Global Hydrogen Fuel Cell Truck Market – Industry Trends and Forecast to 2031

Report ID: MS-156 | Automotive and Transport | Last updated: Nov, 2024 | Formats*:

Hydrogen Fuel Cell Truck Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2031 |

| Base Year Of Estimation | 2023 |

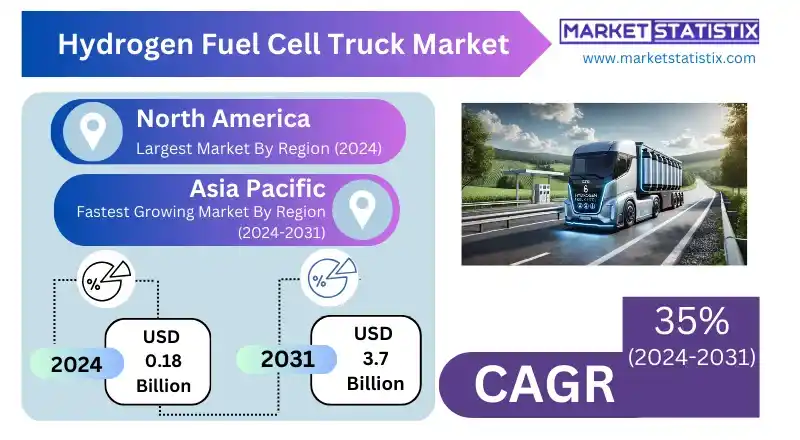

| Growth Rate | CAGR of 35% |

| Forecast Value (2031) | USD 3.7 Billion |

| Key Market Players |

|

| By Region |

Hydrogen Fuel Cell Truck Market Trends

The hydrogen fuel cell truck market is increasing at a great rate; it is being influenced by the rising demand for green and emission-free transportation solutions in logistics and freight. Other vital trends include long-distance hydrogen-powered trucks acting as an alternative to battery-electric trucks in attempting to address the problems like long-distance capabilities and faster refuelling times. Some of the best truck manufacturers in the world are investing a lot of funds into hydrogen fuel cell technology, and partnerships among the car and energy firms are encouraging the development of hydrogen refuelling infrastructure that is further expanding the market. Another crucial trend is the growth of government incentives and regulatory support toward reducing carbon emissions from the transportation sector. Numerous countries begin adopting more stringent regulations on emissions, even with subsidies on adopting hydrogen fuel cell vehicles especially in the freight and public transportation sectors. All these transitions eventually drive hydrogen toward being the clean and scalable option for heavy-duty transport decarbonization.Hydrogen Fuel Cell Truck Market Leading Players

The key players profiled in the report are hyundai motor company, Kenworth Truck Company, Dongfeng Motor Company, Sany Group Co. Ltd., Xiamen King Long International Trading Co. Ltd, Nikola Corporation, Esoro AG, Renault Trucks, XCMG Group, Hyzon Motors.Growth Accelerators

The main driving factors behind the hydrogen fuel cell truck market are the increasing demand for a sustainable and low-emission transportation solution. Stricter emission regulations and carbon-neutral goals in governments worldwide have created the need for clean alternatives to diesel trucks. Hydrogen fuel cell trucks, with no emissions compared with battery electric vehicles but having longer driving ranges, are a viable solution for heavy-duty logistics, including long-haul freight operations. As fleet operators now place more emphasis on minimizing the carbon footprint of the transport sector, hydrogen-powered trucks find their place in the domain of green ventures. Other factors driving market growth are the growing interest and investment in hydrogen technology by the leading manufacturers of automobiles and logistics companies. Such rapid collaboration and innovation are significant for the improvement of the commercial and scalability viability of hydrogen fuel cells as a competitive proposition for the future freight and logistics industry.Hydrogen Fuel Cell Truck Market Segmentation analysis

The Global Hydrogen Fuel Cell Truck is segmented by and Region. . Geographically, the market is assessed across key Regions like {regionNms} and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The market landscape for hydrogen fuel cell decentralized transports is characterized by a combination of the conventional auto manufacturers and specialized startups dealing with green energy solutions. Leading automotive manufacturers, namely Toyota, Daimler, and Volvo, want to stay ahead of the curve by engaging in excessive investments in research and development focused on hydrogen fuel cell technology for use in their commercial vehicles. These companies are also working together with fuel manufacturers and infrastructure providers in order to maintain a promising and reliable hydrogen supply chain, which is necessary for the successful utilization of fuel cell trucks. Emphasis for this sector, however, remains on the achievements of eye-seeking-related motivations within the framework of vehicle emissions technologies, standards, and vehicle design. Apart from the leading manufacturers, a number of companies, including Nikola, Ballard Power Systems, and Hyzon Motors, tend to enter the comparative competition and offer alternative solutions in the market. These companies pursue broader market differentiation through new product features such as modular hydrogen systems or advanced fuel cell technologies. Besides, obtaining the credibility and market presence involves forming partnerships with logistics companies and governments for conducting pilot projects and programs.Challenges In Hydrogen Fuel Cell Truck Market

Validating the potential of hydrogen fuel cell trucks in real-world applications faces a number of basic issues, the predominant one being that the fuel cell technology, together with its necessary support systems, is expensive. Hydrogen fuel cell systems are more costly in financial terms than traditional diesel engines, and electric drives thus represent an obstacle to their extensive deployment, especially among small and medium. Also, the absence of an all-encompassing refuelling system characterized by a few hydrogen stations makes it hard to support long-distance driving, which in turn hinders the growth of the market as the fleets cannot expect easy refuelling. Another problem is the production and availability of green hydrogen, which is necessary for the environmental advantages of fuel cell trucks to be guaranteed. For obvious reasons, the bulk of hydrogen produced today is made from fossil fuels; thus, these production processes do not promote sustainability. With the increase in the temperature of the climate changes, the environmentally friendly hydrogen production command based on the rich renewable resources has just begun and has therefore a number of problems with scalability and cost.Risks & Prospects in Hydrogen Fuel Cell Truck Market

The market for hydrogen fuel-cell vehicles, especially trucks, is forecasted to grow due to the rising need for eco-friendly or zero-emission modes of transportation. In addition, with various governments across the world tightening emission standards and encouraging the adoption of environmentally friendly technologies, industries are now wanting to switch to hydrogen-powered trucks in order to cut down on their carbon emissions. This is especially inconvenient in the case of logistical, freight, or long-haul transportation industries, where most battery electric trucks have very short driving ranges and long refuelling periods as compared to hydrogen fuel cell trucks. There is also a concern for the manufacturers, as the proposition of deploying hydrogen fuel cell trucks into the structure of heavy-duty applications provides an attractive vertical market. Moreover, the rising development of hydrogen-related infrastructure, including but not limited to refuelling stations and hydrogen generation plants, also facilitates the growth of the fuel cell trucks’ market. As nations begin to advocate for energy diversification and sustainability, partnerships between car manufacturers, energy suppliers, and state agencies will lead to increased progress temporally and spatially.Key Target Audience

Transportation and logistics services are the most densely populated groups in the hydrogen fuel cell truck industry, and both seek to become more environmentally friendly. More precisely: large fleet managers and operators, as well as businesses engaged in shipping and freight transportation, all of which require long-haul, heavy vehicles capable of transporting merchandise but still complying with emission regulations. In these sectors, hydrogen fuel cell trucks are becoming more popular than less harmful fossil diesel engines thanks to their fast-refuelling times, long-range driving properties, and clean emissions, especially for long-distance hauls.,, Moreover, another important factor of this market is governments and other policy influencers encouraging the effective use of low-carbon transportation. These actors offer resources—measures, assistance, and provision of necessary infrastructure—to further the goal of replacing the internal combustion engine of heavy-duty vehicles with hydrogen-powered ones. The other market participants are hydrogen producers and engineering companies, energy business players who are developing hydrogen refuelling stations and their infrastructure aiming at fuel cell truck market growth.Merger and acquisition

The market for hydrogen fuel cell trucks is experiencing a surge in mergers and acquisitions as businesses seek to enhance their technological capability and increase their market share. The latest major acquisition is Phoenix Motor Inc., which purchased the manufacturing assets of Altergy Systems, including a highly sophisticated robotic fuel cell assembly line. With this acquisition, Phoenix is now able to make its own hydrogen fuel cells for a number of different uses, including trucks, thus speeding up its foray into the burgeoning hydrogen fuel cell business. With the facility being able to make a fuel cell every 30 seconds, it places Phoenix in a good position to resolve the ever-increasing demand as the market shifts focus to sustainable mobility systems. In addition, the acquisition of Convion Oy by HD Hydrogen worth €72 million is another classic strategic acquisition within the industry. By combining its solid oxide fuel cell and electrolyser technologies with Convion’s, HD Hydrogen hopes to retain its lead in the hydrogen fuel cell sector with an emphasis on commercial markets. This acquisition echoes the current trend of companies merging or partnering in order to maximize the use of their resources and expertise for the development of hydrogen technology and infrastructure. The consolidation movements currently ongoing are also presumed to be a factor that will foster the innovations and speed up the adoption of hydrogen fuel cell vehicles in the commercial vehicle sector.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Hydrogen Fuel Cell Truck- Snapshot

- 2.2 Hydrogen Fuel Cell Truck- Segment Snapshot

- 2.3 Hydrogen Fuel Cell Truck- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Hydrogen Fuel Cell Truck Market by Truck Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Light Duty Truck

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Medium Duty Truck

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Heavy Duty Truck

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

5: Hydrogen Fuel Cell Truck Market by Range

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Below 400 Km

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Above 400 km

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

6: Hydrogen Fuel Cell Truck Market by Power Output

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 Below 150 KW

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 151 - 250 KW

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

- 6.4 Above 250 KW

- 6.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.2 Market size and forecast, by region

- 6.4.3 Market share analysis by country

7: Competitive Landscape

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 hyundai motor company

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 Kenworth Truck Company

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Dongfeng Motor Company

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 Sany Group Co. Ltd.

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Xiamen King Long International Trading Co. Ltd

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Nikola Corporation

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Esoro AG

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 Renault Trucks

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 XCMG Group

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 Hyzon Motors.

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Truck Type |

|

By Range |

|

By Power Output |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the estimated market size of Hydrogen Fuel Cell Truck in 2031?

+

-

What is the growth rate of Hydrogen Fuel Cell Truck Market?

+

-

What are the latest trends influencing the Hydrogen Fuel Cell Truck Market?

+

-

Who are the key players in the Hydrogen Fuel Cell Truck Market?

+

-

How is the Hydrogen Fuel Cell Truck } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Hydrogen Fuel Cell Truck Market Study?

+

-

What geographic breakdown is available in Global Hydrogen Fuel Cell Truck Market Study?

+

-

Which region holds the second position by market share in the Hydrogen Fuel Cell Truck market?

+

-

How are the key players in the Hydrogen Fuel Cell Truck market targeting growth in the future?

+

-

What are the opportunities for new entrants in the Hydrogen Fuel Cell Truck market?

+

-