Global Digital Identity Solutions Market – Industry Trends and Forecast to 2031

Report ID: MS-2114 | IT and Telecom | Last updated: Nov, 2024 | Formats*:

Digital Identity Solutions Report Highlights

| Report Metrics | Details |

|---|---|

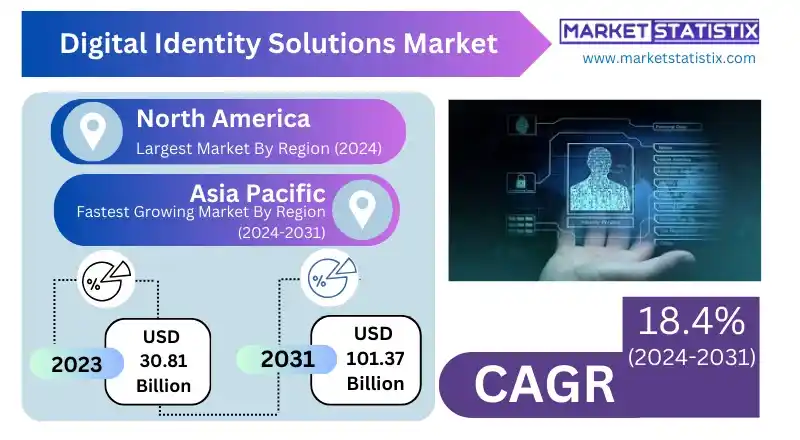

| Forecast period | 2019-2031 |

| Base Year Of Estimation | 2023 |

| Growth Rate | CAGR of 18.4% |

| Forecast Value (2031) | USD 101.37 Billion |

| By Product Type | Centralized, Decentralized |

| Key Market Players |

|

| By Region |

|

Digital Identity Solutions Market Trends

The global digital identity solutions market is witnessing an upsurge owing to growing concerns regarding security and the need for safe ways of authentication. Cybercrime and data breaches have forced companies and governments to turn to sophisticated digital identity solutions, including biometric, multi-factor (MFA), and distributed identity solutions. These enable organizations to securely store confidential information, carry out safe online business, as well as meet the tough regulations such as GDPR and PSD2. The trend towards digital as well as mobile-first services has also been a contributing factor for the increasing prevalence of digital identity technologies in banks, healthcare, and even governmental services. Merging of identity with blockchain is another trend that is increasingly taking root in the market. Due to its proficient decentralization, blockchain provides better security, privacy, and personal data management, which is the main reason as to why there is an appeal in using it for digital identity verification purposes. Furthermore, as the digital transformation processes grow in the generation of revenues for different sectors, more companies are expected to create and implement better identity solutions that are less intrusive and connect to other platforms seamlessly.Digital Identity Solutions Market Leading Players

The key players profiled in the report are Daon, Inc. (U.S.), Saviynt Inc. (U.S.), SailPoint Technologies, Inc. (U.S.), Thales (France), Samsung Group (South Korea), TELUS Communications Inc. (Canada), ForgeRock, Inc. (U.S.), IBM Corporation (U.S.), NEC Corporation (Japan), ImageWare Systems, Inc. (U.S.)Growth Accelerators

The increasing demand for secure online identity verification in a multitude of sectors, such as banking, healthcare, and e-commerce, is what primarily propels the global digital identity solutions market. Cyber threats and data breaches have forced companies to use digital identity solutions to secure borders within their organizations, validate customers more efficiently, and adhere to data privacy management. With the recent changes towards adopting remote digital work, more and more consumers are going online to transact. These developments have increased the quest for well-designed, fast, and impenetrable digital systems to authenticate users and protect their personal information. Another propulsion is the growing incorporation of new technologies, for example, biometrics, artificial intelligence (AI), and blockchain, which all serve to improve the performance and security of digital identity solutions. This gives the possibility to implement such technological innovations as facial and fingerprint identification and self-sovereign identity systems, which makes digital identity solutions more dependable and easier to handle. Furthermore, there are also various government schemes aimed at encouraging the populace to adopt digital and moral systems, such as e-government and citizenship digital ID, that are causing the growth of this market.Digital Identity Solutions Market Segmentation analysis

The Global Digital Identity Solutions is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Centralized, Decentralized . The Application segment categorizes the market based on its usage such as Authentication, Authorization, Access and Lifecycle Management, Others. Geographically, the market is assessed across key Regions like North America(United States, Canada, Mexico), South America(Brazil, Argentina, Chile, Rest of South America), Europe(Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific(China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA(Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The global digital identity solutions market has a wide range of competitors that offer all sorts of products to meet the increasing need for security and compliance within multiple industries. The major players of the market comprise well-known technology companies, including Microsoft, IBM, and Oracle, which are known to offer advanced identity management solutions working alongside the cloud, artificial intelligence, and blockchain technologies. These large corporations utilize their vast capabilities to provide solutions for 360-degree identity verification, authentication, and protection from fraud. There are also smaller actors in the market, such as Okta, Ping Identity, and Thales, who have been able to maintain a big slice of the market by providing identity and access management (IAM) solutions to particular industries such as financial services, healthcare, and government.Challenges In Digital Identity Solutions Market

The digital identity solutions market on a global scale is fraught with challenges, the most important of which are issues relating to data privacy and security. Digital identity solutions are likely to keep a lot of very personal data about individuals, thus inviting possible threats like cyberattacks, data breaches, and even cases of identity theft, consequently making individuals and companies reluctant to embrace such systems. For schadenfreude, how to manage a user's convenience with security is the function of all solution providers and is very difficult to achieve. Universal standards for digital identity systems are lacking, which poses another problem. This can affect how compatible systems are as well as the adoption of such systems globally. Countries and different industries have distinct identity verification processes, which makes it even harder for businesses to operate in cross-border and cross-sector integration. Most importantly, the digital divide also acts as another constraint, as not everyone, and particularly in some developing areas, is able to afford or use the necessary technology to establish and maintain digital identities. Access to digital identity solutions is oftentimes unequal, and this can affect the growth of the market and inclusivity in general, as the potential to adopt these solutions widely is limited.Risks & Prospects in Digital Identity Solutions Market

The worldwide market for digital identity solutions has vast potential owing to the growing demand for secure, fast, and more sophisticated systems of identity verification in many industries. The forms of attack have informed about the rise of cybercrimes and data breaches; therefore, the organizations have been focused on digital identity management to safeguard the customer data and ensure safe transactions online. The financial services, health care, and e-commerce businesses that operate sensitive information, in particular, have been under pressure to embrace digital identity systems in order to prevent fraud and provide secure access. Equally important opportunities can be observed in the increasing adoption of digital identity solutions for the public sector, where digital identification is now coming within reach for citizen satisfaction services, including available public services and electronic voting. In this context of globalization and digitalization of life, more and more countries invest in the innovative, integrated identity management platforms to make service provision easier, more secure, and more user-friendly. The Internet of Things (IoT), as well as blockchain technology and artificial intelligence-based identity verification systems, are gaining popularity day by day; thus, the market is in a position of persistent development, meaning there are considerable expanses for companies producing state-of-the-art digital identity systems.Key Target Audience

, The main target audience for the global digital identity solutions market is enterprises in all sectors where the identity of customers, employees, or users’ needs to be verified in a safe and effective manner. More omni-channel strategies are being executed by enterprises in order to tackle fraud, comply with KYC and other regulations, and also to improve the overall experience of the customers by ensuring easy authentication processes. Financial institutions, for example, are the highest number of users of this technology because it allows transcending time and space for carrying out monetary transactions via the internet., The other large demographic group consists of government agencies and institutions, which employ digital identity solutions to enhance the operation of such services as e-governance, voting, and social assistance programs. Furthermore, the increasing shift towards remote working, coupled with the provision of services online, has necessitated the need for digital identification management within organizations, as they must guarantee protection to their digital and hard copy sensitive information. The rise of digital identity management solutions can also be attributed to consumers, particularly those who are privacy and security advocates, because they want easier and safer ways of protecting their digital identities on different platforms.Merger and acquisition

As noted above, theorists consider that the level of concentration of the global digital identity solutions industry has recently increased as a result of mergers and acquisitions in the market. In November 2023, Certn confirmed that it had purchased Trustmatic, which is a European company specializing in remote ID verification in order to expand its biometrics KYC. Such trends are generally observed, as companies are encouraged to improve the application of technology to address the growing need for quicker and safer forms of identity verification in different industries such as finance, healthcare, and many others. Moreover, BigBear.ai completed the takeover of Pangiam for $70 million and integrated Pangiam's facial and other biometric technologies into its analytic solutions in order to secure government and enterprise customers. In addition to that, Clear introduced a reusable digital identity service in October 2023, which is also a testimony to their innovation in the digital identity market. This service uses ID documents as well as biometric verification in a bid to fast-track KYC processes in finance and several other sectors. The competition is enhanced not only with the addition of new players but also with the formation of alliances such as the one between OneSpan and ForgeRock, which is focused on providing augmented security solutions through integrated identity platforms.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Digital Identity Solutions- Snapshot

- 2.2 Digital Identity Solutions- Segment Snapshot

- 2.3 Digital Identity Solutions- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Digital Identity Solutions Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Centralized

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Decentralized

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: Digital Identity Solutions Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Authentication

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Authorization

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Access and Lifecycle Management

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Others

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

6: Digital Identity Solutions Market by Deployment

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 Cloud

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 On-premises

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

- 6.4 Hybrid

- 6.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.2 Market size and forecast, by region

- 6.4.3 Market share analysis by country

7: Digital Identity Solutions Market by Enterprise Type

- 7.1 Overview

- 7.1.1 Market size and forecast

- 7.2 Small and Medium Enterprises (SMEs)

- 7.2.1 Key market trends, factors driving growth, and opportunities

- 7.2.2 Market size and forecast, by region

- 7.2.3 Market share analysis by country

- 7.3 Large Enterprises

- 7.3.1 Key market trends, factors driving growth, and opportunities

- 7.3.2 Market size and forecast, by region

- 7.3.3 Market share analysis by country

8: Digital Identity Solutions Market by Industry

- 8.1 Overview

- 8.1.1 Market size and forecast

- 8.2 BFSI

- 8.2.1 Key market trends, factors driving growth, and opportunities

- 8.2.2 Market size and forecast, by region

- 8.2.3 Market share analysis by country

- 8.3 Automotive and Manufacturing

- 8.3.1 Key market trends, factors driving growth, and opportunities

- 8.3.2 Market size and forecast, by region

- 8.3.3 Market share analysis by country

- 8.4 Government and Public Services

- 8.4.1 Key market trends, factors driving growth, and opportunities

- 8.4.2 Market size and forecast, by region

- 8.4.3 Market share analysis by country

- 8.5 Energy and Resources

- 8.5.1 Key market trends, factors driving growth, and opportunities

- 8.5.2 Market size and forecast, by region

- 8.5.3 Market share analysis by country

- 8.6 Healthcare

- 8.6.1 Key market trends, factors driving growth, and opportunities

- 8.6.2 Market size and forecast, by region

- 8.6.3 Market share analysis by country

- 8.7 IT and Telecommunication

- 8.7.1 Key market trends, factors driving growth, and opportunities

- 8.7.2 Market size and forecast, by region

- 8.7.3 Market share analysis by country

- 8.8 Others (E-commerce

- 8.8.1 Key market trends, factors driving growth, and opportunities

- 8.8.2 Market size and forecast, by region

- 8.8.3 Market share analysis by country

- 8.9 etc.)

- 8.9.1 Key market trends, factors driving growth, and opportunities

- 8.9.2 Market size and forecast, by region

- 8.9.3 Market share analysis by country

9: Digital Identity Solutions Market by Region

- 9.1 Overview

- 9.1.1 Market size and forecast By Region

- 9.2 North America

- 9.2.1 Key trends and opportunities

- 9.2.2 Market size and forecast, by Type

- 9.2.3 Market size and forecast, by Application

- 9.2.4 Market size and forecast, by country

- 9.2.4.1 United States

- 9.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 9.2.4.1.2 Market size and forecast, by Type

- 9.2.4.1.3 Market size and forecast, by Application

- 9.2.4.2 Canada

- 9.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 9.2.4.2.2 Market size and forecast, by Type

- 9.2.4.2.3 Market size and forecast, by Application

- 9.2.4.3 Mexico

- 9.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 9.2.4.3.2 Market size and forecast, by Type

- 9.2.4.3.3 Market size and forecast, by Application

- 9.2.4.1 United States

- 9.3 South America

- 9.3.1 Key trends and opportunities

- 9.3.2 Market size and forecast, by Type

- 9.3.3 Market size and forecast, by Application

- 9.3.4 Market size and forecast, by country

- 9.3.4.1 Brazil

- 9.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 9.3.4.1.2 Market size and forecast, by Type

- 9.3.4.1.3 Market size and forecast, by Application

- 9.3.4.2 Argentina

- 9.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 9.3.4.2.2 Market size and forecast, by Type

- 9.3.4.2.3 Market size and forecast, by Application

- 9.3.4.3 Chile

- 9.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 9.3.4.3.2 Market size and forecast, by Type

- 9.3.4.3.3 Market size and forecast, by Application

- 9.3.4.4 Rest of South America

- 9.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 9.3.4.4.2 Market size and forecast, by Type

- 9.3.4.4.3 Market size and forecast, by Application

- 9.3.4.1 Brazil

- 9.4 Europe

- 9.4.1 Key trends and opportunities

- 9.4.2 Market size and forecast, by Type

- 9.4.3 Market size and forecast, by Application

- 9.4.4 Market size and forecast, by country

- 9.4.4.1 Germany

- 9.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 9.4.4.1.2 Market size and forecast, by Type

- 9.4.4.1.3 Market size and forecast, by Application

- 9.4.4.2 France

- 9.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 9.4.4.2.2 Market size and forecast, by Type

- 9.4.4.2.3 Market size and forecast, by Application

- 9.4.4.3 Italy

- 9.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 9.4.4.3.2 Market size and forecast, by Type

- 9.4.4.3.3 Market size and forecast, by Application

- 9.4.4.4 United Kingdom

- 9.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 9.4.4.4.2 Market size and forecast, by Type

- 9.4.4.4.3 Market size and forecast, by Application

- 9.4.4.5 Benelux

- 9.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 9.4.4.5.2 Market size and forecast, by Type

- 9.4.4.5.3 Market size and forecast, by Application

- 9.4.4.6 Nordics

- 9.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 9.4.4.6.2 Market size and forecast, by Type

- 9.4.4.6.3 Market size and forecast, by Application

- 9.4.4.7 Rest of Europe

- 9.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 9.4.4.7.2 Market size and forecast, by Type

- 9.4.4.7.3 Market size and forecast, by Application

- 9.4.4.1 Germany

- 9.5 Asia Pacific

- 9.5.1 Key trends and opportunities

- 9.5.2 Market size and forecast, by Type

- 9.5.3 Market size and forecast, by Application

- 9.5.4 Market size and forecast, by country

- 9.5.4.1 China

- 9.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 9.5.4.1.2 Market size and forecast, by Type

- 9.5.4.1.3 Market size and forecast, by Application

- 9.5.4.2 Japan

- 9.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 9.5.4.2.2 Market size and forecast, by Type

- 9.5.4.2.3 Market size and forecast, by Application

- 9.5.4.3 India

- 9.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 9.5.4.3.2 Market size and forecast, by Type

- 9.5.4.3.3 Market size and forecast, by Application

- 9.5.4.4 South Korea

- 9.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 9.5.4.4.2 Market size and forecast, by Type

- 9.5.4.4.3 Market size and forecast, by Application

- 9.5.4.5 Australia

- 9.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 9.5.4.5.2 Market size and forecast, by Type

- 9.5.4.5.3 Market size and forecast, by Application

- 9.5.4.6 Southeast Asia

- 9.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 9.5.4.6.2 Market size and forecast, by Type

- 9.5.4.6.3 Market size and forecast, by Application

- 9.5.4.7 Rest of Asia-Pacific

- 9.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 9.5.4.7.2 Market size and forecast, by Type

- 9.5.4.7.3 Market size and forecast, by Application

- 9.5.4.1 China

- 9.6 MEA

- 9.6.1 Key trends and opportunities

- 9.6.2 Market size and forecast, by Type

- 9.6.3 Market size and forecast, by Application

- 9.6.4 Market size and forecast, by country

- 9.6.4.1 Middle East

- 9.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 9.6.4.1.2 Market size and forecast, by Type

- 9.6.4.1.3 Market size and forecast, by Application

- 9.6.4.2 Africa

- 9.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 9.6.4.2.2 Market size and forecast, by Type

- 9.6.4.2.3 Market size and forecast, by Application

- 9.6.4.1 Middle East

- 10.1 Overview

- 10.2 Key Winning Strategies

- 10.3 Top 10 Players: Product Mapping

- 10.4 Competitive Analysis Dashboard

- 10.5 Market Competition Heatmap

- 10.6 Leading Player Positions, 2022

11: Company Profiles

- 11.1 NEC Corporation (Japan)

- 11.1.1 Company Overview

- 11.1.2 Key Executives

- 11.1.3 Company snapshot

- 11.1.4 Active Business Divisions

- 11.1.5 Product portfolio

- 11.1.6 Business performance

- 11.1.7 Major Strategic Initiatives and Developments

- 11.2 Saviynt Inc. (U.S.)

- 11.2.1 Company Overview

- 11.2.2 Key Executives

- 11.2.3 Company snapshot

- 11.2.4 Active Business Divisions

- 11.2.5 Product portfolio

- 11.2.6 Business performance

- 11.2.7 Major Strategic Initiatives and Developments

- 11.3 IBM Corporation (U.S.)

- 11.3.1 Company Overview

- 11.3.2 Key Executives

- 11.3.3 Company snapshot

- 11.3.4 Active Business Divisions

- 11.3.5 Product portfolio

- 11.3.6 Business performance

- 11.3.7 Major Strategic Initiatives and Developments

- 11.4 ForgeRock

- 11.4.1 Company Overview

- 11.4.2 Key Executives

- 11.4.3 Company snapshot

- 11.4.4 Active Business Divisions

- 11.4.5 Product portfolio

- 11.4.6 Business performance

- 11.4.7 Major Strategic Initiatives and Developments

- 11.5 Inc. (U.S.)

- 11.5.1 Company Overview

- 11.5.2 Key Executives

- 11.5.3 Company snapshot

- 11.5.4 Active Business Divisions

- 11.5.5 Product portfolio

- 11.5.6 Business performance

- 11.5.7 Major Strategic Initiatives and Developments

- 11.6 Daon

- 11.6.1 Company Overview

- 11.6.2 Key Executives

- 11.6.3 Company snapshot

- 11.6.4 Active Business Divisions

- 11.6.5 Product portfolio

- 11.6.6 Business performance

- 11.6.7 Major Strategic Initiatives and Developments

- 11.7 Inc. (U.S.)

- 11.7.1 Company Overview

- 11.7.2 Key Executives

- 11.7.3 Company snapshot

- 11.7.4 Active Business Divisions

- 11.7.5 Product portfolio

- 11.7.6 Business performance

- 11.7.7 Major Strategic Initiatives and Developments

- 11.8 Samsung Group (South Korea)

- 11.8.1 Company Overview

- 11.8.2 Key Executives

- 11.8.3 Company snapshot

- 11.8.4 Active Business Divisions

- 11.8.5 Product portfolio

- 11.8.6 Business performance

- 11.8.7 Major Strategic Initiatives and Developments

- 11.9 Thales (France)

- 11.9.1 Company Overview

- 11.9.2 Key Executives

- 11.9.3 Company snapshot

- 11.9.4 Active Business Divisions

- 11.9.5 Product portfolio

- 11.9.6 Business performance

- 11.9.7 Major Strategic Initiatives and Developments

- 11.10 TELUS Communications Inc. (Canada)

- 11.10.1 Company Overview

- 11.10.2 Key Executives

- 11.10.3 Company snapshot

- 11.10.4 Active Business Divisions

- 11.10.5 Product portfolio

- 11.10.6 Business performance

- 11.10.7 Major Strategic Initiatives and Developments

- 11.11 SailPoint Technologies

- 11.11.1 Company Overview

- 11.11.2 Key Executives

- 11.11.3 Company snapshot

- 11.11.4 Active Business Divisions

- 11.11.5 Product portfolio

- 11.11.6 Business performance

- 11.11.7 Major Strategic Initiatives and Developments

- 11.12 Inc. (U.S.)

- 11.12.1 Company Overview

- 11.12.2 Key Executives

- 11.12.3 Company snapshot

- 11.12.4 Active Business Divisions

- 11.12.5 Product portfolio

- 11.12.6 Business performance

- 11.12.7 Major Strategic Initiatives and Developments

- 11.13 ImageWare Systems

- 11.13.1 Company Overview

- 11.13.2 Key Executives

- 11.13.3 Company snapshot

- 11.13.4 Active Business Divisions

- 11.13.5 Product portfolio

- 11.13.6 Business performance

- 11.13.7 Major Strategic Initiatives and Developments

- 11.14 Inc. (U.S.)

- 11.14.1 Company Overview

- 11.14.2 Key Executives

- 11.14.3 Company snapshot

- 11.14.4 Active Business Divisions

- 11.14.5 Product portfolio

- 11.14.6 Business performance

- 11.14.7 Major Strategic Initiatives and Developments

12: Analyst Perspective and Conclusion

- 12.1 Concluding Recommendations and Analysis

- 12.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

By Deployment |

|

By Enterprise Type |

|

By Industry |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Digital Identity Solutions in 2031?

+

-

What is the growth rate of Digital Identity Solutions Market?

+

-

What are the latest trends influencing the Digital Identity Solutions Market?

+

-

Who are the key players in the Digital Identity Solutions Market?

+

-

How is the Digital Identity Solutions } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Digital Identity Solutions Market Study?

+

-

What geographic breakdown is available in Global Digital Identity Solutions Market Study?

+

-

Which region holds the second position by market share in the Digital Identity Solutions market?

+

-

How are the key players in the Digital Identity Solutions market targeting growth in the future?

+

-

What are the opportunities for new entrants in the Digital Identity Solutions market?

+

-