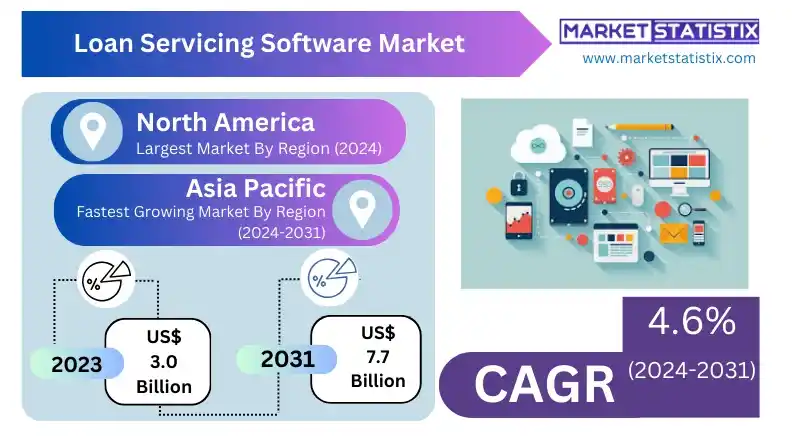

Global Loan Servicing Software Market – Industry Trends and Forecast to 2031

Report ID: MS-56 | Application Software | Last updated: Oct, 2024 | Formats*:

Loan Servicing Software Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2031 |

| Base Year Of Estimation | 2023 |

| Growth Rate | CAGR of 10.7% |

| By Product Type | Origination Software, Loan Management Software, Collection Software, Risk Management Software, Others |

| Key Market Players |

|

| By Region |

|

Loan Servicing Software Market Trends

The global market for loan management software is undergoing impressive evolution as more players in the industry are implementing digital solutions within their arches. One of the overriding trends is the adoption of cloud computing services, which are more scalable, flexible, and cheaper to implement than conventional systems. Banks have started changing from traditional systems, which are installed onsite, to external cloud systems that provide instant data, connectivity, and security. There is also increasing interest in automation and AI-driven analytics, making it possible for lenders to operate more efficiently, reinforce compliance, and carry out customer satisfaction research more quickly, among other interventions such as mortgage processing through the Loan Management System's predictive capabilities. In addition, the growing market dominance of integrated systems is being driven by the need for simpler and more affordable software that allows easier modification, enhanced by the special focus of the software design on a particular mortgage student auto loan and other industry features. The changes in the external environment are rendering more regulations, and as a result, the loan servicing systems are advancing to capture the market without burdening the operation with administrative costs.Loan Servicing Software Market Leading Players

The key players profiled in the report are Emphasys Software, LoanPro, Cloud Lending, C-Loans Inc., Financial Industry Computer Systems Inc., Shaw Systems, Nortridge Software, Altisource, Mortgage Builder, Graveco Software, Q2 Software, GOLDPoint Systems, Fiserv, Applied Business Software, Bryt Software, AutoPal SoftwareGrowth Accelerators

The market for loan servicing software is on the rise due to the increasing need for automation and efficient management of loan portfolios. These solutions are being embraced by financial institutions such as banks and credit unions in an effort to enhance the loan origination services, payment processing services, and customer services, consequently minimising manual errors and increasing efficiency. The growth of digital lending solutions and the need to manage complicated loan designs with strict compliance regulations are also making sophisticated loan servicing applications more appealing. On top of that, the other market driver is the growing preference for the use of cloud-based solutions. The primary benefit of cloud-based loan servicing software is that it provides flexibility in terms of expansion, allows working from anywhere, and has affordable upkeep, thus appealing to both large and small-scale lenders. The financial sector has also been witnessing increasing demand for the use of data analytics and real-time reporting, which has contributed to the growth of the market since these functionalities enable the institutions to make the right decisions, serve their clients better, and mitigate risks.Loan Servicing Software Market Segmentation analysis

The Global Loan Servicing Software is segmented by Type, and Region. By Type, the market is divided into Distributed Origination Software, Loan Management Software, Collection Software, Risk Management Software, Others . Geographically, the market is assessed across key Regions like North America (United States, Canada, Mexico), South America (Brazil, Argentina, Chile, Rest of South America), Europe (Germany, France, Italy, United Kingdom, Benelux, Nordics, Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific), MEA (Middle East, Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The competitive scenario of the Loan Servicing Software (LSS) market is composed of old companies bothered by the innovative solutions offered by new entities included in the same market. One such player is FIS Global, Ellie Mae, or Black Knight, who possesses an extensive web of offerings that come with a lot of advanced features like automated workflows, real-time reporting, or even compliance management. Exotic players also make sure to capitalise in the market since they possess the technological knowhow and have been in the industry long enough to understand what banks, credit unions, and mortgage lenders would need. Startups and small players also cut a huge share in the LSS sector as they come in with very specific and limited solutions, which however differ with the likes of low cost and easy customisation or ease of use. Like in many developing sectors, these companies also prefer agile development strategies, giving them the advantage of agility over market and compliance changes. Hence firms are competing in the market, attempting the provision of different notions for analysing the market and their products. There is increased competition in the management of market firms trying to introduce different tools like enhancing customer engagement features, integrating artificially intelligent analytics systems into the organisational strategies, and integrating financial technologies with other products.Challenges In Loan Servicing Software Market

The loan servicing software market is afflicted with a myriad of challenges, and one of the foremost ones is data and privacy security. This is because financial institutions are responsible for a large amount of sensitive information about their clients, and failure to protect this information can be both financially and harmful in terms of reputation. Added Security Further Complicated Compliance In addition, evolving legislation, such as data protection legislation like the GDPR and financial compliance requirements, makes it more difficult to keep systems secure because they have to be maintained in a state of change and vigilance. Another challenge that is just as hard is the interfacing of the loan servicing software to existing systems of the lending companies. Most of the commercial banks and lending companies are still using some antiquated systems, which are hard and expensive to retrofit with new loan servicer systems. This results in reduced operational efficiency and limits the software scalability, which discourages institutions from full uptake of new technologies. In addition to that, there is the issue of modifying the software to fit the particular organization, which can be quite intricate, raising the costs and duration of deployment.Risks & Prospects in Loan Servicing Software Market

The loan servicing software market has favourable prospects owing to the rise in the population that embraces technology in the modern financial industry. Lenders and financial institutions are automating the carrying out of their business activities in a bid to eliminate mistakes involved in manual processes and improve service delivery, hence the increasing uptake of loan servicing software that incorporates cloud technology and artificial intelligence. Furthermore, the increase in digital lending enables even more growth for loan servicing software suppliers. There has also been an increase in the demand for flexible, scalable, and secure loan servicing systems due to increased mobile banking and work-from-home policies, thus providing an opportunity for companies to create such systems for small to medium-scale lenders and peer-to-peer and alternative finance companies. The changes in this industry will therefore favour a great expansion of the market in the next few years.Key Target Audience

, The loan servicing software market is primarily focused on serving financial institutions, notably banks, credit unions, and mortgage companies. These institutions demand effective software systems as they undertake tasks associated with loan management such as origination, payments, recovery, and managing legal and regulatory requirements. Increasingly stringent demand for compliance, alongside the growing need for proper management of customer relationships, has caused these institutions to look for software that helps achieve operational efficiencies and reductions in manual errors with an added customer service capability., On top of that, several alternative lenders, fintech companies, and servicing organisations are key users of loan servicing software. As more and more of these businesses enter the fray of lending, they too are keen on ensuring, on the one hand, that their processes are efficient and, on the other, that the borrowers they serve are not inconvenienced. The adoption of direct lending and peer-to-peer business models has made it imperative for them to find solutions that are both flexible and can grow with the business.Merger and acquisition

Several strategic partnerships between the companies in the loan servicing software market have been witnessed in the recent past as players quest to improve their technology and widen the market. One such recent acquisition was in the year 2020, when Black Knight acquired a company called Optimal Blue, a provider of a digital loan pricing engine. Because of this acquisition, Optimal Blue’s more advanced product pricing engine was incorporated into Black Knight’s loan servicing software offering, enabling Black Knight to provide wider solutions to lenders and servicers. The acquisition reinforced the trend of enhanced convenience in loan origination and servicing through available digital solutions. Intercontinental Exchange (ICE) also made headlines when it acquired Ellie Mae in 2020, allowing ICE to gain a significant presence in the mortgage technology environment. The lending platform from Ellie Mae integrated with ICE's data and connectivity services, providing a comprehensive system to service and organise the management and origination of loans. This acquisition also demonstrated the increased focus on technology in the loan servicing sector aimed at enhancing efficiency and compliance. Such strategic acquisitions signify the ongoing consolidation and digital evolution of the industry.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Loan Servicing Software- Snapshot

- 2.2 Loan Servicing Software- Segment Snapshot

- 2.3 Loan Servicing Software- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Loan Servicing Software Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Origination Software

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Collection Software

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 Loan Management Software

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Risk Management Software

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

- 4.6 Others

- 4.6.1 Key market trends, factors driving growth, and opportunities

- 4.6.2 Market size and forecast, by region

- 4.6.3 Market share analysis by country

5: Loan Servicing Software Market by Deployment Type

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 On-premises

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Cloud-based

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

6: Loan Servicing Software Market by End-users

- 6.1 Overview

- 6.1.1 Market size and forecast

- 6.2 Banks

- 6.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.2 Market size and forecast, by region

- 6.2.3 Market share analysis by country

- 6.3 Credit Unions

- 6.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.2 Market size and forecast, by region

- 6.3.3 Market share analysis by country

- 6.4 Mortgage Lenders

- 6.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.2 Market size and forecast, by region

- 6.4.3 Market share analysis by country

- 6.5 Loan Servicing Companies

- 6.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.2 Market size and forecast, by region

- 6.5.3 Market share analysis by country

- 6.6 Others

- 6.6.1 Key market trends, factors driving growth, and opportunities

- 6.6.2 Market size and forecast, by region

- 6.6.3 Market share analysis by country

7: Loan Servicing Software Market by Enterprise Size

- 7.1 Overview

- 7.1.1 Market size and forecast

- 7.2 Large Enterprises

- 7.2.1 Key market trends, factors driving growth, and opportunities

- 7.2.2 Market size and forecast, by region

- 7.2.3 Market share analysis by country

- 7.3 Small and Medium-sized Enterprises

- 7.3.1 Key market trends, factors driving growth, and opportunities

- 7.3.2 Market size and forecast, by region

- 7.3.3 Market share analysis by country

8: Loan Servicing Software Market by Region

- 8.1 Overview

- 8.1.1 Market size and forecast By Region

- 8.2 North America

- 8.2.1 Key trends and opportunities

- 8.2.2 Market size and forecast, by Type

- 8.2.3 Market size and forecast, by Application

- 8.2.4 Market size and forecast, by country

- 8.2.4.1 United States

- 8.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 8.2.4.1.2 Market size and forecast, by Type

- 8.2.4.1.3 Market size and forecast, by Application

- 8.2.4.2 Canada

- 8.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 8.2.4.2.2 Market size and forecast, by Type

- 8.2.4.2.3 Market size and forecast, by Application

- 8.2.4.3 Mexico

- 8.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 8.2.4.3.2 Market size and forecast, by Type

- 8.2.4.3.3 Market size and forecast, by Application

- 8.2.4.1 United States

- 8.3 South America

- 8.3.1 Key trends and opportunities

- 8.3.2 Market size and forecast, by Type

- 8.3.3 Market size and forecast, by Application

- 8.3.4 Market size and forecast, by country

- 8.3.4.1 Brazil

- 8.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 8.3.4.1.2 Market size and forecast, by Type

- 8.3.4.1.3 Market size and forecast, by Application

- 8.3.4.2 Argentina

- 8.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 8.3.4.2.2 Market size and forecast, by Type

- 8.3.4.2.3 Market size and forecast, by Application

- 8.3.4.3 Chile

- 8.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 8.3.4.3.2 Market size and forecast, by Type

- 8.3.4.3.3 Market size and forecast, by Application

- 8.3.4.4 Rest of South America

- 8.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 8.3.4.4.2 Market size and forecast, by Type

- 8.3.4.4.3 Market size and forecast, by Application

- 8.3.4.1 Brazil

- 8.4 Europe

- 8.4.1 Key trends and opportunities

- 8.4.2 Market size and forecast, by Type

- 8.4.3 Market size and forecast, by Application

- 8.4.4 Market size and forecast, by country

- 8.4.4.1 Germany

- 8.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.1.2 Market size and forecast, by Type

- 8.4.4.1.3 Market size and forecast, by Application

- 8.4.4.2 France

- 8.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.2.2 Market size and forecast, by Type

- 8.4.4.2.3 Market size and forecast, by Application

- 8.4.4.3 Italy

- 8.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.3.2 Market size and forecast, by Type

- 8.4.4.3.3 Market size and forecast, by Application

- 8.4.4.4 United Kingdom

- 8.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.4.2 Market size and forecast, by Type

- 8.4.4.4.3 Market size and forecast, by Application

- 8.4.4.5 Benelux

- 8.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.5.2 Market size and forecast, by Type

- 8.4.4.5.3 Market size and forecast, by Application

- 8.4.4.6 Nordics

- 8.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.6.2 Market size and forecast, by Type

- 8.4.4.6.3 Market size and forecast, by Application

- 8.4.4.7 Rest of Europe

- 8.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 8.4.4.7.2 Market size and forecast, by Type

- 8.4.4.7.3 Market size and forecast, by Application

- 8.4.4.1 Germany

- 8.5 Asia Pacific

- 8.5.1 Key trends and opportunities

- 8.5.2 Market size and forecast, by Type

- 8.5.3 Market size and forecast, by Application

- 8.5.4 Market size and forecast, by country

- 8.5.4.1 China

- 8.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.1.2 Market size and forecast, by Type

- 8.5.4.1.3 Market size and forecast, by Application

- 8.5.4.2 Japan

- 8.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.2.2 Market size and forecast, by Type

- 8.5.4.2.3 Market size and forecast, by Application

- 8.5.4.3 India

- 8.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.3.2 Market size and forecast, by Type

- 8.5.4.3.3 Market size and forecast, by Application

- 8.5.4.4 South Korea

- 8.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.4.2 Market size and forecast, by Type

- 8.5.4.4.3 Market size and forecast, by Application

- 8.5.4.5 Australia

- 8.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.5.2 Market size and forecast, by Type

- 8.5.4.5.3 Market size and forecast, by Application

- 8.5.4.6 Southeast Asia

- 8.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.6.2 Market size and forecast, by Type

- 8.5.4.6.3 Market size and forecast, by Application

- 8.5.4.7 Rest of Asia-Pacific

- 8.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 8.5.4.7.2 Market size and forecast, by Type

- 8.5.4.7.3 Market size and forecast, by Application

- 8.5.4.1 China

- 8.6 MEA

- 8.6.1 Key trends and opportunities

- 8.6.2 Market size and forecast, by Type

- 8.6.3 Market size and forecast, by Application

- 8.6.4 Market size and forecast, by country

- 8.6.4.1 Middle East

- 8.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 8.6.4.1.2 Market size and forecast, by Type

- 8.6.4.1.3 Market size and forecast, by Application

- 8.6.4.2 Africa

- 8.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 8.6.4.2.2 Market size and forecast, by Type

- 8.6.4.2.3 Market size and forecast, by Application

- 8.6.4.1 Middle East

- 9.1 Overview

- 9.2 Key Winning Strategies

- 9.3 Top 10 Players: Product Mapping

- 9.4 Competitive Analysis Dashboard

- 9.5 Market Competition Heatmap

- 9.6 Leading Player Positions, 2022

10: Company Profiles

- 10.1 Financial Industry Computer Systems Inc.

- 10.1.1 Company Overview

- 10.1.2 Key Executives

- 10.1.3 Company snapshot

- 10.1.4 Active Business Divisions

- 10.1.5 Product portfolio

- 10.1.6 Business performance

- 10.1.7 Major Strategic Initiatives and Developments

- 10.2 C-Loans Inc.

- 10.2.1 Company Overview

- 10.2.2 Key Executives

- 10.2.3 Company snapshot

- 10.2.4 Active Business Divisions

- 10.2.5 Product portfolio

- 10.2.6 Business performance

- 10.2.7 Major Strategic Initiatives and Developments

- 10.3 Graveco Software

- 10.3.1 Company Overview

- 10.3.2 Key Executives

- 10.3.3 Company snapshot

- 10.3.4 Active Business Divisions

- 10.3.5 Product portfolio

- 10.3.6 Business performance

- 10.3.7 Major Strategic Initiatives and Developments

- 10.4 Applied Business Software

- 10.4.1 Company Overview

- 10.4.2 Key Executives

- 10.4.3 Company snapshot

- 10.4.4 Active Business Divisions

- 10.4.5 Product portfolio

- 10.4.6 Business performance

- 10.4.7 Major Strategic Initiatives and Developments

- 10.5 LoanPro

- 10.5.1 Company Overview

- 10.5.2 Key Executives

- 10.5.3 Company snapshot

- 10.5.4 Active Business Divisions

- 10.5.5 Product portfolio

- 10.5.6 Business performance

- 10.5.7 Major Strategic Initiatives and Developments

- 10.6 Nortridge Software

- 10.6.1 Company Overview

- 10.6.2 Key Executives

- 10.6.3 Company snapshot

- 10.6.4 Active Business Divisions

- 10.6.5 Product portfolio

- 10.6.6 Business performance

- 10.6.7 Major Strategic Initiatives and Developments

- 10.7 Mortgage Builder

- 10.7.1 Company Overview

- 10.7.2 Key Executives

- 10.7.3 Company snapshot

- 10.7.4 Active Business Divisions

- 10.7.5 Product portfolio

- 10.7.6 Business performance

- 10.7.7 Major Strategic Initiatives and Developments

- 10.8 Bryt Software

- 10.8.1 Company Overview

- 10.8.2 Key Executives

- 10.8.3 Company snapshot

- 10.8.4 Active Business Divisions

- 10.8.5 Product portfolio

- 10.8.6 Business performance

- 10.8.7 Major Strategic Initiatives and Developments

- 10.9 Altisource

- 10.9.1 Company Overview

- 10.9.2 Key Executives

- 10.9.3 Company snapshot

- 10.9.4 Active Business Divisions

- 10.9.5 Product portfolio

- 10.9.6 Business performance

- 10.9.7 Major Strategic Initiatives and Developments

- 10.10 Emphasys Software

- 10.10.1 Company Overview

- 10.10.2 Key Executives

- 10.10.3 Company snapshot

- 10.10.4 Active Business Divisions

- 10.10.5 Product portfolio

- 10.10.6 Business performance

- 10.10.7 Major Strategic Initiatives and Developments

- 10.11 Shaw Systems

- 10.11.1 Company Overview

- 10.11.2 Key Executives

- 10.11.3 Company snapshot

- 10.11.4 Active Business Divisions

- 10.11.5 Product portfolio

- 10.11.6 Business performance

- 10.11.7 Major Strategic Initiatives and Developments

- 10.12 Q2 Software

- 10.12.1 Company Overview

- 10.12.2 Key Executives

- 10.12.3 Company snapshot

- 10.12.4 Active Business Divisions

- 10.12.5 Product portfolio

- 10.12.6 Business performance

- 10.12.7 Major Strategic Initiatives and Developments

- 10.13 GOLDPoint Systems

- 10.13.1 Company Overview

- 10.13.2 Key Executives

- 10.13.3 Company snapshot

- 10.13.4 Active Business Divisions

- 10.13.5 Product portfolio

- 10.13.6 Business performance

- 10.13.7 Major Strategic Initiatives and Developments

- 10.14 Cloud Lending

- 10.14.1 Company Overview

- 10.14.2 Key Executives

- 10.14.3 Company snapshot

- 10.14.4 Active Business Divisions

- 10.14.5 Product portfolio

- 10.14.6 Business performance

- 10.14.7 Major Strategic Initiatives and Developments

- 10.15 Fiserv

- 10.15.1 Company Overview

- 10.15.2 Key Executives

- 10.15.3 Company snapshot

- 10.15.4 Active Business Divisions

- 10.15.5 Product portfolio

- 10.15.6 Business performance

- 10.15.7 Major Strategic Initiatives and Developments

- 10.16 AutoPal Software

- 10.16.1 Company Overview

- 10.16.2 Key Executives

- 10.16.3 Company snapshot

- 10.16.4 Active Business Divisions

- 10.16.5 Product portfolio

- 10.16.6 Business performance

- 10.16.7 Major Strategic Initiatives and Developments

11: Analyst Perspective and Conclusion

- 11.1 Concluding Recommendations and Analysis

- 11.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Deployment Type |

|

By End-users |

|

By Enterprise Size |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

Which type of Loan Servicing Software is widely popular?

+

-

What is the growth rate of Loan Servicing Software Market?

+

-

What are the latest trends influencing the Loan Servicing Software Market?

+

-

Who are the key players in the Loan Servicing Software Market?

+

-

How is the Loan Servicing Software } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Loan Servicing Software Market Study?

+

-

What geographic breakdown is available in Global Loan Servicing Software Market Study?

+

-

Which region holds the second position by market share in the Loan Servicing Software market?

+

-

How are the key players in the Loan Servicing Software market targeting growth in the future?

+

-

What are the opportunities for new entrants in the Loan Servicing Software market?

+

-