Global Genetic Engineering Market – Industry Trends and Forecast to 2030

Report ID: MS-193 | Business finance | Last updated: Dec, 2024 | Formats*:

Genetic Engineering Report Highlights

| Report Metrics | Details |

|---|---|

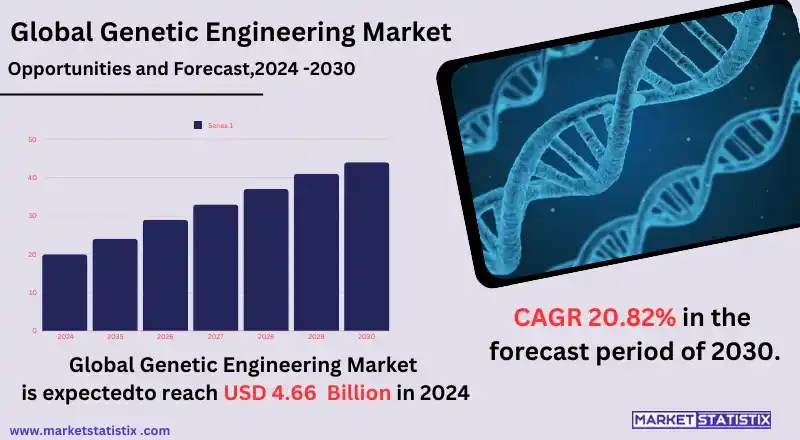

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2023 |

| Growth Rate | CAGR of 24.21% |

| Forecast Value (2030) | USD 7.59 Billion |

| By Product Type | Biochemical, Genetic Markers |

| Key Market Players | Thermo Fisher Scientific Inc. (United States), Illumina, Inc. (United States), CRISPR Therapeutics AG (Switzerland), Merck KGaA (Germany), Lonza Group Ltd. (Switzerland), Genscript Biotech Corporation (China), Qiagen N.V. (Netherlands), Agilent Technologies, Inc. (United States), F. Hoffmann-La Roche Ltd (Switzerland), Novartis International AG (Switzerland). Additionally, other players that are part of this detailed analysis are Editas Medicine, Inc. (United States), Sangamo Therapeutics, Inc. (United States), Bio-Rad Laboratories, Inc. (United States) |

| By Region |

Genetic Engineering Market Trends

The market of genetic engineering has been on its way to growing at a very high rate due to the developments made in CRISPR technology and other gene-editing techniques that have highly revolutionised research in and therapeutic applications. These have enabled modifications in employed precision on DNA and breakthroughs in agriculture, medicine, and biotechnology. Increased adoption of genetically modified crops that are now on the market and have improved pest, drought, and disease resistance traits and development are driving growth of the market in the agriculture sector. In addition to this, gene therapies for curing genetic diseases and cancers are rapidly developing in the market within the healthcare sector. Another trend is the rapid rise in synthetic biology use. Genetic engineering purposes and applications towards bio-based solutions with various industries, mostly into chemicals, fuels, and drugs. As well as rising themes in eco-friendly and sustainable causes, such as engineered microorganisms for waste management and bioremediation, have further led the market to ignite.Genetic Engineering Market Leading Players

The key players profiled in the report are Thermo Fisher Scientific Inc. (United States), Illumina, Inc. (United States), CRISPR Therapeutics AG (Switzerland), Merck KGaA (Germany), Lonza Group Ltd. (Switzerland), Genscript Biotech Corporation (China), Qiagen N.V. (Netherlands), Agilent Technologies, Inc. (United States), F. Hoffmann-La Roche Ltd (Switzerland), Novartis International AG (Switzerland). Additionally, other players that are part of this detailed analysis are Editas Medicine, Inc. (United States), Sangamo Therapeutics, Inc. (United States), Bio-Rad Laboratories, Inc. (United States)Growth Accelerators

The main driver of the genetic engineering market is the ever-increasing demand for high-end agricultural solutions. As the world's population grows, there comes a demand for genetically modified crops that are more resistant to pests, diseases, and environmental stresses, as well as those enhanced by an improved nutritional profile, to meet the needs for higher yield, without which food security and climate change impact mitigation and resource scarcity challenges cannot be addressed. Other drivers include rapid advances in gene therapies and the field of biopharmaceuticals. This genetic engineering goes a long way in delivering treatments for genetic disorders, cancer, and chronic diseases by modifying genes to correct mutations or improve immune responses. All of these encourage further growth in investments toward biotechnology research and development as regulatory approvals for genetic-based therapies continue to increase.Genetic Engineering Market Segmentation analysis

The Global Genetic Engineering is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Biochemical, Genetic Markers . The Application segment categorizes the market based on its usage such as Cereals and Grains, Oilseeds and Pulses, Fruits and Vegetables, Sugar Crops, Ornamentals, Alfalfa. Geographically, the market is assessed across key Regions like {regionNms} and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

Overall, in the arena of mergers and acquisitions, genetic engineering is slowly climbing in both deal values and strategic alliances. In the year 2023, approximately $122.2 billion was spent on biotech mergers and acquisitions, an increase of 45% from the previous year's value. High interests in novel methods of genome editing, such as CRISPR and base editing techniques, are seen to be responsible for the large surge. Apart from the acquisition of technologies, companies are beginning to collaborate to improve their research competencies and increase the speed of product development, which suggests that this sector will keep growing into a robust health engineering market in the future.Challenges In Genetic Engineering Market

The genetic engineering market sees challenges in terms of regulatory obstacles and ethics. Regulatory policies on genetic modification vary widely from country to country, causing confusion about the approval process and leaving the marketplace in uncertainty. These differences in regulatory aspects discourage companies from innovating and investing in genetic engineering development as they must navigate the complex legal system. They have to further face high costs attached to research and development, which restricts accessibility and scalability to many firms, especially start-ups. The cost of developing advanced tools and skills associated with genetic engineering is prohibitively expensive and involves immense financial loss in early trial tests. And these would mean a slower adoption of the market-expensive investment required to ensure implementation and spread.Risks & Prospects in Genetic Engineering Market

Genetic engineering is a significant opportunity tool in agriculture, mostly in the form of GM crops, which have the potential to stay disease- and pest-free as well as to suffer little stress due to the environment. It is thought that the technology would at some point contribute toward alleviating food insecurity that, in turn, would boost crop yield, improve nutritional value, and reduce the dependence on chemical pesticides. The growing population demand pushes agriculture to more productivity and sustainability; thus, genetic engineering is portrayed as an instrument that meets these demands. In healthcare and biopharmaceuticals, genetic engineering can change the arenas through which gene therapy and personalised medicine can reach people and through which biopharmaceuticals can be produced. Advances in CRISPR and other gene-editing technologies have blasted open new frontiers for the treatment of genetic disorders and targeted therapies for complex diseases like cancer. Moreover, the technology can be used to engineer vaccines, antibodies, and other therapeutic proteins, thereby creating an area for growth in both established and emerging biotechnology and healthcare markets.Key Target Audience

Thus, biotechnology companies adopt it as part of developing innovative products related to agriculture, environmental management, and health, mainly, for example, by producing GM crops, biofuels, and therapeutic proteins. Genetic engineering also forms the backbone of drug discovery, vaccines, and gene therapies in the pharmaceutical industry. Consequently, companies in the pharmaceutical industry have engaged in genetic modification for the improvement of personalised medicine, efficacy of treatment, and breakthroughs in biologics.Merger and acquisition

Notably, the market for genetic engineering has seen several mergers and acquisitions driven by the growing demand for advanced genetic technologies and therapies. WuXi AppTec announced the acquisition of OXGENE in March 2023, thus improving its capabilities in developing cell and gene therapy solutions. This is very important to the purpose of advancing genetic engineering applications. Ensoma completed the acquisition of Twelve Bio, a company that specialises in CRISPR-based gene editing solutions, in February 2023. This acquisition is part of a larger trend whereby drug companies are moving fast towards announcing further lines of therapy by acquiring specialised innovative genetic engineering companies. The importance of gene editing in developing therapeutics is increasingly becoming apparent. >Analyst Comment

"The entire market of genetic engineering is growing beyond imagination due to the rapidly advancing biotechnology as well as the increasingly promising scope of application in various sectors. This technology seems to bring solutions to global problems such as food security, health care, and environmental sustainability. Major drivers for growth in the genetic engineering market include the increasing adoption of genetically modified crops, novel therapeutic approaches established on gene editing, and growing applications of genetic engineering in industrial biotechnology. Research and development in this field are continued to be cited among key drivers for the market growth."- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Genetic Engineering- Snapshot

- 2.2 Genetic Engineering- Segment Snapshot

- 2.3 Genetic Engineering- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Genetic Engineering Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Biochemical

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Genetic Markers

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: Genetic Engineering Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Cereals and Grains

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Oilseeds and Pulses

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Fruits and Vegetables

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Sugar Crops

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Ornamentals

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

- 5.7 Alfalfa

- 5.7.1 Key market trends, factors driving growth, and opportunities

- 5.7.2 Market size and forecast, by region

- 5.7.3 Market share analysis by country

6: Genetic Engineering Market by Techniques

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 Gene Splicing

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 Artificial Selection

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

- 6.4 Recombinant DNA Technology

- 6.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.2 Market size and forecast, by region

- 6.4.3 Market share analysis by country

- 6.5 Synthesizing DNA

- 6.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.2 Market size and forecast, by region

- 6.5.3 Market share analysis by country

- 6.6 Gene Editing

- 6.6.1 Key market trends, factors driving growth, and opportunities

- 6.6.2 Market size and forecast, by region

- 6.6.3 Market share analysis by country

- 6.7 Other

- 6.7.1 Key market trends, factors driving growth, and opportunities

- 6.7.2 Market size and forecast, by region

- 6.7.3 Market share analysis by country

7: Competitive Landscape

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 Thermo Fisher Scientific Inc. (United States)

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 Illumina

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Inc. (United States)

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 CRISPR Therapeutics AG (Switzerland)

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Merck KGaA (Germany)

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Lonza Group Ltd. (Switzerland)

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Genscript Biotech Corporation (China)

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 Qiagen N.V. (Netherlands)

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 Agilent Technologies

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 Inc. (United States)

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

- 8.11 F. Hoffmann-La Roche Ltd (Switzerland)

- 8.11.1 Company Overview

- 8.11.2 Key Executives

- 8.11.3 Company snapshot

- 8.11.4 Active Business Divisions

- 8.11.5 Product portfolio

- 8.11.6 Business performance

- 8.11.7 Major Strategic Initiatives and Developments

- 8.12 Novartis International AG (Switzerland). Additionally

- 8.12.1 Company Overview

- 8.12.2 Key Executives

- 8.12.3 Company snapshot

- 8.12.4 Active Business Divisions

- 8.12.5 Product portfolio

- 8.12.6 Business performance

- 8.12.7 Major Strategic Initiatives and Developments

- 8.13 other players that are part of this detailed analysis are Editas Medicine

- 8.13.1 Company Overview

- 8.13.2 Key Executives

- 8.13.3 Company snapshot

- 8.13.4 Active Business Divisions

- 8.13.5 Product portfolio

- 8.13.6 Business performance

- 8.13.7 Major Strategic Initiatives and Developments

- 8.14 Inc. (United States)

- 8.14.1 Company Overview

- 8.14.2 Key Executives

- 8.14.3 Company snapshot

- 8.14.4 Active Business Divisions

- 8.14.5 Product portfolio

- 8.14.6 Business performance

- 8.14.7 Major Strategic Initiatives and Developments

- 8.15 Sangamo Therapeutics

- 8.15.1 Company Overview

- 8.15.2 Key Executives

- 8.15.3 Company snapshot

- 8.15.4 Active Business Divisions

- 8.15.5 Product portfolio

- 8.15.6 Business performance

- 8.15.7 Major Strategic Initiatives and Developments

- 8.16 Inc. (United States)

- 8.16.1 Company Overview

- 8.16.2 Key Executives

- 8.16.3 Company snapshot

- 8.16.4 Active Business Divisions

- 8.16.5 Product portfolio

- 8.16.6 Business performance

- 8.16.7 Major Strategic Initiatives and Developments

- 8.17 Bio-Rad Laboratories

- 8.17.1 Company Overview

- 8.17.2 Key Executives

- 8.17.3 Company snapshot

- 8.17.4 Active Business Divisions

- 8.17.5 Product portfolio

- 8.17.6 Business performance

- 8.17.7 Major Strategic Initiatives and Developments

- 8.18 Inc. (United States)

- 8.18.1 Company Overview

- 8.18.2 Key Executives

- 8.18.3 Company snapshot

- 8.18.4 Active Business Divisions

- 8.18.5 Product portfolio

- 8.18.6 Business performance

- 8.18.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

By Techniques |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Genetic Engineering in 2030?

+

-

Which application type is expected to remain the largest segment in the Global Genetic Engineering market?

+

-

How big is the Global Genetic Engineering market?

+

-

How do regulatory policies impact the Genetic Engineering Market?

+

-

What major players in Genetic Engineering Market?

+

-

What applications are categorized in the Genetic Engineering market study?

+

-

Which product types are examined in the Genetic Engineering Market Study?

+

-

Which regions are expected to show the fastest growth in the Genetic Engineering market?

+

-

Which application holds the second-highest market share in the Genetic Engineering market?

+

-

What are the major growth drivers in the Genetic Engineering market?

+

-