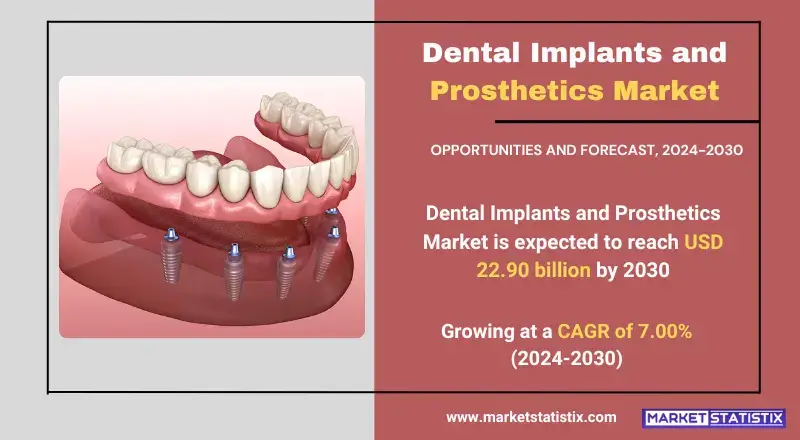

Global Dental Implants and Prosthetics Market Size, Share & Trends Analysis Report, Forecast Period, 2023-2030

Report ID: MS-1929 | Healthcare and Pharma | Last updated: Oct, 2024 | Formats*:

Dental Implants and Prosthetics Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2023 |

| Growth Rate | CAGR of 7.00% |

| By Product Type | Denture, Crown, Bridges, Veneer, Abutment, Inlays |

| Key Market Players |

|

| By Region |

|

Dental Implants and Prosthetics Market Trends

The world market for dental implants and prosthetics is on a remarkable rise due to the improvement in dental technologies and more focus on oral health care as well as high disposable incomes. Improvement in the materials used for dental implantation, especially titanium and zirconia, has extended the life and biocompatibility of dental implants, resulting in positive outcomes for patients. Dental prosthesis placement has been facilitated by visualisation devices and computer-aided devices, thereby making the process fast and accurate, further improving the two-dimensional framework of treatment known as digital dentistry. The rise in dental work coupled with the availability of ultrasound in foreign countries is also one of the prominent trends in the market, where patients travel for inexpensive dental procedures. Patients no longer wish to have expensive, high-quality dental work within the US or other developed countries and are keen to exploring new markets that offer affordable alternatives but with high-quality dental care. In view of these trends, the manufacturers and service providers have concentrated more efforts in expanding their product portfolios as well as improving the service delivery in order to benefit from the increasing market.Dental Implants and Prosthetics Market Leading Players

The key players profiled in the report are 3M (U.S.), Align Technology Inc (U.S.), AVINENT IMPLANT SYSTEM, S.L.U. (Spain), Bicon, LLC (U.S.), CAMLOG Biotechnologies GmbH (Switzerland), Danaher Corporation (U.S.), Dental Wings Inc. (Canada), DENTAURUM GmbH & Co. KG (Germany), Dentsply Sirona (U.S.), Institut Straumann AG (Germany), Ivoclar Vivadent (Switzerland), Mitsui Chemicals, Inc. (Japan), Nobel Biocare Services AG (Switzerland), OSSTEM IMPLANT.CO., LTD. (South Korea), TBR Dental (France), Ultradent Products Inc. (U.S.), Zimmer Biomet (U.S.)Growth Accelerators

The increase in the global dental implants and prosthetics market can be attributed to various factors, the most prominent one being the rise in the number of dental disorders and conditions, including periodontal diseases, tooth loss, and edentulousness. The demand for surgeries and treatments related to the restoration of dentition, including implants and prosthetic devices, has gone up considerably due to the ageing populations and changing lifestyles. Also, improvements in dental technologies, such as novel materials and less invasive methods, have elevated the success and beauty of dental implants, which entice most patients and practitioners alike. Patients' increasing understanding of aesthetics and demands for implants as opposed to dentures tend to propel the market. In addition, dental tourism, which entails travelling overseas to acquire cheap but good quality dental care services, also fuels the growth of the market. As a result of dental practitioners educating the masses on the merits of implants and prosthetics and the political goodwill to promote oral health, the market will continue to experience growth.Dental Implants and Prosthetics Market Segmentation analysis

The Global Dental Implants and Prosthetics is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Denture, Crown, Bridges, Veneer, Abutment, Inlays . The Application segment categorizes the market based on its usage such as Dental Hospitals and Clinics, Dental Research Laboratories. Geographically, the market is assessed across key Regions like North America(United States.Canada.Mexico), South America(Brazil.Argentina.Chile.Rest of South America), Europe(Germany.France.Italy.United Kingdom.Benelux.Nordics.Rest of Europe), Asia Pacific(China.Japan.India.South Korea.Australia.Southeast Asia.Rest of Asia-Pacific), MEA(Middle East.Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The competition in the worldwide market for dental implants and prosthetics is intense, with several key players competing for market dominance. Key players in the market comprise Nobel Biocare, Dental Sirona, Straumann, Zimmer Biomet, and Danaher. Such players manufacture and provide a broad line of dental implants and prosthetics, along with other services like surgical planning, training, and support. The market is also competitive and involves some smaller regional players and new entrants specializing in niche products and technologies.Challenges In Dental Implants and Prosthetics Market

Many challenges line up for the global dental implants and prosthetics market, with the strongest challenges being the high costs and lack of accessibility. Sometimes, dental implants are so costly that a larger population of patients cannot be treated, especially in the underdeveloped region. This can make some people so turned away that they do not seek out the essential dental implants and prosthetics, thus the under usage. Advancement in technologies and increasing competition in the dental sector present another problem. With the introduction of new materials and procedures, the practicing firms have to keep changing in order to keep up with their competitors. There is thus a necessity to put more funds into research and development, which is not very easy, especially for the small companies. These are some of the issues faced by the players in the dental implants and prosthetics markets that force them to find ways to compete while taking care of patients and competing effectively.Risks & Prospects in Dental Implants and Prosthetics Market

The dynamics of the global dental implants and prosthetics market are favourably populated by several factors, such as the growing incidence of dental disorders, modernisation, and increasing oral care awareness amongst the population. The increased prevalence of such ailments as tooth loss, periodontitis, and related diseases aggravated by the increasing age and changes in lifestyles of the populace has given rise to the use of dental implants and other prosthetic appliances. Also, the emerging market of dental tourism is another factor that will fuel the growth of the dental implants and prosthetics industry. A large number of patients prefer to fly overseas to have their dental care done in reputable centres because of low standards and quality treatment. Hence, these countries, where treatment is less expensive, are looking for advanced dental implant technologies. Together with dental implants being conveniently accepted as a treatment option, the supportive interventions from the governments in promoting oral health further propel the market forward. As the sector matures, it will be companies that invest in research and development and new product development to better the experience of patients that will be competitive in the market.Key Target Audience

The worldwide market for dental implants and prosthetics is significantly targeting dental practitioners like dentists, oral surgeons, and periodontists, who are very important in performing dental implant procedures and offering prosthetic solutions to clients. It is these practitioners who evaluate patients' conditions, conduct surgical procedures, and assist in fitting prosthetic appliances. Dental facilities prefer purchasing modern gadgets and materials to enhance the standard of services offered and remain relevant in the competitive healthcare industry.,, Patients who are in search of treatment and rehabilitation solutions also tend to be another group of interest. Such a group entails patients who have lost their teeth for one reason or another, such as decay, injuries, or periodontal disease. Due to increasing knowledge on oral health and the advantages of dental implants, more and more people are repairing their mouth functionality and appearance with these implants. Thus, the dental implants and prosthetics market has a broad base of clients with varied reasons for seeking such procedures, ranging from the functional correction of jaw defects to the purely aesthetic aspects.Merger and acquisition

In recent years, numerous M&A activities have taken place in the global dental implants and prosthetics market, thanks to the corporate strategies of increasing market share, product intensification, and so on. Some of the key mergers and acquisitions include: Acquisition of Galvo Surge by Straumann Group: In May 2023, Straumann Group acquired Swiss-based Medtech company Galvo Surge, known for its dental implant solutions. This acquisition added a new dimension to the treatment solutions for the company and also helped further in the advancement of their market position. Dentsply Sirona's acquisition of Noble Biocare: In the year 2019, Dentsply Sirona purchased Nobel Biocare, which is well known for its work in dental implants. This merger made the two companies a global leader in dental technologies. Due to such mergers and acquisitions, the dental implants and prosthetics market has become more competitive as there is continuous innovation, more products are offered, and the players have a wider geographical coverage.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Dental Implants and Prosthetics- Snapshot

- 2.2 Dental Implants and Prosthetics- Segment Snapshot

- 2.3 Dental Implants and Prosthetics- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Dental Implants and Prosthetics Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Denture

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Crown

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Bridges

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Veneer

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

- 4.6 Abutment

- 4.6.1 Key market trends, factors driving growth, and opportunities

- 4.6.2 Market size and forecast, by region

- 4.6.3 Market share analysis by country

- 4.7 Inlays

- 4.7.1 Key market trends, factors driving growth, and opportunities

- 4.7.2 Market size and forecast, by region

- 4.7.3 Market share analysis by country

5: Dental Implants and Prosthetics Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Dental Hospitals and Clinics

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Dental Research Laboratories

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

6: Dental Implants and Prosthetics Market by Material

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 Zirconium

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 Metal

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

- 6.4 Ceramic

- 6.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.2 Market size and forecast, by region

- 6.4.3 Market share analysis by country

- 6.5 Titanium Dental Implants

- 6.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.2 Market size and forecast, by region

- 6.5.3 Market share analysis by country

- 6.6 Porcelain Fused to Metal

- 6.6.1 Key market trends, factors driving growth, and opportunities

- 6.6.2 Market size and forecast, by region

- 6.6.3 Market share analysis by country

7: Dental Implants and Prosthetics Market by Procedures

- 7.1 Overview

- 7.1.1 Market size and forecast

- 7.2 Root-form Dental Implants

- 7.2.1 Key market trends, factors driving growth, and opportunities

- 7.2.2 Market size and forecast, by region

- 7.2.3 Market share analysis by country

- 7.3 Plate-form Dental Implants

- 7.3.1 Key market trends, factors driving growth, and opportunities

- 7.3.2 Market size and forecast, by region

- 7.3.3 Market share analysis by country

- 7.4 Subperiosteal Dental Implants

- 7.4.1 Key market trends, factors driving growth, and opportunities

- 7.4.2 Market size and forecast, by region

- 7.4.3 Market share analysis by country

- 7.5 Transosteal Dental Implants

- 7.5.1 Key market trends, factors driving growth, and opportunities

- 7.5.2 Market size and forecast, by region

- 7.5.3 Market share analysis by country

8: Dental Implants and Prosthetics Market by Region

- 8.1 Overview

- 8.1.1 Market size and forecast By Region

- 8.2 North America

- 8.2.1 Key trends and opportunities

- 8.2.2 Market size and forecast, by Type

- 8.2.3 Market size and forecast, by Application

- 8.2.4 Market size and forecast, by country

- 8.2.4.1 United States

- 8.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 8.2.4.1.2 Market size and forecast, by Type

- 8.2.4.1.3 Market size and forecast, by Application

- 8.2.4.2 Canada

- 8.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 8.2.4.2.2 Market size and forecast, by Type

- 8.2.4.2.3 Market size and forecast, by Application

- 8.2.4.3 Mexico

- 8.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 8.2.4.3.2 Market size and forecast, by Type

- 8.2.4.3.3 Market size and forecast, by Application

- 8.2.4.1 United States

- 8.3 South America

- 8.3.1 Key trends and opportunities

- 8.3.2 Market size and forecast, by Type

- 8.3.3 Market size and forecast, by Application

- 8.3.4 Market size and forecast, by country

- 8.3.4.1 Brazil

- 8.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 8.3.4.1.2 Market size and forecast, by Type

- 8.3.4.1.3 Market size and forecast, by Application

- 8.3.4.2 Argentina

- 8.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 8.3.4.2.2 Market size and forecast, by Type

- 8.3.4.2.3 Market size and forecast, by Application

- 8.3.4.3 Chile

- 8.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 8.3.4.3.2 Market size and forecast, by Type

- 8.3.4.3.3 Market size and forecast, by Application

- 8.3.4.4 Rest of South America

- 8.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 8.3.4.4.2 Market size and forecast, by Type

- 8.3.4.4.3 Market size and forecast, by Application

- 8.3.4.1 Brazil

- 8.4 Europe

- 8.4.1 Key trends and opportunities

- 8.4.2 Market size and forecast, by Type

- 8.4.3 Market size and forecast, by Application

- 8.4.4 Market size and forecast, by country

- 8.4.4.1 Germany

- 8.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.1.2 Market size and forecast, by Type

- 8.4.4.1.3 Market size and forecast, by Application

- 8.4.4.2 France

- 8.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.2.2 Market size and forecast, by Type

- 8.4.4.2.3 Market size and forecast, by Application

- 8.4.4.3 Italy

- 8.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.3.2 Market size and forecast, by Type

- 8.4.4.3.3 Market size and forecast, by Application

- 8.4.4.4 United Kingdom

- 8.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.4.2 Market size and forecast, by Type

- 8.4.4.4.3 Market size and forecast, by Application

- 8.4.4.5 Benelux

- 8.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.5.2 Market size and forecast, by Type

- 8.4.4.5.3 Market size and forecast, by Application

- 8.4.4.6 Nordics

- 8.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.6.2 Market size and forecast, by Type

- 8.4.4.6.3 Market size and forecast, by Application

- 8.4.4.7 Rest of Europe

- 8.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.7.2 Market size and forecast, by Type

- 8.4.4.7.3 Market size and forecast, by Application

- 8.4.4.1 Germany

- 8.5 Asia Pacific

- 8.5.1 Key trends and opportunities

- 8.5.2 Market size and forecast, by Type

- 8.5.3 Market size and forecast, by Application

- 8.5.4 Market size and forecast, by country

- 8.5.4.1 China

- 8.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.1.2 Market size and forecast, by Type

- 8.5.4.1.3 Market size and forecast, by Application

- 8.5.4.2 Japan

- 8.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.2.2 Market size and forecast, by Type

- 8.5.4.2.3 Market size and forecast, by Application

- 8.5.4.3 India

- 8.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.3.2 Market size and forecast, by Type

- 8.5.4.3.3 Market size and forecast, by Application

- 8.5.4.4 South Korea

- 8.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.4.2 Market size and forecast, by Type

- 8.5.4.4.3 Market size and forecast, by Application

- 8.5.4.5 Australia

- 8.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.5.2 Market size and forecast, by Type

- 8.5.4.5.3 Market size and forecast, by Application

- 8.5.4.6 Southeast Asia

- 8.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.6.2 Market size and forecast, by Type

- 8.5.4.6.3 Market size and forecast, by Application

- 8.5.4.7 Rest of Asia-Pacific

- 8.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.7.2 Market size and forecast, by Type

- 8.5.4.7.3 Market size and forecast, by Application

- 8.5.4.1 China

- 8.6 MEA

- 8.6.1 Key trends and opportunities

- 8.6.2 Market size and forecast, by Type

- 8.6.3 Market size and forecast, by Application

- 8.6.4 Market size and forecast, by country

- 8.6.4.1 Middle East

- 8.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 8.6.4.1.2 Market size and forecast, by Type

- 8.6.4.1.3 Market size and forecast, by Application

- 8.6.4.2 Africa

- 8.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 8.6.4.2.2 Market size and forecast, by Type

- 8.6.4.2.3 Market size and forecast, by Application

- 8.6.4.1 Middle East

- 9.1 Overview

- 9.2 Key Winning Strategies

- 9.3 Top 10 Players: Product Mapping

- 9.4 Competitive Analysis Dashboard

- 9.5 Market Competition Heatmap

- 9.6 Leading Player Positions, 2022

10: Company Profiles

- 10.1 3M (U.S.)

- 10.1.1 Company Overview

- 10.1.2 Key Executives

- 10.1.3 Company snapshot

- 10.1.4 Active Business Divisions

- 10.1.5 Product portfolio

- 10.1.6 Business performance

- 10.1.7 Major Strategic Initiatives and Developments

- 10.2 Align Technology Inc (U.S.)

- 10.2.1 Company Overview

- 10.2.2 Key Executives

- 10.2.3 Company snapshot

- 10.2.4 Active Business Divisions

- 10.2.5 Product portfolio

- 10.2.6 Business performance

- 10.2.7 Major Strategic Initiatives and Developments

- 10.3 AVINENT IMPLANT SYSTEM

- 10.3.1 Company Overview

- 10.3.2 Key Executives

- 10.3.3 Company snapshot

- 10.3.4 Active Business Divisions

- 10.3.5 Product portfolio

- 10.3.6 Business performance

- 10.3.7 Major Strategic Initiatives and Developments

- 10.4 S.L.U. (Spain)

- 10.4.1 Company Overview

- 10.4.2 Key Executives

- 10.4.3 Company snapshot

- 10.4.4 Active Business Divisions

- 10.4.5 Product portfolio

- 10.4.6 Business performance

- 10.4.7 Major Strategic Initiatives and Developments

- 10.5 Bicon

- 10.5.1 Company Overview

- 10.5.2 Key Executives

- 10.5.3 Company snapshot

- 10.5.4 Active Business Divisions

- 10.5.5 Product portfolio

- 10.5.6 Business performance

- 10.5.7 Major Strategic Initiatives and Developments

- 10.6 LLC (U.S.)

- 10.6.1 Company Overview

- 10.6.2 Key Executives

- 10.6.3 Company snapshot

- 10.6.4 Active Business Divisions

- 10.6.5 Product portfolio

- 10.6.6 Business performance

- 10.6.7 Major Strategic Initiatives and Developments

- 10.7 CAMLOG Biotechnologies GmbH (Switzerland)

- 10.7.1 Company Overview

- 10.7.2 Key Executives

- 10.7.3 Company snapshot

- 10.7.4 Active Business Divisions

- 10.7.5 Product portfolio

- 10.7.6 Business performance

- 10.7.7 Major Strategic Initiatives and Developments

- 10.8 Danaher Corporation (U.S.)

- 10.8.1 Company Overview

- 10.8.2 Key Executives

- 10.8.3 Company snapshot

- 10.8.4 Active Business Divisions

- 10.8.5 Product portfolio

- 10.8.6 Business performance

- 10.8.7 Major Strategic Initiatives and Developments

- 10.9 Dental Wings Inc. (Canada)

- 10.9.1 Company Overview

- 10.9.2 Key Executives

- 10.9.3 Company snapshot

- 10.9.4 Active Business Divisions

- 10.9.5 Product portfolio

- 10.9.6 Business performance

- 10.9.7 Major Strategic Initiatives and Developments

- 10.10 DENTAURUM GmbH & Co. KG (Germany)

- 10.10.1 Company Overview

- 10.10.2 Key Executives

- 10.10.3 Company snapshot

- 10.10.4 Active Business Divisions

- 10.10.5 Product portfolio

- 10.10.6 Business performance

- 10.10.7 Major Strategic Initiatives and Developments

- 10.11 Dentsply Sirona (U.S.)

- 10.11.1 Company Overview

- 10.11.2 Key Executives

- 10.11.3 Company snapshot

- 10.11.4 Active Business Divisions

- 10.11.5 Product portfolio

- 10.11.6 Business performance

- 10.11.7 Major Strategic Initiatives and Developments

- 10.12 Institut Straumann AG (Germany)

- 10.12.1 Company Overview

- 10.12.2 Key Executives

- 10.12.3 Company snapshot

- 10.12.4 Active Business Divisions

- 10.12.5 Product portfolio

- 10.12.6 Business performance

- 10.12.7 Major Strategic Initiatives and Developments

- 10.13 Ivoclar Vivadent (Switzerland)

- 10.13.1 Company Overview

- 10.13.2 Key Executives

- 10.13.3 Company snapshot

- 10.13.4 Active Business Divisions

- 10.13.5 Product portfolio

- 10.13.6 Business performance

- 10.13.7 Major Strategic Initiatives and Developments

- 10.14 Mitsui Chemicals

- 10.14.1 Company Overview

- 10.14.2 Key Executives

- 10.14.3 Company snapshot

- 10.14.4 Active Business Divisions

- 10.14.5 Product portfolio

- 10.14.6 Business performance

- 10.14.7 Major Strategic Initiatives and Developments

- 10.15 Inc. (Japan)

- 10.15.1 Company Overview

- 10.15.2 Key Executives

- 10.15.3 Company snapshot

- 10.15.4 Active Business Divisions

- 10.15.5 Product portfolio

- 10.15.6 Business performance

- 10.15.7 Major Strategic Initiatives and Developments

- 10.16 Nobel Biocare Services AG (Switzerland)

- 10.16.1 Company Overview

- 10.16.2 Key Executives

- 10.16.3 Company snapshot

- 10.16.4 Active Business Divisions

- 10.16.5 Product portfolio

- 10.16.6 Business performance

- 10.16.7 Major Strategic Initiatives and Developments

- 10.17 OSSTEM IMPLANT.CO.

- 10.17.1 Company Overview

- 10.17.2 Key Executives

- 10.17.3 Company snapshot

- 10.17.4 Active Business Divisions

- 10.17.5 Product portfolio

- 10.17.6 Business performance

- 10.17.7 Major Strategic Initiatives and Developments

- 10.18 LTD. (South Korea)

- 10.18.1 Company Overview

- 10.18.2 Key Executives

- 10.18.3 Company snapshot

- 10.18.4 Active Business Divisions

- 10.18.5 Product portfolio

- 10.18.6 Business performance

- 10.18.7 Major Strategic Initiatives and Developments

- 10.19 TBR Dental (France)

- 10.19.1 Company Overview

- 10.19.2 Key Executives

- 10.19.3 Company snapshot

- 10.19.4 Active Business Divisions

- 10.19.5 Product portfolio

- 10.19.6 Business performance

- 10.19.7 Major Strategic Initiatives and Developments

- 10.20 Ultradent Products Inc. (U.S.)

- 10.20.1 Company Overview

- 10.20.2 Key Executives

- 10.20.3 Company snapshot

- 10.20.4 Active Business Divisions

- 10.20.5 Product portfolio

- 10.20.6 Business performance

- 10.20.7 Major Strategic Initiatives and Developments

- 10.21 Zimmer Biomet (U.S.)

- 10.21.1 Company Overview

- 10.21.2 Key Executives

- 10.21.3 Company snapshot

- 10.21.4 Active Business Divisions

- 10.21.5 Product portfolio

- 10.21.6 Business performance

- 10.21.7 Major Strategic Initiatives and Developments

11: Analyst Perspective and Conclusion

- 11.1 Concluding Recommendations and Analysis

- 11.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

By Material |

|

By Procedures |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

How do regulatory policies impact the Dental Implants and Prosthetics Market?

+

-

What major players in Dental Implants and Prosthetics Market?

+

-

What applications are categorized in the Dental Implants and Prosthetics market study?

+

-

Which product types are examined in the Dental Implants and Prosthetics Market Study?

+

-

Which regions are expected to show the fastest growth in the Dental Implants and Prosthetics market?

+

-

Which region is the fastest growing in the Dental Implants and Prosthetics market?

+

-

What are the major growth drivers in the Dental Implants and Prosthetics market?

+

-

Is the study period of the Dental Implants and Prosthetics flexible or fixed?

+

-

How do economic factors influence the Dental Implants and Prosthetics market?

+

-

How does the supply chain affect the Dental Implants and Prosthetics Market?

+

-