Global Corn Oil Market Trends and Forecast to 2030

Report ID: MS-750 | Food and Beverages | Last updated: Apr, 2025 | Formats*:

The Corn Oil Market captures the production, distribution, and marketing of oil from the germ nutrient-rich embryo of corn kernels (Zea mays). This vegetable oil is considered to have a mild flavour and high smoke point and is beneficial in terms of nutrition and contains polyunsaturated fatty acids like linoleic acid (omega-6) and oleic acid (omega-9), vitamin E and phytosterols. Corn oil is mostly obtained from corn water milling processing, where corn kernels are steeped, ground, and separated into various components such as starch, protein, fibre, and germ. The germ is taken through mechanical pressing or solvent extraction, followed by refining to remove impurities and enhance its quality and stability. Corn oil usage is broad: food, animal feed, and industrial uses. In food applications, it is commonly used as cooking oil – suitable for frying, sautéing, and baking – a behaviour attributed to its specific resistance to high temperatures with a neutral flavour. Market dynamics depend on corn production levels, wet-milling efficiency, and the demands of food and industry, along with competitive prices for other vegetable oils.

Corn Oil Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2023 |

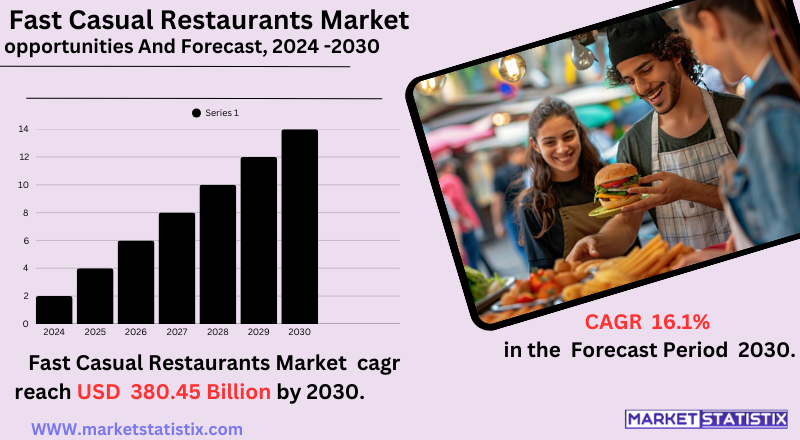

| Growth Rate | CAGR of 16.1% |

| Forecast Value (2030) | USD 380.45 Billion |

| By Product Type | Franchised, Standalone |

| Key Market Players |

|

| By Region |

|

Corn Oil Market Trends

Health consciousness among consumers is an important driver, as a result of which various cooking oils that are low in saturated fats and high in unsaturated fats, such as corn oil, are being demanded. This is further enhanced by the rising awareness of corn oil's nutritional benefits, such as its vitamin E and antioxidant content. The increasing food industry, especially the production of processed and convenience foods, adds greatly to market growth, given that corn oil is ever so adaptable in its use across various food products. Another chief trend is the increasing use of corn oil for biodiesel production, all supported by the global concern of renewable energy and carbon footprints. Besides this, the growing consumption of corn oil for other industrial applications, such as cosmetics, pharmaceuticals, and animal feed, would broaden the overall market. Following this, there rises a demand for "clean label" and non-GMO food ingredients, which paves opportunities for organic and non-GMO corn oil products.

Corn Oil Market Leading Players

The key players profiled in the report are Noodles and Co., Godfathers Pizza Inc., Smashburger Servicing LLC, Shake Shack Inc., MOD Super Fast Pizza LLC, PORTILLOS Inc., Wingstop Inc., LYKE Kitchen, Panda Restaurant Group Inc., Restaurant Brands International Inc., Potbelly Corp., McAlisters Franchisor SPV LLC, The Wendys Co., YUM Brands Inc.Growth Accelerators

The corn oil market is subject to a variety of forces that stimulate its growth and, at the same time, shape its dynamics. One of the significant drivers is the rising health consciousness among consumers. Corn oil, having low saturated fat content with a rich supply of polyunsaturated fatty acids, such as omega 6, is being acknowledged as a healthier option compared to other cooking oils. This has increased the preference for corn oil in the household and food processing industry, for use in cooking and frying and as an ingredient in salad dressings and baked goods. Moreover, the presence of antioxidant vitamin E also attracts health-conscious consumers. Another major driver is the growing applications of corn oil beyond the food industries. With the rising demand for renewable energy resources, there has been an increase in the application of corn oil in biodiesel production, integrating with global efforts to reduce carbon footprints. Besides, corn oil has its application in different industries, including the production of soaps, lubricants, cosmetics, and pharmaceuticals, which add to the market scope and push the demand even further.

Corn Oil Market Segmentation analysis

The Global Corn Oil is segmented by Type, and Region. By Type, the market is divided into Distributed Franchised, Standalone . Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

There are mergers and acquisitions that took place in the market for corn oil with the intention of having some production strength and market reach-induced strategic power. Cargill has increased its tie in the renewable energy and edible oil sectors in Brazil as it acquired the other 50% stake in SJC Bioenergia in February 2025. The Brazilian company based on corn and sugar products is engaged in corn oil, ethanol, and other by-product production. Viterra Limited and Bunge Global SA entered into a merger in June 2023, which further adds to the great partnerships, cost-effectively amounting to 18 billion dollars. This merger will add a very powerful voice of Cargill in the corn oil sphere as well as widen its reach to the entire vegetable oil sector. Such strategic consolidations are an indication of the forces behind strengthening the supply chain and expanding market presence within the corn oil market.

Challenges In Corn Oil Market

The corn oil market is marred by numerous challenges that are standing in the way of its growth. One major problem is the competition from other alternatives such as olive oil, sunflower oil, and soybean oil, which are seen as providing equal or more health benefits. This situation places corn oil manufacturers under pressure to differentiate their products and adapt to inevitable changes in consumers' tastes and preferences for healthier and diversified products. Other challenges facing corn oil processing companies are rising costs of raw materials, erratic supply chain delivery, and increased production costs due to the pressure of finances on manufacturers. Compliance with stringent regulations in food safety and labelling further increases the burden of running operations. Environmental concerns arise from corn cultivation, especially its high-water consumption and degradation of soil, which together present further challenges for this market. Sustainability is emerging as a consumer priority, which makes it imperative for producers to invest in greener technologies to be able to compete in the future. Limited local production in some areas also increases restrictions for openings in entering markets.

Risks & Prospects in Corn Oil Market

The principal growth drivers are rising health-orientated consumer awareness, urbanisation, disposable income growth, and acceptance of organic and non-GMO corn oil. Some of the new opportunities for market growth also arise from wide applications in biodiesel production, pharma, cosmetics, and e-commerce channels. Development innovation in the area of oil refining technology and application of sustainable methods can grow the market potential. From a geographical perspective, North America leads the corn oil market on account of modern food processing industries and great rates of biofuel adoption. The rapid growth in the Asia-Pacific is due to the growing urbanisation coupled with increasing requirements for healthy cooking oil. Europe shows a strong market opportunity due to the rising shift to organic products and sustainable methods.

Key Target Audience

The corn oil market is primarily targeted towards potential audience segments that can be health-conscious customers, food manufacturers, and industrials. Health-conscious status is gained by consumers using corn oil since it contains higher amounts of polyunsaturated fatty acids, beneficial for the heart, making their previous cooking oil choices unhealthy. The food and beverage industry uses corn oil a lot to fry, bake and dress salads because it has a high smoke point and is tasteless – the best of both worlds. Industrial applications form a strong presence; corn oil as biodiesel, animal feed, and cosmetics have all been the various applications of corn oil in industries. Demand generated using renewable energy and environment-friendly products potently caters to the boost the corn oil will receive in these sectors. Therefore, a market with major players such as Cargill, ADM, and Bunge are innovated and supplied further in several parts.

Merger and acquisition

Recently, mergers and acquisitions have happened in the corn oil market in an effort to establish strategic strength in production capabilities and reach in the market. In February 2025, Cargill acquired the remaining 50% stake in SJC Bioenergia, a Brazilian company engaged in processing corn and sugarcane for corn oil, ethanol, and other by-product production. Through this, Cargill increases its imprint in the renewable energy and edible oil sectors in Brazil. In June 2023, Viterra Limited merged with Bunge Global SA in a deal amounting to 18 billion dollars, which augments their global reach footprint and operational synergies. This merger has significantly empowered them within the corn oil market and extended its influence to the wider vegetable oil sectors. These strategic consolidations indicate a trend towards strengthening supply chains and expanding the market presence in the corn oil industry.

>Analyst Comment

Steady growth persists in the corn oil market, owing to the rise in market consumption for healthy cooking oils and its wide variety of uses across industries. This market was valued at $5.73 billion in 2024 and is projected to grow further to $6.16 billion in 2025. The growth is propelled by increasing health consciousness, urbanisation, and growing acceptance of biofuels in which corn oil serves as an important precursor. The food processing and pharmaceutical industries are also furthering this market's growth, utilising corn oil's functional properties – high smoke point and anti-inflammatory effects – for frying, margarine production, and drug formulations.

- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Corn Oil- Snapshot

- 2.2 Corn Oil- Segment Snapshot

- 2.3 Corn Oil- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Corn Oil Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Franchised

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Standalone

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: Corn Oil Market by Region

- 5.1 Overview

- 5.1.1 Market size and forecast By Region

- 5.2 North America

- 5.2.1 Key trends and opportunities

- 5.2.2 Market size and forecast, by Type

- 5.2.3 Market size and forecast, by Application

- 5.2.4 Market size and forecast, by country

- 5.2.4.1 United States

- 5.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.2.4.1.2 Market size and forecast, by Type

- 5.2.4.1.3 Market size and forecast, by Application

- 5.2.4.2 Canada

- 5.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.4.2.2 Market size and forecast, by Type

- 5.2.4.2.3 Market size and forecast, by Application

- 5.2.4.3 Mexico

- 5.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 5.2.4.3.2 Market size and forecast, by Type

- 5.2.4.3.3 Market size and forecast, by Application

- 5.2.4.1 United States

- 5.3 South America

- 5.3.1 Key trends and opportunities

- 5.3.2 Market size and forecast, by Type

- 5.3.3 Market size and forecast, by Application

- 5.3.4 Market size and forecast, by country

- 5.3.4.1 Brazil

- 5.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.3.4.1.2 Market size and forecast, by Type

- 5.3.4.1.3 Market size and forecast, by Application

- 5.3.4.2 Argentina

- 5.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.3.4.2.2 Market size and forecast, by Type

- 5.3.4.2.3 Market size and forecast, by Application

- 5.3.4.3 Chile

- 5.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.4.3.2 Market size and forecast, by Type

- 5.3.4.3.3 Market size and forecast, by Application

- 5.3.4.4 Rest of South America

- 5.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 5.3.4.4.2 Market size and forecast, by Type

- 5.3.4.4.3 Market size and forecast, by Application

- 5.3.4.1 Brazil

- 5.4 Europe

- 5.4.1 Key trends and opportunities

- 5.4.2 Market size and forecast, by Type

- 5.4.3 Market size and forecast, by Application

- 5.4.4 Market size and forecast, by country

- 5.4.4.1 Germany

- 5.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.1.2 Market size and forecast, by Type

- 5.4.4.1.3 Market size and forecast, by Application

- 5.4.4.2 France

- 5.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.2.2 Market size and forecast, by Type

- 5.4.4.2.3 Market size and forecast, by Application

- 5.4.4.3 Italy

- 5.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.3.2 Market size and forecast, by Type

- 5.4.4.3.3 Market size and forecast, by Application

- 5.4.4.4 United Kingdom

- 5.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.4.2 Market size and forecast, by Type

- 5.4.4.4.3 Market size and forecast, by Application

- 5.4.4.5 Benelux

- 5.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.5.2 Market size and forecast, by Type

- 5.4.4.5.3 Market size and forecast, by Application

- 5.4.4.6 Nordics

- 5.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.6.2 Market size and forecast, by Type

- 5.4.4.6.3 Market size and forecast, by Application

- 5.4.4.7 Rest of Europe

- 5.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.7.2 Market size and forecast, by Type

- 5.4.4.7.3 Market size and forecast, by Application

- 5.4.4.1 Germany

- 5.5 Asia Pacific

- 5.5.1 Key trends and opportunities

- 5.5.2 Market size and forecast, by Type

- 5.5.3 Market size and forecast, by Application

- 5.5.4 Market size and forecast, by country

- 5.5.4.1 China

- 5.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.1.2 Market size and forecast, by Type

- 5.5.4.1.3 Market size and forecast, by Application

- 5.5.4.2 Japan

- 5.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.2.2 Market size and forecast, by Type

- 5.5.4.2.3 Market size and forecast, by Application

- 5.5.4.3 India

- 5.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.3.2 Market size and forecast, by Type

- 5.5.4.3.3 Market size and forecast, by Application

- 5.5.4.4 South Korea

- 5.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.4.2 Market size and forecast, by Type

- 5.5.4.4.3 Market size and forecast, by Application

- 5.5.4.5 Australia

- 5.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.5.2 Market size and forecast, by Type

- 5.5.4.5.3 Market size and forecast, by Application

- 5.5.4.6 Southeast Asia

- 5.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.6.2 Market size and forecast, by Type

- 5.5.4.6.3 Market size and forecast, by Application

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.7.2 Market size and forecast, by Type

- 5.5.4.7.3 Market size and forecast, by Application

- 5.5.4.1 China

- 5.6 MEA

- 5.6.1 Key trends and opportunities

- 5.6.2 Market size and forecast, by Type

- 5.6.3 Market size and forecast, by Application

- 5.6.4 Market size and forecast, by country

- 5.6.4.1 Middle East

- 5.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.6.4.1.2 Market size and forecast, by Type

- 5.6.4.1.3 Market size and forecast, by Application

- 5.6.4.2 Africa

- 5.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.6.4.2.2 Market size and forecast, by Type

- 5.6.4.2.3 Market size and forecast, by Application

- 5.6.4.1 Middle East

- 6.1 Overview

- 6.2 Key Winning Strategies

- 6.3 Top 10 Players: Product Mapping

- 6.4 Competitive Analysis Dashboard

- 6.5 Market Competition Heatmap

- 6.6 Leading Player Positions, 2022

7: Company Profiles

- 7.1 Godfathers Pizza Inc.

- 7.1.1 Company Overview

- 7.1.2 Key Executives

- 7.1.3 Company snapshot

- 7.1.4 Active Business Divisions

- 7.1.5 Product portfolio

- 7.1.6 Business performance

- 7.1.7 Major Strategic Initiatives and Developments

- 7.2 LYKE Kitchen

- 7.2.1 Company Overview

- 7.2.2 Key Executives

- 7.2.3 Company snapshot

- 7.2.4 Active Business Divisions

- 7.2.5 Product portfolio

- 7.2.6 Business performance

- 7.2.7 Major Strategic Initiatives and Developments

- 7.3 McAlisters Franchisor SPV LLC

- 7.3.1 Company Overview

- 7.3.2 Key Executives

- 7.3.3 Company snapshot

- 7.3.4 Active Business Divisions

- 7.3.5 Product portfolio

- 7.3.6 Business performance

- 7.3.7 Major Strategic Initiatives and Developments

- 7.4 MOD Super Fast Pizza LLC

- 7.4.1 Company Overview

- 7.4.2 Key Executives

- 7.4.3 Company snapshot

- 7.4.4 Active Business Divisions

- 7.4.5 Product portfolio

- 7.4.6 Business performance

- 7.4.7 Major Strategic Initiatives and Developments

- 7.5 Noodles and Co.

- 7.5.1 Company Overview

- 7.5.2 Key Executives

- 7.5.3 Company snapshot

- 7.5.4 Active Business Divisions

- 7.5.5 Product portfolio

- 7.5.6 Business performance

- 7.5.7 Major Strategic Initiatives and Developments

- 7.6 Panda Restaurant Group Inc.

- 7.6.1 Company Overview

- 7.6.2 Key Executives

- 7.6.3 Company snapshot

- 7.6.4 Active Business Divisions

- 7.6.5 Product portfolio

- 7.6.6 Business performance

- 7.6.7 Major Strategic Initiatives and Developments

- 7.7 PORTILLOS Inc.

- 7.7.1 Company Overview

- 7.7.2 Key Executives

- 7.7.3 Company snapshot

- 7.7.4 Active Business Divisions

- 7.7.5 Product portfolio

- 7.7.6 Business performance

- 7.7.7 Major Strategic Initiatives and Developments

- 7.8 Potbelly Corp.

- 7.8.1 Company Overview

- 7.8.2 Key Executives

- 7.8.3 Company snapshot

- 7.8.4 Active Business Divisions

- 7.8.5 Product portfolio

- 7.8.6 Business performance

- 7.8.7 Major Strategic Initiatives and Developments

- 7.9 Restaurant Brands International Inc.

- 7.9.1 Company Overview

- 7.9.2 Key Executives

- 7.9.3 Company snapshot

- 7.9.4 Active Business Divisions

- 7.9.5 Product portfolio

- 7.9.6 Business performance

- 7.9.7 Major Strategic Initiatives and Developments

- 7.10 Shake Shack Inc.

- 7.10.1 Company Overview

- 7.10.2 Key Executives

- 7.10.3 Company snapshot

- 7.10.4 Active Business Divisions

- 7.10.5 Product portfolio

- 7.10.6 Business performance

- 7.10.7 Major Strategic Initiatives and Developments

- 7.11 Smashburger Servicing LLC

- 7.11.1 Company Overview

- 7.11.2 Key Executives

- 7.11.3 Company snapshot

- 7.11.4 Active Business Divisions

- 7.11.5 Product portfolio

- 7.11.6 Business performance

- 7.11.7 Major Strategic Initiatives and Developments

- 7.12 The Wendys Co.

- 7.12.1 Company Overview

- 7.12.2 Key Executives

- 7.12.3 Company snapshot

- 7.12.4 Active Business Divisions

- 7.12.5 Product portfolio

- 7.12.6 Business performance

- 7.12.7 Major Strategic Initiatives and Developments

- 7.13 Wingstop Inc.

- 7.13.1 Company Overview

- 7.13.2 Key Executives

- 7.13.3 Company snapshot

- 7.13.4 Active Business Divisions

- 7.13.5 Product portfolio

- 7.13.6 Business performance

- 7.13.7 Major Strategic Initiatives and Developments

- 7.14 YUM Brands Inc.

- 7.14.1 Company Overview

- 7.14.2 Key Executives

- 7.14.3 Company snapshot

- 7.14.4 Active Business Divisions

- 7.14.5 Product portfolio

- 7.14.6 Business performance

- 7.14.7 Major Strategic Initiatives and Developments

8: Analyst Perspective and Conclusion

- 8.1 Concluding Recommendations and Analysis

- 8.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Corn Oil in 2030?

+

-

Which type of Corn Oil is widely popular?

+

-

What is the growth rate of Corn Oil Market?

+

-

What are the latest trends influencing the Corn Oil Market?

+

-

Who are the key players in the Corn Oil Market?

+

-

How is the Corn Oil } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Corn Oil Market Study?

+

-

What geographic breakdown is available in Global Corn Oil Market Study?

+

-

Which region holds the second position by market share in the Corn Oil market?

+

-

How are the key players in the Corn Oil market targeting growth in the future?

+

-

The corn oil market is subject to a variety of forces that stimulate its growth and, at the same time, shape its dynamics. One of the significant drivers is the rising health consciousness among consumers. Corn oil, having low saturated fat content with a rich supply of polyunsaturated fatty acids, such as omega 6, is being acknowledged as a healthier option compared to other cooking oils. This has increased the preference for corn oil in the household and food processing industry, for use in cooking and frying and as an ingredient in salad dressings and baked goods. Moreover, the presence of antioxidant vitamin E also attracts health-conscious consumers. Another major driver is the growing applications of corn oil beyond the food industries. With the rising demand for renewable energy resources, there has been an increase in the application of corn oil in biodiesel production, integrating with global efforts to reduce carbon footprints. Besides, corn oil has its application in different industries, including the production of soaps, lubricants, cosmetics, and pharmaceuticals, which add to the market scope and push the demand even further.