Global Household Refrigerators & Freezers Market - Industry Dynamics, Market Size, And Opportunity Forecast To 2030

Report ID: MS-609 | Electronics and Semiconductors | Last updated: Mar, 2025 | Formats*:

Household Refrigerators & Freezers Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

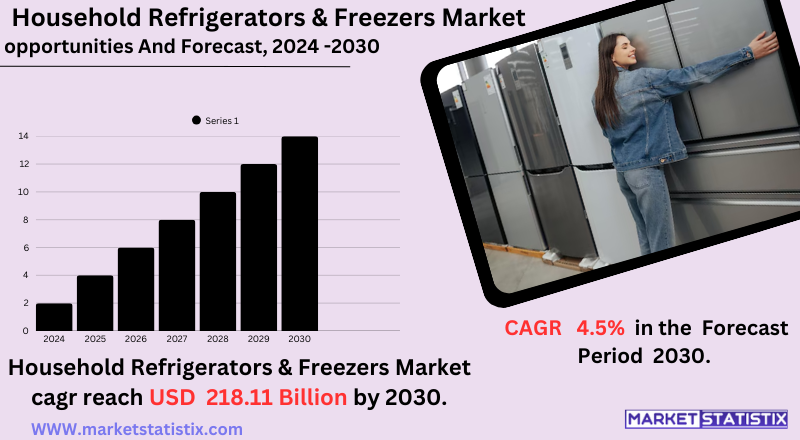

| Growth Rate | CAGR of 4.5% |

| Forecast Value (2030) | USD 218.11 Billion |

| By Product Type | Double Door, Side by Side Door, Single Door, French Door |

| Key Market Players |

|

| By Region |

Household Refrigerators & Freezers Market Trends

As electricity costs rise and awareness of the environment increases, a key trend is increasing interest in energy-efficient appliances. Manufacturers respond by adopting advanced technologies in inverter compressors and better insulation of products that achieve a higher energy rating. Smart refrigerators and freezers are gaining more demand by providing connectivity, remote monitoring, and integration with other smart home electronics. Another strong trend is the increasing desire for aesthetic appeal and spatial efficiency. Consumers are increasingly seen purchasing refrigerators and freezers that match modern kitchen interiors, which include characteristics such as French door designs, built-in models, and customizable finishes. Also, there is an increase in demand for niche storage solutions such as adjustable shelves, humidity-controlled drawers, and allocated compartments for certain foods.Household Refrigerators & Freezers Market Leading Players

The key players profiled in the report are Robert Bosch GmbH, LIEBHERR, AB Electrolux (publ), Panasonic Holdings Corporation, LG Electronics, Haier Group, SAMSUNG, General Electric, Dover Corporation, Whirlpool CorporationGrowth Accelerators

The household refrigerators and freezers market are getting a push owing to a host of factors. To begin with, rising disposable incomes in developing economies are enabling the purchase of these essential appliances by more and more households, widening the consumer base. Urbanization is another key driver; more people are moving to cities, which means smaller living areas and, consequently, greater need for efficient food storage solutions. Besides, the increasing awareness of food waste and the inclination toward longer food preservation indirectly trigger demand for advanced refrigeration technologies. Manufacturers are also forced to work on innovations and products for eco-friendly appliances, thanks to energy efficiency regulations and government initiatives for sustainable living. Moreover, the distribution channels are being widened with the increasing adoption of online retail and e-commerce platforms, enhancing consumer access for a wide range of products.Household Refrigerators & Freezers Market Segmentation analysis

The Global Household Refrigerators & Freezers is segmented by Type, and Region. By Type, the market is divided into Distributed Double Door, Side by Side Door, Single Door, French Door . Geographically, the market is assessed across key Regions like {regionNms} and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

Household refrigerators and freezers: the competitive environment is led by key competitors such as Whirlpool Corporation, Haier Group Corporation, Samsung Electronics, LG Electronics, and Bosch. These manufacturers focus their efforts on innovation to maximize energy efficiency and smart technology in new appliances with features like smartphone connectivity, customizable storage, and environment-friendly refrigerants that evolve with consumer trends. The market is characterized by low concentration, permitting regional and emerging players to enter the arena through cost-effective and localized solutions. The competition is highly intense, which makes advanced technology an existing contention among manufacturers in the attempt to set their products apart from one another in terms of performance, design, and sustainability. Companies now are engaged in bringing innovative designs and features into play, like frost-free technology and inverter compressors.Challenges In Household Refrigerators & Freezers Market

Mainly, the Household Refrigerators & Freezers Market is challenged by increasing competition and shifting consumer demands. Price competitions, especially with new entrants from emerging markets, create competitive profit margin pressures for established brands. In addition, continuous innovation and incorporation of improved technologies such as smart features and energy-efficient systems require significant research and developmental investments. Honestly, balancing all these costs against competitive pricing is one of the major hurdles. Other challenges include dynamically changing consumer preferences for products that are both sustainable and eco-friendly. Supply chain disruptions due to the recent global events may have significant impacts on production and distribution and may even lead to shortages in inventories and increased costs. Long-term sustainability would depend on how well and how quickly businesses adapt to these dynamic market conditions while still making a profit.Risks & Prospects in Household Refrigerators & Freezers Market

The market will also face several emerging trends: customizable storage, inverter compressors that provide energy-efficient operations, and multi-door arrangements. While demand for refrigeration solution innovations is further energized by government initiatives promoting energy-efficient appliances and sustainability. Regionally, the Asia-Pacific region dominates the market due to rapid urbanization, an expanding middle-class population, and increasing penetration of appliances in countries like China and India. Demand is being supported in North America and Europe by technological advancements linked to premium and smart refrigerators, customer trends toward convenience, and product functionality. In Latin America, the Middle East, and Africa, steady growth is observed, supported by improved economic conditions and expanding retail distribution networks.Key Target Audience

The household refrigerator & freezers markets cater to two broad audience segments: the homeowners and renters seeking in-house cooling solutions. The emphasis on simple, convenient, and energy-efficient features within these refrigeration units has grown on consumers, so they now ask for state-of-the-art, Wi-Fi connected units that easily allow temperature control and green refrigerant as part of their specifications. Further, the premium and luxury segments are for high-income households looking to spend on beautiful, high-capacity refrigerators with top-of-the-line technologies for food preservation. Urbanization and more income mean more discontentment with lifestyle preferences; therefore, all these blends to propel the market's demand, especially in developing economies.Merger and acquisition

The market for household refrigerators and freezers has seen some notable merger and acquisition activities by companies trying to consolidate their market positions and expand their product portfolios. Top players like Haier, LG Electronics, Samsung, and Whirlpool have been involved in a series of strategic acquisitions, thereby determining to augment their capabilities and global reach technologically. For instance, the acquisitions in the smart appliance segment allow companies to integrate advanced features such as AI-powered energy management, real-time inventory tracking, and smart home connectivity into their products. These strategies are driven by the growing consumer demand for energy-efficient and technologically advanced refrigerators and the increasing acceptance of smart home ecosystems. >Analyst Comment

The household refrigerators & freezers market is steadily being driven by urbanization, increased income, and the rise in energy-efficient appliances. Consumers demand smart refrigerators with IoT connectivity, temperature control, and voice assistance. This is forcing leading players Whirlpool, Samsung, LG, and Haier to focus on innovations in design and production, use of sustainable materials, and eco-friendly refrigerants for compliance with environmental regulations. Demand for frost-free and multi-door refrigerators is also on the rise, especially in developing regions where lifestyle upgrades are gaining acceptance and modern kitchen trends are widely spread.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Household Refrigerators & Freezers- Snapshot

- 2.2 Household Refrigerators & Freezers- Segment Snapshot

- 2.3 Household Refrigerators & Freezers- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Household Refrigerators & Freezers Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Single Door

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Double Door

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Side by Side Door

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 French Door

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

5: Competitive Landscape

- 5.1 Overview

- 5.2 Key Winning Strategies

- 5.3 Top 10 Players: Product Mapping

- 5.4 Competitive Analysis Dashboard

- 5.5 Market Competition Heatmap

- 5.6 Leading Player Positions, 2022

6: Company Profiles

- 6.1 General Electric

- 6.1.1 Company Overview

- 6.1.2 Key Executives

- 6.1.3 Company snapshot

- 6.1.4 Active Business Divisions

- 6.1.5 Product portfolio

- 6.1.6 Business performance

- 6.1.7 Major Strategic Initiatives and Developments

- 6.2 Dover Corporation

- 6.2.1 Company Overview

- 6.2.2 Key Executives

- 6.2.3 Company snapshot

- 6.2.4 Active Business Divisions

- 6.2.5 Product portfolio

- 6.2.6 Business performance

- 6.2.7 Major Strategic Initiatives and Developments

- 6.3 AB Electrolux (publ)

- 6.3.1 Company Overview

- 6.3.2 Key Executives

- 6.3.3 Company snapshot

- 6.3.4 Active Business Divisions

- 6.3.5 Product portfolio

- 6.3.6 Business performance

- 6.3.7 Major Strategic Initiatives and Developments

- 6.4 Haier Group

- 6.4.1 Company Overview

- 6.4.2 Key Executives

- 6.4.3 Company snapshot

- 6.4.4 Active Business Divisions

- 6.4.5 Product portfolio

- 6.4.6 Business performance

- 6.4.7 Major Strategic Initiatives and Developments

- 6.5 LG Electronics

- 6.5.1 Company Overview

- 6.5.2 Key Executives

- 6.5.3 Company snapshot

- 6.5.4 Active Business Divisions

- 6.5.5 Product portfolio

- 6.5.6 Business performance

- 6.5.7 Major Strategic Initiatives and Developments

- 6.6 LIEBHERR

- 6.6.1 Company Overview

- 6.6.2 Key Executives

- 6.6.3 Company snapshot

- 6.6.4 Active Business Divisions

- 6.6.5 Product portfolio

- 6.6.6 Business performance

- 6.6.7 Major Strategic Initiatives and Developments

- 6.7 Robert Bosch GmbH

- 6.7.1 Company Overview

- 6.7.2 Key Executives

- 6.7.3 Company snapshot

- 6.7.4 Active Business Divisions

- 6.7.5 Product portfolio

- 6.7.6 Business performance

- 6.7.7 Major Strategic Initiatives and Developments

- 6.8 Panasonic Holdings Corporation

- 6.8.1 Company Overview

- 6.8.2 Key Executives

- 6.8.3 Company snapshot

- 6.8.4 Active Business Divisions

- 6.8.5 Product portfolio

- 6.8.6 Business performance

- 6.8.7 Major Strategic Initiatives and Developments

- 6.9 SAMSUNG

- 6.9.1 Company Overview

- 6.9.2 Key Executives

- 6.9.3 Company snapshot

- 6.9.4 Active Business Divisions

- 6.9.5 Product portfolio

- 6.9.6 Business performance

- 6.9.7 Major Strategic Initiatives and Developments

- 6.10 Whirlpool Corporation

- 6.10.1 Company Overview

- 6.10.2 Key Executives

- 6.10.3 Company snapshot

- 6.10.4 Active Business Divisions

- 6.10.5 Product portfolio

- 6.10.6 Business performance

- 6.10.7 Major Strategic Initiatives and Developments

7: Analyst Perspective and Conclusion

- 7.1 Concluding Recommendations and Analysis

- 7.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Household Refrigerators & Freezers in 2030?

+

-

How big is the Global Household Refrigerators & Freezers market?

+

-

How do regulatory policies impact the Household Refrigerators & Freezers Market?

+

-

What major players in Household Refrigerators & Freezers Market?

+

-

What applications are categorized in the Household Refrigerators & Freezers market study?

+

-

Which product types are examined in the Household Refrigerators & Freezers Market Study?

+

-

Which regions are expected to show the fastest growth in the Household Refrigerators & Freezers market?

+

-

What are the major growth drivers in the Household Refrigerators & Freezers market?

+

-

Is the study period of the Household Refrigerators & Freezers flexible or fixed?

+

-

How do economic factors influence the Household Refrigerators & Freezers market?

+

-