Global Hardware as a Service Market Size, Share & Trends Analysis Report, Forecast Period, 2023-2031

Report ID: MS-1829 | IT and Telecom | Last updated: Sep, 2024 | Formats*:

Hardware as a Service Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2031 |

| Base Year Of Estimation | 2023 |

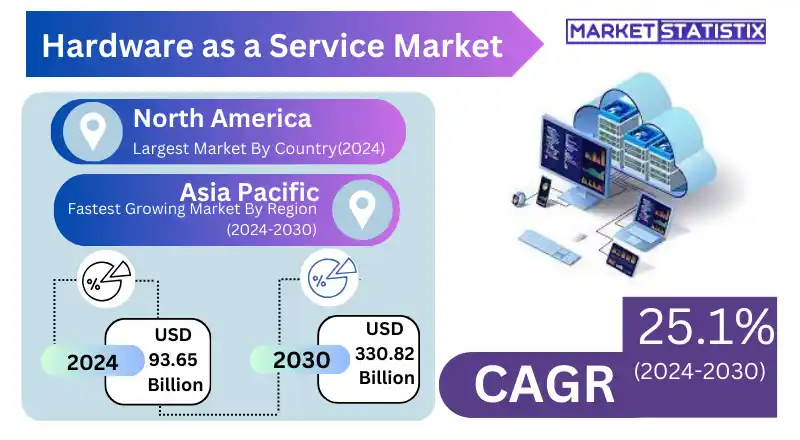

| Growth Rate | CAGR of 25.1% |

| Key Market Players |

|

| By Region |

|

Hardware as a Service Market Trends

More and more enterprises are adopting flexible subscription-based models for acquiring and managing IT hardware, leading to an increase in the Hardware as a Service (HaaS) market. It is through renting or subscribing that through HaaS businesses can access the latest hardware technologies such as servers, storage systems, and networking equipment, hence reducing costs on acquiring the hardware and allowing for scalable upgradability. Essentially, this model conforms to a broader trend towards 'as-a-service' offerings, thus enabling business cost predictability without having to spend large upfront amounts on new technology. The increasing demand for flexible and scalable IT solutions due to the creation of remote work opportunities as well as digitisation drives wider adoption of HaaS. Moreover, its attractiveness has been enhanced by bundled offers that provide comprehensive solutions meeting different business needs through the integration of HaaS with managed IT services and cloud computing. Besides that, the hardware industry is always innovating while businesses have changing ideas that will help them create even more applications that use HaaS. For instance, at present there are various hybrid clouds available that offer a great example of how fast the sector can change.Hardware as a Service Market Leading Players

The key players profiled in the report are Microsoft Corporation, Lenovo Group, MasterIT, LLC, Managed IT Solutions, Custard group, Phoenix NAP, Fujitsu Ltd, Design Data Systems Inc., Navitas Lease Corp., Dell Inc., Amazon.com, ZNet Technologies Pvt. Ltd., FUSE3 Communications, Machado Consulting, ITque Inc., Ingram MicroGrowth Accelerators

The rising demand for flexible and cost-effective IT infrastructure solutions is what drives the global Hardware as a Service (HaaS) market. With HaaS, organisations are able to subscribe and access their hardware resources like servers, storage, and networking equipment, which helps in cutting back on a big initial capital outlay. This model is saleable; it has predictable costs and allows access to current technologies, making it attractive to companies making efforts to optimise their IT investments while at the same time facing rapid changes in technology needs. Top market drivers include increasing digital transformation and cloud computing trends that push organisations into adopting subscription models for IT asset management. Other factors that support the expansion of HaaS include reduced IT maintenance costs and improved operation efficiency. Evolving demands that require businesses to streamline operations while concentrating on core competencies, together with current hardware use without ownership burdens, are expected to fuel a rise in HaaS market growth owing to technological advancement.Hardware as a Service Market Segmentation analysis

The Global Hardware as a Service is segmented by and Region. . Geographically, the market is assessed across key Regions like North America(United States.Canada.Mexico), South America(Brazil.Argentina.Chile.Rest of South America), Europe(Germany.France.Italy.United Kingdom.Benelux.Nordics.Rest of Europe), Asia Pacific(China.Japan.India.South Korea.Australia.Southeast Asia.Rest of Asia-Pacific), MEA(Middle East.Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The mix of prominent cloud providers, tech firms, and upcoming entrants defines the competitive landscape for the Hardware as a Service (HaaS) market. Leading companies in this space include Amazon Web Services (AWS), Microsoft Azure, Google Cloud Platform, and IBM Cloud, who provide a vast range of hardware resources and services among their broader cloud computing offerings. These firms utilise their extensive collection of data centres around the world to offer scalable and dependable HaaS solutions. Besides established cloud providers, the niche market for HaaS solutions includes several smaller firms that specialise in particular hardware resources or industry-specific HaaS solutions. By doing so, they create an ever-changing landscape by always coming up with new ideas at lower prices while also maintaining quality standards.Challenges In Hardware as a Service Market

There are several challenges faced by the Hardware as a Service (HaaS) sector, mainly concerned with hardware integration and management in service-orientated approaches. A notable problem involves the intricate tasks of maintaining and upgrading the hardware while at the same time ensuring seamless incorporation into existing systems and software packages. This often results in inconsistencies in performance delivery, which may make customers less satisfied or even lose interest in voting to support any other functionality that may impede its overall efficiency. Also, security issues as well as data privacy need to be addressed by the HaaS industry. When it comes to sourcing their hardware requirements from third parties, there will always be concerns about data loss as well as equipment susceptibility. In order for the organisations to keep their credibility through protecting every customer’s account number and communicating highly sensitive messages, they must impose strong protective measures on their information systems and follow regulatory requirements too. Therefore, addressing these problems appropriately is critical for the success of Hardware as a Service (HaaS) expansion or adoptions.Risks & Prospects in Hardware as a Service Market

The Hardware as a Service (HaaS) market presents a multitude of opportunities owing to the increasing shift towards flexible and scalable IT solutions. With HaaS, the latest technology can be accessed by organisations without having to invest a large amount of money upfront, thereby reducing capital expenditure and easing asset management through a subscription-based model. This is appealing for businesses that want to avoid the financial and operational burdens associated with owning and maintaining their own hardware but still appreciate continuous upgrades as well as ongoing support. Key market opportunities include the expansion into small and medium-sized enterprises (SMEs) as well as emerging markets where demand for affordable and scalable IT solutions continues rising. Furthermore, sectors like healthcare, retail, or education are slowly adopting HaaS so as to improve their technological infrastructure at minimal initial costs. The HaaS market remains set for growth backed by escalating demand for managed services alongside operational flexibility benefits; this trend is further driven by increased digital transformation adoption among businesses seeking more versatile IT solutions.Key Target Audience

HaaS is mainly targeted at small to medium-sized enterprises (SMEs) and big corporations that are looking for flexible and affordable hardware solutions. In contrast to outright purchase, HaaS allows organisations to rent or subscribe to hardware components like servers, workstations, and networking devices. This option makes it attractive to companies wishing to decrease their capital costs, manage better the cycles of refreshment in technology applied, and avoid challenging issues of maintenance as well as upgrading.,, Moreover, managed service providers (MSPs) and IT solution vendors are crucial in the HaaS market because they use these services to give their clients comprehensive IT solutions together with support. Also, educational institutions, healthcare providers, and governmental agencies are important segments that benefit from the scalability feature of HaaS with little or no upfront charges. The growth of the HaaS market is stimulated by an increasing number of organisations adopting digital transformation strategies due to their need for flexible and managed hardware solutions.Merger and acquisition

Recently, the Hardware as a Service (HaaS) market has seen an upsurge in merger and acquisition activity. This has been propelled by the need to widen market share, diversify service offerings, and enhance the efficiency of operations. Illustratively, cloud service providers have acquired data centre providers while competing HaaS providers have merged. These undertakings are designed to fortify their competitive edge, thus enabling them to provide more all-inclusive and flexible HaaS solutions. Furthermore, mergers and acquisitions can promote economies of scale, better global reach, and greater investments into research and development, which would drive much-needed innovation in HaaS, leading to growth. >Analyst Comment

"In pursuit of cheaper and more flexible solutions for their IT infrastructure, businesses have turned to the global Hardware as a Service (HaaS) market that is growing. The organisations using HaaS get necessary devices, including servers, computers, and networking equipment, on a subscription basis. Unlike in conventional models, where end-users buy the entire item at once, here they pay monthly charges that come with technical support, maintenance, and upgrade costs. With this model, companies can avoid a major upfront financial expenditure, which makes it possible for them to become leaner because of better operational output and more affordable budgets. Some of the contributing factors to this growth are rising cloud computing acceptance rates, an increase in digital transformation endeavours, as well as scalable IT solutions. Some are predictable costing, lowered IT management costs, and quickly saleable hardware resources based on business needs. Consequently, as many organisations learn about outsourcing their hardware management so they can concentrate on their core businesses, this HaaS market is likely to keep growing due to technological advances and demand for agile and responsive IT solutions."- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Hardware as a Service- Snapshot

- 2.2 Hardware as a Service- Segment Snapshot

- 2.3 Hardware as a Service- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Hardware as a Service Market by Offering

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Hardware Model

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Professional Services

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: Hardware as a Service Market by End-User Industry

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Retail/Wholesale

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Education

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 BFSI

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Manufacturing

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Healthcare

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

- 5.7 IT and Telecommunication

- 5.7.1 Key market trends, factors driving growth, and opportunities

- 5.7.2 Market size and forecast, by region

- 5.7.3 Market share analysis by country

- 5.8 Other End-User Industries

- 5.8.1 Key market trends, factors driving growth, and opportunities

- 5.8.2 Market size and forecast, by region

- 5.8.3 Market share analysis by country

6: Hardware as a Service Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 Microsoft Corporation

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 Lenovo Group

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 MasterIT

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 LLC

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Managed IT Solutions

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Custard group

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Phoenix NAP

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 Fujitsu Ltd

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 Design Data Systems Inc.

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 Navitas Lease Corp.

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

- 8.11 Dell Inc.

- 8.11.1 Company Overview

- 8.11.2 Key Executives

- 8.11.3 Company snapshot

- 8.11.4 Active Business Divisions

- 8.11.5 Product portfolio

- 8.11.6 Business performance

- 8.11.7 Major Strategic Initiatives and Developments

- 8.12 Amazon.com

- 8.12.1 Company Overview

- 8.12.2 Key Executives

- 8.12.3 Company snapshot

- 8.12.4 Active Business Divisions

- 8.12.5 Product portfolio

- 8.12.6 Business performance

- 8.12.7 Major Strategic Initiatives and Developments

- 8.13 ZNet Technologies Pvt. Ltd.

- 8.13.1 Company Overview

- 8.13.2 Key Executives

- 8.13.3 Company snapshot

- 8.13.4 Active Business Divisions

- 8.13.5 Product portfolio

- 8.13.6 Business performance

- 8.13.7 Major Strategic Initiatives and Developments

- 8.14 FUSE3 Communications

- 8.14.1 Company Overview

- 8.14.2 Key Executives

- 8.14.3 Company snapshot

- 8.14.4 Active Business Divisions

- 8.14.5 Product portfolio

- 8.14.6 Business performance

- 8.14.7 Major Strategic Initiatives and Developments

- 8.15 Machado Consulting

- 8.15.1 Company Overview

- 8.15.2 Key Executives

- 8.15.3 Company snapshot

- 8.15.4 Active Business Divisions

- 8.15.5 Product portfolio

- 8.15.6 Business performance

- 8.15.7 Major Strategic Initiatives and Developments

- 8.16 ITque Inc.

- 8.16.1 Company Overview

- 8.16.2 Key Executives

- 8.16.3 Company snapshot

- 8.16.4 Active Business Divisions

- 8.16.5 Product portfolio

- 8.16.6 Business performance

- 8.16.7 Major Strategic Initiatives and Developments

- 8.17 Ingram Micro

- 8.17.1 Company Overview

- 8.17.2 Key Executives

- 8.17.3 Company snapshot

- 8.17.4 Active Business Divisions

- 8.17.5 Product portfolio

- 8.17.6 Business performance

- 8.17.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Offering |

|

By End-User Industry |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

How do regulatory policies impact the Hardware as a Service Market?

+

-

What major players in Hardware as a Service Market?

+

-

What applications are categorized in the Hardware as a Service market study?

+

-

Which product types are examined in the Hardware as a Service Market Study?

+

-

Which regions are expected to show the fastest growth in the Hardware as a Service market?

+

-

What are the major growth drivers in the Hardware as a Service market?

+

-

Is the study period of the Hardware as a Service flexible or fixed?

+

-

How do economic factors influence the Hardware as a Service market?

+

-

How does the supply chain affect the Hardware as a Service Market?

+

-

Which players are included in the research coverage of the Hardware as a Service Market Study?

+

-