Global Designated Driver Market Size, Share & Trends Analysis Report, Forecast Period, 2024-2030

Report ID: MS-145 | Automotive and Transport | Last updated: Nov, 2024 | Formats*:

Designated Driver Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2023 |

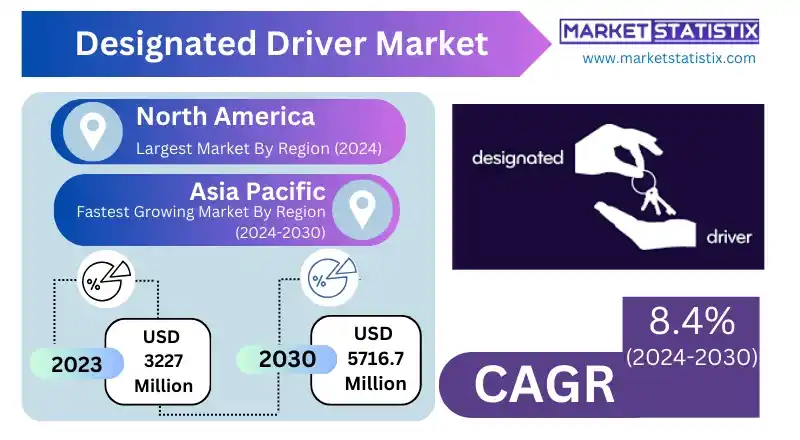

| Growth Rate | CAGR of 8.4% |

| By Product Type | After Driving Designated Driver, Business Designated Driver, Long Distance Designated Driver, Travel Designated Driver |

| Key Market Players |

|

| By Region |

Designated Driver Market Trends

Growth in the designated driver market is led by an increasing awareness of the risks of drunken driving, stricter regulations on alcohol consumption and driving, and higher awareness in road safety promoted by governments and organizations. The move to designated drivers after drinking as a safe alternative relies more and more on consumers. These services from ride-hailing companies, private chauffeur providers, or designated driver apps are marketed to customers needing a surefire way of getting where they want to go without the dangers of drunk driving. Another trend is an integration into technology to enhance the customer experience and access to the designated driver market. Mobile applications and GPS interfaces ensure that bookings, tracking, and payment for designated drivers can be done right away in real time. Most of the providers are also hunting for unique experiences: premium and group transport options, again by using whatever services, including catering for individual customers or corporate event planners.Designated Driver Market Leading Players

The key players profiled in the report are Heinz Field, Designated Driver, DDADD, Beijing Yixin Yixing Automotive Technology Development Services, Crunchbase, Dryver, Sober Drivers, Alberta Motor Association, First Choice, To Arrive Alive, DiDiGrowth Accelerators

Increasing awareness and high emphasis on road safety and stricter legal regulations on drunk driving are driving the business of the designated driver market. Governments around the world, along with the enforcement agencies of various nations, are moving toward imposing stringent punishment for impaired driving, thereby leading to an increase in demand for services offered by designated drivers. This change is coupled with intensive public safety campaigns in America that emphasize safe alternatives for preventing accidents and reducing fatalities due to drunken driving. This has also made it easier for consumers to access the various designated driver options with the rise of ride-sharing services and mobile applications. In most ride-hailing companies, there are now specific services offered that target those who want a driver for their own vehicles, thereby addressing the demand for convenient and affordable solutions for safe transportation. Among other factors, the rise in social activities and entertaining events, particularly for youth, led to a vehicle for growth in the market of a designated driver who ensured safe and reliable transport without impaired driving.Designated Driver Market Segmentation analysis

The Global Designated Driver is segmented by Type, Application, and Region. By Type, the market is divided into Distributed After Driving Designated Driver, Business Designated Driver, Long Distance Designated Driver, Travel Designated Driver . The Application segment categorizes the market based on its usage such as Personal, Enterprise. Geographically, the market is assessed across key Regions like {regionNms} and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The company not only faces traditional service models but also the niche players focused on one type of customer or individual set of needs—for example, corporate clients or unique individual needs. These firms mark their place in the market as they provide such customized services that will better address customer demands. Regional players will also benefit from an understanding of local consumer preferences and regulatory landscapes, helping them to better compete against larger firms. The growing maturity of the designated driver market presses companies to innovate and work closely with customers. Today, the only way companies will succeed in this increasingly demanding market as well as sustain this competitive advantage is through continuous innovation and cooperation between companies.Challenges In Designated Driver Market

One of the major challenges that the designated driver market faces is in relation to consumer awareness and understanding of the service. For most, seeing a taxi or an Uber cab on the street would come before using a designated driver for specific events or needs. In addition, consumer trust and the perception of safety are other market challenges in this regard because users may not be willing to let their vehicle be driven by a stranger, even at the assurance that such a driver is professional. This will lead to slow adoption and limited growth in some areas. The other is the regulatory environment and compliance with local laws applicable to transportation services. A designated driver must necessarily operate under several different rules pertaining to insurance, licensing, and liability, which could prove complex and vary from one area to another. Balancing affordability with high-quality service remains a constant challenge for providers looking to scale their offerings.Risks & Prospects in Designated Driver Market

Opportunities in the designated driver market are significant and have been motivated by recognition of the danger posed by drunken driving and increasing demand for safe, reliable means of transportation. As drunk-driving laws are becoming more stringent everywhere and as enforcement tightens the noose around responsible citizens, it can be observed that consumers are increasingly looking to designated driver services to avoid legal hassles and ensure safety. It is especially relevant in urban areas, where nightlife and social events create a steady demand for services offering responsible, safe transportation, providing an opportunity for growth among both app-based and traditional designated driver providers. Another opportunity relates to partnerships with bars, restaurants, event organizers, and employers who promote corporate responsibility and employee safety. To enable the safe return of patrons, restaurant and event organizers want innovations that would establish partnership avenues for the driver companies. Furthermore, as more people increasingly become concerned with responsible drinking, the companies providing these services may attract premiums from users, resulting in a highly developed market also. Other potential opportunities to make this market more convenient and accessible to customers would include emerging technologies such as integration with mobile applications, real-time tracking, and easy booking sites.Key Target Audience

The targeted individuals for this assigned driver market are people who socially drink, partygoers, and those who attend events with high consumption rates of alcohol. This category of people looks out for a secure means of transportation after drinking some alcohol at a bar, restaurant, or on a social occasion. The more people become cognizant of dangers resulting from drunken driving, the more they take the choice of getting selected drivers to ensure their safety as well as avoid legal ramifications. The market is also attracting the segment that would wish to have social meetings but without consuming alcohol, such as being wedding, corporate event, or festival designated drivers.,, A relevant target market is corporate clients and event planners who require transport solutions for large groups or a workforce, particularly in industries that consider high safety and responsibility attributes. Organizations providing designated driver services target corporate events, conferences, and meetings that entail drinking. In addition, the market is used by the ride-sharing platforms and transportation services to offer designated driver services to attract customers in urban areas where car ownership is not as prevalent and where the demand for alternative drivers when people are impaired is critical.Merger and acquisition

At the moment, the designated driver market is experiencing a significant wave of consolidation, mostly from companies looking to refine their market positions and expand their services. The most notable players in the field are Dryver and To Arrive Alive. These two companies pursue strategic partnerships intended to achieve synergies and strengthen their technological capabilities, which remain largely focused on mobile apps and GPS tracking systems. This consolidation is driven by increased demand for designated driver services, fuelled by heightened public awareness of drunk-driving risks and stringent regulations supporting responsible drinking. The growth in the market, from USD 3.2 billion in 2023 to USD 5.7 billion by 2030, underlines the need for companies to innovate and adapt through strategic alliances. Another growth factor in the designated driver market is new entrants using technology to offer improvements in the delivery of services. Companies such as DiDi and Sober Drivers are focusing on coming up with innovative business models that incorporate app-based solutions for easier access to designated drivers for consumers. More and more partnerships are also being established between hospitality venues and event organizers because these collaborate on safe driving practices while increasing customer reach.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Designated Driver- Snapshot

- 2.2 Designated Driver- Segment Snapshot

- 2.3 Designated Driver- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Designated Driver Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 After Driving Designated Driver

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Business Designated Driver

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Long Distance Designated Driver

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Travel Designated Driver

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

5: Designated Driver Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Personal

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Enterprise

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

6: Competitive Landscape

- 6.1 Overview

- 6.2 Key Winning Strategies

- 6.3 Top 10 Players: Product Mapping

- 6.4 Competitive Analysis Dashboard

- 6.5 Market Competition Heatmap

- 6.6 Leading Player Positions, 2022

7: Company Profiles

- 7.1 Heinz Field

- 7.1.1 Company Overview

- 7.1.2 Key Executives

- 7.1.3 Company snapshot

- 7.1.4 Active Business Divisions

- 7.1.5 Product portfolio

- 7.1.6 Business performance

- 7.1.7 Major Strategic Initiatives and Developments

- 7.2 Designated Driver

- 7.2.1 Company Overview

- 7.2.2 Key Executives

- 7.2.3 Company snapshot

- 7.2.4 Active Business Divisions

- 7.2.5 Product portfolio

- 7.2.6 Business performance

- 7.2.7 Major Strategic Initiatives and Developments

- 7.3 DDADD

- 7.3.1 Company Overview

- 7.3.2 Key Executives

- 7.3.3 Company snapshot

- 7.3.4 Active Business Divisions

- 7.3.5 Product portfolio

- 7.3.6 Business performance

- 7.3.7 Major Strategic Initiatives and Developments

- 7.4 Beijing Yixin Yixing Automotive Technology Development Services

- 7.4.1 Company Overview

- 7.4.2 Key Executives

- 7.4.3 Company snapshot

- 7.4.4 Active Business Divisions

- 7.4.5 Product portfolio

- 7.4.6 Business performance

- 7.4.7 Major Strategic Initiatives and Developments

- 7.5 Crunchbase

- 7.5.1 Company Overview

- 7.5.2 Key Executives

- 7.5.3 Company snapshot

- 7.5.4 Active Business Divisions

- 7.5.5 Product portfolio

- 7.5.6 Business performance

- 7.5.7 Major Strategic Initiatives and Developments

- 7.6 Dryver

- 7.6.1 Company Overview

- 7.6.2 Key Executives

- 7.6.3 Company snapshot

- 7.6.4 Active Business Divisions

- 7.6.5 Product portfolio

- 7.6.6 Business performance

- 7.6.7 Major Strategic Initiatives and Developments

- 7.7 Sober Drivers

- 7.7.1 Company Overview

- 7.7.2 Key Executives

- 7.7.3 Company snapshot

- 7.7.4 Active Business Divisions

- 7.7.5 Product portfolio

- 7.7.6 Business performance

- 7.7.7 Major Strategic Initiatives and Developments

- 7.8 Alberta Motor Association

- 7.8.1 Company Overview

- 7.8.2 Key Executives

- 7.8.3 Company snapshot

- 7.8.4 Active Business Divisions

- 7.8.5 Product portfolio

- 7.8.6 Business performance

- 7.8.7 Major Strategic Initiatives and Developments

- 7.9 First Choice

- 7.9.1 Company Overview

- 7.9.2 Key Executives

- 7.9.3 Company snapshot

- 7.9.4 Active Business Divisions

- 7.9.5 Product portfolio

- 7.9.6 Business performance

- 7.9.7 Major Strategic Initiatives and Developments

- 7.10 To Arrive Alive

- 7.10.1 Company Overview

- 7.10.2 Key Executives

- 7.10.3 Company snapshot

- 7.10.4 Active Business Divisions

- 7.10.5 Product portfolio

- 7.10.6 Business performance

- 7.10.7 Major Strategic Initiatives and Developments

- 7.11 DiDi

- 7.11.1 Company Overview

- 7.11.2 Key Executives

- 7.11.3 Company snapshot

- 7.11.4 Active Business Divisions

- 7.11.5 Product portfolio

- 7.11.6 Business performance

- 7.11.7 Major Strategic Initiatives and Developments

8: Analyst Perspective and Conclusion

- 8.1 Concluding Recommendations and Analysis

- 8.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

How do regulatory policies impact the Designated Driver Market?

+

-

What major players in Designated Driver Market?

+

-

What applications are categorized in the Designated Driver market study?

+

-

Which product types are examined in the Designated Driver Market Study?

+

-

Which regions are expected to show the fastest growth in the Designated Driver market?

+

-

What are the major growth drivers in the Designated Driver market?

+

-

Is the study period of the Designated Driver flexible or fixed?

+

-

How do economic factors influence the Designated Driver market?

+

-

How does the supply chain affect the Designated Driver Market?

+

-

Which players are included in the research coverage of the Designated Driver Market Study?

+

-