Global EV High-Voltage Power Cable Market Size, Share & Trends Analysis Report, Forecast Period, 2024-2030

Report ID: MS-628 | Electronics and Semiconductors | Last updated: Mar, 2025 | Formats*:

EV High-Voltage Power Cable Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

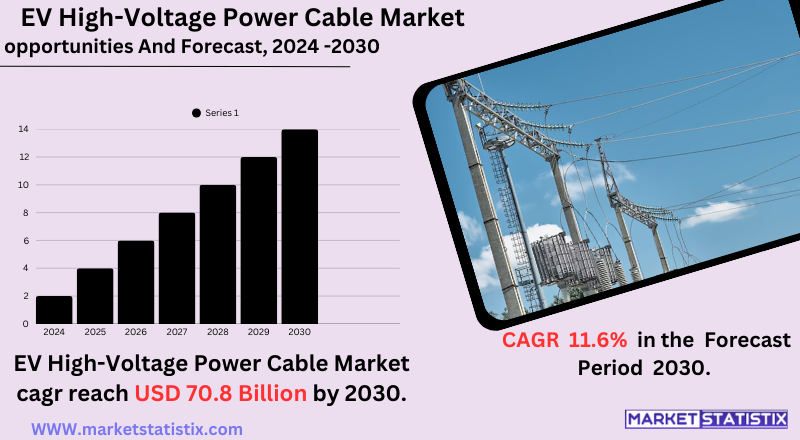

| Growth Rate | CAGR of 11.6% |

| Forecast Value (2030) | USD 70.8 Billion |

| Key Market Players |

|

| By Region |

EV High-Voltage Power Cable Market Trends

The major trends within this market include the design and manufacture of cables that sustain higher voltage levels and can carry more current to support rapid-charging infrastructures. A further trend is lightweight and flexible designs enabling more efficient vehicle application and reduced hassle in installation. Manufacturers are also concentrating on better thermal management and electromagnetic compatibility (EMC) of cables, assuring safety and reliability. The increasing adoption of advanced materials is another trend found in this market, for instance, copper alloys and aluminum, with the intent to optimize conductivity and reduce weight. In addition, one of the modernized aspects attached to the market is sustainability, an increasing demand for recyclable and eco-friendly cable solutions. The smart technologies applied in cables for real-time monitoring and diagnostics are another trend. This makes the market very competitive since all have to put extra effort towards innovating solutions for cost-effectiveness and compliance with all the very stringent requirements.EV High-Voltage Power Cable Market Leading Players

The key players profiled in the report are Jiangnan Group Limited, Tratos, Universal Cables Ltd, General Cable, Brugg Cables, Riyadh Cables Group Company, NKT, Prysmian Group, Schneider Electric, Furukawa Electric Co., Ltd., Nexans, ABB, Synergy Cables, Dubai Cable Company - Ducab, ZTTGrowth Accelerators

Electric mobility is an international phenomenon now sweeping through many countries, thereby providing a primary impetus to the EV High-Voltage Power Cable Market. Stringent environmental laws are in the process of being promulgated by many governments in a bid to cut carbon emissions, hence enhancing consumer awareness of sustainable forms of transport, among these an electric vehicle. As a synthesis of all these factors, demand for high-voltage power cables, which are required for the efficient transfer of energy in conjunction with charging infrastructure for EVs, is growing. Among the ongoing developments being pursued are light, highly efficient, and durable cables capable of handling high voltage and current with increased attributes, which are continuously being enhanced in terms of material, design, and manufacturing processes. Fast charging requires speed-focused cables that also offer huge power-handling capability, which makes industrywide focus on research and development all the more pertinent. The ever-increasing trend of the integration of advanced technologies, smart charging, and autonomous driving requires the most reliable and high-performing power cables, which stimulates market growth further.EV High-Voltage Power Cable Market Segmentation analysis

The Global EV High-Voltage Power Cable is segmented by Application, and Region. . The Application segment categorizes the market based on its usage such as Utility, Industrial. Geographically, the market is assessed across key Regions like {regionNms} and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The EV High-Voltage Power Cable industry is characterized by the presence of established automotive component suppliers and emerging specialized cable producers. With the expansion of the electric vehicle market, competition is rife, with companies trying hard to gain a foothold in the market through technological innovations and alliances. Defining competitive attributes includes cable performance and durability, cost-effectiveness, and the rigorous compliance mandated by automotive AI. Players are spending substantial amounts on research and development to improve cable conductivity, reduce weight, and thermal management—all vital characteristics for optimizing EV efficiency and range.Challenges In EV High-Voltage Power Cable Market

The EV high-voltage power cable market has been expanding rapidly but is facing a lot of challenges. Among them is the most glaring challenge: ever-changing and, at times, limited availability of key raw materials such as copper and aluminum. These are critical in effective power transmission. As a matter of fact, price fluctuations would sometimes affect the cost of production. In addition, this increasing need for these raw materials cuts across a number of industries, leading to supply chain problems. Another major challenge is that these cables must endure very harsh conditions of the environment. These EV cables are experiencing temperature extremes, moisture invasion, and salt debilitation, as well as mechanical stress, which will really cause deterioration of the insulation of the cable and certainly compromise safety and reliability. The advanced materials and manufacturing processes required to accomplish those stringent safety standards, accompanied by durability and standards of performance on those conditions, induce significant complexity and cost to production.Risks & Prospects in EV High-Voltage Power Cable Market

The key opportunities lie in the development of cables that focus on improved thermal management, flexibility, and lightness to meet the growing requirements of advanced EV architectures. An upswing in fast-charging infrastructure will create an additional demand for cables capable of transmitting higher power levels, thus widening the scope for innovative, high-performance solutions. The Asia-Pacific region likely provides the highest growth potential, as the region is leading manufacturing and sales of EVs. China implemented great government initiatives and much investment in EV infrastructure, leading this market. Another great opportunity exists in Europe and North America, where investments in EV production and charging networks are rising. Although there exist unique regulatory and infrastructural challenges in differing regions, a common perspective is the strong outlook for market growth due to the global transition towards electrified vehicles.Key Target Audience

, The prime customers for the EV High-Voltage Power Cable Market are electric vehicle manufacturers, or OEMs, who employ these cables on their vehicle production lines. These OEMs are looking for reliable, high-performance cables that meet stringent safety and quality standards that ensure the operation of their aforementioned EVs, an effective working life. Charging infrastructure providers, on the other hand, adding companies that build, install, and manage public and private charging stations, form an equally important segment. These companies demand heavy-duty cables that meet the requirements of high-power charging and thus would facilitate speedy and safe energy transfer to the EVs., Apart from these, tier-1 industry suppliers also hold an indispensable position in the market. These suppliers provide many components to OEMs and, in most cases, implement cabling systems. Engineering and design firms focused on EV infrastructure development form another key audience since they define cable requirements for different projects. Finally, government bodies and agencies indirectly influence the market by establishing and enacting standards regarding EV safety and infrastructure, which thus also determine specifications regarding high-voltage cables.Merger and acquisition

The EV high-voltage power cable market has seen considerable merger and acquisition (M&A) activities aimed at improving technological competence and strengthening market presence. In May 2022, Aptiv PLC announced its intention to acquire approximately 85% of shares in Intercable Automotive Solutions, a subsidiary of Italy's Intercable, for an estimated USD 605.71 million. This acquisition now allows Aptiv access to advanced high-voltage busbar technology for EVs, ultimately strengthening its foothold in the EV components arena. Intercable Automotive Solutions manufactures high-voltage busbars that can carry much higher electrical power than the conventional cable, with production facilities in Europe and Asia. In another deal in September 2022, Ravicab Cables Private Limited acquired Leoni Cable Solution India Private Limited (LCSI), a wholly-owned subsidiary of Germany's Leoni AG. This acquisition gives Ravicab a platform to increase its market presence and product lines in the EV high-voltage cable segment in line with its growth aspirations in the changing EV infrastructure landscape. These M&A activities indicate a wider industry trend toward consolidation and strategic partnerships to cater to the growing need for efficient and reliable high-voltage power cables in the rapidly expanding EV market. >Analyst Comment

The EV High Voltage Power Cable Market is witnessing dramatic growth owing to the rapid electrification of the automotive sector. Exponential production and sales of electric vehicles are creating a high demand for the strong and dependable high-voltage power cables. The market is characterized by technological advancement for an improved safety performance and efficiency of the cable. Major drivers relate to government restrictions promoting electric mobility, rising consumer awareness toward environmental sustainability, and continued development of battery technology requiring higher voltage and current specifications.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 EV High-Voltage Power Cable- Snapshot

- 2.2 EV High-Voltage Power Cable- Segment Snapshot

- 2.3 EV High-Voltage Power Cable- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: EV High-Voltage Power Cable Market by Application / by End Use

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Utility

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Industrial

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: Competitive Landscape

- 5.1 Overview

- 5.2 Key Winning Strategies

- 5.3 Top 10 Players: Product Mapping

- 5.4 Competitive Analysis Dashboard

- 5.5 Market Competition Heatmap

- 5.6 Leading Player Positions, 2022

6: Company Profiles

- 6.1 Prysmian Group

- 6.1.1 Company Overview

- 6.1.2 Key Executives

- 6.1.3 Company snapshot

- 6.1.4 Active Business Divisions

- 6.1.5 Product portfolio

- 6.1.6 Business performance

- 6.1.7 Major Strategic Initiatives and Developments

- 6.2 Nexans

- 6.2.1 Company Overview

- 6.2.2 Key Executives

- 6.2.3 Company snapshot

- 6.2.4 Active Business Divisions

- 6.2.5 Product portfolio

- 6.2.6 Business performance

- 6.2.7 Major Strategic Initiatives and Developments

- 6.3 General Cable

- 6.3.1 Company Overview

- 6.3.2 Key Executives

- 6.3.3 Company snapshot

- 6.3.4 Active Business Divisions

- 6.3.5 Product portfolio

- 6.3.6 Business performance

- 6.3.7 Major Strategic Initiatives and Developments

- 6.4 NKT

- 6.4.1 Company Overview

- 6.4.2 Key Executives

- 6.4.3 Company snapshot

- 6.4.4 Active Business Divisions

- 6.4.5 Product portfolio

- 6.4.6 Business performance

- 6.4.7 Major Strategic Initiatives and Developments

- 6.5 Furukawa Electric Co.

- 6.5.1 Company Overview

- 6.5.2 Key Executives

- 6.5.3 Company snapshot

- 6.5.4 Active Business Divisions

- 6.5.5 Product portfolio

- 6.5.6 Business performance

- 6.5.7 Major Strategic Initiatives and Developments

- 6.6 Ltd.

- 6.6.1 Company Overview

- 6.6.2 Key Executives

- 6.6.3 Company snapshot

- 6.6.4 Active Business Divisions

- 6.6.5 Product portfolio

- 6.6.6 Business performance

- 6.6.7 Major Strategic Initiatives and Developments

- 6.7 ABB

- 6.7.1 Company Overview

- 6.7.2 Key Executives

- 6.7.3 Company snapshot

- 6.7.4 Active Business Divisions

- 6.7.5 Product portfolio

- 6.7.6 Business performance

- 6.7.7 Major Strategic Initiatives and Developments

- 6.8 Dubai Cable Company - Ducab

- 6.8.1 Company Overview

- 6.8.2 Key Executives

- 6.8.3 Company snapshot

- 6.8.4 Active Business Divisions

- 6.8.5 Product portfolio

- 6.8.6 Business performance

- 6.8.7 Major Strategic Initiatives and Developments

- 6.9 Jiangnan Group Limited

- 6.9.1 Company Overview

- 6.9.2 Key Executives

- 6.9.3 Company snapshot

- 6.9.4 Active Business Divisions

- 6.9.5 Product portfolio

- 6.9.6 Business performance

- 6.9.7 Major Strategic Initiatives and Developments

- 6.10 Schneider Electric

- 6.10.1 Company Overview

- 6.10.2 Key Executives

- 6.10.3 Company snapshot

- 6.10.4 Active Business Divisions

- 6.10.5 Product portfolio

- 6.10.6 Business performance

- 6.10.7 Major Strategic Initiatives and Developments

- 6.11 Tratos

- 6.11.1 Company Overview

- 6.11.2 Key Executives

- 6.11.3 Company snapshot

- 6.11.4 Active Business Divisions

- 6.11.5 Product portfolio

- 6.11.6 Business performance

- 6.11.7 Major Strategic Initiatives and Developments

- 6.12 Universal Cables Ltd

- 6.12.1 Company Overview

- 6.12.2 Key Executives

- 6.12.3 Company snapshot

- 6.12.4 Active Business Divisions

- 6.12.5 Product portfolio

- 6.12.6 Business performance

- 6.12.7 Major Strategic Initiatives and Developments

- 6.13 Brugg Cables

- 6.13.1 Company Overview

- 6.13.2 Key Executives

- 6.13.3 Company snapshot

- 6.13.4 Active Business Divisions

- 6.13.5 Product portfolio

- 6.13.6 Business performance

- 6.13.7 Major Strategic Initiatives and Developments

- 6.14 Riyadh Cables Group Company

- 6.14.1 Company Overview

- 6.14.2 Key Executives

- 6.14.3 Company snapshot

- 6.14.4 Active Business Divisions

- 6.14.5 Product portfolio

- 6.14.6 Business performance

- 6.14.7 Major Strategic Initiatives and Developments

- 6.15 Synergy Cables

- 6.15.1 Company Overview

- 6.15.2 Key Executives

- 6.15.3 Company snapshot

- 6.15.4 Active Business Divisions

- 6.15.5 Product portfolio

- 6.15.6 Business performance

- 6.15.7 Major Strategic Initiatives and Developments

- 6.16 ZTT

- 6.16.1 Company Overview

- 6.16.2 Key Executives

- 6.16.3 Company snapshot

- 6.16.4 Active Business Divisions

- 6.16.5 Product portfolio

- 6.16.6 Business performance

- 6.16.7 Major Strategic Initiatives and Developments

7: Analyst Perspective and Conclusion

- 7.1 Concluding Recommendations and Analysis

- 7.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of EV High-Voltage Power Cable in 2030?

+

-

What is the growth rate of EV High-Voltage Power Cable Market?

+

-

What are the latest trends influencing the EV High-Voltage Power Cable Market?

+

-

Who are the key players in the EV High-Voltage Power Cable Market?

+

-

How is the EV High-Voltage Power Cable } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the EV High-Voltage Power Cable Market Study?

+

-

What geographic breakdown is available in Global EV High-Voltage Power Cable Market Study?

+

-

Which region holds the second position by market share in the EV High-Voltage Power Cable market?

+

-

Which region holds the highest growth rate in the EV High-Voltage Power Cable market?

+

-

How are the key players in the EV High-Voltage Power Cable market targeting growth in the future?

+

-