Global household appliances manufacturing Market - Industry Dynamics, Market Size, And Opportunity Forecast To 2030

Report ID: MS-2023 | Manufacturing and Construction | Last updated: Dec, 2024 | Formats*:

household appliances manufacturing Report Highlights

| Report Metrics | Details |

|---|---|

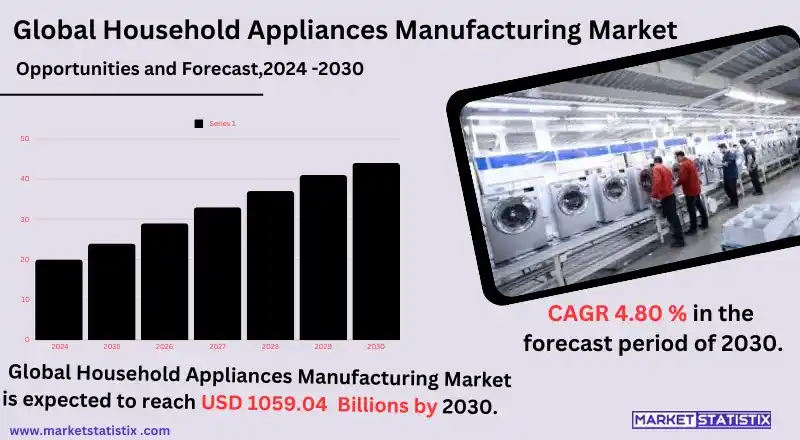

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2023 |

| Growth Rate | CAGR of 4.80% |

| Forecast Value (2030) | USD 1059.04 Billion |

| By Product Type | Major Appliances, Refrigeration Equipment, Cooking Appliances, Washing & Drying Equipment, Heating & Cooling Appliances, Others |

| Key Market Players |

|

| By Region |

|

household appliances manufacturing Market Trends

This global market for manufacturing household appliances is increasingly focusing on smart and connected appliances. As IoT technology develops, it creates new market opportunities that have made customers demand smart, convenient, energy-efficient, and even remotely controllable appliances. For example, there is the refrigerator, oven, or washing machine. This trend is pushing manufacturers to invest in the integration of smart technology into appliances that can communicate with one another and be controlled through mobile applications. This has created a great demand for energy-efficient appliances that not only improve the user experience but also promote sustainability by reducing energy consumption. An aspect that is coming to limelight in the household appliance market is increased consumer need for sustainable, eco-friendly products. Environmental issues now being increasingly concerned with among consumers, households are embracing appliances that not only benefit the environment with environmentally-friendly materials and technology, be it energy-efficient refrigerating mechanisms or water-efficient washing machines. Manufacturers will, then and there, also begin reflecting the same aspect of product design that keeps minimal human interference with nature.household appliances manufacturing Market Leading Players

The key players profiled in the report are Whirlpool Corporation (U.S.), Samsung Electronics Co. Ltd. (South Korea), Haier Inc. (China), Bajaj Electricals Ltd (India), Koninklijke Philips N.V. (South Korea), IFB Appliances (India), KENT (India), Eureka Forbes Ltd. (India), Panasonic Holdings Corporation (Japan), Orient Electric (India)Growth Accelerators

The market for global household appliance manufacturing is primarily driven by consumers’ growing preference for energy-efficient and smart ranges of appliances. In a bid to cut down on energy consumption within households and seek low bills, manufacturers are turning their strategies to work on the energy-labelled innovative devices that fuse technologies such as the Internet of Things and automation. This is more so in areas where the population is more developed in that the people’s concern for the environment makes them buy appliances that help in such causes as well as make their work easier. Urbanisation and lifestyle changes are causing an increase in income levels and, therefore, spending patterns on household appliances, which is another major factor pushing the market growth. Urbanisation is growing rapidly, and thus, there is a growing demand for efficiency and quality in modern appliances that save time and enhance the quality of life. Furthermore, the rapid growth of online shopping has made it easy for customers to buy a range of household appliances, which has stimulated the market furtherhousehold appliances manufacturing Market Segmentation analysis

The Global household appliances manufacturing is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Major Appliances, Refrigeration Equipment, Cooking Appliances, Washing & Drying Equipment, Heating & Cooling Appliances, Others . The Application segment categorizes the market based on its usage such as Coffeemakers, Food Processors, Humidifiers, Microwave Ovens, Others. Geographically, the market is assessed across key Regions like North America(United States, Canada, Mexico), South America(Brazil, Argentina, Chile, Rest of South America), Europe(Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific(China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA(Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The world synthesis of household appliances is a tough one, as the market comprises both global and local firms in almost equal proportions. Some of the prominent firms in this market are, for instance, Whirlpool, LG, Samsung, Bosch, and Electrolux. These companies compete on various levels, such as brand equity, new product development, marketing distribution channels, and pricing. Over the recent past, the competition has also come from new entrants into the market, especially from countries such as China. These companies produce cheap and competitive devices, which makes it hard for the older firms to maintain their positions. Moreover, the development in smart home technology has also intensified this competition, as corporations are now concentrating on their capabilities to produce smart appliances that function alongside other smart appliances and can be used away from the user’s location.Challenges In household appliances manufacturing Market

The worldwide market for the production of home appliances is experiencing a number of issues, one of which is, among other things, the competition from manufacturers of very low-priced goods, especially in the so-called developing countries. These enterprises tend to make their appliances available at cheaper rates, which in turn pressures the existing brands to either lower their costs or improve their value propositions. Furthermore, technological development is moving at a very high rate, and thus the manufacturers have to keep on innovating and improving their products to meet the consumer's demands for smart and energy-saving appliances. If the producer fails to meet these technological standards, he or she is likely to lose the market and even the customers’ loyalty. In addition, another challenge that the global household appliances manufacturing market sector is facing is the increasing sustainability and anti-regulatory focus. It is common for the practice of sustainability to be adopted across all manufacturers. For instance, they tend to source raw materials that are less harmful to the environment and make energy-efficient appliances. In some cases, failure to meet such environmental demands may increase the cost of production or even call for the installation of modern production processes.Risks & Prospects in household appliances manufacturing Market

This global market in household appliance manufacturing is great in providing the opportunity based on demand from energy efficiency and smart appliances. Because of more and more ecological awareness by consumers, there are higher demands on appliances to minimise energy use and reduce carbon footprints. By doing so, manufacturers would find a higher opportunity if they invested money in the research and development of innovation with energy-efficient products. It will keep pace with regulations and create an understanding in the market for environment-conscious consumers. Emerging markets with rising disposable incomes and increasing urbanisation led to growing demand for household appliances. As populations increase and develop, just like in India, Brazil, and Southeast Asia, demand for essential appliances like refrigerators, washing machines, and cooking devices grows. The producers may think of engaging in strategic partnerships and local production to address specific market needs and preferences. Companies could attract customers for such affordable yet quality products and penetrate deeper into the increasing markets in these markets by providing such affordable, high-quality products to local consumers.Key Target Audience

At the forefront of the global household appliance manufacturing market are the home appliance consumers searching specifically for appliances that are trustworthy, energy-efficient, and fitted with cutting-edge technology. They target a wide range of customers, including families, adolescents, and young adults, as well as those who care about the environment and sustainable consumption. As the dual trend of searching for convenience and improved lifestyles through the utilisation of smart home technologies strikes many consumers, manufacturers have opted to create smart appliances that would effortlessly blend into the digital ecology of the consumer, with remote control, automation, energy control, and several other functions.,, Another major demographic in this market includes retailers, wholesalers, and e-commerce that offer various household goods, including household appliances, to the final consumer. Such participants are of great importance to the supply chain of the household appliances market, as they often have the most interaction with the product, providing support, coursing sales, and other services. In addition to this, due to their practice of suggesting or placing home appliances within new building constructions and remodels, property builders, their agents, and even modern interior designers form an important audience.Merger and acquisition

The latest developments in the global household appliance manufacturing industry indicate that the trends of both consolidation and innovation are on the rise. In particular, early 2024 saw Whirlpool Corporation reveal plans to acquire a stake in Midea Group, with the latter’s smart home product lines intent on strengthening its position in the Asia-Pacific region. Such trends come as developing countries in Asia witness an increasing production of connected appliances encapsulating a wider range of Internet of Things capabilities. Besides, Bosch has also been spending a lot of money buying out other companies that create sustainable appliance technologies in the less threatening era, especially as global warming becomes a concern for all. Moreover, competitive forces arise from the transactions and alliances as well as joint ventures between the major protagonists. For example, Samsung Electronics recently completed an agreement with LG Electronics to design and manufacture a new series of kitchen appliances based on artificial intelligence. Such agreements increase product development, and therefore sales, and allow for targeting new customer bases. The emphasis on environmentalism and smart technology has been the main reason behind the upsurge in M&A activities, with companies wanting to reinforce their capabilities and presence as consumers all over the world are demanding more high-tech and environmentally friendly appliances.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 household appliances manufacturing- Snapshot

- 2.2 household appliances manufacturing- Segment Snapshot

- 2.3 household appliances manufacturing- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: household appliances manufacturing Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Major Appliances

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Refrigeration Equipment

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Cooking Appliances

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Washing & Drying Equipment

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

- 4.6 Heating & Cooling Appliances

- 4.6.1 Key market trends, factors driving growth, and opportunities

- 4.6.2 Market size and forecast, by region

- 4.6.3 Market share analysis by country

- 4.7 Others

- 4.7.1 Key market trends, factors driving growth, and opportunities

- 4.7.2 Market size and forecast, by region

- 4.7.3 Market share analysis by country

5: household appliances manufacturing Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Coffeemakers

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Food Processors

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Humidifiers

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Microwave Ovens

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Others

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

6: household appliances manufacturing Market by Channel

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 Supermarkets & Hypermarkets

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 Specialty Stores

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

- 6.4 Online/E-commerce

- 6.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.2 Market size and forecast, by region

- 6.4.3 Market share analysis by country

- 6.5 Others

- 6.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.2 Market size and forecast, by region

- 6.5.3 Market share analysis by country

7: household appliances manufacturing Market by Region

- 7.1 Overview

- 7.1.1 Market size and forecast By Region

- 7.2 North America

- 7.2.1 Key trends and opportunities

- 7.2.2 Market size and forecast, by Type

- 7.2.3 Market size and forecast, by Application

- 7.2.4 Market size and forecast, by country

- 7.2.4.1 United States

- 7.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.1.2 Market size and forecast, by Type

- 7.2.4.1.3 Market size and forecast, by Application

- 7.2.4.2 Canada

- 7.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.2.2 Market size and forecast, by Type

- 7.2.4.2.3 Market size and forecast, by Application

- 7.2.4.3 Mexico

- 7.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.3.2 Market size and forecast, by Type

- 7.2.4.3.3 Market size and forecast, by Application

- 7.2.4.1 United States

- 7.3 South America

- 7.3.1 Key trends and opportunities

- 7.3.2 Market size and forecast, by Type

- 7.3.3 Market size and forecast, by Application

- 7.3.4 Market size and forecast, by country

- 7.3.4.1 Brazil

- 7.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.1.2 Market size and forecast, by Type

- 7.3.4.1.3 Market size and forecast, by Application

- 7.3.4.2 Argentina

- 7.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.2.2 Market size and forecast, by Type

- 7.3.4.2.3 Market size and forecast, by Application

- 7.3.4.3 Chile

- 7.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.3.2 Market size and forecast, by Type

- 7.3.4.3.3 Market size and forecast, by Application

- 7.3.4.4 Rest of South America

- 7.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.4.2 Market size and forecast, by Type

- 7.3.4.4.3 Market size and forecast, by Application

- 7.3.4.1 Brazil

- 7.4 Europe

- 7.4.1 Key trends and opportunities

- 7.4.2 Market size and forecast, by Type

- 7.4.3 Market size and forecast, by Application

- 7.4.4 Market size and forecast, by country

- 7.4.4.1 Germany

- 7.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.1.2 Market size and forecast, by Type

- 7.4.4.1.3 Market size and forecast, by Application

- 7.4.4.2 France

- 7.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.2.2 Market size and forecast, by Type

- 7.4.4.2.3 Market size and forecast, by Application

- 7.4.4.3 Italy

- 7.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.3.2 Market size and forecast, by Type

- 7.4.4.3.3 Market size and forecast, by Application

- 7.4.4.4 United Kingdom

- 7.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.4.2 Market size and forecast, by Type

- 7.4.4.4.3 Market size and forecast, by Application

- 7.4.4.5 Benelux

- 7.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.5.2 Market size and forecast, by Type

- 7.4.4.5.3 Market size and forecast, by Application

- 7.4.4.6 Nordics

- 7.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.6.2 Market size and forecast, by Type

- 7.4.4.6.3 Market size and forecast, by Application

- 7.4.4.7 Rest of Europe

- 7.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.7.2 Market size and forecast, by Type

- 7.4.4.7.3 Market size and forecast, by Application

- 7.4.4.1 Germany

- 7.5 Asia Pacific

- 7.5.1 Key trends and opportunities

- 7.5.2 Market size and forecast, by Type

- 7.5.3 Market size and forecast, by Application

- 7.5.4 Market size and forecast, by country

- 7.5.4.1 China

- 7.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.1.2 Market size and forecast, by Type

- 7.5.4.1.3 Market size and forecast, by Application

- 7.5.4.2 Japan

- 7.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.2.2 Market size and forecast, by Type

- 7.5.4.2.3 Market size and forecast, by Application

- 7.5.4.3 India

- 7.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.3.2 Market size and forecast, by Type

- 7.5.4.3.3 Market size and forecast, by Application

- 7.5.4.4 South Korea

- 7.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.4.2 Market size and forecast, by Type

- 7.5.4.4.3 Market size and forecast, by Application

- 7.5.4.5 Australia

- 7.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.5.2 Market size and forecast, by Type

- 7.5.4.5.3 Market size and forecast, by Application

- 7.5.4.6 Southeast Asia

- 7.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.6.2 Market size and forecast, by Type

- 7.5.4.6.3 Market size and forecast, by Application

- 7.5.4.7 Rest of Asia-Pacific

- 7.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.7.2 Market size and forecast, by Type

- 7.5.4.7.3 Market size and forecast, by Application

- 7.5.4.1 China

- 7.6 MEA

- 7.6.1 Key trends and opportunities

- 7.6.2 Market size and forecast, by Type

- 7.6.3 Market size and forecast, by Application

- 7.6.4 Market size and forecast, by country

- 7.6.4.1 Middle East

- 7.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.6.4.1.2 Market size and forecast, by Type

- 7.6.4.1.3 Market size and forecast, by Application

- 7.6.4.2 Africa

- 7.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.6.4.2.2 Market size and forecast, by Type

- 7.6.4.2.3 Market size and forecast, by Application

- 7.6.4.1 Middle East

- 8.1 Overview

- 8.2 Key Winning Strategies

- 8.3 Top 10 Players: Product Mapping

- 8.4 Competitive Analysis Dashboard

- 8.5 Market Competition Heatmap

- 8.6 Leading Player Positions, 2022

9: Company Profiles

- 9.1 Whirlpool Corporation (U.S.)

- 9.1.1 Company Overview

- 9.1.2 Key Executives

- 9.1.3 Company snapshot

- 9.1.4 Active Business Divisions

- 9.1.5 Product portfolio

- 9.1.6 Business performance

- 9.1.7 Major Strategic Initiatives and Developments

- 9.2 Samsung Electronics Co. Ltd. (South Korea)

- 9.2.1 Company Overview

- 9.2.2 Key Executives

- 9.2.3 Company snapshot

- 9.2.4 Active Business Divisions

- 9.2.5 Product portfolio

- 9.2.6 Business performance

- 9.2.7 Major Strategic Initiatives and Developments

- 9.3 Haier Inc. (China)

- 9.3.1 Company Overview

- 9.3.2 Key Executives

- 9.3.3 Company snapshot

- 9.3.4 Active Business Divisions

- 9.3.5 Product portfolio

- 9.3.6 Business performance

- 9.3.7 Major Strategic Initiatives and Developments

- 9.4 Bajaj Electricals Ltd (India)

- 9.4.1 Company Overview

- 9.4.2 Key Executives

- 9.4.3 Company snapshot

- 9.4.4 Active Business Divisions

- 9.4.5 Product portfolio

- 9.4.6 Business performance

- 9.4.7 Major Strategic Initiatives and Developments

- 9.5 Koninklijke Philips N.V. (South Korea)

- 9.5.1 Company Overview

- 9.5.2 Key Executives

- 9.5.3 Company snapshot

- 9.5.4 Active Business Divisions

- 9.5.5 Product portfolio

- 9.5.6 Business performance

- 9.5.7 Major Strategic Initiatives and Developments

- 9.6 IFB Appliances (India)

- 9.6.1 Company Overview

- 9.6.2 Key Executives

- 9.6.3 Company snapshot

- 9.6.4 Active Business Divisions

- 9.6.5 Product portfolio

- 9.6.6 Business performance

- 9.6.7 Major Strategic Initiatives and Developments

- 9.7 KENT (India)

- 9.7.1 Company Overview

- 9.7.2 Key Executives

- 9.7.3 Company snapshot

- 9.7.4 Active Business Divisions

- 9.7.5 Product portfolio

- 9.7.6 Business performance

- 9.7.7 Major Strategic Initiatives and Developments

- 9.8 Eureka Forbes Ltd. (India)

- 9.8.1 Company Overview

- 9.8.2 Key Executives

- 9.8.3 Company snapshot

- 9.8.4 Active Business Divisions

- 9.8.5 Product portfolio

- 9.8.6 Business performance

- 9.8.7 Major Strategic Initiatives and Developments

- 9.9 Panasonic Holdings Corporation (Japan)

- 9.9.1 Company Overview

- 9.9.2 Key Executives

- 9.9.3 Company snapshot

- 9.9.4 Active Business Divisions

- 9.9.5 Product portfolio

- 9.9.6 Business performance

- 9.9.7 Major Strategic Initiatives and Developments

- 9.10 Orient Electric (India)

- 9.10.1 Company Overview

- 9.10.2 Key Executives

- 9.10.3 Company snapshot

- 9.10.4 Active Business Divisions

- 9.10.5 Product portfolio

- 9.10.6 Business performance

- 9.10.7 Major Strategic Initiatives and Developments

10: Analyst Perspective and Conclusion

- 10.1 Concluding Recommendations and Analysis

- 10.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

By Channel |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of household appliances manufacturing in 2030?

+

-

How big is the Global household appliances manufacturing market?

+

-

How do regulatory policies impact the household appliances manufacturing Market?

+

-

What major players in household appliances manufacturing Market?

+

-

What applications are categorized in the household appliances manufacturing market study?

+

-

Which product types are examined in the household appliances manufacturing Market Study?

+

-

Which regions are expected to show the fastest growth in the household appliances manufacturing market?

+

-

What are the major growth drivers in the household appliances manufacturing market?

+

-

Is the study period of the household appliances manufacturing flexible or fixed?

+

-

How do economic factors influence the household appliances manufacturing market?

+

-