Global Digital Adoption Platform Market - Industry Dynamics, Market Size, And Opportunity Forecast To 2030

Report ID: MS-982 | IT and Telecom | Last updated: Jun, 2025 | Formats*:

The digital adoption platform (DAP) market covers software solutions designed to optimise and improve user involvement with digital tools, applications and corporate systems. These platforms act as an overlap in existing software, guiding users through real-time application assistance workflows such as tool tips, step-by-step, integration tutorials and contextual support. The main objective is to fill the gap between technology and users, accelerating software proficiency, reducing training costs and improving overall productivity. As organizations undergo a quick digital transformation, DAPs have become vital to ensure that employees, customers and partners use digital activities, maximising the return on investment in technology and boosting perfect adoption on various user bases.

Digital Adoption Platform Report Highlights

| Report Metrics | Details |

|---|---|

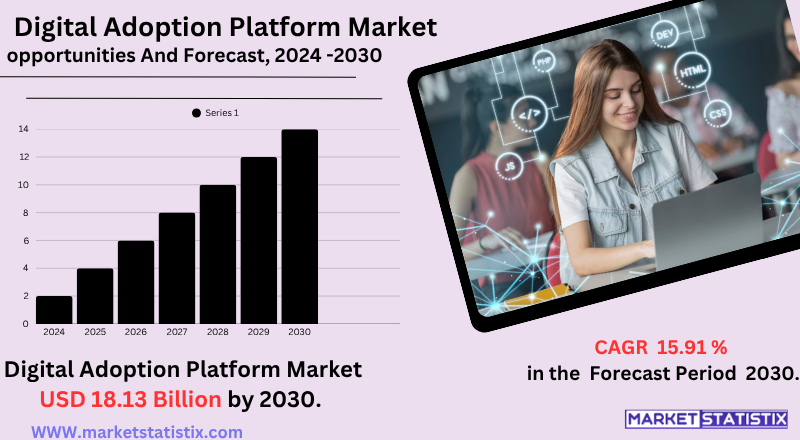

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

| Growth Rate | CAGR of 15.91% |

| Forecast Value (2030) | USD 18.13 Billion |

| By Product Type | Workflow Optimization, Walkthrough and Guided Tours, In-App Messaging and Communication, Others |

| Key Market Players |

|

| By Region |

|

Digital Adoption Platform Market Trends

The main trends include AI integration and machine learning for personalised experiences, mastery of cloud-based implementation for scalability and the growing demand for sectors such as BFSI, health and manufacturing. North America leads the market, but Asia Pacific is emerging as a significant growth area due to digital transformation initiatives. Main players such as WalkMe, Whatfix and Pendo.io are focusing on innovation to meet the evolutionary needs of companies aimed at maximising their digital investments.

Digital Adoption Platform Market Leading Players

The key players profiled in the report are Pendo (United States), WalkMe (Israel), Appcues (United States), Userlane (Germany), Gainsight (United States), Userpilot (United Kingdom), Inline Manual (Czech Republic), UserIQ (United States), Chameleon (United States), AppLearn (United Kingdom)Apty (United States), Whatfix (India)Growth Accelerators

- Rapid Digital Transformation Across Industries: Organizations are accelerating their digital initiatives to improve operational efficiency and customer involvement.

- Increased Demand for Enhanced User Experience: As companies prioritize user -cantered approaches, there is a growing need for solutions that offer intuitive and personalised experiences.

- Increased remote and hybrid work models: Change to remote and hybrid work environments has increased the need for effective training and digital support systems.

- Competitive Advantage: DAPS -taking organizations can get faster digital adoption, leading to better agility and response capacity on the market.

- These drivers collectively underscore the growing importance of DAPs in today's digital landscape, highlighting their role in facilitating effective technology adoption and enhancing overall organizational performance.

Digital Adoption Platform Market Segmentation analysis

The Global Digital Adoption Platform is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Workflow Optimization, Walkthrough and Guided Tours, In-App Messaging and Communication, Others . The Application segment categorizes the market based on its usage such as Software-as-a-Service, Digital Transformation Initiatives, Enterprise Software Adoption, Others. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

- SAP purchases Walkme (June 2024): SAP has completed the acquisition of Walkme, a DAP leader provider, for $1.5 billion. This movement aims to improve SAP corporate software offers, integrating WalkMe's digital adoption features, thus improving user experience and productivity on SAP platforms.

- Nexthink acquires Aceplearn (January 2024): Nexthink, which specializes in digital employee experience management, has acquired Applearn, a DAP company. This acquisition aims to reinforce Nexthink resources to guide users through digital transformations and improve software adoption rates.

These strategic acquisitions reflect the growing importance of digital adoption solutions in enhancing user engagement and streamlining digital transformations within enterprises.

Challenges In Digital Adoption Platform Market

- Resistance to change: Employees often hesitate to adopt new digital tools, fearing established workflows or occupational safety, which makes effective implementation difficult.

- Insufficient training: Limited or inadequate training programmes leave users unprepared to completely use DAPs, leading to underuse and decreased productivity.

- Complex, non-intuitive technology: User-friendly or non-user-friendly platforms can prevent users, making it a challenge to achieve perfect digital adoption.

- Inability to measure and monitor adoption: Lack of effective monitoring metrics and tools make organizations difficult for organisations to evaluate the success of IDA implementations and identify areas to improve.

Risks & Prospects in Digital Adoption Platform Market

Organizations are prioritising digital transformation initiatives, and DAPs play a crucial role to facilitate this by providing real-time guidance in the application, integration and contextual support. This not only enhances employees' productivity, but also reduces training costs and improves the overall return on investment software. The integration of AI-orientated resources within DAPs, such as personalised recommendations and contextual guidance, is a prominent trend, further feeding market expansion. In addition, regulatory compliance requirements and industry standards are leading organizations to implement DAPs that guarantee training and adherence consistent with best practices in distributed teams and geographies.

Key Target Audience

- ,

- SMEs (Small and Medium Enterprises): Leverage cost-effective DAP solutions to boost productivity and reduce dependency on traditional training. ,

- IT and Software Development Teams: Use DAPs to enhance UX/UI feedback loops and support user-centric software rollouts. ,

Merger and acquisition

- SAP purchases Walkme (June 2024): SAP has completed the acquisition of Walkme, a DAP leader provider, for $1.5 billion. This movement aims to improve SAP corporate software offers, integrating WalkMe's digital adoption features, thus improving user experience and productivity on SAP platforms.

- Nexthink acquires Aceplearn (January 2024): Nexthink, which specializes in digital employee experience management, has acquired Applearn, a DAP company. This acquisition aims to reinforce Nexthink resources to guide users through digital transformations and improve software adoption rates.

These strategic acquisitions reflect the growing importance of digital adoption solutions in enhancing user engagement and streamlining digital transformations within enterprises.

>Analyst Comment

The digital adoption platform (DAP) market is undergoing significant growth, driven by the growing need for organizations to maximise the value of their digital investments, improve employee productivity, and improve user experience in an increasingly complex software scenario. Several in approximately US $0.83 billion by 2023, the market is expected to reach about $4.03 billion in 2032. The main factors include the relentless impulse of digital transformation in various sectors, the proliferation of several and complex software solutions, the demand for data insights and the growing prevalence of work and hybrid.

- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Digital Adoption Platform- Snapshot

- 2.2 Digital Adoption Platform- Segment Snapshot

- 2.3 Digital Adoption Platform- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Digital Adoption Platform Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Walkthrough and Guided Tours

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 In-App Messaging and Communication

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Workflow Optimization

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Others

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

5: Digital Adoption Platform Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Enterprise Software Adoption

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Software-as-a-Service

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Digital Transformation Initiatives

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Others

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

6: Digital Adoption Platform Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 Appcues (United States)

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 AppLearn (United Kingdom)Apty (United States)

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Chameleon (United States)

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 Gainsight (United States)

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Inline Manual (Czech Republic)

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Pendo (United States)

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 UserIQ (United States)

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 Userlane (Germany)

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 Userpilot (United Kingdom)

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 WalkMe (Israel)

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

- 8.11 Whatfix (India)

- 8.11.1 Company Overview

- 8.11.2 Key Executives

- 8.11.3 Company snapshot

- 8.11.4 Active Business Divisions

- 8.11.5 Product portfolio

- 8.11.6 Business performance

- 8.11.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Digital Adoption Platform in 2030?

+

-

Which type of Digital Adoption Platform is widely popular?

+

-

What is the growth rate of Digital Adoption Platform Market?

+

-

What are the latest trends influencing the Digital Adoption Platform Market?

+

-

Who are the key players in the Digital Adoption Platform Market?

+

-

How is the Digital Adoption Platform } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Digital Adoption Platform Market Study?

+

-

What geographic breakdown is available in Global Digital Adoption Platform Market Study?

+

-

Which region holds the second position by market share in the Digital Adoption Platform market?

+

-

How are the key players in the Digital Adoption Platform market targeting growth in the future?

+

-

,

,

,

- ,

- Increased Demand for Enhanced User Experience: As companies prioritize user -cantered approaches, there is a growing need for solutions that offer intuitive and personalised experiences.

,,