Global Dental Insurance Market - Industry Dynamics, Market Size, And Opportunity Forecast To 2030

Report ID: MS-1857 | Healthcare and Pharma | Last updated: Sep, 2024 | Formats*:

Dental Insurance Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2023 |

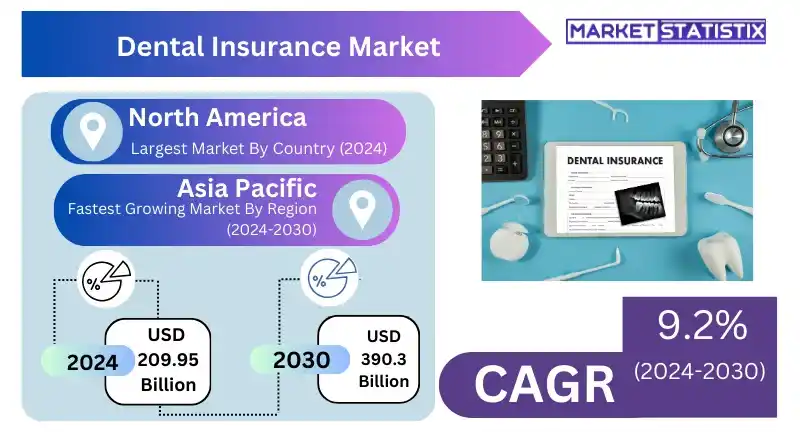

| Growth Rate | CAGR of 9.2% |

| By Product Type | Major, Basic, Preventive |

| Key Market Players |

|

| By Region |

|

Dental Insurance Market Trends

The dental insurance market is increasingly affected by an increasing focus on prevention and general health integration. Insurers are augmenting their coverages to include entire preventive services for the sake of early detection and reducing costs over time, e.g., thus covering routine check-ups or cleanings. This tendency has arisen from growing awareness among consumers regarding oral health and general health connections, prompting them to prefer insurance plans with a wider range of coverages as well as additional benefits. Further, in this globalisation phase that we seem to be entering, there is also observable a move towards digital transformation, evidenced by more use of technology in insurance processes. This encompasses tele-dentistry, online submission of claims, and use of mobile applications for policy management and accessing benefits, among other forms of digitisation within healthcare. These developments facilitate improved customer service, administratively streamlined processes, and enhanced effectiveness, which is in line with a broader trend towards digitalisation in the insurance domain.Dental Insurance Market Leading Players

The key players profiled in the report are Ameritas Life Insurance Corp, Delta Dental Plans Association, HDFC Ergo Health Insurance Ltd, Cigna, Allianz SE, AFLAC Inc, Metlife Services & Solutions, AXA, United Concordia, Aetna, United HealthCare Services Inc.Growth Accelerators

The dental insurance market is fundamentally driven by the growing demand for preventive care along with rising awareness about oral health. In most instances, this leads to, thus, a rising demand for dental insurance plans that cover a broad range of services. The fact that some educational campaigns and public health initiatives have concentrated on promoting the link between good oral health and good general health has seen an upsurge in uptake of these policies. Apart from that, the growth of this market has been powered by, among other things, employer-based and government-sponsored expansion of dental insurance coverage. Employers are increasingly offering dental benefits as part of their employee health packages, while government initiatives and regulations are improving access to dental care and insurance. Thus, more people are becoming able to obtain their own dental plans, which resultantly results in increased enrolment rates that in turn lead to the overall market expansion.Dental Insurance Market Segmentation analysis

The Global Dental Insurance is segmented by Type, and Region. By Type, the market is divided into Distributed Major, Basic, Preventive . Geographically, the market is assessed across key Regions like North America(United States.Canada.Mexico), South America(Brazil.Argentina.Chile.Rest of South America), Europe(Germany.France.Italy.United Kingdom.Benelux.Nordics.Rest of Europe), Asia Pacific(China.Japan.India.South Korea.Australia.Southeast Asia.Rest of Asia-Pacific), MEA(Middle East.Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The dental insurance market is very competitive, where the largest multinational insurers and specialised dental insurance providers interact closely in the industry. Big insurance companies incorporate dental coverage into their comprehensive health insurance plans, thereby making use of extensive systems and longstanding customer bases to get an advantage over others. These providers compete on aspects like options of coverage, premium rates, and also some additional benefits such as preventive care incentives and orthodontic coverage, thus playing a major significance role for them. Furthermore, in this market there exist direct-to-consumer models along with online platforms providing simplified insurance solutions that are often cheaper than others. It is hence no surprise that these diverse offerings create an environment where competitive dynamics thrive as companies work harder than ever before to improve their services accordingly, thus meeting the changing demands of their consumers.Challenges In Dental Insurance Market

The dental insurance market is facing numerous obstacles, most notably limited coverage and high out-of-pocket expenses. Many dental insurance plans limit their coverage, making policyholders incur huge out-of-pocket costs, which may discourage them from seeking necessary dental care. Thus, this limited coverage usually makes consumers dissatisfied with the services; it is also an impediment to the growth of the industry as the potential customers consider dental insurance to be benefiting them less compared to its costs. Complexity and variability in insurance plans are other challenges faced in this sector. Such diversity in terms of structures and benefits implies that making comparisons between various plans becomes very hard for potential clients. Complexity breeds confusion, resulting in a lack of transparency; hence, customers find it difficult to make decisions regarding these policies or even adopt them into their lives. Besides that, variances in coverage amongst different schemes create problems for dental care providers who have to manage patient expectations or reimbursements.Risks & Prospects in Dental Insurance Market

A significant opportunity presents itself in the dental insurance business as there is an increasing awareness of oral health and more people want to take all-round dental care. Many people now realise that they need preventive and restorative dental treatments to maintain good health; hence, they are willing to subscribe to these covers. Supported by increasing incomes amongst middle-class families and rising healthcare expenditures, growth in this industry has come as a respite to insurers, making them provide various types of dental insurance products for their clients. Moreover, technological advances such as tele-dentistry have also enhanced such opportunities while including innovative models like personalised coverages. This allows insurers to provide flexible services that are easily accessible according to customer needs. Through digital tool implementation and data analytic methods, dental insurers may enhance customer participation, thus bringing about faster claims processing and satisfaction of the entire service, hence leading them to become more competitive within this expanding industry.Key Target Audience

The dental insurance market most of the time caters to people and families who are looking for extensive dental care insurance. Included in this category are those who have always been careful to keep their gums and teeth healthy, so as not to spend too much on consultations that may involve routine check-ups, preventive care, or even treatments. In essence, this is what makes such policies an appealing proposition for individuals and families interested in long-term dental health.,, Moreover, employers and organisations providing employee benefits packages represent another crucial market segment. With additional options beyond primary health services, companies providing dental insurance as a component of their employee benefit program can attract and maintain talented staff members. This section recognises family dentists as a means of improving staff happiness and wellness, generally contributing towards stronger benefit programs that take into consideration both retention and recruitment needs of firms.Merger and acquisition

The noteworthy occurrences in the dental insurance market include mergers and acquisitions that occurred lately with the aim of consolidating market presence as well as expanding service offerings. For example, in 2023, Cigna bought Qualchoice, which provides dental benefits, in order to augment its portfolio and enhance its capacity for comprehensive dental coverage. That was so because it enabled it to utilise Qualchoice’s existing network and customer base, thereby enhancing its position within the industry. Another important event was when two major players in dental insurance, MetLife and Dental Plans, became one company; this was finalised by early 2024. The main reason for the merger was to create a stronger and diversify portfolio of dental insurance by leveraging MetLife’s extensive experience together with innovative products from Dental Plans. The merger hopes to bring about improved efficiency, wider market reach, and therefore an increased range of services offered through the joint customer base, thereby enhancing overall competitiveness in the area of dentistry insurance. >Analyst Comment

"The steady growth of the global dental insurance market is attributed to greater awareness of dental health and an increase in the cost of dental care. It is a form of protection against financial loss incurred when one undergoes different kinds of treatments concerning teeth, ranging from routine check-ups to major surgeries. In addition, there are several factors responsible for the rise of this business, such as elderly people, new technologies related to teeth maintenance, and more paying attention to preventive medicine. Therefore, if the demand for cheaper and easier access to dental services keeps increasing, then we expect that more people will come up with different types of products they can offer within this ever-changing field."- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Dental Insurance- Snapshot

- 2.2 Dental Insurance- Segment Snapshot

- 2.3 Dental Insurance- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Dental Insurance Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Major

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Basic

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Preventive

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

5: Dental Insurance Market by Coverage

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Dental Preferred Provider Organizations

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Dental Health Maintenance Organizations (DHMO)

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Dental Indemnity Plans

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Others

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

6: Dental Insurance Market by Demographic

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 Senior Citizens

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 Adults

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

- 6.4 Minors

- 6.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.2 Market size and forecast, by region

- 6.4.3 Market share analysis by country

7: Dental Insurance Market by Region

- 7.1 Overview

- 7.1.1 Market size and forecast By Region

- 7.2 North America

- 7.2.1 Key trends and opportunities

- 7.2.2 Market size and forecast, by Type

- 7.2.3 Market size and forecast, by Application

- 7.2.4 Market size and forecast, by country

- 7.2.4.1 United States

- 7.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.1.2 Market size and forecast, by Type

- 7.2.4.1.3 Market size and forecast, by Application

- 7.2.4.2 Canada

- 7.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.2.2 Market size and forecast, by Type

- 7.2.4.2.3 Market size and forecast, by Application

- 7.2.4.3 Mexico

- 7.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.3.2 Market size and forecast, by Type

- 7.2.4.3.3 Market size and forecast, by Application

- 7.2.4.1 United States

- 7.3 South America

- 7.3.1 Key trends and opportunities

- 7.3.2 Market size and forecast, by Type

- 7.3.3 Market size and forecast, by Application

- 7.3.4 Market size and forecast, by country

- 7.3.4.1 Brazil

- 7.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.1.2 Market size and forecast, by Type

- 7.3.4.1.3 Market size and forecast, by Application

- 7.3.4.2 Argentina

- 7.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.2.2 Market size and forecast, by Type

- 7.3.4.2.3 Market size and forecast, by Application

- 7.3.4.3 Chile

- 7.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.3.2 Market size and forecast, by Type

- 7.3.4.3.3 Market size and forecast, by Application

- 7.3.4.4 Rest of South America

- 7.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.4.2 Market size and forecast, by Type

- 7.3.4.4.3 Market size and forecast, by Application

- 7.3.4.1 Brazil

- 7.4 Europe

- 7.4.1 Key trends and opportunities

- 7.4.2 Market size and forecast, by Type

- 7.4.3 Market size and forecast, by Application

- 7.4.4 Market size and forecast, by country

- 7.4.4.1 Germany

- 7.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.1.2 Market size and forecast, by Type

- 7.4.4.1.3 Market size and forecast, by Application

- 7.4.4.2 France

- 7.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.2.2 Market size and forecast, by Type

- 7.4.4.2.3 Market size and forecast, by Application

- 7.4.4.3 Italy

- 7.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.3.2 Market size and forecast, by Type

- 7.4.4.3.3 Market size and forecast, by Application

- 7.4.4.4 United Kingdom

- 7.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.4.2 Market size and forecast, by Type

- 7.4.4.4.3 Market size and forecast, by Application

- 7.4.4.5 Benelux

- 7.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.5.2 Market size and forecast, by Type

- 7.4.4.5.3 Market size and forecast, by Application

- 7.4.4.6 Nordics

- 7.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.6.2 Market size and forecast, by Type

- 7.4.4.6.3 Market size and forecast, by Application

- 7.4.4.7 Rest of Europe

- 7.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.7.2 Market size and forecast, by Type

- 7.4.4.7.3 Market size and forecast, by Application

- 7.4.4.1 Germany

- 7.5 Asia Pacific

- 7.5.1 Key trends and opportunities

- 7.5.2 Market size and forecast, by Type

- 7.5.3 Market size and forecast, by Application

- 7.5.4 Market size and forecast, by country

- 7.5.4.1 China

- 7.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.1.2 Market size and forecast, by Type

- 7.5.4.1.3 Market size and forecast, by Application

- 7.5.4.2 Japan

- 7.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.2.2 Market size and forecast, by Type

- 7.5.4.2.3 Market size and forecast, by Application

- 7.5.4.3 India

- 7.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.3.2 Market size and forecast, by Type

- 7.5.4.3.3 Market size and forecast, by Application

- 7.5.4.4 South Korea

- 7.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.4.2 Market size and forecast, by Type

- 7.5.4.4.3 Market size and forecast, by Application

- 7.5.4.5 Australia

- 7.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.5.2 Market size and forecast, by Type

- 7.5.4.5.3 Market size and forecast, by Application

- 7.5.4.6 Southeast Asia

- 7.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.6.2 Market size and forecast, by Type

- 7.5.4.6.3 Market size and forecast, by Application

- 7.5.4.7 Rest of Asia-Pacific

- 7.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.7.2 Market size and forecast, by Type

- 7.5.4.7.3 Market size and forecast, by Application

- 7.5.4.1 China

- 7.6 MEA

- 7.6.1 Key trends and opportunities

- 7.6.2 Market size and forecast, by Type

- 7.6.3 Market size and forecast, by Application

- 7.6.4 Market size and forecast, by country

- 7.6.4.1 Middle East

- 7.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.6.4.1.2 Market size and forecast, by Type

- 7.6.4.1.3 Market size and forecast, by Application

- 7.6.4.2 Africa

- 7.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.6.4.2.2 Market size and forecast, by Type

- 7.6.4.2.3 Market size and forecast, by Application

- 7.6.4.1 Middle East

- 8.1 Overview

- 8.2 Key Winning Strategies

- 8.3 Top 10 Players: Product Mapping

- 8.4 Competitive Analysis Dashboard

- 8.5 Market Competition Heatmap

- 8.6 Leading Player Positions, 2022

9: Company Profiles

- 9.1 Ameritas Life Insurance Corp

- 9.1.1 Company Overview

- 9.1.2 Key Executives

- 9.1.3 Company snapshot

- 9.1.4 Active Business Divisions

- 9.1.5 Product portfolio

- 9.1.6 Business performance

- 9.1.7 Major Strategic Initiatives and Developments

- 9.2 Delta Dental Plans Association

- 9.2.1 Company Overview

- 9.2.2 Key Executives

- 9.2.3 Company snapshot

- 9.2.4 Active Business Divisions

- 9.2.5 Product portfolio

- 9.2.6 Business performance

- 9.2.7 Major Strategic Initiatives and Developments

- 9.3 HDFC Ergo Health Insurance Ltd

- 9.3.1 Company Overview

- 9.3.2 Key Executives

- 9.3.3 Company snapshot

- 9.3.4 Active Business Divisions

- 9.3.5 Product portfolio

- 9.3.6 Business performance

- 9.3.7 Major Strategic Initiatives and Developments

- 9.4 Cigna

- 9.4.1 Company Overview

- 9.4.2 Key Executives

- 9.4.3 Company snapshot

- 9.4.4 Active Business Divisions

- 9.4.5 Product portfolio

- 9.4.6 Business performance

- 9.4.7 Major Strategic Initiatives and Developments

- 9.5 Allianz SE

- 9.5.1 Company Overview

- 9.5.2 Key Executives

- 9.5.3 Company snapshot

- 9.5.4 Active Business Divisions

- 9.5.5 Product portfolio

- 9.5.6 Business performance

- 9.5.7 Major Strategic Initiatives and Developments

- 9.6 AFLAC Inc

- 9.6.1 Company Overview

- 9.6.2 Key Executives

- 9.6.3 Company snapshot

- 9.6.4 Active Business Divisions

- 9.6.5 Product portfolio

- 9.6.6 Business performance

- 9.6.7 Major Strategic Initiatives and Developments

- 9.7 Metlife Services & Solutions

- 9.7.1 Company Overview

- 9.7.2 Key Executives

- 9.7.3 Company snapshot

- 9.7.4 Active Business Divisions

- 9.7.5 Product portfolio

- 9.7.6 Business performance

- 9.7.7 Major Strategic Initiatives and Developments

- 9.8 AXA

- 9.8.1 Company Overview

- 9.8.2 Key Executives

- 9.8.3 Company snapshot

- 9.8.4 Active Business Divisions

- 9.8.5 Product portfolio

- 9.8.6 Business performance

- 9.8.7 Major Strategic Initiatives and Developments

- 9.9 United Concordia

- 9.9.1 Company Overview

- 9.9.2 Key Executives

- 9.9.3 Company snapshot

- 9.9.4 Active Business Divisions

- 9.9.5 Product portfolio

- 9.9.6 Business performance

- 9.9.7 Major Strategic Initiatives and Developments

- 9.10 Aetna

- 9.10.1 Company Overview

- 9.10.2 Key Executives

- 9.10.3 Company snapshot

- 9.10.4 Active Business Divisions

- 9.10.5 Product portfolio

- 9.10.6 Business performance

- 9.10.7 Major Strategic Initiatives and Developments

- 9.11 United HealthCare Services Inc.

- 9.11.1 Company Overview

- 9.11.2 Key Executives

- 9.11.3 Company snapshot

- 9.11.4 Active Business Divisions

- 9.11.5 Product portfolio

- 9.11.6 Business performance

- 9.11.7 Major Strategic Initiatives and Developments

10: Analyst Perspective and Conclusion

- 10.1 Concluding Recommendations and Analysis

- 10.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Coverage |

|

By Demographic |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

How do regulatory policies impact the Dental Insurance Market?

+

-

What major players in Dental Insurance Market?

+

-

What applications are categorized in the Dental Insurance market study?

+

-

Which product types are examined in the Dental Insurance Market Study?

+

-

Which regions are expected to show the fastest growth in the Dental Insurance market?

+

-

What are the major growth drivers in the Dental Insurance market?

+

-

Is the study period of the Dental Insurance flexible or fixed?

+

-

How do economic factors influence the Dental Insurance market?

+

-

How does the supply chain affect the Dental Insurance Market?

+

-

Which players are included in the research coverage of the Dental Insurance Market Study?

+

-