Global Electric Vehicle Battery Reuse and Recycling Market – Industry Trends and Forecast to 2030

Report ID: MS-2111 | Automotive and Transport | Last updated: Dec, 2024 | Formats*:

Electric Vehicle Battery Reuse and Recycling Report Highlights

| Report Metrics | Details |

|---|---|

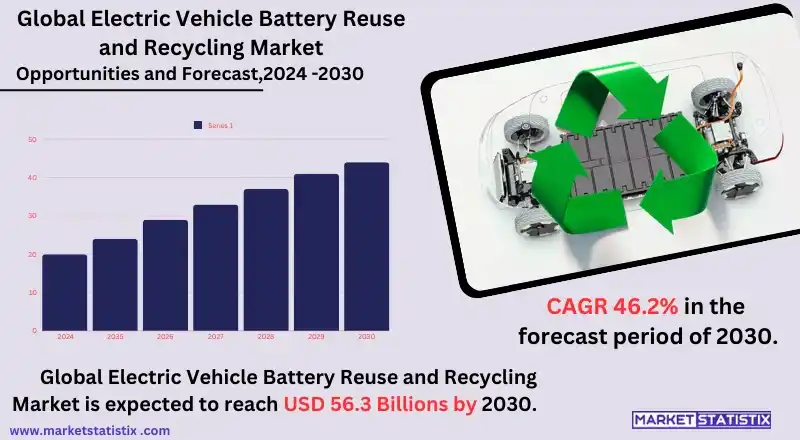

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2023 |

| Growth Rate | CAGR of 46.2% |

| Forecast Value (2030) | USD 56.3 Million |

| Key Market Players |

|

| By Region |

|

Electric Vehicle Battery Reuse and Recycling Market Trends

The battery reuse and recycling for electric vehicles (EVs) market is chiefly fuelled by the rising need for environmentally safe and effective disposal of batteries. Due to the increase in the number of electric vehicles being used across the globe, there is an increased need to tackle the issues brought about by the used batteries. In general, the lifespan of the EV battery in a vehicle is limited to 8 to 10 years, after which the usable storage capacity reduces. Nonetheless, such batteries usually have 70-80% capacity, which makes them fit for second life in many applications, including energy storage, renewable integration, and other markets. The battery reuse segment of the electric vehicle batteries market is also growing due to the increasing demand for applications utilizing second-life batteries. In addition to that, government laws and regulations, as well as initiatives to manage and eliminate e-waste, are key contributors to the market. Most of the governments have introduced regulations and even provided aids for the proper disposal and reprocessing of lithium-ion batteries. Support in the form of grants and financial assistance to battery recycling companies, along with improvement of recycling methods, is gradually making the processes profitable.Electric Vehicle Battery Reuse and Recycling Market Leading Players

The key players profiled in the report are ACCUREC Recycling GmbH (Germany), American Manganese Inc. (Canada), Battery Solutions (US), Recupyl (France), Retriev Technologies (US), Australian Battery Recycling Initiative (Australia), Snam S.p.A. (Italy), Umicore N.V. (Belgium), Li-Cycle Corp. (Canada), G & P Batteries (UK)Growth Accelerators

The EV battery reuse and recycling market is buoyed, perhaps above all, by the great need to implement eco-friendly and efficient disposal strategies. Indeed, the environmental aspect of used batteries is becoming a challenge that needs to be solved with the increased global adoption of EVs. The lifespan of EV batteries is very limited in terms of use in vehicles, as they are designed to last for around 8 to 10 years, after which the storage capacity already starts to dwindle. Nevertheless, on most occasions, these batteries still have about 70-80% of their capacity, thus allowing them to be used for other purposes after their life in a car ceases. This need for second-life battery utilization, especially in energy storage systems and other industries, enhances the reuse segment of the market significantly. Moreover, electronic waste management and greener taxes coupled with policies are some of the powerful forces that are driving the markets. Several nations have instituted battery recycling laws and programs to discourage the proliferation of dangerous lithium-ion batteries in the environment. The last few years have also seen the emergence of serious subsidies and financing for battery recycling businesses as well as better battery recycling technologies that are making the processes cheaper to carry out than before.Electric Vehicle Battery Reuse and Recycling Market Segmentation analysis

The Global Electric Vehicle Battery Reuse and Recycling is segmented by Application, and Region. . The Application segment categorizes the market based on its usage such as Electric Cars, Electric Buses, Energy Storage Systems, Others. Geographically, the market is assessed across key Regions like North America(United States, Canada, Mexico), South America(Brazil, Argentina, Chile, Rest of South America), Europe(Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific(China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA(Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The reuse and recycling economy of electric vehicle batteries is booming with the increase of electric vehicles and the implementations of strict environmental policies. This growth is primarily caused by the escalating need for sustainability and the need to reclaim precious metals like lithium, cobalt, and nickel from used batteries. Also, the governments are enforcing measures regarding the disposal and recycling of EV batteries, which has further propelled the growth of the market and increased investments in recycling technology. This part is concerned with the secondary use of batteries that can no longer be used in vehicles but can still find uses in energy-storing and charging stations. Innovation in recycling and reuse is enhanced by the growing focus towards circular economy and resource efficiency, which has resulted in a situation where old and new firms are racing against each other in the market to expand their market share by investing in advanced technologies and new business alliances.Challenges In Electric Vehicle Battery Reuse and Recycling Market

The market for the reuse and recycling of electric vehicle (EV) batteries presents significant challenges, especially due to the processes involved in recycling lithium-ion batteries, which are elaborate, costly, and difficult to accomplish. In addition, battery recycling demands certain technologies as well as facilities in order to maximize the recovery of battery materials such as lithium, cobalt, and nickel. There exist very high costs on battery plastics recycling processes, outsourcing most of them, making it hard to exploit the economies of scale, especially for the batteries used in electric vehicles, which have various chemistries. In addition to that, the collection and transportation of the batteries also present additional challenges and regulations, since such kinds of batteries require extremely careful handling, and therefore the environmental and safety regulations are strictly adhered to. The other major issue is that there is no single standard for the design of EV batteries, and this hinders recycling. Oftentimes, different manufacturers will use different charge, shapes, and different dimensions of batteries, complicating recycling by automating disassembly. The market for spent batteries for EVs, on the other hand, is still at its infant stage, with very few prospects for the second life of such batteries, such as energy storage for fluctuating renewables.Risks & Prospects in Electric Vehicle Battery Reuse and Recycling Market

The market for the reuse and recycling of EV batteries is at an advantageous stage whereby it is expected to grow considerably owing to the increased acceptance of EVs around the globe and the consequent need to manage EV batteries in an environmentally friendly manner. As more used EVs come into the market, more used lithium-ion batteries, which have lithium, cobalt, nickel, and manganese, which are precious metals in them. There is no sustainable method of recouping these materials, and therefore the need to recycle these batteries is on the increase, as this helps to avoid the dangers presented by mining as well as conserving the endangered resources. Furthermore, there is a potential market related to the secondary use of EV batteries besides recycling. After being used in cars, several EV batteries still possess adequate power for other applications, particularly energy storage systems such as renewables or commercial and residential backup power. This contribution not only aids in the expanded utilization of the battery, but it also ensures an economical solution in the energy storage markets, thereby aiding in the expansion of the renewable energy grids and enhancing energy security. All of these trends present additional opportunities for revenue generation in battery recycling and reuse; hence, making it a highly favourable market for technology developers, recyclers, and energy companies.Key Target Audience

The main demographic that the electric vehicle (EV) battery rebirth and recuperation center concentrates on in the market includes automotive industry players, battery-making companies, and vehicle owners. The automotive manufacturers are more concerned about embracing these practices in order to comply with regulations and attract environmentally friendly consumers. As a result, reuse, and to a lesser extent, recycling of e-waste, allows manufacturers to mitigate their environmental impact by providing previously used batteries with a new purpose and/or recycling precious elements such as lithium, cobalt, and nickel for the production of new batteries. In this respect, EV owners are also important, as their interests are, as in any business, connected with costs, in this case, disposal of the unused batteries inclusive.,, Moreover, not only the consumers and industry stakeholders form the market, as government bodies along with environmental conscience societies take a significant part in the EV battery recycling system. Most notably in the EU and North America, regulation includes standards and regulations that discourage landfilling and virgin material use by encouraging sustainable disposal and reuse of spent batteries. Advocacy organizations promote recycling due to the harmful effects of mining and waste. These audiences contribute to the expansion of the market; thus, the in-vehicle battery pack reuse and recycling have become pivotal for the sustainable development of EVs.Merger and acquisition

There has been a tremendous shift in the occurrence of mergers and acquisitions in the electric vehicle battery reuse and recycling market. This is due to the current market expansion and the emphasis on environmental issues in business all over the world. Major companies, including Umicore, PowerCo, and Li-Cycle Corp, have engaged in several business ventures and strategic alliances in order to increase their levels of recycling operations. In particular, Umicore and PowerCo revealed that they would work together on making precursor materials for batteries and batteries’ recycling strategies. The partnership is expected to make a positive impact in the European market from the year 2025. Regarding the EV battery reuse segment, the market is expected to grow from USD 0.2 billion in 2021 to USD 3.9 billion by 2031. Companies like Neometals and Mercedes-Benz are also establishing joint ventures aimed at building recycling facilities, which shows the trend of convergence in the industry. Recycling as a concept within the electric vehicle battery focus areas is mostly compelled by the emerging requirements of sustainability that are becoming inevitable with the escalation in the number of electric vehicles worldwide and thus the accumulation of waste batteries that need management.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Electric Vehicle Battery Reuse and Recycling- Snapshot

- 2.2 Electric Vehicle Battery Reuse and Recycling- Segment Snapshot

- 2.3 Electric Vehicle Battery Reuse and Recycling- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Electric Vehicle Battery Reuse and Recycling Market by Application / by End Use

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Electric Cars

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Electric Buses

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Energy Storage Systems

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Others

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

5: Electric Vehicle Battery Reuse and Recycling Market by Region

- 5.1 Overview

- 5.1.1 Market size and forecast By Region

- 5.2 North America

- 5.2.1 Key trends and opportunities

- 5.2.2 Market size and forecast, by Type

- 5.2.3 Market size and forecast, by Application

- 5.2.4 Market size and forecast, by country

- 5.2.4.1 United States

- 5.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.2.4.1.2 Market size and forecast, by Type

- 5.2.4.1.3 Market size and forecast, by Application

- 5.2.4.2 Canada

- 5.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.4.2.2 Market size and forecast, by Type

- 5.2.4.2.3 Market size and forecast, by Application

- 5.2.4.3 Mexico

- 5.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 5.2.4.3.2 Market size and forecast, by Type

- 5.2.4.3.3 Market size and forecast, by Application

- 5.2.4.1 United States

- 5.3 South America

- 5.3.1 Key trends and opportunities

- 5.3.2 Market size and forecast, by Type

- 5.3.3 Market size and forecast, by Application

- 5.3.4 Market size and forecast, by country

- 5.3.4.1 Brazil

- 5.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.3.4.1.2 Market size and forecast, by Type

- 5.3.4.1.3 Market size and forecast, by Application

- 5.3.4.2 Argentina

- 5.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.3.4.2.2 Market size and forecast, by Type

- 5.3.4.2.3 Market size and forecast, by Application

- 5.3.4.3 Chile

- 5.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.4.3.2 Market size and forecast, by Type

- 5.3.4.3.3 Market size and forecast, by Application

- 5.3.4.4 Rest of South America

- 5.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 5.3.4.4.2 Market size and forecast, by Type

- 5.3.4.4.3 Market size and forecast, by Application

- 5.3.4.1 Brazil

- 5.4 Europe

- 5.4.1 Key trends and opportunities

- 5.4.2 Market size and forecast, by Type

- 5.4.3 Market size and forecast, by Application

- 5.4.4 Market size and forecast, by country

- 5.4.4.1 Germany

- 5.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.1.2 Market size and forecast, by Type

- 5.4.4.1.3 Market size and forecast, by Application

- 5.4.4.2 France

- 5.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.2.2 Market size and forecast, by Type

- 5.4.4.2.3 Market size and forecast, by Application

- 5.4.4.3 Italy

- 5.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.3.2 Market size and forecast, by Type

- 5.4.4.3.3 Market size and forecast, by Application

- 5.4.4.4 United Kingdom

- 5.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.4.2 Market size and forecast, by Type

- 5.4.4.4.3 Market size and forecast, by Application

- 5.4.4.5 Benelux

- 5.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.5.2 Market size and forecast, by Type

- 5.4.4.5.3 Market size and forecast, by Application

- 5.4.4.6 Nordics

- 5.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.6.2 Market size and forecast, by Type

- 5.4.4.6.3 Market size and forecast, by Application

- 5.4.4.7 Rest of Europe

- 5.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.7.2 Market size and forecast, by Type

- 5.4.4.7.3 Market size and forecast, by Application

- 5.4.4.1 Germany

- 5.5 Asia Pacific

- 5.5.1 Key trends and opportunities

- 5.5.2 Market size and forecast, by Type

- 5.5.3 Market size and forecast, by Application

- 5.5.4 Market size and forecast, by country

- 5.5.4.1 China

- 5.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.1.2 Market size and forecast, by Type

- 5.5.4.1.3 Market size and forecast, by Application

- 5.5.4.2 Japan

- 5.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.2.2 Market size and forecast, by Type

- 5.5.4.2.3 Market size and forecast, by Application

- 5.5.4.3 India

- 5.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.3.2 Market size and forecast, by Type

- 5.5.4.3.3 Market size and forecast, by Application

- 5.5.4.4 South Korea

- 5.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.4.2 Market size and forecast, by Type

- 5.5.4.4.3 Market size and forecast, by Application

- 5.5.4.5 Australia

- 5.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.5.2 Market size and forecast, by Type

- 5.5.4.5.3 Market size and forecast, by Application

- 5.5.4.6 Southeast Asia

- 5.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.6.2 Market size and forecast, by Type

- 5.5.4.6.3 Market size and forecast, by Application

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.7.2 Market size and forecast, by Type

- 5.5.4.7.3 Market size and forecast, by Application

- 5.5.4.1 China

- 5.6 MEA

- 5.6.1 Key trends and opportunities

- 5.6.2 Market size and forecast, by Type

- 5.6.3 Market size and forecast, by Application

- 5.6.4 Market size and forecast, by country

- 5.6.4.1 Middle East

- 5.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.6.4.1.2 Market size and forecast, by Type

- 5.6.4.1.3 Market size and forecast, by Application

- 5.6.4.2 Africa

- 5.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.6.4.2.2 Market size and forecast, by Type

- 5.6.4.2.3 Market size and forecast, by Application

- 5.6.4.1 Middle East

- 6.1 Overview

- 6.2 Key Winning Strategies

- 6.3 Top 10 Players: Product Mapping

- 6.4 Competitive Analysis Dashboard

- 6.5 Market Competition Heatmap

- 6.6 Leading Player Positions, 2022

7: Company Profiles

- 7.1 ACCUREC Recycling GmbH (Germany)

- 7.1.1 Company Overview

- 7.1.2 Key Executives

- 7.1.3 Company snapshot

- 7.1.4 Active Business Divisions

- 7.1.5 Product portfolio

- 7.1.6 Business performance

- 7.1.7 Major Strategic Initiatives and Developments

- 7.2 American Manganese Inc. (Canada)

- 7.2.1 Company Overview

- 7.2.2 Key Executives

- 7.2.3 Company snapshot

- 7.2.4 Active Business Divisions

- 7.2.5 Product portfolio

- 7.2.6 Business performance

- 7.2.7 Major Strategic Initiatives and Developments

- 7.3 Battery Solutions (US)

- 7.3.1 Company Overview

- 7.3.2 Key Executives

- 7.3.3 Company snapshot

- 7.3.4 Active Business Divisions

- 7.3.5 Product portfolio

- 7.3.6 Business performance

- 7.3.7 Major Strategic Initiatives and Developments

- 7.4 Recupyl (France)

- 7.4.1 Company Overview

- 7.4.2 Key Executives

- 7.4.3 Company snapshot

- 7.4.4 Active Business Divisions

- 7.4.5 Product portfolio

- 7.4.6 Business performance

- 7.4.7 Major Strategic Initiatives and Developments

- 7.5 Retriev Technologies (US)

- 7.5.1 Company Overview

- 7.5.2 Key Executives

- 7.5.3 Company snapshot

- 7.5.4 Active Business Divisions

- 7.5.5 Product portfolio

- 7.5.6 Business performance

- 7.5.7 Major Strategic Initiatives and Developments

- 7.6 Australian Battery Recycling Initiative (Australia)

- 7.6.1 Company Overview

- 7.6.2 Key Executives

- 7.6.3 Company snapshot

- 7.6.4 Active Business Divisions

- 7.6.5 Product portfolio

- 7.6.6 Business performance

- 7.6.7 Major Strategic Initiatives and Developments

- 7.7 Snam S.p.A. (Italy)

- 7.7.1 Company Overview

- 7.7.2 Key Executives

- 7.7.3 Company snapshot

- 7.7.4 Active Business Divisions

- 7.7.5 Product portfolio

- 7.7.6 Business performance

- 7.7.7 Major Strategic Initiatives and Developments

- 7.8 Umicore N.V. (Belgium)

- 7.8.1 Company Overview

- 7.8.2 Key Executives

- 7.8.3 Company snapshot

- 7.8.4 Active Business Divisions

- 7.8.5 Product portfolio

- 7.8.6 Business performance

- 7.8.7 Major Strategic Initiatives and Developments

- 7.9 Li-Cycle Corp. (Canada)

- 7.9.1 Company Overview

- 7.9.2 Key Executives

- 7.9.3 Company snapshot

- 7.9.4 Active Business Divisions

- 7.9.5 Product portfolio

- 7.9.6 Business performance

- 7.9.7 Major Strategic Initiatives and Developments

- 7.10 G & P Batteries (UK)

- 7.10.1 Company Overview

- 7.10.2 Key Executives

- 7.10.3 Company snapshot

- 7.10.4 Active Business Divisions

- 7.10.5 Product portfolio

- 7.10.6 Business performance

- 7.10.7 Major Strategic Initiatives and Developments

8: Analyst Perspective and Conclusion

- 8.1 Concluding Recommendations and Analysis

- 8.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Electric Vehicle Battery Reuse and Recycling in 2030?

+

-

How big is the Global Electric Vehicle Battery Reuse and Recycling market?

+

-

How do regulatory policies impact the Electric Vehicle Battery Reuse and Recycling Market?

+

-

What major players in Electric Vehicle Battery Reuse and Recycling Market?

+

-

What applications are categorized in the Electric Vehicle Battery Reuse and Recycling market study?

+

-

Which product types are examined in the Electric Vehicle Battery Reuse and Recycling Market Study?

+

-

Which regions are expected to show the fastest growth in the Electric Vehicle Battery Reuse and Recycling market?

+

-

What are the major growth drivers in the Electric Vehicle Battery Reuse and Recycling market?

+

-

Is the study period of the Electric Vehicle Battery Reuse and Recycling flexible or fixed?

+

-

How do economic factors influence the Electric Vehicle Battery Reuse and Recycling market?

+

-