Global Cosmetic Contract Outsourcing Market - Industry Dynamics, Market Size, And Opportunity Forecast To 2030

Report ID: MS-2602 | Business finance | Last updated: May, 2025 | Formats*:

The cosmetic contract outsourcing market consists of firms that offer specialised third-party services for the creation, production, and packaging of cosmetic and personal care products for other companies. Rather than setting up their own factories, research and development (R&D) centers, and production lines, cosmetic companies from startup to large-scale firms outsource these activities to professional contract manufacturers. This enables brands to concentrate on their core strengths, i.e., product innovation, marketing, and distribution, and benefit from the contract manufacturer's expertise, infrastructure, and economies of scale.

These contracted services are usually wide-ranging in nature, encompassing such things as formulation development (novel recipe design for the product), raw material sourcing, stability testing, quality control, regulatory compliance, bulk manufacturing, filling, package design, and even end-stage logistics. Cosmetic brands benefit from the working arrangement with contract manufacturers in being able to tap into innovative cutting-edge technologies, in-depth scientific expertise, and agile production capabilities, all without commensurate upfront capital requirements.

Cosmetic Contract Outsourcing Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

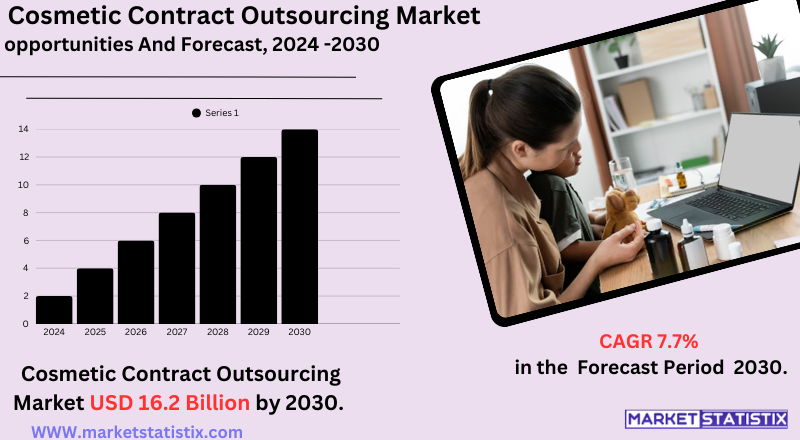

| Growth Rate | CAGR of 7.7% |

| Forecast Value (2030) | USD 16.2 Billion |

| By Product Type | Skin Care Products, Makeup Products, Fragrances, Hair Care Products, Personal Care Products |

| Key Market Players |

|

| By Region |

|

Cosmetic Contract Outsourcing Market Trends

The cosmetic contract outsourcing market is now facing a number of important trends fuelled by changing consumer expectations and market dynamics. One of the key trends is the growing demand for sustainable, natural, and clean beauty products. Consumers are increasingly looking at ingredients and environmental footprints, prompting brands to look for contract manufacturers that have experience in sourcing eco-friendly raw materials, creating vegan and cruelty-free products, and applying sustainable manufacturing and packaging procedures. This movement towards ethical and eco-friendly products is a major chance for contract manufacturers who are capable of meeting these high standards.

Also, the fast-paced growth of direct-to-consumer (DTC) and e-commerce models has reduced entry barriers for new beauty brands, most of which depend on contract manufacturers for bringing such innovative products to market quickly without investing in extensive in-house infrastructure. Such emphasis on speed-to-market and agility continues to drive the outsourcing trend.

Cosmetic Contract Outsourcing Market Leading Players

The key players profiled in the report are Ridgepole, Cosmo Beauty, Mana Products, Kolmar korea, Cosmecca, B.Kolor, Easycare Group, A&H Inteational Cosmetics, Bawei Biotechnology, Arizona Natural Resources, Nox Bellow Cosmetics, Intercos, Chromavis, Opal Cosmetics, Nihon Kolmar, ESTATE CHEMICAL, Ancorotti Cosmetics, KDC/One, PICASO Cosmetic, Toyo Beauty, BioTruly, COSMAX, Foshan wanying cosmeticsGrowth Accelerators

The outsourcing market for cosmetic contracts is mainly influenced by the growing demand for cost savings and lower capital spending for cosmetic companies. It takes a lot of initial investment and continuing operational expense to set up and operate in-house manufacturing units, such as R&D labs, production lines, and quality control units. By outsourcing, companies can sidestep these huge expenditures, making fixed costs variable ones, and direct their resources to core areas such as brand building, marketing, and innovation that have a direct bearing on market success. This malleability is highly attractive to startups and small brands eager to set foot in the market without having to make prohibitive initial investments.

Another key driver is the need for specialised knowledge, quick time-to-market, and capacity to upscale production. The cosmetics market is extremely dynamic with changing trends, consumer tastes (e.g., natural, organic, or customized products), and tight regulatory conditions. Contract manufacturers have specialised expertise in formulation, sourcing of ingredients, compliance with regulations, and sophisticated manufacturing technology, enabling brands to get new products to the market quickly and cost-effectively.

Cosmetic Contract Outsourcing Market Segmentation analysis

The Global Cosmetic Contract Outsourcing is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Skin Care Products, Makeup Products, Fragrances, Hair Care Products, Personal Care Products . The Application segment categorizes the market based on its usage such as Retail Industry, Beauty and Personal Care, Pharmaceuticals, Consumer Goods, Entertainment and Media. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The competitive environment of the market for cosmetic contract outsourcing is characterised by a combination of large, well-established global firms and a considerable number of small, niche manufacturers. Powerful players such as KDC/One, Intercos, COSMAX, and Kolmar Korea hold significant market share. These companies typically have large R&D capabilities, sophisticated manufacturing technologies, and international footprints to leverage in order to provide a broad range of services from formulation and manufacturing through packaging and regulatory assistance. They commonly make strategic acquisitions to increase the range of their services and move into new geographic territories or product classes.

These industry giants share the market with several midsized and niche contract manufacturers. These smaller companies tend to create differentiation by specialising in specific product categories (e.g., natural/organic, clean beauty, or particular skincare categories), providing more flexibility, lower MOQs, or operating in regional markets.

Challenges In Cosmetic Contract Outsourcing Market

The market for cosmetic contract outsourcing is confronted by a number of major challenges affecting manufacturers and brands. Regulatory compliance stands out as the key obstacle, with firms needing to deal with complex and changing local and global requirements for ingredients, labelling, safety, and product claims—failure to comply can lead to expensive delays, recalls, or damage to reputation. Moreover, the necessity to be constantly innovating in order to keep pace with fast-evolving consumer tastes, particularly for customized, natural, and eco-friendly products, necessitates heavy investment in research and development that is both costly and time-consuming.

Operationally, the sector struggles with weaknesses in supply chains such as interruptions, volatile raw material prices, and control of quality that may impinge on production schedules and bottom lines. The growth of product alternatives and end-user focus requires brands to provide a diversified portfolio of innovative, high-quality products to maintain consumer loyalty in an increasingly competitive environment. Successful passage through such challenges, therefore, demands strategic alliances, technological responsiveness, and active emphasis on transparency and sustainability to respond to both regulatory pressures and changing consumer needs.

Risks & Prospects in Cosmetic Contract Outsourcing Market

Some of the main opportunities involve the growth of private-label brands, the mainstreaming of green and clean beauty movements, and the use of sophisticated technologies like automation and AI for streamlined, personalised manufacturing. Companies are also taking advantage of the move towards eco-friendly and vegan product formulations, recyclable formats, and fast product development cycles in order to cater to changing consumer demands.

Regionally, Asia-Pacific dominates the market, fuelled by urbanisation, growing disposable incomes, and a youth-driven, beauty-conscious population, with China and India becoming key manufacturing centers based on cost benefits and support from the governments. North America also maintains a strong presence, marked by demand for cruelty-free and sustainable offerings, online retailing growth, and an increasing male grooming space. Europe follows suit, with emphasis on clean beauty, regulatory compliance, and eco-friendly packaging, while the Middle East & Africa are witnessing growth in halal-certified cosmetics and enhanced consumer lifestyles. The product development and marketing strategies in each region are influenced by the region's individual consumer preferences and regulations; thus, regional adaptation and innovation are the keys for contract manufacturers looking to tap into new market opportunities.

Key Target Audience

,Also, the market caters to component suppliers, consultancies, and research and development entities that join hands with contract manufacturers in order to innovate and enhance product lines. Government agencies and regulatory organizations also contribute by fixing guidelines and standards that influence manufacturing processes. This transformation has led contract manufacturers to implement environmentally friendly processes and formulate sustainable products, reflecting the changing needs of both customers and consumers.

,,The market for cosmetic contract outsourcing mainly focuses on a wide variety of beauty and personal care brands, both well-established multinational companies and new indie players. They aim to benefit from the experience of contract manufacturers to create and manufacture skincare, makeup, haircare, and fragrances with efficiency. Through outsourcing, brands are able to concentrate on primary competencies like marketing and distribution while reaping the benefit of advanced knowledge and expertise of contract manufacturers. With this, it becomes possible to quickly develop products, expand, and comply with regulatory requirements, which are of utmost importance in the highly competitive and fast-moving beauty market.

,,,

Merger and acquisition

The cosmetics contract manufacturing industry has seen significant merger and acquisition (M&A) activity over the last few years, fuelled by increasing demand for scalable, innovative, and sustainable beauty manufacturing solutions. Private equity players have been key drivers of this consolidation phenomenon. For example, in March 2024, Boomerang Laboratories was acquired by Elevation Labs, supported by Knox Lane, strengthening its strengths in beauty and personal care contract formulation and manufacturing. In the same way, Anjac Health and Beauty diversified its portfolio by acquiring APR Beauty in July 2024, aside from earlier acquisitions of Apollo and STEPHID, thus expanding its market hold in turnkey solutions business for brand and private label beauty products.

Strategic acquisitions have also been witnessed, where firms such as Cosmetic Solutions, LLC, have bought Private Label Select in March 2022 to expand their organic and anhydrous product lines. Such M&A reflects a wider industry movement towards adopting advanced technologies and sustainable practices in order to address changing consumer needs.

>

Analyst Comment

The market for cosmetic contract outsourcing is growing strongly, with market size estimates for the global market varying from approximately USD 24.3 billion in 2024 to forecasts of USD 58.41 billion by 2035. Growth is being driven by increasing demand from consumers for customized, innovative, and high-quality beauty products and the global popularity of private-label and indie brands. Outsourcing enables cosmetic businesses to concentrate on branding and marketing and outsource formulation, manufacturing, packaging, and scalability to specialised manufacturers. The clean beauty trend, with its emphasis on natural and organic ingredients and sustainable packaging, is also compelling manufacturers to become greener and adopt more innovative technologies like automation and AI.

- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Cosmetic Contract Outsourcing- Snapshot

- 2.2 Cosmetic Contract Outsourcing- Segment Snapshot

- 2.3 Cosmetic Contract Outsourcing- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Cosmetic Contract Outsourcing Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Skin Care Products

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Hair Care Products

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Makeup Products

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Fragrances

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

- 4.6 Personal Care Products

- 4.6.1 Key market trends, factors driving growth, and opportunities

- 4.6.2 Market size and forecast, by region

- 4.6.3 Market share analysis by country

5: Cosmetic Contract Outsourcing Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Beauty and Personal Care

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Pharmaceuticals

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Consumer Goods

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Retail Industry

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Entertainment and Media

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

6: Cosmetic Contract Outsourcing Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 COSMAX

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 KDC/One

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Intercos

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 Kolmar korea

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Nihon Kolmar

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Cosmo Beauty

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Mana Products

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 Cosmecca

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 PICASO Cosmetic

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 Nox Bellow Cosmetics

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

- 8.11 Toyo Beauty

- 8.11.1 Company Overview

- 8.11.2 Key Executives

- 8.11.3 Company snapshot

- 8.11.4 Active Business Divisions

- 8.11.5 Product portfolio

- 8.11.6 Business performance

- 8.11.7 Major Strategic Initiatives and Developments

- 8.12 Chromavis

- 8.12.1 Company Overview

- 8.12.2 Key Executives

- 8.12.3 Company snapshot

- 8.12.4 Active Business Divisions

- 8.12.5 Product portfolio

- 8.12.6 Business performance

- 8.12.7 Major Strategic Initiatives and Developments

- 8.13 Arizona Natural Resources

- 8.13.1 Company Overview

- 8.13.2 Key Executives

- 8.13.3 Company snapshot

- 8.13.4 Active Business Divisions

- 8.13.5 Product portfolio

- 8.13.6 Business performance

- 8.13.7 Major Strategic Initiatives and Developments

- 8.14 Opal Cosmetics

- 8.14.1 Company Overview

- 8.14.2 Key Executives

- 8.14.3 Company snapshot

- 8.14.4 Active Business Divisions

- 8.14.5 Product portfolio

- 8.14.6 Business performance

- 8.14.7 Major Strategic Initiatives and Developments

- 8.15 Ancorotti Cosmetics

- 8.15.1 Company Overview

- 8.15.2 Key Executives

- 8.15.3 Company snapshot

- 8.15.4 Active Business Divisions

- 8.15.5 Product portfolio

- 8.15.6 Business performance

- 8.15.7 Major Strategic Initiatives and Developments

- 8.16 A&H Inteational Cosmetics

- 8.16.1 Company Overview

- 8.16.2 Key Executives

- 8.16.3 Company snapshot

- 8.16.4 Active Business Divisions

- 8.16.5 Product portfolio

- 8.16.6 Business performance

- 8.16.7 Major Strategic Initiatives and Developments

- 8.17 BioTruly

- 8.17.1 Company Overview

- 8.17.2 Key Executives

- 8.17.3 Company snapshot

- 8.17.4 Active Business Divisions

- 8.17.5 Product portfolio

- 8.17.6 Business performance

- 8.17.7 Major Strategic Initiatives and Developments

- 8.18 Bawei Biotechnology

- 8.18.1 Company Overview

- 8.18.2 Key Executives

- 8.18.3 Company snapshot

- 8.18.4 Active Business Divisions

- 8.18.5 Product portfolio

- 8.18.6 Business performance

- 8.18.7 Major Strategic Initiatives and Developments

- 8.19 B.Kolor

- 8.19.1 Company Overview

- 8.19.2 Key Executives

- 8.19.3 Company snapshot

- 8.19.4 Active Business Divisions

- 8.19.5 Product portfolio

- 8.19.6 Business performance

- 8.19.7 Major Strategic Initiatives and Developments

- 8.20 Easycare Group

- 8.20.1 Company Overview

- 8.20.2 Key Executives

- 8.20.3 Company snapshot

- 8.20.4 Active Business Divisions

- 8.20.5 Product portfolio

- 8.20.6 Business performance

- 8.20.7 Major Strategic Initiatives and Developments

- 8.21 ESTATE CHEMICAL

- 8.21.1 Company Overview

- 8.21.2 Key Executives

- 8.21.3 Company snapshot

- 8.21.4 Active Business Divisions

- 8.21.5 Product portfolio

- 8.21.6 Business performance

- 8.21.7 Major Strategic Initiatives and Developments

- 8.22 Ridgepole

- 8.22.1 Company Overview

- 8.22.2 Key Executives

- 8.22.3 Company snapshot

- 8.22.4 Active Business Divisions

- 8.22.5 Product portfolio

- 8.22.6 Business performance

- 8.22.7 Major Strategic Initiatives and Developments

- 8.23 Foshan wanying cosmetics

- 8.23.1 Company Overview

- 8.23.2 Key Executives

- 8.23.3 Company snapshot

- 8.23.4 Active Business Divisions

- 8.23.5 Product portfolio

- 8.23.6 Business performance

- 8.23.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Cosmetic Contract Outsourcing in 2030?

+

-

Which type of Cosmetic Contract Outsourcing is widely popular?

+

-

What is the growth rate of Cosmetic Contract Outsourcing Market?

+

-

What are the latest trends influencing the Cosmetic Contract Outsourcing Market?

+

-

Who are the key players in the Cosmetic Contract Outsourcing Market?

+

-

How is the Cosmetic Contract Outsourcing } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Cosmetic Contract Outsourcing Market Study?

+

-

What geographic breakdown is available in Global Cosmetic Contract Outsourcing Market Study?

+

-

Which region holds the second position by market share in the Cosmetic Contract Outsourcing market?

+

-

How are the key players in the Cosmetic Contract Outsourcing market targeting growth in the future?

+

-

,

,

,, Another key driver is the need for specialised knowledge, quick time-to-market, and capacity to upscale production. The cosmetics market is extremely dynamic with changing trends, consumer tastes (e.g., natural, organic, or customized products), and tight regulatory conditions. Contract manufacturers have specialised expertise in formulation, sourcing of ingredients, compliance with regulations, and sophisticated manufacturing technology, enabling brands to get new products to the market quickly and cost-effectively.,, ,

The outsourcing market for cosmetic contracts is mainly influenced by the growing demand for cost savings and lower capital spending for cosmetic companies. It takes a lot of initial investment and continuing operational expense to set up and operate in-house manufacturing units, such as R&D labs, production lines, and quality control units. By outsourcing, companies can sidestep these huge expenditures, making fixed costs variable ones, and direct their resources to core areas such as brand building, marketing, and innovation that have a direct bearing on market success. This malleability is highly attractive to startups and small brands eager to set foot in the market without having to make prohibitive initial investments.

,

,