Global Electricity Generation Market - Industry Dynamics, Market Size, And Opportunity Forecast To 2030

Report ID: MS-2197 | Energy and Natural Resources | Last updated: Dec, 2024 | Formats*:

Electricity Generation Report Highlights

| Report Metrics | Details |

|---|---|

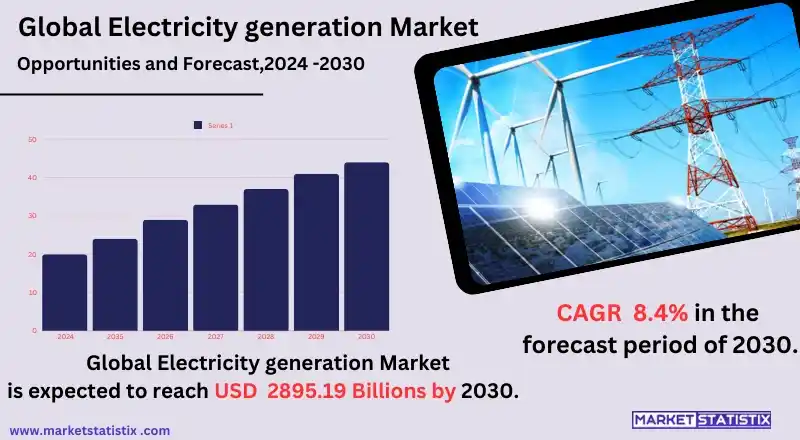

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2023 |

| Growth Rate | CAGR of 8.4% |

| Forecast Value (2030) | USD 2895.19 Billion |

| By Product Type | Hydroelectricity, Fossil Fuel Electricity, Nuclear Electricity, Solar Electricity, Wind Electricity, Geothermal Electricity, Biomass Electricity, Other Electricity |

| Key Market Players |

|

| By Region |

|

Electricity Generation Market Trends

The electricity generation market is driven largely by the global demand for energy, spurred on by the present industrialised state, coupled with the urbanising process and population growth. As countries develop, the demands for electricity increase, and the need for reliable and cheaper electricity becomes paramount, especially in emerging economies. Renewable energy technology development in solar, wind, and hydro has made these options very usable and affordable, thus paving the way towards cleaner, sustainable power generation. The major drivers here include global initiatives to cut carbon emissions and combat climate change. There are policies and incentives by various governments and regulatory bodies for transitioning to renewable energy and improving energy efficiency. Such change is triggering investments in advanced technologies in power generation, such as smart grids, energy storage solutions, and decentralised energy systems, and further fuelling the growth of electricity generation markets.Electricity Generation Market Leading Players

The key players profiled in the report are China Energy Investment Corporation (China), State Grid Corporation of China (China), Engie (France), China Datang Corp (China), Enel (Italy), TEPCO (Japan), EDF Energy (France), KEPCO (South Korea), China Huaneng Group Co Ltd (China), NextEra Energy Inc (U.S.), NTPC Limited (India), Iberdrola (Spain), Kansai Electric Power Company (Japan), Reliance Power (India)Growth Accelerators

The electricity generation market is heavily reliant on global demand for energy that is changing as the world industrialises and urbanises and as populations grow. There is a growing demand for reliable and affordable electricity from developing countries as they advance. The new renewable energy sources, such as solar, wind, and hydro power, have become popular due to great technological advancement in their preparation. These combinations have brought about the much longed-for shift towards cleaner and more sustainable modes of power generation. Other major drivers, also, world commitment is to cut down emissions and tackle climate change. Governments and other regulators are instituting policy measures and incentives to facilitate the transition of energy from renewables and improve energy efficiency. These factors will drive investments into advanced power-generating technologies, for example, smart grids, energy storage solutions, and decentralised energy systems, among others, thereby accelerating progress in the electricity generation market.Electricity Generation Market Segmentation analysis

The Global Electricity Generation is segmented by Type, and Region. By Type, the market is divided into Distributed Hydroelectricity, Fossil Fuel Electricity, Nuclear Electricity, Solar Electricity, Wind Electricity, Geothermal Electricity, Biomass Electricity, Other Electricity . Geographically, the market is assessed across key Regions like North America(United States, Canada, Mexico), South America(Brazil, Argentina, Chile, Rest of South America), Europe(Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific(China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA(Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The competition scenario in the arena of electricity generation involves a mixture of large public enterprises, as well as independent power producers and those inclined towards renewable energy sources. Some large utility companies include General Electric, Siemens, and NextEra Energy, with portfolios that cut across all varieties of traditional fossil fuels, nuclear energy, and renewable sources. The competition is maintained through leverage accorded by government incentives, advanced technologies, and economies of scale. Companies such as Ørsted and First Solar are rapidly increasing their shares of the market by leveraging the global move to clean energy. Again, development in battery storage and smart grid solutions technology will also affect the shape of the market and regional government policy-making, considering energy independence and reduction of carbon emissions, thus making the market highly dynamic and competitive.Challenges In Electricity Generation Market

The electricity generation market has many challenges. One is pollution. Society is increasingly putting pressure on its governments to create tougher laws concerning air and water quality, such that all participants in the energy market should gradually develop their processes towards clean energy generation. The second major challenge is the infrastructure and technology investment required to migrate from fossil fuel electricity generation to solar, wind, and hydroelectric energy sources. Rehabilitation and modification of grid systems should be huge. The next challenge would be in the domain of intermittency caused by renewables, which would further need innovations in energy storage and management of grids for stabilising and securing reliable supply. The escalating "supply chain" and "geopolitical" challenges are other important mountains to cross—these challenges come in the name of raw materials and equipment itself, cost buildup. Moreover, infrastructure is ageing and would appear to be so in many parts of the world; affordability meant when such a case of sustainability would apply. Finally, there would be innovative solutions, enabling policies, and collaborative efforts of stakeholders that should be invoked in the face of these challenges for a resilient and efficient electricity generation market.Risks & Prospects in Electricity Generation Market

In keeping with the growing apprehensions around climate change, there's a lot of increasing demand for clean energy solutions like solar, wind, hydroelectric, and geothermal power. Governments are providing various incentives and subsidies toward investment in renewable energy infrastructures, hence giving opportunities for companies to develop, expand, and diversify their renewable energy portfolios. In addition to this, incredible opportunities for growth are being offered through continued technological advancements in energy storage, grid modernisation, and energy efficiency. Smart grids and battery storage development are vital to improving the reliability and stability of renewable energy generation.Key Target Audience

Utility companies, industrial manufacturers, and government establishments are the main target customers of the electricity generation market. Mostly, electricity generation technologies serve utility companies since they account for electricity generation and supply for residential, commercial, and industrial demand. Industrial manufacturers have a heavy dependency on electricity generation technologies as well, but mainly in energy-intensive sectors such as steel, cement, and chemical production, where a stable, cost-effective power supply is critical.,, Further, renewable energy developers and investors come in as the market's prime movers since there is a need for cleaner and sustainable energy around the world. A major audience would include governments and policymakers, as they would enact regulations, give out subsidies, and invest in the required infrastructure for electricity generation by renewable sources, such as solar, wind, and hydro. Microgrids, or decentralised power systems, also attract end-users. Also, people advocating for their homes in solar installations will come under this market.Merger and acquisition

2024 saw a flurry of activity as far as acquisitions and mergers are concerned in the electricity generation market, with the clear intent of augmenting facilities and increasing portfolios during a significant transition towards cleaner sources of energy. M&A activity in this industry for the first half of 2024 would hence be $105 billion across 234 transactions, notable transactions being the $3.2 billion minority acquisition of Vistra Vision by Vistra. The reason for such impetus is mainly coming from acquisitions, particularly in North America and Europe, for generation and storage assets, with companies adapting to aggressive carbon reduction goals and increased demand for renewable energy solutions. Activity has been particularly brisk regarding solar and offshore wind projects, with solar generation deals alone accounting for $8.2 billion. Permanent renewal of generation assets is also changing market mechanics, thus prompting existing players to resort, in a regime of increasing interest, to mergers and acquisitions that would enhance their competitive edge in front of economic macro-factors. >Analyst Comment

"Electricity generation is a globally important market that serves economies the world over. It includes several energy technologies and sources, such as fossil fuels, nuclear power, and renewable energy. The market is driven by increased energy demand worldwide, combined with urbanisation and industrialization. It continues to undergo transformation with the growing emphasis on sustainability and the reduction of greenhouse gases. This promotes the carrying forward of renewable energy transmission through solar, wind, and hydro power."- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Electricity Generation- Snapshot

- 2.2 Electricity Generation- Segment Snapshot

- 2.3 Electricity Generation- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Electricity Generation Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Hydroelectricity

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Fossil Fuel Electricity

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Nuclear Electricity

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Solar Electricity

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

- 4.6 Wind Electricity

- 4.6.1 Key market trends, factors driving growth, and opportunities

- 4.6.2 Market size and forecast, by region

- 4.6.3 Market share analysis by country

- 4.7 Geothermal Electricity

- 4.7.1 Key market trends, factors driving growth, and opportunities

- 4.7.2 Market size and forecast, by region

- 4.7.3 Market share analysis by country

- 4.8 Biomass Electricity

- 4.8.1 Key market trends, factors driving growth, and opportunities

- 4.8.2 Market size and forecast, by region

- 4.8.3 Market share analysis by country

- 4.9 Other Electricity

- 4.9.1 Key market trends, factors driving growth, and opportunities

- 4.9.2 Market size and forecast, by region

- 4.9.3 Market share analysis by country

5: Electricity Generation Market by End-User

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Industrial

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Commercial

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Residential

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Transportation

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

6: Electricity Generation Market by Source

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 Conventional/Non-Renewable Source

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 Renewable Source

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

7: Electricity Generation Market by Region

- 7.1 Overview

- 7.1.1 Market size and forecast By Region

- 7.2 North America

- 7.2.1 Key trends and opportunities

- 7.2.2 Market size and forecast, by Type

- 7.2.3 Market size and forecast, by Application

- 7.2.4 Market size and forecast, by country

- 7.2.4.1 United States

- 7.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.1.2 Market size and forecast, by Type

- 7.2.4.1.3 Market size and forecast, by Application

- 7.2.4.2 Canada

- 7.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.2.2 Market size and forecast, by Type

- 7.2.4.2.3 Market size and forecast, by Application

- 7.2.4.3 Mexico

- 7.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.3.2 Market size and forecast, by Type

- 7.2.4.3.3 Market size and forecast, by Application

- 7.2.4.1 United States

- 7.3 South America

- 7.3.1 Key trends and opportunities

- 7.3.2 Market size and forecast, by Type

- 7.3.3 Market size and forecast, by Application

- 7.3.4 Market size and forecast, by country

- 7.3.4.1 Brazil

- 7.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.1.2 Market size and forecast, by Type

- 7.3.4.1.3 Market size and forecast, by Application

- 7.3.4.2 Argentina

- 7.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.2.2 Market size and forecast, by Type

- 7.3.4.2.3 Market size and forecast, by Application

- 7.3.4.3 Chile

- 7.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.3.2 Market size and forecast, by Type

- 7.3.4.3.3 Market size and forecast, by Application

- 7.3.4.4 Rest of South America

- 7.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.4.2 Market size and forecast, by Type

- 7.3.4.4.3 Market size and forecast, by Application

- 7.3.4.1 Brazil

- 7.4 Europe

- 7.4.1 Key trends and opportunities

- 7.4.2 Market size and forecast, by Type

- 7.4.3 Market size and forecast, by Application

- 7.4.4 Market size and forecast, by country

- 7.4.4.1 Germany

- 7.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.1.2 Market size and forecast, by Type

- 7.4.4.1.3 Market size and forecast, by Application

- 7.4.4.2 France

- 7.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.2.2 Market size and forecast, by Type

- 7.4.4.2.3 Market size and forecast, by Application

- 7.4.4.3 Italy

- 7.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.3.2 Market size and forecast, by Type

- 7.4.4.3.3 Market size and forecast, by Application

- 7.4.4.4 United Kingdom

- 7.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.4.2 Market size and forecast, by Type

- 7.4.4.4.3 Market size and forecast, by Application

- 7.4.4.5 Benelux

- 7.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.5.2 Market size and forecast, by Type

- 7.4.4.5.3 Market size and forecast, by Application

- 7.4.4.6 Nordics

- 7.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.6.2 Market size and forecast, by Type

- 7.4.4.6.3 Market size and forecast, by Application

- 7.4.4.7 Rest of Europe

- 7.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.7.2 Market size and forecast, by Type

- 7.4.4.7.3 Market size and forecast, by Application

- 7.4.4.1 Germany

- 7.5 Asia Pacific

- 7.5.1 Key trends and opportunities

- 7.5.2 Market size and forecast, by Type

- 7.5.3 Market size and forecast, by Application

- 7.5.4 Market size and forecast, by country

- 7.5.4.1 China

- 7.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.1.2 Market size and forecast, by Type

- 7.5.4.1.3 Market size and forecast, by Application

- 7.5.4.2 Japan

- 7.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.2.2 Market size and forecast, by Type

- 7.5.4.2.3 Market size and forecast, by Application

- 7.5.4.3 India

- 7.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.3.2 Market size and forecast, by Type

- 7.5.4.3.3 Market size and forecast, by Application

- 7.5.4.4 South Korea

- 7.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.4.2 Market size and forecast, by Type

- 7.5.4.4.3 Market size and forecast, by Application

- 7.5.4.5 Australia

- 7.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.5.2 Market size and forecast, by Type

- 7.5.4.5.3 Market size and forecast, by Application

- 7.5.4.6 Southeast Asia

- 7.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.6.2 Market size and forecast, by Type

- 7.5.4.6.3 Market size and forecast, by Application

- 7.5.4.7 Rest of Asia-Pacific

- 7.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.7.2 Market size and forecast, by Type

- 7.5.4.7.3 Market size and forecast, by Application

- 7.5.4.1 China

- 7.6 MEA

- 7.6.1 Key trends and opportunities

- 7.6.2 Market size and forecast, by Type

- 7.6.3 Market size and forecast, by Application

- 7.6.4 Market size and forecast, by country

- 7.6.4.1 Middle East

- 7.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.6.4.1.2 Market size and forecast, by Type

- 7.6.4.1.3 Market size and forecast, by Application

- 7.6.4.2 Africa

- 7.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.6.4.2.2 Market size and forecast, by Type

- 7.6.4.2.3 Market size and forecast, by Application

- 7.6.4.1 Middle East

- 8.1 Overview

- 8.2 Key Winning Strategies

- 8.3 Top 10 Players: Product Mapping

- 8.4 Competitive Analysis Dashboard

- 8.5 Market Competition Heatmap

- 8.6 Leading Player Positions, 2022

9: Company Profiles

- 9.1 China Energy Investment Corporation (China)

- 9.1.1 Company Overview

- 9.1.2 Key Executives

- 9.1.3 Company snapshot

- 9.1.4 Active Business Divisions

- 9.1.5 Product portfolio

- 9.1.6 Business performance

- 9.1.7 Major Strategic Initiatives and Developments

- 9.2 State Grid Corporation of China (China)

- 9.2.1 Company Overview

- 9.2.2 Key Executives

- 9.2.3 Company snapshot

- 9.2.4 Active Business Divisions

- 9.2.5 Product portfolio

- 9.2.6 Business performance

- 9.2.7 Major Strategic Initiatives and Developments

- 9.3 Engie (France)

- 9.3.1 Company Overview

- 9.3.2 Key Executives

- 9.3.3 Company snapshot

- 9.3.4 Active Business Divisions

- 9.3.5 Product portfolio

- 9.3.6 Business performance

- 9.3.7 Major Strategic Initiatives and Developments

- 9.4 China Datang Corp (China)

- 9.4.1 Company Overview

- 9.4.2 Key Executives

- 9.4.3 Company snapshot

- 9.4.4 Active Business Divisions

- 9.4.5 Product portfolio

- 9.4.6 Business performance

- 9.4.7 Major Strategic Initiatives and Developments

- 9.5 Enel (Italy)

- 9.5.1 Company Overview

- 9.5.2 Key Executives

- 9.5.3 Company snapshot

- 9.5.4 Active Business Divisions

- 9.5.5 Product portfolio

- 9.5.6 Business performance

- 9.5.7 Major Strategic Initiatives and Developments

- 9.6 TEPCO (Japan)

- 9.6.1 Company Overview

- 9.6.2 Key Executives

- 9.6.3 Company snapshot

- 9.6.4 Active Business Divisions

- 9.6.5 Product portfolio

- 9.6.6 Business performance

- 9.6.7 Major Strategic Initiatives and Developments

- 9.7 EDF Energy (France)

- 9.7.1 Company Overview

- 9.7.2 Key Executives

- 9.7.3 Company snapshot

- 9.7.4 Active Business Divisions

- 9.7.5 Product portfolio

- 9.7.6 Business performance

- 9.7.7 Major Strategic Initiatives and Developments

- 9.8 KEPCO (South Korea)

- 9.8.1 Company Overview

- 9.8.2 Key Executives

- 9.8.3 Company snapshot

- 9.8.4 Active Business Divisions

- 9.8.5 Product portfolio

- 9.8.6 Business performance

- 9.8.7 Major Strategic Initiatives and Developments

- 9.9 China Huaneng Group Co Ltd (China)

- 9.9.1 Company Overview

- 9.9.2 Key Executives

- 9.9.3 Company snapshot

- 9.9.4 Active Business Divisions

- 9.9.5 Product portfolio

- 9.9.6 Business performance

- 9.9.7 Major Strategic Initiatives and Developments

- 9.10 NextEra Energy Inc (U.S.)

- 9.10.1 Company Overview

- 9.10.2 Key Executives

- 9.10.3 Company snapshot

- 9.10.4 Active Business Divisions

- 9.10.5 Product portfolio

- 9.10.6 Business performance

- 9.10.7 Major Strategic Initiatives and Developments

- 9.11 NTPC Limited (India)

- 9.11.1 Company Overview

- 9.11.2 Key Executives

- 9.11.3 Company snapshot

- 9.11.4 Active Business Divisions

- 9.11.5 Product portfolio

- 9.11.6 Business performance

- 9.11.7 Major Strategic Initiatives and Developments

- 9.12 Iberdrola (Spain)

- 9.12.1 Company Overview

- 9.12.2 Key Executives

- 9.12.3 Company snapshot

- 9.12.4 Active Business Divisions

- 9.12.5 Product portfolio

- 9.12.6 Business performance

- 9.12.7 Major Strategic Initiatives and Developments

- 9.13 Kansai Electric Power Company (Japan)

- 9.13.1 Company Overview

- 9.13.2 Key Executives

- 9.13.3 Company snapshot

- 9.13.4 Active Business Divisions

- 9.13.5 Product portfolio

- 9.13.6 Business performance

- 9.13.7 Major Strategic Initiatives and Developments

- 9.14 Reliance Power (India)

- 9.14.1 Company Overview

- 9.14.2 Key Executives

- 9.14.3 Company snapshot

- 9.14.4 Active Business Divisions

- 9.14.5 Product portfolio

- 9.14.6 Business performance

- 9.14.7 Major Strategic Initiatives and Developments

10: Analyst Perspective and Conclusion

- 10.1 Concluding Recommendations and Analysis

- 10.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By End-User |

|

By Source |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Electricity Generation in 2030?

+

-

How big is the Global Electricity Generation market?

+

-

How do regulatory policies impact the Electricity Generation Market?

+

-

What major players in Electricity Generation Market?

+

-

What applications are categorized in the Electricity Generation market study?

+

-

Which product types are examined in the Electricity Generation Market Study?

+

-

Which regions are expected to show the fastest growth in the Electricity Generation market?

+

-

What are the major growth drivers in the Electricity Generation market?

+

-

Is the study period of the Electricity Generation flexible or fixed?

+

-

How do economic factors influence the Electricity Generation market?

+

-