Global Chocolate Biscuit Market - Industry Dynamics, Market Size, And Opportunity Forecast To 2030

Report ID: MS-765 | Food and Beverages | Last updated: Apr, 2025 | Formats*:

Chocolate Biscuit Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

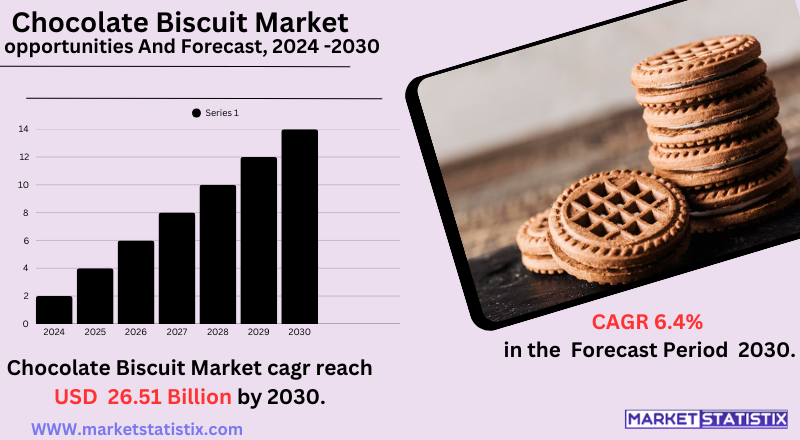

| Growth Rate | CAGR of 6.4% |

| Forecast Value (2030) | USD 26.51 Billion |

| By Product Type | Format, Texture |

| Key Market Players |

|

| By Region |

Chocolate Biscuit Market Trends

The significant driving force is the demand for superior quality as well as indulgent chocolate biscuits that consumers are prepared to pay a significant price for. They are also looking for high-quality ingredients that will distinguish them from common offerings: unique flavour combinations that could include artisanal chocolates, one-of-a-kind gourmet fillings such as hazelnut or salted caramel, and interesting textures. The trend is most significant in urban areas having relatively higher disposable income. At the same time, the increasing awareness of health and wellness factors has also become a market-moving factor. This has raised the demand for less chocolate biscuits with less sugar, low fat, and healthier ingredients like whole grains and nuts and seeds. Another leading trend is the growth-focused expansion of online retail and e-commerce channels. This has broadened the range of chocolate biscuit brands and varieties available to consumers, encompassing local and international niche offerings that would otherwise not be readily found in traditional stores in Kolhapur. It also assists in bringing direct sales to consumers, as well as targeted marketing.Chocolate Biscuit Market Leading Players

The key players profiled in the report are Ishiya, Ezaki Glico, Nestle, TATAWA, Mayora, Danish Speciality Foods Aps, Mondelez Inteational, BALOCCO, Pladis Global, August Storck KGGrowth Accelerators

Growing demand among consumers for convenient and indulgent snacking options is one of the key market drivers for chocolate biscuits. Chocolate biscuits serve as a quick and satisfying treat for impulse buying, considering the hectic lifestyle and trends involving on-the-go consumption. Furthermore, shifting consumer preferences and taste trends create space for innovative flavours, textures, and formats, keeping manufacturers excited to launch new varieties. Another major driving force is the overarching premiumisation trend in the food sector. There is increasing consumer willingness to spend on chocolate biscuits made with high-quality ingredients, unique flavour combinations, and engaging packaging. This subsequent appeal for premium, artisanal products motivate manufacturers to innovate and differentiate their products for the high-value segment of the market. Marketing and branding strategies drive consumer choices and market growth.Chocolate Biscuit Market Segmentation analysis

The Global Chocolate Biscuit is segmented by Type, and Region. By Type, the market is divided into Distributed Format, Texture . Geographically, the market is assessed across key Regions like {regionNms} and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The competitive market structure of the chocolate biscuit market is left by the presence of many global and local players pursuing consumer interest and market share. Almost all major multinational corporations occupy good market shares, notably Mondelez International (Oreo, Cadbury), Nestlé, Kellogg's, and pladis (McVitie's, Godiva), due to brand pull, distribution networks, and product portfolio depth. These large businesses compete for product innovation, pricing, and marketing strategies, introducing new flavours, formats, and packaging in quick succession so as to charm consumers. Apart from these multinationals, there are quite a number of regional biscuit makers that appeal to distinct consumer tastes and preferences in their areas. Those play on unique or traditional recipes, local sourcing, or lower prices. Competitive intensity is further fuelled by increasing consumer interest in healthier biscuits with low sugar, whole grains, or gluten-free ingredients, therefore driving all the market players to innovate more and diversify their products along the line with these changing trends.Challenges In Chocolate Biscuit Market

The chocolate biscuit market has several headwinds it has to face that could hinder the growth path. Supply chain disruptions, aggravated by geopolitical uncertainties and inflation, have increased the costs of raw materials, thereby affecting manufacturers' profit margins. Besides, stringent food safety and labelling regulations across regions make it difficult to comply, which would require heavy investments in quality control and operational upgrades. Increasing health concerns regarding sugar content and a rise in consumer preference for healthier alternatives have also exerted pressure on standard chocolate biscuit offerings, thereby driving manufacturers to come up with innovative offerings, such as reduced-sugar products or gluten-free or plant-based variations. In addition, competition is fierce, with existing manufacturers and new entrants attracting consumer attention through product differentiation and pricing tactics. For these same reasons, shifting consumer preferences will greatly complicate the issue of packaging sustainability. On top of this, logistical hurdles emerge, notably in warm weather where distribution directly correlates to product freshness. On the silver lining, despite many challenges, companies are learning to counter these difficulties by taking advantage of digitalisation, e-commerce channels, and so on while also targeting opportunities in premium and health-orientated segments through advanced manufacturing technologiesRisks & Prospects in Chocolate Biscuit Market

Health trends like gluten-free, organic, and low-sugar variants have propelled innovations, while sustainable packaging has made strong inroads. E-commerce channels have redefined distribution by providing access to an expanded range of products. Increased consumption for premium flavours and ethically sourced ingredients such as fair-trade cocoa is yet another avenue to growth. North America and Europe are the major markets at present, due to the high rates of consumption and established manufacturers, but the region that is purported to be very promising is Asia-Pacific. This is because of the fast-growing middle-class and urban population that aspires for high-priced, health-conscious snacks. Brands have been developing innovations specific to certain regions, including innovative flavours and health-orientated formulations. The advent of e-commerce in Asia-Pacific has also provided the consumer access to a wider variety of products.Key Target Audience

The target market for chocolate biscuits is highly diverse based on demographics, dietary requirements, and consumer motivations. The primary segments include children, attracted towards chocolate biscuits for their sweet taste; adults interested in indulgent snacks or quick-to-go treats; and health-orientated consumers concerned about sugar-free options or gluten-free or organic biscuits. The segmentation shows how chocolate biscuits are commonly found in a large cross-section of ages and income levels.,, The market also differs according to geographic region, doing service to matured ones such as North America and Europe, where innovations for maintaining the health angle and premium options kickstart growth, plus emerging markets such as Asia-Pacific and Latin America, where a rise in disposable incomes and urbanisation trigger demand. Distribution channels further fine-tune these target audiences: supermarkets/hypermarkets attract the traditional buyers, while online buyers are tech-savvy.Merger and acquisition

The recent mergers and acquisitions environment in chocolate biscuits may be interpreted as strategic decisions on the part of major players to diversify portfolios and extend market reach. On December 16, 2024, Mars Inc. announced a merger in which Kellanova, the company making Pringles and Pop-Tarts, was to be acquired by Mars for $35.9 billion. This merger is the biggest in the snacking sector this year and aims to buttress the Mars snacking division and widen its product offerings, including chocolate biscuits, through augmented Kellanova's heterogeneous snack products. Also, Mondelez International, which stands for promoting brands like Cadbury, has been contemplating a $38 billion takeover for Hershey. This acquisition would increase Mondelez's foothold in the U.S. chocolate market immensely, especially in the chocolate biscuit segment. Still, the deal is not devoid of complications, beginning with interference from the Hershey Trust and extending to the scope limitation of Hershey internationally, which can compromise its strategic value for Mondelez. >Analyst Comment

The chocolate biscuit industry is set to expand dramatically, with its valuation set to grow from USD 19.20 billion in 2025 to USD 26.52 billion by 2030. Growth is being led by increasing demand from consumers for indulgent and convenient snacks combined with advancements in flavour, texture, and healthier formats like low-sugar or organic offerings. Premiumisation directions and the use of wholesome ingredients in order to meet dietary choices are transforming the competitive landscape. Apart from that, developments in digital commerce and transportation have also assisted consumers in experiencing varied offerings without much effort, further fuelling market penetration.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Chocolate Biscuit- Snapshot

- 2.2 Chocolate Biscuit- Segment Snapshot

- 2.3 Chocolate Biscuit- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Chocolate Biscuit Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Format

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Texture

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: Competitive Landscape

- 5.1 Overview

- 5.2 Key Winning Strategies

- 5.3 Top 10 Players: Product Mapping

- 5.4 Competitive Analysis Dashboard

- 5.5 Market Competition Heatmap

- 5.6 Leading Player Positions, 2022

6: Company Profiles

- 6.1 Pladis Global

- 6.1.1 Company Overview

- 6.1.2 Key Executives

- 6.1.3 Company snapshot

- 6.1.4 Active Business Divisions

- 6.1.5 Product portfolio

- 6.1.6 Business performance

- 6.1.7 Major Strategic Initiatives and Developments

- 6.2 Nestle

- 6.2.1 Company Overview

- 6.2.2 Key Executives

- 6.2.3 Company snapshot

- 6.2.4 Active Business Divisions

- 6.2.5 Product portfolio

- 6.2.6 Business performance

- 6.2.7 Major Strategic Initiatives and Developments

- 6.3 Mondelez Inteational

- 6.3.1 Company Overview

- 6.3.2 Key Executives

- 6.3.3 Company snapshot

- 6.3.4 Active Business Divisions

- 6.3.5 Product portfolio

- 6.3.6 Business performance

- 6.3.7 Major Strategic Initiatives and Developments

- 6.4 Danish Speciality Foods Aps

- 6.4.1 Company Overview

- 6.4.2 Key Executives

- 6.4.3 Company snapshot

- 6.4.4 Active Business Divisions

- 6.4.5 Product portfolio

- 6.4.6 Business performance

- 6.4.7 Major Strategic Initiatives and Developments

- 6.5 Mayora

- 6.5.1 Company Overview

- 6.5.2 Key Executives

- 6.5.3 Company snapshot

- 6.5.4 Active Business Divisions

- 6.5.5 Product portfolio

- 6.5.6 Business performance

- 6.5.7 Major Strategic Initiatives and Developments

- 6.6 TATAWA

- 6.6.1 Company Overview

- 6.6.2 Key Executives

- 6.6.3 Company snapshot

- 6.6.4 Active Business Divisions

- 6.6.5 Product portfolio

- 6.6.6 Business performance

- 6.6.7 Major Strategic Initiatives and Developments

- 6.7 BALOCCO

- 6.7.1 Company Overview

- 6.7.2 Key Executives

- 6.7.3 Company snapshot

- 6.7.4 Active Business Divisions

- 6.7.5 Product portfolio

- 6.7.6 Business performance

- 6.7.7 Major Strategic Initiatives and Developments

- 6.8 Ishiya

- 6.8.1 Company Overview

- 6.8.2 Key Executives

- 6.8.3 Company snapshot

- 6.8.4 Active Business Divisions

- 6.8.5 Product portfolio

- 6.8.6 Business performance

- 6.8.7 Major Strategic Initiatives and Developments

- 6.9 Ezaki Glico

- 6.9.1 Company Overview

- 6.9.2 Key Executives

- 6.9.3 Company snapshot

- 6.9.4 Active Business Divisions

- 6.9.5 Product portfolio

- 6.9.6 Business performance

- 6.9.7 Major Strategic Initiatives and Developments

- 6.10 August Storck KG

- 6.10.1 Company Overview

- 6.10.2 Key Executives

- 6.10.3 Company snapshot

- 6.10.4 Active Business Divisions

- 6.10.5 Product portfolio

- 6.10.6 Business performance

- 6.10.7 Major Strategic Initiatives and Developments

7: Analyst Perspective and Conclusion

- 7.1 Concluding Recommendations and Analysis

- 7.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Chocolate Biscuit in 2030?

+

-

How big is the Global Chocolate Biscuit market?

+

-

How do regulatory policies impact the Chocolate Biscuit Market?

+

-

What major players in Chocolate Biscuit Market?

+

-

What applications are categorized in the Chocolate Biscuit market study?

+

-

Which product types are examined in the Chocolate Biscuit Market Study?

+

-

Which regions are expected to show the fastest growth in the Chocolate Biscuit market?

+

-

What are the major growth drivers in the Chocolate Biscuit market?

+

-

Is the study period of the Chocolate Biscuit flexible or fixed?

+

-

How do economic factors influence the Chocolate Biscuit market?

+

-