Global Coated Paper Market - Industry Dynamics, Market Size, And Opportunity Forecast To 2031

Report ID: MS-298 | Chemicals And Materials | Last updated: Jan, 2025 | Formats*:

Coated Paper Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2031 |

| Base Year Of Estimation | 2024 |

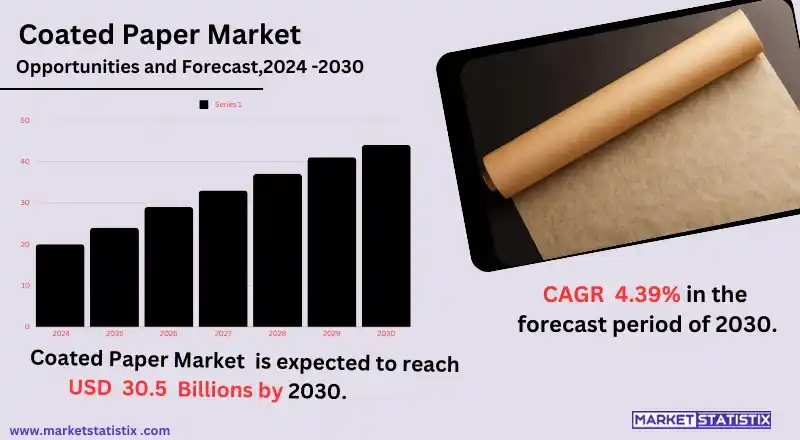

| Growth Rate | CAGR of 4.39% |

| Forecast Value (2031) | USD 30.5 Billion |

| By Product Type | Coated Fine Paper, Standard Coated Fine Paper, Coated Groundwood Powder, Low Coat Weight Paper, Art Paper, Other |

| Key Market Players |

|

| By Region |

Coated Paper Market Trends

The massive coated paper market worldwide is considered to improve by USD 22.40 billion in 2023 to USD 33.01 billion by 2032 within the forecast period from 2024 to 2032. The expansion is primarily due to increased demand for high-quality printed content in advertisement, fashion, corporate communication, and other end-use applications that require better printability and bright colors. This growth is, indeed, strongly contributed to by the booming e-commerce segment in Asia Pacific with increasing demand for improved packaging solutions for better product presentation and shelf life.Coated Paper Market Leading Players

The key players profiled in the report are Shree Krishna Paper Mills & Industries Ltd, Asia Pulp & Paper, Stora Enso Oyj, JK Paper Ltd, Ballarpur Industries Limited, Paradise Packaging Pvt. Ltd, Oji Holdings Corporation, Emami Group, NewPage Corporation, Burgo Group SpA, UPM-Kymmene Corp, Arjowiggins SAS, Sappi Limited, Nippon Paper Industries Co. Ltd, Minerals Technologies Inc.Growth Accelerators

Apart from that, the coated paper market has mainly been revolutionising itself under growing demand from the packaging and printing industries. The growth rates of both areas have been increasing significantly due to the rise in e-commerce and online retail, which now requires high-quality packaging materials. Coated papers have emerged as the most relied-on source for durable, glossy, and easily printable media. Other industries that are fuelling market growth include advertisement and publishing, which create magazines, brochures, and distribution materials. Innovations in coating technology, whether eco-friendly or biodegradable, strongly appeal to the environmentally aware population and businesses as well. The most critical among them includes increasing the use of coated paper for food packaging. They are utterly grease-resistant and moisture-proof, which makes them excellent for food-grade applications. Governments from all corners of the world are pushing for sustainability in packaging, making recyclable and biodegradable coated paper the way to go.Coated Paper Market Segmentation analysis

The Global Coated Paper is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Coated Fine Paper, Standard Coated Fine Paper, Coated Groundwood Powder, Low Coat Weight Paper, Art Paper, Other . The Application segment categorizes the market based on its usage such as Packaging, Printing, Label, Others. Geographically, the market is assessed across key Regions like {regionNms} and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The coated paper market is highly competitive, comprising the world's largest multinational companies, as well as some smaller regional companies. Significant key market players possess large production capacities and worldwide distribution networks, which provide the advantage of economies of scale to meet diverse consumer needs. These companies are very competitive on product innovation, cost efficiency, and relationships with customers, but mainly compete for market shares. Such activities are also indulged in by companies in forming strategic alliances, mergers, and acquisitions to broaden their product portfolios, increase their geography, or strengthen relative opportunities.Challenges In Coated Paper Market

The coated paper market is facing challenges from various angles, above all with price fluctuations in raw materials such as wood pulp and chemicals used for coating. These price fluctuations turn into a cost that can substantially affect production costs, forcing manufacturers to compromise from time to time in their profit margins. In addition, lately, environmental concerns and increasing regulatory pressures on deforestation, waste management, or carbon emissions have seen companies move toward adopting more environmentally sustainable practices. Another major one is increasing competition with digital media, creating less demand for printed materials. E-books, online advertising, and digital publishing have decreased the need for printed advertising and print throughout many sectors. Coated paper manufacturers should, therefore, seek to innovate or create value-added products to remain competitive while finding avenues for diversification in markets to resist declines in traditional demand.Risks & Prospects in Coated Paper Market

Coated papers, especially those with high-gloss coatings, are required in high volumes in premium packaging solutions for various departments such as food and beverages, pharmaceuticals, and luxury products. The greater the e-commerce and online retail, the higher the demand for packaging material that is attractive and durable: coated papers thus become indispensable materials for effective presentation of products. In addition, coated paper manufacturers have developed more biodegradable and recyclable options as consumers lean increasingly toward sustainable and eco-friendly goods. Technological advancements in coating applications are also significant opportunities in that market. Digital printing technologies and modern coating formulations help to improve the quality, performance, and versatility of coated paper. These innovations have attracted new customers into markets such as advertising and marketing because the quality of printed media is critical for brand differentiation.Key Target Audience

Presently, the major intended markets for coated paper include printing, packaging, and other industries where high-quality printing is the primary demand. Printing companies, such as commercial printers and publishers, require glossy magazines, brochures, catalogues, and high-end marketing materials printed to take advantage of this capability. The smoothly glossy nature of coated paper will make it give sharp and vibrant images, thereby providing a way of prompting the premium sector into demanding this kind of printing application.,, But consumer goods packaging, which is the major aspect of this, is also very vital as it relates to attractiveness for identity as going down to brands. Coated paper most often finds its application in luxury and premium quality packaging, product labels, or high-end packaging solutions. The rest of the audience groups would be covered under stationery and art supplies, where these coated papers would be predominantly utilized for high-quality stationery products and certain professional art applications.Merger and acquisition

Mergers and acquisitions continue to dominate the coated paper industry today as key players strategies to increase market presence. For instance, BillerudKorsnas acquired Verso for $825 million in April 2022 in a market move to strengthen the foothold of the company in North America. Such activities clearly indicate the general trend that companies have pursued by consolidating resources and capabilities in preparation for positioning against competition in the future market. Some of the other major players involved in strategic acquisitions to expand their operational capacities and product offerings include Oji Holdings and Stora Enso. Apart from high-profile mergers, inorganic growth strategies such as mergers and acquisitions are ever adopted by companies to address challenges like soaring raw material costs and demand volatilities. Innovations in product development and ongoing expansion of packaging solutions for industries such as food and beverage, cosmetics, and pharmaceuticals are propelling this growth. >Analyst Comment

"The global coated paper market is one of the most critical segments of the paper industry and exhibits a constant growth rate. The printing and packaging industries have been pushing this development as both put very high demands on premium-quality, attractive paper products. Furthermore, developments in coating technologies and their increasing acceptance in digital printing keep contributing to the proliferation of the industry. Factors such as increasing disposable income, rapid urbanization, and changing shopping behavior due to the convenience of online shopping will lead to increased demand for packaging materials that are attractive and durable over the forecast period. Thus, it is expected that the market would grow substantially in the coming years."- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Coated Paper- Snapshot

- 2.2 Coated Paper- Segment Snapshot

- 2.3 Coated Paper- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Coated Paper Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Coated Fine Paper

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Standard Coated Fine Paper

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Coated Groundwood Powder

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Low Coat Weight Paper

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

- 4.6 Art Paper

- 4.6.1 Key market trends, factors driving growth, and opportunities

- 4.6.2 Market size and forecast, by region

- 4.6.3 Market share analysis by country

- 4.7 Other

- 4.7.1 Key market trends, factors driving growth, and opportunities

- 4.7.2 Market size and forecast, by region

- 4.7.3 Market share analysis by country

5: Coated Paper Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Packaging

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Printing

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Label

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Others

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

6: Coated Paper Market by Coating Material Outlook

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 Ground Calcium Carbonate (GCC)

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 Precipitated Calcium Carbonate (PCC)

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

- 6.4 Kaolin Clay

- 6.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.2 Market size and forecast, by region

- 6.4.3 Market share analysis by country

- 6.5 Wax

- 6.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.2 Market size and forecast, by region

- 6.5.3 Market share analysis by country

- 6.6 Others

- 6.6.1 Key market trends, factors driving growth, and opportunities

- 6.6.2 Market size and forecast, by region

- 6.6.3 Market share analysis by country

7: Competitive Landscape

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 Shree Krishna Paper Mills & Industries Ltd

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 Asia Pulp & Paper

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Stora Enso Oyj

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 JK Paper Ltd

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Ballarpur Industries Limited

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Paradise Packaging Pvt. Ltd

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Oji Holdings Corporation

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 Emami Group

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 NewPage Corporation

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 Burgo Group SpA

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

- 8.11 UPM-Kymmene Corp

- 8.11.1 Company Overview

- 8.11.2 Key Executives

- 8.11.3 Company snapshot

- 8.11.4 Active Business Divisions

- 8.11.5 Product portfolio

- 8.11.6 Business performance

- 8.11.7 Major Strategic Initiatives and Developments

- 8.12 Arjowiggins SAS

- 8.12.1 Company Overview

- 8.12.2 Key Executives

- 8.12.3 Company snapshot

- 8.12.4 Active Business Divisions

- 8.12.5 Product portfolio

- 8.12.6 Business performance

- 8.12.7 Major Strategic Initiatives and Developments

- 8.13 Sappi Limited

- 8.13.1 Company Overview

- 8.13.2 Key Executives

- 8.13.3 Company snapshot

- 8.13.4 Active Business Divisions

- 8.13.5 Product portfolio

- 8.13.6 Business performance

- 8.13.7 Major Strategic Initiatives and Developments

- 8.14 Nippon Paper Industries Co. Ltd

- 8.14.1 Company Overview

- 8.14.2 Key Executives

- 8.14.3 Company snapshot

- 8.14.4 Active Business Divisions

- 8.14.5 Product portfolio

- 8.14.6 Business performance

- 8.14.7 Major Strategic Initiatives and Developments

- 8.15 Minerals Technologies Inc.

- 8.15.1 Company Overview

- 8.15.2 Key Executives

- 8.15.3 Company snapshot

- 8.15.4 Active Business Divisions

- 8.15.5 Product portfolio

- 8.15.6 Business performance

- 8.15.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

By Coating Material Outlook |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Coated Paper in 2031?

+

-

What is the growth rate of Coated Paper Market?

+

-

What are the latest trends influencing the Coated Paper Market?

+

-

Who are the key players in the Coated Paper Market?

+

-

How is the Coated Paper } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Coated Paper Market Study?

+

-

What geographic breakdown is available in Global Coated Paper Market Study?

+

-

Which region holds the second position by market share in the Coated Paper market?

+

-

Which region holds the highest growth rate in the Coated Paper market?

+

-

How are the key players in the Coated Paper market targeting growth in the future?

+

-