Global Critical Illness Insurance Market Size, Share & Trends Analysis Report, Forecast Period, 2024-2031

Report ID: MS-214 | Business finance | Last updated: Dec, 2024 | Formats*:

Critical Illness Insurance Report Highlights

| Report Metrics | Details |

|---|---|

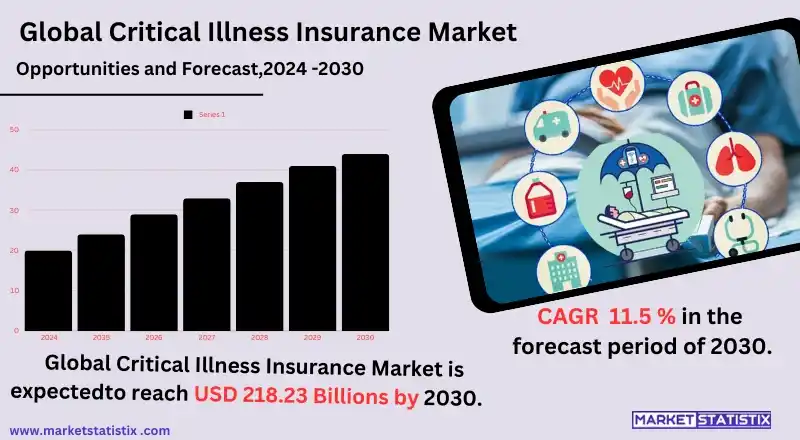

| Forecast period | 2019-2031 |

| Base Year Of Estimation | 2023 |

| Growth Rate | CAGR of 11.5% |

| Forecast Value (2031) | USD 218.23 Billion |

| By Product Type | Medical Insurance, Disease Insurance, Family Insurance, Income Protection Insurance |

| Key Market Players |

|

| By Region |

Critical Illness Insurance Market Trends

The critical illness insurance market features critical transforming trends, as an ageing population, high healthcare costs, and consumer awareness regarding the need for financial protection during very serious illness are all propelling the growth of this market. Today, it is not uncommon for consumers to get proactive about financial help for critical illnesses like cancer, heart disease, or stroke and look for a greater number of policies that will cover as many life-threatening conditions as possible. The insurance companies, in response, are widening their scopes to provide broader coverage, varied plans, and certainly different customer needs across age groups. Another major trend in the marketplace has been the introduction of digital technologies into the critical illness insurance industry. In the recent past, various stakeholders have been seen adopting digital tools, including customer engagement, policy administration, and claims processing, for the convenience that it offers and efficiencies for all concerned. The market also sees hybrid insurance products being introduced, such as critical illness coverage along with life insurance or health insurance, making it a one-stop solution for policyholders.Critical Illness Insurance Market Leading Players

The key players profiled in the report are Allianz, China Life Insurance Company, Aflac Incorporated, AIG, American Fidelity, Aviva, UnitedHealthcare, Desjardins Group, Aegon, PrudentialGrowth Accelerators

Critical Illness Insurance Market: Rising health risk awareness and the increasing number of chronic diseases such as cancers, heart disease, and diabetes are significant market drivers. The more aware people become of the financial costs attached to such serious illnesses, the more they demand insurance products that secure their financial future against any critical health problems. This awareness is most evident in areas where there are ageing populations, given that the risk of critical illness ascends with age and propels demand for such insurances. Changing healthcare scenarios and rising medical costs, along with emerging medical treatments, further justify the critical illness insurance concept. The higher the healthcare costs, the more people want to find financial protection that would cover their out-of-pocket expenses, lost income, and more care needed during the recovery period. Along with that, the insurance companies are launching more customised and flexible products that would cater to different needs as well as making it easier for a larger segment of the population to avail themselves of critical illness insurance.Critical Illness Insurance Market Segmentation analysis

The Global Critical Illness Insurance is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Medical Insurance, Disease Insurance, Family Insurance, Income Protection Insurance . The Application segment categorizes the market based on its usage such as Heart Attack, Cancer, Stroke, Others. Geographically, the market is assessed across key Regions like {regionNms} and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The landscape of the competitive Critical Illness Insurance Market is the blend of established insurance providers, both multinational and regional, offering different types of policies for different customers. AIG, Prudential, MetLife, and some other key players are trying to have a share in the global market of comprehensive coverage options with flexible and extensive support services. By holding all brand names, finance, and distribution networks, these giants maintain a competitive edge. Many of the big insurers are also putting the effort into strategic alliances with their other partners in the healthcare industry and technology to improve customer experience.Challenges In Critical Illness Insurance Market

One of the major problems faced by the critical illness insurance market is lack of awareness and understanding among consumers. Most consumers do not know the benefits provided under or the types of coverage available in critical illness insurances, which generally results in low penetration rates across regions. This, in turn, has led to a lot of people being hesitant or delaying purchase decisions as they do not see it as a priority until they are hit by a health crisis. Another issue is the increasing number of players entering the industry, which puts pressure on insurers to provide more comprehensive and affordable policies. Companies have to juggle profitability and client demands, which drive up premiums or leave clients with less coverage. The ever-changing face of critical illness and the advances in medical technology also create a bitter pill for insurers to swallow as they find it hard to determine risk levels and prescribe accurate pricing models that could either result in under-pricing or financial instability on the part of insurers.Risks & Prospects in Critical Illness Insurance Market

Growth in the critical illness insurance market is due to the increasing awareness about health risks and the increasing prevalence of chronic diseases across the globe. Rising healthcare costs, along with the increase in the average life span, are leading consumers to seek financial protection against critical illnesses such as cancer, heart disease, and stroke. Thus, it can be a business opportunity for insurers in increasing their products and reaching a wider audience, especially in developing markets with low penetration of insurance. Besides, digitalisation in the insurance industry has great opportunities for growth. The emergence of online platforms and mobile applications makes it easy for consumers to access this insurance form. Increasing convenience translates to much more customer reach. The burgeoning interest in wellness and preventive healthcare could create opportunities for incorporating health management services along with critical illness insurance, thereby adding further value to the customer and ensuring loyalty in the long run.Key Target Audience

The prospective main target audience of the Critical Illness Insurance Market is individuals seeking financial security when faced with life-threatening health conditions such as cancer, heart attack, and stroke. This audience consists of middle-aged adults, especially those from 30 to 50 years, who are more likely to suffer from critical illness and need to meet expenses towards treatment and income loss during such an illness. They often buy critical illness insurance to supplement normal medical insurance, thereby cushioning such expenses with additional financial resources for non-medical rehabilitation and treatment.,, Another target audience is employers and other organisations that provide group insurance plans to employees as part of the benefits package. Most companies use critical illness insurance to attract and keep talent to provide a safety net for employees against severe health conditions.Merger and acquisition

It has become one of the most energetic markets in mergers and acquisitions recently, that of Critical Illness Insurance. Only in the last quarter, it has recorded a whopping 15 transactions globally within its purview. Of such transactions is Prudential Financials’ acquisition of Assurance IQ—a digital insurance marketplace—for $2.35 billion that improves Prudential's digital capabilities and reach in the insurance sector. Another did it with Aflac for the integration of Continental American Insurance Company, worth $582 million, more value added to Aflac's stand on the supplemental health insurance market, especially on critical illness. The intensifying winds of a consolidation trend and technology-changing forces are apparent within and outside the industry as a result of strategic alliances. In the near future, the entire scenario of critical illness insurance will be revolutionised as growth is expected at a very high rate. Growing awareness of financial risks from critical illnesses coupled with increasing healthcare costs leads to the development of more critical illness policies. All the recent M&A activities, along with the launch of new products and funds in innovative insurance solutions, point to a strong future for the critical illness insurance sector, likely considered in meeting the human needs and evolving along the technological continuum. >Analyst Comment

"The growing reliance on critical illness insurance has been caused by an increase in costs related to health care, the rising incidence of critical illnesses, and increased awareness of financial protection. People are becoming more health conscious and mindful of their health, so this demand for critical illness insurance is anticipated to continue growing, particularly among developing markets with rapidly ageing nationals. Some major factors projected to chip in on this market growth include rising healthcare costs, increasing prevalence of chronic diseases, growing awareness of critical illness insurance, and changing preferences of consumers for comprehensive financial security."- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Critical Illness Insurance- Snapshot

- 2.2 Critical Illness Insurance- Segment Snapshot

- 2.3 Critical Illness Insurance- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Critical Illness Insurance Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Medical Insurance

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Disease Insurance

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Family Insurance

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Income Protection Insurance

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

5: Critical Illness Insurance Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Heart Attack

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Cancer

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Stroke

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Others

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

6: Competitive Landscape

- 6.1 Overview

- 6.2 Key Winning Strategies

- 6.3 Top 10 Players: Product Mapping

- 6.4 Competitive Analysis Dashboard

- 6.5 Market Competition Heatmap

- 6.6 Leading Player Positions, 2022

7: Company Profiles

- 7.1 Allianz

- 7.1.1 Company Overview

- 7.1.2 Key Executives

- 7.1.3 Company snapshot

- 7.1.4 Active Business Divisions

- 7.1.5 Product portfolio

- 7.1.6 Business performance

- 7.1.7 Major Strategic Initiatives and Developments

- 7.2 China Life Insurance Company

- 7.2.1 Company Overview

- 7.2.2 Key Executives

- 7.2.3 Company snapshot

- 7.2.4 Active Business Divisions

- 7.2.5 Product portfolio

- 7.2.6 Business performance

- 7.2.7 Major Strategic Initiatives and Developments

- 7.3 Aflac Incorporated

- 7.3.1 Company Overview

- 7.3.2 Key Executives

- 7.3.3 Company snapshot

- 7.3.4 Active Business Divisions

- 7.3.5 Product portfolio

- 7.3.6 Business performance

- 7.3.7 Major Strategic Initiatives and Developments

- 7.4 AIG

- 7.4.1 Company Overview

- 7.4.2 Key Executives

- 7.4.3 Company snapshot

- 7.4.4 Active Business Divisions

- 7.4.5 Product portfolio

- 7.4.6 Business performance

- 7.4.7 Major Strategic Initiatives and Developments

- 7.5 American Fidelity

- 7.5.1 Company Overview

- 7.5.2 Key Executives

- 7.5.3 Company snapshot

- 7.5.4 Active Business Divisions

- 7.5.5 Product portfolio

- 7.5.6 Business performance

- 7.5.7 Major Strategic Initiatives and Developments

- 7.6 Aviva

- 7.6.1 Company Overview

- 7.6.2 Key Executives

- 7.6.3 Company snapshot

- 7.6.4 Active Business Divisions

- 7.6.5 Product portfolio

- 7.6.6 Business performance

- 7.6.7 Major Strategic Initiatives and Developments

- 7.7 UnitedHealthcare

- 7.7.1 Company Overview

- 7.7.2 Key Executives

- 7.7.3 Company snapshot

- 7.7.4 Active Business Divisions

- 7.7.5 Product portfolio

- 7.7.6 Business performance

- 7.7.7 Major Strategic Initiatives and Developments

- 7.8 Desjardins Group

- 7.8.1 Company Overview

- 7.8.2 Key Executives

- 7.8.3 Company snapshot

- 7.8.4 Active Business Divisions

- 7.8.5 Product portfolio

- 7.8.6 Business performance

- 7.8.7 Major Strategic Initiatives and Developments

- 7.9 Aegon

- 7.9.1 Company Overview

- 7.9.2 Key Executives

- 7.9.3 Company snapshot

- 7.9.4 Active Business Divisions

- 7.9.5 Product portfolio

- 7.9.6 Business performance

- 7.9.7 Major Strategic Initiatives and Developments

- 7.10 Prudential

- 7.10.1 Company Overview

- 7.10.2 Key Executives

- 7.10.3 Company snapshot

- 7.10.4 Active Business Divisions

- 7.10.5 Product portfolio

- 7.10.6 Business performance

- 7.10.7 Major Strategic Initiatives and Developments

8: Analyst Perspective and Conclusion

- 8.1 Concluding Recommendations and Analysis

- 8.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Critical Illness Insurance in 2031?

+

-

What is the growth rate of Critical Illness Insurance Market?

+

-

What are the latest trends influencing the Critical Illness Insurance Market?

+

-

Who are the key players in the Critical Illness Insurance Market?

+

-

How is the Critical Illness Insurance } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Critical Illness Insurance Market Study?

+

-

What geographic breakdown is available in Global Critical Illness Insurance Market Study?

+

-

Which region holds the second position by market share in the Critical Illness Insurance market?

+

-

How are the key players in the Critical Illness Insurance market targeting growth in the future?

+

-

What are the opportunities for new entrants in the Critical Illness Insurance market?

+

-