Global Hook and Loop Market - Industry Dynamics, Size, And Opportunity Forecast To 2030

Report ID: MS-1927 | Consumer Goods | Last updated: Nov, 2024 | Formats*:

Hook and Loop Report Highlights

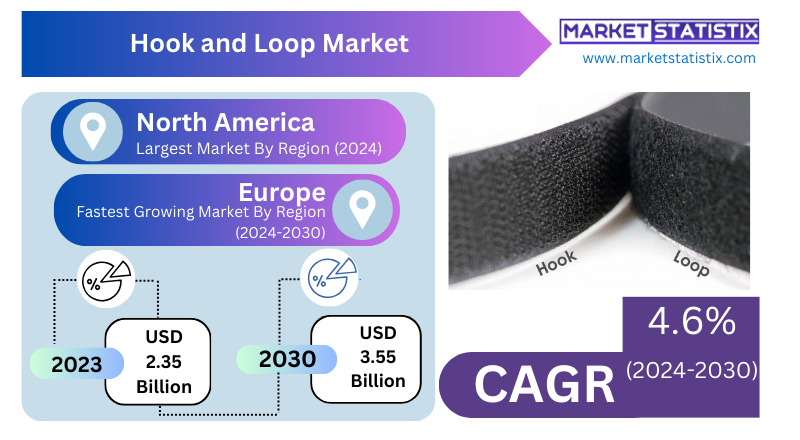

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2023 |

| Growth Rate | CAGR of 4.6% |

| By Product Type | Hook, Loop |

| Key Market Players |

|

| By Region |

|

Hook and Loop Market Trends

The worldwide market for hook and loop is experiencing a constructive outlook on account of the increasing demand in varied industries such as textiles, automotive, and healthcare. Hook and loop fasteners are widely used due to their flexibility and simplicity as fasteners. These fasteners are used in products such as clothing and shoes, medical products, and home improvement products. Further, adoption of hook and loop is being reinforced by the trend of lightweight materials and the need for speed in assembly. Additionally, product development is also considering the availability of new materials that are eco-friendly and reusable. By geography segmentation of the hook and loop market, North America and Europe are the two leading regions holding the major share of the market due to the availability of strong market players and high public awareness on sophisticated fastening systems. However, the fastest growth is expected in the Asia Pacific powerhouse region, which is lavished by industrialisation, rising income levels, and increased occupancy for a wide range of consumer goods. The market is highly concentrated in nature; all the major companies are spending high amounts on R&D for improving the uses of the existing products and for expanding the portfolio. The product mix has to also change in hook-and-loop markets because the personalisation and alteration of products is becoming common.Hook and Loop Market Leading Players

The key players profiled in the report are 3M, Essentra plc, Velcro Inc., LOVETEX INDUSTRIAL CORP., directex.net, Kuraray Co. Ltd, YKK Corporation, HALCO Europe Ltd., Jianli Sticky Ribbon Co., Ltd., Paiho North America Corporation, tesa SE, Gottlieb Binder GmbH & Co. KG, Krahnen & Gobbers GmbH, Dunlap Industries INC., Siddharth Filaments Private LimitedGrowth Accelerators

One of the major factors boosting growth of the global hook and loop market is the rising trend of the use of flexible fastening solutions in a variety of industries such as automobile, aerospace, healthcare, and even textile. These fasteners have a number of benefits, and this makes them more appealing as they are easy to use as well as reusable; they offer different applications for use. Also, due to the increasing use of light-weight materials in manufacturing and design, the hook and loop fasteners market uptakes as there is an efficient and reliable method of fastening than the traditional methods. Moreover, the increasing number of consumers who appreciate the need to personalise and innovate is contributing to enhancing growth as well. With hook and loop fasteners, manufacturers can develop specific solutions for particular needs, and this explains its popularization. In addition, because more people are using e-commerce sites and engaging in more do-it-yourself home renovations, hook-and-loop products are also in high demand. With the industries keeping on developing new ways of doing things and looking for more efficient fastening solutions, the global hook and loop market will likely continue to grow in the coming years.Hook and Loop Market Segmentation analysis

The Global Hook and Loop is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Hook, Loop . The Application segment categorizes the market based on its usage such as Footwear & Apparel, Transportation, Industrial Manufacturing, Medical, Automotive, Other. Geographically, the market is assessed across key Regions like North America(United States, Canada, Mexico), South America(Brazil, Argentina, Chile, Rest of South America), Europe(Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific(China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA(Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The global hook and loop market has ubiquitous manufacturers and suppliers, leading to healthy competition and innovation in the sector. Some of the notable players in this market include Velcro Companies, 3M, and Aplix, which command the market thanks to their brand loyalty, product range, and distribution networks. These entities employ sophisticated technologies in manufacturing durable and high-quality products for textiles, automotive, aerospace, and medical sectors, among others. On the other hand, a few small companies that focus on niche markets have come into the market, which has heightened competition. In recent developments, it has become a norm to emphasise sustainability, leading manufacturers to most times go the extra mile and source for green materials and places of work. Such is attributed to heightened consumer consciousness and regulations concerning the resulting pollution. The competition is expected to change in this market as companies make new products or enhance the existing ones due to market needs and technological dynamism.Challenges In Hook and Loop Market

There are many different aspects to the global hook-and-loop market that act as barriers to profitability and market expansion. One such barrier to growth is the growing threat of substitute fastening solutions such as zippers, buttons, and magnetic closure systems. As manufacturers tend to advance and come up with better fastening solutions, they can also develop products that present competition against existing hook and loop solutions; thus, price competition arises, triggering a decrease in profit levels. Equally, the fastener hook and loop market are experiencing pressure to embrace sustainability. As more companies comply with changing consumer behaviours and laws, they want to steer away from the use of traditional hook-and-loop products. In this regard, there is a need for manufacturers to undertake expensive and time-consuming research and development on fastening alternatives that are backfill-able. There is also an issue of ensuring that performance levels do not compromise due to sustainability requirements in the hook-and-loop market.Risks & Prospects in Hook and Loop Market

The hooked and looped fastening method, also referred to as Velcro, is a technique that is widely embraced in the production of various products such as clothes, foot wear, and some of the interior decorations used in aerospace, among others. The invention of lightweight and also durable fastening methods has hence increased the use of hook-and-loop products even more. People can now access them more due to the growth of electronic commerce, which makes people more aware and demand the products. Other trends, especially in product design through the utilisation of green products and better adhesion mechanisms, are also creating more market opportunities as they target the green consumers and businesses. Also, in addition to this, the growing interest in DIY or Do It Yourself activities commonly associated with refurbishing one’s home is also providing a boost to the market as consumers require fastening options that are versatile. With different industries in search of more effective and cost-efficient fastening techniques that can be used over and over again, the hook and loop market exhibit an opportunity for expansion. Vertical expansion to some of the developing countries, together with manufacturing companies joining hands for cooperation and collaboration, can improve the overall market and stimulate creativity in this area, which, ceteris paribus, multiplies revenues and profits in this industry.Key Target Audience

There are a wide variety of end-user industries and consumers that comprise the global hook-and-loop market. Its main consumers, however, are the textile and apparel industries, where hook and loop fasteners are used by manufacturers in their clothing lines, shoes, and accessories because of how practical and manageable they are. The automotive sector also employs these fasteners in the interiors and components of vehicles. The medical sector is also a large consumer of hook and loop fasteners, as they are used in fastening medical devices, surgical procedures, and equipment for taking care of patients where fastening quickly and firmly is of utmost importance.,, Besides these applications, the global hook and loop market also serves various other end-use markets, such as the do-it-yourself market and crafts, where the fastening feature of these products is utilised in great ways. Furthermore, as consumers have a larger catalogue of products to choose from due to online selling, the growth of the hook and loop product range has grown the targeted audience as well. In conclusion, this market gravitates towards a wide range of industries and consumers owing to the increasing need for fastening systems that are effective, convenient, and easy to use.Merger and acquisition

In the global hook-and-loop market, particularly in the recent and current years, many mergers and acquisitions have arisen from the need to grow and consolidate the enterprises involved. This applies to major companies such as Velcro Companies, 3M, and APLIX, who are engaging in strategic partnerships and acquisitions to fulfil their objectives and goals related to the range of products provided and the scope of the market. For example, Velcro has been seeking out partnerships and otherwise working more on expanding the use of their products into different industries like automotive and healthcare that well clients who need cutting-edge fastening solutions. Moreover, at the same time, the market is registering significant growth owing to the increasing capital expenditure on the automotive and consumer product markets, where hook and loop fasteners are increasingly becoming core. Firms are seeking to gain a firm's competitive advantage by purchasing smaller firms with technological capabilities and an appropriate market or regional position. The same trend is anticipated to be sustained. There is a forecast that the global hook and loop market will record approximately USD 3.69 billion by the year 2028, growing at a compound annual growth rate of approximately 5.8%. Such dynamics imply a positive outlook for the market owing to continuous advancements and strategic mergers in the sector.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Hook and Loop- Snapshot

- 2.2 Hook and Loop- Segment Snapshot

- 2.3 Hook and Loop- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Hook and Loop Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Hook

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Loop

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: Hook and Loop Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Footwear & Apparel

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Transportation

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Industrial Manufacturing

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Medical

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Automotive

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

- 5.7 Other

- 5.7.1 Key market trends, factors driving growth, and opportunities

- 5.7.2 Market size and forecast, by region

- 5.7.3 Market share analysis by country

6: Hook and Loop Market by End-User Industry

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 Rubber Wood processing

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 Plastic

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

- 6.4 Paper

- 6.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.2 Market size and forecast, by region

- 6.4.3 Market share analysis by country

- 6.5 Automotive

- 6.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.2 Market size and forecast, by region

- 6.5.3 Market share analysis by country

- 6.6 Glass

- 6.6.1 Key market trends, factors driving growth, and opportunities

- 6.6.2 Market size and forecast, by region

- 6.6.3 Market share analysis by country

7: Hook and Loop Market by Region

- 7.1 Overview

- 7.1.1 Market size and forecast By Region

- 7.2 North America

- 7.2.1 Key trends and opportunities

- 7.2.2 Market size and forecast, by Type

- 7.2.3 Market size and forecast, by Application

- 7.2.4 Market size and forecast, by country

- 7.2.4.1 United States

- 7.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.1.2 Market size and forecast, by Type

- 7.2.4.1.3 Market size and forecast, by Application

- 7.2.4.2 Canada

- 7.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.2.2 Market size and forecast, by Type

- 7.2.4.2.3 Market size and forecast, by Application

- 7.2.4.3 Mexico

- 7.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.3.2 Market size and forecast, by Type

- 7.2.4.3.3 Market size and forecast, by Application

- 7.2.4.1 United States

- 7.3 South America

- 7.3.1 Key trends and opportunities

- 7.3.2 Market size and forecast, by Type

- 7.3.3 Market size and forecast, by Application

- 7.3.4 Market size and forecast, by country

- 7.3.4.1 Brazil

- 7.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.1.2 Market size and forecast, by Type

- 7.3.4.1.3 Market size and forecast, by Application

- 7.3.4.2 Argentina

- 7.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.2.2 Market size and forecast, by Type

- 7.3.4.2.3 Market size and forecast, by Application

- 7.3.4.3 Chile

- 7.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.3.2 Market size and forecast, by Type

- 7.3.4.3.3 Market size and forecast, by Application

- 7.3.4.4 Rest of South America

- 7.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.4.2 Market size and forecast, by Type

- 7.3.4.4.3 Market size and forecast, by Application

- 7.3.4.1 Brazil

- 7.4 Europe

- 7.4.1 Key trends and opportunities

- 7.4.2 Market size and forecast, by Type

- 7.4.3 Market size and forecast, by Application

- 7.4.4 Market size and forecast, by country

- 7.4.4.1 Germany

- 7.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.1.2 Market size and forecast, by Type

- 7.4.4.1.3 Market size and forecast, by Application

- 7.4.4.2 France

- 7.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.2.2 Market size and forecast, by Type

- 7.4.4.2.3 Market size and forecast, by Application

- 7.4.4.3 Italy

- 7.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.3.2 Market size and forecast, by Type

- 7.4.4.3.3 Market size and forecast, by Application

- 7.4.4.4 United Kingdom

- 7.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.4.2 Market size and forecast, by Type

- 7.4.4.4.3 Market size and forecast, by Application

- 7.4.4.5 Benelux

- 7.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.5.2 Market size and forecast, by Type

- 7.4.4.5.3 Market size and forecast, by Application

- 7.4.4.6 Nordics

- 7.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.6.2 Market size and forecast, by Type

- 7.4.4.6.3 Market size and forecast, by Application

- 7.4.4.7 Rest of Europe

- 7.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.7.2 Market size and forecast, by Type

- 7.4.4.7.3 Market size and forecast, by Application

- 7.4.4.1 Germany

- 7.5 Asia Pacific

- 7.5.1 Key trends and opportunities

- 7.5.2 Market size and forecast, by Type

- 7.5.3 Market size and forecast, by Application

- 7.5.4 Market size and forecast, by country

- 7.5.4.1 China

- 7.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.1.2 Market size and forecast, by Type

- 7.5.4.1.3 Market size and forecast, by Application

- 7.5.4.2 Japan

- 7.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.2.2 Market size and forecast, by Type

- 7.5.4.2.3 Market size and forecast, by Application

- 7.5.4.3 India

- 7.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.3.2 Market size and forecast, by Type

- 7.5.4.3.3 Market size and forecast, by Application

- 7.5.4.4 South Korea

- 7.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.4.2 Market size and forecast, by Type

- 7.5.4.4.3 Market size and forecast, by Application

- 7.5.4.5 Australia

- 7.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.5.2 Market size and forecast, by Type

- 7.5.4.5.3 Market size and forecast, by Application

- 7.5.4.6 Southeast Asia

- 7.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.6.2 Market size and forecast, by Type

- 7.5.4.6.3 Market size and forecast, by Application

- 7.5.4.7 Rest of Asia-Pacific

- 7.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.7.2 Market size and forecast, by Type

- 7.5.4.7.3 Market size and forecast, by Application

- 7.5.4.1 China

- 7.6 MEA

- 7.6.1 Key trends and opportunities

- 7.6.2 Market size and forecast, by Type

- 7.6.3 Market size and forecast, by Application

- 7.6.4 Market size and forecast, by country

- 7.6.4.1 Middle East

- 7.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.6.4.1.2 Market size and forecast, by Type

- 7.6.4.1.3 Market size and forecast, by Application

- 7.6.4.2 Africa

- 7.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.6.4.2.2 Market size and forecast, by Type

- 7.6.4.2.3 Market size and forecast, by Application

- 7.6.4.1 Middle East

- 8.1 Overview

- 8.2 Key Winning Strategies

- 8.3 Top 10 Players: Product Mapping

- 8.4 Competitive Analysis Dashboard

- 8.5 Market Competition Heatmap

- 8.6 Leading Player Positions, 2022

9: Company Profiles

- 9.1 3M

- 9.1.1 Company Overview

- 9.1.2 Key Executives

- 9.1.3 Company snapshot

- 9.1.4 Active Business Divisions

- 9.1.5 Product portfolio

- 9.1.6 Business performance

- 9.1.7 Major Strategic Initiatives and Developments

- 9.2 Essentra plc

- 9.2.1 Company Overview

- 9.2.2 Key Executives

- 9.2.3 Company snapshot

- 9.2.4 Active Business Divisions

- 9.2.5 Product portfolio

- 9.2.6 Business performance

- 9.2.7 Major Strategic Initiatives and Developments

- 9.3 Velcro Inc.

- 9.3.1 Company Overview

- 9.3.2 Key Executives

- 9.3.3 Company snapshot

- 9.3.4 Active Business Divisions

- 9.3.5 Product portfolio

- 9.3.6 Business performance

- 9.3.7 Major Strategic Initiatives and Developments

- 9.4 LOVETEX INDUSTRIAL CORP.

- 9.4.1 Company Overview

- 9.4.2 Key Executives

- 9.4.3 Company snapshot

- 9.4.4 Active Business Divisions

- 9.4.5 Product portfolio

- 9.4.6 Business performance

- 9.4.7 Major Strategic Initiatives and Developments

- 9.5 directex.net

- 9.5.1 Company Overview

- 9.5.2 Key Executives

- 9.5.3 Company snapshot

- 9.5.4 Active Business Divisions

- 9.5.5 Product portfolio

- 9.5.6 Business performance

- 9.5.7 Major Strategic Initiatives and Developments

- 9.6 Kuraray Co. Ltd

- 9.6.1 Company Overview

- 9.6.2 Key Executives

- 9.6.3 Company snapshot

- 9.6.4 Active Business Divisions

- 9.6.5 Product portfolio

- 9.6.6 Business performance

- 9.6.7 Major Strategic Initiatives and Developments

- 9.7 YKK Corporation

- 9.7.1 Company Overview

- 9.7.2 Key Executives

- 9.7.3 Company snapshot

- 9.7.4 Active Business Divisions

- 9.7.5 Product portfolio

- 9.7.6 Business performance

- 9.7.7 Major Strategic Initiatives and Developments

- 9.8 HALCO Europe Ltd.

- 9.8.1 Company Overview

- 9.8.2 Key Executives

- 9.8.3 Company snapshot

- 9.8.4 Active Business Divisions

- 9.8.5 Product portfolio

- 9.8.6 Business performance

- 9.8.7 Major Strategic Initiatives and Developments

- 9.9 Jianli Sticky Ribbon Co.

- 9.9.1 Company Overview

- 9.9.2 Key Executives

- 9.9.3 Company snapshot

- 9.9.4 Active Business Divisions

- 9.9.5 Product portfolio

- 9.9.6 Business performance

- 9.9.7 Major Strategic Initiatives and Developments

- 9.10 Ltd.

- 9.10.1 Company Overview

- 9.10.2 Key Executives

- 9.10.3 Company snapshot

- 9.10.4 Active Business Divisions

- 9.10.5 Product portfolio

- 9.10.6 Business performance

- 9.10.7 Major Strategic Initiatives and Developments

- 9.11 Paiho North America Corporation

- 9.11.1 Company Overview

- 9.11.2 Key Executives

- 9.11.3 Company snapshot

- 9.11.4 Active Business Divisions

- 9.11.5 Product portfolio

- 9.11.6 Business performance

- 9.11.7 Major Strategic Initiatives and Developments

- 9.12 tesa SE

- 9.12.1 Company Overview

- 9.12.2 Key Executives

- 9.12.3 Company snapshot

- 9.12.4 Active Business Divisions

- 9.12.5 Product portfolio

- 9.12.6 Business performance

- 9.12.7 Major Strategic Initiatives and Developments

- 9.13 Gottlieb Binder GmbH & Co. KG

- 9.13.1 Company Overview

- 9.13.2 Key Executives

- 9.13.3 Company snapshot

- 9.13.4 Active Business Divisions

- 9.13.5 Product portfolio

- 9.13.6 Business performance

- 9.13.7 Major Strategic Initiatives and Developments

- 9.14 Krahnen & Gobbers GmbH

- 9.14.1 Company Overview

- 9.14.2 Key Executives

- 9.14.3 Company snapshot

- 9.14.4 Active Business Divisions

- 9.14.5 Product portfolio

- 9.14.6 Business performance

- 9.14.7 Major Strategic Initiatives and Developments

- 9.15 Dunlap Industries INC.

- 9.15.1 Company Overview

- 9.15.2 Key Executives

- 9.15.3 Company snapshot

- 9.15.4 Active Business Divisions

- 9.15.5 Product portfolio

- 9.15.6 Business performance

- 9.15.7 Major Strategic Initiatives and Developments

- 9.16 Siddharth Filaments Private Limited

- 9.16.1 Company Overview

- 9.16.2 Key Executives

- 9.16.3 Company snapshot

- 9.16.4 Active Business Divisions

- 9.16.5 Product portfolio

- 9.16.6 Business performance

- 9.16.7 Major Strategic Initiatives and Developments

10: Analyst Perspective and Conclusion

- 10.1 Concluding Recommendations and Analysis

- 10.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

By End-User Industry |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

How do regulatory policies impact the Hook and Loop Market?

+

-

What major players in Hook and Loop Market?

+

-

What applications are categorized in the Hook and Loop market study?

+

-

Which product types are examined in the Hook and Loop Market Study?

+

-

Which regions are expected to show the fastest growth in the Hook and Loop market?

+

-

What are the major growth drivers in the Hook and Loop market?

+

-

Is the study period of the Hook and Loop flexible or fixed?

+

-

How do economic factors influence the Hook and Loop market?

+

-

How does the supply chain affect the Hook and Loop Market?

+

-

Which players are included in the research coverage of the Hook and Loop Market Study?

+

-