Global K-12 Testing and Assessment Market – Industry Trends and Forecast to 2031

Report ID: MS-1648 | IT and Telecom | Last updated: Sep, 2024 | Formats*:

K-12 Testing and Assessment Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2031 |

| Base Year Of Estimation | 2023 |

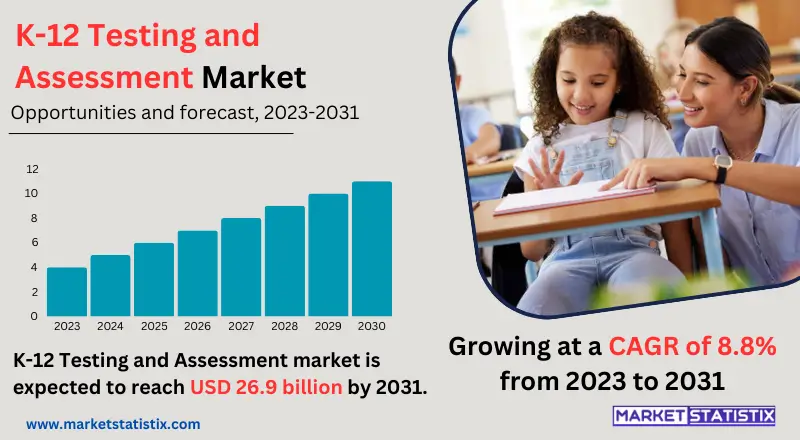

| Growth Rate | CAGR of 8.8% |

| By Product Type | Curriculum-Based Testing, Non-Curriculum-Based Testing |

| Key Market Players |

|

| By Region |

|

K-12 Testing and Assessment Market Trends

In other words, this is a K-12 testing and assessment market in huge transformation. This has been driven by technological changes and shifting educational priorities within the sector. The shift to competency-based assessments and personalised learning gains momentum, requiring flexible and adaptive testing solutions. On the other hand, integrations of technology into things like adaptive testing and AI-powered analytics are making assessment processes efficient and effective. Moreover, the market focusses more on formative assessment, which provides timely feedback to improve student performance. The COVID-19 pandemic accelerated the need for remote and online testing, wherein market changes will prevail in the years to come. Another important trend is the focus on better student well-being and social-emotional learning. Assessments will take a more explicit orientation towards those dimensions again, with new tools and methods of assessment being developed for that purpose. Data privacy and security are also an important part of the industry, for which proper protection of data in testing and assessment is of very critical importance.K-12 Testing and Assessment Market Leading Players

The key players profiled in the report are ETS, MeritTrac, Pearson Education, CogniFit, Edutech, Scantron, CORE Education and Consulting Solutions, Literatu, Proprofs QuizMaker, UMeWorld, OthersGrowth Accelerators

Accountability and student performance are increasingly at the forefront of K–12 testing and assessment. The governments and institutions of learning have been placing great emphasis on measuring student achievement in regard to policy decisions, resource allocation, and assessment of education quality. Furthermore, demands in this respect have been made through the realisation of data-driven instruction, which has pushed requirements for assessments that provide actionable insight into student learning needs. Another major driving force for the market is the identification of students with special needs and providing relevant support services. Technology advancements also drive growth in this sector. Increased efficiency and accuracy in assessments, with technology integrated into assessment methods like adaptive testing and computer-based assessment, have been improving steadily. Technology-based testing solutions are adopted faster because of the trend towards digital learning and remote assessment.K-12 Testing and Assessment Market Segmentation analysis

The Global K-12 Testing and Assessment is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Curriculum-Based Testing, Non-Curriculum-Based Testing . The Application segment categorizes the market based on its usage such as Pre-primary School, Primary School, Middle School, High School. Geographically, the market is assessed across key Regions like North America(United States.Canada.Mexico), South America(Brazil.Argentina.Chile.Rest of South America), Europe(Germany.France.Italy.United Kingdom.Benelux.Nordics.Rest of Europe), Asia Pacific(China.Japan.India.South Korea.Australia.Southeast Asia.Rest of Asia-Pacific), MEA(Middle East.Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

Mix and match: That's the K-12 testing and assessment marketplace in a nutshell. It is a marketplace with legacy testing and assessment providers dominating the large markets of standardised testing and state assessments. They have their years of experience, long-term relationships with schools, and a raft of assessment products. However, the landscape is fast changing with the entry and emergence of companies focused on technology and offering innovative assessment solutions in the marketplace. More specifically, the competitive landscape is affected by government regulations, data privacy concerns, and growing personalised learning. With digitalisation seeping into the education landscape, competition for market share has increased, and companies are focussing on developing a holistic assessment solution to meet the changing requirements of educators and policymakers.Challenges In K-12 Testing and Assessment Market

A good many factors challenge the K-12 testing and assessment market. First, one major challenge in this domain is the overly highlighted debate about excessive testing, further criticised due to its impact on teaching and learning. Much complexity arises in balancing between the requirements for accountability and the holistic development of students. Another persistent challenge is how to ensure fairness and equity of assessments among very different student populations. It is similarly the case that such rapid evolution of the technology also enforces continuous adaptation and investment in assessment tools and platforms if they are to keep up with educational requirements that are changing at an unprecedented rate. Moreover, the market is also becoming increasingly complex in terms of regulation and data privacy. Essentially, test developers/administrators are required to use data-driven decision-making and at the same time maintain the privacy of students' data. Other major challenges facing the test developers and administrators include the utilisation of robust psychometric properties and the construction of assessments that can precisely measure 21st-century skills.Risks & Prospects in K-12 Testing and Assessment Market

Due to the growth of personalised learning and competency-based education, many opportunities are opening in the K–12 testing and assessment market. These emerging requirements will lay down the need for sophistication in the respective assessment tools. These advancements will be made possible by the availability of technology services, including adaptive testing, artificial intelligence, and machine learning. Demand for measures on higher-order thinking skills and real-world competencies continues to grow. Besides, the growing use of on-demand and remote learning opportunities creates space for new ways of delivering assessments. To achieve a more conscious approach to an overall solution in the assessment space that drives actionable insights for teachers and policymakers, an effort should be made globally to enhance student success within educational systems. These basic value-added service deliveries in data analytics and reporting make one marketplace player stand out from the rest and lead in business growth.Key Target Audience

Educational institutions involving schools, districts, and state departments of education use assessment to measure student performance, direct instruction for students, and meet accountability responsibilities. Governmental agencies at all levels, most notably Ministries of Education and regulatory agencies, are involved in setting the standards and policy directives that underpin assessment.,, Other target audiences include test preparation companies, tutoring service providers, and educational research organizations. All such stakeholders put assessment data into multiple uses for example, preparation of materials for test preparation, effectiveness research with an educational intent, and value-enriching services to students and schools.Merger and acquisition

M&A activities have increased radically in the K-12 testing and assessment market due to the need for geographical coverage and full-suite solution offerings. All key companies in this market have strategically merged capabilities with a view to enhancing their product and service portfolio in response to changing institutional needs. Such acquisitions have created larger and more diversified firms capable of delivering end-to-end assessment solutions. Notable mergers and acquisitions focus on growing product portfolios, adding specialised expertise, and opening doors to new markets. Companies combine complementary strengths with the intent of improving market position and developing fresh approaches to assessment solutions that satisfy increasing demands in education through dealmaking.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 K-12 Testing and Assessment- Snapshot

- 2.2 K-12 Testing and Assessment- Segment Snapshot

- 2.3 K-12 Testing and Assessment- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: K-12 Testing and Assessment Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Curriculum-Based Testing

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Non-Curriculum-Based Testing

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: K-12 Testing and Assessment Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Pre-primary School

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Primary School

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Middle School

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 High School

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

6: K-12 Testing and Assessment Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 ETS

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 MeritTrac

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 Pearson Education

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 CogniFit

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 Edutech

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 Scantron

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 CORE Education and Consulting Solutions

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 Literatu

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 Proprofs QuizMaker

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 UMeWorld

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

- 8.11 Others

- 8.11.1 Company Overview

- 8.11.2 Key Executives

- 8.11.3 Company snapshot

- 8.11.4 Active Business Divisions

- 8.11.5 Product portfolio

- 8.11.6 Business performance

- 8.11.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

Which type of K-12 Testing and Assessment is widely popular?

+

-

What is the growth rate of K-12 Testing and Assessment Market?

+

-

What are the latest trends influencing the K-12 Testing and Assessment Market?

+

-

Who are the key players in the K-12 Testing and Assessment Market?

+

-

How is the K-12 Testing and Assessment } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the K-12 Testing and Assessment Market Study?

+

-

What geographic breakdown is available in Global K-12 Testing and Assessment Market Study?

+

-

Which region holds the second position by market share in the K-12 Testing and Assessment market?

+

-

How are the key players in the K-12 Testing and Assessment market targeting growth in the future?

+

-

What are the opportunities for new entrants in the K-12 Testing and Assessment market?

+

-