Global Hair Care Oil Market Trends and Forecast to 2030

Report ID: MS-491 | Consumer Goods | Last updated: Mar, 2025 | Formats*:

Hair Care Oil Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

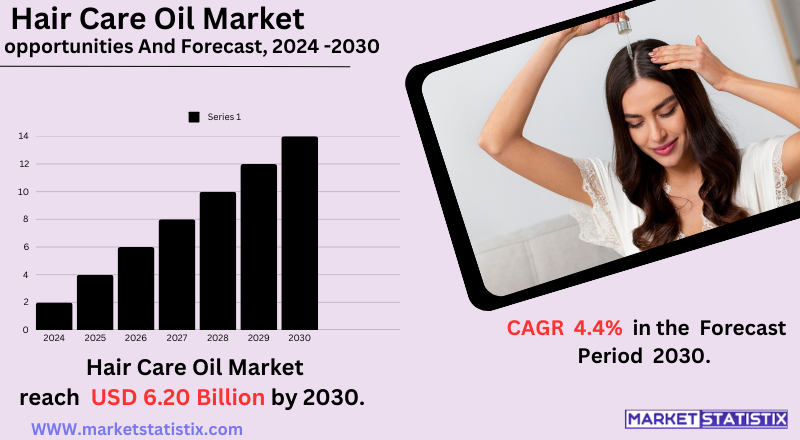

| Growth Rate | CAGR of 4.4% |

| Forecast Value (2030) | USD 6.20 Billion |

| By Product Type | Jojoba Oil, Coconut Oil, Olive Oil, Sunflower Oil, Almond Oil, Others |

| Key Market Players |

|

| By Region |

|

Hair Care Oil Market Trends

The hair care oil market is growing tremendously due to increasing consumer preference for natural and organic hair care products. The demand for multi-functional oils that address various hair problems, such as hair loss, dryness, and damage, is an important trend in the market. Clean-label products containing natural ingredients such as argan, coconut, and jojoba oils are hot objects of desire among consumers. Another important trend gaining momentum is innovation in formulations and delivery systems. Lightweight, non-greasy oils and serums are becoming the new favourites for consumers with different hair types and preferences. Sustainability is also gaining importance, as brands adopt green packaging and sourcing practices. There has been a marked increase in personalised hair care as well; oil blends and formulations are being tailored to individual requirements.Hair Care Oil Market Leading Players

The key players profiled in the report are Merico Inc., Henkel AG & Co. KGaA, Dabur India Ltd., Unilever Plc., Vital’s Cosmetics International Inc., Vogue International LLC., Now Foods, Emami Ltd., The P&G Company, Brock Beauty Inc.Growth Accelerators

Natural and organic are the emerging preferences for hair care solutions among consumers, and this appears to be on the increase. Consumers are increasingly aware of the adverse effects of synthetic chemicals and are actively searching for those products containing natural ingredients that provide holistic benefits. This trend is further gaining traction from social media and beauty influencers who claim the benefits of natural oils for hair health. Increasing incidences of hair problems like hair loss, dryness, and other external factors and styling processes are leading consumers to search for remedies, and hair oils are increasingly becoming an option. The hair care oil market is being favoured by a growing middle class in developing economies on the heels of rising disposable incomes. For this group, personal care and grooming products, hair oils included, are becoming major investment avenues. Coupled with the prolonged availability of different hair oil products meant for different hair types and concerns and their ease of accessibility through online retail channels, they are likely to be further instrumental in propelling the market.Hair Care Oil Market Segmentation analysis

The Global Hair Care Oil is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Jojoba Oil, Coconut Oil, Olive Oil, Sunflower Oil, Almond Oil, Others . The Application segment categorizes the market based on its usage such as Online, Offline. Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

In the segment of competitive forces, the hair-care oil market consists of established heavyweights and small-scale local players, accounting for a proper mix of traditional and innovative products. With names such as L'Oréal, Unilever, Procter & Gamble, Marico Limited, and Dabur, a good deal of the apparatus-laden market is served, presenting an application variety that meets the needs of a wide spectrum of consumers. Hair nourishment, damage repair, scalp care, and a large number of other consumer needs are catered to by these companies, who also enjoy strong distribution networks and brand recognition to win over the market. Regional players like Himalaya Wellness and Patanjali Ayurved keep gaining ground with herbal and natural formulations for consumers with environmental consciousness. Innovation is the principal competitive factor today as companies continue investing in R&D to develop products in line with changing consumer preferences toward organic, cruelty-free, and multifunctional options. A case in point is this increasing demand for considered medicated oils aimed at specific concerns, really, for example, dandruff or hair loss. Suddenly some differentiation is coming into play. E-commerce channels are spreading more widely, giving markets the possibility of positioning their products through targeted marketing strategies.Challenges In Hair Care Oil Market

Several challenges hamper the growth and dynamics of the hair care oil market. One of them is increasing pollution levels, causing even more consumer concern about hair damage and loss. In addition to looking for hair oils that conform to their value system, consumers are also more cognisant about what they use. Another challenge is that the consumer trend is moving towards herbal and natural alternatives. This means a lot for the manufacturers to change their formulations and fulfil the requirements set by natural alternatives, which could cost more since sourcing them is not that easy. The market, moreover, is highly competitive, with gazillions of brands competing for the consumer's attention, so much so that any new entrant finds it nearly impossible to come up to speed. Economic issues, including disposable income fluctuations, also affect the issue: During times of economic distress, consumers may put more priority on essential goods and less on hair care items. All these issues mean ongoing innovation and strategic marketing to retain and grow hair care oil market share.Risks & Prospects in Hair Care Oil Market

Great opportunities in the hair care oil market are forecasted on account of the increasing prevalence of hair-related ailments such as alopecia, dandruff, and dryness of the scalp. Increased consumer awareness regarding the benefits of natural and organic products has further pushed the demand for clean-label, herbal, and cruelty-free hair oils. By introducing product innovations in formulation such as the incorporation of essential oils, health-conscious customers have shown loyalty to hair oils with ingredients like argan, rosemary, and castor oil. Asia-Pacific dominates the region on account of a huge population base, high disposable incomes, and traditional dependence on hair oils for scalp care. Emerging economies in this region are witnessing rapid growth in personal care spending and urbanisation, which further drives demand. The North American region is also a significant market, with the increasing adoption of premium and medicated hair oils intended to address pollution-associated hair damage and scalp-related disbalances. The European region also considers opportunities as the consumer interest in sustainable and eco-friendly products is on the rise.Key Target Audience

Key target audiences for the hair care oil market include individual consumers seeking solutions for common hair problems like hair fall, dandruff, dryness, and damage. This group can be segmented based on age, sex, and type of hair, with women being the largest consumer base due to their high concern about maintenance and grooming of their hair. Another increasingly important demographic is that of men, especially concerning products addressing thinning hair and scalp health.,, The second major audience comprises professional users: salons, spas, and dermatology clinics, all of which will demand high-quality medicated or premium hair oils for their treatments. Such businesses require products targeted toward specific needs like scalp nourishment or hair growth stimulation. With the increase in usage of e-commerce platforms, the scope for reaching those niche audiences looking for specific green or innovative hair care solutions has increased.Merger and acquisition

The hair care oil market reports several major activities on mergers and acquisitions during the previous years; the most recent is the strategic manoeuvres by the leading companies in expanding portfolios and bettering market presence for themselves. In April 2022, the Wella Company acquired Briogeo, a fast-growing brand known for its all-natural and eco-friendly hair care products, thereby making Briogeo part of its expansive beauty portfolio—adding very clean beauty offerings to satisfy the growing consumer demand for sustainable hair care. It was recently that, in October 2024, Dabur India announced declaring an intent to buy up to a 51% holding in Sesa Care Private Limited, which is specialised in Ayurvedic hair care products, for ₹12.59 crore. This will further provide an enhanced establishment in the Ayurvedic hair care market and would open new areas for development for Dabur. This acquisition is now pending necessary statutory and regulatory approvals. It gives an inkling as to where the trend is going, where companies are actively getting into acquisitions to widen their product lines towards the evolving natural and effective preferences of consumers. >Analyst Comment

The hair care oils market is observing considerable growth, driven by increasing consumer preference toward natural and organic hair care products. Major drivers of this growth include the awareness of the benefits of natural oils in maintaining hair health and influence from social media and beauty influencers, coupled with rising incidences of hair-related problems such as loss and damage. It has also received many requests for multi-functional oils serving various properties related to hair, such as moisture, strengthening, and shine enhancement. In addition, manufacturers are innovating formulations and sustainable sourcing in response to changing consumer needs.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Hair Care Oil- Snapshot

- 2.2 Hair Care Oil- Segment Snapshot

- 2.3 Hair Care Oil- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Hair Care Oil Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Coconut Oil

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Almond Oil

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Olive Oil

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Sunflower Oil

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

- 4.6 Jojoba Oil

- 4.6.1 Key market trends, factors driving growth, and opportunities

- 4.6.2 Market size and forecast, by region

- 4.6.3 Market share analysis by country

- 4.7 Others

- 4.7.1 Key market trends, factors driving growth, and opportunities

- 4.7.2 Market size and forecast, by region

- 4.7.3 Market share analysis by country

5: Hair Care Oil Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Online

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Offline

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

6: Hair Care Oil Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 Merico Inc.

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 Dabur India Ltd.

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Emami Ltd.

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 Henkel AG & Co. KGaA

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 The P&G Company

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Unilever Plc.

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Vogue International LLC.

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 Vital’s Cosmetics International Inc.

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 Now Foods

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 Brock Beauty Inc.

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Hair Care Oil in 2030?

+

-

Which application type is expected to remain the largest segment in the Global Hair Care Oil market?

+

-

How big is the Global Hair Care Oil market?

+

-

How do regulatory policies impact the Hair Care Oil Market?

+

-

What major players in Hair Care Oil Market?

+

-

What applications are categorized in the Hair Care Oil market study?

+

-

Which product types are examined in the Hair Care Oil Market Study?

+

-

Which regions are expected to show the fastest growth in the Hair Care Oil market?

+

-

Which application holds the second-highest market share in the Hair Care Oil market?

+

-

What are the major growth drivers in the Hair Care Oil market?

+

-