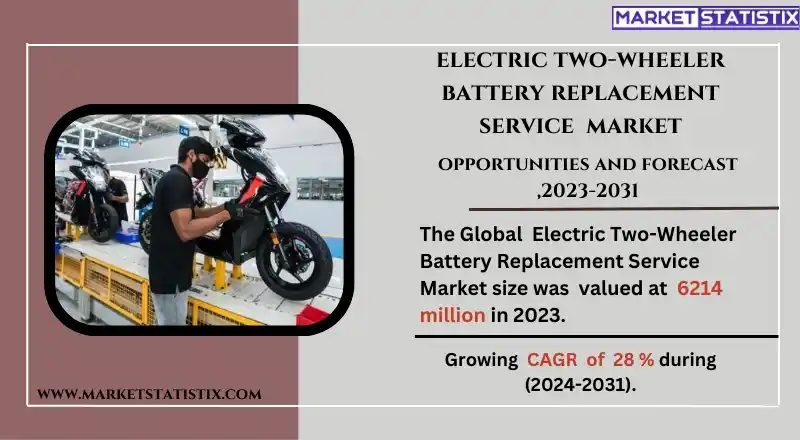

Global Electric Two-Wheeler Battery Replacement Service Market Size, Share & Trends Analysis Report, Forecast Period, 2023-2031

Report ID: MS-1960 | Automotive and Transport | Last updated: Oct, 2024 | Formats*:

Electric Two-Wheeler Battery Replacement Service Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2031 |

| Base Year Of Estimation | 2023 |

| Growth Rate | CAGR of 28% |

| By Product Type | Lithium-ion, Nickel Metal Hydride, Lead Acid |

| Key Market Players |

|

| By Region |

|

Electric Two-Wheeler Battery Replacement Service Market Trends

New opportunities arise in the global electric two-wheeler battery replacement service market as electric vehicles (EVs) are continuously penetrating the market, as well as the need for cleaner modes of transportation escalating. As more and more people use electrical two-wheelers for their eco-friendly and affordable measures, people will also soon be in need of credible services for battery replacement. Moreover, this is also a result of government policies and mobilisation that have increased the numbers of electric two-wheelers. For this reason, the regions see an influx of businessmen seeking to provide services such as battery replacement due to the increase in demand for electric two-wheelers. On the other hand, battery chemistry advancement and battery management systems improvement are some of the most remarkable trends observed in the electric two-wheeler batteries, thanks to the attention they have been given. More service providers are looking to provide battery recycling, refurbishment, and related solutions to enhance eco-friendliness and reduce waste. Further, battery as a service (BaaS) concepts are also becoming popular, whereby people are able to replace used batteries for new ones in stations set aside for this, thus reducing idling time.Electric Two-Wheeler Battery Replacement Service Market Leading Players

The key players profiled in the report are Ample Inc., Ather Energy, Bounce, Gogoro, Hero Electric, Honda Motor Co. Ltd., Kymco, Yamaha Motor Co. Ltd.Growth Accelerators

The increasing trend of using electric two-wheelers is one of the major factors propelling the growth of the global electric two-wheeler battery replacement service market. As the threats of air pollution and carbon emissions increase, people are turning away from the readily available gasoline-powered vehicles and rather looking for electric-powered modes of transport. The combination of the affordable prices of electric two-wheelers, government policies encouraging the use of electric transport, and many other factors have to a great extent increased the demand. With the increase in the number of electric two-wheelers on the road, reliable battery replacement services have become very important to ensure that users can keep up with the performance and longevity of their vehicles. Another driver is the fast changeover in battery technology that results in better performance and increased energy density as well as the lifespan of electric vehicle batteries. With constant enhancement, these batteries make the consumer more favorable towards the purchase of wo-wheelers as efficient battery replacement services are provided. This helps the battery replacement and swapping infrastructure to grow, which helps in the development of the market by alleviating battery deterioration and replacement cost issues, thus encouraging the shift towards electric transport.Electric Two-Wheeler Battery Replacement Service Market Segmentation analysis

The Global Electric Two-Wheeler Battery Replacement Service is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Lithium-ion, Nickel Metal Hydride, Lead Acid . The Application segment categorizes the market based on its usage such as Subscription, Pay-per-use, Ownership Exchange. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

In the global electric two-wheeler battery replacement servicing market, the competition is posed by automobile manufacturers, new upcoming companies, and service providers as well. Most of the key players tend to improve their service networks by providing a quick and efficient way of battery replacement while looking after the quality of the batteries. Companies like Ather Energy, Ola Electric, and Hero Electric have invested in infrastructure development and technology, including mobile applications, to provide effective battery replacement services. In addition, there is a revolutionized development regarding battery technology as well as service provision models in the market that include subscription-based services and battery as a service (BaaS) system. These kinds of models enable users to pay for the battery while using it instead of buying it, which increases the affordability of electric two-wheelers to consumers. Most players are also trying to be eco-friendly by encouraging the responsible disposal and recycling of used batteries. As more people adapt electric two-wheelers, the aggressive growth in the market is expected to give rise to competition as players look to invest more in technology, infrastructure, and customer experience to claim a bigger piece of the market.Challenges In Electric Two-Wheeler Battery Replacement Service Market

The international market of electric two-wheeler battery replacement service is faced with various challenges, mostly arising from the exorbitant costs associated with battery technology and the proper replacement batteries. The electric two-wheeler batteries, especially those made of lithium-ion, are often expensive, which in turn makes it upon the consumers to bear replacement costs, which might not be favorable. In addition to this, the market is faced with the challenge of ensuring there is an adequate supply of good-quality batteries as different manufacturers make batteries with different standards and some incompatibility problems. This inconsistency may lead to unintended reliability issues and performance concerns, which makes battery replacement services much more complex for consumers. Another major challenge is the absence of a battery replacement service of standard design and construction. The energy vehicle sector is expanding, but assisting structures like battery swapping stations or even service points are few and far between as compared to fuel refills at gas stations. This type of unavailability may discourage potential consumers from purchasing electric scooters due to the knowledge that an electric two-wheeler battery replacement service may not be easily accessible. These barriers need to be overcome in order to enhance the confidence of the consumers and expand the market for the electric two-wheeler battery replacement service.Risks & Prospects in Electric Two-Wheeler Battery Replacement Service Market

The worldwide market for replacement services for batteries of electric two-wheelers has many chances owing to rising global use of electric vehicles (EVs) and increasing demand for sustainable transportation systems. Along with the increase in the number of electric two-wheelers, the need for effective battery replacement services is also increasing. Market players have the opportunity to tap this trend by innovating built-in battery swapping stations, mobile service units, or efficient priced battery bundles where customers can replace the battery without breaking the bank. This goes a step further into enhancing the user experience as well as addressing issues of battery disposal and recycling. Batteries irrefutably bring the most attractive opportunity. The already long lines of lithium-ion and solid-state batteries are being constructed towards better efficiency and lower environmental impact. With that, the possibilities of developing such services with capabilities that will cater to the new batteries adapted within electric two-wheelers will arouse. In the electric two-wheeler battery replacement service market, businesses will have an opportunity to grow and assist the world as it makes changes towards electric mobility by innovating, ensuring service delivery is high quality, and going green.Key Target Audience

The foremost target group of the global electric two-wheeler battery replacement service market encompasses owners of electric two-wheelers, which includes commuters, delivery riders, and those using them for pleasure. With the growing trend of electric scooter and bike users, these consumers feel the need for easy and dependable battery-changing services to keep their scooters and bikes functioning. This group of people has a high preference to access the services affordably and quickly because service usually involves battery, which is key for their daily movement and business activities.,, Another key audience is that of manufacturers and fleet operators of electric two-wheelers. The trend among the manufacturers has been developing batteries for customers and looking for service providers for battery replacement services. Fleet operators and other active riders who concentrate in activities such as logistics and ride-sharing services are always looking for battery management strategies so that their services do not encounter long downtimes. This segment focusses on service provision that caters for bulk replacement services, prompt servicing, and management of batteries as part of the fleet.Merger and acquisition

The most recent activities in the global market of battery hopping services for electric two-wheelers include a number of M&As that acknowledge the growing focus on sustainable modes of transport as well as the electric vehicle ecosystem level. To illustrate, NIO, an electric vehicle manufacturer, bought out Aulton, a Chinese battery swapping service provider, in a deal that was closed in January 2023. This acquisition was also in line with the expansion goals of Nio’s battery-as-a-service business model, which allows clients to quickly swap out dead batteries for active ones, therefore ensuring less bulk for them and out time for their batteries. And such expansion shows a guess that the battery swap business is being incorporated into other electric mobility services. In another strategic move in battery installation, Gogoro, the battery-swapping company for electric scooters, teamed up with Yamaha in 2023. This collaboration saw Yamaha putting some funds into the batter-swapping experience that is attached to Gogoro’s electric two-wheeled bikes. The two companies are working together in order to optimize the battery swapping services and their availability in the cities in connection with the use of scooters. However, these strategic mergers and alliances underscore the market dynamics within the electric two-wheeler battery swapping services market in the context of the electric mobility revolution, where there is emphasis on efficiency and scalability.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Electric Two-Wheeler Battery Replacement Service- Snapshot

- 2.2 Electric Two-Wheeler Battery Replacement Service- Segment Snapshot

- 2.3 Electric Two-Wheeler Battery Replacement Service- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Electric Two-Wheeler Battery Replacement Service Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Lithium-ion

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Nickel Metal Hydride

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Lead Acid

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

5: Electric Two-Wheeler Battery Replacement Service Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Subscription

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Pay-per-use

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Ownership Exchange

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

6: Electric Two-Wheeler Battery Replacement Service Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 Ample Inc.

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 Ather Energy

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Bounce

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 Gogoro

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Hero Electric

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Honda Motor Co. Ltd.

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Kymco

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 Yamaha Motor Co. Ltd.

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the growth rate of Electric Two-Wheeler Battery Replacement Service Market?

+

-

What are the latest trends influencing the Electric Two-Wheeler Battery Replacement Service Market?

+

-

Who are the key players in the Electric Two-Wheeler Battery Replacement Service Market?

+

-

How is the Electric Two-Wheeler Battery Replacement Service } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Electric Two-Wheeler Battery Replacement Service Market Study?

+

-

What geographic breakdown is available in Global Electric Two-Wheeler Battery Replacement Service Market Study?

+

-

Which region holds the second position by market share in the Electric Two-Wheeler Battery Replacement Service market?

+

-

How are the key players in the Electric Two-Wheeler Battery Replacement Service market targeting growth in the future?

+

-

What are the opportunities for new entrants in the Electric Two-Wheeler Battery Replacement Service market?

+

-

What are the major challenges faced by the Electric Two-Wheeler Battery Replacement Service Market?

+

-