Global Clothing Fasteners Market Dynamics, Market Size, And Opportunity Forecast To 2030

Report ID: MS-475 | Consumer Goods | Last updated: Mar, 2025 | Formats*:

Clothing Fasteners Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

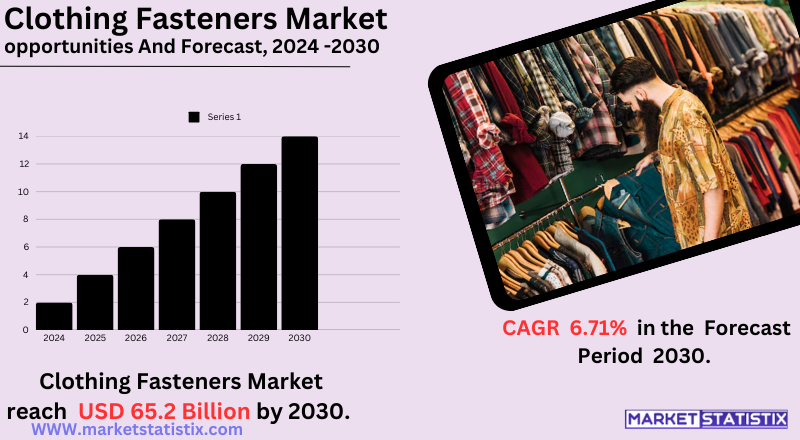

| Growth Rate | CAGR of 6.71% |

| Forecast Value (2030) | USD 65.2 Billion |

| By Product Type | Hook & Loop, Buttons, Zippers, Snaps, Buckles, Others |

| Key Market Players |

|

| By Region |

Clothing Fasteners Market Trends

The clothing fasteners market is witnessing a transition towards innovation and sustainability. The major trends are the creation of more lightweight and durable fasteners, fuelled by the need for higher-performance clothing. There is also an increasing focus on sustainable materials and manufacturing processes, as consumers and producers become greener. The incorporation of smart technology, like embedded sensors in fasteners, is on the horizon, albeit a niche segment. Market analysis further indicates a high emphasis on manufacturing automation and efficiency. In addition, there is growing demand for technical textiles and protective clothing specialised fasteners, which indicates the increasing significance of these industries. The market is also experiencing growth in demand for visually appealing fasteners that contribute to the overall appearance of clothing, with designers increasingly considering them as part of the design.Clothing Fasteners Market Leading Players

The key players profiled in the report are IDEAL Fastener (United States), YBS Zipper (Taiwan), Paiho (Taiwan), APLIX (France), SBS (China), Primotex (China), 3F (Taiwan), Coats Industrial (United Kingdom), Jianli (China), Changcheng La Chain (China), YKK (Japan), MORITO (Japan), RIRI (Switzerland), MAX Zipper (China), HHH Zipper (China), YCC (China), Koh-i-noor (Europe), Kuraray Group (Japan), Weixing Group (China), Shingyi (China), Sanli Zipper (China), Velcro (United States), SALMI (Finland), OthersGrowth Accelerators

The major drivers of the clothing fasteners market are based around the continually developing clothing market. One major driver is the sustained demand by clothes producers for constant and varied fastening options that will serve in differing garment construction and functionality purposes. Fashion constantly shapes the market since fashion designers need creative, as well as good-looking, fasteners that can be added to their clothing creations. The other key driver is the growing emphasis on sustainability and ethical sourcing. Brands and consumers are calling for sustainable fasteners produced from recycled or biodegradable materials. Advances in materials and manufacturing technologies also contribute to the development of more functional, lightweight, and durable fasteners. Finally, the growth of online shopping has made a greater variety of fasteners more accessible, allowing small clothing companies and individual consumers to access specialised parts.Clothing Fasteners Market Segmentation analysis

The Global Clothing Fasteners is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Hook & Loop, Buttons, Zippers, Snaps, Buckles, Others . The Application segment categorizes the market based on its usage such as Lingerie, Jackets and Coats, Trousers, Shirts, Dresses, Footwear, Bags, Others. Geographically, the market is assessed across key Regions like {regionNms} and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The market for clothing fasteners is defined by a dispersed competitive environment with both large multinationals and several small specialist manufacturers. Competitive pressures are most typically based on product innovation, quality, price, and distribution networks. Strong economies of scale and brand loyalty favour established manufacturers, while the focus for small manufacturers is usually the niche markets or specialist ranges. Uncovering the competitive environment indicates an emphasis on supply chain effectiveness and responsiveness to evolving fashion trends. Firms are allocating resources to research and development to produce innovative fasteners that satisfy current garment design needs. Competition moves beyond product features to include aspects such as customer service, customisation capabilities, and the capability to offer timely and dependable delivery.Challenges In Clothing Fasteners Market

The clothing fasteners market is posed with a few major challenges led mainly by price competition and changing raw material costs. The industry is highly material-dependent on sources such as metal and plastic that are exposed to global market changes. Moreover, the fast-paced nature of fashion and its pull for cheap ingredients create pressure among manufacturers to produce at competitive levels, which inevitably affects profit levels. Another major challenge is the fast-changing fashion trend and consumer behaviour, necessitating rapid adaptation and constant innovation on the part of manufacturers. Consumers increasingly demand sustainable and environmentally friendly fasteners, but these can take time and money to develop and manufacture. Additionally, the market is fragmented with many small and big players vying for space. Counterfeiting and quality control are also challenges, especially in channels of online sale. Ensuring product safety and maintaining consistent quality are important in establishing brand reputation and customer confidence.Risks & Prospects in Clothing Fasteners Market

The growth is fuelled by a number of major market opportunities, such as the growing need for innovative and visually attractive fasteners in the fashion sector, technological developments in fastening technologies, and the growing popularity of online shopping platforms. Joint ventures between apparel designers and fastener producers further boost product offerings, responding to changing consumer tastes. Regionally, the market has varying growth trends. Asia-Pacific is notable because of its strong textile production base, with India and China being leading producers. North America and Europe are also significant markets with a strong fashion sector and retail demand for quality clothing. Analysing regional taste and fashion directions is vital for manufacturers seeking to adapt their products effectively and benefit from these trends.Key Target Audience

, The main target of the clothing fasteners market includes garment producers and fashion brands. These need an uninterrupted and regular supply of fasteners to produce their lines of clothing. They range from major fashion chains to small, individual designers and tailor shops. Each of their requirements depends on what type of apparel they make, what the visual appeal should be, and the functionality that needs to be supported by the fasteners., Moreover, the market serves textile and fabric stores, along with individual consumers who sew and craft. These individuals and companies buy fasteners for domestic sewing projects, alterations, and personalisation. This group appreciates variety, quality, and convenience, looking for an extensive variety of fastener sizes and types to address their diverse requirements. DIY fashion, in addition to green clothing culture, has also helped grow this consumer base.Merger and acquisition

The market for clothing fasteners has seen significant mergers and acquisitions over the past few years, a trend toward consolidation and strategic growth. In July 2022, Coats Group, a global industrial thread manufacturer, bought Texon, a footwear component specialist, to enhance its foothold in the athleisure footwear sector. Later, in August 2022, Coats continued to grow its footwear business by acquiring Rhenoflex, a producer of footwear reinforcement parts. Further, in November 2024, Endries International, a fastener and Class-C component distributor, acquired Assembly Fasteners, Inc. (AFI), a latch, fastener, and hardware products company. This acquisition focused on improving Endries' market position and broadening its product base in the fasteners sector. These strategic acquisitions highlight the industry's emphasis on diversification and the enhancement of supply chain capacities to address changing consumer needs. >Analyst Comment

The clothing fasteners market is characterised by steady demand, linked closely to the international apparel industry. Major trends involve an increase in emphasis on sustainable and environmentally friendly materials due to heightened awareness among consumers and manufacturers. Advancements in technology are also impacting, with breakthroughs in the design and function of fasteners, including lighter and stronger materials and even more subtle or decorative types. The fashion world drives the market, with fashion designers looking for novel and creative fasteners to make garments more beautiful and functional. The internet has increased the access of fastener manufacturers to customers globally.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Clothing Fasteners- Snapshot

- 2.2 Clothing Fasteners- Segment Snapshot

- 2.3 Clothing Fasteners- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Clothing Fasteners Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Zippers

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Buttons

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Snaps

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Hook & Loop

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

- 4.6 Buckles

- 4.6.1 Key market trends, factors driving growth, and opportunities

- 4.6.2 Market size and forecast, by region

- 4.6.3 Market share analysis by country

- 4.7 Others

- 4.7.1 Key market trends, factors driving growth, and opportunities

- 4.7.2 Market size and forecast, by region

- 4.7.3 Market share analysis by country

5: Clothing Fasteners Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Jackets and Coats

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Trousers

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Shirts

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Dresses

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Lingerie

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

- 5.7 Bags

- 5.7.1 Key market trends, factors driving growth, and opportunities

- 5.7.2 Market size and forecast, by region

- 5.7.3 Market share analysis by country

- 5.8 Footwear

- 5.8.1 Key market trends, factors driving growth, and opportunities

- 5.8.2 Market size and forecast, by region

- 5.8.3 Market share analysis by country

- 5.9 Others

- 5.9.1 Key market trends, factors driving growth, and opportunities

- 5.9.2 Market size and forecast, by region

- 5.9.3 Market share analysis by country

6: Competitive Landscape

- 6.1 Overview

- 6.2 Key Winning Strategies

- 6.3 Top 10 Players: Product Mapping

- 6.4 Competitive Analysis Dashboard

- 6.5 Market Competition Heatmap

- 6.6 Leading Player Positions, 2022

7: Company Profiles

- 7.1 3F (Taiwan)

- 7.1.1 Company Overview

- 7.1.2 Key Executives

- 7.1.3 Company snapshot

- 7.1.4 Active Business Divisions

- 7.1.5 Product portfolio

- 7.1.6 Business performance

- 7.1.7 Major Strategic Initiatives and Developments

- 7.2 APLIX (France)

- 7.2.1 Company Overview

- 7.2.2 Key Executives

- 7.2.3 Company snapshot

- 7.2.4 Active Business Divisions

- 7.2.5 Product portfolio

- 7.2.6 Business performance

- 7.2.7 Major Strategic Initiatives and Developments

- 7.3 Changcheng La Chain (China)

- 7.3.1 Company Overview

- 7.3.2 Key Executives

- 7.3.3 Company snapshot

- 7.3.4 Active Business Divisions

- 7.3.5 Product portfolio

- 7.3.6 Business performance

- 7.3.7 Major Strategic Initiatives and Developments

- 7.4 Coats Industrial (United Kingdom)

- 7.4.1 Company Overview

- 7.4.2 Key Executives

- 7.4.3 Company snapshot

- 7.4.4 Active Business Divisions

- 7.4.5 Product portfolio

- 7.4.6 Business performance

- 7.4.7 Major Strategic Initiatives and Developments

- 7.5 HHH Zipper (China)

- 7.5.1 Company Overview

- 7.5.2 Key Executives

- 7.5.3 Company snapshot

- 7.5.4 Active Business Divisions

- 7.5.5 Product portfolio

- 7.5.6 Business performance

- 7.5.7 Major Strategic Initiatives and Developments

- 7.6 IDEAL Fastener (United States)

- 7.6.1 Company Overview

- 7.6.2 Key Executives

- 7.6.3 Company snapshot

- 7.6.4 Active Business Divisions

- 7.6.5 Product portfolio

- 7.6.6 Business performance

- 7.6.7 Major Strategic Initiatives and Developments

- 7.7 Jianli (China)

- 7.7.1 Company Overview

- 7.7.2 Key Executives

- 7.7.3 Company snapshot

- 7.7.4 Active Business Divisions

- 7.7.5 Product portfolio

- 7.7.6 Business performance

- 7.7.7 Major Strategic Initiatives and Developments

- 7.8 Koh-i-noor (Europe)

- 7.8.1 Company Overview

- 7.8.2 Key Executives

- 7.8.3 Company snapshot

- 7.8.4 Active Business Divisions

- 7.8.5 Product portfolio

- 7.8.6 Business performance

- 7.8.7 Major Strategic Initiatives and Developments

- 7.9 Kuraray Group (Japan)

- 7.9.1 Company Overview

- 7.9.2 Key Executives

- 7.9.3 Company snapshot

- 7.9.4 Active Business Divisions

- 7.9.5 Product portfolio

- 7.9.6 Business performance

- 7.9.7 Major Strategic Initiatives and Developments

- 7.10 MAX Zipper (China)

- 7.10.1 Company Overview

- 7.10.2 Key Executives

- 7.10.3 Company snapshot

- 7.10.4 Active Business Divisions

- 7.10.5 Product portfolio

- 7.10.6 Business performance

- 7.10.7 Major Strategic Initiatives and Developments

- 7.11 MORITO (Japan)

- 7.11.1 Company Overview

- 7.11.2 Key Executives

- 7.11.3 Company snapshot

- 7.11.4 Active Business Divisions

- 7.11.5 Product portfolio

- 7.11.6 Business performance

- 7.11.7 Major Strategic Initiatives and Developments

- 7.12 Paiho (Taiwan)

- 7.12.1 Company Overview

- 7.12.2 Key Executives

- 7.12.3 Company snapshot

- 7.12.4 Active Business Divisions

- 7.12.5 Product portfolio

- 7.12.6 Business performance

- 7.12.7 Major Strategic Initiatives and Developments

- 7.13 Primotex (China)

- 7.13.1 Company Overview

- 7.13.2 Key Executives

- 7.13.3 Company snapshot

- 7.13.4 Active Business Divisions

- 7.13.5 Product portfolio

- 7.13.6 Business performance

- 7.13.7 Major Strategic Initiatives and Developments

- 7.14 RIRI (Switzerland)

- 7.14.1 Company Overview

- 7.14.2 Key Executives

- 7.14.3 Company snapshot

- 7.14.4 Active Business Divisions

- 7.14.5 Product portfolio

- 7.14.6 Business performance

- 7.14.7 Major Strategic Initiatives and Developments

- 7.15 SALMI (Finland)

- 7.15.1 Company Overview

- 7.15.2 Key Executives

- 7.15.3 Company snapshot

- 7.15.4 Active Business Divisions

- 7.15.5 Product portfolio

- 7.15.6 Business performance

- 7.15.7 Major Strategic Initiatives and Developments

- 7.16 Sanli Zipper (China)

- 7.16.1 Company Overview

- 7.16.2 Key Executives

- 7.16.3 Company snapshot

- 7.16.4 Active Business Divisions

- 7.16.5 Product portfolio

- 7.16.6 Business performance

- 7.16.7 Major Strategic Initiatives and Developments

- 7.17 SBS (China)

- 7.17.1 Company Overview

- 7.17.2 Key Executives

- 7.17.3 Company snapshot

- 7.17.4 Active Business Divisions

- 7.17.5 Product portfolio

- 7.17.6 Business performance

- 7.17.7 Major Strategic Initiatives and Developments

- 7.18 Shingyi (China)

- 7.18.1 Company Overview

- 7.18.2 Key Executives

- 7.18.3 Company snapshot

- 7.18.4 Active Business Divisions

- 7.18.5 Product portfolio

- 7.18.6 Business performance

- 7.18.7 Major Strategic Initiatives and Developments

- 7.19 Velcro (United States)

- 7.19.1 Company Overview

- 7.19.2 Key Executives

- 7.19.3 Company snapshot

- 7.19.4 Active Business Divisions

- 7.19.5 Product portfolio

- 7.19.6 Business performance

- 7.19.7 Major Strategic Initiatives and Developments

- 7.20 Weixing Group (China)

- 7.20.1 Company Overview

- 7.20.2 Key Executives

- 7.20.3 Company snapshot

- 7.20.4 Active Business Divisions

- 7.20.5 Product portfolio

- 7.20.6 Business performance

- 7.20.7 Major Strategic Initiatives and Developments

- 7.21 YBS Zipper (Taiwan)

- 7.21.1 Company Overview

- 7.21.2 Key Executives

- 7.21.3 Company snapshot

- 7.21.4 Active Business Divisions

- 7.21.5 Product portfolio

- 7.21.6 Business performance

- 7.21.7 Major Strategic Initiatives and Developments

- 7.22 YCC (China)

- 7.22.1 Company Overview

- 7.22.2 Key Executives

- 7.22.3 Company snapshot

- 7.22.4 Active Business Divisions

- 7.22.5 Product portfolio

- 7.22.6 Business performance

- 7.22.7 Major Strategic Initiatives and Developments

- 7.23 YKK (Japan)

- 7.23.1 Company Overview

- 7.23.2 Key Executives

- 7.23.3 Company snapshot

- 7.23.4 Active Business Divisions

- 7.23.5 Product portfolio

- 7.23.6 Business performance

- 7.23.7 Major Strategic Initiatives and Developments

- 7.24 Others

- 7.24.1 Company Overview

- 7.24.2 Key Executives

- 7.24.3 Company snapshot

- 7.24.4 Active Business Divisions

- 7.24.5 Product portfolio

- 7.24.6 Business performance

- 7.24.7 Major Strategic Initiatives and Developments

8: Analyst Perspective and Conclusion

- 8.1 Concluding Recommendations and Analysis

- 8.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Clothing Fasteners in 2030?

+

-

Which application type is expected to remain the largest segment in the Global Clothing Fasteners market?

+

-

How big is the Global Clothing Fasteners market?

+

-

How do regulatory policies impact the Clothing Fasteners Market?

+

-

What major players in Clothing Fasteners Market?

+

-

What applications are categorized in the Clothing Fasteners market study?

+

-

Which product types are examined in the Clothing Fasteners Market Study?

+

-

Which regions are expected to show the fastest growth in the Clothing Fasteners market?

+

-

Which application holds the second-highest market share in the Clothing Fasteners market?

+

-

What are the major growth drivers in the Clothing Fasteners market?

+

-