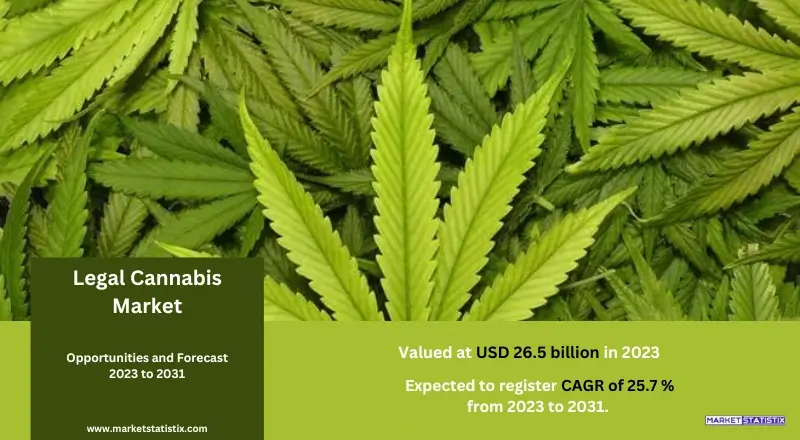

Global Legal Cannabis Market – Industry Trends and Forecast to 2031

Report ID: MS-1903 | Healthcare and Pharma | Last updated: Oct, 2024 | Formats*:

Legal Cannabis Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2031 |

| Base Year Of Estimation | 2023 |

| Growth Rate | CAGR of 25.7% |

| By Product Type | Indoor, Greenhouse |

| Key Market Players |

|

| By Region |

|

Legal Cannabis Market Trends

The legal cannabis industry is witnessing rapid expansion due to the growing adoption for medical and recreational purposes, respectively, across the globe. The market continues to grow and scope out many countries and states that practice such broad and favourable regulations, persuading investors and the innovators in the market with aggressive product developments. The trend is marked with the introduction of many varieties of cannabis products, ranging from food items to oils and capsules, to reach every possible market segment. Moreover, with the technology changes and the changes in the agricultural practices, the cultivation of cannabis is now producing more effective and finer cannabis, which sustains the growth of the industry. Defence of legal cannabis makes the strong sociological trust to a certain reliance on such remedies, while a more aggressive marketing invasion for enhanced techniques practices does address the cognitive behaviour of education. More and more clinical trials are providing evidence of the therapeutic value of cannabis, prompting healthcare providers and patients to consider its application with respect to various diseases, including chronic pains, anxiety, and epilepsy.Legal Cannabis Market Leading Players

The key players profiled in the report are Canopy Growth Corporation (USA), Aphria, Inc. (USA), Aurora Cannabis (Canada), Wayland Group (Canada), Tilray (Canada), The Cronos Group (Canada), Organigram Holding, Inc. (Canada), GW Pharmaceuticals, plc. (United Kingdom), Lexaria Corp. (Canada), Medicine Man Technology (USA)Growth Accelerators

The overall growth of the international legal marijuana economy can also be attributed to the increased embrace and enacting of cannabis laws in numerous countries and territories for both medical and recreational purposes. Governments have begun to legalise use, however, in light of the many benefits that cannabis possesses, such as its use in the treatment of chronic pain, anxiety, and several other illnesses. It is an important aspect in regards to generating additional sources of income through the taxes levied on cannabis sales to consumers. Moreover, it nurtures a whole new sector that propels the development of a variety of new products and ways of delivery that range from the products in the form of food, oils, and creams, among others. Additionally, people are becoming more aware and educated about the components of the products they buy and the therapeutic benefits of the use of the components of the therapeutic oils. Most of these factors come into play with the more recent emergence of a CBD, or cannabidiol, specific market that is expanding dominantly among the health consumers without the intoxicating effects of the tetrahydrocannabinol (THC) present in the cannabis sativa plant.Legal Cannabis Market Segmentation analysis

The Global Legal Cannabis is segmented by Type, Application, and Region. By Type, the market is divided into Distributed Indoor, Greenhouse . The Application segment categorizes the market based on its usage such as Chronic Pain, Mental Disorders, Cancer, Others. Geographically, the market is assessed across key Regions like North America(United States.Canada.Mexico), South America(Brazil.Argentina.Chile.Rest of South America), Europe(Germany.France.Italy.United Kingdom.Benelux.Nordics.Rest of Europe), Asia Pacific(China.Japan.India.South Korea.Australia.Southeast Asia.Rest of Asia-Pacific), MEA(Middle East.Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

Within the boundaries of the global legal cannabis market, the competition is not solely limited to a few players; rather, a wide variety of players exist, including large multinational companies, established drug makers, and numerous budding enterprises concentrating on cannabis sowing, processing, and selling. With more countries and states legalising the use of cannabis in both medical and recreational contexts, companies are now in competition to capture the market by coming up with unique products such as beverages with infused ingredients, edibles, and therapeutics made from CBD. This competition has resulted in high levels of investment in research and development, as well as product branding and marketing, in order to enhance product positioning and reach more consumers. Apart from that, the companies are also witnessing high levels of consolidation in the form of mergers and acquisitions in order to improve their capabilities and the scope of their activities. Major players are entering into exclusive arrangements with distributors, retailers, and e-commerce sites in order to widen their markets and ease distribution. On the other hand, however, regulatory adherence is still a very important issue, as companies need to operate within the existing laws of their country and other jurisdictions. As the market becomes fully developed, functional aspects such as the quality of the products, brand popularity, and consumer literacy will be crucial in determining the level of competition and the final decision of the consumers.Challenges In Legal Cannabis Market

There are many challenges that the global legal cannabis market encounters, and these challenges can be classified mainly into regulatory and compliance issues. However, while several countries and regions have started or completed the process of legalising cannabis for purely medicinal and recreational use, the politics of those countries remain a jigsaw. Businesses are required to deal with different statutes, licensing regimes, and taxes that tend to differ greatly between locations. Such uncertainty may discourage investment and expansion opportunities since the ability of the firms to operate in such markets is limited by the general risks associated with such vague, if not fluctuating, policies. The use of cannabis is also linked with stigma, and that can also hinder acceptance as well as the growth of the market. With more and more cannabis being legalised and considered normal in many places, consumers and businesses are still apprehensive about the use of cannabis products in areas where cannabis is banned. Furthermore, numerous concerns, such as the lack of quality control, failure to standardise products, and lack of compliance with safety regulations, are barriers that companies strive to overcome to gain market acceptance and market credibility. These issues are essential obstacles that need to be surmounted in order for the global legal cannabis industry to grow and develop maturely as it is consistently on the transformative path.Risks & Prospects in Legal Cannabis Market

With more states and nations embracing both therapeutic and leisure use of cannabis, there are huge economic prospects for the global legal cannabis market. The ready expansion of the consumer-packaged market in states with improving cannabis laws looking for various cannabis oils, edibles, topicals, and others has become stronger. This is however common in places that have even allowed medical marijuana, hence a growing range of products and products inventing, such as those designed for use by various types of customers. What is more, the introduction of online shops and online dispensaries increased the level of convenience, as people can order cannabis products without any hassles. There are still more opportunities available in the legal cannabis market with the increasing focus on cannabis research and development, particularly in the area of its medicinal use. More and more resources are directed towards the conducting of clinical trials, and that raises an opportunity for cures based on cannabis to be developed for conditions such as chronic pain, anxiety, and even epilepsy. Such an initiative is not only beneficial in improving the image of the products but also creates room for collaboration between cannabis businesses and drug manufacturing corporations.Key Target Audience

The principal target audience of the global legal cannabis market is consumers who use these products for both leisure and medical purposes. This group comprises people of different ages, notably the Millennials and Generation Z, who do not shy away from cannabis consumption as changing societal perceptions and legal measures take place. In great part, the audience also consists of the medical marijuana patients, suffering from chronic pain, anxiety, or any other forms of illness as they search for effective and safe products that will enhance their wellbeing. With the increase in cannabis legalisation and familiarisation comes a change for these consumers, who are more focused on product quality, safety, and sources of the products.,, Moreover, the legal cannabis market is ever-growing, and many investors and venture capitalists are focussing on the industry, looking for potential investment in both new companies and established ones that have growth potential. For firms dealing in the legal cannabis market, the ability to attract all these different groups of people is critical to coping with the existing regulatory framework and offering the growing demand for cannibalistic products.Merger and acquisition

Presently, such mergers and acquisitions taking place in the global legal cannabis market contain a puzzle in that there is a lot of pressure on the companies to improve their market presence and efficiencies supported by all the possible mergers. For instance, in January 2023, Cresco Labs, together with Columbia Care, finalised their integration, making them one of the biggest marijuana companies in history in the United States. This reorganisation was designed in a way that the companies would enhance their operational efficiency across many states while at the same time increasing the range of products and markets available to them. Another instance similar to this is when Canopy Growth Corporation in the last quarter of 2022 purchased cannabis brand Wana Brands in a bid to help the company’s strategy in the cannabis food market. Trulieve Cannabis Corp., in another instance, made headlines in that in the last quarter of 2021, the company revealed that it was merging with Harvest Health and Recreation. The deal was worth nearly $2.1 billion and was intended to enrich the geographical presence of Trulieve in the USA, focussing on Arizona and Florida states. In addition to increasing Trulieve’s market penetration, the merger enabled Trulieve to take advantage of Harvest’s existing familiar brand and market channels. These mergers and acquisitions are built around the tension that exists in the framework of the legal cannabis industry, which is focused on improvements in turnover, market, and brand creation, all of which have ever-increasing competition.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Legal Cannabis- Snapshot

- 2.2 Legal Cannabis- Segment Snapshot

- 2.3 Legal Cannabis- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Legal Cannabis Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Indoor

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Greenhouse

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

5: Legal Cannabis Market by Application / by End Use

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Chronic Pain

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Mental Disorders

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 Cancer

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Others

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

6: Legal Cannabis Market by End-Users

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 Healthcare Industry

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 Recreational Industry

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

- 6.4 Others

- 6.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.2 Market size and forecast, by region

- 6.4.3 Market share analysis by country

7: Legal Cannabis Market by Region

- 7.1 Overview

- 7.1.1 Market size and forecast By Region

- 7.2 North America

- 7.2.1 Key trends and opportunities

- 7.2.2 Market size and forecast, by Type

- 7.2.3 Market size and forecast, by Application

- 7.2.4 Market size and forecast, by country

- 7.2.4.1 United States

- 7.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.1.2 Market size and forecast, by Type

- 7.2.4.1.3 Market size and forecast, by Application

- 7.2.4.2 Canada

- 7.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.2.2 Market size and forecast, by Type

- 7.2.4.2.3 Market size and forecast, by Application

- 7.2.4.3 Mexico

- 7.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.2.4.3.2 Market size and forecast, by Type

- 7.2.4.3.3 Market size and forecast, by Application

- 7.2.4.1 United States

- 7.3 South America

- 7.3.1 Key trends and opportunities

- 7.3.2 Market size and forecast, by Type

- 7.3.3 Market size and forecast, by Application

- 7.3.4 Market size and forecast, by country

- 7.3.4.1 Brazil

- 7.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.1.2 Market size and forecast, by Type

- 7.3.4.1.3 Market size and forecast, by Application

- 7.3.4.2 Argentina

- 7.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.2.2 Market size and forecast, by Type

- 7.3.4.2.3 Market size and forecast, by Application

- 7.3.4.3 Chile

- 7.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.3.2 Market size and forecast, by Type

- 7.3.4.3.3 Market size and forecast, by Application

- 7.3.4.4 Rest of South America

- 7.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.3.4.4.2 Market size and forecast, by Type

- 7.3.4.4.3 Market size and forecast, by Application

- 7.3.4.1 Brazil

- 7.4 Europe

- 7.4.1 Key trends and opportunities

- 7.4.2 Market size and forecast, by Type

- 7.4.3 Market size and forecast, by Application

- 7.4.4 Market size and forecast, by country

- 7.4.4.1 Germany

- 7.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.1.2 Market size and forecast, by Type

- 7.4.4.1.3 Market size and forecast, by Application

- 7.4.4.2 France

- 7.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.2.2 Market size and forecast, by Type

- 7.4.4.2.3 Market size and forecast, by Application

- 7.4.4.3 Italy

- 7.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.3.2 Market size and forecast, by Type

- 7.4.4.3.3 Market size and forecast, by Application

- 7.4.4.4 United Kingdom

- 7.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.4.2 Market size and forecast, by Type

- 7.4.4.4.3 Market size and forecast, by Application

- 7.4.4.5 Benelux

- 7.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.5.2 Market size and forecast, by Type

- 7.4.4.5.3 Market size and forecast, by Application

- 7.4.4.6 Nordics

- 7.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.6.2 Market size and forecast, by Type

- 7.4.4.6.3 Market size and forecast, by Application

- 7.4.4.7 Rest of Europe

- 7.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 7.4.4.7.2 Market size and forecast, by Type

- 7.4.4.7.3 Market size and forecast, by Application

- 7.4.4.1 Germany

- 7.5 Asia Pacific

- 7.5.1 Key trends and opportunities

- 7.5.2 Market size and forecast, by Type

- 7.5.3 Market size and forecast, by Application

- 7.5.4 Market size and forecast, by country

- 7.5.4.1 China

- 7.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.1.2 Market size and forecast, by Type

- 7.5.4.1.3 Market size and forecast, by Application

- 7.5.4.2 Japan

- 7.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.2.2 Market size and forecast, by Type

- 7.5.4.2.3 Market size and forecast, by Application

- 7.5.4.3 India

- 7.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.3.2 Market size and forecast, by Type

- 7.5.4.3.3 Market size and forecast, by Application

- 7.5.4.4 South Korea

- 7.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.4.2 Market size and forecast, by Type

- 7.5.4.4.3 Market size and forecast, by Application

- 7.5.4.5 Australia

- 7.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.5.2 Market size and forecast, by Type

- 7.5.4.5.3 Market size and forecast, by Application

- 7.5.4.6 Southeast Asia

- 7.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.6.2 Market size and forecast, by Type

- 7.5.4.6.3 Market size and forecast, by Application

- 7.5.4.7 Rest of Asia-Pacific

- 7.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 7.5.4.7.2 Market size and forecast, by Type

- 7.5.4.7.3 Market size and forecast, by Application

- 7.5.4.1 China

- 7.6 MEA

- 7.6.1 Key trends and opportunities

- 7.6.2 Market size and forecast, by Type

- 7.6.3 Market size and forecast, by Application

- 7.6.4 Market size and forecast, by country

- 7.6.4.1 Middle East

- 7.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 7.6.4.1.2 Market size and forecast, by Type

- 7.6.4.1.3 Market size and forecast, by Application

- 7.6.4.2 Africa

- 7.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 7.6.4.2.2 Market size and forecast, by Type

- 7.6.4.2.3 Market size and forecast, by Application

- 7.6.4.1 Middle East

- 8.1 Overview

- 8.2 Key Winning Strategies

- 8.3 Top 10 Players: Product Mapping

- 8.4 Competitive Analysis Dashboard

- 8.5 Market Competition Heatmap

- 8.6 Leading Player Positions, 2022

9: Company Profiles

- 9.1 Canopy Growth Corporation (USA)

- 9.1.1 Company Overview

- 9.1.2 Key Executives

- 9.1.3 Company snapshot

- 9.1.4 Active Business Divisions

- 9.1.5 Product portfolio

- 9.1.6 Business performance

- 9.1.7 Major Strategic Initiatives and Developments

- 9.2 Aphria

- 9.2.1 Company Overview

- 9.2.2 Key Executives

- 9.2.3 Company snapshot

- 9.2.4 Active Business Divisions

- 9.2.5 Product portfolio

- 9.2.6 Business performance

- 9.2.7 Major Strategic Initiatives and Developments

- 9.3 Inc. (USA)

- 9.3.1 Company Overview

- 9.3.2 Key Executives

- 9.3.3 Company snapshot

- 9.3.4 Active Business Divisions

- 9.3.5 Product portfolio

- 9.3.6 Business performance

- 9.3.7 Major Strategic Initiatives and Developments

- 9.4 Aurora Cannabis (Canada)

- 9.4.1 Company Overview

- 9.4.2 Key Executives

- 9.4.3 Company snapshot

- 9.4.4 Active Business Divisions

- 9.4.5 Product portfolio

- 9.4.6 Business performance

- 9.4.7 Major Strategic Initiatives and Developments

- 9.5 Wayland Group (Canada)

- 9.5.1 Company Overview

- 9.5.2 Key Executives

- 9.5.3 Company snapshot

- 9.5.4 Active Business Divisions

- 9.5.5 Product portfolio

- 9.5.6 Business performance

- 9.5.7 Major Strategic Initiatives and Developments

- 9.6 Tilray (Canada)

- 9.6.1 Company Overview

- 9.6.2 Key Executives

- 9.6.3 Company snapshot

- 9.6.4 Active Business Divisions

- 9.6.5 Product portfolio

- 9.6.6 Business performance

- 9.6.7 Major Strategic Initiatives and Developments

- 9.7 The Cronos Group (Canada)

- 9.7.1 Company Overview

- 9.7.2 Key Executives

- 9.7.3 Company snapshot

- 9.7.4 Active Business Divisions

- 9.7.5 Product portfolio

- 9.7.6 Business performance

- 9.7.7 Major Strategic Initiatives and Developments

- 9.8 Organigram Holding

- 9.8.1 Company Overview

- 9.8.2 Key Executives

- 9.8.3 Company snapshot

- 9.8.4 Active Business Divisions

- 9.8.5 Product portfolio

- 9.8.6 Business performance

- 9.8.7 Major Strategic Initiatives and Developments

- 9.9 Inc. (Canada)

- 9.9.1 Company Overview

- 9.9.2 Key Executives

- 9.9.3 Company snapshot

- 9.9.4 Active Business Divisions

- 9.9.5 Product portfolio

- 9.9.6 Business performance

- 9.9.7 Major Strategic Initiatives and Developments

- 9.10 GW Pharmaceuticals

- 9.10.1 Company Overview

- 9.10.2 Key Executives

- 9.10.3 Company snapshot

- 9.10.4 Active Business Divisions

- 9.10.5 Product portfolio

- 9.10.6 Business performance

- 9.10.7 Major Strategic Initiatives and Developments

- 9.11 plc. (United Kingdom)

- 9.11.1 Company Overview

- 9.11.2 Key Executives

- 9.11.3 Company snapshot

- 9.11.4 Active Business Divisions

- 9.11.5 Product portfolio

- 9.11.6 Business performance

- 9.11.7 Major Strategic Initiatives and Developments

- 9.12 Lexaria Corp. (Canada)

- 9.12.1 Company Overview

- 9.12.2 Key Executives

- 9.12.3 Company snapshot

- 9.12.4 Active Business Divisions

- 9.12.5 Product portfolio

- 9.12.6 Business performance

- 9.12.7 Major Strategic Initiatives and Developments

- 9.13 Medicine Man Technology (USA)

- 9.13.1 Company Overview

- 9.13.2 Key Executives

- 9.13.3 Company snapshot

- 9.13.4 Active Business Divisions

- 9.13.5 Product portfolio

- 9.13.6 Business performance

- 9.13.7 Major Strategic Initiatives and Developments

10: Analyst Perspective and Conclusion

- 10.1 Concluding Recommendations and Analysis

- 10.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Application |

|

By End-Users |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

How do regulatory policies impact the Legal Cannabis Market?

+

-

What major players in Legal Cannabis Market?

+

-

What applications are categorized in the Legal Cannabis market study?

+

-

Which product types are examined in the Legal Cannabis Market Study?

+

-

Which regions are expected to show the fastest growth in the Legal Cannabis market?

+

-

What are the major growth drivers in the Legal Cannabis market?

+

-

Is the study period of the Legal Cannabis flexible or fixed?

+

-

How do economic factors influence the Legal Cannabis market?

+

-

How does the supply chain affect the Legal Cannabis Market?

+

-

Which players are included in the research coverage of the Legal Cannabis Market Study?

+

-