Global Marine Lubricants Market – Industry Trends and Forecast to 2030

Report ID: MS-1582 | Chemicals And Materials | Last updated: Aug, 2024 | Formats*:

Marine Lubricants Report Highlights

| Report Metrics | Details |

|---|---|

| Forecast period | 2019-2030 |

| Base Year Of Estimation | 2023 |

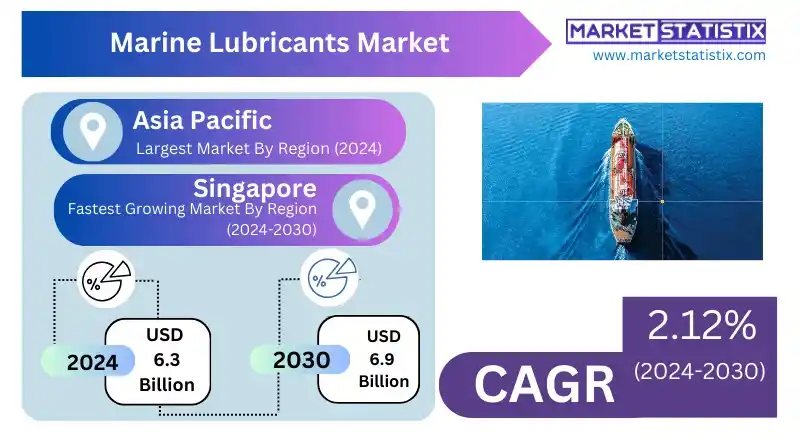

| Growth Rate | CAGR of 2.12% |

| By Product Type | Marine Cylinder oil, Piston Engine Oil, System Oil, Other |

| Key Market Players |

|

| By Region |

|

Marine Lubricants Market Trends

Some of the key trends at play drive the marine lubricant market. Rising global trade and maritime activities drive the demand for high-performance lubricants, which optimise vessel efficiency and reduce maintenance costs. Stringent environmental regulations related to emissions and waste management in general have spurred development in eco-friendly and biodegradable lubricants. Fuel efficiency and energy conservation with a growing impetus have also fuelled the growth of lubricants that improve engine performance and thereby reduce fuel consumption. Moreover, the development of technological advancement in marine engines and systems of propulsion also calls for special lubricants that would be developed to conform to changing requirements. Increasingly, digitalisation, coupled with remote monitoring systems, plays a significant role in the development of lubricants for monitoring and performance optimisation within the maritime industry.Marine Lubricants Market Leading Players

The key players profiled in the report are Eni oil Products, Croda International Plc, AvinOil S.A., Other, The PJSC Lukoil Oil Company, CEPSA, Royal Dutch Shell Plc, Exxon Mobil Corporation, Gazprom Neft PJSC, SINOPEC, Repsol S.A., Chevron Corporation, Total SA, BP p.l.c.Growth Accelerators

Several key factors drive the marine lubricants market. The increasing global trade and associated marine transport activities require good condition and efficiency of vessels; hence, the demand for high-performance lubricants rises. Again, the strict environmental regulations on the shipping industry over reduction in emissions have driven the innovation of environmentally friendly lubricants, thereby stimulating market growth. Moreover, the growing emphasis on vessel safety and operational efficiency has boosted demand for specialised lubricants that can handle such harsh conditions of the marine environment and optimise engine performance. As the maritime industry continues to grow and modernise in the future, demand for advanced marine lubricants is likely to rise and remain positive for the opportunities available to market players.Marine Lubricants Market Segmentation analysis

The Global Marine Lubricants is segmented by Type, and Region. By Type, the market is divided into Distributed Marine Cylinder oil, Piston Engine Oil, System Oil, Other . Geographically, the market is assessed across key Regions like North America(United States.Canada.Mexico), South America(Brazil.Argentina.Chile.Rest of South America), Europe(Germany.France.Italy.United Kingdom.Benelux.Nordics.Rest of Europe), Asia Pacific(China.Japan.India.South Korea.Australia.Southeast Asia.Rest of Asia-Pacific), MEA(Middle East.Africa) and others, each presenting distinct growth opportunities and challenges influenced by the regions.Competitive Landscape

The marine lubricants market comprises various global and regional players with different strengths and product offerings. The major oil and lubricant companies with well-built research and development capabilities orientated towards producing high-performance products characterise the market. Many of these companies have huge global presences and distribution networks. Added to this are larger companies and closely associated lubricant manufacturers that now service the sea industry in terms of special vessel types and specific operating conditions. Smaller regional players retain a small share of the market, typically competing on a regional basis by serving local needs and offering localised services. Product innovation and strict environmental legislation, in addition to increasing demand for more sustainable and environment-friendly lubricants, drive the competitive dynamics of the market further.Challenges In Marine Lubricants Market

The challenges that exist in the market of marine lubricants include stringent environmental regulations, especially those related to sulphur oxide and nitrogen oxide emissions, which call for the development of low-sulphur and environmentally friendly lubricants. Another challenge for the industry is increasing base oil prices and additives used in making them, thereby affecting the cost of production. Again, rising competition from emerging alternative technologies in propulsion especially the electric and hybrid systems presents problems for the sales of traditional marine lubricants. The challenge lies in delivering high-performance lubricants while remaining environmentally sustainable and cost-effective. Another aspect of this industry that is making the operating environment more complex and varied is that special types of lubricants need to be developed, which in turn calls for continuous research and development in the face of changing requirements.Risks & Prospects in Marine Lubricants Market

A few growth opportunities characterise the marine lubricants market, driven by evolving industry trends and increasing demand. One of the major drivers is the growth of the global trading and maritime transportation sector, as it requires special types of lubricants for the purpose of optimal performance of the engines and elongating equipment life. Besides, stringent environmental regulations put on the shipping industries have also contributed to the growth in demand for eco-friendly, biodegradable marine lubricants. Besides that, technological improvement in marine engines and propulsion systems itself allows for new opportunities in the development of specialist lubricants. Not to mention the growth in interest in fuel efficiency and reduced emissions, this last area offers an open potential market opportunity for lubricants to improve engine performance while at the same time tending to be kinder to the environment.Key Target Audience

The core customers of marine lubricants are the shipping companies, vessel owners, and operators. These would be the partners looking to optimise engine performances with good lubricants in order to reduce maintenance costs and address concerns related to environmental performance. Other major customers would be shipbuilding and repair yards due to their requirements for specialised lubricants for new vessels and maintenance services.,, The other applications of the marine lubricants market are in the shipping industry, including container ships, bulk carriers, tankers, cruise liners, and offshore drilling platforms. Each segment has its own specific needs for lubricants, which vary by vessel type, engine size, and conditions of operation.Merger and acquisition

The marine lubricants market has recently witnessed a chain of mergers and acquisitions due to increasing needs for extended market reach, technology, and cost synergies. Key companies in the market formed strategic alliances and made acquisitions that would strengthen their market positions and deliver complete product portfolios. These mergers and acquisitions have caused consolidation in the market, while big companies have emerged as dominant players. Much of the interest has been in the buying of firms that have specialised capability in certain segments like two-stroke engine lubricants, gear oils, or bio-based lubricants within the marine industry. These deals have also provided ways to broaden geographical footprint, which enabled companies to enter new markets and customer segments.- 1.1 Report description

- 1.2 Key market segments

- 1.3 Key benefits to the stakeholders

2: Executive Summary

- 2.1 Marine Lubricants- Snapshot

- 2.2 Marine Lubricants- Segment Snapshot

- 2.3 Marine Lubricants- Competitive Landscape Snapshot

3: Market Overview

- 3.1 Market definition and scope

- 3.2 Key findings

- 3.2.1 Top impacting factors

- 3.2.2 Top investment pockets

- 3.3 Porter’s five forces analysis

- 3.3.1 Low bargaining power of suppliers

- 3.3.2 Low threat of new entrants

- 3.3.3 Low threat of substitutes

- 3.3.4 Low intensity of rivalry

- 3.3.5 Low bargaining power of buyers

- 3.4 Market dynamics

- 3.4.1 Drivers

- 3.4.2 Restraints

- 3.4.3 Opportunities

4: Marine Lubricants Market by Type

- 4.1 Overview

- 4.1.1 Market size and forecast

- 4.2 Marine Cylinder oil

- 4.2.1 Key market trends, factors driving growth, and opportunities

- 4.2.2 Market size and forecast, by region

- 4.2.3 Market share analysis by country

- 4.3 Piston Engine Oil

- 4.3.1 Key market trends, factors driving growth, and opportunities

- 4.3.2 Market size and forecast, by region

- 4.3.3 Market share analysis by country

- 4.4 System Oil

- 4.4.1 Key market trends, factors driving growth, and opportunities

- 4.4.2 Market size and forecast, by region

- 4.4.3 Market share analysis by country

- 4.5 Other

- 4.5.1 Key market trends, factors driving growth, and opportunities

- 4.5.2 Market size and forecast, by region

- 4.5.3 Market share analysis by country

5: Marine Lubricants Market by Ship Type

- 5.1 Overview

- 5.1.1 Market size and forecast

- 5.2 Bulk Carrier

- 5.2.1 Key market trends, factors driving growth, and opportunities

- 5.2.2 Market size and forecast, by region

- 5.2.3 Market share analysis by country

- 5.3 Oil Tankers

- 5.3.1 Key market trends, factors driving growth, and opportunities

- 5.3.2 Market size and forecast, by region

- 5.3.3 Market share analysis by country

- 5.4 General Cargo

- 5.4.1 Key market trends, factors driving growth, and opportunities

- 5.4.2 Market size and forecast, by region

- 5.4.3 Market share analysis by country

- 5.5 Container Ships

- 5.5.1 Key market trends, factors driving growth, and opportunities

- 5.5.2 Market size and forecast, by region

- 5.5.3 Market share analysis by country

- 5.6 Others

- 5.6.1 Key market trends, factors driving growth, and opportunities

- 5.6.2 Market size and forecast, by region

- 5.6.3 Market share analysis by country

6: Marine Lubricants Market by Region

- 6.1 Overview

- 6.1.1 Market size and forecast By Region

- 6.2 North America

- 6.2.1 Key trends and opportunities

- 6.2.2 Market size and forecast, by Type

- 6.2.3 Market size and forecast, by Application

- 6.2.4 Market size and forecast, by country

- 6.2.4.1 United States

- 6.2.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.1.2 Market size and forecast, by Type

- 6.2.4.1.3 Market size and forecast, by Application

- 6.2.4.2 Canada

- 6.2.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.2.2 Market size and forecast, by Type

- 6.2.4.2.3 Market size and forecast, by Application

- 6.2.4.3 Mexico

- 6.2.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.2.4.3.2 Market size and forecast, by Type

- 6.2.4.3.3 Market size and forecast, by Application

- 6.2.4.1 United States

- 6.3 South America

- 6.3.1 Key trends and opportunities

- 6.3.2 Market size and forecast, by Type

- 6.3.3 Market size and forecast, by Application

- 6.3.4 Market size and forecast, by country

- 6.3.4.1 Brazil

- 6.3.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.1.2 Market size and forecast, by Type

- 6.3.4.1.3 Market size and forecast, by Application

- 6.3.4.2 Argentina

- 6.3.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.2.2 Market size and forecast, by Type

- 6.3.4.2.3 Market size and forecast, by Application

- 6.3.4.3 Chile

- 6.3.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.3.2 Market size and forecast, by Type

- 6.3.4.3.3 Market size and forecast, by Application

- 6.3.4.4 Rest of South America

- 6.3.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.3.4.4.2 Market size and forecast, by Type

- 6.3.4.4.3 Market size and forecast, by Application

- 6.3.4.1 Brazil

- 6.4 Europe

- 6.4.1 Key trends and opportunities

- 6.4.2 Market size and forecast, by Type

- 6.4.3 Market size and forecast, by Application

- 6.4.4 Market size and forecast, by country

- 6.4.4.1 Germany

- 6.4.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.1.2 Market size and forecast, by Type

- 6.4.4.1.3 Market size and forecast, by Application

- 6.4.4.2 France

- 6.4.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.2.2 Market size and forecast, by Type

- 6.4.4.2.3 Market size and forecast, by Application

- 6.4.4.3 Italy

- 6.4.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.3.2 Market size and forecast, by Type

- 6.4.4.3.3 Market size and forecast, by Application

- 6.4.4.4 United Kingdom

- 6.4.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.4.2 Market size and forecast, by Type

- 6.4.4.4.3 Market size and forecast, by Application

- 6.4.4.5 Benelux

- 6.4.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.5.2 Market size and forecast, by Type

- 6.4.4.5.3 Market size and forecast, by Application

- 6.4.4.6 Nordics

- 6.4.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.6.2 Market size and forecast, by Type

- 6.4.4.6.3 Market size and forecast, by Application

- 6.4.4.7 Rest of Europe

- 6.4.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.4.4.7.2 Market size and forecast, by Type

- 6.4.4.7.3 Market size and forecast, by Application

- 6.4.4.1 Germany

- 6.5 Asia Pacific

- 6.5.1 Key trends and opportunities

- 6.5.2 Market size and forecast, by Type

- 6.5.3 Market size and forecast, by Application

- 6.5.4 Market size and forecast, by country

- 6.5.4.1 China

- 6.5.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.1.2 Market size and forecast, by Type

- 6.5.4.1.3 Market size and forecast, by Application

- 6.5.4.2 Japan

- 6.5.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.2.2 Market size and forecast, by Type

- 6.5.4.2.3 Market size and forecast, by Application

- 6.5.4.3 India

- 6.5.4.3.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.3.2 Market size and forecast, by Type

- 6.5.4.3.3 Market size and forecast, by Application

- 6.5.4.4 South Korea

- 6.5.4.4.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.4.2 Market size and forecast, by Type

- 6.5.4.4.3 Market size and forecast, by Application

- 6.5.4.5 Australia

- 6.5.4.5.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.5.2 Market size and forecast, by Type

- 6.5.4.5.3 Market size and forecast, by Application

- 6.5.4.6 Southeast Asia

- 6.5.4.6.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.6.2 Market size and forecast, by Type

- 6.5.4.6.3 Market size and forecast, by Application

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.4.7.1 Key market trends, factors driving growth, and opportunities

- 6.5.4.7.2 Market size and forecast, by Type

- 6.5.4.7.3 Market size and forecast, by Application

- 6.5.4.1 China

- 6.6 MEA

- 6.6.1 Key trends and opportunities

- 6.6.2 Market size and forecast, by Type

- 6.6.3 Market size and forecast, by Application

- 6.6.4 Market size and forecast, by country

- 6.6.4.1 Middle East

- 6.6.4.1.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.1.2 Market size and forecast, by Type

- 6.6.4.1.3 Market size and forecast, by Application

- 6.6.4.2 Africa

- 6.6.4.2.1 Key market trends, factors driving growth, and opportunities

- 6.6.4.2.2 Market size and forecast, by Type

- 6.6.4.2.3 Market size and forecast, by Application

- 6.6.4.1 Middle East

- 7.1 Overview

- 7.2 Key Winning Strategies

- 7.3 Top 10 Players: Product Mapping

- 7.4 Competitive Analysis Dashboard

- 7.5 Market Competition Heatmap

- 7.6 Leading Player Positions, 2022

8: Company Profiles

- 8.1 Eni oil Products

- 8.1.1 Company Overview

- 8.1.2 Key Executives

- 8.1.3 Company snapshot

- 8.1.4 Active Business Divisions

- 8.1.5 Product portfolio

- 8.1.6 Business performance

- 8.1.7 Major Strategic Initiatives and Developments

- 8.2 Croda International Plc

- 8.2.1 Company Overview

- 8.2.2 Key Executives

- 8.2.3 Company snapshot

- 8.2.4 Active Business Divisions

- 8.2.5 Product portfolio

- 8.2.6 Business performance

- 8.2.7 Major Strategic Initiatives and Developments

- 8.3 AvinOil S.A.

- 8.3.1 Company Overview

- 8.3.2 Key Executives

- 8.3.3 Company snapshot

- 8.3.4 Active Business Divisions

- 8.3.5 Product portfolio

- 8.3.6 Business performance

- 8.3.7 Major Strategic Initiatives and Developments

- 8.4 Other

- 8.4.1 Company Overview

- 8.4.2 Key Executives

- 8.4.3 Company snapshot

- 8.4.4 Active Business Divisions

- 8.4.5 Product portfolio

- 8.4.6 Business performance

- 8.4.7 Major Strategic Initiatives and Developments

- 8.5 The PJSC Lukoil Oil Company

- 8.5.1 Company Overview

- 8.5.2 Key Executives

- 8.5.3 Company snapshot

- 8.5.4 Active Business Divisions

- 8.5.5 Product portfolio

- 8.5.6 Business performance

- 8.5.7 Major Strategic Initiatives and Developments

- 8.6 CEPSA

- 8.6.1 Company Overview

- 8.6.2 Key Executives

- 8.6.3 Company snapshot

- 8.6.4 Active Business Divisions

- 8.6.5 Product portfolio

- 8.6.6 Business performance

- 8.6.7 Major Strategic Initiatives and Developments

- 8.7 Royal Dutch Shell Plc

- 8.7.1 Company Overview

- 8.7.2 Key Executives

- 8.7.3 Company snapshot

- 8.7.4 Active Business Divisions

- 8.7.5 Product portfolio

- 8.7.6 Business performance

- 8.7.7 Major Strategic Initiatives and Developments

- 8.8 Exxon Mobil Corporation

- 8.8.1 Company Overview

- 8.8.2 Key Executives

- 8.8.3 Company snapshot

- 8.8.4 Active Business Divisions

- 8.8.5 Product portfolio

- 8.8.6 Business performance

- 8.8.7 Major Strategic Initiatives and Developments

- 8.9 Gazprom Neft PJSC

- 8.9.1 Company Overview

- 8.9.2 Key Executives

- 8.9.3 Company snapshot

- 8.9.4 Active Business Divisions

- 8.9.5 Product portfolio

- 8.9.6 Business performance

- 8.9.7 Major Strategic Initiatives and Developments

- 8.10 SINOPEC

- 8.10.1 Company Overview

- 8.10.2 Key Executives

- 8.10.3 Company snapshot

- 8.10.4 Active Business Divisions

- 8.10.5 Product portfolio

- 8.10.6 Business performance

- 8.10.7 Major Strategic Initiatives and Developments

- 8.11 Repsol S.A.

- 8.11.1 Company Overview

- 8.11.2 Key Executives

- 8.11.3 Company snapshot

- 8.11.4 Active Business Divisions

- 8.11.5 Product portfolio

- 8.11.6 Business performance

- 8.11.7 Major Strategic Initiatives and Developments

- 8.12 Chevron Corporation

- 8.12.1 Company Overview

- 8.12.2 Key Executives

- 8.12.3 Company snapshot

- 8.12.4 Active Business Divisions

- 8.12.5 Product portfolio

- 8.12.6 Business performance

- 8.12.7 Major Strategic Initiatives and Developments

- 8.13 Total SA

- 8.13.1 Company Overview

- 8.13.2 Key Executives

- 8.13.3 Company snapshot

- 8.13.4 Active Business Divisions

- 8.13.5 Product portfolio

- 8.13.6 Business performance

- 8.13.7 Major Strategic Initiatives and Developments

- 8.14 BP p.l.c.

- 8.14.1 Company Overview

- 8.14.2 Key Executives

- 8.14.3 Company snapshot

- 8.14.4 Active Business Divisions

- 8.14.5 Product portfolio

- 8.14.6 Business performance

- 8.14.7 Major Strategic Initiatives and Developments

9: Analyst Perspective and Conclusion

- 9.1 Concluding Recommendations and Analysis

- 9.2 Strategies for Market Potential

Scope of Report

| Aspects | Details |

|---|---|

By Type |

|

By Ship Type |

|

Report Licenses

Our Team

Frequently Asked Questions (FAQ):

What is the growth rate of Marine Lubricants Market?

+

-

What are the latest trends influencing the Marine Lubricants Market?

+

-

Who are the key players in the Marine Lubricants Market?

+

-

How is the Marine Lubricants } industry progressing in scaling its end-use implementations?

+

-

What product types are analyzed in the Marine Lubricants Market Study?

+

-

What geographic breakdown is available in Global Marine Lubricants Market Study?

+

-

Which region holds the second position by market share in the Marine Lubricants market?

+

-

How are the key players in the Marine Lubricants market targeting growth in the future?

+

-

What are the opportunities for new entrants in the Marine Lubricants market?

+

-

What are the major challenges faced by the Marine Lubricants Market?

+

-