size and forecast, by Application

- 7.4.4.3 Italy

- 7.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.3.2 Market size and forecast, by Type

- 7.4.4.3.3 Market size and forecast, by Application

- 7.4.4.4 United Kingdom

- 7.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.4.2 Market size and forecast, by Type

- 7.4.4.4.3 Market size and forecast, by Application

- 7.4.4.5 Benelux

- 7.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.5.2 Market size and forecast, by Type

- 7.4.4.5.3 Market size and forecast, by Application

- 7.4.4.6 Nordics

- 7.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.6.2 Market size and forecast, by Type

- 7.4.4.6.3 Market size and forecast, by Application

- 7.4.4.7 Rest of Europe

- 7.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.7.2 Market size and forecast, by Type

- 7.4.4.7.3 Market size and forecast, by Application

- 7.4.4.1 Germany

- 7.5 Asia Pacific

- 7.5.1 Key trends and opportunities

- 7.5.2 Market size and forecast, by Type

- 7.5.3 Market size and forecast, by Application

- 7.5.4 Market size and forecast, by country

- 7.5.4.1 China

- 7.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.1.2 Market size and forecast, by Type

- 7.5.4.1.3 Market size and forecast, by Application

- 7.5.4.2 Japan

- 7.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.2.2 Market size and forecast, by Type

- 7.5.4.2.3 Market size and forecast, by Application

- 7.5.4.3 India

- 7.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.3.2 Market size and forecast, by Type

- 7.5.4.3.3 Market size and forecast, by Application

- 7.5.4.4 South Korea

- 7.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.4.2 Market size and forecast, by Type

- 7.5.4.4.3 Market size and forecast, by Application

- 7.5.4.5 Australia

- 7.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.5.2 Market size and forecast, by Type

- 7.5.4.5.3 Market size and forecast, by Application

- 7.5.4.6 Southeast Asia

- 7.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.6.2 Market size and forecast, by Type

- 7.5.4.6.3 Market size and forecast, by Application

- 7.5.4.7 Rest of Asia-Pacific

- 7.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.7.2 Market size and forecast, by Type

- 7.5.4.7.3 Market size and forecast, by Application

- 7.5.4.1 China

- 7.6 MEA

- 7.6.1 Key trends and opportunities

- 7.6.2 Market size and forecast, by Type

- 7.6.3 Market size and forecast, by Application

- 7.6.4 Market size and forecast, by country

- 7.6.4.1 Middle East

- 7.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.6.4.1.2 Market size and forecast, by Type

- 7.6.4.1.3 Market size and forecast, by Application

- 7.6.4.2 Africa

- 7.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.6.4.2.2 Market size and forecast, by Type

- 7.6.4.2.3 Market size and forecast, by Application

- 7.6.4.1 Middle East

- 8.1 Overview

- 8.2 Key Winning Strategies

- 8.3 Top 10 Players: Product Mapping

- 8.4 Competitive Analysis Dashboard

- 8.5 Market Competition Heatmap

- 8.6 Leading Player Positions, 2022

9: Company Profiles

- 9.1 Great Lakes Engineering

- 9.1.1 Company Overview

- 9.1.2 Key Executives

- 9.1.3 Company snapshot

- 9.1.4 Active Business Divisions

- 9.1.5 Product portfolio

- 9.1.6 Business performance

- 9.1.7 Major Strategic Initiatives and Developments

- 9.2 Inc. (United States)

- 9.2.1 Company Overview

- 9.2.2 Key Executives

- 9.2.3 Company snapshot

- 9.2.4 Active Business Divisions

- 9.2.5 Product portfolio

- 9.2.6 Business performance

- 9.2.7 Major Strategic Initiatives and Developments

- 9.3 Tech Etch Inc. (United States)

- 9.3.1 Company Overview

- 9.3.2 Key Executives

- 9.3.3 Company snapshot

- 9.3.4 Active Business Divisions

- 9.3.5 Product portfolio

- 9.3.6 Business performance

- 9.3.7 Major Strategic Initiatives and Developments

- 9.4 United Western Enterprises Inc. (United States)

- 9.4.1 Company Overview

- 9.4.2 Key Executives

- 9.4.3 Company snapshot

- 9.4.4 Active Business Divisions

- 9.4.5 Product portfolio

- 9.4.6 Business performance

- 9.4.7 Major Strategic Initiatives and Developments

- 9.5 VACCO Industries Inc. (United States)

- 9.5.1 Company Overview

- 9.5.2 Key Executives

- 9.5.3 Company snapshot

- 9.5.4 Active Business Divisions

- 9.5.5 Product portfolio

- 9.5.6 Business performance

- 9.5.7 Major Strategic Initiatives and Developments

- 9.6 Lancaster Metals Science Co. (United States)

- 9.6.1 Company Overview

- 9.6.2 Key Executives

- 9.6.3 Company snapshot

- 9.6.4 Active Business Divisions

- 9.6.5 Product portfolio

- 9.6.6 Business performance

- 9.6.7 Major Strategic Initiatives and Developments

- 9.7 Tech Met

- 9.7.1 Company Overview

- 9.7.2 Key Executives

- 9.7.3 Company snapshot

- 9.7.4 Active Business Divisions

- 9.7.5 Product portfolio

- 9.7.6 Business performance

- 9.7.7 Major Strategic Initiatives and Developments

- 9.8 Inc. (United States)

- 9.8.1 Company Overview

- 9.8.2 Key Executives

- 9.8.3 Company snapshot

- 9.8.4 Active Business Divisions

- 9.8.5 Product portfolio

- 9.8.6 Business performance

- 9.8.7 Major Strategic Initiatives and Developments

- 9.9 Orbel Corporation (United States)

- 9.9.1 Company Overview

- 9.9.2 Key Executives

- 9.9.3 Company snapshot

- 9.9.4 Active Business Divisions

- 9.9.5 Product portfolio

- 9.9.6 Business performance

- 9.9.7 Major Strategic Initiatives and Developments

- 9.10 Precision Micro Ltd. (United Kingdom)

- 9.10.1 Company Overview

- 9.10.2 Key Executives

- 9.10.3 Company snapshot

- 9.10.4 Active Business Divisions

- 9.10.5 Product portfolio

- 9.10.6 Business performance

- 9.10.7 Major Strategic Initiatives and Developments

- 9.11 Veco BV (The Netherlands)

- 9.11.1 Company Overview

- 9.11.2 Key Executives

- 9.11.3 Company snapshot

- 9.11.4 Active Business Divisions

- 9.11.5 Product portfolio

- 9.11.6 Business performance

- 9.11.7 Major Strategic Initiatives and Developments

- 9.12 Micro Etch Technologies (United States)

- 9.12.1 Company Overview

- 9.12.2 Key Executives

- 9.12.3 Company snapshot

- 9.12.4 Active Business Divisions

- 9.12.5 Product portfolio

- 9.12.6 Business performance

- 9.12.7 Major Strategic Initiatives and Developments

10: Analyst Perspective and Conclusion

- 10.1 Concluding Recommendations and Analysis

- 10.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

By End Users |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of chemical milling in 2031?

+

-

What is the growth rate of chemical milling Market?

+

-

What are the latest trends influencing the chemical milling Market?

+

-

Who are the key players in the chemical milling Market?

+

-

How is the chemical milling } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the chemical milling Market Study?

+

-

What geographic breakdown is available in Global chemical milling Market Study?

+

-

Which region holds the second position by market share in the chemical milling market?

+

-

How are the key players in the chemical milling market targeting growth in the future?

+

-

What are the opportunities for new entrants in the chemical milling market?

+

-