Global Electric Double-layer Capacitor (EDLC) Market Size, Share & Trends Analysis Report, Forecast Period, 2024-2030

Report ID: MS-569 | Electronics and Semiconductors | Last updated: Mar, 2025 | Formats*:

Electric Double-layer Capacitor (EDLC) Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

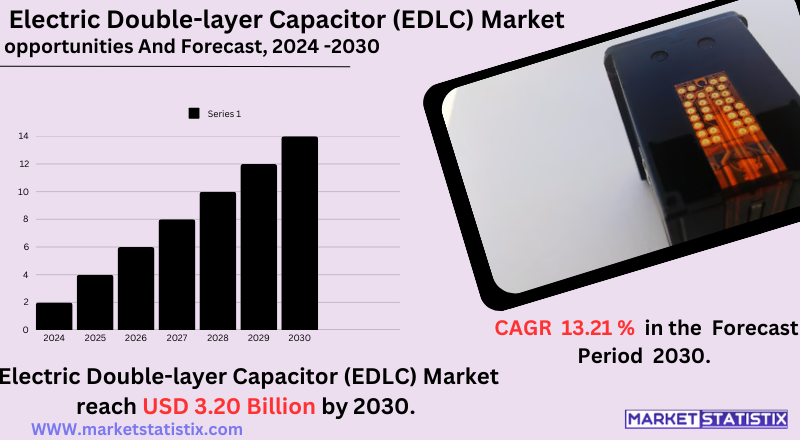

| Growth Rate | CAGR of 13.21% |

| Forecast Value (2030) | USD 3.20 Billion |

| By Product Type | Symmetric Capacitors, Asymmetric Capacitors |

| Key Market Players |

|

| By Region |

Electric Double-layer Capacitor (EDLC) Market Trends

The demand for electric double-layer capacitors (EDLCs) is soaring owing to the requirement of efficient and quick energy storage systems. Major trends in this market include rising adoption of EDLCs in the automotive industry, particularly in hybrid and electric vehicles for regenerative braking and their use in start-stop systems. A significant trend observed is the employment of EDLCs in renewable energy systems like wind and solar to stabilise power output and improve grid reliability. Another trend being witnessed is hybrid energy storage systems that combine EDLCs with batteries in order to tap both technologies' strengths for counteracting performance degradation and extending battery life.Electric Double-layer Capacitor (EDLC) Market Leading Players

The key players profiled in the report are Samwha Electric, Tecate Group, Elna Co., Ltd., Nichicon Corporation, Taiyo Yuden Co., Ltd., Nippon Chemi-Con Corporation, Supreme Power Solutions Co., Ltd., CAP-XX Limited, Jinzhou Kaimei Power Co., Ltd., Maxwell Technologies (Tesla, Inc.), Murata Manufacturing Co., Ltd., Ioxus, Yunasko, CAP-XX (Australia) Pty Limited, LS Mtron, Skeleton Technologies, Panasonic Corporation, Tecate Group (Now part of KEMET Corporation), VinaTech Co., Ltd.Growth Accelerators

Electric double-layer capacitors (EDLCs) cater mainly to the increasing demand for effective and reliable energy storage in different applications. An important aspect of this was the growth of the electric vehicle with EDLCs used for regenerative braking, start-stop systems, and power stabilisation. It augments the high-speed charging and long-life requirements of EVs, thus augmenting the requirements for EDLCs significantly. Renewables integration, especially in grid-stabilising and backup power systems, also lifts the demand for EDLCs due to their features of high-power density and fast charge-discharge capabilities. Another market driver is the increasing application of EDLCs in industrial automation and consumer electronics. In an industrial setting, using them for backup power sources on critical systems increases the efficiency of machinery. The market growth, in turn, is also supplemented by the ongoing trends of portable and wearable electronic devices that require compact, efficient energy storage. In addition, improvements in material science are producing enhanced performance and reduced costs for EDLCs, thus improving their commercial viability. Also, government positions on clean energy, including its advocacy for sustainable transportation, would further boost the market.Electric Double-layer Capacitor (EDLC) Market Segmentation analysis

The Global Electric Double-layer Capacitor (EDLC) is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Symmetric Capacitors, Asymmetric Capacitors . The Application segment categorizes the market based on its usage such as Consumer Electronics, Transportation, Industrial, Renewable Energy, Aerospace and Defense. Geographically, the market is assessed across key Regions like {regionNms} and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The competition in the Electric Double-layer Capacitor (EDLC) market is concentrated in the hands of important participants like Maxwell Technologies (a subsidiary of Tesla), Nippon Chemi-Con, Panasonic, LS Mtron, and Skeleton Technologies. These companies are working toward product innovation with more energy storage capacity and efficiency to meet growing demands in automotive, renewable energy, and industrial applications. These companies commonly indulge in strategic partnerships, mergers, and acquisitions to augment their technological capabilities and market presence.Challenges In Electric Double-layer Capacitor (EDLC) Market

The Electric Double-layer Capacitor (EDLC) market also faces issues with high production costs and their relatively low energy density compared to conventional batteries. The advantages of EDLCs pertain to rapid charge and recharge functionalities; however, due to lower energy storage capacity, they are not suitable for long-term provision of power. Manufacturing costs have further been increased by relying on expensive materials such as activated carbon and advanced electrolytes. Another critical issue is that pertaining to the lack of standardisation and widespread infrastructure for integrating the EDLC into applications across industries. Although they are ideal for applications with high power, like those in regenerative braking and backup power, their use in main energy storage practically is impeded by existing competing lithium-ion batteries. The other technical challenges are leakage current and self-discharge rates, which also cause a need for more innovations in material science and capacitor designs to improve performance and lifetime.Risks & Prospects in Electric Double-layer Capacitor (EDLC) Market

For example, with outside supply chain boosting, government planners are putting a lot of patient work into renewable energy infrastructures. China's plan is to add 30 GW of energy storage capacity by late 2025, making its demand increase. Also, recent advances in EDLC technology—using graphene and carbon nanotube materials—further enhance energy density and efficiency, thus enabling a variety of applications in smart grids, automotive systems, and consumer electronics. As far as the EDLC market is concerned, Asia-Pacific, especially China and Japan, plays the foremost role, thanks to investments in renewable energy and EV adoption. It is anticipated that Asia-Pacific will account for more than 40% of the market share, spurred by such initiatives as China's $350 billion investment in grid modernisation. North America and Europe also account for about 25% of the market each. Strong environmental regulations and advanced technology are also valuable in these regions for achieving sustainable energy solutions. The Middle East & Africa and Latin America are becoming emerging markets that might grow in the future concerning these renewable projects.Key Target Audience

The crucial consumer group in the Electric Double-layer Capacitor (EDLC) market is that of manufacturers and suppliers of energy storage solutions, automotive companies, and industrial equipment providers and all such people who could integrate EDLC applications and EVs, hybrid system applications, or renewable energy installations into a working mechanism development for energy efficiency and energy power management. Research and technology development institutes are also major sponsors of innovation in the performance, density of energy, and sustainability for capacitors.,, Another important segment includes consumer electronics, grid infrastructures, and aerospace industries that require reliable, high-power energy storage. This has opened the door for energy-efficient solutions that fit into portable devices, backup power systems, and regenerative braking applications. Government bodies and regulatory agencies also influence the growth of the market by supporting the clean energy initiative and promoting the improvements of supercapacitor technology.Merger and acquisition

The electric double-layer capacitor (EDLC) market has seen major mergers and acquisitions geared towards increasing technological prowess and market penetration. A classic example of this trend is, of course, Tesla's purchase of Maxwell Technologies, a leader in ultracapacitor technology, in an effort to integrate advanced energy storage into Tesla EVs. This expressively highlights the automotive industry's attention to the application of high-performance EDLCs for better energy efficiencies and performance. In addition to mergers and acquisitions, strategic alliances have been another key factor in the evolution of the EDLC market. An example would be Skeleton Technologies collaborating with Siemens in Germany for manufacturing graphene-based supercapacitors with a view toward increasing production automation and digitisation. Furthermore, these partnerships also promise technological development to redistill EDLCs into diverse applications within other sectors such as automotive and renewable energy. >Analyst Comment

The robust growth experienced by the Electric Double-layer Capacitor (EDLC) market is attributed mainly to the increasing requirements posed by many applications requiring efficient energy storage solutions. As the demand for devices availing high power density with very quick charge-discharge capability along with long cycle life increases, EDLCs are very much suited to those demands. This is especially true in the automotive industry, where applications like regenerative braking systems and start-stop systems are EDLC-intensive, and in the case of industrial applications such as power backup and load levelling. Adding to this, the desire for power- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Electric Double-layer Capacitor (EDLC)- Snapshot

- 2.2 Electric Double-layer Capacitor (EDLC)- Segment Snapshot

- 2.3 Electric Double-layer Capacitor (EDLC)- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Electric Double-layer Capacitor (EDLC) Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Symmetric Capacitors

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Asymmetric Capacitors

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: Electric Double-layer Capacitor (EDLC) Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Transportation

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Industrial

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Consumer Electronics

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Renewable Energy

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Aerospace and Defense

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

6: Competitive Landscape

- 6.1 Overview

- 6.2 Key Winning Strategies

- 6.3 Top 10 Players: Product Mapping

- 6.4 Competitive Analysis Dashboard

- 6.5 Market Competition Heatmap

- 6.6 Leading Player Positions, 2022

7: Company Profiles

- 7.1 Maxwell Technologies (Tesla

- 7.1.1 Company Overview

- 7.1.2 Key Executives

- 7.1.3 Company snapshot

- 7.1.4 Active Business Divisions

- 7.1.5 Product portfolio

- 7.1.6 Business performance

- 7.1.7 Major Strategic Initiatives and Developments

- 7.2 Inc.)

- 7.2.1 Company Overview

- 7.2.2 Key Executives

- 7.2.3 Company snapshot

- 7.2.4 Active Business Divisions

- 7.2.5 Product portfolio

- 7.2.6 Business performance

- 7.2.7 Major Strategic Initiatives and Developments

- 7.3 Panasonic Corporation

- 7.3.1 Company Overview

- 7.3.2 Key Executives

- 7.3.3 Company snapshot

- 7.3.4 Active Business Divisions

- 7.3.5 Product portfolio

- 7.3.6 Business performance

- 7.3.7 Major Strategic Initiatives and Developments

- 7.4 Murata Manufacturing Co.

- 7.4.1 Company Overview

- 7.4.2 Key Executives

- 7.4.3 Company snapshot

- 7.4.4 Active Business Divisions

- 7.4.5 Product portfolio

- 7.4.6 Business performance

- 7.4.7 Major Strategic Initiatives and Developments

- 7.5 Ltd.

- 7.5.1 Company Overview

- 7.5.2 Key Executives

- 7.5.3 Company snapshot

- 7.5.4 Active Business Divisions

- 7.5.5 Product portfolio

- 7.5.6 Business performance

- 7.5.7 Major Strategic Initiatives and Developments

- 7.6 Nippon Chemi-Con Corporation

- 7.6.1 Company Overview

- 7.6.2 Key Executives

- 7.6.3 Company snapshot

- 7.6.4 Active Business Divisions

- 7.6.5 Product portfolio

- 7.6.6 Business performance

- 7.6.7 Major Strategic Initiatives and Developments

- 7.7 Nichicon Corporation

- 7.7.1 Company Overview

- 7.7.2 Key Executives

- 7.7.3 Company snapshot

- 7.7.4 Active Business Divisions

- 7.7.5 Product portfolio

- 7.7.6 Business performance

- 7.7.7 Major Strategic Initiatives and Developments

- 7.8 Skeleton Technologies

- 7.8.1 Company Overview

- 7.8.2 Key Executives

- 7.8.3 Company snapshot

- 7.8.4 Active Business Divisions

- 7.8.5 Product portfolio

- 7.8.6 Business performance

- 7.8.7 Major Strategic Initiatives and Developments

- 7.9 LS Mtron

- 7.9.1 Company Overview

- 7.9.2 Key Executives

- 7.9.3 Company snapshot

- 7.9.4 Active Business Divisions

- 7.9.5 Product portfolio

- 7.9.6 Business performance

- 7.9.7 Major Strategic Initiatives and Developments

- 7.10 Ioxus

- 7.10.1 Company Overview

- 7.10.2 Key Executives

- 7.10.3 Company snapshot

- 7.10.4 Active Business Divisions

- 7.10.5 Product portfolio

- 7.10.6 Business performance

- 7.10.7 Major Strategic Initiatives and Developments

- 7.11 Yunasko

- 7.11.1 Company Overview

- 7.11.2 Key Executives

- 7.11.3 Company snapshot

- 7.11.4 Active Business Divisions

- 7.11.5 Product portfolio

- 7.11.6 Business performance

- 7.11.7 Major Strategic Initiatives and Developments

- 7.12 Samwha Electric

- 7.12.1 Company Overview

- 7.12.2 Key Executives

- 7.12.3 Company snapshot

- 7.12.4 Active Business Divisions

- 7.12.5 Product portfolio

- 7.12.6 Business performance

- 7.12.7 Major Strategic Initiatives and Developments

- 7.13 Supreme Power Solutions Co.

- 7.13.1 Company Overview

- 7.13.2 Key Executives

- 7.13.3 Company snapshot

- 7.13.4 Active Business Divisions

- 7.13.5 Product portfolio

- 7.13.6 Business performance

- 7.13.7 Major Strategic Initiatives and Developments

- 7.14 Ltd.

- 7.14.1 Company Overview

- 7.14.2 Key Executives

- 7.14.3 Company snapshot

- 7.14.4 Active Business Divisions

- 7.14.5 Product portfolio

- 7.14.6 Business performance

- 7.14.7 Major Strategic Initiatives and Developments

- 7.15 Tecate Group

- 7.15.1 Company Overview

- 7.15.2 Key Executives

- 7.15.3 Company snapshot

- 7.15.4 Active Business Divisions

- 7.15.5 Product portfolio

- 7.15.6 Business performance

- 7.15.7 Major Strategic Initiatives and Developments

- 7.16 Elna Co.

- 7.16.1 Company Overview

- 7.16.2 Key Executives

- 7.16.3 Company snapshot

- 7.16.4 Active Business Divisions

- 7.16.5 Product portfolio

- 7.16.6 Business performance

- 7.16.7 Major Strategic Initiatives and Developments

- 7.17 Ltd.

- 7.17.1 Company Overview

- 7.17.2 Key Executives

- 7.17.3 Company snapshot

- 7.17.4 Active Business Divisions

- 7.17.5 Product portfolio

- 7.17.6 Business performance

- 7.17.7 Major Strategic Initiatives and Developments

- 7.18 CAP-XX Limited

- 7.18.1 Company Overview

- 7.18.2 Key Executives

- 7.18.3 Company snapshot

- 7.18.4 Active Business Divisions

- 7.18.5 Product portfolio

- 7.18.6 Business performance

- 7.18.7 Major Strategic Initiatives and Developments

- 7.19 CAP-XX (Australia) Pty Limited

- 7.19.1 Company Overview

- 7.19.2 Key Executives

- 7.19.3 Company snapshot

- 7.19.4 Active Business Divisions

- 7.19.5 Product portfolio

- 7.19.6 Business performance

- 7.19.7 Major Strategic Initiatives and Developments

- 7.20 Jinzhou Kaimei Power Co.

- 7.20.1 Company Overview

- 7.20.2 Key Executives

- 7.20.3 Company snapshot

- 7.20.4 Active Business Divisions

- 7.20.5 Product portfolio

- 7.20.6 Business performance

- 7.20.7 Major Strategic Initiatives and Developments

- 7.21 Ltd.

- 7.21.1 Company Overview

- 7.21.2 Key Executives

- 7.21.3 Company snapshot

- 7.21.4 Active Business Divisions

- 7.21.5 Product portfolio

- 7.21.6 Business performance

- 7.21.7 Major Strategic Initiatives and Developments

- 7.22 Taiyo Yuden Co.

- 7.22.1 Company Overview

- 7.22.2 Key Executives

- 7.22.3 Company snapshot

- 7.22.4 Active Business Divisions

- 7.22.5 Product portfolio

- 7.22.6 Business performance

- 7.22.7 Major Strategic Initiatives and Developments

- 7.23 Ltd.

- 7.23.1 Company Overview

- 7.23.2 Key Executives

- 7.23.3 Company snapshot

- 7.23.4 Active Business Divisions

- 7.23.5 Product portfolio

- 7.23.6 Business performance

- 7.23.7 Major Strategic Initiatives and Developments

- 7.24 Tecate Group (Now part of KEMET Corporation)

- 7.24.1 Company Overview

- 7.24.2 Key Executives

- 7.24.3 Company snapshot

- 7.24.4 Active Business Divisions

- 7.24.5 Product portfolio

- 7.24.6 Business performance

- 7.24.7 Major Strategic Initiatives and Developments

- 7.25 VinaTech Co.

- 7.25.1 Company Overview

- 7.25.2 Key Executives

- 7.25.3 Company snapshot

- 7.25.4 Active Business Divisions

- 7.25.5 Product portfolio

- 7.25.6 Business performance

- 7.25.7 Major Strategic Initiatives and Developments

- 7.26 Ltd.

- 7.26.1 Company Overview

- 7.26.2 Key Executives

- 7.26.3 Company snapshot

- 7.26.4 Active Business Divisions

- 7.26.5 Product portfolio

- 7.26.6 Business performance

- 7.26.7 Major Strategic Initiatives and Developments

8: Analyst Perspective and Conclusion

- 8.1 Concluding Recommendations and Analysis

- 8.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Electric Double-layer Capacitor (EDLC) in 2030?

+

-

Which application type is expected to remain the largest segment in the Global Electric Double-layer Capacitor (EDLC) market?

+

-

How big is the Global Electric Double-layer Capacitor (EDLC) market?

+

-

How do regulatory policies impact the Electric Double-layer Capacitor (EDLC) Market?

+

-

What major players in Electric Double-layer Capacitor (EDLC) Market?

+

-

What applications are categorized in the Electric Double-layer Capacitor (EDLC) market study?

+

-

Which product types are examined in the Electric Double-layer Capacitor (EDLC) Market Study?

+

-

Which regions are expected to show the fastest growth in the Electric Double-layer Capacitor (EDLC) market?

+

-

Which application holds the second-highest market share in the Electric Double-layer Capacitor (EDLC) market?

+

-

What are the major growth drivers in the Electric Double-layer Capacitor (EDLC) market?

+

-