Global Humidity Sensor Market - Industry Dynamics, Market Size, And Opportunity Forecast To 2031

Report ID: MS-2303 | Electronics and Semiconductors | Last updated: Dec, 2024 | Formats*:

Humidity Sensor Report Highlights

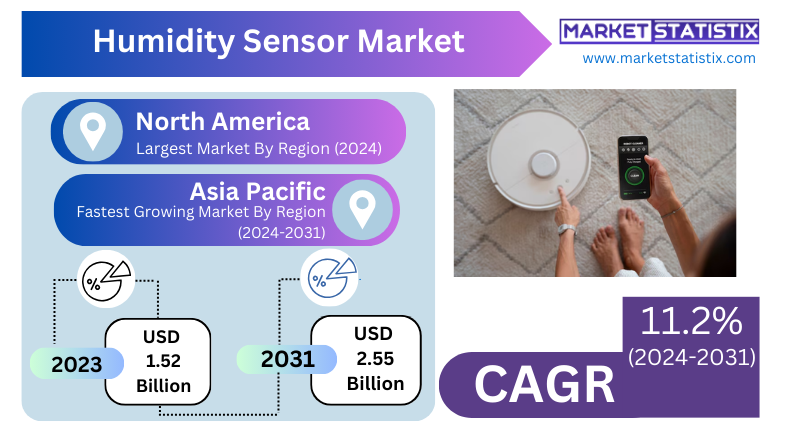

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2031 |

| Base Year Of Estimation | 2023 |

| Growth Rate | CAGR of 11.2% |

| Forecast Value (2031) | USD 2.55 Billion |

| By Product Type | Absolute Humidity Sensor, Relative Humidity Sensor, Others |

| Key Market Players |

|

| By Region |

|

Humidity Sensor Market Trends

Demand for advanced environmental monitoring in different industries is driving the growth of the humidity sensor market. The other important trend is the integration of smart humidity sensors into IoT applications, where the sensors can be used for real-time monitoring in homes, HVAC, and industrial automation. These sensors monitor energy optimisation, air quality, and comfort while making advances in interest in energy-efficient and connected devices. Another interesting trend is miniaturisation and high sensitivity, as it allows compact and comprehensive devices. Automotive applications and healthcare are emerging applications for the humidity sensor market as the two industries seek ways to improve vehicle climate control and monitor environments within medical facilities like clean rooms and incubators. Moreover, sensor calibration and multi-functionality are assigned greater prominence as sensors are going beyond singular environmental parameters like temperature and pressure. Their multi-functionality will provide broader solutions for industrial and agricultural applications.Humidity Sensor Market Leading Players

The key players profiled in the report are Galltec Mess- und Regeltechnik GmbH, PCE Deutschland GmbH, Bosch Sensortec GmbH, E+E Elektronik Ges.m.b.H., Sensata Technologies Inc., Sensirion AG, Honeywell International Inc., Infineon Technologies AG, IST AG, TE Connectivity, B+B Thermo-Technik GmbHGrowth Accelerators

The humidity sensor market is largely driven by applications in smart home devices and building automation. The benefits enjoyed by consumers from humidity sensors in terms of convenience and energy efficiency will lead to their increase in intake from the smart thermostats, air purifiers, and HVACs that control indoor air quality. Bring optimal indoor humidity levels into the house as a consequent improvement in comfort, health, and energy savings, boosting their share in the residential, commercial, and industrial sectors. Apart from that, the most important driver for growth is the increasing demand for industrial applications, mainly in pharmaceuticals, food processing, and agriculture—the three broad industries or fields where it has critical importance to the quality and safety of the product. An example of the use of humidity sensors in flourishing pharmaceutical industries would be the definition of storage conditions for drugs, while another would be in food processing, where the sensors would work on improving the quality and shelf life of perishable goods. The rising concern for environmental monitoring and the accuracy requirement of such control in the aerospace and automotive manufacturing sectors will contribute to the widening of the market.Humidity Sensor Market Segmentation analysis

The Global Humidity Sensor is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Absolute Humidity Sensor, Relative Humidity Sensor, Others . The Application segment categorizes the market based on its usage such as Automotive, Pharmaceutical & Healthcare, Industrial, Building Automation & Domestic Appliances, Food & Beverages, Environmental, Agriculture, Others. Geographically, the market is assessed across key Regions like North America(United States, Canada, Mexico), South America(Brazil, Argentina, Chile, Rest of South America), Europe(Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific(China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA(Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The dust is settling in the humidity sensors marketplace, between already existing competitors and new entrants. Taking a lead in the advanced sensor technologies for different applications includes competitively established companies like Honeywell International, Sensirion, Texas Instruments, Siemens, and a few others. These companies lead in the development of innovative, high-performance humidity sensors to cover industrial, automotive, and consumer electronics applications. They spend much on their R&D budgets in improving sensor accuracy and miniaturization with integration into IoT platforms to widen their competitiveness across multiple markets like HVAC systems, environmental monitoring, and intelligent devices.Challenges In Humidity Sensor Market

The market for humidity sensors is fraught with challenges relating to the accuracy and reliability of sensors. Humidity sensors should work in the most varying environments, even subjecting them to extreme temperatures and high humidities, which often affects their sensitivity and life span. Reduced reliability is in most cases linked with variations in performance due to environmental influences or manufacturing inconsistencies that further increase the need for frequent calibration and maintenance. Integration and compatibility with other systems is still a challenge for humidity sensors. As the market grows, the requirement for sensors that can easily integrate into IoT and other smart systems has grown massively, although incorporating them in highly sophisticated communication protocols and data-processing functionalities makes them difficult to work with in some applications, especially in emerging economies, where cost efficiency is the battleground for growth.Risks & Prospects in Humidity Sensor Market

The profits on this emerging market for humidity sensors include the increasing demand for smart home technologies and environmental monitoring systems. As consumers increase their control over indoor climate and energy efficiency, humidity sensors will become essential accessories in the management of HVAC systems, dehumidifiers, and air purifiers. Also, the market is on fire due to the increasing prevalence of IoT devices in homes and commercial and industrial buildings, as these sensors are fundamental parts of creating connected environments that interactively react to changes in humidity almost immediately and blend in with comfort and energy savings. Another primary area for opportunity is through the automotive and health care sectors. Humidity sensing devices are becoming a standard feature on modern vehicles for controlling cabin environments, which can provide maximum comfort to passengers and even prevent mould growth. Humidity sensors are, in fact, now one of the most crucial components in a healthcare facility for maintaining conditions conducive to medical equipment, pharmaceuticals, patient care in incubators, a storage environment for vaccines, etc.Key Target Audience

The most relevant target audiences for the humidity sensor market comprise industries such as electronics and consumer goods, whereby humidity sensors have been included in air-conditioning and dehumidifying applications as well as smart home appliances. Humidity sensors are made essential, as they bring about optimal indoor air quality, moisture level control, as well as appliance operation performance.,, For a very important further audience, consider the industry as a whole, such as pharmaceuticals, food and beverages, and agriculture. It is always worth installing humidity sensors in any environment where medicines, food, and crops need to be stored because these things are very sensitive. Accurate humidity control becomes very important when dealing with such products, which can easily spoil if left unattended. It should also be noted that motor companies and HVAC industries use these sensors in vehicles for efficient climate control and energy optimisation at the microlevel.Merger and acquisition

The latest **mergers and acquisitions** in the humidity sensor market point increasingly towards consolidation, as companies are eager to improve their technological capabilities and expand their market presence. Process Sensing Technologies announced the acquisition of Sensor Electronic GmbH in September 2023. The merged company is an added value to Process Sensing Technologies' existing sensor portfolio to cater to products specific to applications in critically demanding industries. The acquisition now joins a wider scope—say, Honeywell and E+E Elektronik where both are also into newly launching new products or even collaborations to withstand competition in the market. For example, Weathernews Inc. entered into a collaboration with Omron Corporation on another IoT sensor, Soratena Pro, that is high-performance for weather condition monitoring that is coupled with measuring the humidity value. - . The other emerging thing in the market is its partnerships focused on innovation and product development. In November 2023, E+E Elektronik introduced new high-end humidity and temperature sensors that meet the needs of facility automation applications. This is evidence of yet another continued focus on applying advanced technologies to sensor solutions. >Analyst Comment

"A humidity sensor is an electronic equipment that measures the present amount of water in the air or its specific measurement in the humid air. Such sensors are commonly used in every field: weather forecasting, climate control, industrial processes, etc. The growth of the humidity sensor market is attributed to the increase in demand for all accurate environmental monitoring. Besides, the advancements in sensor technology owing to the miniaturization and increased accuracy would boost the markets across various sectors."- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Humidity Sensor- Snapshot

- 2.2 Humidity Sensor- Segment Snapshot

- 2.3 Humidity Sensor- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Humidity Sensor Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Absolute Humidity Sensor

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Relative Humidity Sensor

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Others

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

5: Humidity Sensor Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Automotive

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Pharmaceutical & Healthcare

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Industrial

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Building Automation & Domestic Appliances

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Food & Beverages

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

- 5.7 Environmental

- 5.7.1 Key market trends, factors driving growth, and opportunities

- 5.7.2 Market size and forecast, by region

- 5.7.3 Market share analysis by country

- 5.8 Agriculture

- 5.8.1 Key market trends, factors driving growth, and opportunities

- 5.8.2 Market size and forecast, by region

- 5.8.3 Market share analysis by country

- 5.9 Others

- 5.9.1 Key market trends, factors driving growth, and opportunities

- 5.9.2 Market size and forecast, by region

- 5.9.3 Market share analysis by country

6: Humidity Sensor Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 Galltec Mess- und Regeltechnik GmbH

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 PCE Deutschland GmbH

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Bosch Sensortec GmbH

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 E+E Elektronik Ges.m.b.H.

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Sensata Technologies Inc.

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Sensirion AG

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Honeywell International Inc.

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 Infineon Technologies AG

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 IST AG

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 TE Connectivity

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

- 8.11 B+B Thermo-Technik GmbH

- 8.11.1 Company Overview

- 8.11.2 Key Executives

- 8.11.3 Company snapshot

- 8.11.4 Active Business Divisions

- 8.11.5 Product portfolio

- 8.11.6 Business performance

- 8.11.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Humidity Sensor in 2031?

+

-

How big is the Global Humidity Sensor market?

+

-

How do regulatory policies impact the Humidity Sensor Market?

+

-

What major players in Humidity Sensor Market?

+

-

What applications are categorized in the Humidity Sensor market study?

+

-

Which product types are examined in the Humidity Sensor Market Study?

+

-

Which regions are expected to show the fastest growth in the Humidity Sensor market?

+

-

Which application holds the second-highest market share in the Humidity Sensor market?

+

-

Which region is the fastest growing in the Humidity Sensor market?

+

-

What are the major growth drivers in the Humidity Sensor market?

+

-