Global Container as a Service Market Size, Share & Trends Analysis Report, Forecast Period, 2024-2030

Report ID: MS-41 | Application Software | Last updated: Oct, 2024 | Formats*:

Container as a Service Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2031 |

| Base Year Of Estimation | 2023 |

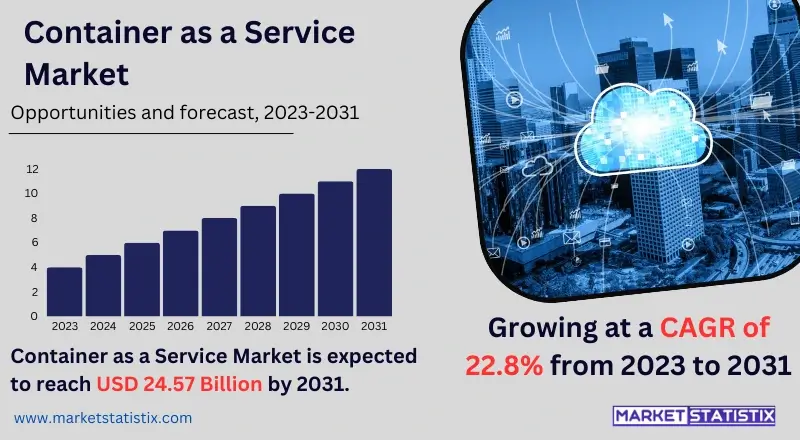

| Growth Rate | CAGR of 22.8% |

| By Product Type | Monitoring and Analytics, Security, Continuous Integration and Continuous, Deployment, Storage and Networking, Management and Orchestration, Training, Constructing |

| Key Market Players |

|

| By Region |

Container as a Service Market Leading Players

The key players profiled in the report are Oracle, IBM, Rackspace Technology, SUSE, Microsoft, Cisco, Google LLC, Amazon Web Services Inc., Hewlett Packard Enterprise Development LP, Accenture, Dell, Tech Mahindra Limited, Fujitsu, Atos S.E., VMware Inc., DXC Technology Company, ActivePlatform, Arrow Electronics Inc., D2iQ Inc.Growth Accelerators

The Container as a Service (CaaS) market is mainly driven by the increasing penetration of cloud computing technology and the need for quick, efficient, and easily manageable deployment of applications. In the modern business world where organisations pursue faster and more flexible information technology services, the CaaS solution is the best fit as it allows businesses to deploy, manage, and scale containers without the hassle of looking after the underlying architecture. The transformation, in this case, entails a significant departure from traditional application delivery models and CaaS growth. There’s a growth in the appeal and use of services-led architecture and that of containerisation, which helps in shortening development times, makes use of available resources more efficiently, and lowers operational costs, which in turn creates a need for CaaS. Another important factor is the increase in emphasis on DevOps, the practice of bringing together software development and operations to ensure quick delivery of software. CaaS enhances the CI/CD process by offering developers a platform with an identical setting to build and release applications. This helps reduce redundancies in the processes but, more importantly, encourages the work of the teams that are likely to be more involved with the applications instead of the infrastructure.Container as a Service Market Segmentation analysis

The Global Container as a Service is segmented by Type, and Region. By Type, the market is divided into Distributed Monitoring and Analytics, Security, Continuous Integration and Continuous, Deployment, Storage and Networking, Management and Orchestration, Training, Constructing . Geographically, the market is assessed across key Regions like {regionNms} and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The Container as a Service (CaaS) market has a very competitive environment that is dominated by big cloud services and some technology companies that provide container management services. For instance, Amazon Web Services (AWS), Microsoft Azure, Google Cloud, and IBM have done well in the market by providing effective CaaS that allows organisations to deploy, manage, and scale containerised applications. These providers take advantage of their strong cloud infrastructure and suite of services to appeal to enterprises that want such dependable and scalable solutions, usually adding features like auto-orchestration, security, and compliance in the process. Apart from the dominant cloud service providers, a number of emerging start-ups and niche providers are mushrooming in the CaaS space in order to address some features and/or industries. Red Hat (with OpenShift), Docker, and Rancher Labs offer compelling products that make developers’ and application deployment easier, which is why they are quickly becoming popular. Furthermore, the rise of microservice architecture and the need to adopt DevOps practices compels all the players in the market to be even more aggressive in expanding their competitive capabilities.Challenges In Container as a Service Market

The growth of the market for Container as a Service (CaaS) is, on the other hand, not without its limitations, security, and compliance concerns for the most part. Given the potential of CaaS for a highly scalable infrastructure, organisations appreciate its adoption; however, the deployment and management of such containerised applications become more complex, thereby potentially exposing them to some security risks. It is important that containers are secure at every stage in the container’s lifecycle, right from the development phase to the deployment and scaling stages. Besides, the need to observe governance in terms of industry regulation and compliance presents a problem because the organisations have to control the way data is managed and applications secured in many containers and services. Moreover, the lack of human resources with qualifications in container technologies and orchestration frameworks creates another layer of challenge; hence, these organisations cannot fully enjoy the benefit of CaaS. It is critical that these challenges are overcome by service providers who wish to instils confidence in the customers and encourage more uptake of container services in the industry.Risks & Prospects in Container as a Service Market

The Container as a Service (CaaS) market is likely to grow as cloud computing becomes more common and the application deployment solutions become agile and elastic, all selling points. Organisations want to improve their business processes by applying containers for application development, testing, and even deployment at a faster rate. This shift allows businesses to cut costs, enhance resource efficiency, and most importantly, reduce the product and service time-to-market. As the number of enterprises adopting the microservices architecture increases, it is expected that demand will increase for CaaS solutions that solve the problem of container management and orchestration, which will present wider opportunities to the service providers. In addition, hardening of DevOps practices and embedding continuous integration/continuous delivery pipelines also propels the CaaS market. Organisations have been more focused and resourceful on the tools for deploying automatically and working in sync with the operations team more efficiently than before. Thus, CaaS vendors have a ripe opportunity to expand their CaaS offerings through, for example, security, monitoring, and analytics.Key Target Audience

The Container as a Service (CaaS) market—the major buyers of this solution are the IT departments and DevOps teams of organisations that need to optimise the application deployment process. They want to use container technology in order to achieve better scale, adaptability, and efficiency of the cloud infrastructure. This group consists of IT administrators, cloud architects, and CTOs who focus on CaaS solutions enabling faster creation and rollout of applications while making the orchestration of the containerised infrastructure easier to manage. Such audience, which comprises many verticals like technology, finance, healthcare, and retail, where fast and effective software delivery is ever so critical.,, Moreover, the startups and SMEs trying to implement modern cloud standards also constitute another emerging segment, since they are looking for cost-effective and scalable solutions to stay in the race. For the CaaS solution companies, these are important target audiences because they influence the product's acceptance and sometimes evolution is necessary, and they also help in the struggles of developing cloud-based application services.Merger and acquisition

Consolidation among cloud service providers is indicated by recent developments in the container as a service (CaaS) market. In 2022, for instance, several companies like Microsoft and Oracle added CaaS to their already existing table by acquiring firms aimed at enhancing their cloud infrastructures. For instance, Microsoft bought companies that design container orchestration systems and services, whereas Oracle's acquisition of such firms added vertical integration of container services in the company’s cloud infrastructure. This integration not only reinforces their stature in the cutthroat competition in the CaaS market but also provides evidence for the growing embraced need for unified and on-demand cloud structures. Moreover, mergers and acquisitions are also witnessed in the activities of smaller players who have entered the fray, and younger companies with distinctive container management solutions are often the prey of their older and larger counterparts. Enterprises have amplified CaaS adoption; hence, such deals have occurred due to the uptick of multi-cloud approaches among organizations. It is likely that more changes will happen in the competitive environment as these cloud providers will try to come up with more effective strategies that will incorporate containers within the cloud services provided to end users in a more functional manner.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Container as a Service- Snapshot

- 2.2 Container as a Service- Segment Snapshot

- 2.3 Container as a Service- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Container as a Service Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Monitoring and Analytics

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Security

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Continuous Integration and Continuous

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Deployment

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

- 4.6 Storage and Networking

- 4.6.1 Key market trends, factors driving growth, and opportunities

- 4.6.2 Market size and forecast, by region

- 4.6.3 Market share analysis by country

- 4.7 Management and Orchestration

- 4.7.1 Key market trends, factors driving growth, and opportunities

- 4.7.2 Market size and forecast, by region

- 4.7.3 Market share analysis by country

- 4.8 Training

- 4.8.1 Key market trends, factors driving growth, and opportunities

- 4.8.2 Market size and forecast, by region

- 4.8.3 Market share analysis by country

- 4.9 Constructing

- 4.9.1 Key market trends, factors driving growth, and opportunities

- 4.9.2 Market size and forecast, by region

- 4.9.3 Market share analysis by country

5: Container as a Service Market by Deployment Model

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Public Cloud

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Private Cloud

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Hybrid Cloud

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

6: Container as a Service Market by Orgnization size

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 Small and Medium-Sized Enterprises

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 Large Enterprises

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

7: Container as a Service Market by Vertical

- 7.1 Overview

- 7.1.1 Market size and forecast

- 7.2 Banking

- 7.2.1 Key market trends, factors driving growth, and opportunities

- 7.2.2 Market size and forecast, by region

- 7.2.3 Market share analysis by country

- 7.3 Financial Services and Insurance

- 7.3.1 Key market trends, factors driving growth, and opportunities

- 7.3.2 Market size and forecast, by region

- 7.3.3 Market share analysis by country

- 7.4 Retail and Consumer Goods

- 7.4.1 Key market trends, factors driving growth, and opportunities

- 7.4.2 Market size and forecast, by region

- 7.4.3 Market share analysis by country

- 7.5 Healthcare and Life Sciences

- 7.5.1 Key market trends, factors driving growth, and opportunities

- 7.5.2 Market size and forecast, by region

- 7.5.3 Market share analysis by country

- 7.6 Manufacturing

- 7.6.1 Key market trends, factors driving growth, and opportunities

- 7.6.2 Market size and forecast, by region

- 7.6.3 Market share analysis by country

- 7.7 Media

- 7.7.1 Key market trends, factors driving growth, and opportunities

- 7.7.2 Market size and forecast, by region

- 7.7.3 Market share analysis by country

- 7.8 Entertainment and Gaming

- 7.8.1 Key market trends, factors driving growth, and opportunities

- 7.8.2 Market size and forecast, by region

- 7.8.3 Market share analysis by country

- 7.9 IT and Telecommunication

- 7.9.1 Key market trends, factors driving growth, and opportunities

- 7.9.2 Market size and forecast, by region

- 7.9.3 Market share analysis by country

- 7.10 Transportation and Logistics

- 7.10.1 Key market trends, factors driving growth, and opportunities

- 7.10.2 Market size and forecast, by region

- 7.10.3 Market share analysis by country

- 7.11 Travel and Hospitality

- 7.11.1 Key market trends, factors driving growth, and opportunities

- 7.11.2 Market size and forecast, by region

- 7.11.3 Market share analysis by country

- 7.12 Others

- 7.12.1 Key market trends, factors driving growth, and opportunities

- 7.12.2 Market size and forecast, by region

- 7.12.3 Market share analysis by country

8: Competitive Landscape

- 8.1 Overview

- 8.2 Key Winning Strategies

- 8.3 Top 10 Players: Product Mapping

- 8.4 Competitive Analysis Dashboard

- 8.5 Market Competition Heatmap

- 8.6 Leading Player Positions, 2022

9: Company Profiles

- 9.1 Oracle

- 9.1.1 Company Overview

- 9.1.2 Key Executives

- 9.1.3 Company snapshot

- 9.1.4 Active Business Divisions

- 9.1.5 Product portfolio

- 9.1.6 Business performance

- 9.1.7 Major Strategic Initiatives and Developments

- 9.2 IBM

- 9.2.1 Company Overview

- 9.2.2 Key Executives

- 9.2.3 Company snapshot

- 9.2.4 Active Business Divisions

- 9.2.5 Product portfolio

- 9.2.6 Business performance

- 9.2.7 Major Strategic Initiatives and Developments

- 9.3 Rackspace Technology

- 9.3.1 Company Overview

- 9.3.2 Key Executives

- 9.3.3 Company snapshot

- 9.3.4 Active Business Divisions

- 9.3.5 Product portfolio

- 9.3.6 Business performance

- 9.3.7 Major Strategic Initiatives and Developments

- 9.4 SUSE

- 9.4.1 Company Overview

- 9.4.2 Key Executives

- 9.4.3 Company snapshot

- 9.4.4 Active Business Divisions

- 9.4.5 Product portfolio

- 9.4.6 Business performance

- 9.4.7 Major Strategic Initiatives and Developments

- 9.5 Microsoft

- 9.5.1 Company Overview

- 9.5.2 Key Executives

- 9.5.3 Company snapshot

- 9.5.4 Active Business Divisions

- 9.5.5 Product portfolio

- 9.5.6 Business performance

- 9.5.7 Major Strategic Initiatives and Developments

- 9.6 Cisco

- 9.6.1 Company Overview

- 9.6.2 Key Executives

- 9.6.3 Company snapshot

- 9.6.4 Active Business Divisions

- 9.6.5 Product portfolio

- 9.6.6 Business performance

- 9.6.7 Major Strategic Initiatives and Developments

- 9.7 Google LLC

- 9.7.1 Company Overview

- 9.7.2 Key Executives

- 9.7.3 Company snapshot

- 9.7.4 Active Business Divisions

- 9.7.5 Product portfolio

- 9.7.6 Business performance

- 9.7.7 Major Strategic Initiatives and Developments

- 9.8 Amazon Web Services Inc.

- 9.8.1 Company Overview

- 9.8.2 Key Executives

- 9.8.3 Company snapshot

- 9.8.4 Active Business Divisions

- 9.8.5 Product portfolio

- 9.8.6 Business performance

- 9.8.7 Major Strategic Initiatives and Developments

- 9.9 Hewlett Packard Enterprise Development LP

- 9.9.1 Company Overview

- 9.9.2 Key Executives

- 9.9.3 Company snapshot

- 9.9.4 Active Business Divisions

- 9.9.5 Product portfolio

- 9.9.6 Business performance

- 9.9.7 Major Strategic Initiatives and Developments

- 9.10 Accenture

- 9.10.1 Company Overview

- 9.10.2 Key Executives

- 9.10.3 Company snapshot

- 9.10.4 Active Business Divisions

- 9.10.5 Product portfolio

- 9.10.6 Business performance

- 9.10.7 Major Strategic Initiatives and Developments

- 9.11 Dell

- 9.11.1 Company Overview

- 9.11.2 Key Executives

- 9.11.3 Company snapshot

- 9.11.4 Active Business Divisions

- 9.11.5 Product portfolio

- 9.11.6 Business performance

- 9.11.7 Major Strategic Initiatives and Developments

- 9.12 Tech Mahindra Limited

- 9.12.1 Company Overview

- 9.12.2 Key Executives

- 9.12.3 Company snapshot

- 9.12.4 Active Business Divisions

- 9.12.5 Product portfolio

- 9.12.6 Business performance

- 9.12.7 Major Strategic Initiatives and Developments

- 9.13 Fujitsu

- 9.13.1 Company Overview

- 9.13.2 Key Executives

- 9.13.3 Company snapshot

- 9.13.4 Active Business Divisions

- 9.13.5 Product portfolio

- 9.13.6 Business performance

- 9.13.7 Major Strategic Initiatives and Developments

- 9.14 Atos S.E.

- 9.14.1 Company Overview

- 9.14.2 Key Executives

- 9.14.3 Company snapshot

- 9.14.4 Active Business Divisions

- 9.14.5 Product portfolio

- 9.14.6 Business performance

- 9.14.7 Major Strategic Initiatives and Developments

- 9.15 VMware Inc.

- 9.15.1 Company Overview

- 9.15.2 Key Executives

- 9.15.3 Company snapshot

- 9.15.4 Active Business Divisions

- 9.15.5 Product portfolio

- 9.15.6 Business performance

- 9.15.7 Major Strategic Initiatives and Developments

- 9.16 DXC Technology Company

- 9.16.1 Company Overview

- 9.16.2 Key Executives

- 9.16.3 Company snapshot

- 9.16.4 Active Business Divisions

- 9.16.5 Product portfolio

- 9.16.6 Business performance

- 9.16.7 Major Strategic Initiatives and Developments

- 9.17 ActivePlatform

- 9.17.1 Company Overview

- 9.17.2 Key Executives

- 9.17.3 Company snapshot

- 9.17.4 Active Business Divisions

- 9.17.5 Product portfolio

- 9.17.6 Business performance

- 9.17.7 Major Strategic Initiatives and Developments

- 9.18 Arrow Electronics Inc.

- 9.18.1 Company Overview

- 9.18.2 Key Executives

- 9.18.3 Company snapshot

- 9.18.4 Active Business Divisions

- 9.18.5 Product portfolio

- 9.18.6 Business performance

- 9.18.7 Major Strategic Initiatives and Developments

- 9.19 D2iQ Inc.

- 9.19.1 Company Overview

- 9.19.2 Key Executives

- 9.19.3 Company snapshot

- 9.19.4 Active Business Divisions

- 9.19.5 Product portfolio

- 9.19.6 Business performance

- 9.19.7 Major Strategic Initiatives and Developments

10: Analyst Perspective and Conclusion

- 10.1 Concluding Recommendations and Analysis

- 10.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Deployment Model |

|

By Orgnization size |

|

By Vertical |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

How do regulatory policies impact the Container as a Service Market?

+

-

What major players in Container as a Service Market?

+

-

What applications are categorized in the Container as a Service market study?

+

-

Which product types are examined in the Container as a Service Market Study?

+

-

Which regions are expected to show the fastest growth in the Container as a Service market?

+

-

What are the major growth drivers in the Container as a Service market?

+

-

Is the study period of the Container as a Service flexible or fixed?

+

-

How do economic factors influence the Container as a Service market?

+

-

How does the supply chain affect the Container as a Service Market?

+

-

Which players are included in the research coverage of the Container as a Service Market Study?

+

-