Global Industrial Smoke Alarm Market Trends and Forecast to 2030

Report ID: MS-633 | Electronics and Semiconductors | Last updated: Mar, 2025 | Formats*:

Industrial Smoke Alarm Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2024 |

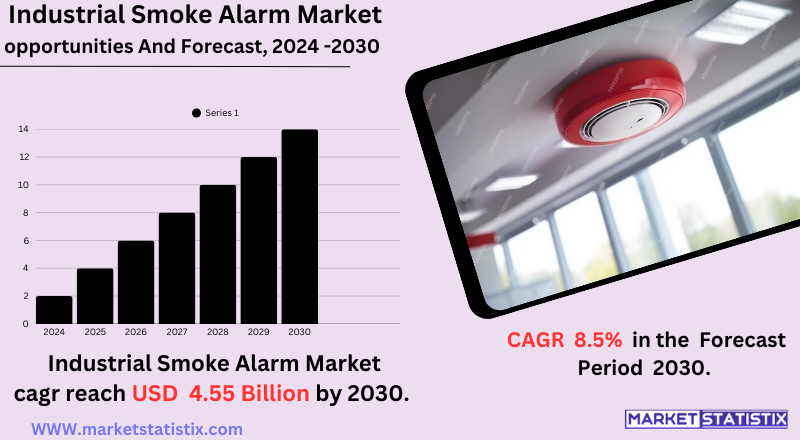

| Growth Rate | CAGR of 8.5% |

| Forecast Value (2030) | USD 4.55 Billion |

| Key Market Players |

|

| By Region |

Industrial Smoke Alarm Market Trends

The market for industrial current sensor ICs is seeing the emergence of several key trends that are critical to their growth. One such trend is the increased adoption of Hall effect-based current sensors owing to their non-intrusive high-precision measurement. This technology becomes even more important, especially in applications where current may be observed without direct electrical contact, as in the case of very high voltage as well as high current conditions. Another relevant aspect is the great popularity of a miniaturized and integrated current sensor IC that supports the continuously miniaturizing electronic devices and the increasingly complex industrial automation systems. In addition, smart sensors with enhanced signal processing and machine learning algorithms that enable predictive maintenance and fault detection are slowly emerging in the market. The key drivers of these advances would include a growing awareness of the need for more reliable and efficient current monitoring in industries like automotive, renewable energy, and industrial automation.Industrial Smoke Alarm Market Leading Players

The key players profiled in the report are Robert Bosch GmbH, Mircom Group, TycoFIS (Tyco International Ltd), Honeywell International, Hochiki Corporation, Siemens AG, Johnson Controls International PLC, ABB Group, Kidde Fire Safety (United Technologies Corporation), Nittan Co., Ltd.Growth Accelerators

The fast adoption of automation and robotics in industrialization is the primary key driver of the Industrial Current Sensor IC market. Quite naturally, as industries look to become more efficient and precise, currents become a much-needed input to monitoring flow. Improved control and optimization of machinery and processes would escalate the demand for such monitoring. Electric vehicles and renewable energy systems, too, have increased the demand for accurate current sensing in battery management, power conversion, and grid integration. Further, applications in real-time data acquisition and analysis would drive the market for next-generation current sensor ICs. Rigorous safety regulations and energy efficiency gains are forcing industries into strong current measurement structures. The other large emerging driver is the learning of IoT and Industry 4.0 because they all make accurate current measurements necessary for predictive maintenance, fault detection, and process optimization. The escalating demand for neat, effective, and powerful current sensor ICs thus promotes innovation in advanced sensing solutions.Industrial Smoke Alarm Market Segmentation analysis

The Global Industrial Smoke Alarm is segmented by Application, and Region. . The Application segment categorizes the market based on its usage such as Commercial, Industrial, Residential. Geographically, the market is assessed across key Regions like {regionNms} and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

On the whole, the industrial current sensor IC market is a platform for competition where semiconductor manufacturers are coerced into the scene with companies that specialize in sensor-based technology. Players contest for market share by continuous and significant innovation that concentrates on improving products' accuracy, reliability, and integration capabilities. Companies invest heavily in R&D to gain a competitive edge in advanced sensing technologies like Hall effect sensors, fluxgate sensors, shunt resistors, etc., to achieve the evolving requirements of industrial applications. Commercial pricing, product separation, and the ability to provide rigorous technical support are what influence this early market formation. Smart manufacturing and demand for data-driven insights are driving companies toward integrating advanced communication interfaces and digital signal processing capabilities into their sensor ICs, creating further competition for a pure technological edge.Challenges In Industrial Smoke Alarm Market

The industrial current sensor IC market itself is faced with various challenges that restrict its growth and adoption. For one, the cost of advanced sensor technologies is high, limiting access to small-scale industries and price-sensitive markets. Their integration and calibration require high developmental costs, rendering operational use costly. They can also be prevented from widespread use. Added to this is the occurrence of strained supply chain disruptions, for instance, the availability of semiconductors due to geopolitical standoffs, which greatly affects one's production timeline and stability. These factors come together to limit the ability of manufacturers to come up with cost-effective solutions while delivering technological innovation. Another one is to produce accurate and reliable solutions in extreme industrial environments like high temperatures, EMI, and mechanical stresses. Moreover, these will significantly incapacitate sensor performance, leading to inefficiencies or equipment malfunctioning. Hence, manufacturers need to come out with durable sensors, which are also stated to have signal processing performance improvements. Premium sensor providers face additional challenges of price wars and new entrants of low-cost alternatives, prompting them toward investment in R&D for miniaturized and energy-efficient designs, all done with a narrow profit margin.Risks & Prospects in Industrial Smoke Alarm Market

The increasing demand for precise current sensing in EV battery management, motor control, and energy distribution is responsible for sensor technology innovations like Hall-effect and fluxgate sensors. IoT-enabled monitoring solutions further provide avenues for real-time data analysis, predictive maintenance, and operational efficiency enhancement in industrial applications. The Asia-Pacific region is set to grow the fastest on account of its industrialization, increasing electrification, and government efforts to support automation and renewable energy-building infrastructure. Regionally, North America occupies the largest market share, thanks to its sophisticated manufacturing base and strong adoption of smart grid technologies. Asia-Pacific is, however, characterized by the fastest growth rate, led by industrialization in China, India, and South Korea. Governments in these areas invest hugely in semiconductor manufacturing and energy-efficient systems for fostering industry growth. This interest in synergizing Industry 4.0 technologies with energy-efficient sensor design would further ramp up the market opportunities across regions. Thus, this ever-changing regional setting indicates an ongoing global transition to intelligent power management and sustainable industrial practices.Key Target Audience

The industrial current sensor IC market will be significantly influenced in the near future by manufacturers from the automotive, energy, and industrial automation sectors. Automotive manufacturers employ current sensors to manage batteries used in electric and hybrid cars—the sensors yield accurate measurements required for optimal performance as well as for safety purposes. For instance, power grid operators and renewable utility generators include current sensor ICs in their solar inverters, wind turbines, and other smart grid systems to facilitate energy distribution management.,, Apart from the manufacturers, the electronic device manufacturers and IoT solutions providers also form a big audience to be featured in future developments because they may be looking for accurate power monitoring for their smart devices, data centers, and telecommunication networks. They will be mobilized by the regulatory and investment initiatives devised by government entities and research institutions in the areas of energy efficiency and sustainability. Industries are migrating toward Industry 4.0, AI-driven analytics, and 5G infrastructure as they demand more precise and efficient current sensing solutions, thus making sensor ICs vital components in modern connected systems.Merger and acquisition

The market for industrial current sensor ICs has recently experienced significant mergers and acquisitions, representing a strategic move by key industry players to improve their market standing and technological compatibility. In October 2023, Allegro MicroSystems finalized its acquisition of Crocus Technology for $420 million to further facilitate innovation in Tunnel Magnetoresistance (TMR) sensing technology. This is intended to enhance Allegro's portfolio of high-performance magnetic sensors for automotive and industrial applications. In March 2025, Allegro MicroSystems attracted acquisition interest from ON Semiconductor (Onsemi), with Onsemi reportedly offering $35.10 per share. Allegro, however, rejected this as inadequate. This is also coming on the heels of TE Connectivity's February 2025 announcement regarding its acquisition of Richards Manufacturing for about $2.3 billion. It is aimed at expanding TE's foothold into electric utilities as demand for power increases with AI innovations and an improved infrastructure. These are indicative of the ongoing consolidation trend in the current sensor IC market, where companies also want to extend their technological capabilities while satisfying the craving for stronger, more advanced sensing solutions from end-users. >Analyst Comment

Currently, the industrial smoke alarm market is growing owing to various aspects like rising public awareness of fire hazards and prescribed norms and stringent standards by specific industries. Recently, the market has also seen a shift to advanced technologies such as wireless connections or smart sensor systems to achieve real-time monitoring and early detection of fire hazards. Increased demand for reliable smoke detection solutions comes from manufacturing, oil and gas, and warehousing, where fire risks are severe.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Industrial Smoke Alarm- Snapshot

- 2.2 Industrial Smoke Alarm- Segment Snapshot

- 2.3 Industrial Smoke Alarm- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Industrial Smoke Alarm Market by Application / by End Use

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Commercial

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Industrial

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Residential

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

5: Competitive Landscape

- 5.1 Overview

- 5.2 Key Winning Strategies

- 5.3 Top 10 Players: Product Mapping

- 5.4 Competitive Analysis Dashboard

- 5.5 Market Competition Heatmap

- 5.6 Leading Player Positions, 2022

6: Company Profiles

- 6.1 Honeywell International

- 6.1.1 Company Overview

- 6.1.2 Key Executives

- 6.1.3 Company snapshot

- 6.1.4 Active Business Divisions

- 6.1.5 Product portfolio

- 6.1.6 Business performance

- 6.1.7 Major Strategic Initiatives and Developments

- 6.2 ABB Group

- 6.2.1 Company Overview

- 6.2.2 Key Executives

- 6.2.3 Company snapshot

- 6.2.4 Active Business Divisions

- 6.2.5 Product portfolio

- 6.2.6 Business performance

- 6.2.7 Major Strategic Initiatives and Developments

- 6.3 Siemens AG

- 6.3.1 Company Overview

- 6.3.2 Key Executives

- 6.3.3 Company snapshot

- 6.3.4 Active Business Divisions

- 6.3.5 Product portfolio

- 6.3.6 Business performance

- 6.3.7 Major Strategic Initiatives and Developments

- 6.4 Hochiki Corporation

- 6.4.1 Company Overview

- 6.4.2 Key Executives

- 6.4.3 Company snapshot

- 6.4.4 Active Business Divisions

- 6.4.5 Product portfolio

- 6.4.6 Business performance

- 6.4.7 Major Strategic Initiatives and Developments

- 6.5 Johnson Controls International PLC

- 6.5.1 Company Overview

- 6.5.2 Key Executives

- 6.5.3 Company snapshot

- 6.5.4 Active Business Divisions

- 6.5.5 Product portfolio

- 6.5.6 Business performance

- 6.5.7 Major Strategic Initiatives and Developments

- 6.6 Robert Bosch GmbH

- 6.6.1 Company Overview

- 6.6.2 Key Executives

- 6.6.3 Company snapshot

- 6.6.4 Active Business Divisions

- 6.6.5 Product portfolio

- 6.6.6 Business performance

- 6.6.7 Major Strategic Initiatives and Developments

- 6.7 Mircom Group

- 6.7.1 Company Overview

- 6.7.2 Key Executives

- 6.7.3 Company snapshot

- 6.7.4 Active Business Divisions

- 6.7.5 Product portfolio

- 6.7.6 Business performance

- 6.7.7 Major Strategic Initiatives and Developments

- 6.8 Kidde Fire Safety (United Technologies Corporation)

- 6.8.1 Company Overview

- 6.8.2 Key Executives

- 6.8.3 Company snapshot

- 6.8.4 Active Business Divisions

- 6.8.5 Product portfolio

- 6.8.6 Business performance

- 6.8.7 Major Strategic Initiatives and Developments

- 6.9 TycoFIS (Tyco International Ltd)

- 6.9.1 Company Overview

- 6.9.2 Key Executives

- 6.9.3 Company snapshot

- 6.9.4 Active Business Divisions

- 6.9.5 Product portfolio

- 6.9.6 Business performance

- 6.9.7 Major Strategic Initiatives and Developments

- 6.10 Nittan Co.

- 6.10.1 Company Overview

- 6.10.2 Key Executives

- 6.10.3 Company snapshot

- 6.10.4 Active Business Divisions

- 6.10.5 Product portfolio

- 6.10.6 Business performance

- 6.10.7 Major Strategic Initiatives and Developments

- 6.11 Ltd.

- 6.11.1 Company Overview

- 6.11.2 Key Executives

- 6.11.3 Company snapshot

- 6.11.4 Active Business Divisions

- 6.11.5 Product portfolio

- 6.11.6 Business performance

- 6.11.7 Major Strategic Initiatives and Developments

7: Analyst Perspective and Conclusion

- 7.1 Concluding Recommendations and Analysis

- 7.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the projected market size of Industrial Smoke Alarm in 2030?

+

-

Which application type is expected to remain the largest segment in the Global Industrial Smoke Alarm market?

+

-

How big is the Global Industrial Smoke Alarm market?

+

-

How do regulatory policies impact the Industrial Smoke Alarm Market?

+

-

What major players in Industrial Smoke Alarm Market?

+

-

What applications are categorized in the Industrial Smoke Alarm market study?

+

-

Which product types are examined in the Industrial Smoke Alarm Market Study?

+

-

Which regions are expected to show the fastest growth in the Industrial Smoke Alarm market?

+

-

Which application holds the second-highest market share in the Industrial Smoke Alarm market?

+

-

Which region is the fastest growing in the Industrial Smoke Alarm market?

+

-