Global Electric Vehicle Telematics Market Size, Share & Trends Analysis Report, Forecast Period, 2030

Report ID: MS-2108 | Automotive and Transport | Last updated: Dec, 2024 | Formats*:

Electric Vehicle Telematics Report Highlights

| Report Metrics | Details |

|---|---|

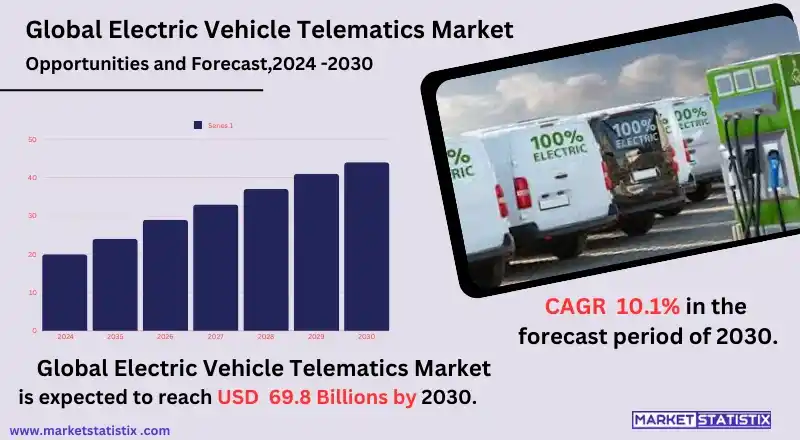

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2023 |

| Growth Rate | CAGR of 10.1% |

| Forecast Value (2030) | USD 69.8 Billion |

| By Product Type | Two Wheelers, Passenger Vehicles, Commercial Vehicles |

| Key Market Players |

|

| By Region |

|

Electric Vehicle Telematics Market Trends

The kick scooter market is registering high growth due to an increased urge for eco-friendly and accessible modes of transportation in cities. Consumers, mainly in metros, are increasingly being guided by the forces of greater urbanisation and traffic conditions to opt for the kick scooter as the fastest and most cost-effective way to travel between short distances. Better and lighter materials for kick scooters and better folding models have made these highly convenient for commuters to use after combining several types of conveyance. Another trend driving the kick scooter market is smart technology, including GPS tracking, app connectivity, and enhanced safety features. To cater to the needs of tech-savvy consumers and make scooters more durable in shared fleets, manufacturers are integrating anti-theft systems, smart locks, and performance monitoring into scooters. This further means that with the awareness of the environment, people are opting for electric kick scooters, which have fewer emissions and less maintenance and can be used individually or by fleet operators searching for environmentally friendly transport modes.Electric Vehicle Telematics Market Leading Players

The key players profiled in the report are TomTom International (Netherlands), Robert Bosch GmbH (Germany), Geotab Inc. (Canada), CSS Electronics (Denmark), Intellicar (India), Inventure Ltd (Hungary), Agero, Inc. (U.S.), Airbiquity, Inc. (U.S.), Continental AG (Germany), Trimble, Inc. (U.S.)Growth Accelerators

As more people are purchasing electric vehicles (EVs) and the need for advanced fleet management systems is on the rise, the electric vehicle telematics market is gaining traction. Given the increasing population of EVs on the streets, telematics allows manufacturers, fleet managers, and even individual drivers to monitor the operational aspects of the vehicle, manage battery life effectively, and collect data for pre-emptive service maintenance. Telematics extends EV effectiveness by enhancing charging patterns, energy use, and driver behaviour, allowing for effective range-based management and lower operational costs, which is key for commercial fleets. From the perspective of authorities, laws and policies further reinforce the market of EV telematics as they attach equal importance to the collection and analysis of data on the operation of the electric vehicles to manage their associated emissions. Government benefits and direct subsidies for using telematics systems motivate fleet operators and individual EV owners even more to install these systems purely for the purposes of safety and compliance. Furthermore, the increasing adoption of connected and driverless cars, as well as the expansion of 5G, gives rise to telematics by facilitating data transfer that is critical for providing real-time operation of electric vehicles.Electric Vehicle Telematics Market Segmentation analysis

The Global Electric Vehicle Telematics is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Two Wheelers, Passenger Vehicles, Commercial Vehicles . The Application segment categorizes the market based on its usage such as Safety & Security, Entertainment, Information & Navigation, Diagnostics, Others. Geographically, the market is assessed across key Regions like North America(United States, Canada, Mexico), South America(Brazil, Argentina, Chile, Rest of South America), Europe(Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific(China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA(Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The expected growth for this market can be attributed mainly to the electric vehicle adoption rate across regions, an effort steered by authorities along with advancement in telematics, which is also focused on real-time information and connectivity to the end user. Forecasts show that the hardware segment is likely to account for the largest share in the coming years. However, battery electric vehicles (BEVs) will experience healthy growth within the vehicle solutions segment. Additional growth is expected from a broader entertainment and navigation services market for connected vehicle solutions. The competitive scenario of the EV telematics market is changing swiftly, with new technologies being introduced daily and more consumers seeking such connected vehicles. There is a global trend by major telematics companies in the adoption of AI, IoT, and incorporation of advanced safety features in their telematics systems to improve their overall interactive performance for their users. The present North American region has a big share of the best telematics systems owing to the advanced automotive sector, and the policies are conducive, while the key growth-contributing region is likely to be Asia Pacific owing to urbanization and policies to control emissions from vehicles.Challenges In Electric Vehicle Telematics Market

The electric vehicles (EV) telematics market presents some notable hurdles, such as data security and privacy issues as well. Telematics systems are designed to gather a certain amount of information in real time on the vehicle's operations, its location, as well as the driver's input, and this can be quite intrusive to the consumer, hence involving enormous risks in data management. As cyberattacks are on the increase, companies should ensure that their telematics systems are watertight for any forms of data readiness and access since some of this information can be sensitive and even damaging to a company’s image. Different markets also demand compliance with different data protection policies, such as the General Data Protection Regulation, which complicates the situation further, especially for firms that do business in several regions. Furthermore, the expensive nature of most advanced telematics features may keep smaller fleet operators and individual users from using such technologies, thus limiting the market growth. It will be important to facilitate interest in EV telematics by ensuring compatibility and offering lower prices to overcome these challenges.Risks & Prospects in Electric Vehicle Telematics Market

The growth of the electric vehicle (EV) telematics market is a good measure of the prospects of the market, owing to the increasing number of electric vehicles and the need for analytics to enhance the performance of the vehicles. Telematics systems fitted in EVs help monitor the battery status, energy used, and other vehicle diagnostics in real time, thus helping fleet operators, insurance companies, and even individual EV users to control and maintain their vehicles better. As more and more companies, which are adopting sustainability and cost-efficient strategies, implement EV fleets, telematics helps improve their operational efficiency by reducing time wastage, ensuring streamlined operations, and scheduling charging periods when it is least busy. The other major opportunity exists in using telematics information for advanced driver assistance systems, predictive maintenance, and other services that focus on location, which are important components of any connected EV. Insurance firms also benefited from EV telematics information as they incorporated the data in the UBI usage vehicle insurance, where rates are adjusted according to the driver’s patterns and how the vehicle is used. In such telematics systems, for instance, data on vehicular movement, energy usage, and pollution levels can be collected by local authorities for effective assessment of road networks and accessibility to support green policies.Key Target Audience

The main target audience for the electric vehicle (EV) telematics market involves, namely, EV manufacturers, individual fleet operators, and individual owners of electric vehicles. EV manufacturers harness the power of telematics systems to augment vehicle performance, predict faults in advance, and give real-time information about the car, its battery levels, and efficiency to enhance user experience. Fleet operators, like delivery services and ridesharing companies, equip their vehicles with telematics systems to check where the vehicles are, how best to route them, and when to charge the vehicles, thereby saving costs and making the operation of the fleet eco-friendlier.,, In addition to these stakeholders, other groups like government agencies, insurance companies, and infrastructure providers are integral in the EV telematics market. Government authorities can also use telematics information for urban development and traffic control as well as for enhancing the installation of EVs. For instance, insurance providers can collect such information to create a new type of insurance policy based on actual usage and not on estimated risk, making the pricing of such policies competitive and appealing to the users of electric cars. These forces put together result in the growing demand for EV-specific telematics solutions, which in turn propels the growth of the market.Merger and acquisition

Current trends in electric vehicle telematics indicate an increase in mergers and acquisitions as players in the industry seek to improve their technological capabilities and to establish their presence in the market. In one of these transactions, in October 2023, Banyan Software Inc. bought LEVL Telematics Limited in a bid to enhance its fleet and telematics solution for electric vehicles. The acquisition of LEVL is in line with Banyan’s goals of addressing changes in the industry and increasing their competitive advantage in a fast-emerging market. Moreover, Bosch Group has also enriched its business area by acquiring Evatronix, especially known for its solutions in EV fleet management systems, to enhance Bosch's offering to vehicle and fleet service providers. Further confirming the trend, strategic alliances are formed, for example, the one between Continental AG and NXP Semiconductors for the purpose of innovating telematics for battery drivers and on-board systems. These alliances are key in order to tap into some of the modern-day technologies, such as artificial intelligence and the Internet of Things, which are important in improving vehicle efficiency and connectivity.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Electric Vehicle Telematics- Snapshot

- 2.2 Electric Vehicle Telematics- Segment Snapshot

- 2.3 Electric Vehicle Telematics- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Electric Vehicle Telematics Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Two Wheelers

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Passenger Vehicles

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Commercial Vehicles

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

5: Electric Vehicle Telematics Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Safety & Security

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Entertainment

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Information & Navigation

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Diagnostics

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Others

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

6: Electric Vehicle Telematics Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 TomTom International (Netherlands)

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 Robert Bosch GmbH (Germany)

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Geotab Inc. (Canada)

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 CSS Electronics (Denmark)

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Intellicar (India)

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Inventure Ltd (Hungary)

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Agero

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 Inc. (U.S.)

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 Airbiquity

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 Inc. (U.S.)

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

- 8.11 Continental AG (Germany)

- 8.11.1 Company Overview

- 8.11.2 Key Executives

- 8.11.3 Company snapshot

- 8.11.4 Active Business Divisions

- 8.11.5 Product portfolio

- 8.11.6 Business performance

- 8.11.7 Major Strategic Initiatives and Developments

- 8.12 Trimble

- 8.12.1 Company Overview

- 8.12.2 Key Executives

- 8.12.3 Company snapshot

- 8.12.4 Active Business Divisions

- 8.12.5 Product portfolio

- 8.12.6 Business performance

- 8.12.7 Major Strategic Initiatives and Developments

- 8.13 Inc. (U.S.)

- 8.13.1 Company Overview

- 8.13.2 Key Executives

- 8.13.3 Company snapshot

- 8.13.4 Active Business Divisions

- 8.13.5 Product portfolio

- 8.13.6 Business performance

- 8.13.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Electric Vehicle Telematics in 2030?

+

-

What is the growth rate of Electric Vehicle Telematics Market?

+

-

What are the latest trends influencing the Electric Vehicle Telematics Market?

+

-

Who are the key players in the Electric Vehicle Telematics Market?

+

-

How is the Electric Vehicle Telematics } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Electric Vehicle Telematics Market Study?

+

-

What geographic breakdown is available in Global Electric Vehicle Telematics Market Study?

+

-

Which region holds the second position by market share in the Electric Vehicle Telematics market?

+

-

How are the key players in the Electric Vehicle Telematics market targeting growth in the future?

+

-

What are the opportunities for new entrants in the Electric Vehicle Telematics market?

+

-