Global DNA Sequencing Market Size, Share & Trends Analysis Report, Forecast Period, 2024-2032

Report ID: MS-915 | Healthcare and Pharma | Last updated: May, 2025 | Formats*:

The DNA sequencing market refers to the worldwide industry dealing with the technologies, instruments, consumables, and services employed to find the exact sequence of nucleotides (adenine, guanine, cytosine, and thymine) in a DNA molecule. The basic process supplies the genetic code that directs all biological processes and is essential to comprehend genetic differences, detect disease, and design targeted therapies.

The market covers different sequencing technologies, ranging from conventional Sanger sequencing to next-generation sequencing (NGS) and nascent third-generation approaches, each with differing throughput, accuracy, and cost-competitiveness. The growing incidence of genetic diseases and chronic illnesses, along with high investments in genomics by the government and private players, further add to the demand for DNA sequencing products and services.

DNA Sequencing Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2032 |

| Base Year Of Estimation | 2024 |

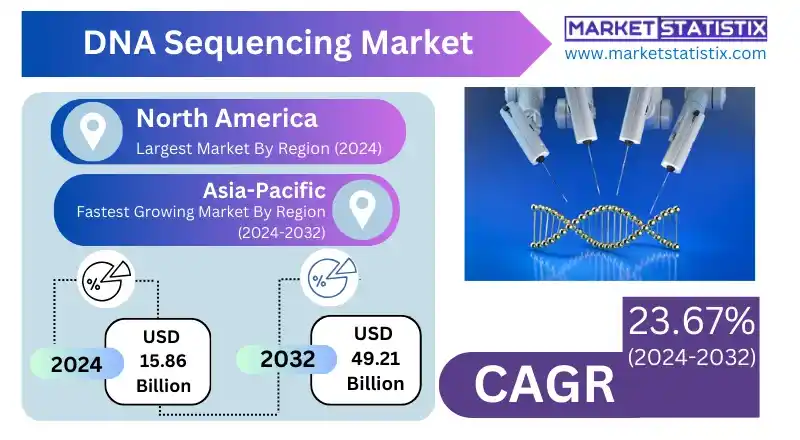

| Growth Rate | CAGR of 23.67% |

| Forecast Value (2032) | USD 49.21 Billion |

| By Product Type | Third-Generation Sequencing, Whole Genome Sequencing, Next-Generation Sequencing (NGS), Sanger Sequencing, Targeted Sequencing |

| Key Market Players |

|

| By Region |

|

DNA Sequencing Market Trends

One of the strongest trends is the continuing drop in sequencing costs, which has enabled genomic analysis to become more affordable for research, clinical diagnostics, and even consumer genomics. The decline in costs is mostly attributed to the improvement of Next-Generation Sequencing (NGS) platforms, which provide high-throughput activity and quick turnaround times. In addition, the advent of third-generation sequencing technologies like single-molecule real-time (SMRT) sequencing and nanopore sequencing is gathering pace with their potential to generate long reads, providing richer genomic data and dealing with challenging genomic areas.

Yet another major trend is the rapid adoption of DNA sequencing in clinical diagnosis and targeted or personalised medicine. With a growing knowledge of genetic disease-causing variations, sequencing is increasingly important for diagnosing inherited disorders, cancer treatment planning (precision oncology), and even non-penetrative prenatal testing. In addition to medicine, the market is witnessing rising use in other fields such as research agriculture (to enhance crop development and resistance to disease), forensic analysis, and metagenomics (researching microbial ecosystems)

DNA Sequencing Market Leading Players

The key players profiled in the report are PierianDx, Partek Incorporated, BGI, Myriad Genetics, QIAGEN, Eurofins Scientific, PerkinElmer Genomics, Bio-Rad Laboratories Inc., Thermo Fisher Scientific Inc, Illumina Inc., PacBio, F. Hoffmann-La Roche Ltd., Macrogen Inc., Agilent TechnologyGrowth Accelerators

The DNA sequencing market is driven mostly by the spectacular and ongoing reduction in sequencing prices, which has turned what was previously a multi-billion-dollar project into a few-hundred-dollar process. Affordability has democratised access to sequencing, shifting from only large research institutions to small labs, clinics, and even direct-to-consumer use. In addition to this cost savings, profound technological improvements in Next-Generation Sequencing (NGS) and new third-generation platforms have resulted in greater throughput, improved precision, and reduced turnaround times, and DNA sequencing has become more efficient and viable for a broader array of uses.

Additionally, the increasing uses of DNA sequencing in many industries are driving growth in the market. In clinical diagnosis, it is witnessing a leap in applications for the identification of genetic diseases, cancer-associated mutations, and prenatal screening, allowing for earlier and accurate diagnosis. Increasing usage of personalised medicine and targeted therapies is a significant driver, as genomic information is essential to personalise treatments according to an individual's own genetic makeup.

DNA Sequencing Market Segmentation analysis

The Global DNA Sequencing is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Third-Generation Sequencing, Whole Genome Sequencing, Next-Generation Sequencing (NGS), Sanger Sequencing, Targeted Sequencing . The Application segment categorizes the market based on its usage such as Consumer Genomics, Metagenomics, Epidemiology & Drug Development, Reproductive Health, Oncology, Agrigenomics & Forensics, Clinical Investigation, HLA Typing/Immune System Monitoring, Others. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The market for DNA sequencing has an extremely dynamic competitive environment dominated by a shortlist of large players, together with many specialised firms and newborn innovators. Illumina, Inc. is the generally recognised global industry leader, having an immense market share through its sophisticated Next-Generation Sequencing (NGS) platforms, high-throughput sequencing capabilities, and large ecosystem of reagents and bioinformatics tools. Other major players are Thermo Fisher Scientific, with a wide range of sequencing analysers and consumables, and Pacific Biosciences (PacBio) and Oxford Nanopore Technologies (ONT), both early leaders in the technologies of long-read sequencing, providing one-of-a-kind benefits for particular applications such as de novo genome assembly and real-time sequencing.

Competition in the market is based chiefly on ongoing innovation in sequencing technologies to achieve lower prices, greater accuracy, shorter turnaround times, and longer read lengths. Firms also compete based on the depth of their product offerings, such as sample preparation kits, bioinformatics software, and customer support. Strategic partnerships, mergers, and acquisitions are routine as firms try to broaden their technological expertise, market penetration, and application scope, especially in fast-emerging markets such as clinical diagnostics, personalised medicine, and single-cell analysis

Challenges In DNA Sequencing Market

The DNA sequencing industry is also confronted with some key challenges that may hinder its growth and usage. Exorbitant costs related to sequencing technologies, managing data, and the need for specialised hardware continue to serve as pressing obstacles, especially for developing market institutions and small-scale laboratories. Furthermore, the lack of trained manpower in genomics and bioinformatics, combined with data complexity, hinders one from utilising developments in sequencing technologies to their maximum potential and tends to lead to blunders or inaccuracies in sequencing outcomes, causing loss of confidence in the technology.

Apart from technical and operational barriers, the market is also facing ethical, legal, and regulatory issues. Uncertainty is increased by the sensitive nature of genomic data itself regarding data privacy and security, and inconsistency in regulatory frameworks and intellectual property rights poses uncertainty for stakeholders. Standardisation and quality assurance among platforms and laboratories are also persistent issues, as heterogeneity in protocols can influence reliability and reproducibility of results. Overcoming these complex challenges will be essential to the DNA sequencing market's ability to achieve its full potential in clinical, research, and commercial uses.

Risks & Prospects in DNA Sequencing Market

There are opportunities in the application of next-generation sequencing (NGS) in oncology, rare disease diagnosis, and individualised therapies as well as in creating high-throughput and affordable sequencing platforms. The market is also supported by surging needs for genomic information, technological advancements in sequencing platforms, and the healthcare industry's increased focus on precision medicine and early disease diagnosis.

Geographically, the North American region leads the market with the help of developed healthcare facilities, high R&D spending, and top industry players, especially in the United States, which holds the lion's share in the regional market. Europe, spearheaded by Germany, is the region of robust research potential and government backing for genomics, whereas Asia-Pacific is rapidly becoming the region with the fastest growth because of increasing expenditure on healthcare, growing biotechnology industries, and government-supportive policies, spearheaded by China and Japan. Other areas like the Middle East & Africa and South America demonstrate growing adoption fuelled by healthcare modernisation and investments in research infrastructure, providing further opportunities for market growth.

Key Target Audience

,,

The DNA sequencing industry addresses primarily healthcare professionals, researchers, and patients in diverse populations. Healthcare providers use DNA sequencing to diagnose, tailor treatment to the individual, and plan treatment, mainly in cancer, rare genetic diseases, and prenatal testing. Researchers in academic and clinical institutions use sequencing technologies to study genetic variation, disease processes, and targets for treatment. Patients, particularly those with chronic diseases or a history of genetic disorders, approach sequencing services for preventive medicine and customized health plans.

,,Direct-to-consumer genetic testing services have further increased the reach of the market as individuals gain access to genetic data for health and ancestry information. The integration of sequencing into digital health platforms boosts its use in the management of personalised healthcare.

Merger and acquisition

The market for DNA sequencing has seen large mergers and acquisitions (M&A) in recent years as a sign of the dynamics of the industry and strategic actions of the major players to expand their strengths. In May 2025, Regeneron Pharmaceuticals made a move to acquire consumer DNA testing firm 23andMe for $256 million after 23andMe filed for bankruptcy. This acquisition comprises 23andMe's Personal Genome Service, Total Health and Research Services, and its genetic sample and data biobank. Regeneron intends to continue uninterrupted consumer genetic services presently provided by 23andMe, with the transaction anticipated to close in the third quarter of 2025.

In another significant move, GeneDx, a prominent genetic testing services provider, said that it has acquired AI-driven genomic company Fabric Genomics for as much as $51 million. The transaction entails a $33 million cash upfront payment and as much as $18 million in milestone payments. The acquisition is intended to drive closer alignment between AI and human interpretation in genomics, allowing for quicker, scalable insights. GeneDx CEO highlighted the need for such genomic testing to be made available, particularly in underused venues such as neonatal intensive care units, where less than 5% of U.S. babies receive genetic testing each year.

These strategic acquisitions underscore the growing emphasis on integrating advanced technologies and expanding service offerings in the DNA sequencing market. Companies are increasingly focusing on enhancing their data analytics capabilities and broadening their consumer base to stay competitive in this rapidly evolving industry.

>Analyst Comment

The international DNA sequencing industry is growing at a very fast rate, with the 2025 market value being estimated at about USD 12.3 billion and USD 20.4 billion, while forecasts place the industry between USD 51.3 billion and more than USD 101.9 billion by 2032–2034. This growth is supported by a strong compound annual growth rate (CAGR), buttressed by advances in technology like next-generation and third-generation sequencing that enable high-throughput, affordable, and accurate analysis of genetic material. The rise of DNA sequencing usage in clinical diagnostics, personal medicine, and drug discovery particularly in oncology and rare disease investigation further speeds up market expansion.

- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 DNA Sequencing- Snapshot

- 2.2 DNA Sequencing- Segment Snapshot

- 2.3 DNA Sequencing- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: DNA Sequencing Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Sanger Sequencing

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Next-Generation Sequencing (NGS)

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Third-Generation Sequencing

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Whole Genome Sequencing

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

- 4.6 Targeted Sequencing

- 4.6.1 Key market trends, factors driving growth, and opportunities

- 4.6.2 Market size and forecast, by region

- 4.6.3 Market share analysis by country

5: DNA Sequencing Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Oncology

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Reproductive Health

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Clinical Investigation

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Agrigenomics & Forensics

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 HLA Typing/Immune System Monitoring

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

- 5.7 Metagenomics

- 5.7.1 Key market trends, factors driving growth, and opportunities

- 5.7.2 Market size and forecast, by region

- 5.7.3 Market share analysis by country

- 5.8 Epidemiology & Drug Development

- 5.8.1 Key market trends, factors driving growth, and opportunities

- 5.8.2 Market size and forecast, by region

- 5.8.3 Market share analysis by country

- 5.9 Consumer Genomics

- 5.9.1 Key market trends, factors driving growth, and opportunities

- 5.9.2 Market size and forecast, by region

- 5.9.3 Market share analysis by country

- 5.10 Others

- 5.10.1 Key market trends, factors driving growth, and opportunities

- 5.10.2 Market size and forecast, by region

- 5.10.3 Market share analysis by country

6: DNA Sequencing Market by Product & Services

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 Consumables

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 Instruments

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

- 6.4 Services

- 6.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.2 Market size and forecast, by region

- 6.4.3 Market share analysis by country

7: DNA Sequencing Market by Workflow

- 7.1 Overview

- 7.1.1 Market size and forecast

- 7.2 Pre-sequencing

- 7.2.1 Key market trends, factors driving growth, and opportunities

- 7.2.2 Market size and forecast, by region

- 7.2.3 Market share analysis by country

- 7.3 Sequencing

- 7.3.1 Key market trends, factors driving growth, and opportunities

- 7.3.2 Market size and forecast, by region

- 7.3.3 Market share analysis by country

- 7.4 Data Analysis

- 7.4.1 Key market trends, factors driving growth, and opportunities

- 7.4.2 Market size and forecast, by region

- 7.4.3 Market share analysis by country

8: DNA Sequencing Market by End-use

- 8.1 Overview

- 8.1.1 Market size and forecast

- 8.2 Academic Research

- 8.2.1 Key market trends, factors driving growth, and opportunities

- 8.2.2 Market size and forecast, by region

- 8.2.3 Market share analysis by country

- 8.3 Clinical Research

- 8.3.1 Key market trends, factors driving growth, and opportunities

- 8.3.2 Market size and forecast, by region

- 8.3.3 Market share analysis by country

- 8.4 Hospitals & Clinics

- 8.4.1 Key market trends, factors driving growth, and opportunities

- 8.4.2 Market size and forecast, by region

- 8.4.3 Market share analysis by country

- 8.5 Pharmaceutical & Biotechnology Companies

- 8.5.1 Key market trends, factors driving growth, and opportunities

- 8.5.2 Market size and forecast, by region

- 8.5.3 Market share analysis by country

- 8.6 Other Users

- 8.6.1 Key market trends, factors driving growth, and opportunities

- 8.6.2 Market size and forecast, by region

- 8.6.3 Market share analysis by country

9: DNA Sequencing Market by Region

- 9.1 Overview

- 9.1.1 Market size and forecast By Region

- 9.2 North America

- 9.2.1 Key trends and opportunities

- 9.2.2 Market size and forecast, by Type

- 9.2.3 Market size and forecast, by Application

- 9.2.4 Market size and forecast, by country

- 9.2.4.1 United States

- 9.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 9.2.4.1.2 Market size and forecast, by Type

- 9.2.4.1.3 Market size and forecast, by Application

- 9.2.4.2 Canada

- 9.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 9.2.4.2.2 Market size and forecast, by Type

- 9.2.4.2.3 Market size and forecast, by Application

- 9.2.4.3 Mexico

- 9.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 9.2.4.3.2 Market size and forecast, by Type

- 9.2.4.3.3 Market size and forecast, by Application

- 9.2.4.1 United States

- 9.3 South America

- 9.3.1 Key trends and opportunities

- 9.3.2 Market size and forecast, by Type

- 9.3.3 Market size and forecast, by Application

- 9.3.4 Market size and forecast, by country

- 9.3.4.1 Brazil

- 9.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 9.3.4.1.2 Market size and forecast, by Type

- 9.3.4.1.3 Market size and forecast, by Application

- 9.3.4.2 Argentina

- 9.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 9.3.4.2.2 Market size and forecast, by Type

- 9.3.4.2.3 Market size and forecast, by Application

- 9.3.4.3 Chile

- 9.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 9.3.4.3.2 Market size and forecast, by Type

- 9.3.4.3.3 Market size and forecast, by Application

- 9.3.4.4 Rest of South America

- 9.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 9.3.4.4.2 Market size and forecast, by Type

- 9.3.4.4.3 Market size and forecast, by Application

- 9.3.4.1 Brazil

- 9.4 Europe

- 9.4.1 Key trends and opportunities

- 9.4.2 Market size and forecast, by Type

- 9.4.3 Market size and forecast, by Application

- 9.4.4 Market size and forecast, by country

- 9.4.4.1 Germany

- 9.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 9.4.4.1.2 Market size and forecast, by Type

- 9.4.4.1.3 Market size and forecast, by Application

- 9.4.4.2 France

- 9.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 9.4.4.2.2 Market size and forecast, by Type

- 9.4.4.2.3 Market size and forecast, by Application

- 9.4.4.3 Italy

- 9.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 9.4.4.3.2 Market size and forecast, by Type

- 9.4.4.3.3 Market size and forecast, by Application

- 9.4.4.4 United Kingdom

- 9.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 9.4.4.4.2 Market size and forecast, by Type

- 9.4.4.4.3 Market size and forecast, by Application

- 9.4.4.5 Benelux

- 9.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 9.4.4.5.2 Market size and forecast, by Type

- 9.4.4.5.3 Market size and forecast, by Application

- 9.4.4.6 Nordics

- 9.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 9.4.4.6.2 Market size and forecast, by Type

- 9.4.4.6.3 Market size and forecast, by Application

- 9.4.4.7 Rest of Europe

- 9.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 9.4.4.7.2 Market size and forecast, by Type

- 9.4.4.7.3 Market size and forecast, by Application

- 9.4.4.1 Germany

- 9.5 Asia Pacific

- 9.5.1 Key trends and opportunities

- 9.5.2 Market size and forecast, by Type

- 9.5.3 Market size and forecast, by Application

- 9.5.4 Market size and forecast, by country

- 9.5.4.1 China

- 9.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 9.5.4.1.2 Market size and forecast, by Type

- 9.5.4.1.3 Market size and forecast, by Application

- 9.5.4.2 Japan

- 9.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 9.5.4.2.2 Market size and forecast, by Type

- 9.5.4.2.3 Market size and forecast, by Application

- 9.5.4.3 India

- 9.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 9.5.4.3.2 Market size and forecast, by Type

- 9.5.4.3.3 Market size and forecast, by Application

- 9.5.4.4 South Korea

- 9.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 9.5.4.4.2 Market size and forecast, by Type

- 9.5.4.4.3 Market size and forecast, by Application

- 9.5.4.5 Australia

- 9.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 9.5.4.5.2 Market size and forecast, by Type

- 9.5.4.5.3 Market size and forecast, by Application

- 9.5.4.6 Southeast Asia

- 9.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 9.5.4.6.2 Market size and forecast, by Type

- 9.5.4.6.3 Market size and forecast, by Application

- 9.5.4.7 Rest of Asia-Pacific

- 9.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 9.5.4.7.2 Market size and forecast, by Type

- 9.5.4.7.3 Market size and forecast, by Application

- 9.5.4.1 China

- 9.6 MEA

- 9.6.1 Key trends and opportunities

- 9.6.2 Market size and forecast, by Type

- 9.6.3 Market size and forecast, by Application

- 9.6.4 Market size and forecast, by country

- 9.6.4.1 Middle East

- 9.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 9.6.4.1.2 Market size and forecast, by Type

- 9.6.4.1.3 Market size and forecast, by Application

- 9.6.4.2 Africa

- 9.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 9.6.4.2.2 Market size and forecast, by Type

- 9.6.4.2.3 Market size and forecast, by Application

- 9.6.4.1 Middle East

- 10.1 Overview

- 10.2 Key Winning Strategies

- 10.3 Top 10 Players: Product Mapping

- 10.4 Competitive Analysis Dashboard

- 10.5 Market Competition Heatmap

- 10.6 Leading Player Positions, 2022

11: Company Profiles

- 11.1 Thermo Fisher Scientific Inc

- 11.1.1 Company Overview

- 11.1.2 Key Executives

- 11.1.3 Company snapshot

- 11.1.4 Active Business Divisions

- 11.1.5 Product portfolio

- 11.1.6 Business performance

- 11.1.7 Major Strategic Initiatives and Developments

- 11.2 Partek Incorporated

- 11.2.1 Company Overview

- 11.2.2 Key Executives

- 11.2.3 Company snapshot

- 11.2.4 Active Business Divisions

- 11.2.5 Product portfolio

- 11.2.6 Business performance

- 11.2.7 Major Strategic Initiatives and Developments

- 11.3 Macrogen Inc.

- 11.3.1 Company Overview

- 11.3.2 Key Executives

- 11.3.3 Company snapshot

- 11.3.4 Active Business Divisions

- 11.3.5 Product portfolio

- 11.3.6 Business performance

- 11.3.7 Major Strategic Initiatives and Developments

- 11.4 Myriad Genetics

- 11.4.1 Company Overview

- 11.4.2 Key Executives

- 11.4.3 Company snapshot

- 11.4.4 Active Business Divisions

- 11.4.5 Product portfolio

- 11.4.6 Business performance

- 11.4.7 Major Strategic Initiatives and Developments

- 11.5 Eurofins Scientific

- 11.5.1 Company Overview

- 11.5.2 Key Executives

- 11.5.3 Company snapshot

- 11.5.4 Active Business Divisions

- 11.5.5 Product portfolio

- 11.5.6 Business performance

- 11.5.7 Major Strategic Initiatives and Developments

- 11.6 F. Hoffmann-La Roche Ltd.

- 11.6.1 Company Overview

- 11.6.2 Key Executives

- 11.6.3 Company snapshot

- 11.6.4 Active Business Divisions

- 11.6.5 Product portfolio

- 11.6.6 Business performance

- 11.6.7 Major Strategic Initiatives and Developments

- 11.7 PierianDx

- 11.7.1 Company Overview

- 11.7.2 Key Executives

- 11.7.3 Company snapshot

- 11.7.4 Active Business Divisions

- 11.7.5 Product portfolio

- 11.7.6 Business performance

- 11.7.7 Major Strategic Initiatives and Developments

- 11.8 QIAGEN

- 11.8.1 Company Overview

- 11.8.2 Key Executives

- 11.8.3 Company snapshot

- 11.8.4 Active Business Divisions

- 11.8.5 Product portfolio

- 11.8.6 Business performance

- 11.8.7 Major Strategic Initiatives and Developments

- 11.9 BGI

- 11.9.1 Company Overview

- 11.9.2 Key Executives

- 11.9.3 Company snapshot

- 11.9.4 Active Business Divisions

- 11.9.5 Product portfolio

- 11.9.6 Business performance

- 11.9.7 Major Strategic Initiatives and Developments

- 11.10 PacBio

- 11.10.1 Company Overview

- 11.10.2 Key Executives

- 11.10.3 Company snapshot

- 11.10.4 Active Business Divisions

- 11.10.5 Product portfolio

- 11.10.6 Business performance

- 11.10.7 Major Strategic Initiatives and Developments

- 11.11 Bio-Rad Laboratories Inc.

- 11.11.1 Company Overview

- 11.11.2 Key Executives

- 11.11.3 Company snapshot

- 11.11.4 Active Business Divisions

- 11.11.5 Product portfolio

- 11.11.6 Business performance

- 11.11.7 Major Strategic Initiatives and Developments

- 11.12 PerkinElmer Genomics

- 11.12.1 Company Overview

- 11.12.2 Key Executives

- 11.12.3 Company snapshot

- 11.12.4 Active Business Divisions

- 11.12.5 Product portfolio

- 11.12.6 Business performance

- 11.12.7 Major Strategic Initiatives and Developments

- 11.13 Illumina Inc.

- 11.13.1 Company Overview

- 11.13.2 Key Executives

- 11.13.3 Company snapshot

- 11.13.4 Active Business Divisions

- 11.13.5 Product portfolio

- 11.13.6 Business performance

- 11.13.7 Major Strategic Initiatives and Developments

- 11.14 Agilent Technology

- 11.14.1 Company Overview

- 11.14.2 Key Executives

- 11.14.3 Company snapshot

- 11.14.4 Active Business Divisions

- 11.14.5 Product portfolio

- 11.14.6 Business performance

- 11.14.7 Major Strategic Initiatives and Developments

12: Analyst Perspective and Conclusion

- 12.1 Concluding Recommendations and Analysis

- 12.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

By Product & Services |

|

By Workflow |

|

By End-use |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of DNA Sequencing in 2032?

+

-

How big is the Global DNA Sequencing market?

+

-

How do regulatory policies impact the DNA Sequencing Market?

+

-

What major players in DNA Sequencing Market?

+

-

What applications are categorized in the DNA Sequencing market study?

+

-

Which product types are examined in the DNA Sequencing Market Study?

+

-

Which regions are expected to show the fastest growth in the DNA Sequencing market?

+

-

Which region is the fastest growing in the DNA Sequencing market?

+

-

What are the major growth drivers in the DNA Sequencing market?

+

-

The DNA sequencing market is driven mostly by the spectacular and ongoing reduction in sequencing prices, which has turned what was previously a multi-billion-dollar project into a few-hundred-dollar process. Affordability has democratised access to sequencing, shifting from only large research institutions to small labs, clinics, and even direct-to-consumer use. In addition to this cost savings, profound technological improvements in Next-Generation Sequencing (NGS) and new third-generation platforms have resulted in greater throughput, improved precision, and reduced turnaround times, and DNA sequencing has become more efficient and viable for a broader array of uses.

Additionally, the increasing uses of DNA sequencing in many industries are driving growth in the market. In clinical diagnosis, it is witnessing a leap in applications for the identification of genetic diseases, cancer-associated mutations, and prenatal screening, allowing for earlier and accurate diagnosis. Increasing usage of personalised medicine and targeted therapies is a significant driver, as genomic information is essential to personalise treatments according to an individual's own genetic makeup.

Is the study period of the DNA Sequencing flexible or fixed?

+

-