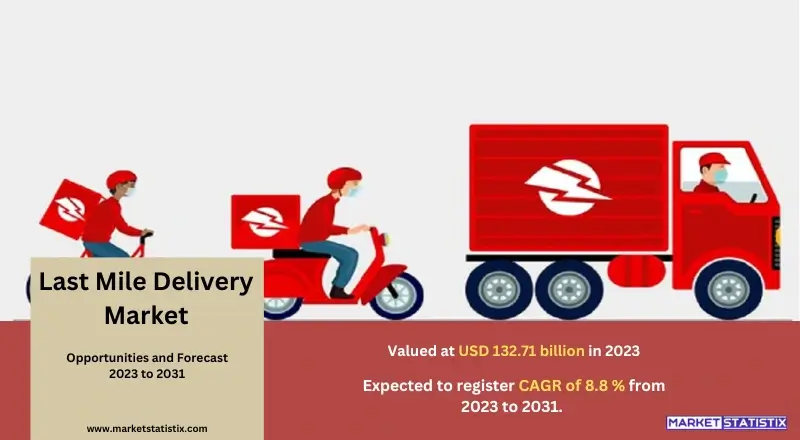

Global Last Mile Delivery Market – Industry Trends and Forecast to 2031

Report ID: MS-1881 | Automotive and Transport | Last updated: Sep, 2024 | Formats*:

Last Mile Delivery Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2031 |

| Base Year Of Estimation | 2023 |

| Growth Rate | CAGR of 8.8% |

| By Product Type | B2C, B2B |

| Key Market Players |

|

| By Region |

|

Last Mile Delivery Market Trends

There are several trends impacting the last mile delivery market on a global scale, including the growing market of e-commerce and the faster and more flexible options that consumers are looking for nowadays. With the rise of internet shopping, consumers are becoming accustomed to faster delivery times, which is compelling firms to enhance and improve their logistics and supply chain processes. There have been technologies such as route planning software, global positioning systems, and even automated delivery techniques like drones and self-driving cars to cut costs and save time. Likewise, urban logistics is also transforming to solve issues presented by traffic and city space, which leads to the emergence of micro-fulfilment centres and associations with on-demand delivery services. Furthermore, since people are becoming more conscious of the environment, organisations are incorporating eco-friendly methods in their last mile delivery systems that include policies taking effect in the near future and policy objectives of their clients.Last Mile Delivery Market Leading Players

The key players profiled in the report are Deutsche Post DHL Group (Germany), FedEx Corporation (United States), Kuehne + Nagel International AG (Switzerland), United Parcel Service (USA), XPO Logistics, Inc. (USA), C.H. Robinson (USA), Uber Technologies Inc. (USA), USPS (USA), DPD (France), Clipper Logistics plc (United Kingdom), Additional players considered in the study are as follows:, Gophr (United Kingdom)Growth Accelerators

The last-mile delivery market across the globe is anticipated to grow at a high CAGR due to the booming e-commerce sector as well as the need for faster and more reliable delivery services. With the increase in online shopping and accessibility, shipping processes are not only expected to be efficient but also much faster with real-time tracking. Such consumer trends compel retail and logistics firms to employ sophisticated last-mile delivery technology in order to improve customer satisfaction and keep in pace with competition. Furthermore, increased mobile phone usage and mobile commerce have bypassed all these factors and further increased the need for hassle-free delivery services, thus the need for businesses to enhance their delivery logistics. A rising trend that will also cause hindrance to last-mile delivery is the occurrence of sustainable practices. For instance, consumers do not want to buy products and have them delivered in a way that is harmful to the environment. This has led companies to come up with other delivery systems that are less harmful, like electric delivery vans, courier companies that use bicycles, or planning delivery trips with fewer emissions.Last Mile Delivery Market Segmentation analysis

The Global Last Mile Delivery is segmented by Type, and Region. By Type, the market is divided into Distributed B2C, B2B . Geographically, the market is assessed across key Regions like North America(United States.Canada.Mexico), South America(Brazil.Argentina.Chile.Rest of South America), Europe(Germany.France.Italy.United Kingdom.Benelux.Nordics.Rest of Europe), Asia Pacific(China.Japan.India.South Korea.Australia.Southeast Asia.Rest of Asia-Pacific), MEA(Middle East.Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

There is fierce competition for the last-mile delivery market around the globe with the presence of established logistics companies, technology companies, and new entries. The prominent operators in the markets are FedEx, UPS, DHL, and Amazon, which provide all last-mile delivery services and take advantage of their vast networks and infrastructure. Apart from conventional logistics providers, it is also observed that there are a number of smaller organisations that provide niche volumes for specific deliveries or regions. Such firms tend to be very creative in employing new solutions and strategies to win markets in order to survive, thereby increasing the level of competition in last-mile delivery.Challenges In Last Mile Delivery Market

The last-mile delivery market across the globe is not immune to the following challenges, especially with the demanding consumer season expected and wanting services to be fast and better. With the increase of e-commerce, the fulfilment of customers’ orders comes under pressure, requiring faster completion of certain operational processes and the provision of real-time updates on order status, which otherwise intensifies the planning complexity and his costs. Moreover, the problem of overpopulation and traffic jams faced within cities make it difficult for any company’s delivery routes, which in turn creates difficulties in meeting these high expectations at reasonable costs. In addition, legislation as well as the societal pushes towards green delivery policies have made it necessary for companies to go green in their operations, which makes last-mile operations even more tedious. The last mile logistics continues to present difficulties to the players within the industry; trying to achieve this state of affairs without incurring any losses is another monumental task, and it is critical for all the stakeholders in the last mile economic sector.Risks & Prospects in Last Mile Delivery Market

The current last-mile delivery market across the globe offers various economic prospects as a result of rapid growth in e-commerce and new consumer trends that expect good delivery services in a matter of minutes. Online retail is on the rise, hence the urgent need for businesses to adopt modern last-mile distribution tactics to cater for customer demand for speedy and efficient order deliveries. Hence, logistics firms are able to improve their services using advanced technologies, such as the way that a delivery service can be enhanced by the use of routing and scheduling optimisation software, GPS-powered real-time tracking, and even drones and self-driving trucks. Such advancements can be embraced by organisations functioning within the retail environment for better competitive advantages in the market. One more attractive opportunity to consider is a current trend towards sustainability or eco-friendliness of delivery services. Given that people are becoming more eco-friendly, there is an increase in the demand for solutions in logistics that do not, however, incorporate internal combustion engines, such as electric vans or green packaging. Sustainable development is practiced not only for the satisfaction of customers and their preferences but also assists in staying in compliance with laws that seek to curb emissions.Key Target Audience

The primary focus for the global last mile delivery market is drawn on e-commerce retailers and businesses whose work heavily involves optimised delivery services so that customer orders can be fulfilled. Such companies are keen on delivery solutions that are not only fast but also dependable as a way to improve the levels of customer satisfaction while also remaining distinct in the cutthroat market of online shopping. In the current social media where consumers tend to demand and expect quick and effective delivery systems, the trend has however forced the major players in retail business to start looking for advanced systems to manage the last mile that can vary in capacity and be able to provide location updates accurately.,, Moreover, members within the market also comprise technology developers and software providers, players that come up with solutions for managing last-mile logistics. These solutions include, among others, route optimisation, e-tracking, and interaction with customers. Also, a local authority and regulatory bodies are other stakeholders in the last mile market where they shape the policies and regulations in which last mile delivery operates, more so in relation to environmental concerns and urban mobility policies.Merger and acquisition

Recent trends in the global last-mile delivery market show that mergers and acquisitions have also been targeted in order to increase competitiveness, operational effectiveness, and to take advantage of advanced technologies. Other notable transactions include: Postmates acquisition by Uber: This acquisition helped Uber ramp up its last-mile delivery services by not only increasing the number of delivery services but expanding in more countries. Acquisition of Whole Foods Market by Amazon: With this acquisition, Amazon expanded its distribution reach by allowing it to provide grocery delivery services via its already existing logistical framework. These corporate mergers and acquisitions in the last mile delivery services have greatly changed the status quo of competition in the last mile delivery market, resulting in higher degrees of consolidation and the birth of bigger and stronger companies.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Last Mile Delivery- Snapshot

- 2.2 Last Mile Delivery- Segment Snapshot

- 2.3 Last Mile Delivery- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Last Mile Delivery Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 B2C

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 B2B

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: Last Mile Delivery Market by Delivery

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Deferred Delivery

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Time-Definite Delivery

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Same Day Delivery

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Instant Delivery

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

6: Last Mile Delivery Market by Industry Verticals

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 E-commerce

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 FMCG

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

- 6.4 Food & Beverage

- 6.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.2 Market size and forecast, by region

- 6.4.3 Market share analysis by country

- 6.5 Pharmaceutical Healthcare

- 6.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.2 Market size and forecast, by region

- 6.5.3 Market share analysis by country

- 6.6 Others

- 6.6.1 Key market trends, factors driving growth, and opportunities

- 6.6.2 Market size and forecast, by region

- 6.6.3 Market share analysis by country

7: Last Mile Delivery Market by Region

- 7.1 Overview

- 7.1.1 Market size and forecast By Region

- 7.2 North America

- 7.2.1 Key trends and opportunities

- 7.2.2 Market size and forecast, by Type

- 7.2.3 Market size and forecast, by Application

- 7.2.4 Market size and forecast, by country

- 7.2.4.1 United States

- 7.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.1.2 Market size and forecast, by Type

- 7.2.4.1.3 Market size and forecast, by Application

- 7.2.4.2 Canada

- 7.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.2.2 Market size and forecast, by Type

- 7.2.4.2.3 Market size and forecast, by Application

- 7.2.4.3 Mexico

- 7.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.3.2 Market size and forecast, by Type

- 7.2.4.3.3 Market size and forecast, by Application

- 7.2.4.1 United States

- 7.3 South America

- 7.3.1 Key trends and opportunities

- 7.3.2 Market size and forecast, by Type

- 7.3.3 Market size and forecast, by Application

- 7.3.4 Market size and forecast, by country

- 7.3.4.1 Brazil

- 7.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.1.2 Market size and forecast, by Type

- 7.3.4.1.3 Market size and forecast, by Application

- 7.3.4.2 Argentina

- 7.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.2.2 Market size and forecast, by Type

- 7.3.4.2.3 Market size and forecast, by Application

- 7.3.4.3 Chile

- 7.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.3.2 Market size and forecast, by Type

- 7.3.4.3.3 Market size and forecast, by Application

- 7.3.4.4 Rest of South America

- 7.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.4.2 Market size and forecast, by Type

- 7.3.4.4.3 Market size and forecast, by Application

- 7.3.4.1 Brazil

- 7.4 Europe

- 7.4.1 Key trends and opportunities

- 7.4.2 Market size and forecast, by Type

- 7.4.3 Market size and forecast, by Application

- 7.4.4 Market size and forecast, by country

- 7.4.4.1 Germany

- 7.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.1.2 Market size and forecast, by Type

- 7.4.4.1.3 Market size and forecast, by Application

- 7.4.4.2 France

- 7.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.2.2 Market size and forecast, by Type

- 7.4.4.2.3 Market size and forecast, by Application

- 7.4.4.3 Italy

- 7.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.3.2 Market size and forecast, by Type

- 7.4.4.3.3 Market size and forecast, by Application

- 7.4.4.4 United Kingdom

- 7.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.4.2 Market size and forecast, by Type

- 7.4.4.4.3 Market size and forecast, by Application

- 7.4.4.5 Benelux

- 7.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.5.2 Market size and forecast, by Type

- 7.4.4.5.3 Market size and forecast, by Application

- 7.4.4.6 Nordics

- 7.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.6.2 Market size and forecast, by Type

- 7.4.4.6.3 Market size and forecast, by Application

- 7.4.4.7 Rest of Europe

- 7.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.7.2 Market size and forecast, by Type

- 7.4.4.7.3 Market size and forecast, by Application

- 7.4.4.1 Germany

- 7.5 Asia Pacific

- 7.5.1 Key trends and opportunities

- 7.5.2 Market size and forecast, by Type

- 7.5.3 Market size and forecast, by Application

- 7.5.4 Market size and forecast, by country

- 7.5.4.1 China

- 7.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.1.2 Market size and forecast, by Type

- 7.5.4.1.3 Market size and forecast, by Application

- 7.5.4.2 Japan

- 7.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.2.2 Market size and forecast, by Type

- 7.5.4.2.3 Market size and forecast, by Application

- 7.5.4.3 India

- 7.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.3.2 Market size and forecast, by Type

- 7.5.4.3.3 Market size and forecast, by Application

- 7.5.4.4 South Korea

- 7.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.4.2 Market size and forecast, by Type

- 7.5.4.4.3 Market size and forecast, by Application

- 7.5.4.5 Australia

- 7.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.5.2 Market size and forecast, by Type

- 7.5.4.5.3 Market size and forecast, by Application

- 7.5.4.6 Southeast Asia

- 7.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.6.2 Market size and forecast, by Type

- 7.5.4.6.3 Market size and forecast, by Application

- 7.5.4.7 Rest of Asia-Pacific

- 7.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.7.2 Market size and forecast, by Type

- 7.5.4.7.3 Market size and forecast, by Application

- 7.5.4.1 China

- 7.6 MEA

- 7.6.1 Key trends and opportunities

- 7.6.2 Market size and forecast, by Type

- 7.6.3 Market size and forecast, by Application

- 7.6.4 Market size and forecast, by country

- 7.6.4.1 Middle East

- 7.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.6.4.1.2 Market size and forecast, by Type

- 7.6.4.1.3 Market size and forecast, by Application

- 7.6.4.2 Africa

- 7.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.6.4.2.2 Market size and forecast, by Type

- 7.6.4.2.3 Market size and forecast, by Application

- 7.6.4.1 Middle East

- 8.1 Overview

- 8.2 Key Winning Strategies

- 8.3 Top 10 Players: Product Mapping

- 8.4 Competitive Analysis Dashboard

- 8.5 Market Competition Heatmap

- 8.6 Leading Player Positions, 2022

9: Company Profiles

- 9.1 Deutsche Post DHL Group (Germany)

- 9.1.1 Company Overview

- 9.1.2 Key Executives

- 9.1.3 Company snapshot

- 9.1.4 Active Business Divisions

- 9.1.5 Product portfolio

- 9.1.6 Business performance

- 9.1.7 Major Strategic Initiatives and Developments

- 9.2 FedEx Corporation (United States)

- 9.2.1 Company Overview

- 9.2.2 Key Executives

- 9.2.3 Company snapshot

- 9.2.4 Active Business Divisions

- 9.2.5 Product portfolio

- 9.2.6 Business performance

- 9.2.7 Major Strategic Initiatives and Developments

- 9.3 Kuehne + Nagel International AG (Switzerland)

- 9.3.1 Company Overview

- 9.3.2 Key Executives

- 9.3.3 Company snapshot

- 9.3.4 Active Business Divisions

- 9.3.5 Product portfolio

- 9.3.6 Business performance

- 9.3.7 Major Strategic Initiatives and Developments

- 9.4 United Parcel Service (USA)

- 9.4.1 Company Overview

- 9.4.2 Key Executives

- 9.4.3 Company snapshot

- 9.4.4 Active Business Divisions

- 9.4.5 Product portfolio

- 9.4.6 Business performance

- 9.4.7 Major Strategic Initiatives and Developments

- 9.5 XPO Logistics

- 9.5.1 Company Overview

- 9.5.2 Key Executives

- 9.5.3 Company snapshot

- 9.5.4 Active Business Divisions

- 9.5.5 Product portfolio

- 9.5.6 Business performance

- 9.5.7 Major Strategic Initiatives and Developments

- 9.6 Inc. (USA)

- 9.6.1 Company Overview

- 9.6.2 Key Executives

- 9.6.3 Company snapshot

- 9.6.4 Active Business Divisions

- 9.6.5 Product portfolio

- 9.6.6 Business performance

- 9.6.7 Major Strategic Initiatives and Developments

- 9.7 C.H. Robinson (USA)

- 9.7.1 Company Overview

- 9.7.2 Key Executives

- 9.7.3 Company snapshot

- 9.7.4 Active Business Divisions

- 9.7.5 Product portfolio

- 9.7.6 Business performance

- 9.7.7 Major Strategic Initiatives and Developments

- 9.8 Uber Technologies Inc. (USA)

- 9.8.1 Company Overview

- 9.8.2 Key Executives

- 9.8.3 Company snapshot

- 9.8.4 Active Business Divisions

- 9.8.5 Product portfolio

- 9.8.6 Business performance

- 9.8.7 Major Strategic Initiatives and Developments

- 9.9 USPS (USA)

- 9.9.1 Company Overview

- 9.9.2 Key Executives

- 9.9.3 Company snapshot

- 9.9.4 Active Business Divisions

- 9.9.5 Product portfolio

- 9.9.6 Business performance

- 9.9.7 Major Strategic Initiatives and Developments

- 9.10 DPD (France)

- 9.10.1 Company Overview

- 9.10.2 Key Executives

- 9.10.3 Company snapshot

- 9.10.4 Active Business Divisions

- 9.10.5 Product portfolio

- 9.10.6 Business performance

- 9.10.7 Major Strategic Initiatives and Developments

- 9.11 Clipper Logistics plc (United Kingdom)

- 9.11.1 Company Overview

- 9.11.2 Key Executives

- 9.11.3 Company snapshot

- 9.11.4 Active Business Divisions

- 9.11.5 Product portfolio

- 9.11.6 Business performance

- 9.11.7 Major Strategic Initiatives and Developments

- 9.12 Additional players considered in the study are as follows:

- 9.12.1 Company Overview

- 9.12.2 Key Executives

- 9.12.3 Company snapshot

- 9.12.4 Active Business Divisions

- 9.12.5 Product portfolio

- 9.12.6 Business performance

- 9.12.7 Major Strategic Initiatives and Developments

- 9.13 Gophr (United Kingdom)

- 9.13.1 Company Overview

- 9.13.2 Key Executives

- 9.13.3 Company snapshot

- 9.13.4 Active Business Divisions

- 9.13.5 Product portfolio

- 9.13.6 Business performance

- 9.13.7 Major Strategic Initiatives and Developments

10: Analyst Perspective and Conclusion

- 10.1 Concluding Recommendations and Analysis

- 10.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Delivery |

|

By Industry Verticals |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

How do regulatory policies impact the Last Mile Delivery Market?

+

-

What major players in Last Mile Delivery Market?

+

-

What applications are categorized in the Last Mile Delivery market study?

+

-

Which product types are examined in the Last Mile Delivery Market Study?

+

-

Which regions are expected to show the fastest growth in the Last Mile Delivery market?

+

-

What are the major growth drivers in the Last Mile Delivery market?

+

-

Is the study period of the Last Mile Delivery flexible or fixed?

+

-

How do economic factors influence the Last Mile Delivery market?

+

-

How does the supply chain affect the Last Mile Delivery Market?

+

-

Which players are included in the research coverage of the Last Mile Delivery Market Study?

+

-