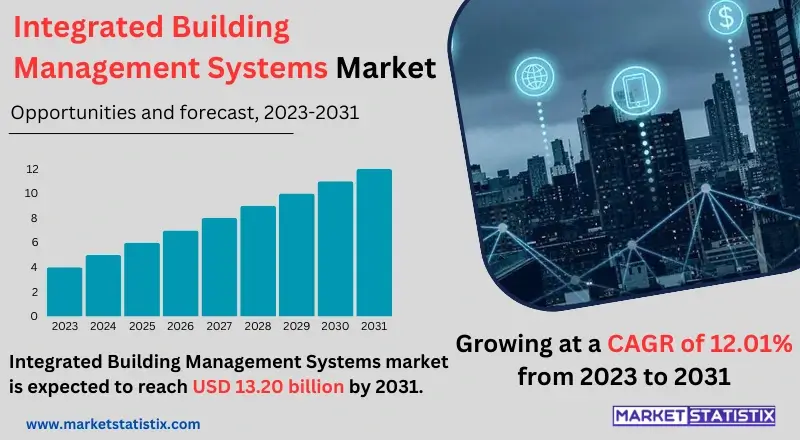

Global Integrated Building Management Systems Market Size, Share & Trends Analysis Report, Forecast Period, 2023-2031

Report ID: MS-1700 | Electronics and Semiconductors | Last updated: Sep, 2024 | Formats*:

Integrated Building Management Systems Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2031 |

| Base Year Of Estimation | 2023 |

| Growth Rate | CAGR of 12.01% |

| By Product Type | Professional Services, Managed Services |

| Key Market Players |

|

| By Region |

|

Integrated Building Management Systems Market Trends

The IBMS market is gargantuan—energy efficiency, sustainability, and automation of buildings are the trends now. With the integration of IoT abilities, advanced analytics, and AI incorporated, these are completely challenging IBMS solutions. This makes it possible to perform prognostic maintenance and optimise energy consumption to ensure an occupant's comfort. The new trends provided by a remote monitoring, data management, and system security facility include cloud-based platforms and cybersecurity. Moreover, the alignment of IBMS with other technologically driven building management things, such as smart grids or building automation systems, makes the vista wide open for integrated solutions in this direction. Fast adoption of advanced analytics and machine learning capabilities within IBMS platforms is evidenced through the key focal points: from data-driven to decision-making and actionable insights.Integrated Building Management Systems Market Leading Players

The key players profiled in the report are Honeywell International Inc., Siemens AG, Johnson Controls International PLC, Schneider Electric SE, United Technologies Corp., IBM Corporation, Ingersoll-Rand Plc, Delta ControlsGrowth Accelerators

A number of factors drive the IBMS market. Increasing energy costs and the globally growing need for sustainability are major drivers for efficient building operations. IBMS offers control over the overall consumption of energy, operational cost, and environmental impact. Another major factor is that modern buildings have systems of increasing complexity that call for centralised control, hence in need of advanced management solutions. Inherent factors in the integration of IoT devices and increasing building data drive the adoption of IBMS through organisational interests in extracting useful insights for operational improvements. Government regulations and incentives on energy efficiency and sustainability raised interest in the adoption of IBMS. With increasing demands from building occupants on comfort, safety, and productivity, IBMS has become a central factor in driving market growth by ensuring optimised indoor environments.Integrated Building Management Systems Market Segmentation analysis

The Global Integrated Building Management Systems is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Professional Services, Managed Services . The Application segment categorizes the market based on its usage such as Residential, Commercial, Industrial. Geographically, the market is assessed across key Regions like North America(United States.Canada.Mexico), South America(Brazil.Argentina.Chile.Rest of South America), Europe(Germany.France.Italy.United Kingdom.Benelux.Nordics.Rest of Europe), Asia Pacific(China.Japan.India.South Korea.Australia.Southeast Asia.Rest of Asia-Pacific), MEA(Middle East.Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The IBMS market is accordingly very competitive, with established industry giants competing with emerging technology providers. The key players would focus on comprehensive solutions and integration of multiple building systems, thereby increasing advanced analytics capabilities. Strategic partnerships, acquisitions, and research and development investments are accordingly important for competitiveness. The market is further witnessing new entrants supplying niche solutions and cloud-based platforms. In this background, product differentiation through innovative features, quality customer service, and promotion of energy efficiency would remain the core success drivers. Competitive dynamics are also affected by regional variances in market development, regulations, and customer needs.Challenges In Integrated Building Management Systems Market

The wide diffusion of the IBMS market faces several impediments. First, integrating all kinds of building systems into one platform can be a challenge in itself and will be time-consuming, requiring high IT skills and resources. This includes the interchange of data through various system components working together and their interoperability—a technically difficult task. Also important is the question of cybersecurity: IBMS platforms contain sensitive building data, hence making them a potential target of cyberattacks. Lastly, high investment in the setting up of IBMS solutions deters some building owners from doing so, mostly for smaller facilities.Risks & Prospects in Integrated Building Management Systems Market

The IBMS market offers enormous potential for growth and innovation. Rising emphasis on sustainability and energy efficiency creates a growing need for solutions that can optimise building performance to reduce impacts on the environment. Demand response, advanced analytics, and integration with renewable energy sources can unlock tremendous energy savings. Moreover, growing focus on occupant comfort and well-being creates huge opportunities for the development of intelligent building systems that would optimise the indoor environment in terms of individual preference and real-time data. IBMS solutions that make use of advanced technologies like artificial intelligence and machine learning enable better occupant experiences through enhanced productivity and healthier indoor spaces.Key Target Audience

Building owners, facility managers, and property management companies are the major target customers for IBMS solutions. These are the key stakeholders with the mandate to make buildings efficiently work with regard to energy use, occupant comfort, and overall building performance. Another critical category of customers that remains within focus is the system integrators, IT professionals, and consultants associated with building automation and control systems.,, The other targets are government agencies, schools, healthcare facilities, and commercial enterprises that own or have large buildings. These organisations, hence, turn to IBMS to achieve energy efficiency, sustainability goals, and occupant satisfaction.Merger and acquisition

The market for IBMS has lately seen many amalgamations via strategic mergers and acquisitions. Major industry players have made a series of policies that target increasing product portfolios and overall technology capabilities while at the same time strengthening market positions. Such deals bring in specific skill sets in areas like IoT integration, cybersecurity, and cloud-based solutions. Also, cross-industry mergers have occurred as companies try to diversify their offerings and scout for new market segments. Such mergers and acquisitions have resulted in the redefinition of the competitive landscape into larger, more diversified players in the IBMS market. These trends are sure to continue in the future as all these companies strive to seek a competitive advantage through scale, innovation, and geographical expansion.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Integrated Building Management Systems- Snapshot

- 2.2 Integrated Building Management Systems- Segment Snapshot

- 2.3 Integrated Building Management Systems- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Integrated Building Management Systems Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Professional Services

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Managed Services

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: Integrated Building Management Systems Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Residential

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Commercial

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Industrial

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

6: Integrated Building Management Systems Market by software

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 Facility Management

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 Energy Management

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

- 6.4 Security Management

- 6.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.2 Market size and forecast, by region

- 6.4.3 Market share analysis by country

- 6.5 Infrastructure Management

- 6.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.2 Market size and forecast, by region

- 6.5.3 Market share analysis by country

- 6.6 Emergrncy Management

- 6.6.1 Key market trends, factors driving growth, and opportunities

- 6.6.2 Market size and forecast, by region

- 6.6.3 Market share analysis by country

7: Integrated Building Management Systems Market by Region

- 7.1 Overview

- 7.1.1 Market size and forecast By Region

- 7.2 North America

- 7.2.1 Key trends and opportunities

- 7.2.2 Market size and forecast, by Type

- 7.2.3 Market size and forecast, by Application

- 7.2.4 Market size and forecast, by country

- 7.2.4.1 United States

- 7.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.1.2 Market size and forecast, by Type

- 7.2.4.1.3 Market size and forecast, by Application

- 7.2.4.2 Canada

- 7.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.2.2 Market size and forecast, by Type

- 7.2.4.2.3 Market size and forecast, by Application

- 7.2.4.3 Mexico

- 7.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.3.2 Market size and forecast, by Type

- 7.2.4.3.3 Market size and forecast, by Application

- 7.2.4.1 United States

- 7.3 South America

- 7.3.1 Key trends and opportunities

- 7.3.2 Market size and forecast, by Type

- 7.3.3 Market size and forecast, by Application

- 7.3.4 Market size and forecast, by country

- 7.3.4.1 Brazil

- 7.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.1.2 Market size and forecast, by Type

- 7.3.4.1.3 Market size and forecast, by Application

- 7.3.4.2 Argentina

- 7.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.2.2 Market size and forecast, by Type

- 7.3.4.2.3 Market size and forecast, by Application

- 7.3.4.3 Chile

- 7.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.3.2 Market size and forecast, by Type

- 7.3.4.3.3 Market size and forecast, by Application

- 7.3.4.4 Rest of South America

- 7.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.4.2 Market size and forecast, by Type

- 7.3.4.4.3 Market size and forecast, by Application

- 7.3.4.1 Brazil

- 7.4 Europe

- 7.4.1 Key trends and opportunities

- 7.4.2 Market size and forecast, by Type

- 7.4.3 Market size and forecast, by Application

- 7.4.4 Market size and forecast, by country

- 7.4.4.1 Germany

- 7.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.1.2 Market size and forecast, by Type

- 7.4.4.1.3 Market size and forecast, by Application

- 7.4.4.2 France

- 7.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.2.2 Market size and forecast, by Type

- 7.4.4.2.3 Market size and forecast, by Application

- 7.4.4.3 Italy

- 7.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.3.2 Market size and forecast, by Type

- 7.4.4.3.3 Market size and forecast, by Application

- 7.4.4.4 United Kingdom

- 7.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.4.2 Market size and forecast, by Type

- 7.4.4.4.3 Market size and forecast, by Application

- 7.4.4.5 Benelux

- 7.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.5.2 Market size and forecast, by Type

- 7.4.4.5.3 Market size and forecast, by Application

- 7.4.4.6 Nordics

- 7.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.6.2 Market size and forecast, by Type

- 7.4.4.6.3 Market size and forecast, by Application

- 7.4.4.7 Rest of Europe

- 7.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.7.2 Market size and forecast, by Type

- 7.4.4.7.3 Market size and forecast, by Application

- 7.4.4.1 Germany

- 7.5 Asia Pacific

- 7.5.1 Key trends and opportunities

- 7.5.2 Market size and forecast, by Type

- 7.5.3 Market size and forecast, by Application

- 7.5.4 Market size and forecast, by country

- 7.5.4.1 China

- 7.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.1.2 Market size and forecast, by Type

- 7.5.4.1.3 Market size and forecast, by Application

- 7.5.4.2 Japan

- 7.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.2.2 Market size and forecast, by Type

- 7.5.4.2.3 Market size and forecast, by Application

- 7.5.4.3 India

- 7.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.3.2 Market size and forecast, by Type

- 7.5.4.3.3 Market size and forecast, by Application

- 7.5.4.4 South Korea

- 7.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.4.2 Market size and forecast, by Type

- 7.5.4.4.3 Market size and forecast, by Application

- 7.5.4.5 Australia

- 7.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.5.2 Market size and forecast, by Type

- 7.5.4.5.3 Market size and forecast, by Application

- 7.5.4.6 Southeast Asia

- 7.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.6.2 Market size and forecast, by Type

- 7.5.4.6.3 Market size and forecast, by Application

- 7.5.4.7 Rest of Asia-Pacific

- 7.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.7.2 Market size and forecast, by Type

- 7.5.4.7.3 Market size and forecast, by Application

- 7.5.4.1 China

- 7.6 MEA

- 7.6.1 Key trends and opportunities

- 7.6.2 Market size and forecast, by Type

- 7.6.3 Market size and forecast, by Application

- 7.6.4 Market size and forecast, by country

- 7.6.4.1 Middle East

- 7.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.6.4.1.2 Market size and forecast, by Type

- 7.6.4.1.3 Market size and forecast, by Application

- 7.6.4.2 Africa

- 7.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.6.4.2.2 Market size and forecast, by Type

- 7.6.4.2.3 Market size and forecast, by Application

- 7.6.4.1 Middle East

- 8.1 Overview

- 8.2 Key Winning Strategies

- 8.3 Top 10 Players: Product Mapping

- 8.4 Competitive Analysis Dashboard

- 8.5 Market Competition Heatmap

- 8.6 Leading Player Positions, 2022

9: Company Profiles

- 9.1 Honeywell International Inc.

- 9.1.1 Company Overview

- 9.1.2 Key Executives

- 9.1.3 Company snapshot

- 9.1.4 Active Business Divisions

- 9.1.5 Product portfolio

- 9.1.6 Business performance

- 9.1.7 Major Strategic Initiatives and Developments

- 9.2 Siemens AG

- 9.2.1 Company Overview

- 9.2.2 Key Executives

- 9.2.3 Company snapshot

- 9.2.4 Active Business Divisions

- 9.2.5 Product portfolio

- 9.2.6 Business performance

- 9.2.7 Major Strategic Initiatives and Developments

- 9.3 Johnson Controls International PLC

- 9.3.1 Company Overview

- 9.3.2 Key Executives

- 9.3.3 Company snapshot

- 9.3.4 Active Business Divisions

- 9.3.5 Product portfolio

- 9.3.6 Business performance

- 9.3.7 Major Strategic Initiatives and Developments

- 9.4 Schneider Electric SE

- 9.4.1 Company Overview

- 9.4.2 Key Executives

- 9.4.3 Company snapshot

- 9.4.4 Active Business Divisions

- 9.4.5 Product portfolio

- 9.4.6 Business performance

- 9.4.7 Major Strategic Initiatives and Developments

- 9.5 United Technologies Corp.

- 9.5.1 Company Overview

- 9.5.2 Key Executives

- 9.5.3 Company snapshot

- 9.5.4 Active Business Divisions

- 9.5.5 Product portfolio

- 9.5.6 Business performance

- 9.5.7 Major Strategic Initiatives and Developments

- 9.6 IBM Corporation

- 9.6.1 Company Overview

- 9.6.2 Key Executives

- 9.6.3 Company snapshot

- 9.6.4 Active Business Divisions

- 9.6.5 Product portfolio

- 9.6.6 Business performance

- 9.6.7 Major Strategic Initiatives and Developments

- 9.7 Ingersoll-Rand Plc

- 9.7.1 Company Overview

- 9.7.2 Key Executives

- 9.7.3 Company snapshot

- 9.7.4 Active Business Divisions

- 9.7.5 Product portfolio

- 9.7.6 Business performance

- 9.7.7 Major Strategic Initiatives and Developments

- 9.8 Delta Controls

- 9.8.1 Company Overview

- 9.8.2 Key Executives

- 9.8.3 Company snapshot

- 9.8.4 Active Business Divisions

- 9.8.5 Product portfolio

- 9.8.6 Business performance

- 9.8.7 Major Strategic Initiatives and Developments

10: Analyst Perspective and Conclusion

- 10.1 Concluding Recommendations and Analysis

- 10.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

By software |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

Which type of Integrated Building Management Systems is widely popular?

+

-

What is the growth rate of Integrated Building Management Systems Market?

+

-

What are the latest trends influencing the Integrated Building Management Systems Market?

+

-

Who are the key players in the Integrated Building Management Systems Market?

+

-

How is the Integrated Building Management Systems } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Integrated Building Management Systems Market Study?

+

-

What geographic breakdown is available in Global Integrated Building Management Systems Market Study?

+

-

Which region holds the second position by market share in the Integrated Building Management Systems market?

+

-

How are the key players in the Integrated Building Management Systems market targeting growth in the future?

+

-

What are the opportunities for new entrants in the Integrated Building Management Systems market?

+

-