Global Family Travel Insurance Market – Industry Trends and Forecast to 2030

Report ID: MS-1956 | Healthcare and Pharma | Last updated: Dec, 2024 | Formats*:

Family Travel Insurance Report Highlights

| Report Metrics | Details |

|---|---|

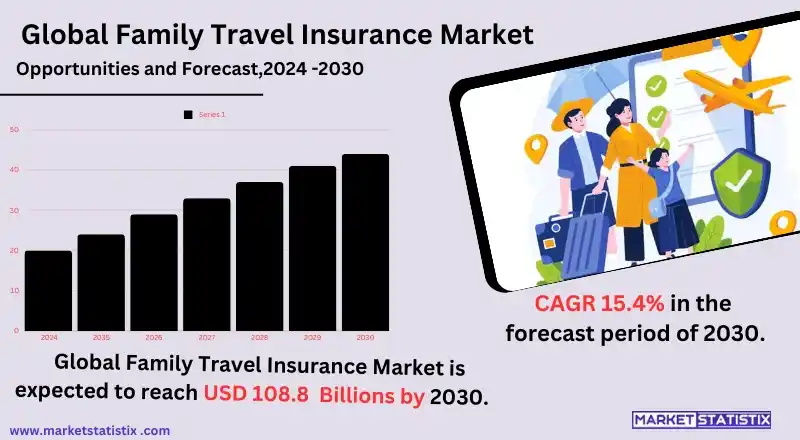

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2023 |

| Growth Rate | CAGR of 15.4% |

| Forecast Value (2030) | USD 108.8 Billion |

| Key Market Players |

|

| By Region |

|

Family Travel Insurance Market Trends

There is an increasing trend in the family travel insurance market as more and more families are aware of and use travel insurance protection due to their worries over issues like travel interruptions and health. Situations like the COVID-19 outbreak have increased the attention given to health and well-being, more so families tend to seek for all-encompassing insurance that covers, medical costs, scheduled trips reversal, and unplanned risks. This is also reinforced by the advancements of online systems which enable families to easily look at companies and their offers and purchase insurances that suit their plans. Moreover, there is also an increasing trend towards the provision of family travel insurance policies that are flexible and that can be tailored to meet the needs of the family. Insurance companies have had to adapt to this trend by introducing family covers that provide a single policy for several travellers, adding benefits like lower rates for children and coverage for extreme sports. This trend is appropriate for the increasing popularity of family packages and the need for insurance services suitable for travel in groups. As travel increases, the emphasis on customer individualization, cost and wider families travel insurance cover is expected to propel the expansion of family travel insurance in the near future.Family Travel Insurance Market Leading Players

The key players profiled in the report are Allianz, American International Group, Inc., AXA, ASSICURAZIONI GENERALI S.P.A., USI Insurance Services, LLC, battleface, Insure & Go Insurance Services Limited, Seven Corners Inc., Travel Insured International, Zurich, Delphi Financial Group, Inc., Ping An Insurance (Group) Company of China, Ltd.Growth Accelerators

The global family travel insurance market is experiencing growth due to an increase in the number of family trips and the growing recognition of the need to undergo travel insurance by consumers. Families are now, more than ever, willing to travel for leisure, educational purposes, and to bond together; thus, they require an all-inclusive cover that would shield them from any occurrences like trip cancellation, medical emergencies, or loss of luggage. Social media and the internet have also fuelled this trend where families’ experiences of travelling get to be viewed by many people, and as a result, a lot of people want to travel but with the assurance of insurance. On the other hand, natural catastrophes, civil unrest, and even the threat of health issues like epidemics have made it commonplace for families to travel insurance. Families are now very careful and looking for insurance that offers cover for them as they travel. In response to these changes within the market, family travel insurance has also been provided to several insurers along with friendly coverage for children and the family as a whole along with adventure activities. This is also a reason why the family travel insurance market is on the rise and widening.Family Travel Insurance Market Segmentation analysis

The Global Family Travel Insurance is segmented by and Region. . Geographically, the market is assessed across key Regions like North America(United States, Canada, Mexico), South America(Brazil, Argentina, Chile, Rest of South America), Europe(Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific(China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA(Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The family travel insurance market on a global scale has a number of players, ranging from traditional insurance companies to start-up financial technology firms. Among the more prominent figures are such recognisable brands as Allianz Global Assistance, AXA Assistance, and Travel Guard, who all provide family travel insurance services that take care of medical emergencies, trip cancellations, or loss of baggage. These firms take advantage of their recognition in the industry, large client base, and customer service-orientated approach in order to gain a sizable proportion of the market. They also tend to offer custom-made packages that appeal to, especially, family units, some of which include children even willing to cover for extra activities like adrenalin sports or family get-togethers. Some of the established players in the market are also under threat from non-traditional firms such as World Nomads and InsureMyTrip, which belong to the digital natives or insurtech. These players are changing the dynamics of the market by introducing easy-to-use internet-based services through which users can review the various policies, buy insurance in a matter of minutes, and even talk to someone through the screen. The introduction of software applications for mobile devices and other digital platforms is improving the experience of customers in the industry and appealing to the young families who are looking for easy insurance products.Challenges In Family Travel Insurance Market

The worldwide family travel insurance market also has its obstacles, with those relating to competition and market growth rate being the key considerations. The moment the new players invade the market, it becomes tougher to separate the products and come up with unique selling propositions. At this saturation level, competition leads to price wars, which tend to discourage the premium rates charged and may affect the coverage quality and customer service standards. In addition, many options may be presented for the consumers, causing confusion and making it hard for the families to know the right insurance they need according to their requirements. Another challenge arises from the inconsistency in regulations in various regions, which affects policies and compliance. Local differentials in guidelines may baffle the insurers and the families since the families may have to deal with different offered coverage and its limitations according to the destination.Risks & Prospects in Family Travel Insurance Market

With the increasing tendencies of family trips undertaken and the understanding of the need for insuring travel, there are great opportunities existing in the global family travel insurance market. As more and more families aim at visiting different places at the same time, there has been an upsurge in the demand for all-round coverage. This is an opening for the insurance companies to give offers that are composed of features that assess the need for a family, such as the case of insuring more than one person normally, covering child benefits, and engaging in activities that are only suitable for the families. As health problems, trip cancellations, and other forms of interruption that affect travel are becoming more common in the population, there is no travel out there without travel insurance. Moreover, the insurance services in the modern world undergo fast changes due to advancements in technology, thereby creating more horizons in the family travel insurance market. Since the development of the web and high-tech mobile software, purchasing travel insurance has been made easy for many users. They can also be able to customise products and services to client’s needs, assist clients during trips, and perform proper marketing through their mobile phones and the internet. These possibilities will enable the travel insurers to enjoy more of the growing family travel insurance market shareKey Target Audience

The primary target audience of the global family travel insurance market is represented by families wishing to go on holidays or trips, especially those with kids. These users are typically concerned about risks associated with travelling, whether they be health concerns, trip cancellations, or loss of personal belongings. Therefore, they tend to purchase fully comprehensive travel insurance, which includes medical and trip interruption coverage, in addition to provision for children travelling with the family. This category of consumers prefers hassle-free experiences while travelling, thus would be more inclined to buy insurance products that are more flexible and have features intended for children.,, The other significant audience embraced are travel agents, tour operators, and online organisations that specialise in families traveling. These agencies have no trouble offering travel insurance to their clients and even make it a requirement for members in order to enhance the travel services offered to them. Also, providing family travel insurance assists in maintaining the positive image of clients, which is useful when more affordable family holidays are sought in the future. This combination of audiences creates both the necessity and the motivating force for expanding family travel insurance provisions.Merger and acquisition

At the global level, the family travel insurance sector has witnessed a recent history of mergers and acquisitions, which is in line with the trend of consolidation where companies aim to increase their product lines and market access. Issuer Travel Guard was acquired by Allianz Partners, one of the largest travel insurance operators, at the beginning of 2024. This was done with the aim of enhancing their family travel business. The acquisition of Travel Guard by Allianz enabled them to utilise Travel Guard‘s family-centric offerings and consumer intelligence, thus improving their family travel market and services. In another example of strategic logic before engagement, InsureMyTrip, an online travel insurance provider, announced a merger with World Nomads, a company that targets families with children who are slightly adventurous in nature. This was intended to help build a more holistic travel insurance cover that incorporates various travel insurance products for families. Due to the merger, these two companies will be able to offer better customer service, faster order fulfilment, and a wider range of options, including insurance plans specifically for families, that are driving the growth of this market- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Family Travel Insurance- Snapshot

- 2.2 Family Travel Insurance- Segment Snapshot

- 2.3 Family Travel Insurance- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Family Travel Insurance Market by End-users

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Senior Citizens

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Education Travelers

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Business Travelers

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Family Travelers

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

- 4.6 Others

- 4.6.1 Key market trends, factors driving growth, and opportunities

- 4.6.2 Market size and forecast, by region

- 4.6.3 Market share analysis by country

5: Family Travel Insurance Market by Region

- 5.1 Overview

- 5.1.1 Market size and forecast By Region

- 5.2 North America

- 5.2.1 Key trends and opportunities

- 5.2.2 Market size and forecast, by Type

- 5.2.3 Market size and forecast, by Application

- 5.2.4 Market size and forecast, by country

- 5.2.4.1 United States

- 5.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.2.4.1.2 Market size and forecast, by Type

- 5.2.4.1.3 Market size and forecast, by Application

- 5.2.4.2 Canada

- 5.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.4.2.2 Market size and forecast, by Type

- 5.2.4.2.3 Market size and forecast, by Application

- 5.2.4.3 Mexico

- 5.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 5.2.4.3.2 Market size and forecast, by Type

- 5.2.4.3.3 Market size and forecast, by Application

- 5.2.4.1 United States

- 5.3 South America

- 5.3.1 Key trends and opportunities

- 5.3.2 Market size and forecast, by Type

- 5.3.3 Market size and forecast, by Application

- 5.3.4 Market size and forecast, by country

- 5.3.4.1 Brazil

- 5.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.3.4.1.2 Market size and forecast, by Type

- 5.3.4.1.3 Market size and forecast, by Application

- 5.3.4.2 Argentina

- 5.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.3.4.2.2 Market size and forecast, by Type

- 5.3.4.2.3 Market size and forecast, by Application

- 5.3.4.3 Chile

- 5.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.4.3.2 Market size and forecast, by Type

- 5.3.4.3.3 Market size and forecast, by Application

- 5.3.4.4 Rest of South America

- 5.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 5.3.4.4.2 Market size and forecast, by Type

- 5.3.4.4.3 Market size and forecast, by Application

- 5.3.4.1 Brazil

- 5.4 Europe

- 5.4.1 Key trends and opportunities

- 5.4.2 Market size and forecast, by Type

- 5.4.3 Market size and forecast, by Application

- 5.4.4 Market size and forecast, by country

- 5.4.4.1 Germany

- 5.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.1.2 Market size and forecast, by Type

- 5.4.4.1.3 Market size and forecast, by Application

- 5.4.4.2 France

- 5.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.2.2 Market size and forecast, by Type

- 5.4.4.2.3 Market size and forecast, by Application

- 5.4.4.3 Italy

- 5.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.3.2 Market size and forecast, by Type

- 5.4.4.3.3 Market size and forecast, by Application

- 5.4.4.4 United Kingdom

- 5.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.4.2 Market size and forecast, by Type

- 5.4.4.4.3 Market size and forecast, by Application

- 5.4.4.5 Benelux

- 5.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.5.2 Market size and forecast, by Type

- 5.4.4.5.3 Market size and forecast, by Application

- 5.4.4.6 Nordics

- 5.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.6.2 Market size and forecast, by Type

- 5.4.4.6.3 Market size and forecast, by Application

- 5.4.4.7 Rest of Europe

- 5.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 5.4.4.7.2 Market size and forecast, by Type

- 5.4.4.7.3 Market size and forecast, by Application

- 5.4.4.1 Germany

- 5.5 Asia Pacific

- 5.5.1 Key trends and opportunities

- 5.5.2 Market size and forecast, by Type

- 5.5.3 Market size and forecast, by Application

- 5.5.4 Market size and forecast, by country

- 5.5.4.1 China

- 5.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.1.2 Market size and forecast, by Type

- 5.5.4.1.3 Market size and forecast, by Application

- 5.5.4.2 Japan

- 5.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.2.2 Market size and forecast, by Type

- 5.5.4.2.3 Market size and forecast, by Application

- 5.5.4.3 India

- 5.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.3.2 Market size and forecast, by Type

- 5.5.4.3.3 Market size and forecast, by Application

- 5.5.4.4 South Korea

- 5.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.4.2 Market size and forecast, by Type

- 5.5.4.4.3 Market size and forecast, by Application

- 5.5.4.5 Australia

- 5.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.5.2 Market size and forecast, by Type

- 5.5.4.5.3 Market size and forecast, by Application

- 5.5.4.6 Southeast Asia

- 5.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.6.2 Market size and forecast, by Type

- 5.5.4.6.3 Market size and forecast, by Application

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 5.5.4.7.2 Market size and forecast, by Type

- 5.5.4.7.3 Market size and forecast, by Application

- 5.5.4.1 China

- 5.6 MEA

- 5.6.1 Key trends and opportunities

- 5.6.2 Market size and forecast, by Type

- 5.6.3 Market size and forecast, by Application

- 5.6.4 Market size and forecast, by country

- 5.6.4.1 Middle East

- 5.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 5.6.4.1.2 Market size and forecast, by Type

- 5.6.4.1.3 Market size and forecast, by Application

- 5.6.4.2 Africa

- 5.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 5.6.4.2.2 Market size and forecast, by Type

- 5.6.4.2.3 Market size and forecast, by Application

- 5.6.4.1 Middle East

- 6.1 Overview

- 6.2 Key Winning Strategies

- 6.3 Top 10 Players: Product Mapping

- 6.4 Competitive Analysis Dashboard

- 6.5 Market Competition Heatmap

- 6.6 Leading Player Positions, 2022

7: Company Profiles

- 7.1 Allianz

- 7.1.1 Company Overview

- 7.1.2 Key Executives

- 7.1.3 Company snapshot

- 7.1.4 Active Business Divisions

- 7.1.5 Product portfolio

- 7.1.6 Business performance

- 7.1.7 Major Strategic Initiatives and Developments

- 7.2 American International Group

- 7.2.1 Company Overview

- 7.2.2 Key Executives

- 7.2.3 Company snapshot

- 7.2.4 Active Business Divisions

- 7.2.5 Product portfolio

- 7.2.6 Business performance

- 7.2.7 Major Strategic Initiatives and Developments

- 7.3 Inc.

- 7.3.1 Company Overview

- 7.3.2 Key Executives

- 7.3.3 Company snapshot

- 7.3.4 Active Business Divisions

- 7.3.5 Product portfolio

- 7.3.6 Business performance

- 7.3.7 Major Strategic Initiatives and Developments

- 7.4 AXA

- 7.4.1 Company Overview

- 7.4.2 Key Executives

- 7.4.3 Company snapshot

- 7.4.4 Active Business Divisions

- 7.4.5 Product portfolio

- 7.4.6 Business performance

- 7.4.7 Major Strategic Initiatives and Developments

- 7.5 ASSICURAZIONI GENERALI S.P.A.

- 7.5.1 Company Overview

- 7.5.2 Key Executives

- 7.5.3 Company snapshot

- 7.5.4 Active Business Divisions

- 7.5.5 Product portfolio

- 7.5.6 Business performance

- 7.5.7 Major Strategic Initiatives and Developments

- 7.6 USI Insurance Services

- 7.6.1 Company Overview

- 7.6.2 Key Executives

- 7.6.3 Company snapshot

- 7.6.4 Active Business Divisions

- 7.6.5 Product portfolio

- 7.6.6 Business performance

- 7.6.7 Major Strategic Initiatives and Developments

- 7.7 LLC

- 7.7.1 Company Overview

- 7.7.2 Key Executives

- 7.7.3 Company snapshot

- 7.7.4 Active Business Divisions

- 7.7.5 Product portfolio

- 7.7.6 Business performance

- 7.7.7 Major Strategic Initiatives and Developments

- 7.8 battleface

- 7.8.1 Company Overview

- 7.8.2 Key Executives

- 7.8.3 Company snapshot

- 7.8.4 Active Business Divisions

- 7.8.5 Product portfolio

- 7.8.6 Business performance

- 7.8.7 Major Strategic Initiatives and Developments

- 7.9 Insure & Go Insurance Services Limited

- 7.9.1 Company Overview

- 7.9.2 Key Executives

- 7.9.3 Company snapshot

- 7.9.4 Active Business Divisions

- 7.9.5 Product portfolio

- 7.9.6 Business performance

- 7.9.7 Major Strategic Initiatives and Developments

- 7.10 Seven Corners Inc.

- 7.10.1 Company Overview

- 7.10.2 Key Executives

- 7.10.3 Company snapshot

- 7.10.4 Active Business Divisions

- 7.10.5 Product portfolio

- 7.10.6 Business performance

- 7.10.7 Major Strategic Initiatives and Developments

- 7.11 Travel Insured International

- 7.11.1 Company Overview

- 7.11.2 Key Executives

- 7.11.3 Company snapshot

- 7.11.4 Active Business Divisions

- 7.11.5 Product portfolio

- 7.11.6 Business performance

- 7.11.7 Major Strategic Initiatives and Developments

- 7.12 Zurich

- 7.12.1 Company Overview

- 7.12.2 Key Executives

- 7.12.3 Company snapshot

- 7.12.4 Active Business Divisions

- 7.12.5 Product portfolio

- 7.12.6 Business performance

- 7.12.7 Major Strategic Initiatives and Developments

- 7.13 Delphi Financial Group

- 7.13.1 Company Overview

- 7.13.2 Key Executives

- 7.13.3 Company snapshot

- 7.13.4 Active Business Divisions

- 7.13.5 Product portfolio

- 7.13.6 Business performance

- 7.13.7 Major Strategic Initiatives and Developments

- 7.14 Inc.

- 7.14.1 Company Overview

- 7.14.2 Key Executives

- 7.14.3 Company snapshot

- 7.14.4 Active Business Divisions

- 7.14.5 Product portfolio

- 7.14.6 Business performance

- 7.14.7 Major Strategic Initiatives and Developments

- 7.15 Ping An Insurance (Group) Company of China

- 7.15.1 Company Overview

- 7.15.2 Key Executives

- 7.15.3 Company snapshot

- 7.15.4 Active Business Divisions

- 7.15.5 Product portfolio

- 7.15.6 Business performance

- 7.15.7 Major Strategic Initiatives and Developments

- 7.16 Ltd.

- 7.16.1 Company Overview

- 7.16.2 Key Executives

- 7.16.3 Company snapshot

- 7.16.4 Active Business Divisions

- 7.16.5 Product portfolio

- 7.16.6 Business performance

- 7.16.7 Major Strategic Initiatives and Developments

8: Analyst Perspective and Conclusion

- 8.1 Concluding Recommendations and Analysis

- 8.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By End-users |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Family Travel Insurance in 2030?

+

-

What is the growth rate of Family Travel Insurance Market?

+

-

What are the latest trends influencing the Family Travel Insurance Market?

+

-

Who are the key players in the Family Travel Insurance Market?

+

-

How is the Family Travel Insurance } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Family Travel Insurance Market Study?

+

-

What geographic breakdown is available in Global Family Travel Insurance Market Study?

+

-

Which region holds the second position by market share in the Family Travel Insurance market?

+

-

How are the key players in the Family Travel Insurance market targeting growth in the future?

+

-

What are the opportunities for new entrants in the Family Travel Insurance market?

+

-