Global Digital Twins Market - Industry Dynamics, Size, And Opportunity Forecast To 2032

Report ID: MS-2345 | IT and Telecom | Last updated: Jan, 2025 | Formats*:

Digital Twins Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2032 |

| Base Year Of Estimation | 2024 |

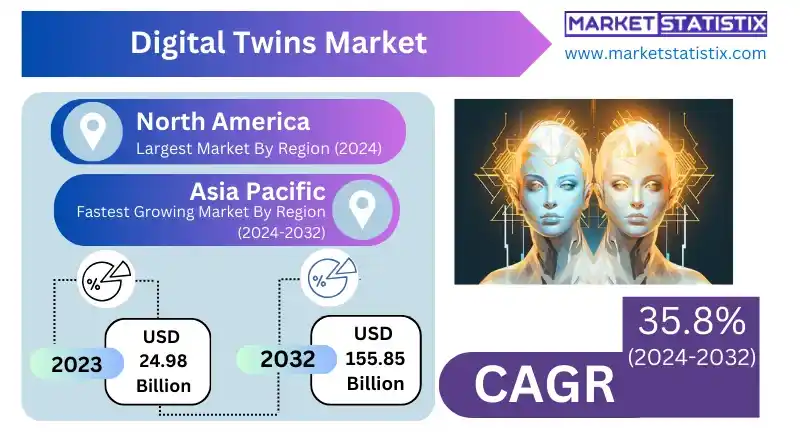

| Growth Rate | CAGR of 35.8% |

| Forecast Value (2032) | USD 155.85 Billion |

| Key Market Players |

|

| By Region |

|

Digital Twins Market Trends

Currently, the digital twin’s market is experiencing massive growth because of a constantly increasing use across multiple industries, such as manufacturing, automotive, and healthcare, including smart cities. Companies are using digital twin technology to improve operations, product development, and predictive maintenance. Real-time equipment and system monitoring have improved manufacturing efficiencies, reduced downtime, and better asset management. In healthcare, it now provides for a virtual model of a patient for a more personalized treatment plan and possible simulations, thus making healthcare more precise. The other significant trend in the digital twin’s market is the incorporation of ground-breaking technologies such as the IoT (Internet of Things), AI (Artificial Intelligence), and machine learning with the idea of boosting the performance of digital twin models. The new advances enable data-driven insights, predictive analytics, and autonomous decision-making, which will further spur the flow of the market. The increasing moments of automation and digitalization would very much raise the need for digital twins, becoming one of the best tools for the optimization of operations while enabling smarter decisions in this age of digitization.Digital Twins Market Leading Players

The key players profiled in the report are ABB Group, PTC Inc., Siemens AG, Amazon Web Services, Inc., AVEVA Group plc, Rockwell Automation, Hexagon AB, Microsoft Corporation, ANSYS, Inc., Robert Bosch GmbH, General Electric, Dassault Systemes, Bentley Systems Inc., SAP SE, International Business Machines Corporation, Autodesk Inc.Growth Accelerators

However, digital twin markets exhibit consistent and positive driving forces towards real-time data analysis and its optimization in various industrial applications such as manufacturing, healthcare, and smart cities. By using digital twins, businesses have an even greater virtual representation of the respective physical assets, processes, or systems for predicting failures, real-time monitoring, and enhanced decision-making. The facilitation of the Internet of Things (IoT) and improvements in sensors and connectivity mainly supply the data for building and accurate updating of digital models. Additionally, Industry 4.0 emphasis and smart manufacturing push digital twins further yet. They are also creating just-in-time solutions for companies to optimize production processes to minimize downtime and improve quality. Furthermore, the combined effects of AI and machine learning have made a finger too on the growing amount of data.Digital Twins Market Segmentation analysis

The Global Digital Twins is segmented by Application, and Region. . The Application segment categorizes the market based on its usage such as Product Design & Development, Predictive Maintenance, Business Optimization, Performance Monitoring, Inventory Management, Other Applications. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The domain of digital twins has inauspicious competition based on long-established works in technology, with many software providers and startups engaged in both popular and innovative solutions across several different industries. Some of the notable players are IBM, Microsoft, and Siemens-like multinational companies in developing holistic digital twin platforms along with artificial intelligence (AI), machine learning (ML), and Internet of Things (IoT) technologies. They concentrate on providing solutions across different verticals such as manufacturing and properties, automotive, healthcare, and energy, which use digital twins for predictive maintenance, real-time monitoring, and optimizing the process.Challenges In Digital Twins Market

Some of the challenges that face this digital twin’s market, among them, high implementation costs. Digital twin technology development and maintenance is capital-intensive, generally to the extent of requiring advanced sensors and IoT devices, software, and skilled personnel. Smaller firms or those entirely lacking in budgets find it increasingly difficult to have normalised adoption, and that in itself limits the market. Subsequently, implementing digital twins will take time and require skills as well as resources before the result can be realized. This needs lots of money. Another challenge has the characteristics that its data privacy and security concerns pose. Digital twins involve the actual data being collected in real-time from many sources. This attribute makes them almost a nugget for breaching the point of crucial sensitive information; hence it is exceedingly dependent on the time of application in a place like healthcare, manufacturing, and smart cities.Risks & Prospects in Digital Twins Market

The digital twin market presents massive potential for industries such as manufacturing, construction, and healthcare. In manufacturing, it allows real-time monitoring and optimization of all production processes, thereby enhancing efficiency and minimizing downtime while ensuring that predictive maintenance is carried out. Cost savings and product quality improvement thus make digital twins valuable tools to companies adopting Industry 4.0 technologies an equivalent advancement for constructing projects, better project management, design accuracy, and lifecycle management of buildings all ushering in new possibilities for smart cities and sustainable infrastructure development. The healthcare sector can offer great promise for the digital twin’s market, especially in applications related to personalized medicine and patient monitoring. Digital twins provide health care professionals with an opportunity to create a full digital replica of the patient to simulate treatment and predict results, which, in turn, allow for better, more personalized care. Digital twins are also being marketed for asset management in hospitals and medical facilities to optimize schedules and improve operational costs.Key Target Audience

Industries such as manufacturing, automotive, aerospace, and energy are the major actor groups for the digital twin’s market. Such an industry can easily integrate models with its physical component to enhance efficiency and predictive maintenance needs. In manufacturing, the digital twin helps companies optimize production processes, enhance product design and performance, and monitor equipment in real time. The automotive and aerospace industries use digital twins to analyse the performance of their vehicles, ensuring they are safe while reducing time and costs in production.,, The other primary group consists of smart cities and infrastructure: digital twins act in the management of urbanisation, transport networks, and energy systems. Digital twins are being used by municipalities and local government agencies for urban planning, as urban monitoring creates a bridge with infrastructure and improves sustainability by optimising energy consumption and traffic flow.Merger and acquisition

The newest mergers and acquisitions in the digital twin’s market are demonstrating a strategic movement among companies to augment technological capabilities and footprint in the market. In December 2022, Hexagon AB took over LocLab, which provides 3D content for digital twins. Now, the integration of LocLab offerings into Hexagon's own cloud-based visualization platform, HxDR, adds applications for urban planning and construction sectors. Aside from this, Schneider Electric's acquisition of AVEVA in the early weeks of 2023 also strengthens the company's position toward the industrial software market through more digital twin solutions along asset lifecycles. Market size: Entry of an estimated 110 billion by 2028 will be fuelled by adoption across applications and increase into other sectors, including manufacturing, healthcare, and smart cities. Key players in this game include IBM, which has been recently acquiring, with the objective of broadening their digital transformation capabilities. This frenzy of activities reflects the general trend of mergers among enterprises, which seek to develop various synergies and expand their technological offerings to adapt to changing market demands. >Analyst Comment

"According to reports, high growth is observed in the digital twin’s market, which is credited to the growing adoption of Industry 4.0 technologies and the requirements to bring forth data-driven decision-making across various sectors. The driving forces of economic growth include complexity in the products and systems, demand for more operational efficiency, and predictive maintenance, all of which cut down on downtime and maximize asset performance. The market has a diverse range of players, including technology providers, system integrators, and end users across several industries. The competitive landscape for this increasing dynamic is that the companies tend to make heavy investments in research to further enhance their high-level digital twin platforms and other solutions."- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Digital Twins- Snapshot

- 2.2 Digital Twins- Segment Snapshot

- 2.3 Digital Twins- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Digital Twins Market by Application / by End Use

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Product Design & Development

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Predictive Maintenance

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Business Optimization

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Performance Monitoring

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

- 4.6 Inventory Management

- 4.6.1 Key market trends, factors driving growth, and opportunities

- 4.6.2 Market size and forecast, by region

- 4.6.3 Market share analysis by country

- 4.7 Other Applications

- 4.7.1 Key market trends, factors driving growth, and opportunities

- 4.7.2 Market size and forecast, by region

- 4.7.3 Market share analysis by country

5: Digital Twins Market by Solution Outlook

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Component

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Process

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 System

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

6: Digital Twins Market by Deployment Outlook

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 Cloud

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 On-premise

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

7: Digital Twins Market by Enterprise Size Outlook

- 7.1 Overview

- 7.1.1 Market size and forecast

- 7.2 Large Enterprises

- 7.2.1 Key market trends, factors driving growth, and opportunities

- 7.2.2 Market size and forecast, by region

- 7.2.3 Market share analysis by country

- 7.3 Small and Medium Enterprises (SMEs)

- 7.3.1 Key market trends, factors driving growth, and opportunities

- 7.3.2 Market size and forecast, by region

- 7.3.3 Market share analysis by country

8: Digital Twins Market by End-use Outlook

- 8.1 Overview

- 8.1.1 Market size and forecast

- 8.2 Manufacturing

- 8.2.1 Key market trends, factors driving growth, and opportunities

- 8.2.2 Market size and forecast, by region

- 8.2.3 Market share analysis by country

- 8.3 Agriculture

- 8.3.1 Key market trends, factors driving growth, and opportunities

- 8.3.2 Market size and forecast, by region

- 8.3.3 Market share analysis by country

- 8.4 Automotive & Transport

- 8.4.1 Key market trends, factors driving growth, and opportunities

- 8.4.2 Market size and forecast, by region

- 8.4.3 Market share analysis by country

- 8.5 Energy & Utilities

- 8.5.1 Key market trends, factors driving growth, and opportunities

- 8.5.2 Market size and forecast, by region

- 8.5.3 Market share analysis by country

- 8.6 Healthcare & Life Sciences

- 8.6.1 Key market trends, factors driving growth, and opportunities

- 8.6.2 Market size and forecast, by region

- 8.6.3 Market share analysis by country

- 8.7 Residential & Commercial

- 8.7.1 Key market trends, factors driving growth, and opportunities

- 8.7.2 Market size and forecast, by region

- 8.7.3 Market share analysis by country

- 8.8 Retail & Consumer Goods

- 8.8.1 Key market trends, factors driving growth, and opportunities

- 8.8.2 Market size and forecast, by region

- 8.8.3 Market share analysis by country

- 8.9 Aerospace

- 8.9.1 Key market trends, factors driving growth, and opportunities

- 8.9.2 Market size and forecast, by region

- 8.9.3 Market share analysis by country

- 8.10 Telecommunication

- 8.10.1 Key market trends, factors driving growth, and opportunities

- 8.10.2 Market size and forecast, by region

- 8.10.3 Market share analysis by country

- 8.11 Others

- 8.11.1 Key market trends, factors driving growth, and opportunities

- 8.11.2 Market size and forecast, by region

- 8.11.3 Market share analysis by country

9: Digital Twins Market by Region

- 9.1 Overview

- 9.1.1 Market size and forecast By Region

- 9.2 North America

- 9.2.1 Key trends and opportunities

- 9.2.2 Market size and forecast, by Type

- 9.2.3 Market size and forecast, by Application

- 9.2.4 Market size and forecast, by country

- 9.2.4.1 United States

- 9.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 9.2.4.1.2 Market size and forecast, by Type

- 9.2.4.1.3 Market size and forecast, by Application

- 9.2.4.2 Canada

- 9.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 9.2.4.2.2 Market size and forecast, by Type

- 9.2.4.2.3 Market size and forecast, by Application

- 9.2.4.3 Mexico

- 9.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 9.2.4.3.2 Market size and forecast, by Type

- 9.2.4.3.3 Market size and forecast, by Application

- 9.2.4.1 United States

- 9.3 South America

- 9.3.1 Key trends and opportunities

- 9.3.2 Market size and forecast, by Type

- 9.3.3 Market size and forecast, by Application

- 9.3.4 Market size and forecast, by country

- 9.3.4.1 Brazil

- 9.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 9.3.4.1.2 Market size and forecast, by Type

- 9.3.4.1.3 Market size and forecast, by Application

- 9.3.4.2 Argentina

- 9.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 9.3.4.2.2 Market size and forecast, by Type

- 9.3.4.2.3 Market size and forecast, by Application

- 9.3.4.3 Chile

- 9.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 9.3.4.3.2 Market size and forecast, by Type

- 9.3.4.3.3 Market size and forecast, by Application

- 9.3.4.4 Rest of South America

- 9.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 9.3.4.4.2 Market size and forecast, by Type

- 9.3.4.4.3 Market size and forecast, by Application

- 9.3.4.1 Brazil

- 9.4 Europe

- 9.4.1 Key trends and opportunities

- 9.4.2 Market size and forecast, by Type

- 9.4.3 Market size and forecast, by Application

- 9.4.4 Market size and forecast, by country

- 9.4.4.1 Germany

- 9.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 9.4.4.1.2 Market size and forecast, by Type

- 9.4.4.1.3 Market size and forecast, by Application

- 9.4.4.2 France

- 9.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 9.4.4.2.2 Market size and forecast, by Type

- 9.4.4.2.3 Market size and forecast, by Application

- 9.4.4.3 Italy

- 9.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 9.4.4.3.2 Market size and forecast, by Type

- 9.4.4.3.3 Market size and forecast, by Application

- 9.4.4.4 United Kingdom

- 9.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 9.4.4.4.2 Market size and forecast, by Type

- 9.4.4.4.3 Market size and forecast, by Application

- 9.4.4.5 Benelux

- 9.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 9.4.4.5.2 Market size and forecast, by Type

- 9.4.4.5.3 Market size and forecast, by Application

- 9.4.4.6 Nordics

- 9.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 9.4.4.6.2 Market size and forecast, by Type

- 9.4.4.6.3 Market size and forecast, by Application

- 9.4.4.7 Rest of Europe

- 9.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 9.4.4.7.2 Market size and forecast, by Type

- 9.4.4.7.3 Market size and forecast, by Application

- 9.4.4.1 Germany

- 9.5 Asia Pacific

- 9.5.1 Key trends and opportunities

- 9.5.2 Market size and forecast, by Type

- 9.5.3 Market size and forecast, by Application

- 9.5.4 Market size and forecast, by country

- 9.5.4.1 China

- 9.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 9.5.4.1.2 Market size and forecast, by Type

- 9.5.4.1.3 Market size and forecast, by Application

- 9.5.4.2 Japan

- 9.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 9.5.4.2.2 Market size and forecast, by Type

- 9.5.4.2.3 Market size and forecast, by Application

- 9.5.4.3 India

- 9.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 9.5.4.3.2 Market size and forecast, by Type

- 9.5.4.3.3 Market size and forecast, by Application

- 9.5.4.4 South Korea

- 9.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 9.5.4.4.2 Market size and forecast, by Type

- 9.5.4.4.3 Market size and forecast, by Application

- 9.5.4.5 Australia

- 9.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 9.5.4.5.2 Market size and forecast, by Type

- 9.5.4.5.3 Market size and forecast, by Application

- 9.5.4.6 Southeast Asia

- 9.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 9.5.4.6.2 Market size and forecast, by Type

- 9.5.4.6.3 Market size and forecast, by Application

- 9.5.4.7 Rest of Asia-Pacific

- 9.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 9.5.4.7.2 Market size and forecast, by Type

- 9.5.4.7.3 Market size and forecast, by Application

- 9.5.4.1 China

- 9.6 MEA

- 9.6.1 Key trends and opportunities

- 9.6.2 Market size and forecast, by Type

- 9.6.3 Market size and forecast, by Application

- 9.6.4 Market size and forecast, by country

- 9.6.4.1 Middle East

- 9.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 9.6.4.1.2 Market size and forecast, by Type

- 9.6.4.1.3 Market size and forecast, by Application

- 9.6.4.2 Africa

- 9.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 9.6.4.2.2 Market size and forecast, by Type

- 9.6.4.2.3 Market size and forecast, by Application

- 9.6.4.1 Middle East

- 10.1 Overview

- 10.2 Key Winning Strategies

- 10.3 Top 10 Players: Product Mapping

- 10.4 Competitive Analysis Dashboard

- 10.5 Market Competition Heatmap

- 10.6 Leading Player Positions, 2022

11: Company Profiles

- 11.1 ABB Group

- 11.1.1 Company Overview

- 11.1.2 Key Executives

- 11.1.3 Company snapshot

- 11.1.4 Active Business Divisions

- 11.1.5 Product portfolio

- 11.1.6 Business performance

- 11.1.7 Major Strategic Initiatives and Developments

- 11.2 PTC Inc.

- 11.2.1 Company Overview

- 11.2.2 Key Executives

- 11.2.3 Company snapshot

- 11.2.4 Active Business Divisions

- 11.2.5 Product portfolio

- 11.2.6 Business performance

- 11.2.7 Major Strategic Initiatives and Developments

- 11.3 Siemens AG

- 11.3.1 Company Overview

- 11.3.2 Key Executives

- 11.3.3 Company snapshot

- 11.3.4 Active Business Divisions

- 11.3.5 Product portfolio

- 11.3.6 Business performance

- 11.3.7 Major Strategic Initiatives and Developments

- 11.4 Amazon Web Services

- 11.4.1 Company Overview

- 11.4.2 Key Executives

- 11.4.3 Company snapshot

- 11.4.4 Active Business Divisions

- 11.4.5 Product portfolio

- 11.4.6 Business performance

- 11.4.7 Major Strategic Initiatives and Developments

- 11.5 Inc.

- 11.5.1 Company Overview

- 11.5.2 Key Executives

- 11.5.3 Company snapshot

- 11.5.4 Active Business Divisions

- 11.5.5 Product portfolio

- 11.5.6 Business performance

- 11.5.7 Major Strategic Initiatives and Developments

- 11.6 AVEVA Group plc

- 11.6.1 Company Overview

- 11.6.2 Key Executives

- 11.6.3 Company snapshot

- 11.6.4 Active Business Divisions

- 11.6.5 Product portfolio

- 11.6.6 Business performance

- 11.6.7 Major Strategic Initiatives and Developments

- 11.7 Rockwell Automation

- 11.7.1 Company Overview

- 11.7.2 Key Executives

- 11.7.3 Company snapshot

- 11.7.4 Active Business Divisions

- 11.7.5 Product portfolio

- 11.7.6 Business performance

- 11.7.7 Major Strategic Initiatives and Developments

- 11.8 Hexagon AB

- 11.8.1 Company Overview

- 11.8.2 Key Executives

- 11.8.3 Company snapshot

- 11.8.4 Active Business Divisions

- 11.8.5 Product portfolio

- 11.8.6 Business performance

- 11.8.7 Major Strategic Initiatives and Developments

- 11.9 Microsoft Corporation

- 11.9.1 Company Overview

- 11.9.2 Key Executives

- 11.9.3 Company snapshot

- 11.9.4 Active Business Divisions

- 11.9.5 Product portfolio

- 11.9.6 Business performance

- 11.9.7 Major Strategic Initiatives and Developments

- 11.10 ANSYS

- 11.10.1 Company Overview

- 11.10.2 Key Executives

- 11.10.3 Company snapshot

- 11.10.4 Active Business Divisions

- 11.10.5 Product portfolio

- 11.10.6 Business performance

- 11.10.7 Major Strategic Initiatives and Developments

- 11.11 Inc.

- 11.11.1 Company Overview

- 11.11.2 Key Executives

- 11.11.3 Company snapshot

- 11.11.4 Active Business Divisions

- 11.11.5 Product portfolio

- 11.11.6 Business performance

- 11.11.7 Major Strategic Initiatives and Developments

- 11.12 Robert Bosch GmbH

- 11.12.1 Company Overview

- 11.12.2 Key Executives

- 11.12.3 Company snapshot

- 11.12.4 Active Business Divisions

- 11.12.5 Product portfolio

- 11.12.6 Business performance

- 11.12.7 Major Strategic Initiatives and Developments

- 11.13 General Electric

- 11.13.1 Company Overview

- 11.13.2 Key Executives

- 11.13.3 Company snapshot

- 11.13.4 Active Business Divisions

- 11.13.5 Product portfolio

- 11.13.6 Business performance

- 11.13.7 Major Strategic Initiatives and Developments

- 11.14 Dassault Systemes

- 11.14.1 Company Overview

- 11.14.2 Key Executives

- 11.14.3 Company snapshot

- 11.14.4 Active Business Divisions

- 11.14.5 Product portfolio

- 11.14.6 Business performance

- 11.14.7 Major Strategic Initiatives and Developments

- 11.15 Bentley Systems Inc.

- 11.15.1 Company Overview

- 11.15.2 Key Executives

- 11.15.3 Company snapshot

- 11.15.4 Active Business Divisions

- 11.15.5 Product portfolio

- 11.15.6 Business performance

- 11.15.7 Major Strategic Initiatives and Developments

- 11.16 SAP SE

- 11.16.1 Company Overview

- 11.16.2 Key Executives

- 11.16.3 Company snapshot

- 11.16.4 Active Business Divisions

- 11.16.5 Product portfolio

- 11.16.6 Business performance

- 11.16.7 Major Strategic Initiatives and Developments

- 11.17 International Business Machines Corporation

- 11.17.1 Company Overview

- 11.17.2 Key Executives

- 11.17.3 Company snapshot

- 11.17.4 Active Business Divisions

- 11.17.5 Product portfolio

- 11.17.6 Business performance

- 11.17.7 Major Strategic Initiatives and Developments

- 11.18 Autodesk Inc.

- 11.18.1 Company Overview

- 11.18.2 Key Executives

- 11.18.3 Company snapshot

- 11.18.4 Active Business Divisions

- 11.18.5 Product portfolio

- 11.18.6 Business performance

- 11.18.7 Major Strategic Initiatives and Developments

12: Analyst Perspective and Conclusion

- 12.1 Concluding Recommendations and Analysis

- 12.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Application |

|

By Solution Outlook |

|

By Deployment Outlook |

|

By Enterprise Size Outlook |

|

By End-use Outlook |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Digital Twins in 2032?

+

-

How big is the Global Digital Twins market?

+

-

How do regulatory policies impact the Digital Twins Market?

+

-

What major players in Digital Twins Market?

+

-

What applications are categorized in the Digital Twins market study?

+

-

Which product types are examined in the Digital Twins Market Study?

+

-

Which regions are expected to show the fastest growth in the Digital Twins market?

+

-

Which region is the fastest growing in the Digital Twins market?

+

-

What are the major growth drivers in the Digital Twins market?

+

-

Is the study period of the Digital Twins flexible or fixed?

+

-