Global Citrus Fibers Market - Industry Dynamics, Market Size, And Opportunity Forecast To 2031

Report ID: MS-2249 | Food and Beverages | Last updated: Dec, 2024 | Formats*:

Citrus Fibers Report Highlights

| Report Metrics | Details |

|---|---|

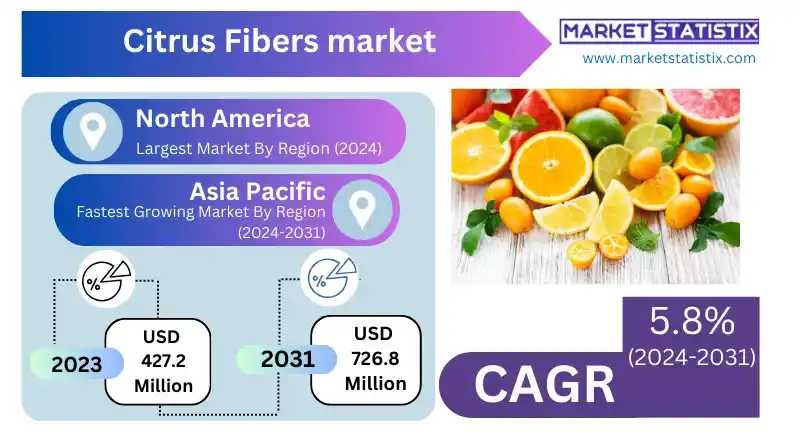

| Forecast period | 2019-2031 |

| Base Year Of Estimation | 2023 |

| Growth Rate | CAGR of 5.8% |

| Forecast Value (2031) | USD 726.8 Million |

| By Product Type | Orange, Tangerines/Mandarins, Grapefruit, Lemon, Lime, Others |

| Key Market Players |

|

| By Region |

|

Citrus Fibers Market Trends

There is increasing growth in the citrus fibers market resulting from an upsurge in demand for natural and plant-derived ingredients in the food and beverage industries. Citrus fibers are largely used as a dietary fiber that is health rewarding, thus enhancing digestion and weight management. It is treated and incorporated into bakery products, beverages, snacks, and dairy alternatives, majorly because consumers are becoming fond of clean labels and functional foods. Apart from that, citrus fiber is used as a texturing and compositional stabilizing agent commonly found in gluten-free and low-calorie products. The market is expanding due to the rising awareness of the health benefits associated with fiber. The rising trend in the citrus fibers market is the adoption of a new outlook by regions on the sustainable and green ingredients. Citrus fibers are extremely popular for sustainability in their area of production, being a waste because they arise from the entire juicing industry, hence lessening the food waste. Citrus fibers include more than food; they transcend boundaries into personal care and cosmetics, pharmaceuticals, and, in these applications, they also find uses such as emulsion stabilizers, thickeners, and so forth.Citrus Fibers Market Leading Players

The key players profiled in the report are Naturex SA, Quadra Chemicals Ltd., Nans Products, EDGE Ingredients, Koninklijke DSM N.V., Ingredients by Nature, Cargill Incorporated, JRS Silvateam Ingredients S.r.l., Ingredion Incorporated, Citrus Extracts LLC, AMC Group, Herbafood Ingredients GmbH, Golden Health, Lucid Colloids Ltd., Carolina Ingredients, Hebei Lemont Biotechnology Co. Ltd., CP Kelco, CEAMSA, Fiberstar Inc., FGF TrapaniGrowth Accelerators

Rising demand for clean-label and natural ingredients in food and beverages is expected to drive the citrus fibers market. Such health-conscious consumers are increasingly avoiding additives and, instead, favoring fruits and vegetables, particularly in juices, snacks, and baked goods. Citrus fibers, characterized by excellent dietary fiber contents and natural origin, are increasingly gaining attention among consumers because they offer healthy features in food products. Its benefits include improvement in texture, moisture retention, and provision of dietary fiber that supports digestive health and overall wellness. Increased acceptance of plant-based functional food products is another driver where citrus fibers are included as natural thickeners and stabilizers. Increasing demand for gluten-free, low-calorie, and sugar-free foods will boost this market, as citrus fibers help to develop better nutritional profiles. The other markets further extended by the versatility of these fibers are cosmetics and personal care, where they are used for their emulsifying and texturizing properties.Citrus Fibers Market Segmentation analysis

The Global Citrus Fibers is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Orange, Tangerines/Mandarins, Grapefruit, Lemon, Lime, Others . The Application segment categorizes the market based on its usage such as Bakery, Sauces and Seasonings, Meat and Egg Replacement, Desserts and Ice-Creams, Beverages, Flavorings, and Coatings, Snacks and Meals, Others. Geographically, the market is assessed across key Regions like North America(United States, Canada, Mexico), South America(Brazil, Argentina, Chile, Rest of South America), Europe(Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific(China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA(Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The competitive environment in the market of citrus fibers has landmines of all types: from the multinational food ingredient giants to the niche specialized suppliers focusing on plant-based ingredients. Major companies invest their resources in research and development programs to enhance the functionality of citrus fibers for food, beverage, and dietary supplement applications. Other strategies common in the citrus fiber segment include partnerships, collaborations, and acquisitions for presence strengthening and portfolio expansion.Challenges In Citrus Fibers Market

Due to the seasonal nature of citrus fruit production, the citrus fibers market is subject to price and supply chain fluctuations. Raw material availability is cyclical and dependent on factors such as weather and crop yield; this instability in raw materials leads to price fluctuations of citrus fibers. Therefore, costs of citrus fiber products will fluctuate and increase manufacturers' difficulties in maintaining a consistent supply and production, eventually affecting market growth. Another challenge threatening the citrus fibers market is consumer awareness and acceptance of its usage, particularly in developing regions where alternative fibers are readily available. Citrus fibers have many advantages over high dietary fiber content, sustainability, and clean-label appeal, yet those who still have little or no idea of the benefits of citrus fibers vis-à-vis traditional ingredients are still awestruck at imagining the conventional applications.Risks & Prospects in Citrus Fibers Market

This has been able to present a much larger profitable opportunity for the use of citrus fibres in foods and beverages as natural additives to improve the texture, mouthfeel, and nutritional profile of products. These fibres have mainly been introduced to present applications in gluten-free, plant-based, and clean-label foods as dietary fibres, enhancing the quality of baked goods, beverages, snacks, and meat alternatives. The citrus fibres will serve as a sustainable and functional culprit for the needs of both the manufacturer and the health-conscious consumer in the advent of the ever-increasing demand for richer and healthier, highly fibrous diets. Another high-potential opportunity emerges from the application of citrus fibres in cosmetics and personal care products, where the fibres have been added in the specialities pertaining to skin and hair care, highlighting their benefits of moisturising, exfoliating, and emulsifying activity. With rising demand for natural and green ingredients in beauty products, citrus fibres could be quite a natural and attractive alternative to synthetic chemicals.Key Target Audience

The market for citrus fibers has a significant target audience of food and beverage manufacturers that apply citrus fibers as a natural ingredient in texture improvement, moisture retention, and nutritional value. Citrus fibers are typically added to processed food products such as bakery, dairy, snack, and beverage items to improve the fiber content and enhance the shelf life and overall quality.,, Cosmetics and personal care manufacturers are also potential beneficiary target audiences, as citrus fibers are utilized in skin care and cosmetic products for their physical exfoliating properties; improvement in hydration and texture is also noted. Agricultural companies and ingredient suppliers fit into this group by providing citrus fibers to industries. The segment of the market that inspires the most interest is occurring from brands increasingly prioritizing health, wellness, and green products as consumer demand swells for clean labels, natural, and sustainable ingredients.Merger and acquisition

Companies have recently engaged in a frenzy of merger activity in the citrus fibers market, as they desire to augment their product portfolios and boost their market presences. For example, CP Kelco made such an investment by announcing in early September 2021 the commitment of more than $50 million into the expansion of its production capacity for NUTRAVA® citrus fiber used mainly in food applications like dressings, soups, and baked goods. Such an initiative forms part of a dynamic pattern where big names, including Cargill and Fiberstar, pursue partnerships and acquisitions to enhance their abilities in innovative citrus fibre products. Hence, the increasing demand for using natural ingredients in food products compels the companies to consolidate and improve their technological capabilities. Consumer awareness about health benefits is rising, which, in turn, enables companies to incorporate clean-label products into the market. As a result, companies are active in pursuing mergers and acquisitions as the major strategy for leveraging new opportunities in this growing market. >Analyst Comment

"Today, the citrus fiber market is booming due to the increase in the consumer demand for the 'natural and sustainable' ingredients among end-users. The fibers, extracted from citrus fruits, find application in a wide variety of industries ranging from food to pharmaceuticals to cosmetics and textiles. They have been known to have a plethora of excellent functional properties, including water-holding capacity, gelling, and emulsification. Clean labels, the growing market for plant-based ingredients, and increasing emphasis on sustainability are the important factors driving the market."- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Citrus Fibers- Snapshot

- 2.2 Citrus Fibers- Segment Snapshot

- 2.3 Citrus Fibers- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Citrus Fibers Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Orange

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Tangerines/Mandarins

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Grapefruit

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Lemon

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

- 4.6 Lime

- 4.6.1 Key market trends, factors driving growth, and opportunities

- 4.6.2 Market size and forecast, by region

- 4.6.3 Market share analysis by country

- 4.7 Others

- 4.7.1 Key market trends, factors driving growth, and opportunities

- 4.7.2 Market size and forecast, by region

- 4.7.3 Market share analysis by country

5: Citrus Fibers Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Bakery

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Sauces and Seasonings

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Meat and Egg Replacement

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Desserts and Ice-Creams

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Beverages

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

- 5.7 Flavorings

- 5.7.1 Key market trends, factors driving growth, and opportunities

- 5.7.2 Market size and forecast, by region

- 5.7.3 Market share analysis by country

- 5.8 and Coatings

- 5.8.1 Key market trends, factors driving growth, and opportunities

- 5.8.2 Market size and forecast, by region

- 5.8.3 Market share analysis by country

- 5.9 Snacks and Meals

- 5.9.1 Key market trends, factors driving growth, and opportunities

- 5.9.2 Market size and forecast, by region

- 5.9.3 Market share analysis by country

- 5.10 Others

- 5.10.1 Key market trends, factors driving growth, and opportunities

- 5.10.2 Market size and forecast, by region

- 5.10.3 Market share analysis by country

6: Citrus Fibers Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 Naturex SA

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 Quadra Chemicals Ltd.

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Nans Products

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 EDGE Ingredients

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Koninklijke DSM N.V.

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Ingredients by Nature

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Cargill Incorporated

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 JRS Silvateam Ingredients S.r.l.

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 Ingredion Incorporated

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 Citrus Extracts LLC

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

- 8.11 AMC Group

- 8.11.1 Company Overview

- 8.11.2 Key Executives

- 8.11.3 Company snapshot

- 8.11.4 Active Business Divisions

- 8.11.5 Product portfolio

- 8.11.6 Business performance

- 8.11.7 Major Strategic Initiatives and Developments

- 8.12 Herbafood Ingredients GmbH

- 8.12.1 Company Overview

- 8.12.2 Key Executives

- 8.12.3 Company snapshot

- 8.12.4 Active Business Divisions

- 8.12.5 Product portfolio

- 8.12.6 Business performance

- 8.12.7 Major Strategic Initiatives and Developments

- 8.13 Golden Health

- 8.13.1 Company Overview

- 8.13.2 Key Executives

- 8.13.3 Company snapshot

- 8.13.4 Active Business Divisions

- 8.13.5 Product portfolio

- 8.13.6 Business performance

- 8.13.7 Major Strategic Initiatives and Developments

- 8.14 Lucid Colloids Ltd.

- 8.14.1 Company Overview

- 8.14.2 Key Executives

- 8.14.3 Company snapshot

- 8.14.4 Active Business Divisions

- 8.14.5 Product portfolio

- 8.14.6 Business performance

- 8.14.7 Major Strategic Initiatives and Developments

- 8.15 Carolina Ingredients

- 8.15.1 Company Overview

- 8.15.2 Key Executives

- 8.15.3 Company snapshot

- 8.15.4 Active Business Divisions

- 8.15.5 Product portfolio

- 8.15.6 Business performance

- 8.15.7 Major Strategic Initiatives and Developments

- 8.16 Hebei Lemont Biotechnology Co. Ltd.

- 8.16.1 Company Overview

- 8.16.2 Key Executives

- 8.16.3 Company snapshot

- 8.16.4 Active Business Divisions

- 8.16.5 Product portfolio

- 8.16.6 Business performance

- 8.16.7 Major Strategic Initiatives and Developments

- 8.17 CP Kelco

- 8.17.1 Company Overview

- 8.17.2 Key Executives

- 8.17.3 Company snapshot

- 8.17.4 Active Business Divisions

- 8.17.5 Product portfolio

- 8.17.6 Business performance

- 8.17.7 Major Strategic Initiatives and Developments

- 8.18 CEAMSA

- 8.18.1 Company Overview

- 8.18.2 Key Executives

- 8.18.3 Company snapshot

- 8.18.4 Active Business Divisions

- 8.18.5 Product portfolio

- 8.18.6 Business performance

- 8.18.7 Major Strategic Initiatives and Developments

- 8.19 Fiberstar Inc.

- 8.19.1 Company Overview

- 8.19.2 Key Executives

- 8.19.3 Company snapshot

- 8.19.4 Active Business Divisions

- 8.19.5 Product portfolio

- 8.19.6 Business performance

- 8.19.7 Major Strategic Initiatives and Developments

- 8.20 FGF Trapani

- 8.20.1 Company Overview

- 8.20.2 Key Executives

- 8.20.3 Company snapshot

- 8.20.4 Active Business Divisions

- 8.20.5 Product portfolio

- 8.20.6 Business performance

- 8.20.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Citrus Fibers in 2031?

+

-

How big is the Global Citrus Fibers market?

+

-

How do regulatory policies impact the Citrus Fibers Market?

+

-

What major players in Citrus Fibers Market?

+

-

What applications are categorized in the Citrus Fibers market study?

+

-

Which product types are examined in the Citrus Fibers Market Study?

+

-

Which regions are expected to show the fastest growth in the Citrus Fibers market?

+

-

Which region is the fastest growing in the Citrus Fibers market?

+

-

What are the major growth drivers in the Citrus Fibers market?

+

-

Is the study period of the Citrus Fibers flexible or fixed?

+

-