Global Customer Analytics Market – Industry Trends and Forecast to 2031

Report ID: MS-1532 | IT and Telecom | Last updated: Dec, 2024 | Formats*:

Customer Analytics Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2031 |

| Base Year Of Estimation | 2023 |

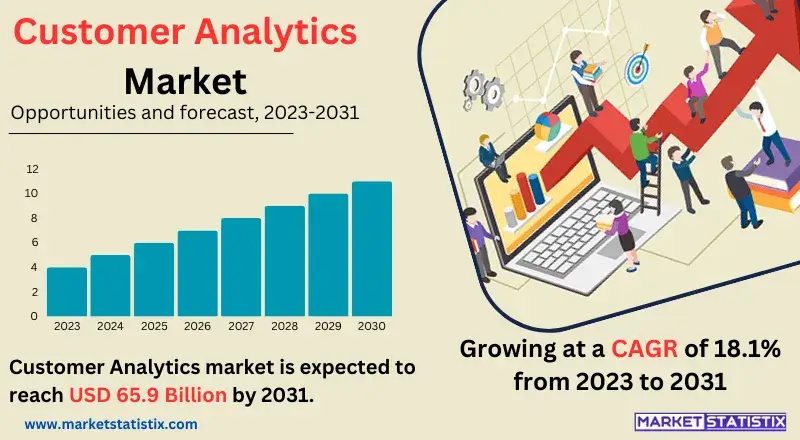

| Growth Rate | CAGR of 18.1% |

| By Product Type | Descriptive, Predictive, Prescriptive |

| Key Market Players |

|

| By Region |

|

Customer Analytics Market Trends

The growth of the customer analytics market accelerates with increasing data-driven decision-making and advanced analytical tools adopted in business. Companies use artificial intelligence (AI) and machine learning (ML) for collecting deep insights into the behavioural, preference, and purchase patterns of customers. This will bring about personalisation of experiences, enhancement of customer engagement, and optimisation of marketing verticals. The growing installation of predictive analytics anticipates a growing trend in organisations for "looking into" the needs of customers and developing improved retention strategies. Many businesses invest in understanding their customers' real-time interactions, driven by ever-increasing amounts of data from big data and IoT happening today. Another dimension of such development is the rising demand for real-time analytics concerning customers. It brings forth the advanced possibilities of customer analytics that quickly respond to bringing forth their much-loved satisfaction. This constitutes some of the factors that drive the customer analytics market in all facilities, be it retail, banking, healthcare, or telecommunications.Customer Analytics Market Leading Players

The key players profiled in the report are IBM Corporation, Oracle Corporation, Pitney Bowes, Adobe Systems Incorporated, Actuate Software Corporation, Fair Isaac Corporation, SAS Institute, Teoco Corporation, Verint System, SAP AGGrowth Accelerators

The growing requirement for personalised customer experiences is driving the customer analytics market. Be it retail or finance, businesses have adopted a customer analytic tool to capture customer behaviour, preferences, and buying patterns. Companies can now use this information for marketing strategies, product optimisation, and customer engagement to have more satisfied and loyal customers. With the continued growth of e-commerce and other digital platforms, businesses increasingly require these advanced solutions to monitor and analyse their customers' real-time interactions with their companies. The adoption of AI and machine learning technologies is a further propelling driver for the booming customer analytics market. In turn, such vast amounts of data can be interpreted in a small fraction of the time compared with doing so manually.Customer Analytics Market Segmentation analysis

The Global Customer Analytics is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Descriptive, Predictive, Prescriptive . The Application segment categorizes the market based on its usage such as Government and Defence, Telecommunication and IT, Healthcare, Hospitality and Travel, Media and Entertainment, Manufacturing, BFSI, Transportation and Logistics, Retail. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

Indeed, the customer analytics market is an amalgamation of old giants and new start-ups, competing within the innovative software solutions segment. Here, a company like IBM, SAP, Oracle, or Microsoft makes the top ranks with such mature customer analytics offerings. Those platforms combine artificial intelligence, machine learning, and big data for businesses to derive actionable insights from their consumer behaviour. These indeed include advanced predictive analytics, customer segmentation, and personalised marketing for the varied industries of retail, finance, and healthcare.Challenges In Customer Analytics Market

In the domain of customer analytics, many issues have resulted from data privacy and security challenges from the collection of a great deal of personal and behavioural data to understand customer preferences. With the rising concern over data breaches and strict regulations like that of GDPR, organisations are therefore obliged to comply with very sophisticated requirements while ensuring customer data protection. It, therefore, creates hurdles to implementing effective analytics on customers, especially for those working in different regions with varied laws on data protection. Another challenge to effective customer analytics is the mishmash of data sources because it is most often divided into silos across many points, such as CRMs, social media, and e-commerce applications. It's difficult and resource-heavy to integrate all these data channels and view them in one cause, actionable perspective of customer behaviour.Risks & Prospects in Customer Analytics Market

The potential of the customer analytics market in retail, e-commerce, and other financial industries is huge, as it seeks to unlock consumer behaviour and improve personalised offerings at the business end. With customer analytics, retailers may now optimise inventory, improve shopping experiences, and develop more efficient marketing strategies. With customer analytics, data could develop effective product recommendations, improve customer engagement, and increase e-commerce conversion rates. Financial institutions can also use customer analytics to personalise their financial products and improve customer retention using an understanding of the spending habits and preferences of their customers. Integrating advanced technologies such as artificial intelligence (AI), machine learning, and big data analytics will also boost customer insight on the new user end. Companies can exploit this technology to predict trends, identify new segments of customers, and improve decision-making processes. Data is of increasing concern for private information security; thus, there is also a rising demand for regulatory-compliant analytics tools, which further opens an opportunity for businesses to deliver solutions securely and reliably.Key Target Audience

Customer analytics serves some of the most valued audiences: businesses all over industrial sectors such as retail, banking, e-commerce, and telecommunications that want to improve customer engagement and sales through insights from data. While retailers and e-commerce companies use customer analytics to have a better understanding of their purchasing behaviours, optimise product recommendations, and personalise their marketing campaigns, banks use it to improve customer service, fraud detection, and tailor financial products to individual customers.,, Another big audience for the customer analytics market belongs to marketing agencies and consultancy firms that assist businesses in optimising their tactics through customer data. Such a company uses customer analytics tools in evaluating campaign performances, segmenting customers, and monitoring customers through various channels. The other category of companies is that of technology companies providing analytic solutions, particularly those that offer AI-powered platforms and data visualisation tools.Merger and acquisition

Due to enhanced trends in making decision-making more data-orientated, there have been so many mergers and acquisitions in the area of customer analytics. Accenture has made this acquisition as part of its strategy to expand its customer analytics services by acquiring GemSeek, an important player in customer experiences analytics. With this acquisition, Accenture emphasises its focus on investing in technologies that will develop solutions that will assist businesses in better understanding their customers through advanced insights and predictive models using data and AI technologies. With the infusion of GemSeek's capabilities, Accenture's strategy is going to achieve great heights in the competitive customer analytics environment. The very latest innovation is centred on Accenture's acquisition; other significant trends include increased innovations by key players such as Adobe and Salesforce, which have recently launched fresh tools for improving customer journey analytics integrated with their respective platforms. Customer Journey Analytics, the latest addition to Adobe's Experience Cloud, is intended to allow organisations to attain greater insights into more customer interactions through a variety of touchpoints. Likewise, Customer 360 technologies from Salesforce are designed to link businesses and automate customer interaction. Their strategic direction will enhance business and growth in the industry as it indicates more reliance on analytics to build better customer relationships. >Analyst Comment

"The customer analytics market is growing extremely fast, mainly because the businesses' understanding of their customers in today's world is imperative, and so is making connections to engage customers. Some of the key drivers include digital channels, an ever-increasing volume of customer data, and the emerging personalisation of customer experiences. The segmentation of the market based on tools and technologies consists of data warehousing, data mining, predictive modelling, and customer journey analytics. The key players in the field continue to focus on innovative solutions that leverage AI and ML capabilities from customer data to achieve improved business outcomes."- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Customer Analytics- Snapshot

- 2.2 Customer Analytics- Segment Snapshot

- 2.3 Customer Analytics- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Customer Analytics Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Descriptive

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Predictive

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Prescriptive

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

5: Customer Analytics Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Government and Defence

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Telecommunication and IT

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Healthcare

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Hospitality and Travel

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Media and Entertainment

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

- 5.7 Manufacturing

- 5.7.1 Key market trends, factors driving growth, and opportunities

- 5.7.2 Market size and forecast, by region

- 5.7.3 Market share analysis by country

- 5.8 BFSI

- 5.8.1 Key market trends, factors driving growth, and opportunities

- 5.8.2 Market size and forecast, by region

- 5.8.3 Market share analysis by country

- 5.9 Transportation and Logistics

- 5.9.1 Key market trends, factors driving growth, and opportunities

- 5.9.2 Market size and forecast, by region

- 5.9.3 Market share analysis by country

- 5.10 Retail

- 5.10.1 Key market trends, factors driving growth, and opportunities

- 5.10.2 Market size and forecast, by region

- 5.10.3 Market share analysis by country

6: Customer Analytics Market by Service

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 Professional Service

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 Support and Maintenance Service

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

7: Customer Analytics Market by solution

- 7.1 Overview

- 7.1.1 Market size and forecast

- 7.2 Web Analytical Tools

- 7.2.1 Key market trends, factors driving growth, and opportunities

- 7.2.2 Market size and forecast, by region

- 7.2.3 Market share analysis by country

- 7.3 Social Analysis Tool

- 7.3.1 Key market trends, factors driving growth, and opportunities

- 7.3.2 Market size and forecast, by region

- 7.3.3 Market share analysis by country

- 7.4 Reporting

- 7.4.1 Key market trends, factors driving growth, and opportunities

- 7.4.2 Market size and forecast, by region

- 7.4.3 Market share analysis by country

8: Customer Analytics Market by Organization size

- 8.1 Overview

- 8.1.1 Market size and forecast

- 8.2 Large Enterprise

- 8.2.1 Key market trends, factors driving growth, and opportunities

- 8.2.2 Market size and forecast, by region

- 8.2.3 Market share analysis by country

- 8.3 SMEs

- 8.3.1 Key market trends, factors driving growth, and opportunities

- 8.3.2 Market size and forecast, by region

- 8.3.3 Market share analysis by country

9: Customer Analytics Market by Region

- 9.1 Overview

- 9.1.1 Market size and forecast By Region

- 9.2 North America

- 9.2.1 Key trends and opportunities

- 9.2.2 Market size and forecast, by Type

- 9.2.3 Market size and forecast, by Application

- 9.2.4 Market size and forecast, by country

- 9.2.4.1 United States

- 9.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 9.2.4.1.2 Market size and forecast, by Type

- 9.2.4.1.3 Market size and forecast, by Application

- 9.2.4.2 Canada

- 9.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 9.2.4.2.2 Market size and forecast, by Type

- 9.2.4.2.3 Market size and forecast, by Application

- 9.2.4.3 Mexico

- 9.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 9.2.4.3.2 Market size and forecast, by Type

- 9.2.4.3.3 Market size and forecast, by Application

- 9.2.4.1 United States

- 9.3 South America

- 9.3.1 Key trends and opportunities

- 9.3.2 Market size and forecast, by Type

- 9.3.3 Market size and forecast, by Application

- 9.3.4 Market size and forecast, by country

- 9.3.4.1 Brazil

- 9.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 9.3.4.1.2 Market size and forecast, by Type

- 9.3.4.1.3 Market size and forecast, by Application

- 9.3.4.2 Argentina

- 9.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 9.3.4.2.2 Market size and forecast, by Type

- 9.3.4.2.3 Market size and forecast, by Application

- 9.3.4.3 Chile

- 9.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 9.3.4.3.2 Market size and forecast, by Type

- 9.3.4.3.3 Market size and forecast, by Application

- 9.3.4.4 Rest of South America

- 9.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 9.3.4.4.2 Market size and forecast, by Type

- 9.3.4.4.3 Market size and forecast, by Application

- 9.3.4.1 Brazil

- 9.4 Europe

- 9.4.1 Key trends and opportunities

- 9.4.2 Market size and forecast, by Type

- 9.4.3 Market size and forecast, by Application

- 9.4.4 Market size and forecast, by country

- 9.4.4.1 Germany

- 9.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 9.4.4.1.2 Market size and forecast, by Type

- 9.4.4.1.3 Market size and forecast, by Application

- 9.4.4.2 France

- 9.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 9.4.4.2.2 Market size and forecast, by Type

- 9.4.4.2.3 Market size and forecast, by Application

- 9.4.4.3 Italy

- 9.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 9.4.4.3.2 Market size and forecast, by Type

- 9.4.4.3.3 Market size and forecast, by Application

- 9.4.4.4 United Kingdom

- 9.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 9.4.4.4.2 Market size and forecast, by Type

- 9.4.4.4.3 Market size and forecast, by Application

- 9.4.4.5 Benelux

- 9.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 9.4.4.5.2 Market size and forecast, by Type

- 9.4.4.5.3 Market size and forecast, by Application

- 9.4.4.6 Nordics

- 9.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 9.4.4.6.2 Market size and forecast, by Type

- 9.4.4.6.3 Market size and forecast, by Application

- 9.4.4.7 Rest of Europe

- 9.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 9.4.4.7.2 Market size and forecast, by Type

- 9.4.4.7.3 Market size and forecast, by Application

- 9.4.4.1 Germany

- 9.5 Asia Pacific

- 9.5.1 Key trends and opportunities

- 9.5.2 Market size and forecast, by Type

- 9.5.3 Market size and forecast, by Application

- 9.5.4 Market size and forecast, by country

- 9.5.4.1 China

- 9.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 9.5.4.1.2 Market size and forecast, by Type

- 9.5.4.1.3 Market size and forecast, by Application

- 9.5.4.2 Japan

- 9.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 9.5.4.2.2 Market size and forecast, by Type

- 9.5.4.2.3 Market size and forecast, by Application

- 9.5.4.3 India

- 9.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 9.5.4.3.2 Market size and forecast, by Type

- 9.5.4.3.3 Market size and forecast, by Application

- 9.5.4.4 South Korea

- 9.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 9.5.4.4.2 Market size and forecast, by Type

- 9.5.4.4.3 Market size and forecast, by Application

- 9.5.4.5 Australia

- 9.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 9.5.4.5.2 Market size and forecast, by Type

- 9.5.4.5.3 Market size and forecast, by Application

- 9.5.4.6 Southeast Asia

- 9.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 9.5.4.6.2 Market size and forecast, by Type

- 9.5.4.6.3 Market size and forecast, by Application

- 9.5.4.7 Rest of Asia-Pacific

- 9.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 9.5.4.7.2 Market size and forecast, by Type

- 9.5.4.7.3 Market size and forecast, by Application

- 9.5.4.1 China

- 9.6 MEA

- 9.6.1 Key trends and opportunities

- 9.6.2 Market size and forecast, by Type

- 9.6.3 Market size and forecast, by Application

- 9.6.4 Market size and forecast, by country

- 9.6.4.1 Middle East

- 9.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 9.6.4.1.2 Market size and forecast, by Type

- 9.6.4.1.3 Market size and forecast, by Application

- 9.6.4.2 Africa

- 9.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 9.6.4.2.2 Market size and forecast, by Type

- 9.6.4.2.3 Market size and forecast, by Application

- 9.6.4.1 Middle East

- 10.1 Overview

- 10.2 Key Winning Strategies

- 10.3 Top 10 Players: Product Mapping

- 10.4 Competitive Analysis Dashboard

- 10.5 Market Competition Heatmap

- 10.6 Leading Player Positions, 2022

11: Company Profiles

- 11.1 IBM Corporation

- 11.1.1 Company Overview

- 11.1.2 Key Executives

- 11.1.3 Company snapshot

- 11.1.4 Active Business Divisions

- 11.1.5 Product portfolio

- 11.1.6 Business performance

- 11.1.7 Major Strategic Initiatives and Developments

- 11.2 Oracle Corporation

- 11.2.1 Company Overview

- 11.2.2 Key Executives

- 11.2.3 Company snapshot

- 11.2.4 Active Business Divisions

- 11.2.5 Product portfolio

- 11.2.6 Business performance

- 11.2.7 Major Strategic Initiatives and Developments

- 11.3 Pitney Bowes

- 11.3.1 Company Overview

- 11.3.2 Key Executives

- 11.3.3 Company snapshot

- 11.3.4 Active Business Divisions

- 11.3.5 Product portfolio

- 11.3.6 Business performance

- 11.3.7 Major Strategic Initiatives and Developments

- 11.4 Adobe Systems Incorporated

- 11.4.1 Company Overview

- 11.4.2 Key Executives

- 11.4.3 Company snapshot

- 11.4.4 Active Business Divisions

- 11.4.5 Product portfolio

- 11.4.6 Business performance

- 11.4.7 Major Strategic Initiatives and Developments

- 11.5 Actuate Software Corporation

- 11.5.1 Company Overview

- 11.5.2 Key Executives

- 11.5.3 Company snapshot

- 11.5.4 Active Business Divisions

- 11.5.5 Product portfolio

- 11.5.6 Business performance

- 11.5.7 Major Strategic Initiatives and Developments

- 11.6 Fair Isaac Corporation

- 11.6.1 Company Overview

- 11.6.2 Key Executives

- 11.6.3 Company snapshot

- 11.6.4 Active Business Divisions

- 11.6.5 Product portfolio

- 11.6.6 Business performance

- 11.6.7 Major Strategic Initiatives and Developments

- 11.7 SAS Institute

- 11.7.1 Company Overview

- 11.7.2 Key Executives

- 11.7.3 Company snapshot

- 11.7.4 Active Business Divisions

- 11.7.5 Product portfolio

- 11.7.6 Business performance

- 11.7.7 Major Strategic Initiatives and Developments

- 11.8 Teoco Corporation

- 11.8.1 Company Overview

- 11.8.2 Key Executives

- 11.8.3 Company snapshot

- 11.8.4 Active Business Divisions

- 11.8.5 Product portfolio

- 11.8.6 Business performance

- 11.8.7 Major Strategic Initiatives and Developments

- 11.9 Verint System

- 11.9.1 Company Overview

- 11.9.2 Key Executives

- 11.9.3 Company snapshot

- 11.9.4 Active Business Divisions

- 11.9.5 Product portfolio

- 11.9.6 Business performance

- 11.9.7 Major Strategic Initiatives and Developments

- 11.10 SAP AG

- 11.10.1 Company Overview

- 11.10.2 Key Executives

- 11.10.3 Company snapshot

- 11.10.4 Active Business Divisions

- 11.10.5 Product portfolio

- 11.10.6 Business performance

- 11.10.7 Major Strategic Initiatives and Developments

12: Analyst Perspective and Conclusion

- 12.1 Concluding Recommendations and Analysis

- 12.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

By Service |

|

By solution |

|

By Organization size |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the growth rate of Customer Analytics Market?

+

-

What are the latest trends influencing the Customer Analytics Market?

+

-

Who are the key players in the Customer Analytics Market?

+

-

How is the Customer Analytics } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Customer Analytics Market Study?

+

-

What geographic breakdown is available in Global Customer Analytics Market Study?

+

-

Which region holds the second position by market share in the Customer Analytics market?

+

-

How are the key players in the Customer Analytics market targeting growth in the future?

+

-

What are the opportunities for new entrants in the Customer Analytics market?

+

-

What are the major challenges faced by the Customer Analytics Market?

+

-