Global Drone Emergency Supplies Delivery Market Size, Share & Trends Analysis Report, Forecast Period, 2023-2030

Report ID: MS-2263 | Automation and Process Control | Last updated: Dec, 2024 | Formats*:

Drone Emergency Supplies Delivery Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2023 |

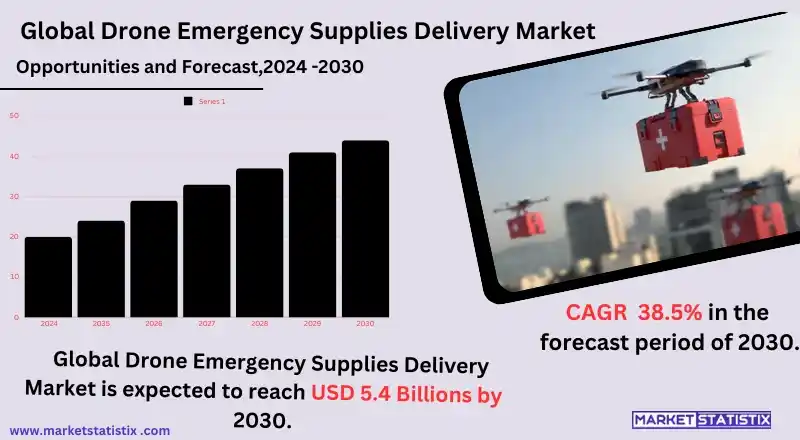

| Growth Rate | CAGR of 38.5% |

| Forecast Value (2030) | USD 5.4 Billion |

| By Product Type | Fixed Wing, Rotary Wing, Hybrid |

| Key Market Players |

|

| By Region |

|

Drone Emergency Supplies Delivery Market Trends

The market for drone delivery of emergency supplies is poised for fast-paced growth due to advancements in drone technology, coupled with increased demands for faster, better delivery systems, especially at times of emergencies. Drones will now form an important tool for the delivery of medical supplies like vaccines, blood, and other medicines as they reach hitherto inaccessible areas or disaster-affected parts of the world when traditional means of delivery are either slowed terribly or not available altogether. The market is also expanding as governments and private organisations attribute this kind of potential to an increased number of affected people's shortened disaster response timings by reducing human life risk through critical supply delivery without the use of ground transport or manned flights. One of the most significant drivers of the market is autonomous navigation combined with AI-based applications to operate an efficient drone, particularly in a difficult environment. The rise of partnerships between drone suppliers, emergency service providers, and health institutions will also continue to shape the market as these partnerships seek to optimise the networks for delivery and expand access to drone deliveries in both urban and rural settings. These trends point to a future where drones play a very important role in emergency logistics and humanitarian efforts.Drone Emergency Supplies Delivery Market Leading Players

The key players profiled in the report are Amazon.com, Inc., United Parcel Service, Inc., Drone Delivery Canada Corp., FedEx Corporation, Workhorse Group, Wingcopter Gm, Wing Aviation LLC, Zipline International Inc., Flytrex Inc., bH, Matternet Inc.Growth Accelerators

Faster and more efficient delivery methods in relation to emergencies have fuelled the market for drone emergency supplies delivery. Drones efficiently transfer critical supplies, such as medical equipment, medicines, and first aid kits, to unreachable areas or disaster-stricken regions where traditional delivery systems cannot get through. Instant response gains are crucial to emergencies like natural or human-made disasters, accidents, or medical crises, as they bypass traffic, traverse inaccessible terrain, and access remote locations in minutes. Government support and efforts towards the inclusion of drone services within logistics networks have further enhanced market growth. The advocacy of drones as a cost-effective and expandable solution to both private and public health organisations has led to the inroad towards enhancing emergency supply chains. Another aspect that fuels the increase in demand for drones as alternative delivery solutions is an advanced emphasis in the current trend in the healthcare logistics sector, especially in rural or underserved areas.Drone Emergency Supplies Delivery Market Segmentation analysis

The Global Drone Emergency Supplies Delivery is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Fixed Wing, Rotary Wing, Hybrid . The Application segment categorizes the market based on its usage such as Food Delivery, Healthcare & Medical Aid, Postal Delivery, Retail Logistics & Transportation, Others. Geographically, the market is assessed across key Regions like North America(United States, Canada, Mexico), South America(Brazil, Argentina, Chile, Rest of South America), Europe(Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific(China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA(Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The competitive landscape of the drone emergency supplies delivery market is composed of long-standing and newly established firms. Market leaders such as Zipline and Matternet have achieved a major deal through drone delivery of medical supplies to medically underserved areas. Most of them work under agreements with governments, health organisations, and logistics organisations to advance their services to a larger audience. They compete to make drone deliveries faster, more reliable, and farther-reaching while navigating regulatory challenges and innovating on technologies such as autonomous navigation, real-time monitoring, and longer battery life.Challenges In Drone Emergency Supplies Delivery Market

Regulatory and legal barriers are the main obstacles even in the drone emergency supplies delivery market. These days, governments have been busy making uniform regulations, which would allow the safe use of drones in several domains all around the globe. The regulations take care of airspace management, safety protocols, and privacy. Though these differ from one nation to another, all-important companies in this domain are required to abide by such laws, which delay or inflate the operational costs. Another technology constraint of a drone is payload, range, and battery life. Using drones is ideal in delivering small and time-sensitive emergency supplies; however, the capacity is hardly enough, so it can limit how far or to what extent such delivery systems may be. These innovations are needed to be overcome with the promise of satisfactory, reliable, and on-time delivery so the market for drone emergency supply delivery can grow.Risks & Prospects in Drone Emergency Supplies Delivery Market

It provides tourism opportunities to locations that are remote, disaster-hit, or where conventional modes of delivery are slow or impossible. Drones will be much faster and more efficient than traditional ways of delivering supplies, such as medicines, food, and water, to any place affected by natural disasters, like floods, earthquakes, or wildfires, for example. The main reason is that they have access to an area where there are infrastructural barriers, such as blocked or broken roads, and they very much become a useful tool for emergency response teams, governments, and humanitarian organisations that would like to save lives as well as reduce response time in cardiosurgical incidents. Among the other opportunities is establishing partnerships with the healthcare industry, pharmacies, and governments for an integrated drone-based supply chain to deliver time-sensitive medical supplies, e.g., vaccines, blood, and critical medications. Interest in using drones for emergency service grows with advances in their technology, including greater flight ranges, larger payload capacities, and real-time tracking systems, thus becoming even more viable and cost-effective for urgent delivery.Key Target Audience

The target customer market for the drone delivery of emergency supplies would include government agencies, disaster response teams, and humanitarian organisations that have lifelines that should be provided to disaster-stricken places or hard-to-reach areas quickly and effectively. These organisations have been looking for new solutions in order to reduce the time of response in cases where infrastructure becomes a hindrance or where environmental conditions do not allow normal delivery methods. Drones would enable quick and precise delivery of medical supplies, food, water, and other necessities in emergencies such as natural disasters, medical emergencies, or remote medical emergencies.,, Another segment of this target market is made up of healthcare providers, hospitals, and logistics companies that want to improve their value chain operations and get medical equipment, vaccines, or emergency medicines quickly. Such institutions would have added drones to their networks with a view to improving their capabilities for saving lives quickly and efficiently when it matters most.Merger and acquisition

A recent surge in mergers and acquisitions focused on improving operational capabilities and expanding their footprint within the drone emergency supplies delivery market. The most significant merger occurred in September 2024, when Volatus Aerospace and Drone Delivery Canada announced their merger of equals. In this case, Volatus' drone service offerings were complements with Drone Delivery Canada's expertise in cargo drone delivery for medical and emergency supplies. Increased partnership networks among competitors in the market to tap into the advances in drone technology have also been made. Examples of which are Zipline International, known for the automated delivery of medical supplies, made a contract deal with the Cleveland Clinic to be used for making healthcare delivery easier to access through drone logistics. To have their patient access essential medical supplies faster—pretty much what drones were there for when it came to providing an emergency response—systematic use of drone technology in that framework. >Analyst Comment

"The increasing awareness of drone’s potential to change the dynamics of disaster response and humanitarian assistance makes the emergency supplies delivery market for drones a lucrative one. Continuous developments within the drone technology space and progression in regulations that are slowly allowing more complex drone operation, including beyond visual line of sight (BVLOS), are other characteristics of this market. The market is witnessing increasing collaborations between drone manufacturers, software developers, logistics providers, and emergency responders to build integrated delivery solutions."- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Drone Emergency Supplies Delivery- Snapshot

- 2.2 Drone Emergency Supplies Delivery- Segment Snapshot

- 2.3 Drone Emergency Supplies Delivery- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Drone Emergency Supplies Delivery Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Fixed Wing

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Rotary Wing

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Hybrid

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

5: Drone Emergency Supplies Delivery Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Food Delivery

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Healthcare & Medical Aid

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Postal Delivery

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Retail Logistics & Transportation

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Others

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

6: Drone Emergency Supplies Delivery Market by Range

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 Short Range

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 Long Range

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

7: Drone Emergency Supplies Delivery Market by Package Size

- 7.1 Overview

- 7.1.1 Market size and forecast

- 7.2 Up to 2Kg

- 7.2.1 Key market trends, factors driving growth, and opportunities

- 7.2.2 Market size and forecast, by region

- 7.2.3 Market share analysis by country

- 7.3 2Kg - 5Kg

- 7.3.1 Key market trends, factors driving growth, and opportunities

- 7.3.2 Market size and forecast, by region

- 7.3.3 Market share analysis by country

- 7.4 Above 5Kg

- 7.4.1 Key market trends, factors driving growth, and opportunities

- 7.4.2 Market size and forecast, by region

- 7.4.3 Market share analysis by country

8: Drone Emergency Supplies Delivery Market by Region

- 8.1 Overview

- 8.1.1 Market size and forecast By Region

- 8.2 North America

- 8.2.1 Key trends and opportunities

- 8.2.2 Market size and forecast, by Type

- 8.2.3 Market size and forecast, by Application

- 8.2.4 Market size and forecast, by country

- 8.2.4.1 United States

- 8.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 8.2.4.1.2 Market size and forecast, by Type

- 8.2.4.1.3 Market size and forecast, by Application

- 8.2.4.2 Canada

- 8.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 8.2.4.2.2 Market size and forecast, by Type

- 8.2.4.2.3 Market size and forecast, by Application

- 8.2.4.3 Mexico

- 8.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 8.2.4.3.2 Market size and forecast, by Type

- 8.2.4.3.3 Market size and forecast, by Application

- 8.2.4.1 United States

- 8.3 South America

- 8.3.1 Key trends and opportunities

- 8.3.2 Market size and forecast, by Type

- 8.3.3 Market size and forecast, by Application

- 8.3.4 Market size and forecast, by country

- 8.3.4.1 Brazil

- 8.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 8.3.4.1.2 Market size and forecast, by Type

- 8.3.4.1.3 Market size and forecast, by Application

- 8.3.4.2 Argentina

- 8.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 8.3.4.2.2 Market size and forecast, by Type

- 8.3.4.2.3 Market size and forecast, by Application

- 8.3.4.3 Chile

- 8.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 8.3.4.3.2 Market size and forecast, by Type

- 8.3.4.3.3 Market size and forecast, by Application

- 8.3.4.4 Rest of South America

- 8.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 8.3.4.4.2 Market size and forecast, by Type

- 8.3.4.4.3 Market size and forecast, by Application

- 8.3.4.1 Brazil

- 8.4 Europe

- 8.4.1 Key trends and opportunities

- 8.4.2 Market size and forecast, by Type

- 8.4.3 Market size and forecast, by Application

- 8.4.4 Market size and forecast, by country

- 8.4.4.1 Germany

- 8.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.1.2 Market size and forecast, by Type

- 8.4.4.1.3 Market size and forecast, by Application

- 8.4.4.2 France

- 8.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.2.2 Market size and forecast, by Type

- 8.4.4.2.3 Market size and forecast, by Application

- 8.4.4.3 Italy

- 8.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.3.2 Market size and forecast, by Type

- 8.4.4.3.3 Market size and forecast, by Application

- 8.4.4.4 United Kingdom

- 8.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.4.2 Market size and forecast, by Type

- 8.4.4.4.3 Market size and forecast, by Application

- 8.4.4.5 Benelux

- 8.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.5.2 Market size and forecast, by Type

- 8.4.4.5.3 Market size and forecast, by Application

- 8.4.4.6 Nordics

- 8.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.6.2 Market size and forecast, by Type

- 8.4.4.6.3 Market size and forecast, by Application

- 8.4.4.7 Rest of Europe

- 8.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.7.2 Market size and forecast, by Type

- 8.4.4.7.3 Market size and forecast, by Application

- 8.4.4.1 Germany

- 8.5 Asia Pacific

- 8.5.1 Key trends and opportunities

- 8.5.2 Market size and forecast, by Type

- 8.5.3 Market size and forecast, by Application

- 8.5.4 Market size and forecast, by country

- 8.5.4.1 China

- 8.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.1.2 Market size and forecast, by Type

- 8.5.4.1.3 Market size and forecast, by Application

- 8.5.4.2 Japan

- 8.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.2.2 Market size and forecast, by Type

- 8.5.4.2.3 Market size and forecast, by Application

- 8.5.4.3 India

- 8.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.3.2 Market size and forecast, by Type

- 8.5.4.3.3 Market size and forecast, by Application

- 8.5.4.4 South Korea

- 8.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.4.2 Market size and forecast, by Type

- 8.5.4.4.3 Market size and forecast, by Application

- 8.5.4.5 Australia

- 8.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.5.2 Market size and forecast, by Type

- 8.5.4.5.3 Market size and forecast, by Application

- 8.5.4.6 Southeast Asia

- 8.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.6.2 Market size and forecast, by Type

- 8.5.4.6.3 Market size and forecast, by Application

- 8.5.4.7 Rest of Asia-Pacific

- 8.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.7.2 Market size and forecast, by Type

- 8.5.4.7.3 Market size and forecast, by Application

- 8.5.4.1 China

- 8.6 MEA

- 8.6.1 Key trends and opportunities

- 8.6.2 Market size and forecast, by Type

- 8.6.3 Market size and forecast, by Application

- 8.6.4 Market size and forecast, by country

- 8.6.4.1 Middle East

- 8.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 8.6.4.1.2 Market size and forecast, by Type

- 8.6.4.1.3 Market size and forecast, by Application

- 8.6.4.2 Africa

- 8.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 8.6.4.2.2 Market size and forecast, by Type

- 8.6.4.2.3 Market size and forecast, by Application

- 8.6.4.1 Middle East

- 9.1 Overview

- 9.2 Key Winning Strategies

- 9.3 Top 10 Players: Product Mapping

- 9.4 Competitive Analysis Dashboard

- 9.5 Market Competition Heatmap

- 9.6 Leading Player Positions, 2022

10: Company Profiles

- 10.1 Amazon.com

- 10.1.1 Company Overview

- 10.1.2 Key Executives

- 10.1.3 Company snapshot

- 10.1.4 Active Business Divisions

- 10.1.5 Product portfolio

- 10.1.6 Business performance

- 10.1.7 Major Strategic Initiatives and Developments

- 10.2 Inc.

- 10.2.1 Company Overview

- 10.2.2 Key Executives

- 10.2.3 Company snapshot

- 10.2.4 Active Business Divisions

- 10.2.5 Product portfolio

- 10.2.6 Business performance

- 10.2.7 Major Strategic Initiatives and Developments

- 10.3 United Parcel Service

- 10.3.1 Company Overview

- 10.3.2 Key Executives

- 10.3.3 Company snapshot

- 10.3.4 Active Business Divisions

- 10.3.5 Product portfolio

- 10.3.6 Business performance

- 10.3.7 Major Strategic Initiatives and Developments

- 10.4 Inc.

- 10.4.1 Company Overview

- 10.4.2 Key Executives

- 10.4.3 Company snapshot

- 10.4.4 Active Business Divisions

- 10.4.5 Product portfolio

- 10.4.6 Business performance

- 10.4.7 Major Strategic Initiatives and Developments

- 10.5 Drone Delivery Canada Corp.

- 10.5.1 Company Overview

- 10.5.2 Key Executives

- 10.5.3 Company snapshot

- 10.5.4 Active Business Divisions

- 10.5.5 Product portfolio

- 10.5.6 Business performance

- 10.5.7 Major Strategic Initiatives and Developments

- 10.6 FedEx Corporation

- 10.6.1 Company Overview

- 10.6.2 Key Executives

- 10.6.3 Company snapshot

- 10.6.4 Active Business Divisions

- 10.6.5 Product portfolio

- 10.6.6 Business performance

- 10.6.7 Major Strategic Initiatives and Developments

- 10.7 Workhorse Group

- 10.7.1 Company Overview

- 10.7.2 Key Executives

- 10.7.3 Company snapshot

- 10.7.4 Active Business Divisions

- 10.7.5 Product portfolio

- 10.7.6 Business performance

- 10.7.7 Major Strategic Initiatives and Developments

- 10.8 Wingcopter Gm

- 10.8.1 Company Overview

- 10.8.2 Key Executives

- 10.8.3 Company snapshot

- 10.8.4 Active Business Divisions

- 10.8.5 Product portfolio

- 10.8.6 Business performance

- 10.8.7 Major Strategic Initiatives and Developments

- 10.9 Wing Aviation LLC

- 10.9.1 Company Overview

- 10.9.2 Key Executives

- 10.9.3 Company snapshot

- 10.9.4 Active Business Divisions

- 10.9.5 Product portfolio

- 10.9.6 Business performance

- 10.9.7 Major Strategic Initiatives and Developments

- 10.10 Zipline International Inc.

- 10.10.1 Company Overview

- 10.10.2 Key Executives

- 10.10.3 Company snapshot

- 10.10.4 Active Business Divisions

- 10.10.5 Product portfolio

- 10.10.6 Business performance

- 10.10.7 Major Strategic Initiatives and Developments

- 10.11 Flytrex Inc.

- 10.11.1 Company Overview

- 10.11.2 Key Executives

- 10.11.3 Company snapshot

- 10.11.4 Active Business Divisions

- 10.11.5 Product portfolio

- 10.11.6 Business performance

- 10.11.7 Major Strategic Initiatives and Developments

- 10.12 bH

- 10.12.1 Company Overview

- 10.12.2 Key Executives

- 10.12.3 Company snapshot

- 10.12.4 Active Business Divisions

- 10.12.5 Product portfolio

- 10.12.6 Business performance

- 10.12.7 Major Strategic Initiatives and Developments

- 10.13 Matternet Inc.

- 10.13.1 Company Overview

- 10.13.2 Key Executives

- 10.13.3 Company snapshot

- 10.13.4 Active Business Divisions

- 10.13.5 Product portfolio

- 10.13.6 Business performance

- 10.13.7 Major Strategic Initiatives and Developments

11: Analyst Perspective and Conclusion

- 11.1 Concluding Recommendations and Analysis

- 11.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

By Range |

|

By Package Size |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Drone Emergency Supplies Delivery in 2030?

+

-

Which application type is expected to remain the largest segment in the Global Drone Emergency Supplies Delivery market?

+

-

How big is the Global Drone Emergency Supplies Delivery market?

+

-

How do regulatory policies impact the Drone Emergency Supplies Delivery Market?

+

-

What major players in Drone Emergency Supplies Delivery Market?

+

-

What applications are categorized in the Drone Emergency Supplies Delivery market study?

+

-

Which product types are examined in the Drone Emergency Supplies Delivery Market Study?

+

-

Which regions are expected to show the fastest growth in the Drone Emergency Supplies Delivery market?

+

-

Which application holds the second-highest market share in the Drone Emergency Supplies Delivery market?

+

-

What are the major growth drivers in the Drone Emergency Supplies Delivery market?

+

-