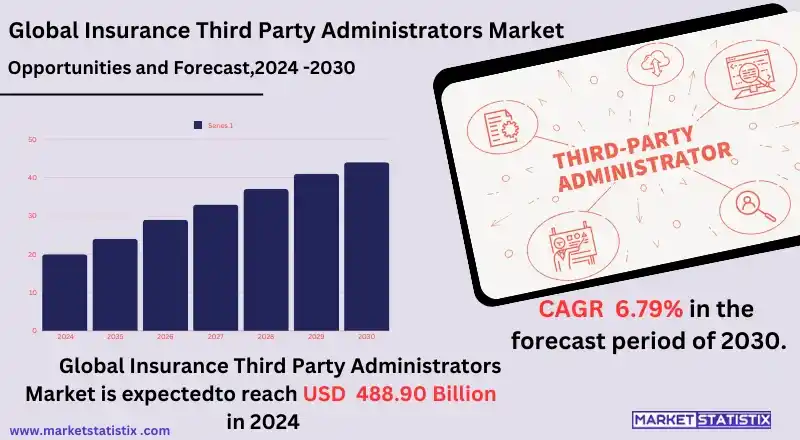

Global Insurance Third Party Administrators Market - Industry Dynamics, Market Size, And Opportunity Forecast To 2030

Report ID: MS-197 | Business finance | Last updated: Dec, 2024 | Formats*:

Insurance Third Party Administrators Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2023 |

| Growth Rate | CAGR of 6.79% |

| Forecast Value (2030) | USD 650.80 Billion |

| By Product Type | Health Plan Administrators, Third-party Claims Administration, Worker’s Compensation TPA |

| Key Market Players |

|

| By Region |

Insurance Third Party Administrators Market Trends

The substantial growth in insurance third-party administrators (TPAs) has been brought about as a result of the increasing demand for outsourced claims management and administrative services. Insurers increasingly turn to the TPAs in order to enhance operational efficiencies, cut costs, and improve customer experience in operations. Advanced technologies such as artificial intelligence, blockchain, and data analytics hold the possibility of qualifying a new business model with TPAs that enable faster claims processing, fraud detection, and personalised customer service. Other major examples include the extension of TPAs into specialised niches such as health, travel, and property insurance, which have become increasingly complicated markets. Moreover, the regulatory evolution and the increasing focus on compliance have their share in boosting the engagement of TPAs in these ever-changing landscapes.Insurance Third Party Administrators Market Leading Players

The key players profiled in the report are Crawford & Company, Sedgwick, UMR, Gallagher Bassett Services Inc., Corvel Corporation, Helmsman Management Services LLC, ESIS Inc., Maritain Health, Healthscope Benefits, Charles Taylor, OthersGrowth Accelerators

Increasing complexity in insurance claims, as well as the growing demand for cost-effective solutions, are the major drivers of the insurance third-party administrator’s market. The insurer may outsource its core activities to TPAs while keeping the requisite support services under the core management, like claims processing, policy servicing, and customer support, thus streamlining operations. With emerging insurance penetration in these markets, the pressure has increasingly piled upon the insurers with high volumes of claims and yet meeting customers' satisfaction levels. Also, breakthrough technologies like automation, digital platforms, and AI-driven analytics give very good impetus for the TPA market. The value added by such solutions allows TPAs to process claims faster and more accurately and provide real-time reporting, which adds importance to the business direction by the insurers. Rising healthcare costs and complicated health insurance systems in regions, especially North America and Europe, fuel the need for TPAs to control the claims as well as the administrative burden.Insurance Third Party Administrators Market Segmentation analysis

The Global Insurance Third Party Administrators is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Health Plan Administrators, Third-party Claims Administration, Worker’s Compensation TPA . The Application segment categorizes the market based on its usage such as Healthcare, Construction, Real Estate and Hospitality, Transportation, Staffing. Geographically, the market is assessed across key Regions like {regionNms} and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

An eclectic mix of old-world players and regional ones offering myriad services comprises the competitive landscape in the insurance third-party administrator’s market. Global majors in TPA compete by providing integrated services that include claims processing, risk management, customer support, and their trusted partner—their advanced technology feature, such as AI and data analytics, to improve efficiencies and reduce operational costs. The focus of such players has primarily been on partnering with the big insurance companies, healthcare companies, and corporates and extending their services and geographic coverage.Challenges In Insurance Third Party Administrators Market

The insurance third-party administration (TPA) is overcrowded with challenges related to the regulation and compliance part of it, as well as issues with security in data. Such countries and their evolving insurance laws and regulations require TPAs to change with time, with every angle requiring lots of legal compliance and possible resources. In addition, the TPAs are heavily pouring in resources into advanced cybersecurity in order to effectively guard customer information against breaches. Another major source of pressure is improvement of efficiency at operations coupled with well-priced overhead costs. TPAs would indeed be dealing with high claims volumes and services that may become mismanaged, slow in responding to customers by the act of not doing much. The environment becomes more and more aggressive as time passes, necessitating that they begin focusing on doing the same improvements in speed with technology and automation as are achievable in redoing efficiencies they had with cost reductions and customer satisfaction.Risks & Prospects in Insurance Third Party Administrators Market

The market for third-party administrators (TPAs) for insurance is very bright, as there is consistent growth in the demand for outsourcing administrative functions such as claim processing, underwriting support, and policyholder management, which insurance companies are seeking in their quest for cost reduction and operational efficiency. Such types of outsourcing are seen more in emerging markets where insurance penetration increases, as this produces a ripe scenario for TPAs to enhance service offerings and meet the increasing clientele. This digitisation push in the insurance sector will also become a fertile ground for TPAs to utilise advanced technology such as AI, machine learning, and data analytics. This allows TPAs to innovate with claims processing and provide better customer experience and fraud detection, making them attractive partners for insurance companies looking to improve efficiency and efficacy.Key Target Audience

The prime target audience for the insurance third-party administrators (TPA) market consists of insurance companies and self-insured organisations that are looking forward to outsourcing their claims management, underwriting support, as well as administrative tasks. TPA offers these services to reduce operational costs and boost efficiency as well as customer service. The insurance companies will be able to pay more attention to their core business while having their claims timely and accurately processed and administered as well as risk managed by TPA services.,, The second most targeted audience is health facilities, such as hospitals, clinics, and pharmacies that partner with TPAs to administer and manage the claims for medical services. These are the entities that pay TPAs to process claims more efficiently and adhere to the different stipulations by health insurance.Merger and acquisition

The current state of the insurance third-party administrators (TPAs) is one of merger and acquisition activity seeking more service possibilities and an improved market footprint. By far, the most remarkable acquisition activity currently is the recent acquisition of Raksha Insurance by Medi Assist. This will significantly strengthen its position in its retail segment by nearly 30% while also extending operations into North and West India. In addition, this acquisition helps Medi Assist integrate smaller competitors into the technology-driven platform for operational efficiency and consistency in services across the diverse TPA landscape in India. Charles Taylor and Crawford & Company, besides the prominent Medi Assist, are also keen on acquisitions to extend their portfolios in the market. This can be viewed in the context of the acquisition of Aegis Corporation by Charles Taylor, aimed at enhancing third-party claims administration capabilities. By the year 2032, the total market size of the insurance TPAs is forecast to approach around $795.1 billion; this is an indication of the proliferating trend toward outsourcing of administrative functions of the insurance sectors in the increasing complexities of claims processing and multi-channel services. >Analyst Comment

"The third-party administrator (TPA) insurance market worldwide is expanding rapidly due to the increasing complexity of insurance products along with the needs for specialised services. Third-party administrators (TPAs) offer administrative functions such as claims processing, policy administration, and customer support, thus enabling the insurers to streamline operations and react to their primary business objectives. The important drivers stimulating market growth are the increase in technology adoption, such as AI and machine learning; the increasing emphasis on improving customer experience; and the greater need for cost-effective solutions. However, issues such as data security concerns and compliance with regulations may inhibit market growth."- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Insurance Third Party Administrators- Snapshot

- 2.2 Insurance Third Party Administrators- Segment Snapshot

- 2.3 Insurance Third Party Administrators- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Insurance Third Party Administrators Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Health Plan Administrators

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Third-party Claims Administration

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Worker’s Compensation TPA

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

5: Insurance Third Party Administrators Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Healthcare

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Construction

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Real Estate and Hospitality

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Transportation

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Staffing

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

6: Insurance Third Party Administrators Market by Enterprise Size

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 Large Enterprises

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 Small and Medium-Sized Enterprises

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

7: Competitive Landscape

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 Crawford & Company

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 Sedgwick

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 UMR

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 Gallagher Bassett Services Inc.

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Corvel Corporation

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Helmsman Management Services LLC

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 ESIS Inc.

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 Maritain Health

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 Healthscope Benefits

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 Charles Taylor

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

- 8.11 Others

- 8.11.1 Company Overview

- 8.11.2 Key Executives

- 8.11.3 Company snapshot

- 8.11.4 Active Business Divisions

- 8.11.5 Product portfolio

- 8.11.6 Business performance

- 8.11.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

By Enterprise Size |

|

Report Licenses

Frequently Asked Questions (FAQ):

What is the projected market size of Insurance Third Party Administrators in 2030?

+

-

How big is the Global Insurance Third Party Administrators market?

+

-

How do regulatory policies impact the Insurance Third Party Administrators Market?

+

-

What major players in Insurance Third Party Administrators Market?

+

-

What applications are categorized in the Insurance Third Party Administrators market study?

+

-

Which product types are examined in the Insurance Third Party Administrators Market Study?

+

-

Which regions are expected to show the fastest growth in the Insurance Third Party Administrators market?

+

-

What are the major growth drivers in the Insurance Third Party Administrators market?

+

-

Is the study period of the Insurance Third Party Administrators flexible or fixed?

+

-

How do economic factors influence the Insurance Third Party Administrators market?

+

-