Global Composite Materials Market Size, Share & Trends Analysis Report, Forecast Period, 2024-2030

Report ID: MS-361 | Chemicals And Materials | Last updated: Feb, 2025 | Formats*:

The composite materials market is a dynamic industry that develops, produces, and applies materials made through the combination of at least two different components. Those components have different physical and chemical properties that combine in some way to become a new material that has some improved characteristics. Generally, the new material has greater strength, stiffness, lightweight, or resistance to heat and corrosion than the original component materials. Applications range from aerospace and automotive, where weight reduction is essential for fuel efficiency, to construction and infrastructure, where durability and longevity are key. The composite materials market is one of innovation because researchers and manufacturers are continuously looking for some new combinations of materials and processing techniques to tailor composites with specific properties for applications.

Composite Materials Report Highlights

| Report Metrics | Details |

|---|---|

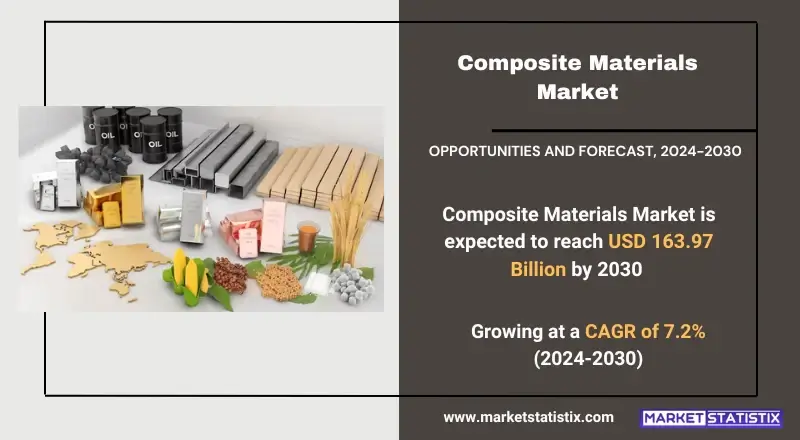

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

| Growth Rate | CAGR of 7.2% |

| Forecast Value (2030) | USD 163.97 Billion |

| By Product Type | Glass Fiber, Carbon Fiber, Others |

| Key Market Players |

|

| By Region |

|

Composite Materials Market Trends

The composite materials market is now experiencing several significant trends. One of these trends remains the increasing demand for lightweight and high-performance materials across various industries, especially within the automotive and aerospace industries. This is predicated on improving fuel economy, lowering emissions, and enhancing the overall performance of vehicles and aircraft. Other than these trends, manufacturing technologies such as automated fibre placement and resin transfer moulding are also being developed within the market for increased efficiencies and cost-wise advantages in producing composites. There is also a growing emphasis on increasing the advanced composite materials having properties such as greater longevity, heat resistance, and conductivity to suit the changing needs of several applications.

Composite Materials Market Leading Players

The key players profiled in the report are SGL Group, Owens Corning, PPG Industries, Inc., Weyerhaeuser Company, Teijin Ltd., Huntsman Corporation LLC, DuPont, Toray Industries, Inc., Hexcel Corporation, Compagnie de Saint-Gobain S.A., Kineco Limited, China Jushi Co., Ltd., Cytec Industries (Solvay, S.A.), Momentive Performance Materials, Inc., Veplas GroupGrowth Accelerators

Due to the rising demand for composite materials with lightweight and high strength in industries such as aerospace, automotive, and construction, the composite materials market is flourishing. These materials provide greater strength-to-weight ratio, corrosion resistance, and durability, which are essential towards applications demanding high performance and fuel efficiency. The growing emphasis on sustainability and fuel economy in transportation, notably in electric vehicles (EVs) and aircraft, accelerates the market growth further, as manufacturers are now looking for materials that would reduce emissions and enhance efficiency. On the other hand, the need for wind energy is pushing the use of composites for wind turbine blades, while the gradual conversion of the construction industry to new-age durable materials continues to further add to your market opportunities. The tenor of government regulations aimed at promoting eco-friendly and energy-saving solutions has undoubtedly aided the increasing acceptance rate of composites into the different sectors.

Composite Materials Market Segmentation analysis

The Global Composite Materials is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Glass Fiber, Carbon Fiber, Others . The Application segment categorizes the market based on its usage such as Wind Energy, Automotive & Transportation, Marine, Pipes & Tanks, Electrical & Electronics, Construction and Infrastructure, Others. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

Within the composite materials market, intense competition exists among such global giants as Hexcel Corporation, Toray Industries, SGL Carbon, Owens Corning, and Teijin Limited. These companies put emphasis on the spheres of innovation, strategic partnership, and merger activities to be able to gain a foothold in the respective market and enhance their offerings. With its fast-paced developments in material science and increasing demands for lightweight and strong materials in aerospace, automotive, and wind energy for sustainable alternatives, the competition has intensified in the industry. Regional players and new entrants are also helping to broaden market competition by providing affordable and customised solutions. At present, companies are undertaking a lot of R&D for composites with desirable longevity, recyclability, and performance against extreme conditions.

Challenges In Composite Materials Market

The composite materials market is excellent yet has a few problems toward wider acceptance. With advanced fibres such as carbon fibre, one of these hurdles is the raw material costs, which make composites more from-the-pocket-expenditure-wise than traditional materials like metal, consequently limiting applications to non-price-sensitive cases. Another hurdle concerns the intricate manufacturing processes related to composites. In order to produce good quality composite parts, one needs special equipment and expertise; this can act as a barrier to small companies or those from underdeveloped regions. Moreover, the environmental impact of the composite production and disposal should also be addressed since some materials and processes could be very energy-consuming, resulting in waste.

Risks & Prospects in Composite Materials Market

The composite materials market has considerable opportunities in all sectors. It is the demand for lightweight, high-performance materials that has led to new composite applications in aerospace, automotive, etc., where fuel economy is a major factor. Moreover, new developments in sustainable architecture open up possibilities for composites in structural applications, where they provide durability and design flexibility. Another opportunity presented to composites by an ever-growing renewable energy sector is soaring demand for composite materials in wind turbine blades. Resistant to harsh climatic conditions while ensuring structural integrity, composites make an excellent candidate for this application.

Key Target Audience

The composite materials market chiefly targets the aerospace, automotive, and transport industries, wherein lightweight and high-strength materials can help fuel efficiency and performance. Composites are used by these industries' manufacturers and engineers to increase durability, reduce weight, and meet strict safety requirements. The construction and infrastructure sector uses composites to produce corrosion-resistant and durable material for bridges, buildings, and pipelines, with cost-effective and viable solutions. Another large audience includes wind encounters, sporting goods, and marine industries that benefit from the composites' strength, flexibility, and resistance to the harsh environment. Suppliers, distributors, and research institutes are also vital in propelling the growth of composite material technologies.

Merger and acquisition

Recent mergers and acquisitions in the composite materials space are becoming focused on augmenting capabilities in order to enhance market positions. In February 2024, Owens Corning made headlines by acquiring Masonite for $3.9 billion, focusing on expanding its building materials and glass reinforcement footprint within its composites segment. The acquisition is in line with Owens Corning's broader strategy to focus on high-value material solutions, especially in the construction area, due to the acquisition of WearDeck, which diversified its offerings in the composites area even further. In this context, bigger value transactions also signal the ongoing consolidation trend, such as the acquisition of DSM Dyneema's Protective Materials division by Avient Corporation for $1 billion. It allowed Avient to not only increase the high-performance materials segment but also get into new growth markets like ballistic protection and marine applications. The composite materials industry has seen investments of over $430 billion in several thousand transactions ever since 2020, showing a strong interest in innovative technologies and sustainable solutions with an aim to meet rising demand across several industries, including aerospace and automotive.

>Analyst Comment

The composite materials market shows an arduous growth with the increasing demand for lightweight, high-performance materials in every sphere of life. This increased demand arises from factors such as the need for fuel efficiency in transportation applications, the desire for durable and sustainable materials in construction, and the quest for advanced materials in aerospace and defence. The demand scenario has always ushered in new innovations, with manufacturers giving life to new composite materials with improved properties for wider applications. Looking ahead, the composite materials market is poised to not only carry on the lasting growth but to augment and blossom further with the strengthening of technological advancements, further investments in research and development, and greater awareness of the benefits of composite materials.

- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Composite Materials- Snapshot

- 2.2 Composite Materials- Segment Snapshot

- 2.3 Composite Materials- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Composite Materials Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Carbon Fiber

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Glass Fiber

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Others

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

5: Composite Materials Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Automotive & Transportation

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Wind Energy

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Electrical & Electronics

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Construction and Infrastructure

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Pipes & Tanks

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

- 5.7 Marine

- 5.7.1 Key market trends, factors driving growth, and opportunities

- 5.7.2 Market size and forecast, by region

- 5.7.3 Market share analysis by country

- 5.8 Others

- 5.8.1 Key market trends, factors driving growth, and opportunities

- 5.8.2 Market size and forecast, by region

- 5.8.3 Market share analysis by country

6: Composite Materials Market by Process

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 Layup Process

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 Filament Winding Process

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

- 6.4 Injection Molding Process

- 6.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.2 Market size and forecast, by region

- 6.4.3 Market share analysis by country

- 6.5 Pultrusion Process

- 6.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.2 Market size and forecast, by region

- 6.5.3 Market share analysis by country

- 6.6 Compression Molding Process

- 6.6.1 Key market trends, factors driving growth, and opportunities

- 6.6.2 Market size and forecast, by region

- 6.6.3 Market share analysis by country

- 6.7 Resin Transfer Molding Process

- 6.7.1 Key market trends, factors driving growth, and opportunities

- 6.7.2 Market size and forecast, by region

- 6.7.3 Market share analysis by country

- 6.8 Others

- 6.8.1 Key market trends, factors driving growth, and opportunities

- 6.8.2 Market size and forecast, by region

- 6.8.3 Market share analysis by country

7: Composite Materials Market by Region

- 7.1 Overview

- 7.1.1 Market size and forecast By Region

- 7.2 North America

- 7.2.1 Key trends and opportunities

- 7.2.2 Market size and forecast, by Type

- 7.2.3 Market size and forecast, by Application

- 7.2.4 Market size and forecast, by country

- 7.2.4.1 United States

- 7.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.1.2 Market size and forecast, by Type

- 7.2.4.1.3 Market size and forecast, by Application

- 7.2.4.2 Canada

- 7.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.2.2 Market size and forecast, by Type

- 7.2.4.2.3 Market size and forecast, by Application

- 7.2.4.3 Mexico

- 7.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.3.2 Market size and forecast, by Type

- 7.2.4.3.3 Market size and forecast, by Application

- 7.2.4.1 United States

- 7.3 South America

- 7.3.1 Key trends and opportunities

- 7.3.2 Market size and forecast, by Type

- 7.3.3 Market size and forecast, by Application

- 7.3.4 Market size and forecast, by country

- 7.3.4.1 Brazil

- 7.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.1.2 Market size and forecast, by Type

- 7.3.4.1.3 Market size and forecast, by Application

- 7.3.4.2 Argentina

- 7.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.2.2 Market size and forecast, by Type

- 7.3.4.2.3 Market size and forecast, by Application

- 7.3.4.3 Chile

- 7.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.3.2 Market size and forecast, by Type

- 7.3.4.3.3 Market size and forecast, by Application

- 7.3.4.4 Rest of South America

- 7.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.4.2 Market size and forecast, by Type

- 7.3.4.4.3 Market size and forecast, by Application

- 7.3.4.1 Brazil

- 7.4 Europe

- 7.4.1 Key trends and opportunities

- 7.4.2 Market size and forecast, by Type

- 7.4.3 Market size and forecast, by Application

- 7.4.4 Market size and forecast, by country

- 7.4.4.1 Germany

- 7.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.1.2 Market size and forecast, by Type

- 7.4.4.1.3 Market size and forecast, by Application

- 7.4.4.2 France

- 7.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.2.2 Market size and forecast, by Type

- 7.4.4.2.3 Market size and forecast, by Application

- 7.4.4.3 Italy

- 7.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.3.2 Market size and forecast, by Type

- 7.4.4.3.3 Market size and forecast, by Application

- 7.4.4.4 United Kingdom

- 7.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.4.2 Market size and forecast, by Type

- 7.4.4.4.3 Market size and forecast, by Application

- 7.4.4.5 Benelux

- 7.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.5.2 Market size and forecast, by Type

- 7.4.4.5.3 Market size and forecast, by Application

- 7.4.4.6 Nordics

- 7.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.6.2 Market size and forecast, by Type

- 7.4.4.6.3 Market size and forecast, by Application

- 7.4.4.7 Rest of Europe

- 7.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.7.2 Market size and forecast, by Type

- 7.4.4.7.3 Market size and forecast, by Application

- 7.4.4.1 Germany

- 7.5 Asia Pacific

- 7.5.1 Key trends and opportunities

- 7.5.2 Market size and forecast, by Type

- 7.5.3 Market size and forecast, by Application

- 7.5.4 Market size and forecast, by country

- 7.5.4.1 China

- 7.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.1.2 Market size and forecast, by Type

- 7.5.4.1.3 Market size and forecast, by Application

- 7.5.4.2 Japan

- 7.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.2.2 Market size and forecast, by Type

- 7.5.4.2.3 Market size and forecast, by Application

- 7.5.4.3 India

- 7.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.3.2 Market size and forecast, by Type

- 7.5.4.3.3 Market size and forecast, by Application

- 7.5.4.4 South Korea

- 7.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.4.2 Market size and forecast, by Type

- 7.5.4.4.3 Market size and forecast, by Application

- 7.5.4.5 Australia

- 7.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.5.2 Market size and forecast, by Type

- 7.5.4.5.3 Market size and forecast, by Application

- 7.5.4.6 Southeast Asia

- 7.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.6.2 Market size and forecast, by Type

- 7.5.4.6.3 Market size and forecast, by Application

- 7.5.4.7 Rest of Asia-Pacific

- 7.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.7.2 Market size and forecast, by Type

- 7.5.4.7.3 Market size and forecast, by Application

- 7.5.4.1 China

- 7.6 MEA

- 7.6.1 Key trends and opportunities

- 7.6.2 Market size and forecast, by Type

- 7.6.3 Market size and forecast, by Application

- 7.6.4 Market size and forecast, by country

- 7.6.4.1 Middle East

- 7.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.6.4.1.2 Market size and forecast, by Type

- 7.6.4.1.3 Market size and forecast, by Application

- 7.6.4.2 Africa

- 7.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.6.4.2.2 Market size and forecast, by Type

- 7.6.4.2.3 Market size and forecast, by Application

- 7.6.4.1 Middle East

- 8.1 Overview

- 8.2 Key Winning Strategies

- 8.3 Top 10 Players: Product Mapping

- 8.4 Competitive Analysis Dashboard

- 8.5 Market Competition Heatmap

- 8.6 Leading Player Positions, 2022

9: Company Profiles

- 9.1 Teijin Ltd.

- 9.1.1 Company Overview

- 9.1.2 Key Executives

- 9.1.3 Company snapshot

- 9.1.4 Active Business Divisions

- 9.1.5 Product portfolio

- 9.1.6 Business performance

- 9.1.7 Major Strategic Initiatives and Developments

- 9.2 Toray Industries

- 9.2.1 Company Overview

- 9.2.2 Key Executives

- 9.2.3 Company snapshot

- 9.2.4 Active Business Divisions

- 9.2.5 Product portfolio

- 9.2.6 Business performance

- 9.2.7 Major Strategic Initiatives and Developments

- 9.3 Inc.

- 9.3.1 Company Overview

- 9.3.2 Key Executives

- 9.3.3 Company snapshot

- 9.3.4 Active Business Divisions

- 9.3.5 Product portfolio

- 9.3.6 Business performance

- 9.3.7 Major Strategic Initiatives and Developments

- 9.4 Owens Corning

- 9.4.1 Company Overview

- 9.4.2 Key Executives

- 9.4.3 Company snapshot

- 9.4.4 Active Business Divisions

- 9.4.5 Product portfolio

- 9.4.6 Business performance

- 9.4.7 Major Strategic Initiatives and Developments

- 9.5 PPG Industries

- 9.5.1 Company Overview

- 9.5.2 Key Executives

- 9.5.3 Company snapshot

- 9.5.4 Active Business Divisions

- 9.5.5 Product portfolio

- 9.5.6 Business performance

- 9.5.7 Major Strategic Initiatives and Developments

- 9.6 Inc.

- 9.6.1 Company Overview

- 9.6.2 Key Executives

- 9.6.3 Company snapshot

- 9.6.4 Active Business Divisions

- 9.6.5 Product portfolio

- 9.6.6 Business performance

- 9.6.7 Major Strategic Initiatives and Developments

- 9.7 Huntsman Corporation LLC

- 9.7.1 Company Overview

- 9.7.2 Key Executives

- 9.7.3 Company snapshot

- 9.7.4 Active Business Divisions

- 9.7.5 Product portfolio

- 9.7.6 Business performance

- 9.7.7 Major Strategic Initiatives and Developments

- 9.8 SGL Group

- 9.8.1 Company Overview

- 9.8.2 Key Executives

- 9.8.3 Company snapshot

- 9.8.4 Active Business Divisions

- 9.8.5 Product portfolio

- 9.8.6 Business performance

- 9.8.7 Major Strategic Initiatives and Developments

- 9.9 Hexcel Corporation

- 9.9.1 Company Overview

- 9.9.2 Key Executives

- 9.9.3 Company snapshot

- 9.9.4 Active Business Divisions

- 9.9.5 Product portfolio

- 9.9.6 Business performance

- 9.9.7 Major Strategic Initiatives and Developments

- 9.10 DuPont

- 9.10.1 Company Overview

- 9.10.2 Key Executives

- 9.10.3 Company snapshot

- 9.10.4 Active Business Divisions

- 9.10.5 Product portfolio

- 9.10.6 Business performance

- 9.10.7 Major Strategic Initiatives and Developments

- 9.11 Compagnie de Saint-Gobain S.A.

- 9.11.1 Company Overview

- 9.11.2 Key Executives

- 9.11.3 Company snapshot

- 9.11.4 Active Business Divisions

- 9.11.5 Product portfolio

- 9.11.6 Business performance

- 9.11.7 Major Strategic Initiatives and Developments

- 9.12 Weyerhaeuser Company

- 9.12.1 Company Overview

- 9.12.2 Key Executives

- 9.12.3 Company snapshot

- 9.12.4 Active Business Divisions

- 9.12.5 Product portfolio

- 9.12.6 Business performance

- 9.12.7 Major Strategic Initiatives and Developments

- 9.13 Momentive Performance Materials

- 9.13.1 Company Overview

- 9.13.2 Key Executives

- 9.13.3 Company snapshot

- 9.13.4 Active Business Divisions

- 9.13.5 Product portfolio

- 9.13.6 Business performance

- 9.13.7 Major Strategic Initiatives and Developments

- 9.14 Inc.

- 9.14.1 Company Overview

- 9.14.2 Key Executives

- 9.14.3 Company snapshot

- 9.14.4 Active Business Divisions

- 9.14.5 Product portfolio

- 9.14.6 Business performance

- 9.14.7 Major Strategic Initiatives and Developments

- 9.15 Cytec Industries (Solvay

- 9.15.1 Company Overview

- 9.15.2 Key Executives

- 9.15.3 Company snapshot

- 9.15.4 Active Business Divisions

- 9.15.5 Product portfolio

- 9.15.6 Business performance

- 9.15.7 Major Strategic Initiatives and Developments

- 9.16 S.A.)

- 9.16.1 Company Overview

- 9.16.2 Key Executives

- 9.16.3 Company snapshot

- 9.16.4 Active Business Divisions

- 9.16.5 Product portfolio

- 9.16.6 Business performance

- 9.16.7 Major Strategic Initiatives and Developments

- 9.17 China Jushi Co.

- 9.17.1 Company Overview

- 9.17.2 Key Executives

- 9.17.3 Company snapshot

- 9.17.4 Active Business Divisions

- 9.17.5 Product portfolio

- 9.17.6 Business performance

- 9.17.7 Major Strategic Initiatives and Developments

- 9.18 Ltd.

- 9.18.1 Company Overview

- 9.18.2 Key Executives

- 9.18.3 Company snapshot

- 9.18.4 Active Business Divisions

- 9.18.5 Product portfolio

- 9.18.6 Business performance

- 9.18.7 Major Strategic Initiatives and Developments

- 9.19 Kineco Limited

- 9.19.1 Company Overview

- 9.19.2 Key Executives

- 9.19.3 Company snapshot

- 9.19.4 Active Business Divisions

- 9.19.5 Product portfolio

- 9.19.6 Business performance

- 9.19.7 Major Strategic Initiatives and Developments

- 9.20 Veplas Group

- 9.20.1 Company Overview

- 9.20.2 Key Executives

- 9.20.3 Company snapshot

- 9.20.4 Active Business Divisions

- 9.20.5 Product portfolio

- 9.20.6 Business performance

- 9.20.7 Major Strategic Initiatives and Developments

10: Analyst Perspective and Conclusion

- 10.1 Concluding Recommendations and Analysis

- 10.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

By Process |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Composite Materials in 2030?

+

-

How big is the Global Composite Materials market?

+

-

How do regulatory policies impact the Composite Materials Market?

+

-

What major players in Composite Materials Market?

+

-

What applications are categorized in the Composite Materials market study?

+

-

Which product types are examined in the Composite Materials Market Study?

+

-

Which regions are expected to show the fastest growth in the Composite Materials market?

+

-

Which region is the fastest growing in the Composite Materials market?

+

-

What are the major growth drivers in the Composite Materials market?

+

-

Due to the rising demand for composite materials with lightweight and high strength in industries such as aerospace, automotive, and construction, the composite materials market is flourishing. These materials provide greater strength-to-weight ratio, corrosion resistance, and durability, which are essential towards applications demanding high performance and fuel efficiency. The growing emphasis on sustainability and fuel economy in transportation, notably in electric vehicles (EVs) and aircraft, accelerates the market growth further, as manufacturers are now looking for materials that would reduce emissions and enhance efficiency. On the other hand, the need for wind energy is pushing the use of composites for wind turbine blades, while the gradual conversion of the construction industry to new-age durable materials continues to further add to your market opportunities. The tenor of government regulations aimed at promoting eco-friendly and energy-saving solutions has undoubtedly aided the increasing acceptance rate of composites into the different sectors.

Is the study period of the Composite Materials flexible or fixed?

+

-