Global Discrete Manufacturing ERP Market - Industry Dynamics, Market Size, And Opportunity Forecast To 2030

Report ID: MS-1037 | IT and Telecom | Last updated: Jun, 2025 | Formats*:

The discrete manufacturing ERP industry focuses on adapted software solutions to manage production operations in industries where finished products are distinct and content-rich, such as automotive, electronics, aerospace, and machines. These ERP systems optimise complex workflows, such as the material list, inventory tracking, and quality production planning and control, allowing manufacturers to quickly respond to design changes, supply chain interruptions, and personalised orders. In real-time practice, the demand for discrete manufacturing ERP is increasing as companies seek to improve operational agility, integrate IoT and AI for predictive maintenance, and ensure compliance with globally distributed facilities.

Discrete Manufacturing ERP Report Highlights

| Report Metrics | Details |

|---|---|

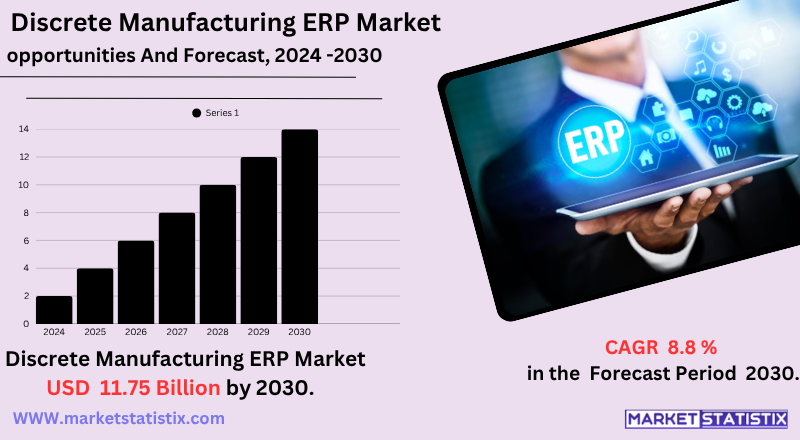

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

| Growth Rate | CAGR of 8.8% |

| Forecast Value (2030) | USD 11.75 Billion |

| By Product Type | On Premise ERP, Cloud-Based ERP |

| Key Market Players |

|

| By Region |

Discrete Manufacturing ERP Market Trends

Real-time data integration and analysis

Companies increasingly require real-time visibility in production processes and predictive insights. ERP systems connect store floor operations to analysis tools, allowing proactive decision-making, reduced inactivity time, and agile answers to interruptions.

Operational efficiency and cost reduction

Manufacturers intend to optimise workflows, cut manual work, and reduce waste; ERP automates tasks such as inventory management, scheduling, and good handling, directly increasing productivity and reducing overload.

Regulatory compliance and quality control

Rigid quality standards and regulatory demands in sectors such as aerospace and automotive require traceability and audits. Centralised ERP data management ensures precise reports, engineering control, and consistent quality adherence.

Discrete Manufacturing ERP Market Leading Players

The key players profiled in the report are Infor (U.S.), abas Software AG (Germany), QAD Inc (U.S.), NetSuite(Oracle) (U.S.), ECi Software Solutions (U.S.), SAP (Germany), Sage Group (U.K.), Microsoft (U.S.), SYSPRO (South Africa), Global Shop Solutions (U.S.), Epicor (U.S.), Visibility (U.S.)Growth Accelerators

Real-time data integration and analysis

Companies increasingly require real-time visibility in production processes and predictive insights. ERP systems connect store floor operations to analysis tools, allowing proactive decision-making, reduced inactivity time, and agile answers to interruptions.

Operational efficiency and cost reduction

Manufacturers intend to optimise workflows, cut manual work, and reduce waste; ERP automates tasks such as inventory management, scheduling, and good handling, directly increasing productivity and reducing overload.

Regulatory compliance and quality control

Rigid quality standards and regulatory demands in sectors such as aerospace and automotive require traceability and audits. Centralised ERP data management ensures precise reports, engineering control, and consistent quality adherence.

Discrete Manufacturing ERP Market Segmentation analysis

The Global Discrete Manufacturing ERP is segmented by Type, Application, and Region. By Type, the market is divided into Distributed On Premise ERP, Cloud-Based ERP . The Application segment categorizes the market based on its usage such as Private Enterprise, Government Agency. Geographically, the market is assessed across key Regions like {regionNms} and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The competitive scenario of the discrete manufacturing ERP industry is dominated by some major players—like SAP, Oracle, Microsoft (Dynamics 365), Infor, EPICOR, and QAD—EVERYHEAVED to offer comprehensive and final solutions that are part of the core without problems with MES, PLM, supply chain, ITT, ITTRED, and the supply chain and the chain of supplies. and the supply chain and ITP and ITP and the supply chain and ITP and ITP and ITP and ITP. These suppliers continually lead AI, machine learning, and cloud-native infrastructures to provide scalable and global platforms that serve large companies and medium-sized manufacturers. Its domain is reinforced by strong ecosystems, strategic acquisitions, profound experience in vertical industries, and extensive partnership networks, which together ensure rapid deployments and continuous improvements adapted to discrete manufacturing needs.

Challenges In Discrete Manufacturing ERP Market

- Complex data integration: Discrete ERP systems are struggling to perfectly connect machines, inherited systems, and business processes—causing gaps between real-time operations and programming control.

- Data integrity problems: Low-quality input data (e.g., BOM errors, inventory incompatibilities) damage ERP functionality, leading to incorrect predictions and inefficiencies unless they are approached with robust protocols.

- Personalisation vs. Standardisation Tension: Balancing the need for deep customisation to adjust exclusive manufacturing processes with the standard structure of better practice of ERP systems decreases implementation and complicates maintenance.

Risks & Prospects in Discrete Manufacturing ERP Market

Real-time data integration and analysis

Companies increasingly require real-time visibility in production processes and predictive insights. ERP systems connect store floor operations to analysis tools, allowing proactive decision-making, reduced inactivity time, and agile answers to interruptions.

Operational efficiency and cost reduction

Manufacturers intend to optimise workflows, cut manual work, and reduce waste; ERP automates tasks such as inventory management, scheduling, and good handling, directly increasing productivity and reducing overload.

Regulatory compliance and quality control

Rigid quality standards and regulatory demands in sectors such as aerospace and automotive require traceability and audits. Centralised ERP data management ensures precise reports, engineering control, and consistent quality adherence.

Key Target Audience

- , These companies require advanced ERP features to manage operations from various websites, complex supply chains, and custom production orders. They adopt discrete manufacturing ERP to improve efficiency, reduce delivery times, and ensure regulatory compliance.

- OEMs and tier suppliers

, These professionals are the main decision-makers who drive ERP adoption to unify production data, automate reports, and optimise resource planning. They seek scalable platforms that allow real-time visibility and agile decision-making between departments. , - Medium- to large-scale manufacturers

, , - IT and Operations Managers

,

, Original equipment manufacturers and component suppliers in sectors such as automotive, aerospace, and electronics depend on ERP systems to synchronise engineering, inventory, and delivery schedules. This helps maintain production accuracy and meet the rigorous demands of customers.

, ,

Merger and acquisition

- Vista Equity Partners → Amtech Software

Equity Partners acquired AMTECH Software from Peak Rock Capital in mid‑June 2025. This movement enhances Vista's footprint on industrial ERP, leveraging AMTECH's growing signing model and expanded international reach.

- APTEAN → Germanedge

From February to March 2025, Aptean agreed to purchase Germanedge, a Munich platform that offers MES, QMS, APS, and solutions connected to discrete manufacturing and Aptean Digital Factory and ERP Digital Factory enabled for IoT.

- APTEAN → LOGILY

Also in early 2025, APTEAN signed a definitive contract to acquire Logility, a chain of supplies and suppliers of AI-orientated production planning. This enhances APTEAN ERP offers with advanced forecasting and planning capabilities, with the agreement that should finish in Q2 2025.

>

Analyst Comment

The global discrete manufacturing ERP industry is thriving, currently valued at $5.5 billion (2023) and $6.4 billion (2024), with expansion projected to $11.8-13.8 billion in 2032-33, representing a strong CAGR. Growth is fuelled by the widespread digital transformation in discrete automotive, electronics, electronic machines, cloud adoption machines, AI, and real-time analysis. Currently North America leads the size of the market, followed by Europe and Asia-Pacific, although APAC is rapidly accelerating due to industrialisation and SMEs. The tendency to cloud ERP, IoT integration, and AI-orientated production optimisation continues to boost this market ahead.

- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Discrete Manufacturing ERP- Snapshot

- 2.2 Discrete Manufacturing ERP- Segment Snapshot

- 2.3 Discrete Manufacturing ERP- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Discrete Manufacturing ERP Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 On Premise ERP

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Cloud-Based ERP

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: Discrete Manufacturing ERP Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Private Enterprise

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Government Agency

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

6: Competitive Landscape

- 6.1 Overview

- 6.2 Key Winning Strategies

- 6.3 Top 10 Players: Product Mapping

- 6.4 Competitive Analysis Dashboard

- 6.5 Market Competition Heatmap

- 6.6 Leading Player Positions, 2022

7: Company Profiles

- 7.1 SAP (Germany)

- 7.1.1 Company Overview

- 7.1.2 Key Executives

- 7.1.3 Company snapshot

- 7.1.4 Active Business Divisions

- 7.1.5 Product portfolio

- 7.1.6 Business performance

- 7.1.7 Major Strategic Initiatives and Developments

- 7.2 Epicor (U.S.)

- 7.2.1 Company Overview

- 7.2.2 Key Executives

- 7.2.3 Company snapshot

- 7.2.4 Active Business Divisions

- 7.2.5 Product portfolio

- 7.2.6 Business performance

- 7.2.7 Major Strategic Initiatives and Developments

- 7.3 Sage Group (U.K.)

- 7.3.1 Company Overview

- 7.3.2 Key Executives

- 7.3.3 Company snapshot

- 7.3.4 Active Business Divisions

- 7.3.5 Product portfolio

- 7.3.6 Business performance

- 7.3.7 Major Strategic Initiatives and Developments

- 7.4 NetSuite(Oracle) (U.S.)

- 7.4.1 Company Overview

- 7.4.2 Key Executives

- 7.4.3 Company snapshot

- 7.4.4 Active Business Divisions

- 7.4.5 Product portfolio

- 7.4.6 Business performance

- 7.4.7 Major Strategic Initiatives and Developments

- 7.5 Microsoft (U.S.)

- 7.5.1 Company Overview

- 7.5.2 Key Executives

- 7.5.3 Company snapshot

- 7.5.4 Active Business Divisions

- 7.5.5 Product portfolio

- 7.5.6 Business performance

- 7.5.7 Major Strategic Initiatives and Developments

- 7.6 Infor (U.S.)

- 7.6.1 Company Overview

- 7.6.2 Key Executives

- 7.6.3 Company snapshot

- 7.6.4 Active Business Divisions

- 7.6.5 Product portfolio

- 7.6.6 Business performance

- 7.6.7 Major Strategic Initiatives and Developments

- 7.7 QAD Inc (U.S.)

- 7.7.1 Company Overview

- 7.7.2 Key Executives

- 7.7.3 Company snapshot

- 7.7.4 Active Business Divisions

- 7.7.5 Product portfolio

- 7.7.6 Business performance

- 7.7.7 Major Strategic Initiatives and Developments

- 7.8 abas Software AG (Germany)

- 7.8.1 Company Overview

- 7.8.2 Key Executives

- 7.8.3 Company snapshot

- 7.8.4 Active Business Divisions

- 7.8.5 Product portfolio

- 7.8.6 Business performance

- 7.8.7 Major Strategic Initiatives and Developments

- 7.9 ECi Software Solutions (U.S.)

- 7.9.1 Company Overview

- 7.9.2 Key Executives

- 7.9.3 Company snapshot

- 7.9.4 Active Business Divisions

- 7.9.5 Product portfolio

- 7.9.6 Business performance

- 7.9.7 Major Strategic Initiatives and Developments

- 7.10 SYSPRO (South Africa)

- 7.10.1 Company Overview

- 7.10.2 Key Executives

- 7.10.3 Company snapshot

- 7.10.4 Active Business Divisions

- 7.10.5 Product portfolio

- 7.10.6 Business performance

- 7.10.7 Major Strategic Initiatives and Developments

- 7.11 Global Shop Solutions (U.S.)

- 7.11.1 Company Overview

- 7.11.2 Key Executives

- 7.11.3 Company snapshot

- 7.11.4 Active Business Divisions

- 7.11.5 Product portfolio

- 7.11.6 Business performance

- 7.11.7 Major Strategic Initiatives and Developments

- 7.12 Visibility (U.S.)

- 7.12.1 Company Overview

- 7.12.2 Key Executives

- 7.12.3 Company snapshot

- 7.12.4 Active Business Divisions

- 7.12.5 Product portfolio

- 7.12.6 Business performance

- 7.12.7 Major Strategic Initiatives and Developments

8: Analyst Perspective and Conclusion

- 8.1 Concluding Recommendations and Analysis

- 8.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Discrete Manufacturing ERP in 2030?

+

-

Which application type is expected to remain the largest segment in the Global Discrete Manufacturing ERP market?

+

-

How big is the Global Discrete Manufacturing ERP market?

+

-

How do regulatory policies impact the Discrete Manufacturing ERP Market?

+

-

What major players in Discrete Manufacturing ERP Market?

+

-

What applications are categorized in the Discrete Manufacturing ERP market study?

+

-

Which product types are examined in the Discrete Manufacturing ERP Market Study?

+

-

Which regions are expected to show the fastest growth in the Discrete Manufacturing ERP market?

+

-

Which application holds the second-highest market share in the Discrete Manufacturing ERP market?

+

-

What are the major growth drivers in the Discrete Manufacturing ERP market?

+

-

Real-time data integration and analysis

Companies increasingly require real-time visibility in production processes and predictive insights. ERP systems connect store floor operations to analysis tools, allowing proactive decision-making, reduced inactivity time, and agile answers to interruptions.

Operational efficiency and cost reduction

Manufacturers intend to optimise workflows, cut manual work, and reduce waste; ERP automates tasks such as inventory management, scheduling, and good handling, directly increasing productivity and reducing overload.

Regulatory compliance and quality control

Rigid quality standards and regulatory demands in sectors such as aerospace and automotive require traceability and audits. Centralised ERP data management ensures precise reports, engineering control, and consistent quality adherence.