Global Enterprise Manufacturing Intelligence Market - Industry Dynamics, Market Size, And Opportunity Forecast To 2030

Report ID: MS-989 | IT and Telecom | Last updated: Jun, 2025 | Formats*:

The Enterprise Manufacturing Intelligence (EMI) market refers to software systems and solutions that add, analyse and view manufacturing data from various sources – like machines, sensors, corporate systems and control systems – to provide actionable information for decision-making. EMI platforms turn gross production data into contextualised intelligence, helping manufacturers optimise performance, improve quality, reduce inactivity time, and ensure compliance with operational standards. As Industry 4.0 and intelligent manufacturing initiatives accelerate, EMI tools play a critical role in bridging the gap between plant floor operations and business-level strategies. These systems allow real-time monitoring, historical analysis and predictive insights, enabling manufacturers to boost continuous improvement and improve operational agility in competitive and intensive data.

Enterprise Manufacturing Intelligence Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

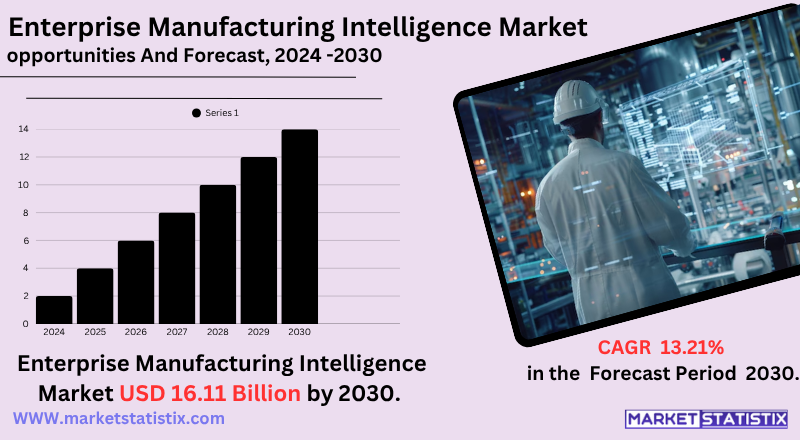

| Growth Rate | CAGR of 13.21% |

| Forecast Value (2030) | USD 16.11 Billion |

| By Product Type | Embedded, Standalone |

| Key Market Players |

|

| By Region |

|

Enterprise Manufacturing Intelligence Market Trends

The Enterprise Manufacturing Intelligence (EMI) market is currently experiencing significant growth, driven by the broad adoption of industry principles 4.0 and the growing demand for real-time visibility in manufacturing operations. Main trends include accelerated integration of artificial intelligence (AI), machine learning (ML) and the Internet of Things (IoT) to enable predictive analysis, improve operational efficiency and improve quality control. There is a strong focus on data-orientated decision-making, with manufacturers leveraging EMI solutions to optimise production processes, reduce inactivity time, and manage more efficiently efficient complex supply chains. The move to cloud-based EMI solutions is also a prominent trend, offering higher scalability and flexibility.

Enterprise Manufacturing Intelligence Market Leading Players

The key players profiled in the report are Schneider Electric SE (France), Dassault Systems SA (France), Honeywell International Inc. (United States), General Electric Co. (United States), Rockwell Automation Inc. (United States), Siemens AG (Germany), Aspen Technology Inc. (United States), Emerson Electric Co. (United States), SAP SE (Germany), Yokogawa Electric Corporation (Japan)Growth Accelerators

- Demand for real-time operational visibility: Manufacturers need instant access to production data to detect inefficiencies and make quick decisions. EMI systems allow live monitoring in operations, improving response capacity.

- AI integration and predictive analysis: Advanced tools now use AI to predict equipment problems before failure. This reduces inactivity time and supports data-orientated maintenance planning.

- Shift Towards Cloud-Based Solutions: Cloud EMI platforms offer scalability and remote access, meeting the needs of global operations and multi-sites. They reduce load and optimise system integration.

Enterprise Manufacturing Intelligence Market Segmentation analysis

The Global Enterprise Manufacturing Intelligence is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Embedded, Standalone . The Application segment categorizes the market based on its usage such as Chemical, Energy & Power, Pharmaceutical, Aerospace & Defense, Food & Beverage, Oil & Gas, Automotive, Medical Devices, Semiconductors & Electronics. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

- Siemens Acquires Altair Engineering: In March 2025, Siemens completed the acquisition of Altair Engineering for approximately $10 billion. This strategic movement enhances Siemens's AI industrial resources, integrating advanced simulation and Altair data science technologies.

- Honeywell Acquires Johnson Matthey's Catalyst Technologies: In May 2025, Honeywell agreed to purchase Johnson Matthey's Catalyst technology business for 1.8 billion pounds. This acquisition expands Honeywell's energy and sustainability segment, allowing it to offer comprehensive solutions for lower emission fuels, including sustainable methanol and aviation fuel.

- DiFACTO Robotics Acquires RoboFinish Division from Grind Master: In May 2025, Difacto Robotics and Automation PVT. Ltd. acquired intellectual property rights related to Grind Master robofinish operations. This acquisition strengthens the slander position in the finishing of the robotic surface, improving your product offerings and market presence.

Challenges In Enterprise Manufacturing Intelligence Market

Manufacturers are increasingly seeking real-time visibility in their operations to increase efficiency, reduce costs and improve quality. This creates a strong demand for EMI solutions that leverage advanced analysis, predictive maintenance and optimised production planning. The increasing complexity of global supply chains and the need for greater resilience also amplify the value of EMI in end-to-end visibility supply and facilitate data-orientated decision-making. In addition, the effort for sustainable manufacturing practices and more rigorous regulatory compliance is leading companies to invest in EMI to monitor environmental impact and ensure adherence to standards.

Risks & Prospects in Enterprise Manufacturing Intelligence Market

Manufacturers are increasingly seeking real-time visibility in their operations to increase efficiency, reduce costs and improve quality. This creates a strong demand for EMI solutions that leverage advanced analysis, predictive maintenance and optimised production planning. The increasing complexity of global supply chains and the need for greater resilience also amplify the value of EMI in end-to-end visibility supply and facilitate data-orientated decision-making. In addition, the effort for sustainable manufacturing practices and more rigorous regulatory compliance is leading companies to invest in EMI to monitor environmental impact and ensure adherence to standards.

Key Target Audience

,

- , , ,

- Siemens Acquires Altair Engineering: In March 2025, Siemens completed the acquisition of Altair Engineering for approximately $10 billion. This strategic movement enhances Siemens's AI industrial resources, integrating advanced simulation and Altair data science technologies.

,

Merger and acquisition

- Siemens Acquires Altair Engineering: In March 2025, Siemens completed the acquisition of Altair Engineering for approximately $10 billion. This strategic movement enhances Siemens's AI industrial resources, integrating advanced simulation and Altair data science technologies.

- Honeywell Acquires Johnson Matthey's Catalyst Technologies: In May 2025, Honeywell agreed to purchase Johnson Matthey's Catalyst technology business for 1.8 billion pounds. This acquisition expands Honeywell's energy and sustainability segment, allowing it to offer comprehensive solutions for lower emission fuels, including sustainable methanol and aviation fuel.

- DiFACTO Robotics Acquires RoboFinish Division from Grind Master: In May 2025, Difacto Robotics and Automation PVT. Ltd. acquired intellectual property rights related to Grind Master robofinish operations. This acquisition strengthens the slander position in the finishing of the robotic surface, improving your product offerings and market presence.

Analyst Comment

Enterprise Manufacturing Intelligence (EMI) market is experiencing significant growth, which is inspired by the growing requirement of operating efficiency in real-time data insights and manufacturing. In 2023, at a price of about 5.18 billion USD, the market is expected to reach USD 16.11 billion by 2032. This surge is fuelled by the widespread adoption of Industry 4.0 principles, including the integration of AI, IoT, and big data analytics, which enable manufacturers to optimise production processes, reduce costs, and enhance decision-making capabilities. North America currently holds a major stake due to the adoption of early technology, while the Asia-Pacific region is ready for adequate growth.

- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Enterprise Manufacturing Intelligence- Snapshot

- 2.2 Enterprise Manufacturing Intelligence- Segment Snapshot

- 2.3 Enterprise Manufacturing Intelligence- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Enterprise Manufacturing Intelligence Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Embedded

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Standalone

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: Enterprise Manufacturing Intelligence Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Chemical

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Energy & Power

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Food & Beverage

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Oil & Gas

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Pharmaceutical

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

- 5.7 Aerospace & Defense

- 5.7.1 Key market trends, factors driving growth, and opportunities

- 5.7.2 Market size and forecast, by region

- 5.7.3 Market share analysis by country

- 5.8 Automotive

- 5.8.1 Key market trends, factors driving growth, and opportunities

- 5.8.2 Market size and forecast, by region

- 5.8.3 Market share analysis by country

- 5.9 Medical Devices

- 5.9.1 Key market trends, factors driving growth, and opportunities

- 5.9.2 Market size and forecast, by region

- 5.9.3 Market share analysis by country

- 5.10 Semiconductors & Electronics

- 5.10.1 Key market trends, factors driving growth, and opportunities

- 5.10.2 Market size and forecast, by region

- 5.10.3 Market share analysis by country

6: Enterprise Manufacturing Intelligence Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 Aspen Technology Inc. (United States)

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 Dassault Systems SA (France)

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Emerson Electric Co. (United States)

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 General Electric Co. (United States)

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Honeywell International Inc. (United States)

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Rockwell Automation Inc. (United States)

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 SAP SE (Germany)

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 Schneider Electric SE (France)

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 Siemens AG (Germany)

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 Yokogawa Electric Corporation (Japan)

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Enterprise Manufacturing Intelligence in 2030?

+

-

Which application type is expected to remain the largest segment in the Global Enterprise Manufacturing Intelligence market?

+

-

How big is the Global Enterprise Manufacturing Intelligence market?

+

-

How do regulatory policies impact the Enterprise Manufacturing Intelligence Market?

+

-

What major players in Enterprise Manufacturing Intelligence Market?

+

-

What applications are categorized in the Enterprise Manufacturing Intelligence market study?

+

-

Which product types are examined in the Enterprise Manufacturing Intelligence Market Study?

+

-

Which regions are expected to show the fastest growth in the Enterprise Manufacturing Intelligence market?

+

-

Which application holds the second-highest market share in the Enterprise Manufacturing Intelligence market?

+

-

What are the major growth drivers in the Enterprise Manufacturing Intelligence market?

+

-

- Demand for real-time operational visibility: Manufacturers need instant access to production data to detect inefficiencies and make quick decisions. EMI systems allow live monitoring in operations, improving response capacity.

- AI integration and predictive analysis: Advanced tools now use AI to predict equipment problems before failure. This reduces inactivity time and supports data-orientated maintenance planning.

- Shift Towards Cloud-Based Solutions: Cloud EMI platforms offer scalability and remote access, meeting the needs of global operations and multi-sites. They reduce load and optimise system integration.